Transcription

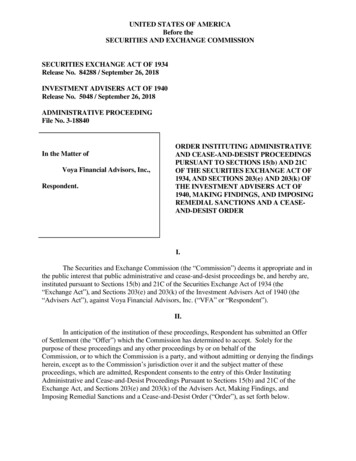

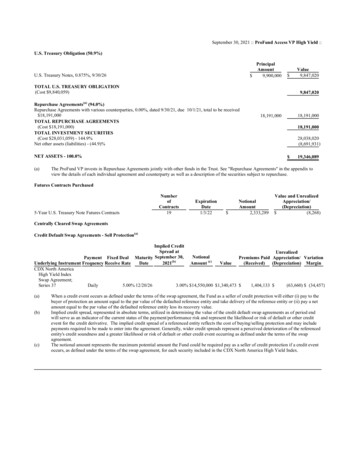

Page 1 of 318September 30, 2021 :: ProFund Access VP High Yield ::U.S. Treasury Obligation (50.9%)PrincipalAmount 9,900,000U.S. Treasury Notes, 0.875%, 9/30/26 TOTAL U.S. TREASURY OBLIGATION(Cost 9,840,059)9,847,020Repurchase Agreements(a) (94.0%)Repurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 18,191,000TOTAL REPURCHASE AGREEMENTS(Cost 18,191,000)TOTAL INVESTMENT SECURITIES(Cost 28,031,059) - 144.9%Net other assets (liabilities) - (44.9)%18,191,00018,191,000NET ASSETS - 931) 19,346,089The ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.Futures Contracts Purchased5-Year U.S. Treasury Note Futures ContractsNumberofContracts19ExpirationDate1/3/22 NotionalAmount2,333,289Value and UnrealizedAppreciation/(Depreciation) (8,268)Centrally Cleared Swap AgreementsCredit Default Swap Agreements - Sell Protection(a)Implied CreditSpread atUnrealizedNotionalPayment Fixed Deal Maturity September 30,Premiums Paid Appreciation/ VariationAmount (c)Underlying Instrument Frequency Receive RateDate2021(b)Value(Received)(Depreciation) MarginCDX North AmericaHigh Yield IndexSwap Agreement;Series 37Daily5.00% 12/20/263.00% 14,550,000 1,340,473 1,404,133 (63,660) (34,457)(a)(b)(c)When a credit event occurs as defined under the terms of the swap agreement, the Fund as a seller of credit protection will either (i) pay to thebuyer of protection an amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) pay a netamount equal to the par value of the defaulted reference entity less its recovery value.Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period endwill serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other creditevent for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may includepayments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of the referencedentity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the swapagreement.The notional amount represents the maximum potential amount the Fund could be required pay as a seller of credit protection if a credit eventoccurs, as defined under the terms of the swap agreement, for each security included in the CDX North America High Yield wz206b/vpro.htm11/9/2021

