Transcription

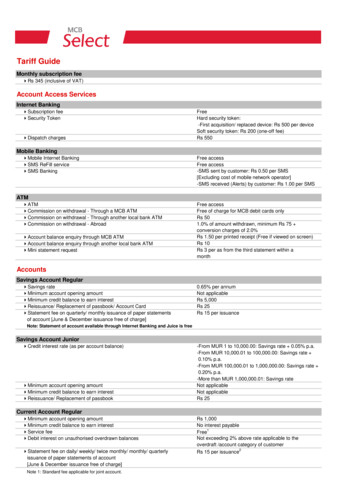

Tariff GuideMonthly subscription fee4Rs 345 (inclusive of VAT)Account Access ServicesInternet Banking4Subscription fee4Security Token4Dispatch chargesFreeHard security token:-First acquisition/ replaced device: Rs 500 per deviceSoft security token: Rs 200 (one-off fee)Rs 550Mobile Banking4Mobile Internet Banking4SMS ReFill service4SMS BankingFree accessFree access-SMS sent by customer: Rs 0.50 per SMS[Excluding cost of mobile network operator]-SMS received (Alerts) by customer: Rs 1.00 per SMSATM4ATM4Commission on withdrawal - Through a MCB ATM4Commission on withdrawal - Through another local bank ATM4Commission on withdrawal - Abroad4Account balance enquiry through MCB ATM4Account balance enquiry through another local bank ATM4Mini statement requestFree accessFree of charge for MCB debit cards onlyRs 501.0% of amount withdrawn, minimum Rs 75 conversion charges of 2.0%Rs 1.50 per printed receipt (Free if viewed on screen)Rs 10Rs 3 per as from the third statement within amonthAccountsSavings Account Regular4Savings rate4Minimum account opening amount4Minimum credit balance to earn interest4Reissuance/ Replacement of passbook/ Account Card4Statement fee on quarterly/ monthly issuance of paper statementsof account [June & December issuance free of charge]0.65% per annumNot applicableRs 5,000Rs 25Rs 15 per issuanceNote: Statement of account available through Internet Banking and Juice is freeSavings Account Junior4Credit interest rate (as per account balance)4Minimum account opening amount4Minimum credit balance to earn interest4Reissuance/ Replacement of passbook-From MUR 1 to 10,000.00: Savings rate 0.05% p.a.-From MUR 10,000.01 to 100,000.00: Savings rate 0.10% p.a.-From MUR 100,000.01 to 1,000,000.00: Savings rate 0.20% p.a.-More than MUR 1,000,000.01: Savings rateNot applicableNot applicableRs 25Current Account Regular4Minimum account opening amount4Minimum credit balance to earn interest4Service fee4Debit interest on unauthorised overdrawn balances4Statement fee on daily/ weekly/ twice monthly/ monthly/ quarterlyissuance of paper statements of account[June & December issuance free of charge]Note 1: Standard fee applicable for joint account.Rs 1,000No interest payableFree1Not exceeding 2% above rate applicable to theoverdraft /account category of customerRs 15 per issuance2

