Transcription

TAdministered by:Account #: 296701AFNew Mexico Retiree Health CareAuthorityDRA Guide To Your Group Medicare Supplement Plan - Health Care Coverage Secondaryto Medicare296701 (July 1, 2017)

CUSTOMER ASSISTANCECustomer Service: Medical/Surgical ClaimsWhen you have a non- medical benefit question or concern, call BCBSNM Monday through Friday from 6 A.M. - 8P.M. and 8 A.M. - 5 P.M. on Saturdays and most holidays or visit the BCBSNM Customer Service department inAlbuquerque. (If you need assistance outside normal business hours, you may call the Customer Service telephonenumber and leave a message. A Customer Service Advocate will return your call by 5 P.M. the next business day.) Youmay either call toll-free or visit the BCBSNM office in Albuquerque at:Street address: 4373 Alexander Blvd. NEToll-free telephone number: 1-800-788-1792Send all written inquiries/preauthorization requests and submit medical/surgical claims* to:Blue Cross and Blue Shield of New MexicoP.O. Box 27630Albuquerque, New Mexico 87125-7630Preauthorizations: Medical/Surgical Services—For preauthorization requests, call a Health Servicesrepresentative, Monday through Friday 8 A.M. - 5 P.M., Mountain Time. Written requests should be sent to theaddress given above. Note: If you need preauthorization assistance between 5 P.M. and 8 A.M. or on weekends, callCustomer Service. If you call after normal Customer Service hours, you will be asked to leave a message.1-505-291-3585 or 1-800-325-8334Website—For provider network information, claim forms, and other information, or to e-mail your question toBCBSNM, visit the BCBSNM website at:www.bcbsnm.com*Exceptions to Claim Submission Procedures—Claims for health care services received from providers thatdo not contract directly with BCBSNM, should be sent to the Blue Cross and Blue Shield Plan in the state whereservices were received. Note: Do not submit drug plan claims to BCBSNM. See Section 6: Claim Payments andDisputes for details on submitting claims.Be sure to read this benefit booklet carefully and refer to the Summary of Benefits.Prescription Drugs - Prescription drug benefits are administered by a pharmacy benefit manager (PBM). Formore information, call NMRHCA at 1- 800- 233- 2576. Details about drug benefits are also on the NMRCHA web sitewww.nmrhca.state.nm.us. You can also visit the PBM’s web site at www.express- scripts.com. Drug claims should besent to Express Scripts, Attn: Commercial Claims at P.O. Box 2872, Clinton, IA 52733- 2872A Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association.

A message fromNew Mexico Retiree Health Care AuthorityMedicare SupplementWelcome to the Medicare Supplement health care benefit plan for eligible participants of New Mexico RetireeHealth Care Authority (NMRHCA) and their eligible family members. Blue Cross and Blue Shield of NewMexico (BCBSNM), a Division of Health Care Service Corporation, a Mutual Legal Reserve Company, and anIndependent Licensee of the Blue Cross and Blue Shield Association is pleased to serve as the ClaimsAdministrator for the NMRHCA self- funded health care benefit plan. These benefits are available to all retireesand their dependents who are eligible and enrolled in both Parts A and B of Medicare.Please take some time to get to know your health care benefit plan coverage, including its benefit limits andexclusions, by reviewing this important document and any enclosures. Learning how this plan works can helpmake the best use of your health care benefits. For a current Medicare Handbook, contact your local SocialSecurity Administration office. The NMRHCA stresses the importance of preventive measures against illness regular exercise, adequate rest, good nutrition, and periodic medical examinations.Note: The Plan’s benefit administrator (BCBSNM) and NMRHCA (your group) may change the benefitsdescribed in this benefit booklet. If that happens, BCBSNM or NMRHCA will notify you of those mutuallyagreed upon changes.If you have any questions once you have read this benefit booklet, talk to your benefits administrator or call us atthe number listed on the back of your ID card, or as listed in Customer Assistance on the inside front cover. It isimportant to all of us that you understand the protection this coverage gives you.Visit the NMRHCA web site at www.nmrhca.state.nm.us for more information about your health plan benefits,including for prescription drugs, enrollment and termination information, or to download copies of forms.Thank you for selecting BCBSNM for your health care coverage. We look forward to working with you to providepersonalized and affordable health care now and in the future.Sincerely,NMRHCARevision History: offcycle group effective 07/17 with all applicable updates