Page 2 of 318September 30, 2021 :: ProFund VP Asia 30 ::Schedule of Portfolio Investments (unaudited)Common Stocks 04314,9746,98432,91414,91247,612Alibaba Group Holding, Ltd.*ADR (Internet & Direct Marketing Retail)Baidu, Inc.*ADR (Interactive Media & Services)Beigene, Ltd.*ADR (Biotechnology)BHP Billiton PLCADR (Metals & Mining)BHP Billiton, Ltd.ADR (Metals & Mining)Bilibili, Inc.*ADR (Entertainment)Daqo New Energy Corp.*ADR (Semiconductors & Semiconductor Equipment)Futu Holdings, Ltd.*ADR (Capital Markets)Gaotu Techedu, Inc.*ADR (Diversified Consumer Services)GDS Holdings, Ltd.*ADR (IT Services)HDFC Bank, Ltd.ADR (Banks)Hello Group, Inc.ADR (Interactive Media & Services)Huazhu Group, Ltd.*ADR (Hotels, Restaurants & Leisure)HUYA, Inc.*ADR(a) (Entertainment)ICICI Bank, Ltd.ADR (Banks)Infosys Technologies, Ltd.ADR (IT Services)JD.com, Inc.*ADR (Internet & Direct Marketing Retail)JinkoSolar Holding Co., Ltd.*ADR(a) (Semiconductors & Semiconductor Equipment)JOYY, Inc.ADR (Interactive Media & Services)Kingsoft Cloud Holdings, Ltd.*ADR (IT Services)NetEase, Inc.ADR (Entertainment)New Oriental Education & Technology Group, Inc.*ADR (Diversified Consumer Services)NIO, Inc.*ADR (Automobiles)Pinduoduo, Inc.*ADR (Internet & Direct Marketing Retail)Sea, Ltd.*ADR (Entertainment)Taiwan Semiconductor Manufacturing Co., Ltd.ADR (Semiconductors & Semiconductor Equipment)TAL Education Group*ADR (Diversified Consumer Services)Tencent Music Entertainment Group*ADR (Entertainment)Trip.com Group, Ltd.*ADR (Internet & Direct Marketing Retail)ZTO Express Cayman, Inc.ADR (Air Freight & Logistics) TOTAL COMMON STOCKS(Cost 575Repurchase Agreements(b) (3.0%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 767,000TOTAL REPURCHASE AGREEMENTS(Cost 767,000) 767,000Value 767,000767,000Collateral for Securities Loaned (c)(2.8%)BlackRock Liquidity Funds FedFund Portfolio - Institutional Shares, 0.03%(d)TOTAL COLLATERAL FOR SECURITIES LOANED(Cost 704,528)TOTAL INVESTMENT SECURITIES(Cost 15,067,898) - 105.9%Net other assets (liabilities) - (5.9)%NET ASSETS - 100.0%*(a)Shares704,528 Value704,528704,52826,693,103(1,477,014) 25,216,089Non-income producing security.All or part of this security was on loan as of September 30, 2021. The total value of securities on loan as of September 30, 2021 was p/wz206b/vpro.htm11/9/2021

Page 3 of 318(b)(c)(d)ADRThe ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.Securities were purchased with cash collateral held from securities on loan at September 30, 2021.Rate periodically changes. Rate disclosed is the daily yield on September 30, 2021.American Depositary /wz206b/vpro.htm11/9/2021

Page 4 of 318:: ProFund VP Asia 30 :: September 30, 2021ProFund VP Asia 30 invested in the following industries as of September 30, 2021:Air Freight & LogisticsAutomobilesBanksBiotechnologyCapital MarketsDiversified Consumer ServicesEntertainmentHotels, Restaurants & LeisureInteractive Media & ServicesInternet & Direct Marketing RetailIT ServicesMetals & MiningSemiconductors & Semiconductor EquipmentOther**Total 721,9033,086,076(5,486)25,216,089% ofNet 758,8302,244,8151,671,847(5,486)25,216,089% ofNet Assets10.8%58.9%14.9%8.9%6.6%(0.1)%100.0%ProFund VP Asia 30 invested in securities with exposure to the following countries as of September 30, l** Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payable forcapital shares mp/wz206b/vpro.htm11/9/2021

