Transcription

Situation Analysis:Home DepotSamantha DintschRebecca HarrisCamille HarveyNatalie TownsendMary Carlie VaughnNatalie White

Ta b l e O f C o n t e n t sIntroduction1Industry Overview4-8Client Profile: The Home Depot9-11Competitor Analysis: Lowe’s12Comparative Analysis13Secondary Competitor Analysis: Sears and WalMart14Consumer Analysis15Quantitative Research16-19Qualitative Research20-Marketing/Communications RecommendationsAppendix I: SurveyAppendix II: Qualitative GuideReference List2

IntroductionAs the largest home improvement store in the United States,market.The Home Depot has made a name for itself in the home imy looking at all the different aspects of the home improvementprovement industry. With the recent decline in the home imindustry, we can better recognize The Home Depot’s roleprovement industry and increased competition from Lowe’s, The Homewithin the industry. Knowing the details of the industry is cruDepot must innovate in order to maintain its place in the market. Bycial to implementing the correct marketing strategy in order to mainanalyzing the home improvement market and competition within thetain The Home Depot’s place in the market.market, The Home Depot can gain insight into industry trends andmarket its brand accordingly. The following report will explore theo gain further information about females attihome improvement industry as a whole, The Home Depottudes and beliefs of The Home Depot, our groupand its competitors, and the consumer base.designed and conducted a survey. We hand dis-BTtributed the survey in locations such as The Home Depot,y highlighting valuable information about the homeLowe’s, WalMart, Sears, Bed, Bath and Beyond. The ultiimprovement industry, the industry overview promate goal of this survey was to discover information onvides the information necessary to begin researchingthe following research objectives: To measure the targetThe Home Depot. The Industry Overview also illustrates howmarket's current, past (last 12 months) or future (next 12 months) homeThe Home Depot compares to its competitors. Key points in the Indusimprovement projects or plans, to assess the target market's attitudestry Overview are the history of the industry, industry size, advertisingand beliefs about home improvement retailers, to assess the target marexpenditures, growth Industry Overview are The Home Depot’s primaryket's attitudes and beliefs about The Home Depot, to assess the targetand secondary competitors, social and cultural trends, the effect of themarket’s attitudes and beliefs about Lowe’s in comparison to your clieconomic environment on the industry, regulatory and legal issues, andent, to measure the target market's The Home Depot usage, and to idennew developments within the home improvement industry. Followingtify if there are consumer behavioral differences in age, gender, income,the Industry Overview is the Client Profile and Competitor Analysis.etc.This section is very important because it not only provides informationabout The Home Depot’s history, sales, and marketing mix, but it alsofter the survey was conducted there was still some lack of inprovides the same information about The Home Depot’s primary comformation and gaps in fully understanding the home improvepetitor, Lowe’s.ment consumers. Therefore we conducted six personal inter-BAviews to fill in those gaps, gain further consumer insight and attitudestowards The Home Depot. These personal interviews allowed moreflexibility and probing than the survey. These interview questions directly addressed the needed information to conclude the findings fromthe quantitative research.he final section of the situation analysis is the Consumer Analysis. In order for The Home Depot’s marketing efforts to be successful it must be aware of its target market. This section analyzes consumer trends in the home improvement industry, highlightingthe demographics and psychographics that comprise the overall targetT3

HistoryTNow, the home improvement industry is one of the most thriving industries inThe United States.3 The Home Depot andLowe’s have even expanded their locations toCanada and in 2006 The Home Depot acquired a twelve store chain in China. The success of the home improvement industry isbased largely on the boom that was generated by WWII veterans and the first subdivision that was created from the post-war efforts.2Ever since this boom, The Home Depot and Lowe’s have been the two main players that comprise the Home ImprovementIndustry.chased the homes and since they all lookedalike, the homeowners sought out hardwarestores to buy items that would create individuality.A U.S. census showed that home repair/improvement boomed from 1982 to1992. Overall, Lowe’s dominated the industryuntil the 1980s.2 Due to the popularity of theindustry, Bernie Marcus and Arthur Blankfounded The Home Depot in 1978 . Theyopened their first store in Atlanta, Georgia in1979. In 1980, The Home Depot introducedthe first “Do It Yourself” workshop. This created a phenomenon within the home improvement industry.19211949197819802006North WilkesboroHardware StoreopenedFirst Subdivision created by Arthur LevittHome Depot wasfoundedHome Depot offeredfirst Do-It-YourselfprogramHome Depot acquiredstores in China19611946Figure : 1First Lowe’s Home Improvement Store opened inNorth CarolinaLowe’s went publicon NASDAQ19811979First Home Depotopened in GASource: HomeDepot.com4Home Depot wentpublic on NASDAQ2007Lowe’s openedfirst store inCanadaIndustry Overviewhe home improvement industry began primarily with many local hardware stores, such as Lowe’s NorthWilkesboro Hardware Store. Lucious S. Loweopened this small store in North Carolina in1921. After his death, his son, Jim Lowe andwar veteran friend, Carl Buchan, took overthe business. They expanded the businessand created the first official Lowe’s HomeImprovement store in 1946 in North Carolina.1The home improvement industryboomed after World War II. In 1949, ArthurLevitt and sons created the first modern subdivision in Long Island. War veterans pur-

