Transcription

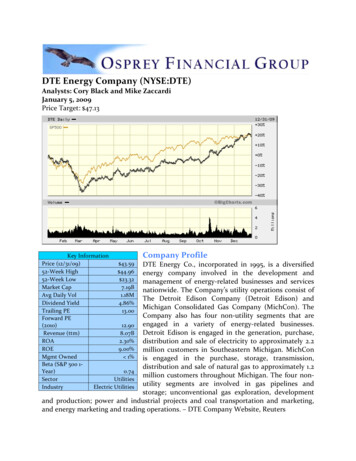

DTE Energy Company (NYSE:DTE)Analysts: Cory Black and Mike ZaccardiJanuary 5, 2009Price Target: 47.13Key InformationPrice (12/31/09) 43.5952‐Week High 44.9652‐Week Low 23.32Market Cap7.19BAvg Daily Vol1.18MDividend Yield4.86%Trailing PE13.00Forward PE(2010)12.90Revenue (ttm)8.07BROA2.30%ROE9.00%Mgmt Owned 1%Beta (S&P 500 1‐Year)0.74SectorUtilitiesIndustryElectric UtilitiesCompany ProfileDTE Energy Co., incorporated in 1995, is a diversifiedenergy company involved in the development andmanagement of energy‐related businesses and servicesnationwide. The Company’s utility operations consist ofThe Detroit Edison Company (Detroit Edison) andMichigan Consolidated Gas Company (MichCon). TheCompany also has four non‐utility segments that areengaged in a variety of energy‐related businesses.Detroit Edison is engaged in the generation, purchase,distribution and sale of electricity to approximately 2.2million customers in Southeastern Michigan. MichConis engaged in the purchase, storage, transmission,distribution and sale of natural gas to approximately 1.2million customers throughout Michigan. The four non‐utility segments are involved in gas pipelines andstorage; unconventional gas exploration, developmentand production; power and industrial projects and coal transportation and marketing,and energy marketing and trading operations. – DTE Company Website, Reuters

Estimated vs. Actual EarningsOrange: EstimatedGreen: Actual (non‐GAAP)Blue: Actual (GAAP)*SmartMoneyColor on Quarter: 3Q 2009DTE posted earnings of 0.95 per share,excluding non‐recurring items, 0.04 belowFirst Call consensus of 0.99. Revenues fell16.1% from the third quarter last year to 1.96B versus 2.09B consensus. DTEreaffirmed its recently increased FY09guidance, seeing EPS of 3.20‐3.40 versus 3.19 consensus. In a statement thecompany said “Continuous improvementefforts at DTE Energy continue to evolve,mature and accelerate. We are pleased toreport that our continuous improvement initiatives are yielding substantial andsustainable results.” The Loss from MichCon segment is a typical seasonal event, 3Q 09saw a 23mm loss in that segment versus a 13mm loss in 3Q 08. The company issteadfast in its projected 5‐6% EPS growth in coming years and a healthy dividend of 2.12per share.Revenues by SegmentDTE 10Q*

