Transcription

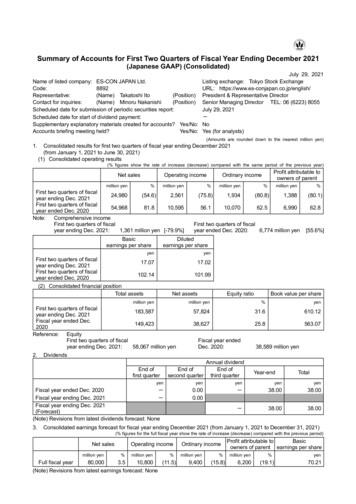

Summary of Accounts for First Two Quarters of Fiscal Year Ending December 2021(Japanese GAAP) (Consolidated)July 29, 2021Listing exchange: Tokyo Stock ExchangeURL: https://www.es-conjapan.co.jp/english/President & Representative DirectorSenior Managing Director TEL: 06 (6223) 8055July 29, 2021-NoYes (for analysts)Name of listed company: ES-CON JAPAN Ltd.Code:8892Representative:(Name) Takatoshi Ito(Position)Contact for inquiries:(Name) Minoru Nakanishi(Position)Scheduled date for submission of periodic securities report:Scheduled date for start of dividend payment:Supplementary explanatory materials created for accounts? Yes/No:Accounts briefing meeting held?Yes/No:(Amounts are rounded down to the nearest million yen)1.Consolidated results for first two quarters of fiscal year ending December 2021(from January 1, 2021 to June 30, 2021)(1) Consolidated operating results(% figures show the rate of increase (decrease) compared with the same period of the previous year)Net salesmillion yenOperating income%million yenFirst two quarters of fiscal24,980(54.6)2,561year ending Dec. 2021First two quarters of fiscal54,96881.810,595year ended Dec. 2020Note:Comprehensive incomeFirst two quarters of fiscalyear ending Dec. 2021:1,361 million yen [-79.9%]Basicearnings per share%million yen%million 062.8First two quarters of fiscalyear ended Dec. 2020:6,774 million yen[55.6%]Dilutedearnings per shareyenyenFirst two quarters of fiscal17.07year ending Dec. 2021First two quarters of fiscal102.14year ended Dec. 2020(2) Consolidated financial positionTotal assets17.02101.99Net assetsmillion yenFirst two quarters of fiscal183,587year ending Dec. 2021Fiscal year ended Dec.149,4232020Reference: EquityFirst two quarters of fiscalyear ending Dec. 2021:58,067 million yen2.Profit attributable toowners of parentOrdinary incomeEquity ratioBook value per sharemillion yen%yen57,82431.6610.1238,62725.8563.07Fiscal year endedDec. 2020:38,589 million yenDividendsEnd offirst quarterEnd ofsecond quarterAnnual dividendEnd ofthird quarterYear-endTotalyenyenyenyenyenFiscal year ended Dec. 2020-Fiscal year ending Dec. 2021-Fiscal year ending Dec. 2021(Forecast)(Note) Revisions from latest dividends forecast: ed earnings forecast for fiscal year ending December 2021 (from January 1, 2021 to December 31, 2021)(% figures for the full fiscal year show the rate of increase (decrease) compared with the previous period)Net salesFull fiscal yearOperating incomeOrdinary incomemillion yenmillion yen%million yen80,0003.510,800(Note) Revisions from latest earnings forecast: None%(11.5)9,400%(15.8)Profit attributable toBasicowners of parent earnings per sharemillion yen6,200%(19.1)yen70.21