Note 2: Statement of account available through Internet Banking and Juice is free.31 Day Notice Account4Minimum account opening amount4Minimum credit balance to earn interest4Early Withdrawal Fee:100,000 USD/ 100,000 EUR100,000 USD/ 100,000 EUR-For USD accounts: 1 month USD Libor p.a. on thewithdrawn amount calculated for 31 days.-For EUR accounts: 0.40% p.a. on the withdrawnamount calculated for 31 daysForeign Currency Account4Minimum account opening amount4Service fee4Monthly charges on credit balances in account4Cash withdrawal fee4Cash deposit fee4Transfer commission charged on debit transactions (over and abovestandard charges applicable to debit transactions)No minimum required10 USD VAT half yearly, i.e. 11.50 USD half yearlyCHF (Swiss Francs) accounts:-Balance of CHF 100,000 up to 10 million: 0.30% p.a.-Balance greater than CHF 10 million: 0.80% p.a.-In USD notes: 1.0%, min. 10/ max. 100 USD orequivalent-In other currencies: 0.125%, min. 10/ max. 75 USD orequivalentNot applicable0.125%, min. 10/ max. 75 USD or equivalentFixed Deposit Account in local currencyRs 100,0004Minimum deposit amountInterest forfeited4Deposit withdrawn before maturity within 3 months4Deposit withdrawn before maturity after 3 months:Penalty of 1% deposit amount per annum calculated on the period between the pre-termination date and the maturity date.Rates and other fees & charges applicable to Fixed Deposit Account are available at our counters.Fixed Deposit Account in foreign currency4Minimum deposit amount4Deposit withdrawn before maturity5,000 GBP/ USD/ EUR10,000 AUD/ 50,000 ZARPenalty rate of 1.5% p.a. charged on the amount beingredeemed over the period between the date of pretermination and the date of maturity of the depositRates and other fees & charges applicable to Deposit Account are available at our counters.Accounts Transactions or ServicesLocal Funds Transfer Internal Transfer4For credit to a MCB account pertaining to the same customer4For credit to a MCB account not pertaining to the same customerAt CounterRs 251Rs 252On Internet BankingFreeFreeAt CounterRs 50Rs 125On Internet BankingFreeRs 75Note 1: Free of charge for funds transfer between accounts in local currency (MUR)Note 2: A fee of USD 5 is charged in case of a funds transfer between FCY accountsLocal Funds Transfer Domestic Transfer (in local currency only)4For credit to another local bank account - Standard Payment4For credit to another local bank account - Express PaymentNote: -Other fees and charges apply in case of debit of a Foreign Currency Account. More information are available at our counters.-Funds transfer in foreign currencies to another local bank will be treated and charged similarly as an outward SWIFT fundstransfer request.Third Party Wallet/Account4Registration of MCB Account to a Third Party Wallet/AccountFree of charge4Loading of Third Party Wallet/Account through pre-registered MCB Account 0.2%, max Rs 5

International Funds Transfer Inward Transfer4Telegraphic transferRs 100 (Free of charge in case of credit of aForeign Currency Account)International Funds Transfer Outward Transfer4Through SWIFTRequest made over the counter: MUR 400Request made through Internet Banking: MUR 250Note: Excluding Overseas Bank Charges/ Transfer Commission4Investigation chargesRs 300 any other charges as claimed by overseasbanksNote: Other fees and charges apply in case of debit of a Foreign Currency Account. More information are available at our counters.Standing Order4Credited to a MCB account4Credited to another local bank account4Overseas Standing Instruction4Failed Standing OrderFree1Rs 30Rs 100 Overseas Bank ChargesRs 150Note: An additional postage charge may be claimed in case a payment is made under a standing order direct by the bank to a beneficiary residentoutside Mauritius.Note 1: Standard fee applicable for joint account.Direct Debit4In favour of CEB, CWA and Mauritius Telecom (per direct debit)4In favour of other companies (per direct debit)4Failed Direct DebitFree1Free1Rs 150Note 1: Standard fee applicable for joint account.Debit CardMasterCard Debit Card4Annual fee4Replacement fee for lost/ stolen/ damaged card-Standard request-Express request (delivery on same day)4Conversion fee (in case of cross currency transactions)Note: Refer to section 'ATM' for other related charges.FreeFreeFree2.00%MasterCard Platinum Debit Card4Annual fee4Replacement fee for lost/ stolen/ damaged card-Standard request-Express request (delivery on same day)4Conversion fee (in case of cross currency transactions)Note: Refer to section 'ATM' for other related charges.FreeFreeFree2.00%Prepaid CardMCB UPI Prepaid Card/ MCB VISA Prepaid Card4Card Issuance fee-UPI Prepaid Card-VISA Prepaid Card4Loading/ Reloading feeUSD 5 VAT, i.e. USD 5.75CNY 30 VAT, i.e. CNY 34.50USD 5 VAT, i.e. USD 5.75GBP 3 VAT, i.e. GBP 3.45EUR 4 VAT, i.e. EUR 4.60ZAR 55 VAT, i.e. ZAR 63.25MUR 150 VAT, i.e. MUR 172.500.5% of loaded/ reloaded amount with,-minimum of USD 2/ GBP 1.20/ EUR 1.50/ ZAR 20/MUR 60/ CNY 10-maximum of USD 65/ GBP 40/ EUR 50/ ZAR 700/MUR 1,950/ CNY 400