Page 5 of 318September 30, 2021 :: ProFund VP Banks ::Schedule of Portfolio Investments (unaudited)Common Stocks 014681,47433014,886377208588Bank of America Corp. (Banks)Bank OZK (Banks)BOK Financial Corp. (Banks)Citigroup, Inc. (Banks)Citizens Financial Group, Inc. (Banks)Comerica, Inc. (Banks)Commerce Bancshares, Inc. (Banks)Cullen/Frost Bankers, Inc. (Banks)East West Bancorp, Inc. (Banks)F.N.B. Corp. (Banks)Fifth Third Bancorp (Banks)First Citizens BancShares, Inc. - Class A (Banks)First Financial Bankshares, Inc. (Banks)First Horizon Corp. (Banks)First Republic Bank (Banks)Glacier Bancorp, Inc. (Banks)Home BancShares, Inc. (Banks)Huntington Bancshares, Inc. (Banks)JPMorgan Chase & Co. (Banks)KeyCorp (Banks)M&T Bank Corp. (Banks)New York Community Bancorp, Inc. (Thrifts & Mortgage Finance)People's United Financial, Inc. (Banks)Pinnacle Financial Partners, Inc. (Banks)Popular, Inc. (Banks)Prosperity Bancshares, Inc. (Banks)Regions Financial Corp. (Banks)Signature Bank (Banks)SVB Financial Group* (Banks)Synovus Financial Corp. (Banks)TFS Financial Corp. (Thrifts & Mortgage Finance)The PNC Financial Services Group, Inc. (Banks)Truist Financial Corp. (Banks)U.S. Bancorp (Banks)UMB Financial Corp. (Banks)Umpqua Holdings Corp. (Banks)United Bankshares, Inc. (Banks)Valley National Bancorp (Banks)Webster Financial Corp. (Banks)Wells Fargo & Co. (Banks)Western Alliance Bancorp (Banks)Wintrust Financial Corp. (Banks)Zions Bancorp (Banks) TOTAL COMMON STOCKS(Cost hase Agreements(a) (1.5%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 121,000TOTAL REPURCHASE AGREEMENTS(Cost 121,000)TOTAL INVESTMENT SECURITIES(Cost 2,246,082) - 78.7%Net other assets (liabilities) - 21.3%NET ASSETS - 100.0%* 121,000Value 121,000121,0006,527,0151,768,001 8,295,016Non-income producing mp/wz206b/vpro.htm11/9/2021

Page 6 of 318(a)The ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to Temp/wz206b/vpro.htm11/9/2021

Page 7 of 318:: ProFund VP Banks :: September 30, 2021Total Return Swap Agreements — LongUnderlying InstrumentDow Jones U.S. Banks Index(1)(2)CounterpartyGoldman Sachs InternationalTerminationDate(1)10/25/21Rate Paid(Received)(2)Notional Amount0.57% 1,885,462Value andUnrealizedAppreciation/(Depreciation) 877Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of September 30, 2021, on the notional amount of the swap agreement paid to the counterparty orreceived from the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).ProFund VP Banks invested in the following industries as of September 30, 2021:BanksThrifts & Mortgage FinanceOther**Total** Value6,380,98125,0341,889,0018,295,016% ofNet Assets76.9%0.3%22.8%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payable forcapital shares mp/wz206b/vpro.htm11/9/2021

Page 8 of 318September 30, 2021 :: ProFund VP Basic Materials ::Schedule of Portfolio Investments (unaudited)Common Stocks Air Products & Chemicals, Inc. (Chemicals)Albemarle Corp. (Chemicals)Alcoa Corp.* (Metals & Mining)Ashland Global Holdings, Inc. (Chemicals)Axalta Coating Systems, Ltd.* (Chemicals)Celanese Corp. (Chemicals)CF Industries Holdings, Inc. (Chemicals)Cleveland-Cliffs, Inc.* (Metals & Mining)Commercial Metals Co. (Metals & Mining)Corteva, Inc. (Chemicals)Dow, Inc. (Chemicals)DuPont de Nemours, Inc. (Chemicals)Eastman Chemical Co. (Chemicals)Ecolab, Inc. (Chemicals)Element Solutions, Inc. (Chemicals)FMC Corp. (Chemicals)Freeport-McMoRan, Inc. (Metals & Mining)Huntsman Corp. (Chemicals)Ingevity Corp.* (Chemicals)International Flavors & Fragrances, Inc. (Chemicals)Linde PLC (Chemicals)LyondellBasell Industries N.V. - Class A (Chemicals)MP Materials Corp.* (Metals & Mining)NewMarket Corp. (Chemicals)Newmont Corp. (Metals & Mining)Nucor Corp. (Metals & Mining)Olin Corp. (Chemicals)PPG Industries, Inc. (Chemicals)Reliance Steel & Aluminum Co. (Metals & Mining)Royal Gold, Inc. (Metals & Mining)RPM International, Inc. (Chemicals)Steel Dynamics, Inc. (Metals & Mining)The Chemours Co. (Chemicals)The Mosaic Co. (Chemicals)The Scotts Miracle-Gro Co. - Class A (Chemicals)United States Steel Corp. (Metals & Mining)Valvoline, Inc. (Chemicals)Westlake Chemical Corp. (Chemicals) TOTAL COMMON STOCKS(Cost 114,014115,321107,69658,05615,194,493Repurchase Agreements(a) (2.1%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 328,000TOTAL REPURCHASE AGREEMENTS(Cost 328,000)TOTAL INVESTMENT SECURITIES(Cost 7,046,878) - 99.5%Net other assets (liabilities) - 0.5%NET ASSETS - 100.0%*(a) 328,000Value 328,000328,00015,522,49384,550 15,607,043Non-income producing security.The ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to Temp/wz206b/vpro.htm11/9/2021

