Transcription

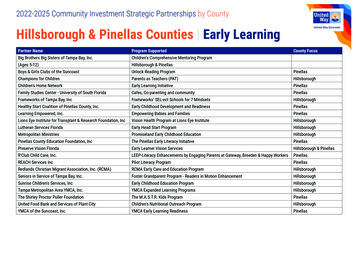

RETIREE BENEFITS GUIDE2022 BENEFlex Program1

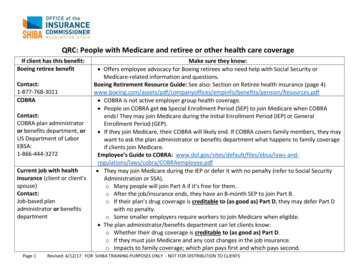

PINELLAS COUNTY SCHOOLS CONTACTSRisk Management Retirement TeamP.O. Box 2942, Largo, FL 33779RISK MANAGEMENT AND INSURANCERisk Management Retirement Team727-588-6214Risk-retirement@pcsb.orgRisk Management and Insurance727-588-6195Fax: 727-588-6182Aetna (Claims and Account tna (Health & Wellness)727-588-6137www.pcsb.org/wellnessAetna Concierge Customer Service866-253-0599www.aetnapcsb.comAetna Pharmacy Mail Order re k866-299-1358www.eyemedvisioncare.comHumana Dental Advantage Plus 2S Plan (Group#48085)800-979-4760www.myhumana.comMetLife Dental PDP (#G95682)800-942-0854www.metlife.com/dentalMedCom (Enrollment and Billing questions)800-523-7542email (retireeservices@medcom.net)LIFE INSURANCEThe Standard Life Insurance Company (Group#92959)MEDICARE ADVANTAGE PLAN800-628-8600Pcsb.org/risk-benefitsHumana Medicare Advantage Plans727-792-2103Humana.comFlorida Retirement System (FRS)866-446-9377www.myfrs.comFederal Health Insurance 227Medicare.gov800-963-5337Floridashine.orgONSITE REPRESENTATIVESINSURANCE CARRIERSMEDICALVISIONEyeMed VisionDENTALNON-PCS PROGRAMS AND OTHER RESOURCESMedicare Services (800-MEDICARE)You must contact the appropriate provider 3 monthsprior to being eligible for MedicareSHINE—Serving Health Insurance Needs ofElders Non-profit Medicare Counseling2

CONTENTSNEW RETIREE INSURANCE ELIGIBILITYRE-EMPLOYMENT AFTER RETIREMENT GUIDELINES FORHEALTH INSURANCEPCS BE SMART WELLNESS PROGRAM2021 MONTHLY INSURANCE RATESAETNA MEDICAL PLANSAETNA PRESCRIPTION DRUG PROGRAMAETNA MEDICAL PLAN COMPARISON CHARTHEALTH CARE REFORM AND YOUR MEDICAL PLAN CHOICEMEDICARE ELIGIBILITYDENTAL INSURANCEEYEMED VISION CARE PLANMETLIFE HOSPITAL INDEMNITY PLAN (HIP)DISABILITY INSURANCE PLANSLIFE INSURANCE55678910-1314141520232324This document is an outline of the coverage proposed by the carrier(s), based on information provided by your company. It does not include all of the terms,coverage, exclusions, limitations, and conditions of the actual contract language. The policies and contracts themselves must be read for those details. Policy forms foryour reference will be made available upon request.The intent of this document is to provide you with general information regarding the status of, and/or potential concerns related to, your current employee benefitsenvironment. It does not necessarily fully address all of your specific issues. It should not be construed as, nor is it intended to provide, legal advice. Questionsregarding specific issues should be addressed by your general counsel or an attorney who specializes in this practice area.3