* Explanatory notes(1) Changes in significant subsidiaries during the first two quarters(Changes in specified subsidiaries resulting in change in scope of consolidation):Newly included: - companies (Company name) -- companies (Company name) -Excluded:None(2) Application of accounting treatments specific to preparation of quarterly consolidated financial statements:(3) Changes in accounting policies, changes in accounting estimates, and restatement1) Changes in accounting policies due to amendment of accounting standards, etc.:2) Changes in accounting policies other than 1):3) Changes in accounting estimates:4) Restatement:NoneNoneNoneNoneNone(4) Number of shares issued and outstanding (common shares)First two quarters1) Number of shares issued and outstanding98,580,887 Fiscal year ended 71,961,887of fiscal year(including treasury shares) at end of periodshares Dec. 2020sharesending Dec. 2021First two quarters3,407,100 Fiscal year ended3,428,4002) Number of treasury shares at end of period of fiscal yearshares Dec. 2020sharesending Dec. 2021First two quartersFirst two quarters3) Average number of shares during period81,333,67668,439,758of fiscal yearof fiscal year(cumulative total of first two quarters)sharessharesending Dec. 2021ended Dec. 2020Note: The number of treasury shares at end of period includes shares of ES-CON JAPAN held in a share-basedpayment benefits trust for directors and a share-based payment benefits-type ESOP trust (first two quartersof fiscal year ending December 2021: 851,000 shares in the share-based payment benefits trust for directorsand 225,800 shares in the share-based payment benefits-type ESOP trust). In the calculation of the averagenumber of shares during period (cumulative total of first two quarters), the treasury shares to be subtracted inthat calculation includes shares of ES-CON JAPAN held in the share-based payment benefits trust for directorsand the share-based payment benefits-type ESOP trust (first two quarters of fiscal year ending December2021: 1,080,846 shares).*This quarterly summary of accounts is not subject to quarterly review of certified public accountant or Audit Corporation.*Explanation regarding appropriate use of earnings forecasts, and other notesThe earnings outlook and other forward-looking statements contained in this document are based on informationcurrently available to and certain assumptions that are thought to be reasonable by ES-CON JAPAN. Accordingly, actualbusiness performance and other results may differ materially due to various reasons. For the conditions forming theassumptions on which earnings forecasts are based and explanatory notes for use of earnings forecasts, etc., pleasesee “Attachment; 1. Qualitative Information on Quarterly Results; (4) Explanation of Consolidated Earnings Forecastand Other Forward-Looking Information” on page 9.

Contents of Attachment1. Qualitative Information on Quarterly Results . 2(1) Business Risks . 2(2) Explanation of Operating Results . 2(3) Explanation of Financial Position . 8(4) Explanation of Consolidated Earnings Forecast and Other Forward-Looking Information . 92. Quarterly Consolidated Financial Statements and Key Notes . 11(1) Quarterly Consolidated Balance Sheet . 11(2) Quarterly Consolidated Statement of Income and Quarterly Consolidated Statement of Comprehensive Income . 13(Quarterly Consolidated Statement of Income) . 13(Quarterly Consolidated Statement of Comprehensive Income). 14(3) Quarterly Consolidated Statement of Cash Flows . 15(4) Notes to Quarterly Consolidated Financial Statements . 16(Notes on Going Concern Assumption). 16(Notes on Substantial Changes in the Amount of Shareholders’ Equity) . 16(Additional Information) . 16(Segment Information, Etc.) . 18(Significant Subsequent Events) . 183. Other . 19Status of Contracts and Sales . 19- 1 -

Attachment1. Qualitative Information on Quarterly Results(1) Business RisksThere are no business risks that newly arose in the second quarter.In addition, there are no significant changes in the business risks stated in the previous fiscal year’s securities report.(2) Explanation of Operating ResultsIn the first two quarters, the Japanese economy is still in a harsh situation as the spread of COVID-19 infection cannotbe contained. The outlook is unforeseeable, although the economy is expected to recover due to the effects of variouspolicies and improvement in overseas economies if COVID-19 vaccination progresses smoothly.In the real estate industry in which the ES-CON JAPAN Group operates, the real estate market showed relatively stableperformance with no substantial deterioration as the policies and measures related to tackling COVID-19 and monetaryeasing measures continued. However, it is extremely difficult to predict how COVID-19 developments will impact theJapanese economy and overseas economies as well as the real estate market amid resumption of social and economicactivities in phases while preventive measures against the spread of COVID-19 are taken across the country andvaccination is promoted.Despite the difficult business environment described above, we made strategic moves towards expansion of newbusiness fields and sustainable growth by taking the current situation as an opportunity to develop our business.As a measure to increase capital for proactive business development, we procured funds amounting to 20.4 billion yenby implementing capital increase through third-party allotment (hereinafter the “capital increase through third-partyallotment”) with Chubu Electric Power Co., Inc. (hereinafter “Chubu Electric Power”) as the allotee on April 5, 2021.With the capital increase through third-party allotment resulting in Chubu Electric Power owning 51.54% of the votingrights, ES-CON JAPAN is now a consolidated subsidiary of Chubu Electric Power.We assessed that becoming a consolidated subsidiary of Chubu Electric Power, which boasts strong corporate creditstanding, through the capital increase through third-party allotment will allow diversification of fundraising methods andreduce fundraising costs by improving our creditworthiness. The move will also enable participation in large-scaleurban-development projects through further business partnerships with the Chubu Electric Power Group. This will makeit possible for us to increase our corporate value still further by stabilizing and expanding our earnings base, enhancingmanagement stability, and so forth.In conjunction, we formulated “IDEAL to REAL 2023,” the fourth medium-term management plan, for the three-yearperiod from the fiscal year ending December 2021 through the fiscal year ending December 2023. The new mediumterm management plan sets “Establishing business foundations able to withstand unexpected changes in economicconditions” and “Simultaneously changing the revenue structure and expanding business domains” as managementstrategies. The detailed plans are as follows.1)Overview of Fourth Medium-Term Management Plan1. Basic Management Strategy Policies(1) Establishing business foundations able to withstand unexpected changes in economic conditionsEstablishing business and financial standings that would be sound and enable us to maintain our fund-raisingabilities under any economic conditions(2) Simultaneously changing the revenue structure and expanding business domainsTransforming the revenue structure from one based on flows to one based on stock by strengthening the realestate leasing business while at the same time realizing business diversification and expanding businessterritories2. Basic Policy: Transformation and Rapid ProgressTransformation・ Proactive investment in long-term revenue-generating real estate and improving the structure of the balancesheet・ Transforming the focus of management from flows to stock- 2 -

