Transcription

Item: 11a suppMeeting Date: September 28,20212022 Central ServicesPreliminary Budget BriefingDate: September 28, 2021

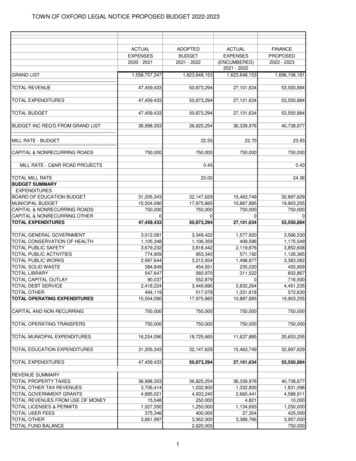

Outline for the Presentation Strategy to Budget Process2022 Budget Guiding Principles and Strategy2022 Budget Target and Approach2022 New Budget Requests2022 Proposed Operating Budget5 Year CIP (2022 – 2026)2022 Preliminary Portwide BudgetRemaining 2022 Budget ScheduleAppendix2

2022 Budget Timeline2022 BusinessPlan and CIPDevelopment2022 BudgetDevelopmentBudget BriefingsFirst Reading &Public Hearing for2022 Budget2nd Reading &Final Passage of2022 )(Late November)3

Strategy to Budget ProcessCentury WOT5- 10 YearsGapObjectives & KPIs3–5Years2022 Business Plan2022 Budget2022 Performance PlansAnnual4

Century Agenda Drives Port Priorities and Budgets Position the Puget Sound Region as a Premier International Logistics HubAdvance this Region as a Leading TourismDestination and Business GatewayResponsibly Invest in the Economic Growthof the Region and all its CommunitiesBe the Greenest and Most Energy EfficientPort in North AmericaBecome a Model for Equity, Diversity andInclusionBe a Highly Effective Public Agency

SWOT AnalysisIn 2020, the Port began assessing the overall health of the organization andoverall strategic planning priorities through a Port-wide SWOT analysis.Each Operating Division, COE and Central Services Department submits itsreview of current Strengths, Weaknesses, Opportunities and Threats.They are then synthesized into a high-level, comprehensive snapshot of thefactors that will drive strategic planning and resource allocation for theorganization.6

2021 SWOT Analyses are an important factor in2022 Strategic Budget Requests an allocationsThe Port-wide SWOTs conducted at the beginning of business planning are usedto directly inform strategic goal setting and requests for additional resources.Each division has used its own SWOT analysis to inform funding requests andchanges.Below are a few examples of SWOT results and their budget implications:SWOT Analyses ResultsBudget RequestStaff is overworked and under resourcedNeed to unfreeze positions and add FTEsInequitable economic recoveryInvestments SKFC/workforce development requestsProperties not designed for customer needs orvolumesCapitol Improvement Program requires significant resourcesCyber Security risks grew exponentially during COVIDAdditional funding for protection against cyber threat may be required.7

Port-wide SWOT SummaryStrengthsWeaknessesOpportunitiesThreatsPort has an adaptable knowledgeable workforce Knowledgeable, highly-trained, specialized staffOur diverse portfolio of assets and essential businesses SEA hub airlines are recovering well post-COVID; diversevaluable facilitiesRelationships, Reputation & Community Support Positive reputation, partnerships, relationshipsAdaptability Internal processes adapted quickly and effectively topandemicLeverage innovation to improve productivity & cust. exp. Comms/banking tech and automationCruise Rebound of a more sustainable cruise industry Develop cruise terminal into multi-use facilityCOVID regional recovery has opened new doors More competitive construction costs; Increased realestate investmentTelework opens new strategic possibilities Reduced commute time, emissions, costs to the PortStaffing Challenges Multiple vacancies, staff capacity at its limitCompeting Priorities/Inefficient processes Lack of capacity for new projects and maintain existing Complex processes hinders external partnershipDecreased/Uncertain Capital Capacity Lower debt svc coverage, cash balance, capital capacityFacility/Business growth capacity is diminishing SEA and MT properties not designed for customer needsor volumesStaff, the Port’s greatest asset, is under resourced Aging workforce, unexpected attrition, inability to hireUncertain Costs and Revenue Projections Ongoing COVID related uncertainty, slower rebound ofcruise/travel industry, inequitable economic recoveryClimate Change moves inexorably forward Impact on fisheries from sea temperature changes andacidificationCyber Security must be a priority Cyber attacks are increasing; the port is more vulnerable8