BENEFLEX RETIREE INSURANCE GUIDE 2021As a new retiree of Pinellas County Schools, you are eligible to continue the following insurance benefits. NOTE: If youcancel any of your PCS-sponsored coverage when you retire, you cannot re-enroll, unless otherwise stated.BENEFIT PLANENROLLED AT TIME OFCAN YOU CONTINUE AFTER YOU ic Term Life InsuranceYesMinimum 10,000 Basic Board Term Life Insurance coverage required to continue this coverageFamily Term Life InsuranceYesFixed 5,000Optional Term Life Insurance(you and your spouse)YesYou may convert your or your spouse’s OptionalTerm Life coverage to individual policies directlythrough The StandardAccidental Death &Dismemberment (AD&D)YesNoDisability InsuranceYesNoMetLife Legal or Pet InsuranceYesNoYesMetLife will send you a Continuation of Coverage(COC) letter to the address on file with the District. Or you can call MetLife at 1-866-626-3705.Available to all employeesYes, you are still eligible for certain programsoffered through this program.MetLife HIPBe SMART Wellness ProgramIf you are enrolled at the time of retirement, youcan continue your coverage under any of theseplans* If you are not enrolled in coverage at the time of retirement, you cannot enroll when you retire or during any subsequent Annual Enrollment.Each year during Annual Enrollment, you will have the opportunity to review your benefit elections and make limitedchanges. This guide provides information about your and your dependents’ eligibility and coverage options. If youhave questions, you may call the Risk Management Retirement Team at 727-588-6214.4

NEW RETIREEINSURANCE ELIGIBILITYYou may participate in the retiree BENEFlex program if you have six years of service and were hired before July 1, 2011.Members starting employment after July 1, 2011, will need eight years of service to participate in the retiree BENEFlexprogram. All members must: Receive a Florida Retirement System check, or Be at least 59½ with eight years of service or have completed 30 years of service and be eligible for withdrawalsunder the State Investment Plan.Retirees fall into two categories: Under age 65: PCS medical plans Over age 65: Medicare optionsRE-EMPLOYMENT AFTER RETIREMENT GUIDELINES FOR HEALTH INSURANCEIt is your responsibility to contact the PCS retirement team when and if you return to work or leave employment withPinellas County Schools.Official retirement includes early retirement, retirement from DROP, normal retirement from the Pension Plan, orretirement from the Investment Plan.NEW RETIREES: Return your enrollment paperwork and premium payments 2 months prior to your retirement date to avoid interruption of your benefits.Mail to: Pinellas County SchoolsThe Risk Management and Insurance Retirement TeamP.O. Box 2942, Largo, FL 33779-29425

PCS BE SMART WELLNESS PROGRAMThe Be SMART Wellness Program is availablethroughout the year to PCS retirees who elect tocontinue their medical plan coverage with Aetna.Starting March 1, 2021, the wellness program willinclude many initiatives. For information on theprograms, visit pcsb.org/risk-benefits.DIABETES CARE PROGRAMThe wellness program included the Diabetes CAREProgram. When you or a covered dependent enrollin this program and complete the requirements,your co-pay is waived for diabetic supplies.* Formore information, visit pcsb.org/diabetes-careprogram.BE SMART CONTACT INFORMATIONPCS Wellness Coordinator727-588-6031Employee Wellness Specialist727-588-6151Health Advocate EmployeeAssistance Program727-588-6507Aetna Patient Advocate727-588-6137Aetna Claims Advisor727-588-6367Aetna Wellness Specialist727-588-6134PCS Retirement Team727-588-6214*Available to PCS retirees and their dependents enrolledin a PCS-sponsored Aetna medical plan.6