Operating SegmentsUtility OperationsThe Electric Utility segment consists of Detroit Edison, which is engaged in thegeneration, purchase, distribution and sale of electricity to approximately 2.2 millioncustomers in southeastern Michigan.The Gas Utility segment consists of MichCon and Citizens Gas Fuel Company (Citizens).MichCon is engaged in the purchase, storage, transmission, distribution and sale ofnatural gas to approximately 1.2 million customers throughout Michigan. MichCon alsohas subsidiaries involved in the gathering, processing and transmission of natural gas innorthern Michigan. Citizens distributes natural gas in Adrian, Michigan to approximately17,000 customers.Unfavorable national and economic trends have reduced demand for electricity andincreased uncollectible accounts receivable. The closures of plants in the automobileindustry could have a further impact on Detroit Edison. A cool summer hurt revenues inthe past year and a mild winter is predicted due to the El Nino climatological pattern.Detroit Edison filed for a rate increase in January of last year and the final decision will bemade this month. Since the filing, rates have increased causing revenues for the thirdquarter to increase 40MM. The company believes that it is possible, not probable, thatthe final rate case does not support the self‐implemented rate increase – in which caseDetroit Edison would have to refund the difference with interest. MichCon recentlybegan a self‐implemented rate increase as of January 1, 2010. Further climate changeinitiatives may have an adverse impact on operations, in which case the costs would bepassed to customers. The company as a whole is in favor of an allocation‐style Cap andTrade reform.Non‐Utility OperationsThe company has significant investments in non‐utility asset‐intensive businesses.Gas Midstream – DTE has a partnership interest in Vector Pipeline (Vector), aninterstate transmission pipeline, which connects Michigan to Chicago and Ontario. Thecompany also has a partnership interest in Millennium Pipeline Company (Millennium),which was placed in service in December 2008. Millennium indirectly connects southernNew York State to Upper Midwest/Canadian supply, while providing transportationservice into the New York City markets. The company also has storage assets in Michigancapable of storing up to 89 Bcf in natural gas storage fields located in Southeast Michigan.Unconventional Gas Production – The UGP business is engaged in natural gasexploration, development and production within the Barnett shale in north Texas.Power and Industrial Projects ‐ Power and Industrial Projects is comprised primarily ofprojects that deliver energy and utility‐type products and services to industrial,commercial and institutional customers; provide coal transportation and marketing; andsell electricity from biomass‐fired energy projects. This business segment provides utility‐

type services using project assets usually located on or near the customers’ premises inthe steel, automotive, pulp and paper, airport and other industries.Energy Trading ‐ Energy Trading focuses on physical and financial power and gasmarketing and trading, structured transactions, enhancement of returns from DTEEnergy’s asset portfolio, and optimization of contracted natural gas pipelinetransportation and storage, and power transmission and generating capacity positions.Energy Trading also provides natural gas, power and ancillary services to various utilitieswhich may include the management of associated storage and transportation contractson the customers’ behalf. –DTE Company WebsiteValuationWe have a price target of 47.13 for DTE Energy. We used a discounted cash flow methodfor valuation using the estimated 3.30 FY 09 earnings with a 5.5% EPS growth rate thatthe company is confident at achieving for the next 5 years. Using a discount rate of 11 (S&P 500 benchmark return), the value comes to 47.13. The current stock price of DTE is 43.59, a 7.51% discount to the DCF valuation.Other AnalystsDTE Company WebsiteDTE Energy vs. Competitors 1‐year

*YahooFinanceCompetitors: American Electric Power Co. Inc, Dominion Resources Inc. (Virginia), Duke Energy Corp., FPL Group,Southern CoDTE Energy has outperformed all of its competitors and the S&P 500 over the last year.DTE had been the laggard in the downturn compared to its competitors, but since thebottom, DTE has shown tremendous upside and has led the move within the industry.All Analyst RecommendationsDTE Company WebsiteLonger‐term Performance

*YahooFinanceDTE Energy does not follow the broader XLU with high correlation. DTE outperformedsignificantly in the early part of the decade as the overall market moved downward. Inthe recovery from 2003‐2007, the Utilities sector outperformed DTE. During thedownturn from 2007‐2009, the two followed closely, however during the upturn sinceMarch of last year, DTE has significantly outperformed the benchmark exchange‐traded‐fund.Technical Analysis