2022 Budget Guiding Principles Continue to focus on the health and safety of employees, customers andthe public with increased utilization of Port facilities Ensure the efficient operation of Port business gateways as businessvolumes recover Support regional equitable economic recovery through advancing thePort’s capital improvement plan and continued investment in communityprograms Assess the longer-term effects of COVID-19 on Port operations and facilityneeds Invest in employee development, retention, and recruitment Need to be adaptable and flexible to the changing business environment9

2022 Budget Strategies Maintain expense growth in line with projected revenuegrowth Reassess staffing needs considering projected increases inbusiness activity Restore merit pay increases for non-represented staff andincrease expenditures for training and development Begin to incorporate an equity lens in developing andreviewing budgets and operational plans10

Budget Context The Port is on the path to recovery, but much uncertainty remainsgiven COVID variants and lagging vaccination rates Resources have been severely constrained over the past two years;Central Services departments direct support business units and costsare not driven by business volumes Major budget drivers include the following:––––Support a regional equitable recoveryEffectively operate the Port’s business gatewaysSupport the Port’s large and growing capital programInvest in employees through restoring pay increases and employeeenrichment programs– Support organizational effectiveness and division objectives includingenvironmental sustainability and customer experience11

2022 Non-Payroll Budget Targets Baseline Target: 75% of the 2020 Approved Budget for most nonpayroll accounts (with exceptions for specific non-discretionaryitems)Key exceptions: Property Rentals, Insurance, Utilities, and TelecommunicationsWorker’s CompensationContracted services including software licenses/maintenance,equipment maintenanceTravel & Other Employee Expenses – Some discretion betweenTravel and Training12

Baseline Budget Increase Drivers Payroll Increases– 6.0% average Pay for Performance increase for non-representedemployees– Increase for represented groups based on contracts– Approved 15 new mid-year FTEs, 5 unfrozen FTEs, and 1 overlap FTE Non-discretionary contractual and other increases Port wide employee enrichment programs– Reinstatement of funds for Tuition Reimbursement Program andemployee/retiree recognition– Teleworking equipment reimbursement13

2022 Budget Target Approach Approach distinguishes between Core Central Services (primarilyadministrative support functions) and Police, Engineering and PortConstruction Services, which have different cost drivers Core Central Services budget target started with the 2020 ApprovedBudget (adjusted for one-time items), which was inflated by 3% peryear to 2022 or 6.1% compounded increase above 2020 approvedbudget The difference between this amount and the 2022 Baseline budgetcreated an amount available to fund new requests The Police budget was separately reviewed by operating divisions todetermine agreed-upon service levels14

2022 New Budget Requests SummaryExpense ItemsNumberAmount (in 000's)Number of 6733.839.072.824.834.058.815

Proposed New FTEs DetailsCategoryDescriptionRegional Equitable Recovery6 New: Apprentices (4); Contract Administrator, Service Agreements (2)6.0Business Gateways4 New: Traffic Support Specialist (4)Unfreeze 0.8: Customer Research Field Worker6 New: Assistant Manager Field Operations; Buyer II (2); Contract Administrator 5;Senior Construction Manager; Structure Engineer IIIUnfreeze 11: Construction Inspector II (4); Assist. Resident Eng (2); Project Assistant;Eng. Technician; Mechanical Eng III; Sr. Design Architect; Civil Eng II11 New: Info Sec Compliance and Risk Manager; Information Security SrEngineer/Analyst; Health & Safety Program Manager; Police officer (6); CrisisCoordinator; Seaport Patrol OfficerUnfreeze 6: Police Officer (4); Police Specialist; Police/Fire Comm Specialist7 New: Investigation Specialist; Bus. Analyst; Sustainability Analyst for GHG emissionsinventory; Env. Innovation and Performance Communications; Buyer III-P-Card; Sr.Treasury Analyst; Sr. FRC AnalystUnfreeze 7: Creative Services Manager; Employee Relations Consultant; TalentAcquisition Representative; Workers Compensation Claims Assistant;Test Engineer;System Engineer; Desktop Engineer4.8Capital ProgramSafety & SecurityOrganizational Effectiveness andDivision PrioritiesTotalTotal17.017.014.058.816