2022 MONTHLY INSURANCE RATESMedical, Vision, and Life Insurance Payments: Your monthly rates will be deducted from your monthly FRSpension check. If you do not receive an FRS pension check, payment coupons will be sent to you. Please note, if yourannual premiums total 150 or less for dental or vision, you will need to make one annual payment.Dental Insurance Payments: If you have Humana Advantage or MetLife Dental, they will bill you directly for yourdental insurance. Dental insurance cannot be deducted from your FRS pension check.AETNA MEDICAL PLANSRETIREERETIREE SPOUSE RETIREE CHILDRENRETIREE FAMILYSelect Open Access 803.33 1,596.67 1,420.67 2,298.00Choice POS II 820.00 1,631.67 1,455.67 2,368.00CDHP HRA 770.00 1,525.00 1,349.00 2,199.67Basic Essential 706.67 1,401.67 1,247.33 2,018.00HUMANA DENTAL ADVANTAGE 2S PLUS PLANMETLIFE DENTAL PLANEYEMED VISION CARE PLANRETIREERETIREE 1RETIREE FAMILY 23.22 39.27 57.12RETIREERETIREE 1RETIREE FAMILY 34.89 60.60 87.49RETIREERETIREE 1RETIREE FAMILY 3.65 8.37 13.51The Standard Life Insurance Rates (Board Life)AGERATEAGERATE35-39 0.1155-59 0.5140-44 0.1460-64 0.9845-49 0.2165-69 1.5550-54 0.3570 2.23The life insurance rates are per 1,000 of coverage, based on your age as of January 1, and are subject to reduction at age 70.The Standard Dependent Term LifeDEPENDENT RATE 1.50 for 5,000 of coverage7

UNDERSTANDING YOUR AETNA MEDICAL PLANHOW MUCH YOU HAVE TO PAYHealth Reimbursement Account (HRA) (CDHP only) Use your HRA to pay your deductible, coinsurance, and Rx co-pays,reducing your out-of-pocket costs. Note the IRS requires that 100% of disbursements made from your HRA be substantiated or verified.Medical Plan Deductible (Choice POS II, CDHP HRA, and Basic Essential) This is the amount you pay for medical expenses before the plan begins paying benefits.Coinsurance (Choice POS II, CDHP HRA, and Basic Essential) This is the percentage of eligible medical expenses youpay after paying the deductible for most services.Co-pays. The fixed amount you pay for medical care and prescriptions. With the Aetna Prescription Drug Program, youpay co-pays for generic and preferred brand drugs. For non-preferred brand and specialty drugs, you pay the Rx deductible before you pay co-pays.Out-of-Pocket (OOP) Maximums This is the most you will pay for deductibles (if applicable), co-pays, and/or coinsurance in a plan year. There are two OOPs, one for medical expenses and one for Rx. When you reach an OOP maximum, the plan will pay 100% of those eligible expenses for the remainder of the plan year.COORDINATION OF MEDICAL BENEFITSIf you, your spouse, or your child(ren) have coverage under another health care plan (medical, dental, etc.) in additionto coverage under your PCS plan, coordination of benefits (COB) between the health plans generally will apply. Usually, the “birthday rule” of order of benefit determination will apply. This means that the health plan of the spouse orparent whose birthday occurs earlier in the year will pay regular benefits and the other health plan will coordinatetheir benefits with the primary plan.If you or one of your covered dependents has Medicare, generally Medicare will be your primary health plan. Your PCShealth plan will coordinate benefits with Medicare if your provider is an Aetna contracted in-network provider. For example, if you are a retiree, have Medicare and are enrolled in the Aetna Select Open Access or the CDHP HRA plan,Aetna will coordinate with Medicare only if your provider is an Aetna contracted in-network provider.If you have questions about your specific situation or claims, please call Aetna Concierge Customer Service at 866-2530599.Routine Eye Exam Not Covered. Routine eye exams are not covered under the Aetna medical plans.If you are enrolled in the EyeMed Vision Care Plan, routine eye exams are covered.Diabetes CARE Program. See the online BENEFlex Guide for details about the Diabetes CARE Program andfree diabetic testing supplies.8

