Transcription

R in Finance Conference - ChicagoMay 2016Measuring Income Statement Sharpe Ratios using RMark J. Bennettmjbennett@uchicago.edu

The American football Passing Effiency Ratio provides ananalytical measurement of the success of the quarterbackPssrRtgNCAA (8.4 Yds) (330 TDs) (100 Compl) (200 Intcps)AtmpsIWhile Aaron Rogers was a quarterback in college, playing forthe University of California at Berkeley (”Cal”), he played twoseasonsIIIIII5,469 total passing yards424 completions665 attemptsonly 13 interceptionsa hefty 43 touchdown passesThis yielded, according to our formula above, to a Cal recordcareer passer rating of 150.2 and high QB NFL draft pick

What is one of the most important Financial Ratios?I”Sure returns areimportant”I”But what aboutvolatility?”I”Consistency is the key insports.”I”. and finance”

The Sharpe Ratio (SR) is well known analytical metric tocompare securities. It rewards good Financial Returns andit penalizes Irratic Behavior of those returns.rS E {RP } µfσP

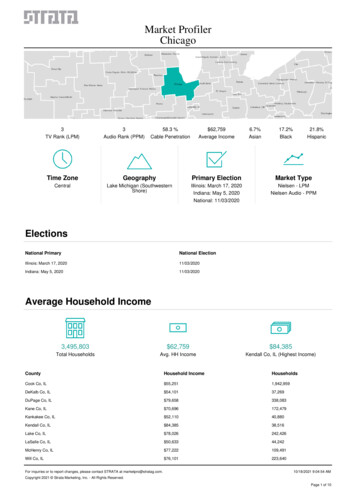

Income statement figures for thousands of stock tickerscan be read via R program using quantmod package2.52.0PCLN1.5PCCCPCARGross PCH1.0Gross Return2.53.0Total Revenue Growth3.0Net Income 51.0PCCCPCTIPCARPDCOPCMIPCTIPCLN1.01.5PCHPCYGGross ReturnPCLN2.03.0Diluted Norm EPS GrowthPDCE2.5Gross Profit GrowthGross .5Years3.03.54.0

