Transcription

USINESS SERIEREPORTPromoting Decent Workby Digitizing WagesResponsibly in JordanOCTOBER 2021A

AuthorsTareq ABU QAOUD, Better Work JordanKawther ALZOBI, Deutsche Gesellschaft für Internationale ZusammenarbeitGmbH (GIZ)Marjolaine CHAINTREAU & Jean Pascal MVONDO, Better Than Cash AllianceDiana CAZACU, Avrio ImpactCover photo: Better Work Jordan1

FOREWORDThe world has witnessed the devastating impact of COVID-19 on the apparel supply chain andits workers. Compared to other garment industries, which saw major contractions of between30 and 50 percent in 2020, Jordan’s garment sector has shown resilience, with only a 15–20percent reduction in exports, proving its ability to adapt to the new economic context.However, several challenges surfaced during the pandemic, including the impact ofgovernment restrictions and regulations implemented under defence laws. Jordanexperienced the closure of a few factories due to unbearable losses, the downsizing ofproduction lines and a decrease in the number of orders from US buyers. As a consequence,there has been a rise in the number of violations of decent work, including reports of forcedlabour due to a lack of workers, and inaccurate and late payment of wages.These exceptional circumstances provided an opportunity to advance the rapid adoption ofdigital financial tools as a means to enhance workers’ protection. Digital payments can help toprotect and empower financially excluded people, especially women and migrants who makeup the majority of the workforce, to start experiencing broader and longer-term benefits fromformal financial services. In addition, digital payment of wages has proven to be beneficialfor companies by increasing productivity and reducing operating costs associated with cashmanagement without sacrificing decent work.Jordan’s leadership in this area is enabling a digital wage transition, as more workers beginusing digital payment tools. The insights shared in this report, in support of a national agendain Jordan, provide a nearly ‘real-time’ look at the policies, digital infrastructure, tools andcriteria to support responsible digital wages at scale. It also transparently identifies andaddresses barriers to delivering benefits for both workers and employers.By partnering with other organizations, including the International Labour Organization(ILO), the United Nations-based Better Than Cash Alliance and the Deutsche Gesellschaftfür Internationale Zusammenarbeit (GIZ) GmbH, Better Work has reinforced its commitmentto promote a global agenda on wage digitization to advance decent work and a responsibleeconomic recovery. This collaboration in Jordan is the first of its kind for Better Work.The ILO has now established the Global Centre on Digital Wages for Decent Work to stimulatedecent work via a transition to digital wage payments through peer sharing and evidencebased advocacy. We are happy to say the Jordan experience is contributing directly to thatglobal agenda.We invite all relevant stakeholders from government, workers’ associations, the privatesector and financial service providers to use the example of Jordan and join us in addressingthe challenges identified in this report, to build a more sustainable and responsibleeconomic recovery where workers, particularly women and migrants, are well protectedand financially empowered.DINA KHAYYATDAN REESVice-chairman of the Jordan Garments,Accessories & Textiles Exporters’Association (JGATE)Director of the ILO/IFCBetter Work programme1

TABLE OFCONTENTS XECUTIVE SUMMARYE/41. J OURNEY TO INCLUSIVEWAGE DIGITIZATION/142. L EADING THE CHANGETO OVERCOMEEXISTING BARRIERS/30ANNEXESUNDERSTANDING THE DIGITAL PAYMENTS JOURNEY FORJORDANIAN AND MIGRANT WORKERS IN THE GARMENTSECTOR, TO DESIGN RESPONSIBLE SOLUTIONS /46FRAMEWORK OF COMMON DIRECT AND INDIRECT COSTSFOR PAYING WAGES /52PARTNERS & METHODOLOGYBIBLIOGRAPHY2/55/53