AETNA MEDICAL PLANS You and your eligible dependents must be enrolled in a PCS medical plan at the time of your retirement to continuemedical coverage.You must remain in that plan or elect to terminate your coverage. If you remain in the plan, you can change yourelection at the next Annual Enrollment. Your change will be effective on January 1 of the following year.You may continue to cover your enrolled dependents or cancel their coverage. In some instances, newborns may beadded, subject to state legislation and carrier requirements. Please contact the Risk Management and InsuranceDepartment Retirement Team for information.AETNA PRESCRIPTION DRUG PROGRAM All medical plans include prescription drug coverage from Aetna. The program uses Aetna’s Standard Formulary.Each drug is grouped as a generic, preferred brand, non-preferred brand, or specialty drug. Call Aetna’s ConciergeCustomer Service at 866-253-0599 if you have questions.Maintenance drugs are filled under the Maintenance Choice Program, which requires that your physicianwrite a 90-day prescription for all maintenance medications. You must fill the 90-day supply through CVS Caremarkmail order or at your local CVS Pharmacy retail locations. You will only pay two co-pays for a 90-day supplyYour cost copay depends on the Aetna medical plan in which you are enrolled: 25 co-payfor Select Open Access, Choice POS II, and CDHP; 40 co-pay for Basic Essential.After registering, you can talk to a doctor by phone or video 24/7 who can treat colds, sore throats, flu symptoms,allergies and sinus infections, earaches, and more. Call 855-835-2362 to register by phone. Go to www.Teladoc.com/Aetna, click "set up account.” Download the mobile app, click “activate account.”Available to all Aetna medical plan members, this free online and mobile resource makes it easy to shop for affordable high-quality health care—fromdiagnostics and imaging to outpatient surgery—at a fair price. Go to pcsb.org/healthcarebluebook to learnmore.The Aetna In Touch Care program offers personal, ongoing support to help you manage ahealth event or chronic condition. Offering both digital and nurse support, the programallows you to easily move between the two. The program is easy to access from your securemember website at aetnapcsb.com. And, it comes as part of your benefits plan, so there is no additional cost toyou. Aetna will reach out to members who may benefit from extra support, so please answer your phone whenthey call.9

AETNA MEDICAL PLANS COMPARISON CHARTSELECT OPEN ACCESSCHOICE POS IIIN-NETWORK ONLYIN-NETWORKOUT-OF-NETWORK1Any provider in the Aetna SelectOpen Access national networkAny provider in the Choice POS IINetwork (national network)Any ProviderHealth Reimbursement Account (HRA)—Individual/Family HRA funds can onlybe used for medical plan and prescription drug /A 500 individual; 1,000 family (combined in– and out-of-network)Medical Out-of-Pocket Maximum—Includesmedical deductible, coinsurance, and/or co-pays 5,000 individual; 10,000 family 5,000 individual; 10,000 family (combined in– and out-ofnetwork)Rx Out-of-Pocket Maximum—IncludesRx co-pays and deductible 2,000 individual; 4,000 family 2,000 individual; 4,000 family (combined in– and out-of-network)UnlimitedUnlimitedBENEFITService Areas/NetworksLifetime MaximumPHYSICIAN OFFICE VISITSYOU PAYYOU PAYYOU PAYPrimary Care Physician (PCP) 35 co-pay20% after deductible40% after deductibleSpecialist (SPC) 60 co-pay20% after deductible40% after deductibleTeladoc: Doctor 25 co-pay 25 co-payN/ATeladoc: Behavioral Health 25 co-pay20% after deductibleN/APreventative Adult Physical ExamsNo co-pay0%40% after deductiblePreventative GYN Care (including Pap test)(direct access to participating providers)No co-pay0%40% after deductibleMammography Preventive ScreeningNo co-pay0%40% after deductibleImmunizationsNo co-pay0%40% after deductibleCo-pay waived for allergy injectionsbilled separately20% after deductible40% after deductibleAllergy TestsLabX-Ray OutpatientAdvanced Outpatient Radiology Services(MRI, CAT scan, PET scan, etc.) 50 co-pay 25 co-pay 50 co-pay 250 co-pay20% after deductible40% after deductibleColonoscopy Screenings—Preventive andDiagnosticNo co-pay0%40% after deductibleChiropractic Services (limits apply)(direct access to participating providers) 60 co-pay, 20 visits per calendaryear20% after deductible40% after deductibleAllergy InjectionsHearing Exam 25 co-pay20 visits per calendar year combined in– or out-of-network20% after deductible40% after deductibleThis chart provides a brief outline of the medical coverage options available to you through Aetna. Complete details are in the official plan documents. In any conflict between the plan documents andthis basic comparison chart, the plan documents will control.Please note: The dollar amounts are co-pays, deductibles, and maximums, which you pay; the percentages are coinsurance amounts, which you pay after you meet applicabledeductibles. The amount the plan pays may be based on usual, reasonable, and customary (URC) fees for out-of-network services only.1 Usual, customary, reasonable (UCR) fees. Out-of-network charges that exceed UCR fees may be billed to the member.10