The Income Statement Sharpe Ratio (ISSR) can becomputed like Sharpe Ratio of log returns of price historyTotal Revenue Gth SRJKHYROLCASS200200Net Income Gth ENTKKD NRDLXTUJBSSHSNITIFGOOGFTKSMRTLAMRCAKEEVRTGPBRLIGM KWR OMI SSSUNSIPCMRTNUGPINXNJBHTINTUTLFCRWN IDXXCP EGP HRLWSM CHYSHWCSVODCIEXLHTCKSIALOMC SSDAXP CRMMWVWTSMMMESLTTTTCWMSONCGE KMPEMRCEC DPSENRHSTMNTZIBMN PIIALGNMLABMGICSYNTTXRHVSICRI EXR JECBRSEFIIROPPOOLKSUHSICMJNAZOFIS IRMJNJBDXRMTISLGNIMKTARCLMTDBGSBIOZMH CHDN FORRJOUTJW.ASXTSMGHCOMPEPTAIT MFACCUNOCDV FT ASSCLANHEXPE JBLUTMHGGGAOSWRLDFMSUNPPMDDTVEMCANURBNMGRCWSTHCP TRHWCCCPLAOMABMDLZEPR TDORMDFTNMRXAMTDISHGKVASCM NPDNXTM LUVWUASTEDISCIRTUPSTNFEICSBHMXIMGEFRSTNOV REFLCXWHIWDAKTTVCVXGHLFOSLIHSAXLUTXFTR TCAPPYNYMXMILOMEXPCYOOXBTEFCTARO AGEN CREGFLML DFTROP UGPDPZPAYXSSSMRTNEATAXPMKCFLWSUSTRKMPSYY WSMMDTBLL CVSGLDCSTMPZMHAXENPD SWFTJBHT NTRS SIALCSGSVASCKEXENS NA TWMYGN RCII VRNTAMTBYIWX BRCMKELYAEVRFSC KELYBVMWCTCTPAC STJKWRNKEFISVCHRWCNWSYKCAHSXI WYN CASSCHHIILGAZOCHKPEFIIDPS GRAFORRDLXACNBIOFIZZICLRMTD SKMGPIIRMBACBRLCMGLINTBLINTAKOMDCECMINI PLKIEGHTJJSFORANADSIPCMDTVHAINHSNIHOFTXRXPFE STNTSSALB BOOMOMCNDSNKAMNWAGIHSCBLJOUTWATAPOLGSHCTASUTHRROK TLKLLLHCOMEXPEIBMM UGREFRTYGISIS05001000Index1500100SRvecMOCORRGB UNFIMASIIMKTAMSTRTXRHWOOFNUTR GSHW UPSRSCVXEGPSAHHRB MMMPEBWTSTGPWMTWMDEIROL TSSLKQCSXHEIHXLCASSJKHYVFCEAT HDIBM MTDORLYNKEWRLDPHIWSM CHDNPOOLCTSHTTCELPZZADLXMKCMDTRJFCLMMMTRNSCTC FDS TUCRRDW HOGAPEICHEWYNNTRSRSGCHTAMEPAYX MGACHDMOG.AKEXVARNRTSNA UNPUAMSFTNVOROPGEMCKCVSFISVBKECCEMMCHRLGWWPTRM CLNYMRTNR SSL DUNULSORLRANDDKSOFLXADS OBVSNCLNENXTMCIEN ESCOVRLADATMBISCASMREDFTEARKOOLNNTZ ACB 50SRvecSNHMIDD10050VIABVIAPLLTSCOCRM0Earning per Share Gth KE150200POL1500IndexGross Profit Gth SRCNSEPD HOGDGHDCFNBWSUSMOSTRAGTFSCSCCOGMTHEI ULAZO CTCFDSPOOL TXRHMCODVAPDCOMTDGBDCUAZMHROKPAYX SSL UTXHXLKEXTRNSLOMMCRMDDW GPCLLLTHSFASTGOOGLOPETTCTSCOCOLMTXFWRDRANDADP LYMIDDMMM WFT VZNEU SKMALXBCEEAT HON MDTBWS DEIDG150150TECHVSCI05001000Index1500

The 4 ISSRs can be sorted and we can ’cherry pick’ best200All Income Stmt Gth HPOOLWSMAZO HSIC NTRS PAYXSIAL SCTCAMEMTDUAROKPAYXPXUA MDPX ELPXKMPCSX HSICAZO MDPCLNIKNXIKNXPCLNSIALAMEJKHYNTRSPCLN CTCNRTAMEPAYXROKPCPSIALKAMNNRTPCPPX NRTKAMNFDSNTRSNKECTCNKENRTSNAUAUASNA50CSXIKNX EL012345Income Stmt Gth TypeFigure: 33 candidates & ISSRs 1 Income Growth, Net;2 Total RevGrowth; 3 Gross Profit Growth;4 Diluted Norm Earn per Share Growth

The 4 IS RVs can be used as predictors of Up/Down pricebehavior for Long/Short positions with 61% accuracy usingthe party decision tree package in R1dnepsgthp 0.001 1.030.8Node 3 (n 1687)Down 0110.80.60.60.40.40.20.20Up 0Up 0Down 0Node 2 (n 1565) 1.030

Financial Analytics with R: Building a Laptop Laboratoryfor Data ScienceIIIIFrom Cambridge UniversityPress in Fall 2016For professionals andstudents seeking financialanalytics training in datascience.Business, investor, andconsumer-level problemsare attacked with toolsfrom statistics, computerscience and finance.Thousand of lines ofoperational R code areincluded to help the readerbuild their “LaptopLaboratory”

can be read via r program using quantmod package 1.0 1.5 2.0 2.5 3.0 3.5 4.0 0.5 1.0 1.5 2.0 2.5 3.0 net income growth . unf unp unsuntupsuri usna usphuti utx uvvvale var vcovfcvgrvgviv vmwvlovmivpg vrs vshvsi vtr vvivz wabwag wat wbc . dnp dnrdo dov dow dpm dps dpz drc dri drq dst dsw dv dva dw dx dy e eat ebf ebs ec ecl edu efc efx egp el .