Better Work Jordan3

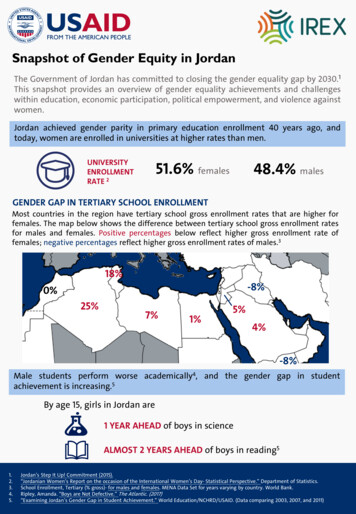

Better Work JordanExecutive SummaryThe Jordanian garment industry is a very important economic sectorthat employs over 76,000 people or 9 percent of the total adult privatesector workforce in Jordan. 73 percent of Jordan’s garment workers arewomen, who typically have less access to financial services. The industryaccounts for approximately 23 percent of total domestic exports for atotal value of US 1.9 billion in 2019. Today, an estimated two-thirdsof garment workers in Jordan still receive their wages in cashevery month.However, digital transactions could offer garment companies significantbenefits. Data shows that disbursing wages in cash can cost factoriesup to US 1,000 per month, equivalent to the monthly wages of4.4 workers. When three Jordanian garment companies (employing12 percent of garment workers in Jordan) paid wages digitally, theadministrative time to disburse wages dropped by 66 percent fordeposits made directly to bank accounts, and by 70 percent forpayments made directly to e-wallets.4

Direct payments to bank accounts and e-wallets also benefitworkers. Digital transactions are typically more secure and transparentthan cash. They are also an important step toward increasing financialaccount use and greater financial capability.1 This is particularly truefor women, who are less likely to have bank accounts or e-wallets.88 percent of male respondents we surveyed held one of these twomethods for participating in digital finance, compared with only 53percent of women.During the COVID-19 crisis, the Jordanian government’s commitmentto a strong, inclusive digital payment system proved to be a criticalasset in making a quick transition to digital service. At the onset of thepandemic, the government and financial sector worked together tomake it possible to safely onboard consumers to digital banking,by opening e-wallets and accomplishing E-KYC remotely. As aresult, the number of e-wallets more than doubled between Marchand December 2020, breaking 1 million in June and reaching 1,255,546e-wallets, with 1.3 million transactions, by year end. More than 260,000families who previously depended on cash also accessed governmentalaid through mobile money during the pandemic.2This report outlines how the Jordanian garment industry can build onthis upward trend in digital infrastructure and digital transactions, tobenefit from a responsible and sustainable transition to digital wages.73% of Jordan’s garment workers are women,who typically have less access to financial services5

EXECUTIVE SUMMARYFour important building blocksDRIVE THE TRANSITION TO SCALABLE AND RESPONSIBLEWAGE DIGITIZATION IN THE JORDANIAN MARKET:1Jordan already has effectiveINFRASTRUCTURE and aregulatory framework fordigital payments.Jordan currently employs internationallyrecognized good practices in regulationsand infrastructure, including The JordanMobile Payments Switch (JoMoPay), whichallows interoperability between all e-wallets;an electronic billing and payment system(eFAWATEERcom); and a strong public-privatecompany to develop payment systems inJordan (JOPACC).3COMPETITIONin Jordan’sfinancial systemsis stimulating ashift to a moreworker centricapproach.The banking systemin Jordan is bothcompetitive andcustomer-focused,with 24 commercialbanks and 7 licensedmobile payment serviceproviders. Two moremobile payment serviceproviders will join themarket in 2021.4Active workers’ associationsand international organizationsENGAGE all stakeholders to supporta responsible and sustainabletransition to digital wages in Jordan.6 2Jordan’s garment companiesare setting an example for otherindustries by PAYING WAGESdigitally, and responsibly.Garment factory management givesdigital payments broad-based supportbecause digital payments makestrategic sense for them. Jordaniangarment companies already usedigital tools to record worker hours.Payroll management is also digitized,which is critical to drive digitalpayments of wages. 34 percent ofworkers surveyed were paid viabank accounts, and an additional7 percent received wages via e-wallets.Significantly, all respondents receivingdigital wages were either satisfied orvery satisfied with that methodof payment.The garment sector trade unionrecognizes the benefits of digitalpayments and is committed toensuring that the worker perspectiveis taken into consideration whencompanies transition from cash todigital. More than 20 internationalorganizations, in partnership withtrade unions and/or government, areactively rolling out financial literacyprograms across the country.