AETNA MEDICAL PLANS COMPARISON CHARTCDHP HRABASIC ESSENTIALIN-NETWORK ONLYIN-NETWORK ONLYService Areas/NetworksAny provider in the Aetna SelectOpen Access national networkAny provider in the Choice POS IINetwork (national network)Health Reimbursement Account (HRA)—Individual/Family HRS funds can onlybe used for medical plan and prescription drug expenses. 500 individual 750 employee child(ren) 750 employee spouse 1,000 familyHRA contributions are proratedbased on your date of hireN/ADeductibles—Individual/Family 1,500 individual; 3,000 family 2,300 individual, 6,900 familyMedical Out-of-Pocket Maximum—Includesmedical deductible, coinsurance, and/or co-pays 5,000 individual; 10,000 family 8,550 individual; 17,100 familyRx Out-of-Pocket Maximum—IncludesRx co-pays and deductible 2,000 individual; 4,000 familyCombined with medicalUnlimitedUnlimitedPHYSICIAN OFFICE VISITSYOU PAYYOU PAYPrimary Care Physician (PCP)20% after deductible 50 co-paySpecialist (SPC)20% after deductible30% after deductibleTeladoc: Doctor 25 co-pay 40 co-pay20% after deductible0% no deductiblePreventative Adult Physical Exams0%, no deductible0%, no deductiblePreventative GYN Care (including Pap test)(direct access to participating providers)0%, no deductible0%, no deductibleMammography Preventive Screening0%, no deductible0%, no deductibleImmunizations0%, no deductible0%, no deductibleAllergy Injections20% after deductible30% after deductibleAllergy TestsLabX-Ray OutpatientAdvanced Outpatient Radiology Services(MRI, CAT scan, PET scan, etc.)20% after deductible30% after deductibleColonoscopy Screenings—Preventive andDiagnostic0%, no deductible0%Chiropractic Services (limits apply)(direct access to participating providers)20% after deductible; 20 visits percalendar year30% after deductible; 20 visits percalendar year20% after deductible30% after deductibleBENEFITLifetime MaximumTeladoc: Behavioral HealthHearing ExamUnderstanding HowMuch You Have to PayHealthReimbursementAccount (HRA) (CDHPonly). Use your HRA to payyour deductible,coinsurance, and Rx copays, reducing your out-ofpocket costs. The amountdeposited in your HRA isprorated based on yourbenefits effective date.Note the IRS requires that100% of disbursementsmade from your HRA besubstantiated or verified.Medical PlanDeductible (Choice POSII, CDHP HRA, BasicEssential). The amount youpay for medical expensesbefore the plan beginspaying benefits.Coinsurance (ChoicePOS II, CDHP HRA, BasicEssential). The percentageof eligible medicalexpenses you pay afterpaying the deductible formost services.Co-pays. The fixedamount you pay formedical care andprescriptions.Aetna PrescriptionDrug Program. You payco-pays for generic andpreferred brand drugs. Fornon-preferred brand andspecialty drugs, you pay theRx deductible before youpay co-pays. Thedeductible does not applyto the non-preferred branddrugs. More informationcan be found on page 17.11