Over the last 6 months DTE has been performing quite well. The chart continues tomake higher highs and has continued to ride its 50 day MA upwards. RSI is showing a bitof a pullback, but looks like the 50 level is when buyers have been stepping back in. Ontop of all this, the stock has outperformed the S&P over the last 3‐month, 6‐month, and12‐month periods. I would wait a few weeks to enter as I think there is room for furtherpullback or consolidation and would look for an entry point around the 42 level. Oneworry for me is the long term resistance level DTE is hitting around the 45‐ 50 range.Technically though, the stock should be an ok buy on a pullback.How DTE makes moneyDTE Energy is a diversified energy company involved in the development andmanagement of energy‐related businesses and services nationwide. The largest operatingsubsidiaries are Detroit Edison and MichCon. Together, these regulated utility companiesprovide electric and/or gas services to more than three million residential, business andindustrial customers throughout Michigan. The electric and gas utility businesses haveeach been in operation for over a century. The company is experienced and has assets todevelop a number of non‐utility subsidiaries which provide energy‐related services tobusiness and industry nationwide.StrategyDTE is focused on selling non‐regulated operations and reinvesting the proceeds inregulated investments, while planning billions in utility investments between 2009 and2013. DTE is poised to benefit from project improvements related to Michigan’s agedpower and utility infrastructure improvements.Management & OwnershipDTE is under the management of Anthony F. Earley, Jr. who has been chairman of theboard and chief executive officer since 1998 and was also DTE Energy’s president andchief operating officer from 1994‐2004. He joined the company in 1994, and that sameyear was elected to the board. Gerard M. Anderson has been the president and chiefoperating officer of DTE Energy Company since 2005. He also served as the presidentfrom 2004 through 2005 and Executive Vice President from 1997 through 2004. He joinedthe company in 1993. Anderson was elected to the board in 2009. Management owns lessthan 1% of the total shares outstanding, and majority of shares are owned by institutionaland mutual fund owners, approximately 55%.3rd Quarter Earnings CallDavid Meador, CFO, felt that the utilities are holding up during a weak economy andbelieves they will return to “full earnings power” in 2010. The Power Trading group had astrong 3rd quarter and he expects the Power and Industrial Group to perform well throughthe remainder of the year. 1.7B in liquidity

Based on 3rd quarter results, still expect 2009 EPS of 3.20‐ 3.40/share 3rd quarter operating earnings 0.95/share or 157 million FCF YTD before dividends 900 million Lower net debt by 600 million compared with 2008 Expect 50%‐52% leverage for 2009 & 20% cash flow/debt DTE Cap Ex was 840 million YTD, down 20% from 2008 O&M expenses up 5 million due to higher benefit costs and M&R costsKey business driver for DTE, according to Meador, is a fair regulatory environment andframework that allows utilities to earn their authorized ROE. For them to remain anattractive investment, they need a strong balance sheet, substantial dividend policy, andsufficient liquidity.Green DTE EnergyDTE supports federal legislation to reduce emissions of carbon dioxide (CO2) and othergreenhouse gases and the company is working to ensure that the plan ultimately adoptedby Congress protects customers and the economy from the impact of unnecessary rateincreases. DTE Energy’s net CO2 emissions have declined while generation has increased.DTE supports an allocation approach to cap and trade and opposes an auction approach.Under the allocation approach, companies are given a certain emission level and thosecompanies who do not reach the cap can trade to those who are at the maximum. Underthe auction method, the company would purchase credits from the government, causingprices to rise – these costs would be passed to the customers. The company continues toexplore alternative forms of energy including nuclear energy. Nuclear power is thenation’s largest source of carbon‐free electricity. DTE Energy’s Fermi 2 nuclear powerplant has provided reliable, low‐cost power to 2.2 million customers in SoutheastMichigan for more than 20 years. With the concern of further regulation on carbonemissions, the company has begun development of a new unit at its Fermi site. Thecompany’s analysts see nuclear power as being the most cost‐effective method of powerfor customers while achieving environmental goals. DTE was among the first utilities tosign onto the US Department of Energy’s Climate Challenge Program, and is a member ofthe Chicago Climate Exchange.Fear Regulatory Risks – Tendency to Favor ConsumersEconomic Uncertainty‐ Michigan 15% UnemploymentLack of International ExposureLack of Ability to Recover Costs and Receive Rate IncreasesWeatherGreed Diversity of OperationsImproved Regulatory Reforms in 2008 in MichiganHealthy Dividend – 4.8%

Strong Price Performance vs. CompetitorsConsistent Earnings Past 5 YearsRecommendationWe recommend selling all holdings of XLU and FXU and purchasing an amountequal to our target weighting of the Utilities Sector in the form of DTE.

DTE Energy Company (NYSE:DTE) Analysts: Cory Black and Mike Zaccardi January 5, 2009 Price Target: 47.13 Company Profile DTE Energy Co., incorporated in 1995, is a diversified energy company involved in the development and management of energy‐related businesses and services nationwide.