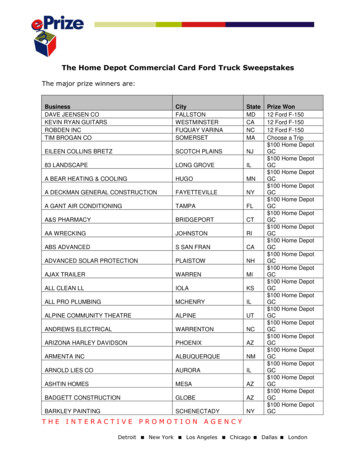

ASizeAdvertising Spendinglargest portion of the market with 271,200-30%.5 One secondary competitorfor The Home Depot is Wal-Martbecause it offers a variety of home1,000improvement products such as:paint, tools, and hardware for a low800price. Sears is also a secondary competitor because it offers tools along600with appliances and electronics thatcould be purchased at The Home400Depot. The Home Depot spentmore than 1.1200million on adverTotal Retail Sales by Home Improvementtising in 2005Retailers0and 2006.20062005YearSpending lessthan The HomeGraph: 2 Source: Leading National AdvertisersDepot, Lowe’s investeding expenditures among the home improve 778 thousand in adverment industry.6tising in 2005 and 838thousand in 2006.When combined, these“Longer terms, trends underlying the hometwo companies make upimprovement industry remain favorable foralmost 80% of the homecontinued sales and market share growth.”improvement retail market. Graph 2 reveals the-Arthur Blank 92000 2001 2002 2003 2004 2005 2006 2007overall trend of advertis-350300250200150100500Advertiseing dollars spent(thousands)s shown in Graph 1, the sales inthe home improvement industryare steadily increasing. Since2000, its revenues increased from 176 billion to 306 billion in 2007.4 The HomeDepot is the largest home retail center controlling 42-46% of the market. The primarycompetitor for The Home Depot is Lowe’sbecause it sells the same products as TheHome Depot and also appeals to the sametarget market. Lowe’s controls the secondSales (in billions)Industry OverviewIndustryY earGraph: 1Source: NHRA5

Figure: 2Stage in ProductLife CycleSource: hoovers.comQuarterly Income Statements: Home Depot andLowe’s (millions)1. Ending Jan 07Quarter2. Ending Apr 07Quarter3. Ending Jul 07Quarter4. Ending Oct 07QuarterSeasonalityThe Home Depot 10,405 20,265 12,172 21,585 14,166 19,144 11,566 18,961mained healthy. Since ownership has remained positive and homeowners view their homes as investments and therefore spend moreon improvement than renters do, this should continue to drivemarket growth. According to market research firm Global Insight,the total home improvement products market in the U.S. was estimated to have declined to 308.9 billion in 2007, from 312.9 billion in 2006. However, it is projected to advance to 394.1 billionby 2012, a 5.0% compound annual growth rate. 8According to Figure 2, quarterly income statements from the largest market shareholders in the industry, The Home Depot andLowe’s, show the most money is spent on home improvement during the second and third quarters. Statements report that duringthe second quarter, The Home Depot was most profitable andearned 21,585 million in profit. It was the least profitable in thefourth quarter with sales of 18,961 million. Lowe’s was most profitable in the third quarter with sales of 14,166 million while itslowest sales, 10,405 million, occurred in the first quarter.7G r o w t h &F o r e c a s tLowe’sTheEconomyP o t e n t i a lGDP DeclineThe growth potential for the home improvement industry is neutral. The housing market has been on a decline for nearly two yearsand is not predicted to show any improvement through 2008. Although the housing market is low, there is still hope for the homeimprovement industry due to the fact that home ownership has re-Graph 3 shows that the real domestic growth product (GDP) decreased 2.9% in 2006 to 2.2% in 2007, which leads economists tobelieve that the GDP will fall another 1.9% in 2008.10 Some of thefactors that may account for the decline in GDP could be: the ever6Industry OverviewQuarterAccording to the North American Retail Hardware Association’sannual report, the home improvement industry is mature.4 At thismature stage, the industry is well established , sales volumes havepeaked, costs are very low, competition is increasing, and storesstrive to differ from the competition with the products offered. Itstill shows a positive growth as demonstrated by retail sales, featured in Graph 1.