AETNA MEDICAL PLANS COMPARISON CHARTSELECT OPEN ACCESSHOSPITALIN-NETWORK ONLYInpatient (Includes maternity andnewborn services)CHOICE POS IIIN-NETWORK 500 co-pay per day; up to 5- 500 co-pay per day; up to 5day maximum-day maximumOUT-OF-NETWORK140% after deductibleOutpatient Surgery (including facilitycharges) 500 co-pay20% after deductible40% after deductibleEmergency Room Services 500 co-pay20% after deductible20% after deductibleAmbulanceNo co-pay20% after deductible20% after deductibleUrgent Care Facility 50 co-pay20% after deductible40% after deductible 50 co-pay for initial visit only20% after deductible40% after deductible 25 co-pay20% after deductible40% after deductible 500 co-pay per day; up to 5-daymaximum 500 co-pay per day; up to 5-daymaximum40% after deductibleHome Health Care (limits apply) 25 co-pay20% after deductible40% after deductibleHospice—Inpatient (limits apply) 500 co-pay per day; up to 5-daymaximum2 500 co-pay per day after deductible; up to 5-day maximum240% after deductible; 30-daylifetime maximumSkilled Nursing Facility (limits apply) 500 co-pay per day; up to 5-daymaximum; up to 120-visit limit percalendar year 500 co-pay per day after deductible; up to 120-visit per calendaryear40% after deductible, 120-visitlimit per calendar year 25 co-pay per visit, 60-visit limit per 20% after deductible; 60-visit limitcalendar year for all therapies com- per calendar year for all therapiesbinedcombined40% after deductible, 60-visitper calendar year for all therapies combinedMaternity Care/OB VisitsMENTAL HEALTH SERVICESOutpatient Mental Health ServicesInpatient Mental Health ServicesMISCELLANEOUSShort-Term Rehabilitation/OutpatientTherapy (speech, physical, occupational)Diabetic Supplies (syringes, test strips)Durable Medical Equipment (DME)See prescription drugs belowSee prescription drugs belowSee prescription drugs below 50 co-pay20% after deductible40% after deductibleAETNA PRESCRIPTION DRUG PROGRAM—SOME DRUGS MAY BE SUBJECT TO STEP-THERAPY OR PRECERTIFICATION3Mandatory Generics UnlessDispensed As WrittenUp to 30-day supply: 15 co-pay, no Rx deductible 60 co-pay, no Rx deductible 90 co-pay, after Rx deductible30% coinsurance, 0 if enrolledGenericPreferred BrandNon-Preferred BrandSpecialty—PrudentRx*90-day Supply (maintenance medications) at CVS retail or mail order (mailorder must be through CVS Caremarkmail order delivery.)GenericPreferred BrandNon-Preferred BrandSpecialty—PrudentRx*Mandatory Generics UnlessDispensed As Written 30 co-pay, no Rx deductible 120 co-pay, no Rx deductible 180 co-pay, after Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As Written 15 co-pay, no Rx deductible 60 co-pay, no Rx deductible 90 co-pay, after Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As Written 30 co-pay, no Rx deductible 120 co-pay, no Rx deductible 180 co-pay, after Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As WrittenNOT COVEREDMandatory Generics UnlessDispensed As WrittenNOT COVERED1 Usual, customary, reasonable (UCR) fees. Out-of-network charges that exceed UCR fees may be billed to the member. 2 Waived if transferred from hospital 3 See page 17 for Aetna PrescriptionDrug Program and step-therapy information*May be eligible for 0 co-pay under PrudentRx program, see page 18 for details.12