With these basic building blocks in place, Jordan is on the right pathto achieve a fully digitized payments ecosystem, Digital 2.0, in thenext few years (Figure 1). Success requires effort from all members ofthe system, including regulators, service providers, brands, garmentcompanies, policymakers, industry associations and workers.FIGURE 1:THE VISION OF MATURE DIGITAL ECOSYSTEM IN JORDAN - DIGITAL 2.0.FINANCIAL SERVICES PROVIDERS (FSPs)& ECOSYSTEM Provide easy to use and multi-lingual service Expand agent network, ATM locations &ecosystem partnerships Scale business models and develop moreaffordable offerings Improve value proposition – highly efficient andcost effective basic offer attractive add-onsand customizationsFACTORY Digitize clocking inof workers and paycalculation as wellas payrollWORKER Increase digital and financial literacy Better understanding of the true costs andbenefits of digital payments Openness to change Early adopters as peer “champions” No need forfactories to managecash-out process Manage the changeprocess intelligently Negotiate betterpartnerships and dealswith Financial servicesproviders (FSPs)7

EXECUTIVE SUMMARYSome key recommendations toaddress early stage constraintsand achieve the vision of Digital2.0 include:1Design worker-centric and value-added paymentsolutions3 for all workers, Jordanian andmigrants. To trigger adoption, the different user journeys ofJordanian and migrant workers must be taken into account, aswell as the different financial habits of female and male workers.Developing an international digital remittances product coulddrive adoption of digital payments among migrant workers.All migrants surveyed remit part of their wages home, with62 percent indicating that they remit at least two-thirdsof their wages every month. Our survey also highlightedthat these remittances are organized after individuals cashout their wages. The Deutsche Gesellschaft für InternationaleZusammenarbeit (GIZ) GmbH and the Central Bank of Jordan(CBJ) are currently working to support the development andlaunch of a digital international remittances product to reducethe pressure and cost of cash-out for digital wages in Jordan.Expandingacceptanceof digitalpayments is animportant wayto support digitaltransactionsfor Jordanianworkers inparticular.82Create conditions for merchants and others toaccept digital payments. If workers are certain that they3Build a sustainable business model that appealsto employers and workers. Many companies like the ideacan use their e-wallets widely, at no additional cost, some wouldconsider them “better than cash,” and make more use of themfor day-to-day purchases. This would reduce costs and pressureon cash-out. Expanding acceptance of digital payments is animportant way to support digital transactions for Jordanianworkers in particular.of wage digitization, but do not understand the medium- andlong-term business case. To gain long-term benefits, companiesmust factor in upfront investment and recurrent costs. In theshort term, the overall cost to the factory may increase, as it maybe necessary to hire mobile ATMs or install one in the factory,for example. Trade organisations, like the Jordan Garments,Accessories & Textiles Exporter’s Association (JGATE), areimportant players to gather experience and good practicessupporting digital wages for all garment companies at scale.