Graph: 3 Source: Global InsightConsumer ConfidenceGraph: 4Source: Global rlingering effects of Hurricane Katrina on theGulf’s energy production, low automobilesales, reduced business investment and reduced federal defense. Currently, the economy is facing a deficit in personal consumption and federal spending. However, thehome improvement industry sales may notdecline due to home owners hoping to addvalue to their home in practical and economical ways.11Consumer Price IndexConsumer Price Index (CPI) is an indexnumber that measures the average cost ofconsumer goods and services purchased byhouseholds. The industry shows a negativechange of 2.2% in 2007, from 2.9% in2006.10 CPI is important to the home improvement industry because it can be used toindex salaries, wages and prices.Consumer confidence has taken a recentdecline as people take notice of fallinghome values, the weak job market andhigh gas prices. In January 2008, the index of consumer confidence fell to 69.6from 78.4, which is the lowest index since1992.12 Consumer spending is also expected to slow from 2.9% in 2007 to 1.8%in 2008.10Unemployment RateThe home improvement industry is alsoaffected by high unemployment rates in theUS. Graph 4 displays the increase of unemployment rates over the past seven years.10High unemployment causes a decrease inconsumer confidence and spending becausethe more uneasy consumers feel about theirjob stability, the less likely they are to spendmoney. This could also be a leading cause asto why the number of housing starts, shownin Figure 3, has declined over the past sixyears. 137United States Unem ploy m ent RatesUnemployement Rate (%)Industry OverviewGDP (% change)765432102002 2003 2004 2005 2006 2007 2008YearLegala n dRegulatoryIssuesRegulations are set on the home improvement retailing industry to maintain a freeand competitive economy. The regulationsfor the home improvement industry are determined by each individual state. TheSherman Antitrust Act prevents monopoliesfrom using its power to censor the competition. Another regulation, The Wilson TariffAct, prevents the restraints of importingtrade. Furthermore, the Clayton Antitrust Actprotects the marketplace by banning trusts

The main two customers in the industryare:Societal &Cultural issuesThe main factor in how consumers maketheir home improvement purchasing decisions is based on their level of income andthe allocated budget for home improvement products and projects. The larger thebudget, the more choices consumers haveregarding the durability and finish of theproducts they choose. Therefore, theamount of money that consumers have tospend on their purchases not only increasesdemand for improvement products but willalso affect the range of products offered.11 Do-It –Yourself Do-It-For-MeThese are social considerations for the industry to remember in order to provide thebest customer service and products. 16Do-It-YourselfThe Do-It-Yourself Market (DIY) is a largecustomer group in the home improvementindustry where consumers purchases supplies and complete their own projects. Thisis a driving trend for the industry that accounts for approximately 40% of the totalmarket. To increase spending among DIYconsumers, home improvement retailershave started to provide in store customerassistance and websites specifically for DIYprojects.16Housing Market (number of housing starts in thousands of units per year)2,2001,900Figure: 3Source: Standardand Industry Overviewboard of directors, fixed prices, etc. to control the supply and price of products to gaina monopoly. These regulations are put inplace to ensure that the general public isprovided with the best prices, quality andto maintain competition between businesses.14 Since the highest complaint in theindustry among consumers is home improvement fraud, The Federal Trade Commission, the National Association of HomeBuilders Remodelors Council and theNational Association of Consumer AgencyAdministrators have created a kit called“Home Improvement: Tools You Can Use,”which lists several tips for hiring a contractor and avoiding home improvementfraud.15