Page 9 of 06b/vpro.htm11/9/2021

Page 10 of 318:: ProFund VP Basic Materials :: September 30, 2021Total Return Swap Agreements — LongUnderlying InstrumentCounterpartyDow Jones U.S. Basic Materials Index Goldman Sachs International(1)(2)TerminationDate(1)10/25/21Rate Paid(Received)(2)0.57% NotionalAmount413,089Value andUnrealizedAppreciation/(Depreciation) (7,560)Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of September 30, 2021, on the notional amount of the swap agreement paid to the counterparty orreceived from the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).ProFund VP Basic Materials invested in the following industries as of September 30, 2021:ChemicalsMetals & MiningOther**Total** Value11,808,1823,386,311412,55015,607,043% ofNet Assets75.7%21.7%2.6%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payable forcapital shares mp/wz206b/vpro.htm11/9/2021

Page 11 of 318September 30, 2021 :: ProFund VP Bear ::Schedule of Portfolio Investments (unaudited)Repurchase Agreements(a)(b) (98.4%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 6,411,000TOTAL REPURCHASE AGREEMENTS(Cost 6,411,000)TOTAL INVESTMENT SECURITIES(Cost 6,411,000) - 98.4%Net other assets (liabilities) - 1.6% 6,411,000(b) 6,411,0006,411,0006,411,000105,254NET ASSETS - 100.0%(a)Value 6,516,254A portion of these securities were held in a segregated account for the benefit of swap counterparties in the event of default. At September 30,2021, the aggregate amount held in a segregated account was 959,000.The ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.Futures Contracts SoldNumberofContracts1E-Mini S&P 500 Futures ContractsExpirationDate12/20/21 Notional Amount(214,888) Value l Return Swap Agreements — ShortUnderlying InstrumentS&P 500S&P 500(1)(2)CounterpartyGoldman Sachs InternationalUBS AGTerminationDate(1)10/27/2110/27/21Rate Paid(Received)(2)(0.42)% (0.22)% Value ion)(1,787,629) 51,872(4,504,395)138,827(6,292,024) 190,699Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of September 30, 2021, on the notional amount of the swap agreement paid to the counterparty orreceived from the counterparty, excluding any commissions. This amount is included as part of the unrealized he/AppData/Local/Temp/wz206b/vpro.htm11/9/2021