4Drive change management through collaborationbetween garment companies, financial serviceproviders, workers and the trade union. If workerswitness a small group in the factory successfully using digitalfinancial services, they will be more likely to adopt them personally,workers told us in surveys. When companies implement appropriatefinancial and digital capability campaigns for workers, inpartnership with other providers, workers will develop better skillsto make effective use of digital payments.5Create conditions for a more robust e-walletmarket. Despite important advancements in digital finance,6Build workers’ trust and adoption of digitalsolutions by improving liquidity at cash-out pointsand increase network density. 90 percent of workers weadoption may be limited because interoperability at the agent levelis still not available in Jordan. Government could play an importantpart in encouraging companies to adopt digital wage solutionsthat will enable a sector-wide shift in the garment industry. Timedappropriately, along with an increase in cash-out points, betterliquidity and more widespread acceptance of digital payments bymerchants, a shift to digital wages can lead to stronger uptake ofdigital payment services among garment workers, offering themmore secure and responsible wages and greater financial inclusion.surveyed who received digital wages were very satisfied with themethod. However, 100 percent of the workers surveyed who receivedigital wages cashed-out their wages. The majority cashed-outimmediately, in response to anticipated difficulty accessing theircash. Ensuring that digital financial service providers have enoughcash points (ATM, bank branches and mobile money agents) andsufficient liquidity will help to build workers’ trust and adoption ofdigital solutions.Together, our partner organizations will continue to collaborate withJordan’s key stakeholders to support responsible scaling and use ofdigital wage payments to advance a national agenda on promotingdigital wages for decent work.9

VisionReimagining the worker experienceWith digital wages, garment workers can access value-added financialservices, to pay bills, make purchases, send money abroad, start to buildtheir credit history, and save, conveniently and within seconds.1Digital 2.0: A vision for garment companies and workersWith further commitment to and investments in the emerginginclusive digital payment system garment companies will reap thebenefits of digital payments; more efficiency, higher productivity,increased revenue, lower costs, and greater transparency andsecurity. Costs to process monthly salaries will fall by 80 percent.Wages will be transferred to individual bank accounts or e-wallets,followed instantly by notifications to workers’ mobile phones, withconfirmation of hours worked and digital payslips which may reducewage related disputes. Factory productivity losses, due to distributionof cash wages will be eliminated. Stronger business relationships willbe built through digital transactions. For example, when Gap Inc. inIndia began to pay 95 percent of factory workers digitally, factoriesexperienced a 15–20 percent general reduction in worker attrition andturnover, on average.Workers will gain digital and financial literacy and access to valueadded financial services. As workers become increasingly familiar withdigital payment technology, they will gain autonomy and control overtheir finances. Workers will build a financial footprint, making it easier toaccess other formal financial services, such as savings and loans, whenthey need them. Digital transactions will be simple to launch and takemere seconds to execute when paying bills, making purchases, sendingmoney abroad or saving. The cost of these transactions will be minimaland very attractive to workers. Rather than spending hours travellingand queuing to convert their wages into cash every month, workers willhave more time for things they want to do. The risk of theft or loss ofwages will be eliminated.Women will be just as likely as men to have an e-wallet or bank accountin their own name. Women will be empowered as they gain financial anddigital literacy, giving them more access and choice in financial services,so they can make their own decisions about their money.10

The Jordan payments ecosystem in theDigital 2.0 eraA competitive, user-centered ecosystem will provide a range of wellsegmented, value-added services to garment sector workers, enabling themto conduct all financial transactions digitally, effortlessly and inexpensively.2Digital 2.0: A vision for financial service providersand ecosystemAgents. In the initial stages of digitization, it will be easy for workersto access their cash wherever and whenever they need it, due tohigh liquidity levels and a ubiquitous network of agents and ATMs.A sufficiently dense network of agents at agent outlets, in factories orat workers’ dormitories, will ensure that workers do not have to travelto access points.Digital financial service providers. Digital payment applicationproviders will improve user interfaces to meet the needs of bothJordanian and migrant workers.4 With more providers on the scene,costs for digital services will fall sharply. Service providers will create arange of attractive add-ons and services for different market segments,with high levels of customization for individual users. Banks will offereffective hybrid solutions that allow the user to transition seamlesslyfrom paying a bus fare with a mobile phone to using mobile or InternetBanking for remittances.Merchants. Digital payment will be accepted almost everywhere,from retail stores to transportation, at physical, digital or multichannel establishments. Digital financial service providers will supportmerchants with real-time authentication and anti-fraud services,and provide a seamless customer experience for workers. Fees forcustomers will drop. Merchants will be able to access high-qualitycustomer data, to improve their own offerings to customers.Can this vision be achieved in Jordan? The prognosis is good.The ecosystem in the Jordanian garment sector is now in a positionto kick-start the transition towards the vision of Digital 2.0. The nextsection looks at each of the four building blocks already in place tosupport this transition.11