4Loading limits*Applicable if customer opts for a bundle of products4ATM Cash Withdrawal fee-Through MCB ATM-Through other ATM (local & overseas)4Conversion feeFree1.0% of amount withdrawn, minimum Rs 75-UPI Prepaid card: 2%-Visa Prepaid card: 3%Credit CardAnnual Fee4Premium Bundle (American Express Green & VISA Platinum)4American Express Green4American Express Gold4VISA Platinum4VISA Signature4MasterCard/ VISA Classic4MasterCard/ VISA Gold4MasterCard PrimoPrimary CardFreeRs 1,500 VAT, i.e. Rs 1,725Rs 3,000 VAT, i.e. Rs 3,450Rs 1500 VAT, i.e Rs 1,725Rs 2,500 VAT, i.e. Rs 2,875Rs 200 VAT, i.e. Rs 230Rs 950 VAT, i.e. Rs 1,092.50Rs 150 VAT, i.e. Rs 172.504Premium Bundle (American Express Green & VISA Platinum)4American Express Green4American Express Gold4VISA Platinum4VISA Signature4MasterCard/ VISA Classic4MasterCard/ VISA Gold4MasterCard PrimoSecondary CardRs 1,600 VAT, i.e. Rs 1,840Rs 1,000 VAT, i.e. Rs 1,150Rs 2,000 VAT, i.e. Rs 2,300Rs 1000 VAT, i.e Rs 1,150Rs 2,000 VAT, i.e. Rs 2,300Rs 150 VAT, i.e. Rs 172.50Rs 600 VAT, i.e. Rs 690Rs 150 VAT, i.e. Rs 172.50Cash Advance Fee4American Express Green/ Gold & VISA Platinum/ Signature4MasterCard Classic/ Gold/ Primo4VISA Classic/ Gold2% of amount withdrawn, minimum Rs 1002% of amount withdrawn, minimum Rs 502% of amount withdrawn, minimum Rs 50Card Replacement FeeFree4American Express Green/ Gold & VISA Platinum/ SignatureFree4MasterCard/ VISA GoldRs 200 VAT, i.e. Rs 2304MasterCard/ VISA ClassicRs 200 VAT, i.e. Rs 2304MasterCard PrimoRs 200 VAT, i.e. Rs 2304FleetmanNote: Emergency card fee, in case replaced card needs to be delivered urgently abroad, is Rs 2,000 VAT, i.e. Rs 2,300Overlimit FeeRs 2004American Express Green/ Gold & VISA Platinum/ SignatureRs 1504MasterCard Classic/ Gold/ PrimoRs 1504VISA Classic/ GoldNote: Overlimit fee applies when the authorised credit limit has been exceededLate Payment FeeRs 2004American Express Green/ Gold & VISA Platinum/ SignatureRs 1504MasterCard Classic/ Gold/ PrimoRs 1504VISA Classic/ GoldNote: Late payment fee applies when the mandatory minimum payment is not made by the due date