2022 Central Services Proposed FTEs SummaryDescriptionFTEs2021 Approved Budget845.5Changes in 2021:Mid-Year ApprovalsEliminatedTransfer2021 Baseline15.00.00.0860.52022 Budget Changes:TransferEliminatedNew FTEs ApprovedNet Change0.0-8.734.025.32022 Proposed FTEs885.8Frozen FTEs SummaryFrozen FTEs as of Jan 2021Mid-Yr Exemptions from HF2022 Apprv'd to UnfreezeFrzn FTEs to be eliminatedTTL remaining Fzn FTEs43.8-5.0-24.8-4.010.0NotesPCS (1), Legal (1), CPO (5), HR (3), OEDI (1), Eng (2), AFR (1), Ext Rel (1); excludes overlap in LegalF&B(.63), OSI (2), Ext. Rel (2), HS Interns (restructured prgm) Ext Relations (2), OSI (2)Original request 72.8 FTEs(39 New & 33.8 Frzn)Approved 58.8 FTEs (34New & 24.8 Frzn)10.0 Frzn FTEs remain for202217

Major Non-Payroll Budget Additions Summary Computer Refresh Increase: 500KOutside Legal Contract Increase: 500KSea Tac Court Service Agreement: 445KResiliency Initiative: 250KAnalytics Automation, SAAS Migration and P69 Surface Hubs 373KScope 3 Emissions: 200KImplementation of Police Assessment Recommendations: 150KAnnual cloud services for Body Worn Camera: 145KInformation Security: 128KSouth King County Fund Community Capacity Building Contract: 125KEast King County Work Locations and Conferencing Privileges: 100K18

Central Services Preliminary Budget Highlights Total operating expense is 140.3M, 6.0M or 4.5% highercompared to the 2020 Approved Budget– Payroll budget increase by 5.6M or 4.5% due to: 6% average pay increase (for both represented and non-represented employees) 15 mid-year approvals and 5 unfrozen FTEs 34 new and 24.8 unfrozen FTEs– Non-payroll reduced by 1.6M or 3.4% mainly due to: Lower on-site consultant costs, travel and other employee exp. Partially offset by higher Insurance Exp, Worker’s Comp, and PC Refresh19

2022 Preliminary Expense Budget Summary(in 000's)Core Central ServicesPolice DepartmentEngineeringPort Construction ServicesTotal Central Services201920202021Actual *BudgetBudget2022ProposedBudgetInc/(Dec)Change from 2020 1%(15.3%)30.9%4.5%* The 2019 actual included a 8.3M DRS pension credit.20

Central Services Preliminary Budget by Account2019DESCRIPTION (in 000's)TOTAL OPERATING REVENUEOPERATING EXPENSESalaries & BenefitsWages & BenefitsPayroll to Cap/Govt/Envrs ProjTOTAL SALARIES & BENEFITSEquipment ExpenseUtilitiesSupplies & StockOutside ServicesTravel & Other Employee ExpsPromotional ExpensesTelecommunicationsProperty RentalsWorker's Compensation ExpenseGeneral ExpensesOverhead AllocationsTOTAL NON-PAYROLL EXPENSES20202021Actual hange from 2020 3090417551(25)(1,605)Notes366.0%7.4% 6% PfP increase and new/unfrozen (28.8%)4.4%7.5%111.2%19.4%(100.0%)(3.4%)Increase in PC refreshReduced On-site Consultant costsIncrease rent in STOC leaseIncrease in Worker's CompensationIncrease in Insurance expensesTOTAL COSTS BEFORE CAPITAL s to Cap/Govt/Envrs ) Less Charges to Capital than 2020 budgetTOTAL OPERATING EXPENSE113,891134,279123,194140,2565,9774.5%* The 2019 actual included a 8.3M DRS pension credit.21

Risks/Issues Continued uncertainty regarding path of recovery. If recoverystalls and revenues fall short of budget, expense and othercuts may be required as in 2020/21 Ability to execute on a growing number of programs andinitiatives Ability to hire large number of new staff in addition to normalturnover—5% vacancy rate assumed in budget22

Central Services CIPSeptember 28, 202123

Central Services Capital Projects Summary2022-2026TotalFive Year Capital Plan ( 000's) *20222023Commission Authorized ProjectsProjects Pending AuthorizationSmall CapitalCIP Cashflow Management 202420252026* Excludes ICT projects budgeted within operating divisions as well as ICT portions of PMG led projects.24

Commission Authorized ProjectsFive Year Capital Plan ( n Authorized ProjectsPOS Offices Wi-FiPhone SystemEnvironmental Mgmt Info 1,0004003,700* N New System or Function U System Upgrades or Replacements25

