Transcription

07/19TRANSAMERICA PROVIDER SELECT SMHOSPITAL INDEMNITY INSURANCETransamerica Provider Select, underwritten byTransamerica Life Insurance Company, is extraprotection when you need care.POLICY HIGHLIGHTSA young working mother, Talia, needs to stay healthy to help support her family.Unexpectedly, she develops a cough that turns into pneumonia, and she ends upin the hospital. Requires no physicalsor blood work¹ There’s no waiting periodSince she had signed up for her employer’s hospital indemnity insurance, whichprovides cash benefits for policy-specified hospital care, she was able to gettwice the benefits by using her employer's designated facilities. Individual and family optionsare available There are no co-pays,co-insurance, or deductibles Deduct premiums from payrollYOUR HEALTH CARE YOUR WAYWith Transamerica Provider Select, you can choose any facility for health services.However, if you select care through your employer's designated facilities, you receivetwice the hospital indemnity insurance benefits.Use your benefits for anything you choose, deductibles and co-pays, or even yourcar payment, rent, or childcare — costs that might add up while you’re out of work.There’s no ID card required, and we pay benefits directly to you unless you assignthem to your healthcare provider.The base policy is a daily in-hospital indemnity benefit that pays a specified amountfor each day you are confined to the hospital as the result of a covered accidentor illness. The policy: Visit:transamerica.comCustomer Service:888-763-7474Provides twice the benefits for using your employer's designated facilitiesOffers benefits for full-time, part-time, hourly, seasonal, and temporaryworkers (and eligible family members)Requires no co-insurance, co-pays, deductibles, or waiting periodsPays benefits in addition to other insurance you may haveQUALIFY EASILY WITH BROAD ELIGIBILITYThis policy is available to individuals, single-parent families, individuals with spouses or another adult dependent, and families.(children under age 26 can be insured). There is no maximum issue age for employees and their adult dependents, includingcommon-law marriage partners, domestic partners, or civil union partners.¹There are no physical exams required. We base your acceptance on the information on your application.THIS IS NOT MAJOR MEDICAL INSURANCE AND IS NOT A SUBSTITUTE FOR MAJOR MEDICAL INSURANCE. IT DOES NOT QUALIFYAS MINIMUM ESSENTIAL HEALTH COVERAGE UNDER THE FEDERAL AFFORDABLE CARE ACT.This is a brief summary of Transamerica Provider Select SM Limited Group Hospital Indemnity Insurance, underwritten by Transamerica LifeInsurance Company, Cedar Rapids, Iowa. Policy Form Series CGPHI600 and CCGHI600 or CPGHI700 and CCGHI700.Forms and form numbers may vary. This insurance may not be available in all jurisdictions. Limitations and exclusions apply. Refer to the policyand riders for complete details.Up-to-date information regarding our compensation practices can be found in the Disclosures section of our website at tebcs.com.121802

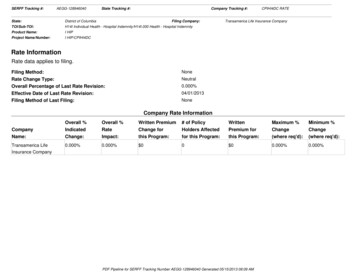

Product DetailsThe following benefits are included in the policy quoted. Unless otherwise noted, all benefits and maximums are per insured person.Daily In-Hospital BenefitDaily In-Hospital Indemnity Policy (CPGHI700)Plan Option 1Plan Option 2Pays each day an insured is confined to a hospital (but not for an emergency room stay, outpatient stay or stay in an observation unit) as the result ofa covered accident or sickness.Benefit per day when confined to a designated facilityCalendar year maximum when confined to a designated facility 100.00 200.0031 days per Confinement31 days per Confinement 50.00 100.0031 days per confinement31 days per confinementBenefit per day when confined to a non-designated facilityCalendar year maximum when confined to a non-designated facilityAdditional Benefits Included:Hospital Confinement Indemnity Benefit Rider (Rider Form Series CRHA0700)Pays each day an insured is confined to a hospital (but not for an emergency room stay, outpatient stay or stay in an observation unit) as the resultof a covered accident or sickness lasting a minimum of 24 continuous hours from time of admission.Benefit per day when confined to a designated facility 1000.00 2000.00Benefit per day when confined to a non-designated facility 500.00 1000.00Calendar Year Maximum 1 day(s) per calendar year1 day(s) per calendar yearIntensive Care Indemnity Benefit Rider (Rider Form Series CRCIC700)Pays each day an insured is confined to an intensive care unit as the result of a covered accident or sickness.Benefit per day when confined to a designated facility 100.00 200.00Benefit per day when confined to a non-designated facility 50.00 100.00Calendar Year Maximum10 Days10 DaysPlan Option 1AgeAll AgesEmployee 18.65Monthly PremiumEmployee and SpouseEmployee and Child 39.72 27.40Ver 1.L5.0.00Family 45.01*The illustrated rates DO NOT contain a pre-existing condition limitation.The above rates are quoted for this group with 5263 eligible lives.Should this plan design sell and the submitted group size is different, rates may be different.Plan Option 2Monthly PremiumAgeAll AgesEmployee 36.28Employee and Spouse 78.41Employee and Child 53.76Ver 1.L5.0.00Family 89.01*The illustrated rates DO NOT contain a pre-existing condition limitation.The above rates are quoted for this group with 5263 eligible lives.Should this plan design sell and the submitted group size is different, rates may be different.When groups are eligible to offer 2 plan designs to employees in a group, the premium for the "high" (more expensive) plan cannot be more than50% greater than the premium for the "low" (less expensive) plan. When groups are eligible to offer 3 plan designs, the premium for the middleplan cannot be more than 50% greater than the low plan, and the premium for the high plan cannot be more than 50% greater than the middle plan.THIS IS NOT MAJOR MEDICAL INSURANCE AND IS NOT A SUBSTITUTE FOR MAJOR MEDICAL INSURANCE. IT DOES NOT QUALIFY ASMINIMUM ESSENTIAL HEALTH COVERAGE UNDER THE FEDERAL AFFORDABLE CARE ACT.Issue State: OhioRate generation date: June 20, 2018Transamerica Life Insurance Company