Industry OverviewSocietal&CulturalissuesDo-It-For Meinfluence the do-it-for me service category.and more comfortable. The industry’s mainhe Do-It-For-MeAdditionally, this popula-stores, The Home Depot andMarket (DIFM) istion is likely to drive anLowe’s, have added “green” prod-a large home im-increase in existing homeucts such as flooring, lighting, pan-provement industry group insales as many of them ei-eling, materials such as paint andwhich consumers purchasether look to downsize orvarnish, appliances, heating andsupplies and hire a third-acquire a second vacationcooling systems, and electronics.party to complete the projector retirement home. TheseAs theTfor them. This market is predicted to increase with theretirement of many baby boomers, whichshould lead to continuous home improvementspending.16Baby BoomersAs America’s baby boomer population gets older, they are increasing their spending. Baby boomersare responsible for more than half of allhome improvement expenditures, today.They are expected to increase their spending on home improvement projects aftertheir kids have moved out. Within the homeimprovement industry, they are expected toscenarios should have a positive im-world adjusts topact on the home improvement in-“going green,”dustry.11the Home Im-Green MovementOver the last few years, buyingenvironment ally friendly products for the home has become anincreasingly important consideration forhomeowners looking to make "green" improvements to their living space. Consumers feel the need to add environmentallyfriendly, “green,” products and practices totheir homes in order to make it healthier9provement Industry is adjusting to provideenvironmentally friendly products and options for theconsumer. 20, 27

HistoryFigure: 5Figure: 4Source: HomeDepot.com1978: Corporationfounded by Marcusand Banks1981: Companywent public onNASDAQ1980: First how-toproduct trainingseminars began1984: Had 19operatingstores andsales of 256million1986: Had 56operating storesand reached 1billion in sales10Source: referenceforbusiness.com1990: SurpassedLowe’s as top homeimprovement industryseller2000:Launchedonline store2006: Extendedstores to China2005: Launched“Rebuilding Hopeand Homes” forKatrina victimsClient ProfileHome Depot was founded on JuneThe embecome the largest home-repair chain in the22, 1978 in Atlanta Georgia. It was ployees had vast knowledge of all their prod- US.17started by two entreucts and even offered “howpreneurs, pictured in Figureto” clinics to consumers.“Bernie and I picked our5, Bernie Marcus and ArBy 1984, the companyselves up, and we mappedthur Blank.Marcuswas operating 19out Home Depot on a napkininourfavoritecoffeeshop.”and Blank found themstores and reported-Arthur Blank 18selves without jobs aftersales of 256 million, athe change in management at118% increase from 1983. Inthe Handy Dan home center chain.1986, The Home Depot’s salesMarcus and Blank decided to open their own reached the 1 billion mark, and the comhome improvement store. From the beginpany was operating 50 retail outlets. Homening, the employees at Home Depot recogDepot surpassed Lowe’s in sales in 1989 tonized the importance of customer service.

Salestelevision to reach the largest number of its target audience.6Figure: 6 Source: Ad AgeThe Hom e Depot - 2006 Media s for the Fiscal Year Ending JanuarySales (in millions)Client ProfileThe revenues for The Home Depot are rising slowly but steadily. From2002 to 2007, the sales have increased from 55 million a year to morethan 90 million a year. As shown by Graph 5, sales beginning to leveloff is an indication that The Home Depot is in the mature stage of theproduct life cycle.19Graph: 5 Source: Standard and 50%2007YearShare of VoiceThe share of voice shows where the advertising dollars are best beingspent. The share of voice is the total percentage of advertising that TheHome Depot possesses within the home improvement industry. Figure8 shows that in 2005 The Home Depot held 71% of the market share,then dropped down to 57% in 2006. 6Advertising ExpendituresThe ad expenditures for The Home Depot have increased from 1,109million in 2005 to 1,118 million in 2006, shown in Graph 2, page 4.Although The Home Depot has a solid consumer base, advertising isimportant so it doesn’t lose sales to the competitors. The increase inmoney spent on advertising corresponds to the increase in the revenuesfor The Home Depot. 6PositioningThe Home Depot reports that one key to its success is treating peoplewell. The company executes this important principle within the company by urging associates to be creative, express their ideas, take risks,acknowledging and rewarding good performances, and teaching its employees in order to grow. Most importantly, the company wants customers to feel as if they are number one when they enter any of TheMedia AllocationFigure 6 indicates that television dominated the media allocation forThe Home Depot in 2006. Outdoor advertising held the lowest part ofthe media allocation. The Home Depot shows its advertisements on11