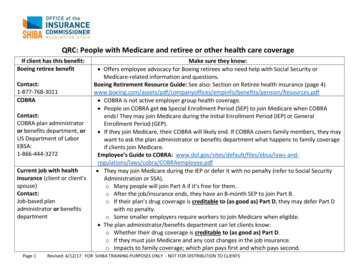

BCBSNM Medicare Supplement Plan – 01/01/18Medicare (Part A) Hospital Services — Per Benefit Period*SERVICESHospitalization*Semiprivate room and board, generalnursing, and miscellaneous servicesand supplies First 60 days61st through 90th day91st day and after: While using 60 lifetime reserve days Once lifetime reserve days are used:– Additional 365 daysMEDICARE PAYS– Beyond the additional 365 daysAll but 1,340All but 335 a day 1,340 (Part A Deductible) 335 a dayAll but 670 a day 670 a day 0100% of Medicare eligibleexpenses 0 0Skilled Nursing Facility Care*You must meet Medicare’s requirements,including having been in a hospital for atleast 3 days and entered a Medicareapproved facility within 30 days afterleaving the hospital First 20 days21st through 100th day101st day and afterBloodFirst 3 pintsAdditional amountsPLAN PAYSAll approved amountsAll but 167.50 a day 0 0Up to 167.50 a day 0YOU PAY 0 0 0All costs 0 0All costsosts 0100%3 pints (100%) 0 0 0 100% for hospice care All but 5 for RX 95% for inpatient(All but very limitedcoinsurance for outpatientdrugs and inpatient respitecare) 0 0 5% for inpatient 0Hospice CareAvailable as long as your doctor certifies youare terminally and you elect to receive theseservices* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of the hospital and have not receivedskilled care in any other facility for 60 days in a row.Medicare (Parts A and B)Home Health CareMedicare-approved servicesMedically necessary skilled care servicesand medical suppliesDurable Medical Equipment Remainder of Medicare-approvedamountsOutpatient Psychiatric CareMedicare-approved servicesRemainder of Medicare-approved amountsNM81283100% 0 0 0 until you meet 183Part B deductible80% 0 until you meet 183Part B deductible20% 183 (Part Bdeductible) 0 0 0Generally 80%Generally 20% 183 (Part Bdeductible) 0Customer Service (800) 788-1792RHCA Medigap 01/01/18

Medicare (Part B) Medical Services — Per Calendar Year*SERVICESMEDICARE PAYSPLAN PAYSYOU PAYMedical ExpensesIn or out of the hospital and outpatient hospitaltreatment, such as physician’s services,inpatient and outpatient medical and surgicalservices and supplies, physical and speechtherapy, diagnostic tests, durable medicalequipmentFirst 183 of Medicare-approved amounts** 0 0 183 (Part Bdeductible)Remainder of Medicare-approved amountsPart B excess charges (above Medicareapproved amounts)Blood Note:First 3 pintsNext 183 of Medicare-approved amounts*Generally 80% 0Generally 20%80% 020% 0 0Remainder of Medicare-approved amounts80%100% 0 until you meet 183 PartB deductible20% 0 183 (PartB deductible) 0Clinical Laboratory ServicesBlood tests for diagnostic services100% 0 0 0Up to 40 per visitAll costs over 40 per visit 0 1,600n/a80%20% 0Home Health Care – At HomeRecovery (Not Covered byMedicare)Each visit (additional visits to assist you withactivities of daily living during recovery from anillness, injury, or surgery)Annual Maximum – at Home recoveryMedicare-covered Preventive CareRoutine checkups and screening testsOther Benefits — Not Covered by MedicareSERVICESMEDICARE PAYSPLAN PAYSPreventive Care – Not Covered by MedicareRoutine checkups and screening tests 0100% allowable chargesAcupuncture and Rolfing – Not Covered by MedicareCombined Max. 1,500 per year 080% allowable chargesForeign Travel — Not Covered by MedicareMedically necessary emergency careservices beginning during the first 60days of each trip outside the USA:First 250 each calendar yearRemainder of charges 0 0 080% to a lifetime maximumbenefit of 50,000YOU PAY 020% allowable charges 25020% and amounts overthe 50,000 lifetimemaximumOnce you have been billed 183 of Medicare-approved amounts for covered services your Part B deductible will have been met for the calendaryear.The 2018 Part A and Part B deductible as updated by Centers for Medicare and Medicaid Services (CMS).NOTE: Prescription drug coverage is offered through Express Scripts under the New Mexico Retiree Health Care Authority.A Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association.NM81283Customer Service (800) 788-1792RHCA Medigap 01/01/18