Page 12 of 318September 30, 2021 :: ProFund VP Biotechnology ::Schedule of Portfolio Investments (unaudited)Common Stocks (98.9%)10X Genomics, Inc.* - Class A (Life Sciences Tools & Services)AbbVie, Inc. (Biotechnology)ACADIA Pharmaceuticals, Inc.* (Biotechnology)Acceleron Pharma, Inc.* (Biotechnology)Agilent Technologies, Inc. (Life Sciences Tools & Services)Agios Pharmaceuticals, Inc.* (Biotechnology)Alkermes PLC* (Biotechnology)Allogene Therapeutics, Inc.* (Biotechnology)Alnylam Pharmaceuticals, Inc.* (Biotechnology)Amgen, Inc. (Biotechnology)Arrowhead Pharmaceuticals, Inc.* (Biotechnology)Avantor, Inc.* (Life Sciences Tools & Services)Beam Therapeutics, Inc.* (Biotechnology)Berkeley Lights, Inc.* (Life Sciences Tools & Services)Biogen, Inc.* (Biotechnology)Biohaven Pharmaceutical Holding Co., Ltd.* (Biotechnology)BioMarin Pharmaceutical, Inc.* (Biotechnology)Bio-Techne Corp. (Life Sciences Tools & Services)Blueprint Medicines Corp.* (Biotechnology)Bridgebio Pharma, Inc.* (Biotechnology)Charles River Laboratories International, Inc.* (Life Sciences Tools & Services)Denali Therapeutics, Inc.* (Biotechnology)Emergent BioSolutions, Inc.* (Biotechnology)Exact Sciences Corp.* (Biotechnology)Exelixis, Inc.* (Biotechnology)Fate Therapeutics, Inc.* (Biotechnology)Gilead Sciences, Inc. (Biotechnology)Halozyme Therapeutics, Inc.* (Biotechnology)Horizon Therapeutics PLC* (Pharmaceuticals)Illumina, Inc.* (Life Sciences Tools & Services)Incyte Corp.* (Biotechnology)Intellia Therapeutics, Inc.* (Biotechnology)Invitae Corp.* (Biotechnology)Ionis Pharmaceuticals, Inc.* (Biotechnology)IQVIA Holdings, Inc.* (Life Sciences Tools & Services)Maravai LifeSciences Holdings, Inc.* - Class A (Life Sciences Tools & Services)Medpace Holdings, Inc.* (Life Sciences Tools & Services)Mettler-Toledo International, Inc.* (Life Sciences Tools & Services)Mirati Therapeutics, Inc.* (Biotechnology)Moderna, Inc.* (Biotechnology)Natera, Inc.* (Biotechnology)Nektar Therapeutics* (Pharmaceuticals)Neurocrine Biosciences, Inc.* (Biotechnology)Novavax, Inc.* (Biotechnology)Pacific Biosciences of California, Inc.* (Life Sciences Tools & Services)PPD, Inc.* (Life Sciences Tools & Services)Regeneron Pharmaceuticals, Inc.* (Biotechnology)Repligen Corp.* (Biotechnology)Sarepta Therapeutics, Inc.* (Biotechnology)Seagen, Inc.* (Biotechnology)Sotera Health Co.* (Life Sciences Tools & Services)Syneos Health, Inc.* (Life Sciences Tools & Services)Twist Bioscience Corp.* (Biotechnology)Ultragenyx Pharmaceutical, Inc.* (Biotechnology)United Therapeutics Corp.* (Biotechnology)Vertex Pharmaceuticals, Inc.* (Biotechnology)Vir Biotechnology, Inc.* (Biotechnology)TOTAL COMMON STOCKS(Cost 12,7253,588 ase Agreements(a) wz206b/vpro.htm11/9/2021

Page 13 of 318PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 9/30/21, due 10/1/21, total to be received 597,000TOTAL REPURCHASE AGREEMENTS(Cost 597,000)TOTAL INVESTMENT SECURITIES(Cost 22,723,224) - 99.8%Net other assets (liabilities) - 0.2%NET ASSETS - 100.0%*(a) 597,000Value 597,000597,00063,416,036135,119 63,551,155Non-income producing security.The ProFund VP invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to Temp/wz206b/vpro.htm11/9/2021

Page 14 of 318:: ProFund VP Biotechnology :: September 30, 2021Total Return Swap Agreements — LongUnderlying InstrumentDow Jones U.S. Biotechnology Index(1)(2)CounterpartyGoldman Sachs InternationalTerminationDate(1)10/25/21Rate Paid(Received)(2)0.57% NotionalAmount772,743Value andUnrealizedAppreciation/(Depreciation) (44,457)Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of September 30, 2021, on the notional amount of the swap agreement paid to the counterparty orreceived from the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).ProFund VP Biotechnology invested in the following industries as of September 30, 2021:BiotechnologyLife Sciences Tools & ServicesPharmaceuticalsOther**Total** 5% ofNet Assets73.9%22.8%2.2%1.1%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payable forcapital shares mp/wz206b/vpro.htm11/9/2021