AETNA MEDICAL PLANS COMPARISON CHARTCDHP HRABASIC ESSENTIALIN-NETWORK ONLYIN-NETWORK ONLYInpatient (Includes maternity andnewborn services)20% after deductible30% after deductibleOutpatient Surgery (including facilitycharges)20% after deductible30% after deductibleEmergency Room Services20% after deductible30% after deductibleAmbulance20% after deductible30% after deductibleUrgent Care Facility20% after deductible30% after deductibleMaternity Care/OB Visits20% after deductible30% after deductibleYOU PAYYOU PAYOutpatient Mental Health Services20% after deductible0% no deductibleInpatient Mental Health Services20% after deductible30% after deductibleHome Health Care (limits apply)20% after deductible; 120-visit limitper calendar year30% after deductible; 120-visitlimit per calendar yearHospice—Inpatient (limits apply)20% after deductible30% after deductibleSkilled Nursing Facility (limits apply)20% after deductible; 120-visit limitper calendar year30% after deductible; 120-visitlimit per calendar yearShort-Term Rehabilitation/OutpatientTherapy (speech, physical, occupational)20% after deductible; 60-visit limitper calendar year for all therapiescombined30% after deductibleSee prescription drugs belowN/A20% after deductible30% after deductibleHOSPITALMENTAL HEALTH SERVICESMISCELLANEOUSDiabetic Supplies (syringes, test strips)Durable Medical Equipment (DME)AETNA PRESCRIPTION DRUG PROGRAM—SOME DRUGS MAY BE SUBJECT TO STEP-THERAPYOR PRECERTIFICATION3Up to 30-day supply:GenericPreferred BrandNon-Preferred BrandSpecialty—PrudentRx*90-day Supply (maintenance medications) at CVS retail or mail order (mailorder must be through CVS Caremarkmail order delivery.)GenericPreferred BrandNon-Preferred BrandSpecialty—PrudentRx*Mandatory Generics UnlessDispensed As Written 15 co-pay, no Rx deductible 60 co-pay, no Rx deductible 90 co-pay, after Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As Written 30 co-pay, no Rx deductible 120 co-pay, no Rx deductible 180 co-pay, after Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As Written 25 co-pay, no Rx deductible 60 co-pay, no Rx deductible 90 co-pay, no Rx deductible30% coinsurance, 0 if enrolledMandatory Generics UnlessDispensed As WrittenAetna Concierge(Group #109718)Customer ServicePlease note: Thedollar amounts are copays, deductibles, andmaximums, which youpay; the percentagesare coinsuranceamounts, which youpay after you meetapplicable deductibles.The amount the planpays may be based onusual, reasonable, andcustomary (URC) feesfor out-of-networkservices only.This chart provides abrief outline of themedical coverage optionsavailable to you throughAetna. Complete detailsare in the official plandocuments. In anyconflict between the plandocuments and this basiccomparison chart, theplan documents willcontrol.See the Diabetes CAREProgram informationfor details about freediabetic testingsupplies. 50 co-pay, no Rx deductible 120 co-pay, no Rx deductible 180 co-pay, no Rx deductible30% coinsurance, 0 if enrolled3 See page 17 for Aetna Prescription Drug Program and step-therapy information.*May be eligible for 0 co-pay under PrudentRx program, see page 18 for details. Some exclusions apply. Any specialty prescriptions not eligible under PrudentRx will fall to applicable tier for thatdrug.13