Rapid Progress・ Developing synergies in the Chubu Electric Power Group・ Achieving net sales of 110 billion yen and operating income of 16 billion yen (in the final fiscal year of themedium-term management plan)3. Management Strategies(1) Transformation to a structure of sustained and stable revenues(2) Stable growth in existing core businesses through business diversification and area strategies(3) Growing new businesses into core businesses through business diversification and area strategies(4) Taking on the challenges of new business domains(5) Enhancing synergies within the ES-CON JAPAN Group(6) Expanding bases, primarily in the five largest urban areas(7) Enhancing synergies within the Chubu Electric Power Group(8) Promoting ESG initiatives4. Performance PlanFiscal year endedDec. 2020ActualNet sales77,308Operating income12,202Fiscal year endingDec. 2021Second quarterFull fiscal yearActualPlan24,98080,0002,56110,800Fiscal year endingDec. 2022(Unit: million yen)Fiscal year endingDec. 2023PlanPlan98,000110,00014,00016,0005. Management TargetsFiscal year endedDec. 2020ActualFiscal year endingDec. 2021PlanFiscal year endingDec. 2022PlanFiscal year endingDec. 2023PlanShare of profits from leasing *114.2%23.0%24.0%26.0%Return on equity %26.0%23.0%9.5%12.0%14.0%18.0%38.6 billion yen61.0 billion yen66.0 billion yen72.0 billion yenReturn on invested capital(ROIC) *2Equity ratioShare of long-term earningsfrom real estate *3Net assets(Note 1)(Note 2)(Note 3)Share of profits from leasing:Leasing segment profits Segment total profits (not including adjustments)Return on invested capital (ROIC):After-tax operating income (Shareholders’ equity Interest-bearing liabilities)Share of long-term earnings from real estate:Real estate generating leasing revenues recorded as non-current assets Net assets6. Investment PlanFiscal year endingDec. 2021PlanInvestment in revenuegenerating real estateInvestment in otherdevelopmentGross investmentFiscal year endingDec. 2022PlanFiscal year endingDec. 2023Plan(Unit: million yen)3-year 30,00035,00090,00055,00070,00095,000220,000- 3 -