TABLE OF CONTENTSSECTION 1: HOW TO USE THIS BENEFIT BOOKLET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3SECTION 2: ENROLLMENT AND TERMINATION INFORMATION . . . . . . . . . . . . . . . . . . . .6SECTION 3: COVERED SERVICES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12SECTION 4: EXCLUSIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16SECTION 5: CLAIMS FILING, PAYMENT AND DISPUTES . . . . . . . . . . . . . . . . . . . . . . . . . . .20SECTION 6: COORDINATION OF BENEFITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23SECTION 7: TERMINATION OF COVERAGE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24SECTION 9: DEFINITIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .25SUMMARY OF HEALTH INSURANCE GRIEVANCE PROCEDURES . . . . . . . . . . . . . . . . . .292Customer Service: (800) 788- 1792ASO-NM HCSC

SECTION 1: HOW TO USE THIS BENEFIT BOOKLETThis benefit booklet describes the benefits and limitations of the BCBSNM Medicare Supplement. If you havequestions after reading this benefit booklet, please call a BCBSNM Customer Service Advocate at 1- 800- 788- 1792.This BCBSNM Medicare Supplement pays for the Medicare Part A deductible and coinsurance amounts not paid byMedicare when services are covered by Medicare. This benefit booklet is designed to make it easy for you todetermine your coverage.If you are looking for answers to a specific question, review the Table of Contents where major sections of this bookletare listed.To know what is covered by this BCBSNM Medicare Supplement, see Section 4: Covered Services. Certain chargesare not covered by this Plan because a limit or exclusion applies. See Section 5: Exclusions for more information. Ifyou need to know how to file claims or if you have a claims problem, see Section 6: Claims Filing, Payment, andDisputes.DEFINITIONSThroughout this benefit booklet, many words are used that have a specific meaning when applied to your health carecoverage. When you come across these terms while reading this benefit booklet, please refer to Section 9: Definitions,for an explanation of the limitations or special conditions that may apply to your benefits.SUMMARY OF BENEFITS AND COVERAGE (SBC)The Summary of Benefits and Coverage is referred to as the Summary of Benefits throughout this benefit booklet. TheSummary of Benefits shows specific member cost-sharing amounts and coverage limitations of your Plan. If you do nothave a Summary of Benefits, please contact a BCBSNM Customer Service Advocate (the phone number is at thebottom of each page of this benefit booklet). You will receive a new Summary of Benefits if changes are made to yourhealth care plan.IDENTIFICATION (ID) CARDYou will receive a BCBSNM identification (ID) card. The ID card contains your “group” number and youridentification number (including an alpha prefix) and tells providers that you are entitled to benefits under this healthcare plan with BCBSNM.Carry it with you. Do not let anyone who is not named in your coverage use your card to receive benefits. If you needan additional card or need to replace a lost card, contact a BCBSNM Customer Service Advocate.Have both your BCBSNM issued ID card and your Medicare ID card handy when you call for an appointment andshow them to the receptionist when you sign in for an appointment. Each member, including your spouse or otherdependent received his/her own ID card from BCBSNM.Your ID card is part of your BCBSNM Medicare Supplement coverage. Do not let anyone who is not named in yourcoverage use your card to receive benefits. If you want additional cards or need to replace a lost card, contact aCustomer Service Advocate. You should have received a separate ID card for the prescription drug plan.DRUG PLAN BENEFITSBCBSNM has contracted with a separate pharmacy benefit manager to administer your outpatient drug plan benefits.In addition to your benefit booklet, you will be sent important information about your drug plan benefits.LIMITATIONS AND EXCLUSIONSEach provision in Section 4: Covered Services not only describes what is covered, but may list some limitations andexclusions that specifically relate to a particular type of service. Section 6: Exclusions lists limitations and exclusionsthat apply to all services.296701 (07/17)3