Conversion ChargesVISA credit cardMasterCard credit cardAMEX credit cardNote: Conversion charges apply where transaction currency is not equal to the billing currency.Conversion Fee2.00%2.00%2.00%Administrative Fee4FleetmanRs 40 monthlyInterest Rates4MCB Prime Lending Rate (PLR)4American Express Green/ Gold & VISA Platinum/ Signature4MasterCard Classic/ Gold/ Primo4VISA Classic/ Gold4Fleetman4.50% per annumPLR 9.50% per annumPLR 13.50% per annumPLR 13.50% per annum16.75% per annumOther fees & charges applicable to credit cards are available at our counters.Reports & GuaranteesConfidential Reports4Auditors Report4Testimonial for educational/ medical purpose4Testimonial for travel purpose - for local residents4Testimonial for travel purpose - for foreigners4Letter of reference4Clearance certificate4Certificate of balance4Loan balance certificateFor recurrent service: Rs 400For ad hoc/ outside date request: Rs nce bonds4Tender bonds4Shipping bonds-For first Rs 5 million: 1.5% p.a.-For any amount above Rs 5 million: 1.0% p.a.,minimum Rs 1,500-For first 180 days: 1.0% flat, minimum Rs 750-For each additional period of 90 days or part:0.25% flat, minimum Rs 750-For the first two months: Rs 800-For each additional period of one month or part:Rs 3001.0% p.a., minimum Rs 1,5004Guarantees to the Customs & Government bodies covering paymentof cheques2.0% p.a., minimum Rs 1,0004'Aval' of negotiable instruments1.0% p.a., minimum Rs 1,5004Advance payment bonds/ Retention money bonds2.0% p.a., minimum Rs 1,5004Guarantees in favour of Corporate/ Government bodies fordisbursement of loans/ banking facilities4Unredeemed shipping guaranteed commissionRs 300 per month1.0% p.a., minimum Rs 1,5004Guarantee in favour of IVTBRs 5004Amendment feeRs 1,0004Cancellation feeA processing fee shall be charged, where applicable, in addition to the fee charged for a Bank Guarantee transactionFinancingLending Rates4.50% per annum4MCB Prime Lending Rate (PLR)Interest rates vary according to loan amount, purpose, level of financing or customer's existing facilities with thebank. More details are available at our counters.

Processing Fee4Unsecured loans4Educational loans4Housing loans4Loans fully secured by cash collateral held with MCB4Loans fully secured by cash collateral held with other institutions4Other secured loans & overdraft4Renewal of facility4Temporary banking facility1% of facility amount, minimum Rs 1,000/maximum Rs 25,0001% of facility amount, minimum Rs 3,000/maximum Rs 25,0001% of facility amount, minimum Rs 3,000/maximum Rs 50,0001% of facility amount, minimum Rs 1,000/maximum Rs 3,0001% of facility amount, minimum Rs 1,000/maximum Rs 25,0001% of facility amount, minimum Rs 1,000/maximum Rs 25,0000.50% of facility amount, minimum Rs 500/maximum Rs 3,0000.25% of facility amount, minimum Rs 500/maximum Rs 3,000Early Repayment Fee1% of loan amount prepaid4Educational/ housing loans2% of loan amount prepaid, minimum Rs 3,0004Other loan typesNote: Early repayment fee is not applicable (1) for loans falling under the Borrowers' Protection Act, (2) in case the prepaymentoption fee has been paid upfront or (3) loans granted after 01st January 2014Amendment/ Cancellation Fee4Amendment/ cancellation feeRs 300Recovery of balance4Recovery of balanceAll expenses including legal fees, commission &costs not exceeding 10% of the sum coveredValuation Survey & Report Fee4Valuation survey & report fee0.5% of loan amount, minimum Rs 1,000/maximum Rs 5,000Note:- Fee is not applicable in case of banking facilities of Rs 50,000 or less and at renewal of a credit facility- Different pricing applies for properties in Rodrigues.Site Inspection Fee4Site inspection feeFree of chargeLegal & Administration Fees (excluding Registrar's charges)4Pari-Passu documents4'Cession de Priorité'4Erasure of charges ('Radiation')4Part erasure of charges ('Dégrèvement')4Fixed/ Floating charges & Gage sans deplacementRs 500Rs 500Rs 300 per chargeRs 500 per requestRs 100Other rates, fees & charges applicable to credit facilities are available at our counters.Other ServicesCheque4Cost of cheque books4Stop cheque request4Cheque returned/ Dishonoured cheque4Fee on uncollected / undelivered cheque book4Special presentation of cheques :-To local banks (minimum of Rs 200,000)-From local banks (minimum of Rs 200,000)-MCB cheques credited to MCB accounts (minimum of Rs 50,000)4Cheques paid over the counter within one-month period:-First 50 cheques-For each addional cheque cashed within the same periodRs 5 per sheetRs 100 per requestRs 300 per chequeRs 125Rs 100 per chequeRs 250 per chequeRs 100 per chequeFreeRs 20 per cheque