2)Status of Demonstration of Synergy Effect with Chubu Electric Power GroupSince the conclusion of a capital and business partnership agreement with Chubu Electric Power in August 2018,we have positioned the Chubu region as a core business area comparable to the Tokyo metropolitan area and theKansai region, and established a Nagoya branch in March 2019. Following the establishment, we have alreadyacquired land for nine new projects in the Chubu Region.Furthermore, as joint projects with Chuden Real Estate Co., Inc., we launched condominium/commercialdevelopment projects in Shirakabe, Higashi Ward, Nagoya City; Ichinomiya City, Aichi Prefecture; Kakegawa City,Shizuoka Prefecture; and Suita City, Osaka Prefecture.In May 2021, we entered into an investor agreement regarding the establishment of TSUNAGU Community FarmLLC (hereinafter the “new company”), which will construct and operate vertical farms, with Chubu Electric Powerand Spread Co., Ltd. (hereinafter “Spread”). Based on this investor agreement, ES-CON JAPAN, Chubu ElectricPower and Spread will establish the new company in July 2021 and promote initiatives for constructing andoperating vertical farms. More specifically, the aim is to start construction of Techno Farm Fukuroi at the project sitein Fukuroi City, Shizuoka Prefecture (ES-CON JAPAN already acquired it in March 2021), which will be the world’slargest vertical farm utilizing fully artificial light and capable of producing 10 tons of lettuce per day, in October 2021.The farm will be set to launch production in January 2024. With the integration of Chubu Electric Power’s capitaland knowledge on energy management and ES-CON JAPAN’s development know-how, we intend to make effortsfor decarbonization and reduce costs, and contribute to the production of cheaper vegetables at plants as well asrealize efficient and stable production of “safe and clean” lettuce in collaboration with Spread that has a track recordin cultivation and logistics.In June 2021, a consortium of businesses led by Chubu Electric Power of which ES-CON JAPAN is a member wasselected as the preferred candidate contractor in bidding organized by Aichi Prefecture and the city of Nagoya. Thewinning bidder will operate the site of 20th Asian Games Aichi-Nagoya 2026 Athletes’ Village after the games. Inthe said business, the vision targets a next-generation approach to community development whereby diverse peopleconnect with and help each other to promote happiness and find solutions to various issues facing society. Planscall for ES-CON JAPAN to develop retail complexes as part of this community development project.Now a consolidated subsidiary of Chubu Electric Power, we intend to proactively work on large-scale urbandevelopment and realization of a “new form of community” not only in the Chubu region but expanding to acrossJapan by continuously strengthening the partnership with the Chubu Electric Power Group.3)Progress of Projects under Hokkaido Ballpark ConceptWith regard to the naming rights for “ES CON FIELD HOKKAIDO,” the new ballpark of the Hokkaido Nippon-HamFighters planned to be established and opened in 2023 in Kitahiroshima City, Hokkaido, we concluded a ballparknaming rights agreement with Hokkaido Nippon-Ham Fighters Baseball Club Co., Ltd. and Fighters Sports &Entertainment Co., Ltd. in January 2020.The area surrounding the new ballpark is a large-scale development area for HOKKAIDO BALLPARK F VILLAGE(total development area: approx. 36.7 ha, hereinafter “F VILLAGE”) with construction of a new station also planned.We are participating in Japan’s first ballpark development, engaging in the development of various real estate in thearea such as a hotel on the land of approximately 9,400 m2 adjoining the ballpark.In June 2021, we acquired land for a sales project located in F VILLAGE centering on the new ballpark “ES CONFIELD HOKKAIDO.”In addition, we concluded a partnership agreement for the JR Kitahiroshima Station “Train Station West Exit AreaRevitalization Project” in Kitahiroshima City, Hokkaido, with the City of Kitahiroshima on March 30, 2021.Expectations are increasingly building for JR Kitahiroshima Station as a key access point to the ballpark beingsituated between JR Sapporo Station and New Chitose Airport Station in a highly convenient location approximately20 minutes from the airport and approximately 16 minutes from Sapporo by train. Leveraging such location and ourdevelopment expertise such as from the for-sale condominium and commercial facility development conducted inthe station vicinity to date, we will engage in not only development of the ballpark area but also development of thearea surrounding Kitahiroshima Station, the gateway to such, and thereby promote community-based urbandevelopment that would create bustle throughout Kitahiroshima City.Continuing to also support sports, cultural promotion, etc., we will contribute to revitalization and development ofthe entire Hokkaido region for the happiness of its residents.- 4 -