VISIONFIGURE 2:AN INTEGRATED, ITERATIVE CHANGE PROCESSChange processesDigital 1.0Transition period Digitize calculation anddisbursement of wages Make initial savings but initiallydigital costs relatively high Need workaround to enableworkers to cash outImproving the lives of workersthrough DFSEvolution of digital FSP offer Scale business modelMore competitive fee structurePartnerships with ecosystem membersMore market coverage (cash out and purchases)Workers andfactories adopt Easy to use, multilingual applications Reasonable cost,convenientJordan is currentlyobserving thebeginning ofEcosystemIntegrationJordan’s progress202012

Digital 2.0 Digital becomes mainstreamamong workers Easy to remit internationallyand make purchases Added value services available Early adopters provide use casesImproved efficiencies lead to additional savingsSeek additional value from FSPNegotiate better deals and service levelsEcosystem integration Understand factory and worker needs betterSeamless end-to-end interoperable serviceProvide value added service and differentiateSupply side matures and basic services become cheaperDeepen partnerships202313

Better Work JordanS EC T I O N 1Journey to inclusivewage digitizationTo build an inclusive wage digitization journey, Jordanianstakeholders have already started to leverage fourbuilding blocks:(1) Regulations and infrastructure that enabledigital payments(2) The leadership of garment companies’ in drivingdigital wages which leads to satisfaction for workers(3) A maturing financial services sector(4) Committed workers’ associations andinternational organizations.14

BUILDINGBLOCK1Regulatory framework andtechnology infrastructureare already in placeThe Central Bank of Jordan (CBJ), which provides regulation andoversight of payment service providers (PSPs) and banks, has beeninstrumental in facilitating rapid digital onboarding and more convenientdigital payments transactions. At the onset of the COVID-19 pandemic in 2020,the Jordanian government made remote E-KYC and opening of e-wallets possible,so that consumers could be onboarded safely. The CBJ also increased transactionlimits, reduced bank fees and eliminated minimum balances. The garment sectorwas identified as one of the sectors most negatively affected by the COVID-19pandemic. In response, in early 2021, the Social Security Corporation (SSC)committed to paying 75 percent of the wages of Jordanian workers in the sector.This required workers to have active bank accounts or e-wallets to receive wagesdirectly. For migrant workers, the CBJ authorized digital international remittancesin the final quarter of 2020, clearing the way for the development of new digitalinitiatives. At the time of this report, eFAWATEERcom, an electronic billing andpayment system under the supervision of the CBJ has integrated with WesternUnion, enabling migrants to open an account with Western Union. They may thenforward money to their account, and send remittances from it. Recently, somePSPs have started to integrate their apps with the Exchange House for smoothertransactions. To increase accessibility to cash and e-money the CBJ also issuedguidelines about continuity procedures for ATMs and point of sale operations.The Ministry of Digital Economy and Entrepreneurship (MODEE) hasdemonstrated a strong commitment to digital transformation of theeconomy by developing appropriate policies and supporting the enabling pillars.In collaboration with the CBJ and the Ministry of Finance, the MODEE encouragedmerchants to accept e-wallets and facilitated the onboarding process betweenmerchants or vendors and individuals. The MODEE also encouraged gas stationsand other entities in the energy sector to accept payments via e-wallets. Inaddition, the government is actively promoting e-payments from citizens, with agrowing number of government organizations no longer accepting cash.The number of e-wallets more than doubled and the totalnumber of digital transactions has quadrupled in only9 months in 2020.MOBILE WALLET PAYMENTS MADE IN JORDAN,JOMOPAY, MONTHLY EDITIONS, JANUARY TO DECEMBER 202015