Projects Pending AuthorizationFive Year Capital Plan ( 000's)*202220232024202520262022-2026TotalProjects Pending AuthorizationIT Renewal/ReplacementPublic Safety Dispatch SystemMicrowave Radio Tower LoopEnterprise Network RefreshSTIA Network RedundancyContract Management System ReplacementID Badge System UpgradeConference Room CommunicationsPolice - Bomb Disposal Robot AcquisitionEnvironmental Remediation 1,0001,00015,71026

Small Capital ProjectsFive Year Capital Plan ( 000's)Small y logy Business Applications1,5001,5001,5001,5001,5007,500CDD Fleet Replacement1,4657859704501153,785Corporate Fleet Replacement6457137257487663,597Enterprise GIS Small Capital2502502502502501,250Engineering Small Cap3941821252301251,056Corporate Small 25,188(3,900)(3,125)2,3422,3422,342Total - Small CapitalCIP Cashflow Management ReserveCIP Reserve - Central Services-27

Portwide RollupSeptember 28, 202128

2022 Preliminary Portwide Budget(in 000's)Operating Revenues (Subclass)AeronauticalNon-Aeronautical RevAviationMaritimeEDDJoint VentureStormwater UtilityCentral ServicesPortwide getInc/(Dec)Change from 2020 .0%-4.0%Operating Expenses (Subclass)AviationMaritimeEDDJoint VentureStormwater UtilityCentral 73128,5965.6%6.3%-3.7%84.6%14.3%95.1%6.1%Net Operating Income (NOI)322,474341,847257,448280,490-61,357-17.9%29

2022 Community ProgramsProgram (in 000)1) Airport Community Ecology (ACE) Fund2) Duwamish Valley Community Equity Program3) South King County Support Program4) EDD Partnership Grants5) City of SeaTac Community Relief6) Airport Spotlight Ad Program7) Energy & Sustainability Fund8) Maritime Blue (formerly Maritime Innovation Center)9) Tourism Marketing Support Program10) Workforce Development1a. Opportunity Youth Initiative (OYI)11) Diversity in Contractinga. Small Bus. Accelarator (DIC) under SKCF12) High School Internship Program13) Equity, Diversity & Inclusion14) Sustainable Aviation Fuels & Air Emissions Program15) Low Carbon Fuel Standard/GHG Reduction Effort Support16) Orca Recovery ProgramTOTAL20222021 2021 Q2 81502,4813871,6752,6827443,140% of the20222022ProposedProposedBudgetBudgetFunded by Funded bythe levythe 08,049100%0%0%100%0%100%55%Note:1 2.0M budget for OYI was added for 2021 in May 2021.30

Remaining 2022 Budget Schedule Operating division budgets briefing (10/12)2022 Preliminary Budget Document Available to the Commission (10/19)2022 Preliminary Budget Document Available to the Public (10/21)2022 Tax Levy & Draft Plan of Finance Commission Briefing (10/26)Introduction and Public Hearing of the 2022 Budget (11/9)Commission Approval of the 2022 ILA between POS and the NWSA (11/9)NWSA Budget Adoption by Managing Members (11/9)Adoption of the 2022 Budget (11/16)Filing of 2022 Statutory Budget with King County Council & Assessor (12/1)Release of 2022 Budget to the Public (12/15)31

Appendix32

2022 New Budget Requests by Dept2022 New Budget Requests (in 000s)Commission OfficeExecutive OfficeLegalExternal RelationsOEDIBIHRICTInfo SecAFRInternal AuditsF&BOSIENV AdminCPOCore Central Support ServicesRequest O&MAmount 54011,91533

2022 Preliminary Budget Summary(in 000's)201920202021Actual *BudgetBudget2022ProposedBudgetInc/(Dec)Change from 2020 %Total Payroll Costs (with Capital)Total Non-Payroll Costs (with Capital)Total Costs (with 3,9564.5%-3.4%2.3%Sal/Wage-Cap/Govt/Envrs ProjCap/Govt/Envrs Projects OHOnsiteConsult-Cap/Gov/Env ProjTotal Charges to 123,194140,2565,9774.5%Total Payroll ExpensesNon-Payroll O&M ExpenseTotal O&M Expenses* The 2019 actual included a 8.3M DRS pension credit.34