4)Initiatives for Formation of Private REITWe intend to form and commence operation of a private real estate investment corporation (private REIT) with ESCON Asset Management Ltd., which is a consolidated subsidiary, as the company entrusted with asset managementin fiscal 2021. To that end, we formed private funds operating rental apartments in Higashiyamato City, Tokyo,Fujisawa City, Kanagawa Prefecture, and Inagi City, Tokyo, in 2020 in cooperation with NISSHIN FUDOSANCompany, Limited. We then formed the fourth, operating in Isehara City, Kanagawa Prefecture, in January 2021and the eighth, operating in Kawasaki Ward, Kawasaki City, in April 2021 and Toshima Ward, Tokyo, and Hino City,Tokyo, and Ebina City, Kanagawa Prefecture, in June 2021.5)Launch of Sale of Permanent Use Rights and Management of ColumbariumWe acquired Ryomon Co., Ltd., which is a company engaged in management of urban columbarium in Minato Ward,Tokyo, in October 2020 to solve issues in modern society, such as a shortage of burial grounds due to a largenumber of deaths resulting from aging population, the situation in which there will be nobody to look after gravesdue to small families with fewer children, and particularly the situation in which having a grave in central Tokyo isextremely difficult. We launched sale of permanent use rights of the columbarium in March 2021.6)Status of ESG InitiativesWe have set “Address social issues through promotion of ESG initiatives” as one of our key management strategies.1. Environment (E)・EcoAction 21 CertificationIn May 2020, ES-CON JAPAN acquired EcoAction 21 Certification, a Japanese environmental managementsystem (EMS) established by the Ministry of the Environment. EcoAction 21 is an EMS for proactive, effectiveenvironmental management including reduction of CO2 emissions, and EMS activities aim for continuous effortsbased on the PDCA cycle. By continuing to conduct environmentally friendly management through EcoAction 21initiatives, companies are expected to fulfill their social responsibility to reduce environmental burden while suchactivities also bring benefits to management, such as cost reduction and improved productivity, and contribute tothe enhancement of corporate value.・Green BuildingIn July 2020, “tonarie Yamato-Takada” and “tonarie Toga-Mikita,” which are commercial facilities owned byESCON JAPAN REIT Investment Corporation (hereinafter “EJR”), obtained DBJ Green Building Certification (acertification system created by Development Bank of Japan Inc. (hereinafter “DBJ”) in April 2011 to support realestate properties with environmental and social awareness (“Green Buildings”)) from DBJ. These were followedalso by “tonarie Minamisenri” and “tonarie Seiwadai” in February 2021 and commercial facility “Asumigaoka BrandNew Mall” in July 2021. There are currently five properties that have acquired the certification.・“Rank S” Certification for CASBEE for Real EstateIn July 2020, “tonarie Fujimino,” a commercial facility owned by ES-CON JAPAN, obtained “Rank S,” the highestrank of the Certification for CASBEE(*1) for Real Estate from a CASBEE accreditation body authorized by theInstitute for Building Environment and Energy Conservation.*1CASBEE (Comprehensive Assessment System for Built Environment Efficiency) is a system to comprehensively assess thequality of a building, which evaluates and ranks the environmental performance of the building by taking into account not onlyenvironmental considerations such as energy savings and use of environmentally friendly materials, but also comfort in thebuilding and its visual impact on the area.・ZEH BuilderIn November 2020, ES-CON Home Co., Ltd. and ES-CON Craft Co., Ltd., which are consolidated subsidiaries ofES-CON JAPAN, were registered for ZEH(*2) Builder Certification.*2ZEH (Net Zero Energy House) is a house aiming to make the annual primary energy consumption zero by introducing renewableenergy after realizing significant conservation of energy while maintaining the quality of the indoor environment with significantimprovement in the thermal insulation performance of the outer building skin as well as the introduction of a highly efficientequipment system.- 5 -