Note: Fee will be charged to the drawer's account on the 5th of each month for cheques cashed during the previous month, ifapplicableOffice Cheque/ Bank DraftRs 1504Issue of office cheque (payment by debit of account only)4Office cheque cancellationRs 100Rs 2004Issue of bank draft (payment by debit of account only)Note: Additional charge of AUD 15 (or equivalent) applies for issuance of ANZ bank draft in AUD.Rs 3004Deposit of drafts & Miscellaneaous Remittances AbroadNote: Other fees and charges apply in case of debit/ credit of a Foreign Currency Account and are available at our counters.Safe Deposit Lockers4Annual rental fee4Access fee4Key deposit fee4Replacement of lock and keys4Non-payment of annual rental fee-Type A: Rs 3,450 (VAT inclusive)-Type B: Rs 5,175 (VAT inclusive)-Type C: Rs 7,187.50 (VAT inclusive)-Type D: Rs 11,500 (VAT inclusive)-Type E: Rs 2,300 (VAT inclusive)-First 2 visits per month: Free-Additional visits within the same month: Rs 100 per visitRs 9,200 (paid upfront and refundable after cancellationof Safe Deposit Box service)Rs 9,200 (VAT inclusive)Failed Standing Order fee appliesCopies, photocopies & Duplicate Printouts4Request for duplicate documents [Including copy of IBAN, SWIFT transfer,Book transfer, statement of account]Rs 50 Rs 10 per additional pageNote: In case the retrieval of documents needs to be done manually, the following pricing will apply: Rs 200 Rs 10 per additional pageEscheated Accounts (Abandoned Funds)4Processing fee before funds are transferred to Bank of MauritiusMUR 200SWIFT Account Statement4SWIFT Statement feeNote: Fee varies according to dispatch frequencyRs 500/ 600/ 800Treasury Bills4Minimum account opening balanceNot applicableMobile Payment4'Transfer' transaction4'Payment' transaction4'Cash' transaction4'ATM' transaction4Funds transfer to a Visa card4PayPal servicesFree of chargeFree of chargeFree of chargeFree of charge-Transfer to a local card: MUR 20 per transfer-Transfer to a card abroad: MUR 200 per transfer-Send money to PayPal user: 2% of transaction amount-Top-up PayPal account: 2% of transaction amount-Withdrawal: 1.5% of withdrawan amount, minimumMUR 100Note: Current VAT rate at 15%Disclaimer“The above Rates and Fees shall apply to the products and services provided by the Mauritius Commercial Bank Ltd ('the Bank') as from 8 June 2022.The Bank may, from time to time amend, vary and supplement the above and shall communicate same to its customers by way of notices displayed in itsbranches and on its website http://www.mcb.mu. For more information on the MCB Rates and Fees, please do contact us on ( 230) 202 6060 or emailus at mcbselect@mcb.mu”

At Counter On Internet Banking 4For credit to a MCB account pertaining to the same customer Rs 251 Free 4For credit to a MCB account not pertaining to the same customer Rs 252 Free Note 1: Free of charge for funds transfer between accounts in local currency (MUR) Note 2: A fee of USD 5 is charged in case of a funds transfer between FCY accounts