HEALTH CARE REFORM AND YOUR MEDICAL PLAN CHOICEIf you cannot afford to enroll your dependents in a PCS medical plan, consider the following:Children: Florida KidCare is the state-sponsored health care program for children from birth through age 18 who meet specific eligibilityrequirements. For more information, call 888-540-5437 or visit floridakidcare.org.Spouse and/or child(ren): You can consider your spouse’s employer-sponsored plans. If your spouse is not employed or his or heremployer doesn’t offer health insurance, the federal Health Insurance Marketplace may offer cost-effective alternatives. You can also enrollyour child(ren) in a federal Marketplace plan. For more information about health care reform, go to: pcsb.org/affordable-care-act.ENROLLMENT IN A FEDERAL HEALTH INSURANCE MARKETPLACE PLANYou can enroll in a medical plan through the Federal Health Insurance Marketplace. If you enroll in a medical plan through the MarketPlace after the PCS annual enrollment window, you must contact us within 31 days of your enrollment to discontinue your PCS groupcoverage. Your request to discontinue your coverage will be effective the first of the month following receipt of your enrollment and changeform by PCS.If, within 12-months after enrolling in a plan through the marketplace, you are not happy with your decision and would like to re-enroll ina PCS medical plan, please contact us at 727-588-6140 during the next annual enrollment and we can reinstate your coverage in anequivalent plan. You will be responsible for the applicable rates.MEDICARE ELIGIBILITYGenerally, you are eligible for Medicare, if you: Or your spouse worked for at least 10 years inMedicare-covered employment, AND Are 65 years old or older, AND Are a citizen or permanent resident of the UnitedStates, OR Are a younger person with a disability or with end-stage renal disease (permanent kidney failurerequiring dialysis or transplant)?MEDICARE COORDINATION THROUGHAETNAIf you are eligible for Medicare due to kidney dialysisand/or transplant, Medicare becomes your primary coverage when the 30-month coordination period has ended. If you are a retiree and on Medicare, Medicare isalways primary.RESOURCES FOR MEDICARE-ELIGIBLE RETIREESYou must contact the appropriate provider directly toenroll in a plan, make changes, access provider directories, and get information.SHINE – Serving Health Insurance Needs of Elders800-963-5337 floridashine.orgSHINE is a free program offered by the Florida Department of Elder Affairs and your local Area Agency on Aging.Specially trained volunteers can assist you with yourMedicare, Medicaid, and health insurance questions byproviding one-on-one counseling and information.MedicareFor general Medicare inquiries, contact: 800-MEDICARE(800-633-4227)TYY/TDD# 877-486-2048 medicare.gov14

DENTAL BENEFITSPCS offers two dental plans, the HumanaDental Advantage Plus 2S Plan and the MetLife Preferred Dentist Program. The chart belowcompares the plan benefits. All services are subject to plan limits, exclusions and other provisions. A complete description of the plan canbe found on the Certificate of Coverage.CAUTION: If you cancel your and/or your dependent’s dental coverage as a new retiree, during the year, during annual enrollment ordiscontinue your payment, you will not be able to re-enroll. If you elect either dental plan, you will be billed by the carrier and will berequired to pay them directlyHUMANA DENTAL (#548085)METLIFE PREFERRED DENTAL PROGRAM (#95682)800-979-4760 WWW.MYHUMANA.COM1-800-GET-MET8 WWW.METLIFE.COM/DENTALState of Florida Service Area. In-network only. This is anOpen Access Dental HMO.In or out-of-network. Save the most when you choose a participatingIn-network provider.NetworkHumana Dental Advantage Plus 2S PlanMetLife Preferred Dentist Program (PDP Plus)Primary Care Dentist andSpecialist ReferralsNot requiredNot requiredDeductibleNone 50/individual; 150/family (Applies to Type B and C Services)Calendar Year MaximumNone 1,250 per personPreventative ServicesNo chargeNo charge, no deductible (Type A)Basic ServicesNo charge20% coinsurance after deductible (Type B)Major ServicesScheduled co-pays50% coinsurance after deductible (Type C)OrthodontiaScheduled co-pays (Adult and child)50% (up to age 19)Lifetime Orthodontia LimitN/A 1,000 individualHUMANA DENTAL ADVANTAGE PLUS 2S PLAN (GROUP #548085)You and your eligible enrolled dependents may contin

Federal Health Insurance Marketplace 800-318-2596 www.healthcare.gov Medicare Services (800-MEDICARE) . METLIFE DENTAL PLAN 34.89 60.60 87.49 RETIREE RETIREE 1 RETIREE FAMILY EYEMED VISION CARE PLAN 3.65 8.37 13.51 The Standard Dependent Term Life