・Received Award for Excellence in the Environmental Human Resource Development Corporate AwardsIn March 2021, we received the Award for Excellence in the Environmental Human Resource DevelopmentCorporate Awards 2020 (recognizing companies leading the way in developing environment-related humanresources) hosted by the Ministry of the Environment and the Environmental Consortium for LeadershipDevelopment (EcoLeaD). The Awards were created in a fiscal 2014 project by the Ministry of the Environmentwith an aim to encourage Japanese companies to engage in and train human resources for environmentallyfriendly business management and increase the number of companies contributing to comprehensiveimprovement of the environment, economy and society, considering the situation where efforts toward asustainable society have become essential.・Construction and Operation of “Techno Farm Fukuroi,” a Vertical Farm Utilizing Fully Artificial LightAs mentioned above, we plan to start construction of Techno Farm Fukuroi, which will be the world’s largestvertical farm utilizing fully artificial light and capable of producing 10 tons of lettuce per day. We will make effortsto realize efficient and stable production of “safe and clean” lettuce in collaboration with Chubu Electric Powerand Spread. The three companies will solve issues in food and agricultural fields through the plant factorybusiness as well as contribute to the realization of a sustainable and livable society and the achievement of SDGsby making efforts towards decarbonization such as the proactive use of green energy and effective use of CO2 inthe process of cultivation.2. Social (S)・Contributing to HealthcareWe have been providing monetary donations since 2020 to Kyoto University’s “iPS Cell Research Fund” to supportactivities realizing provision of early and inexpensive treatment using iPS cells for people suffering from diseasesand accidents.We have also been providing monetary donations since 2019 to Osaka University’s Graduate School of Medicineas support for clinical trials of cancer vaccines showing promise for the treatment of cancer.・Contribution to sports promotionIn April 2021, we invested in Ryukyu Football Club Co., Ltd. (hereinafter “Ryukyu FC”) which operates FC Ryukyu,a professional soccer team. With this investment, we will contribute to the local community through sportspromotion by securing a foothold for the creation of business opportunities in Okinawa as well as supportingRyukyu FC ‘s regional revitalization activities in Okinawa Prefecture.3. Governance (G)・Establishment of Voluntary Committee on Nomination and Remuneration of DirectorsIn January 2020, we established the “Nomination and Remuneration Advisory Committee” with an aim tostrengthen the independence and objectivity of functions as well as the accountability of the board of directorswith regard to nomination and remuneration of directors and other matters.・Nurturing SuccessorsWe also launched initiatives for a succession plan called the candidate successor system. In January 2021, wenewly appointed seven employed executive officers.・Diversity of the Board of DirectorsIn order to secure diversity of the board of directors, two independent directors were appointed at the 26th RegularGeneral Meeting of Shareholders held on March 26, 2021, and the number of independent directors increased tofour. In addition to the traditional certified public accountant, tax accountant and lawyer, a director experienced incorporate management and a female independent director who is also a securities analyst have been newlyadded for a diverse board composition.In addition, the skills matrix for directors is disclosed in the corporate governance report.4. OtherIn March 2020 and December 2020, we procured funds through “ESG/SDG assessment-based loans” providedby Sumitomo Mitsui Banking Corporation. Deemed to be “implementing good ESG and SDG initiatives andinformation disclosure,” each earned an overall ranking that is the third-best ranking out of seven. Combined, 6.5billion yen was procured for two projects.- 6 -

We have been participating in GRESB, which is an annual benchmark assessment measuring ESG considerationin the real estate sector, every year since 2018 with an aim to continuously improve the assessment results. Asa result, in November 2020, our rating improved to “3 Stars” from “2 Stars” in 2019 for the first time in GRESBRating, which is a five-grade evaluation system that reflects the applicant’s relative evaluation based on totalGRESB Score, for efforts on environmental consideration and sustainability in the “Development Benchmark.” Inaddition, we acquired “Green Star(*3)” rating by receiving high marks in both “Management Component” and“Development Component” for two consecutive years.*3”Green Star” in the “Development Benchmark” is given to participants whose score is 50% or more in the absolute assessmentbased on the two main points which are “Management Component” and “Development Component.”7)Business Development by SegmentIn the real estate sales business, our core business, we conducted revenue-generating real estate sales, etc., inaddition to achieving progress in condominium sales.In the condominium sales business, we commenced selling new sales projects, including “Le JADE IbarakiHigashichujyo” (Ibaraki City, Osaka Prefecture; 40 units in total), “Le JADE Urawa” (Urawa Ward, Saitama City; 44units in total), “Le JADE Kakegawa Ekimae” (Kakegawa City, Shizuoka Prefecture; 83 units in total), “Le JADE GifuKoganekoen” (Gifu City, Gifu Prefecture; 38 units in total) and “Le JADE Kyoto Horikawa” (Shimogyo Ward, KyotoCity; 60 units in total). “Le JADE Nagaikoendori” (Sumiyoshi Ward, Osaka City; 108 units in total) and “Le JADEHirano” (Hirano Ward, Osaka City; 58 units in total) are contracted to sell out.In the Kyushu area and Hokkaido area as well, we acquired land

(Japanese GAAP) (Consolidated) July 29, 2021 Name of listed company: ES-CON JAPAN Ltd. Listing exchange: Tokyo Stock Exchange . In the first two quarters, the Japanese economy is still in a harsh situation as the spread of COVID-19 infection cannot be contained. The outlook is unforeseeable, although the economy is expected to recover due to .

![CONSOLIDATED EARNINGS REPORT FOR FISCAL 2020 [Japanese GAAP]](/img/28/12517813990599999999-dec450c5-8652-4f54-8376-7abc1527dd0b.jpg)

![Consolidated Earnings Report for Fiscal 2022 [Japanese GAAP] April 27, 2022](/img/28/2022042707085820596416576268ec0ae8d57.jpg)