Figure: 8 Source:Leading National 3%67%77%Home Depot stores. The Home Depot strives to provide excellent customer service by providing customers with information that will maximize all of the benefits of products purchased. Its eight core values aregiving back, excellent customer service, creating shareholder value, entrepreneurial spirit, taking care of their people, respect for all people,doing the right thing, and building strong relationships.21New DevelopmentsThe Home Depot announced in April 2007 that it would offer moreenvironmentally friendly products. There were more than 2,500 products included in this announcement ranging from front-loading washing machines to water efficient toilets, to programmable thermostats.The Home Depot’s slogan for Eco Options is “Improve your Home.And the Environment.”22Creative StrategySince females will most likely remodel, The Home Depot has targetedthem by making the interior of its store softer, adding more kitchen layouts, and an assortment of appliances.33There are several links available on thecompany’s homepage that offer additional advice and services aimed at the different target audiences that shop at TheHome Depot. It offers a link that is targeted at DIY consumers. This link hasonline workshops that the DIY consumercan view from theprivacy of their own home. There is also a link,shown to the left, providing information, maps,and pictures of the philanthropic work that TheHome Depots has been doing with Habitat forHumanity in the rebuilding of homes after Hurricane Katrina. The Home Depot also has a complete website, shown above, dedicated to theNASCAR sponsorship it has with Tony Stewart’snumber 20 racing team.Recently, for the Home Depot, there has been a Public Relations offensive to help protect the environment. This campaign is aimed at all consumers to become actively interested in environmental issues and support environmental causes. The need for this Public Relations campaign is due to the world population expanding and the depletion ofnatural resources.2012Client ProfileMuch of The Home Depot’s advertising isabout showing the feeling of satisfactionhomeowners get from home improvement.The ad to the right shows a young womanbeing convinced that it is possible for her toretile her floors, despite her doubting husband. The Home Depot’s ads show the power of the brand and howassociates can help regular people accomplish great things in theirhome.Share of Voice

30Net Sales20% Change10boro Hardware Store in North Carolina in1921. in 1946, Lowe and his sons expandedthe business and opened the first Lowe’s.2006which Lowe’s spends more advertising dollarsnounced their donation of 500,000 to theDepot.6YMCA in Toronto.24 Their contributions fo-compared to HomeAdvertising ExpendituresImprovement Industry until 1978 , and theyThe Home Depot. In 2006, Lowe’s increasedare now second to The Home Depot. Theytheir advertising expense to 835.thousand,have over 1,500 operating stores within thebut The Home Depot still spent 279.6 thou-US. 1sand more. Graph 8 gives a visual representa-Salestion of the numbers above.6Graph: 8Media AllocationLowe’s allocates the majority of its advertisingexpenditures on the medium of television.The second largest advertising expense iscus on education, community renovation, andthe construction of safe and affordable housing. To ensure the satisfaction of customers,Lowe’s web page provides information on installation, credit options, and protectionplans. 25New DevelopmentsSource: Ad Advantage December 10, 2007: Opened first threestores in Canada. Three more to open byAdvertising Expendituresits amount of sales every year. Graph 7 shows2006. 23Creative Strategyand Educational Foundation recently an-Lowe’s advertising expenditures are less thanthe exact amounts of increase from 2002 totheir slogan, “Lets build something together.”communities they service. Lowe’s CharitableLowe’s held the number one spot in the HomeSince 2002, Lowe’s has consistently increasedLowe’s promotes a warm, family friendly im-Lowe’s is invested in the well being of theYearLowe’s Home Improvement stores began withLucious S. Lowe. He opened North Wilkes-2004200502002HistoryPositioningage and gives a feeling of connection through402003voice, number of stores in the United States.50(billions)competitor in terms of net sales, share ofAmount of Net SalesLowe’s is the primary competitor for theHome Depot because they are the closestSource: Shareholder.comLowe's Net Sales 2002-2006Amount of Moneyspent (thousand)Competitor AnalysisGraph: 7first of February he HomeDepotLow e's Earned Environmental Excellence Awardfrom the EPA’s SmartWay Transport Partnership through their attempts to lowergreen house gas emissions by decreasing car-20052006Year of Expenditurenewspapers. Internet is the only medium on13bon dioxide emissions on the highway.26,27