Page 15 of 318September 30, 2021 :: ProFund VP Bull ::Schedule of Portfolio Investments (unaudited)Common Stocks (75.3%)Shares3M Co. (Industrial Conglomerates)A.O. Smith Corp. (Building Products)Abbott Laboratories (Health Care Equipment & Supplies)AbbVie, Inc. (Biotechnology)ABIOMED, Inc.* (Health Care Equipment & Supplies)Accenture PLC - Class A (IT Services)Activision Blizzard, Inc. (Entertainment)Adobe, Inc.* (Software)Advance Auto Parts, Inc. (Specialty Retail)Advanced Micro Devices, Inc.* (Semiconductors & Semiconductor Equipment)Aflac, Inc. (Insurance)Agilent Technologies, Inc. (Life Sciences Tools & Services)Air Products & Chemicals, Inc. (Chemicals)Akamai Technologies, Inc.* (IT Services)Alaska Air Group, Inc.* (Airlines)Albemarle Corp. (Chemicals)Alexandria Real Estate Equities, Inc. (Equity Real Estate Investment Trusts)Align Technology, Inc.* (Health Care Equipment & Supplies)Allegion PLC (Building Products)Alliant Energy Corp. (Electric Utilities)Alphabet, Inc.* - Class A (Interactive Media & Services)Alphabet, Inc.* - Class C (Interactive Media & Services)Altria Group, Inc. (Tobacco)Amazon.com, Inc.* (Internet & Direct Marketing Retail)Amcor PLC (Containers & Packaging)Ameren Corp. (Multi-Utilities)American Airlines Group, Inc.* (Airlines)American Electric Power Co., Inc. (Electric Utilities)American Express Co. (Consumer Finance)American International Group, Inc. (Insurance)American Tower Corp. (Equity Real Estate Investment Trusts)American Water Works Co., Inc. (Water Utilities)Ameriprise Financial, Inc. (Capital Markets)AmerisourceBergen Corp. (Health Care Providers & Services)AMETEK, Inc. (Electrical Equipment)Amgen, Inc. (Biotechnology)Amphenol Corp. - Class A (Electronic Equipment, Instruments & Components)Analog Devices, Inc. (Semiconductors & Semiconductor Equipment)ANSYS, Inc.* (Software)Anthem, Inc. (Health Care Providers & Services)Aon PLC (Insurance)APA Corp. (Oil, Gas & Consumable Fuels)Apple, Inc. (Technology Hardware, Storage & Peripherals)Applied Materials, Inc. (Semiconductors & Semiconductor Equipment)Aptiv PLC* (Auto Components)Archer-Daniels-Midland Co. (Food Products)Arista Networks, Inc.* (Communications Equipment)Arthur J. Gallagher & Co. (Insurance)Assurant, Inc. (Insurance)AT&T, Inc. (Diversified Telecommunication Services)Atmos Energy Corp. (Gas Utilities)Autodesk, Inc.* (Software)Automatic Data Processing, Inc. (IT Services)AutoZone, Inc.* (Specialty Retail)AvalonBay Communities, Inc. (Equity Real Estate Investment Trusts)Avery Dennison Corp. (Containers & Packaging)Baker Hughes Co. - Class A (Energy Equipment & Services)Ball Corp. (Containers & Packaging)Bank of America Corp. (Banks)Bath & Body Works, Inc. (Household Durables)Baxter International, Inc. (Health Care Equipment & Supplies)Becton, Dickinson & Co. (Health Care Equipment & Supplies)Berkshire Hathaway, Inc.* - Class B (Diversified Financial 332171291,28850711,5044117784452,879 109,390785,79411/9/2021

Page 16 of 318Best Buy Co., Inc. (Specialty Retail)Biogen, Inc.* (Biotechnology)Bio-Rad Laboratories, Inc.* - Class A (Life Sciences Tools & Services)Bio-Techne Corp. (Life Sciences Tools & Services)BlackRock, Inc. - Class A (Capital Markets)Booking Holdings, Inc.* (Internet & Direct Marketing Retail)BorgWarner, Inc. (Auto Components)Boston Properties, Inc. (Equity Real Estate Investment Trusts)Boston Scientific Corp.* (Health Care Equipment & Supplies)Bristol-Myers Squibb Co. (Pharmaceuticals)Broadcom, Inc. (Semiconductors & Semiconductor Equipment)Broadridge Financial Solutions, Inc. (IT 3,72995,935204,196308,90030,16211/9/2021