CUSTOMER SERVICEIf you have any questions about your coverage, call or e- mail BCBSNM’s Customer Service department. CustomerService Advocates are available Monday through Friday from 6 A.M. - 8 P.M. and 8 A.M. - 5 P.M., MountainStandard Time on Saturdays and most holidays. If you need assistance outside normal business hours, you may call theCustomer Service telephone number and leave a message. A Customer Service Advocate will return your call by 5P.M. the next business day.Customer Service representatives can help with the following:S answer questions about your benefitsS assist with preauthorization requestsS check on a claim’s statusS order a replacement ID card, provider directory, benefit booklet, or formsFor your convenience, the toll- free customer service number is printed at the bottom of every page in this benefitbooklet. Refer to Customer Assistance on the inside cover of this booklet for important phone numbers, website, andmailing information. You can also e- mail the Customer Service unit via the BCBSNM website noted below:In addition to accepting e- mail inquiries, the BCBSNM website contains valuable information about BCBSNMprovider networks, and other Plan benefits. It also has various forms you can print off that could save you time whenyou need to file a claim.Website: www.bcbsnm.comDeaf and Speech Disabled AssistanceDeaf, hard- of- hearing, and speech disabled callers may use the New Mexico Relay Network. Dialing 711 connectsthe caller to the state transfer relay service for TTY and voice calls.Translation AssistanceIf you need help communicating with BCBSNM, BCBSNM offers Spanish bilingual interpreters for members whocall Customer Service. If you need multi- lingual services, call the Customer Service phone number on the back ofyour ID card.After Hours HelpIf you need or want help to file a complaint outside normal business hours, you may call Customer Service. Yourcall will be answered by an automatic phone system. You can use the system to:S leave a message for BCBSNM to call you back on the next business dayS leave a message saying you have a complaint or appealS talk to a nurse at the 24/7 Nurseline right away if you have a health problemBLUE ACCESS FOR MEMBERSSMTo help members track claim payments, make health care choices, and reduce health care costs, BCBSNM maintainsa flexible array of online programs and tools for health care plan members. The online “Blue Access for Members”(BAM) tool provides convenient and secure access to claim information and account management features and theCost Estimator tool. While online, members can also access a wide range of health and wellness programs and tools,including a health assessment and personalized health updates. To access these online programs, go towww.bcbsnm.com, log into Blue Access for Members and create a user ID and password for instant and secure access.4Customer Service: (800) 788- 1792296701 (07/17)

If you need help accessing the BAM site, call:BAM Help Desk (toll- free): 1-888-706-0583Help Desk Hours: Monday through Friday 6 A.M. - 9 P.M., Mountain Standard TimeSaturday 6 A.M. - 2:30 P.M. Mountain Standard TimeNote: Depending on your group’s coverage, you may not have access to all online features. Check with your benefitsadministrator or call Customer Service at the number on the back of your ID card. BCBSNM uses data about programusage and member feedback to make changes to online tools as needed. Therefore, programs and their rules areupdated, added, or terminated, and may change without notice as new programs are designed and/or as our members’needs change. We encourage you to enroll in BAM and check the online features available to you - and check back inas frequently as you like. BCBSNM is always looking for ways to add value to your health care plan and hope you willfind the website helpful.HEALTH CARE FRAUD INFORMATIONHealth care and insurance fraud results in cost increases for health care plans. You can help; always:S Be wary of offers to waive copayments, deductibles, or coinsurance. These costs are passed on to youeventually.S Be wary of mobile health testing labs. Ask what your health care insurance will be charged for the tests.S Review the bills from your providers and the Explanation of Benefits (EOB) you receive from BCBSNM.Verify that services for all charges were received. If there are any discrepancies, call a BCBSNM CustomerService Advocate.S Be very cautious about giving information about your health care insurance over the phone.If you suspect fraud, contact the BCBSNM Fraud Hotline at 1-888-841-7998.296701 (07/17)5