J O U R N E Y T O I N C L U S I V E W A G E D I G I T I Z AT I O NIn 2020, the Jordan Payments and Clearing Corporation (JoPACC)launched a number of initiatives to promote the use of DFS (digitalfinancial services) in Jordan, including an online gateway for people to opene-wallets online; an interoperable, instant payments system called CliQ; and apartnership with GIZ to promote merchants’ acceptance of digital payments. Finally,in parallel with the efforts of JoPACC, the CBJ continues to promote the use of DFS,including it as a central pillar in its 2018 National Financial Inclusion Strategy.E-wallets and associated transactions show strong growth. These measuresresulted in a marked increase in the use of e-wallets in 2020 (Figure 3). In January2020, JoMoPay reported 374,400 e-wallet transactions for the month. BetweenMarch and December 2020, the number of e-wallets in Jordan more than doubled,breaking the 1 million barrier in June and reaching 1.3 million transactions inJanuary 2021.5 eFAWATEERcom payments from e-wallets also jumped, from about1.9 million JD in January 20206 to 7.6 million JD in January 2021, although thesepayments are dwarfed by the flow of digital payments from bank accounts into theeFAWATEERcom system.Interoperability is in the early stages of development in Jordan.Interoperability which facilitates more convenient, affordable, fast, seamless andsecure transactions between e-wallets and bank accounts, which is crucial forreaching users who are new to digital finance, as positive experiences with newservices will ensure uptake and ongoing usage. Interoperability is complex andselecting the appropriate approach and type of interoperability such as platformlevel, agent-level and/or customer level interoperability will depend on localconditions and context. Either way, it is essential that policymakers and serviceproviders support collaboration on the infrastructure whilst allowing the market tocompete on products and services.In Jordan, JoPACC played a critical role in encouraging interoperability betweene-wallets, and is working towards interoperability between e-wallets and bankaccounts. Seven licensed PSPs, are players in this market, each with differentbusiness models, fee structures and agent networks. As a result, even thoughJoMoPay and CliQ technically enable cross-PSP and bank-PSP interoperability,PSPs have not agreed on the commercial terms that would govern such a system.Most importantly, the PSPs have not reached an agreement on fee-sharing andagent-management structures. Unless a cooperation agreement is reachedinteroperability will not be fully operational and workers will continue to convertmoney transfers into cash given the limitations to transact with customers ofdifferent PSPs. In order to encourage further interoperability options such as agentinteroperability and interconnection with platforms outside of Jordan (to facilitateremittances), the regulator may be a need to play a more active role workingwith the private sector to develop a centralised mechanism as has been done inplaces like Peru and Mexico. Additional technical assistance could also support theprivate sector to identify business cases that maintain financial viability. Financialassistance may also be an option to support key moments of transition.16

Better Work Jordan17

J O U R N E Y T O I N C L U S I V E W A G E D I G I T I Z AT I O NFIGURE 3:Growth of e-wallets and transations since the onset of covid-19MONTHLY TRANSACTION VALUE (JD) IN 2020 YJUNJULSource: Mobile Wallet Payments made in Jordan, JoMoPay, Monthly editions, January to September 2020 inclusivehttp://www.jopacc.com/En/List/Payment Systems Reports18AUGSEP

Better Work Jordan Better Work JordanEVOLUTION OF NUMBER OF E-WALLETS IN 2020 AUGSEPEVOLUTION OF TOTAL MONTHLY NUMBER OF TRANSACTIONS VIA E-WALLETS IN 2020 (MILLIONS)21.510.5JANFEBMARAPRMAYJUNJULAUGSEP19