Page 17 of 318:: ProFund VP Bull :: September 30, 2021Common Stocks, continuedSharesBrown & Brown, Inc. (Insurance)Brown-Forman Corp. - Class B (Beverages)C.H. Robinson Worldwide, Inc. (Air Freight & Logistics)Cabot Oil & Gas Corp. (Oil, Gas & Consumable Fuels)Cadence Design Systems, Inc.* (Software)Caesars Entertainment, Inc.* (Hotels, Restaurants & Leisure)Campbell Soup Co. (Food Products)Capital One Financial Corp. (Consumer Finance)Cardinal Health, Inc. (Health Care Providers & Services)CarMax, Inc.* (Specialty Retail)Carnival Corp.* - Class A (Hotels, Restaurants & Leisure)Carrier Global Corp. (Building Products)Catalent, Inc.* (Pharmaceuticals)Caterpillar, Inc. (Machinery)Cboe Global Markets, Inc. (Capital Markets)CBRE Group, Inc.* - Class A (Real Estate Management & Development)CDW Corp. (Electronic Equipment, Instruments & Components)Celanese Corp. (Chemicals)Centene Corp.* (Health Care Providers & Services)CenterPoint Energy, Inc. (Multi-Utilities)Ceridian HCM Holding, Inc.* (Software)Cerner Corp. (Health Care Technology)CF Industries Holdings, Inc. (Chemicals)Charles River Laboratories International, Inc.* (Life Sciences Tools & Services)Charter Communications, Inc.* - Class A (Media)Chevron Corp. (Oil, Gas & Consumable Fuels)Chipotle Mexican Grill, Inc.* (Hotels, Restaurants & Leisure)Chubb, Ltd. (Insurance)Church & Dwight Co., Inc. (Household Products)Cigna Corp. (Health Care Providers & Services)Cincinnati Financial Corp. (Insurance)Cintas Corp. (Commercial Services & Supplies)Cisco Systems, Inc. (Communications Equipment)Citigroup, Inc. (Banks)Citizens Financial Group, Inc. (Banks)Citrix Systems, Inc. (Software)CME Group, Inc. (Capital Markets)CMS Energy Corp. (Multi-Utilities)Cognizant Technology Solutions Corp. - Class A (IT Services)Colgate-Palmolive Co. (Household Products)Comcast Corp. - Class A (Media)Comerica, Inc. (Banks)Conagra Brands, Inc. (Food Products)ConocoPhillips (Oil, Gas & Consumable Fuels)Consolidated Edison, Inc. (Multi-Utilities)Constellation Brands, Inc. - Class A (Beverages)Copart, Inc.* (Commercial Services & Supplies)Corning, Inc. (Electronic Equipment, Instruments & Components)Corteva, Inc. (Chemicals)Costco Wholesale Corp. (Food & Staples Retailing)Crown Castle International Corp. (Equity Real Estate Investment Trusts)CSX Corp. (Road & Rail)Cummins, Inc. (Machinery)CVS Health Corp. (Health Care Providers & Services)Danaher Corp. (Health Care Equipment & Supplies)Darden Restaurants, Inc. (Hotels, Restaurants & Leisure)DaVita, Inc.* (Health Care Providers & Services)Deere & Co. (Machinery)Delta Air Lines, Inc.* (Airlines)DENTSPLY SIRONA, Inc. (Health Care Equipment & Supplies)Devon Energy Corp. (Oil, Gas & Consumable Fuels)DexCom, Inc.* (Health Care Equipment & Supplies)Diamondback Energy, Inc. (Oil, Gas & Consumable Fuels)Digital Realty Trust, Inc. (Equity Real Estate Investment Trusts)Discover Financial Services (Consumer Finance)file:///C:/Users/RTroche/Ap

Pinnacle Financial Partners, Inc. (Banks) 275 25,872 . (Banks) 220 59,902 SVB Financial Group* (Banks) 213 137,785 Synovus Financial Corp. (Banks) 533 23,393 TFS Financial Corp. (Thrifts & Mortgage Finance) 175 3,336 The PNC Financial Services Group, Inc. (Banks) 1,541 301,481 . which includes any receivable for capital shares issued and .