SECTION 2: ENROLLMENT AND TERMINATION INFORMATIONWHO IS ELIGIBLEEach person who becomes eligible for coverage can apply by submitting an application to the NMRHCA within 31days of becoming eligible. Eligibility conditions are mandated by the Retiree Health Care Act and are subject toperiodic changes. You may call NMHRCA at 1- 800- 233- 2576 or check the NMRHCA web site atwww.nmrhca.state.nm.us for more information.COVERAGE TYPESYour coverage is one of the following types:S Single (Individual) - Only the retiree (or his/her dependent) is covered.S Two- Party - The retiree and one dependent (or any two dependents) are covered.S Family - The retiree and his/her (or three or more dependents) are covered.NOTE: Dependents are allowed to be covered under the non- Medicare NMRHCA Plan when the retiree (or survivingspouse) is covered under a NMRHCA Medicare program.If only one member of a family is enrolled in the BCBSNM Medicare Supplement, it does not necessarily mean thatthe coverage type is Single.ELIGIBLE RETIREESYou are an eligible retiree (a retiree eligible to participate in the NMRHCA) if:S You receive a disability or normal retirement benefit from public service in New Mexico with anNMRHCA participating employer, andS You did one of the following:- You retired with a pension before your employer’s effective date with NMRHCA program, or- You and/or your employer (on your behalf) made contributions to the NMRHCA fund from youremployer’s NMRHCA effective date until your date of retirement, or- You and/or your employer (on your behalf) made contributions to the NMRHCA fund for at least fiveyears before your date of retirement.Former legislators who served in the New Mexico State Legislature for at least two years are also eligible.It is your responsibility to notify the NMRHCA (who will then notify BCBSNM) of any change in your coveragestatus, including a name or address change. If you have any questions about your eligibility or change in status,contact the NMRHCA for details and forms. You may call NMRHCA at 1- 800- 233- 2576 or check the NMRHCAweb site at www.mnrhca.state.nm.us.BCBSNM Medicare Supplement Eligibility - To qualify for full coverage under the BCBSNM MedicareSupplement Plan, you must be enrolled in both Parts A and B of Medicare. To continue eligibility under this Plan, youmust continue to pay any Medicare premiums and remain enrolled in both Medicare Parts A and B. If you do not haveMedicare Part B, you will be responsible for the portion that Medicare Part B would have covered approximately 80%.Medicare Part B - If you have coverage through NMRHCA and elect to decline or cancel your Medicare Part Bbenefit (but keep Part A of Medicare), you will automatically be enrolled in the BCBSNM Medicare Supplement andyou will still be responsible for the portion that Medicare Part B would have covered approximately 80%.Medicare Part A - If you did not contribute a minimum of 40 quarters to Social Security through your employer, youmay not be entitle to premium- free Medicare Part A; NMRHCA will not penalize you for not enrolling in Part A.however, if you do not choose to purchase Medicare Part A (see below), you must provide NMRHCA with writtennotice and communication from the Social Security Administration indicating why you are not entitle to premium- freePart A. If you do not have Medicare Part A, you are not eligible for coverage under the NMRHCA Medicare Plan.Your choices are:6Customer Service: (800) 788- 1792296701 (07/17)

S You do not have Part A, but you have Part B - you may enroll in one of the non- Medicare PPO offered plans.S You do not have Part A and have declined Part B - you will remain on the Supplement plan and be responsiblefor the portion that Medicare Part B would have covered approximately 80%.Please note: You do have the option of purchasing Medicare Part A through the Social Security Administration, whichwould make you eligible for coverage under a NMRHCA Medicare plan. The monthly premium amount for Part A,which is based on the number of quarters during which you contributed to Social Security, can be obtained from theSocial Security Administration. If you elect to pay for Part A, you must have Part B coverage in order to be eligible forany NMRHCA Medicare plan, as explained prior.ELIGIBLE FAMILY MEMBERSCovered family member, covered spouse, covered child - An eligible spouse or eligible child (as defined below)who has applied for and been granted coverage under the subscriber’s policy based on his/her family relationship tothe subscriber.Eligible family members - Family members of the subscriber, limited to the following persons:S the subscriber’s legal spouseS the subscriber’s eligible child through the end of the month in which the child reaches age 26 (Once acovered child reaches age 26, the child is automatically removed from coverage and rates adjustedaccordingly - unless the child is an eligible family member under this Plan due to a disability as describedbelow.)S the subscriber’s unmarried child age 26 or older who was enrolled as the subscriber’s covered child inthis health plan at the time of reaching the age limit, and who is medically certified as disabled, chieflydependent upon the subscriber for support and maintenance, and incapable of self- sustaining employmentby reason of his/her disability. Such condition must be certified by a physician and BCBSNM. Also, achild may continue to be eligible for coverage age 26 only if the condition began before or during themonth in which the child would lose coverage due to his/her age. BCBSNM must receive written notice ofthe disabling condition within 31 days of the child’s attainment of the limiting age and subsequently, asmay be required by BCBSNM,but not more frequently than annually after the two- year period followingthe Child’s attainment of the limiting age of 26.S the subscriber’s domestic partner (NOTE: Not all governing bodies of the entities have approvedallowing a participant’s domestic partner and his/her children to be eligible for insurance coverage. Checkwith your benefits administrator for more information.)Eligible child - The following family members of the subscriber through the end of the month during which thechild turns age 26:S natural or legally adopted child of the subscriberS child placed in the subscriber’s home for purposes of adoption (including a child for whom the subscriberis a party in a suit in which the adoption of the child by the subscriber is being sought)S stepchild of the subscriber (or otherwise eligible child of a domestic partner, if domestic partners arecovered under your benefit plan)S child for whom the subscriber must provide coverage because of a court order or administrative orderpursuant to state lawA child meeting the criteria above is an “eligible child” whether or not the subscriber is the custodial ornoncustodial parent, and whether or not the eligible child is claimed on income tax, employed, married, attendingschool or residing in the subscriber’s home, except that:S once the subscriber is no longer a legal guardian of a child or there is no longer a court order to providecoverage to a child, the child must be eligible as a natural child, legally adopted child, or stepchild of thesubscriber in order to retain eligibility as a family member under this health plan.A domestic partner is a person of the same or opposite sex who meets all of the following criteria:S shares your permanent residence and has resided with you for no less than one year;296701 (07/17)7