J O U R N E Y T O I N C L U S I V E W A G E D I G I T I Z AT I O NBUILDINGBLOCK 2Garment companies are drivingthe transformation to digitalwages, which give workershigh satisfactionThe transition to digital makes sound financial sense. Companies incur aseries of costs by paying cash, including: Direct costs. The wages of administrative staff to prepare and disbursewages; the cost of consumables such as pay-slips and envelopes; and the costof securely transporting cash from bank to factory or the amortization of theinstallation of cash machines. Opportunity cost. The time workers spend collecting and signing for theirwages, although the time lost depends on company procedure.This cost structure is illustrated in Figure 4. Figure 5 demonstrates the costsassociated with disbursing wages in cash.FIGURE 4:Illustration of the cost structure of wage payments for companiesCOMPANYDIRECT COSTCOMPANYOPPORTUNITY COSTDIGITALPAYMENT COSTIncludes:Includes:Includes for companies: Administrative stafftime (hourly wage)spent on preparingand disbursing wages W orkers’ time spentcollecting wages Bank fees F or cash payments: timespent queuing and / orsigning for wages Payment serviceproviders fees Consumables (payslipsand envelopes) When paying in cash:amortization of cashmachines, cost of cashtransport and insurance20 F or digital payments:time spent queuingto cash out duringworking hoursTime lost varies dependingon company procedure ATM related feesOnly fees paid bycompanies are includedin the calculation.In some cases, therecan be cash out fees forworkers too.

FIGURE 5:Illustration of the costs in disbursing wages in cashCOST OF ADMINISTRATIVE EMPLOYEESPer factory the administrative staff time dedicatedto payroll counting and disbursement95ORHOURS PER MONTH309JD( 436) PER MONTHCOST OF CASH TRANSPORTCost of withdrawing and safely transportingcash from bank to factory for disbursement2,508308JD( 434) PER MONTHLONG SLEEVED SHIRTS*Indicative only: the precisenumber varies with level of Factoryautomation, productivity, garmentcomplexity and other factorsOPPORTUNITY COST FOR COMPANIESAverage time lost on production line topay wages in cash391HOURS PER MONTHOR445JD( 627) PER MONTH*Equivalent to: 1,062JD ( 1,497) total monthly cost or 4.4 worker salaries per monthSource: interviews with 3 companies, averaging 3,000 workers and representing 12 percent garment workers in Jordanreporting on cost of paying workers in cash21

J O U R N E Y T O I N C L U S I V E W A G E D I G I T I Z AT I O NClear savings can be achieved by switching to digital. Three companiesin Jordan, that represent 12 percent of the garment industry, switched to payingwages digitally. Time spent by administrative staff in these companies droppedby 66 percent for payments made to bank accounts and 70 percent for paymentsmade to e-wallets. Figure 6 provides an overview of these calculations.FIGURE 6:Immediate savings & benefits from switching to digitalIMMEDIATE BENEFIT 1:IMMEDIATE BENEFIT 2:IMMEDIATE BENEFIT 3:Time savings foradministrative staffdisbursing wagesFactory no longerbears the risk ofcash transportationIntangible benefits Companiesusing bankaccounts Average cost savingfor transport,security & insurance Companiesusinge-wallets66% 70%TIME SAVINGFROM Greater transparency,governance, as well asmore security and lessrisk of loss or theft.TO308JD 0TIME SAVING(US 434)Certain costs shiftfrom internalto external Internal costs drop asexternal costs increase. Overall cost to the factorymay increase in theshort termHIREMOBILEATM22ORINSTALLATM INFACTO

customer-focused, with 24 commercial banks and 7 licensed mobile payment service providers. Two more mobile payment service providers will join the market in 2021. Jordan already has effective INFRASTRUCTURE and a regulatory framework for 1 digital payments. Jordan currently employs internationally-recognized good practices in regulations