Central Services Preliminary Budget by Dept2019Departments (in 000's)O1100-ExecutiveO1200-Commission OfficeO1310-LegalO1330-Risk ServicesO1400-External RelationsO1460-Equity, Diversity and InclusionO1500-Business IntelligenceO1600-EngineeringO1700-Port Construction ServicesO1800-Human ResourcesO1810-Labor RelationsO1900-Information & Comm. TechnologyO1980-Information SecurityO2100-Finance & BudgetO2200-Accounting/Financial ReportingO2280-Internal AuditO2400-Offic of Strategic InitiativesO2700-Environment & SustainabilityO2900-Corporate ContingenciesO4300-Police DepartmentO9200-Central Procurement OfficeTOTAL OPERATING EXPENSE *Actual 6Inc/(Dec)Change from 2020 %NotesApproved mid-year new FTE in 2021Increase in Outside Legal expense and new FTEIncrease in Insurance expense and unfrozen FTEsReduced outside servicesFrozen FTEReduced On-site consultant costAdded new FTE and less charges to capitalNew and unfrozen FTEsNew/unfrozen FTEs, PC Refresh, Resilient InitiativeIncrease budget for cyber securityAdded a new FTEAdded new FTEsAdded a new consultant contract for IAF auditOne-time item in the 2020 budgetIncrease in outside consultant servicesIncrease vacancy factor from 3% to 4%COLA increase and new/unfrozen FTEsNew and unfrozen FTEs* The 2019 actual included a 8.3M DRS pension credit.35

Approved FTEs New and Unfrozen36

Approved FTEs New and Unfrozen cont’d.37

Approved FTEs New and Unfrozen cont’d.38

Unfrozen FTE Details Engineering-4 Construction Inspector II, 2 Assistant Resident Engineer, ProjectAssistant, Waterfront, Engineering Technician, Mechanical Engineer III, SeniorDesign Architect, and Civil Engineer II (11.0 FTEs)Police-4 Police Officer, Police Specialist, and Police/Fire Comm Spec (6.0 FTEs)Human Resources-Employee Relations Consultant, Talent AcquisitionRepresentative, and Workers Compensation Claims Assistant- (3.0 FTEs)Information & Communications Technology-Test Engineer, System Engineer, andDesktop Engineer (3.0 FTEs)External Relations-Creative Services Manager (1.0 FTE)Business Intelligence-Customer Research Field Worker (.75 FTE)39

Proposed New FTEs Details Police-6 Police Officers, Seaport patrol officer, Crisis Coordinator, and 4 Traffic SupportSpecialist (12.0 FTEs)Central Procurement Office-2 Buyer II, Buyer III P-Card Administrator, 2 CA5 for ServiceAgreements, and CA5 for Construction (6.0 FTEs)OEDI/Workforce Development-4 Apprentices (4.0 FTEs)Engineering-Sr. Construction Manager & Design and Structure Engineer III (2.0 FTEs)Environmental & Sustainability-Environmental Innovation and PerformanceCommunications & Sustainability Analyst for Greenhouse Gas emissions inventory (2.0 FTEs)Information Security-Compliance and Risk Manager and Sr Engineer/Analyst (2.0 FTEs)Legal-Investigation Specialist (1.0 FTE)Human Resources-Health & Safety Program Manager – Fall Protection (1.0 FTE)Port Construction Services-Assistant Manager Field Operations (1.0 FTE)Information & Communications Technology-Business Analyst (1.0 FTE)Finance & Budget-Sr. Treasury Analyst-replace LTD (1.0 FTE)Accounting & Financial Reporting-Sr. FRC Analyst (1.0 FTE)40

List of remaining Frozen FTEs in 2022DeptPos IDPosition TitleFTECommission OfficeExternal RelationsOffice of Equity, Diversity and InclusionBusiness IntelligenceHuman ResourcesInformation & Communication 65500005984000059860000337500005972FZN21-Bdgtd20 Wrting Comm SpecFZN21-Sr Admin AssistantFZN21-EDI AV Program MgrFZN21-Principal BI Data EngineerFZN21-Bdgtd 20 Talent Dev SpecFZN21-Sr Windows Server EngFZN21-Lead Software DeveloperFZN21-Web CoordinatorFZN21-Sr Internal AuditorFZN21-Bdgtd 20 Admin l AuditPort Construction ServicesTotal41

Telework opens new strategic possibilities Reduced commute time, emissions, costs to the Port . . Workers Compensation Claims Assistant;Test Engineer; System Engineer; Desktop Engineer. Total 58.8 4.8 17.0 14.0 . Worker's Comp, and PC Refresh . 19. 2022 Preliminary Expense Budget Summary. 20. 2019 2020 2021 2022