S is not less than 18 years of age;S is financially interdependent with you and has proven such interdependence by providing documentationof at least two of the following arrangements: common ownership of real property or a common leaseholdinterest in such property; community ownership of a motor vehicle; a joint bank account or a joint creditaccount; designation as a beneficiary for life insurance or retirement benefits or under your partner’s will;assignment of a durable power of attorney or health care power of attorney; or such other proof as isconsidered by BCBSNM to be sufficient to establish financial interdependency under the circumstances ofyour particular case;S is not a blood relative any closer than would prohibit legal marriage; andS has signed jointly with you, a notarized affidavit which can be made available to BCBSNM on request.NMRHCA may require acceptable proof (such as copies of income tax forms, legal adoption or legal guardianshippapers, or court orders) that an individual qualifies as an eligible family member under this coverage. Unless listed asan eligible family member, no other family member, relative or person is eligible for coverage as a family member.Common- law spouses are not considered legal spouses; in order to be considered eligible for coverage, acommon- law spouse must meet the definition of “domestic partner.”Information for Noncustodial ParentsWhen a child is covered by the Plan through the child’s noncustodial parent, then NMRHCA will:S provide such information to the custodial parent as may be necessary for the child to obtain benefitsthrough the Plan;S permit the custodial parent or the provider (with the custodial parent’s approval) to submit claims forcovered services with the approval of the noncustodial parent; andS make payments on claims submitted in accordance with the above provision directly to the custodialparent, the provider, or the state Medicaid agency as applicable.Dependents Who Are Not Eligible - Your spouse or children are not eligible while on active duty in the armed forcesof any country or covered under NMRHCA as a retiree or a dependent of another retiree.It is your responsibility to notify the NMRHCA (who will then notify BCBSNM) of any change in your coveragestatus, including a name or address change or any additions or removals of a dependent (spouse or child). If you haveany questions about a dependent’s eligibility, contact the NMRHCA at 1- 800- 233- 2576 for details. Forms are postedon the NMRHCA web site at www.nmrhca.state.nm.us.RIGHT TO SURVIVORSHIPAn eligible dependent of a decease eligible retiree/vested- active employee may be covered under the health plan in thesame terms and conditions as would apply if the retiree were still living. The surviving dependent is enrolled (orre- enrolled) under his/her own identification number and is assessed the appropriate dependent rate for medical planpremium contributions. This is called right of survivorship, and it will continue to be offered to the eligible spouseuntil his/her death or the eligible dependent until his/her death, marriage, or ineligibility. Eligible dependents of thesurviving spouse or child are not eligible for this program unless they are related to the deceased retiree as describedunder Eligible Dependents, in this section of the booklet. For example, if a surviving spouse remarries, his/her newspouse is not eligible for this program.APPLYING FOR COVERAGEAn eligible person can apply for coverage, including for his/her eligible family members, by submitting anenrollment/change form to NMRHCA within 31 days after becoming eligible according to the terms of theAdministrative Services Agreement. Note: NMRHCA cannot use genetic information or require genetic testing inorder to determine or to limit or deny coverage.WHEN COVERAGE BEGINSNMRHCA will determine your effective date of coverage according to the provisions of the Administrative ServicesAgreement.8Customer Service: (800) 788- 1792296701 (07/17)

This Plan does not cover any service received before your effective date of coverage (which, for eligible familymembers, may be later than the subscriber’s effective date). A

This benefit booklet describes the benefits and limitations of the BCBSNM Medicare Supplement. If you have questions after reading this benefit booklet, please call a BCBSNM Customer Service Advocate at 1-800-788-1792. This BCBSNM Medicare Supplement pays for the Medicare Part A deductible and coinsurance amounts not paid by