Product Details*HSA Compatible - Based on its understanding of available guidance, Transamerica Life Insurance Company views the insurance benefits shown inthis proposal as compatible with High-Deductible Health Plans and Health Savings Accounts. However, there is no guarantee that the relevantauthorities will agree with Transamerica's understanding. Current guidance is not complete and is subject to change. Neither Transamerica nor itsagents or representatives provide legal or tax advice. Accordingly, Transamerica encourages its customers to consult with and rely upon independenttax and legal advisors regarding their particular situations, the use of the products presented here with High-Deductible Health Plans and HealthSavings Accounts, and the persons/dependents that may be insured under such plans and accounts.Issue State: OhioRate generation date: June 20, 2018Transamerica Life Insurance Company

Limitations and ExclusionsConfinement for the same or related condition within 30 days of discharge will be treated as a continuation of the prior confinement. Successiveconfinements separated by more than 30 days will be treated as new and separate confinements.No benefits under this contract will be payable as the result of the following:an insured person's suicide or attempted suicide, while sane or insane.an insured person's intentionally self-inflicted injury.rest care or rehabilitative care and treatment.immunization shots and routine examinations such as: physical examinations, mammograms, Pap smears, immunizations, flexiblesigmoidoscopy, prostate-specific antigen tests and blood screenings.any pregnancy of a dependent child, including confinement rendered to her child after birth.routine newborn care.an insured person's abortion, except for medically necessary abortions performed to save the mother's life.the treatment of: an insured person's mental or emotional disorder; or an insured person's alcoholism or drug addiction.an insured person's participation in a riot, or insurrection.dental care or treatment, except for such care or treatment due to accidental injury to sound natural teeth within 12 months of the accident andexcept for dental care or treatment necessary due to congenital disease or anomaly.any accidental injury caused by the participation in any activity or event, including the operation of a vehicle, while under the influence of acontrolled substance (unless administered by a physician or taken according to the physician's instructions) or while intoxicated (intoxicatedmeans that condition as defined by the law of the jurisdiction in which the accident occurred).an insured person's sex change, reversal of tubal ligation or reversal of vasectomy.artificial insemination, in vitro fertilization, and test tube fertilization, including any related testing, medications or physician's services, unlessrequired by law.committing, attempting to commit, or taking part in a felony or assault, or engaging in an illegal occupation.traveling in or descending from any vehicle or device for aerial navigation, except as a fare-paying passenger in an aircraft operated by acommercial airline (other than a charter airline) on a regularly scheduled passenger trip.any loss incurred while an insured person is on active duty status in the armed forces. (If you notify us of such active duty, we will refund anypremiums paid for any period for which no benefits are provided as a result of this exception.)an accidental injury or sickness arising out of or in the course of any occupation for compensation, wage or profit or for which benefits may bepayable under an Occupational Disease Law or similar law, whether or not application for such benefits has been made.an insured person's involvement in any war or act of war, whether declared or undeclared.hospital confinement of a newborn child following the child's birth, unless the newborn child is being treated for accidental injury or sickness.Termination of InsuranceYour insurance will cease on the earliest of:the date the policy terminates, subject to the portability option;the date you cease to be eligible for insurance;the date of your death;the premium due date on which we fail to receive your premium, subject to the grace period provision; orthe date you send us written notice that you want to cancel insurance.The insurance for a dependent will cease on the earliest of:the date your insurance terminates;the premium due date on which we fail to receive your premium, subject to the grace period provision;the date the dependent child no longer meets the definition of child as set forth in the policy certificate;the date an insured spouse or other adult dependent no longer meets the definition of same;the date the policy is modified so as to exclude a dependent; orthe date you send us written notice that you want to cancel insurance on your dependent.We will have the right to terminate the insurance of any insured who submits a fraudulent claim under the policy.Termination of your insurance will not affect any claim which begins before the date of termination.Transamerica Life Insurance Company

Limitations and ExclusionsPortability OptionIf the employee loses eligibility for any reason other than nonpayment of premiums, the insurance can be continued by paying premiums directly to uswithin 31 days after termination. We will bill the employee directly once we receive notification to continue insurance.If an insured spouse loses insurance because of the insured employee’s death or a valid divorce decree, insurance can be continued by submitting anapplication to continue insurance within 31 days following the entry of a divorce decree or the insured employee’s death and pay the appropriatepremium directly to us. We will bill the surviving or former spouse directly.This Portability Option is only available for the Insured and the Insured's Dependents. It is not available for the Insured's Dependents without theInsured.Transamerica Life Insurance Company

This is a brief summary of Transamerica Provider SelectSM Limited Group Hospital Indemnity Insurance, underwritten by Transamerica Life Insurance Company, Cedar Rapids, Iowa. Policy Form Series CGPHI600 and CCGHI600 or CPGHI700 and CCGHI700. Forms and form numbers may vary. This insurance may not be available in all jurisdictions.