PhotoYear Founded19781946Number of weeklyvisitsSlogan22 million14 millionYou can do it. We canhelp.Let’s Build SomethingTogether2006 Sales 90.8 billion 46.9 billion2006 number ofstoresStores outside ofUS2,0741,385Canada, Puerto Rico,US Virgin Islands,Mexico, ChinaCanadaNumber of products availableNumber of employeesNumber of storesopening in 2008FORTUNE 500List40,000 in store40,000 in store364,000215,00055120Ranked #17Ranked #45DIY Workshops OfferedYesYes14he Home Depot and Lowe’s are themajor companies that comprise theHome Improvement Industry. Figure 9 demonstrate the differences betweenthe two companies. As depicted in the table,Home Depot has more weekly visits fromcustomers, larger sales, more stores, storesin more countries, more employees, and isranked higher in the FORTUNE 500 Listthan Lowe’s.TComparative AnalysisSource: The Home Depot, Lowe’s. Hoovers.comLowe’sThe Home DepotFigure 9

Secondary Competitorsand displays information from many differ-We have identified Sears and WalMart asent sources to assist companies in how to bet-secondary competitors because they eachter understand its target consumers. Thispose a threat to Home Depot’s sales by tar-information for The Home Depot has beengeting a similar market and having similarWalMart grossed 348,650 million this pastcategorized into different demographics,services or products.year.30 WalMart is competition for Thepsychographics and geographics. With theseHome Depot because they provide hardwarefacts, the SMRB has divided the sample intotools and home appliances amongst theirDIY consumers versus DIFM consumers, ex-broad selection of products. With an empha-penditures on home improvement and re-sis on customer service, WalMart offersmodeling in the past versus remodeling in thepaint, gardening supplies, and tools at a lowfuture. The samples represent those 21 andprice. Known as one of the original “super-older.centers,” consumers view WalMart as theirTotal ExpendituresSears, Roebuck and Co. is the leader of theU.S home appliance market. It is also a leaderin retail sales for tools, lawn and gardenequipment, and home electronics. Sears’stores carry top names like Kenmore, Craftsman, and Die Hard; brands that can not befound at other retailers.28 Known for its extensive service and repair plans, Sears provides the country with the largest productrepair service. Sears rivals Home Depot forsales based upon their vast appliance selection, top brand names, home service and repairs. Although Sears’ product selection extends beyond home appliances, their commitment to service, protection, and installation services place them in the arena of homeone stop shop for groceries, beauty supplies,electronics, and hardware materials.31 Theconvenience of finding everything in one location is attracting busy consumers more andmore. As a result of the totality of WalMartshopping centers, Home Improvement centers like The Home Depot might be less appealing to consumers in need of small homerepairs or tool purchases.Consumer Analysisimprovement retail and therefore make themSimmons Market Research Bureau (SMRB) isan indirect competitor of The Home Depot.29a syndicated research company that gathers15Men and women are most likely to spend 251- 999 on home improvements. As ageincreases, the money spent on home improvement also increases. Caucasians andAfrican Americans are most likely to spend 251- 999 on home improvements. As to beexpected, as the household income increasesso does the likelihood of people spendingmore money on home improvements.

Home Remodeling: Last 12months vs. Plan in the next12 monthsFemales (106) are above average and held52% of the sample to have remodeled in thepast 12 months. More than average males(104) held 51% of the sample in planning toremodel in the next 12 months, furthermoremen have more influence in the purchase ofremodeling products at 55%.32 Ages 35-44are most likely to have completed a projectin the last 12 months with 27% and 31% arealso most likely to remodel in the next 12months. Caucasians, held 86% of the sample, are most likely to have remodeled in thepast and 85% plan to remodel in the future;while all other races have below averageindex numbers to complete any project.People who attended college for less than 1-the most likely to have completed projectsHome Depot will market to a white popula-in the past or to complete projects in thetion of 239,746,254, a female population offuture.35151,886,332, an age population of roughlyDIY vs. DIFMFemales (109), people ages 45-65 (140 and132), college graduates, and the Northeastern region (124) are most likely to be DIFMcustomers. Males (103), people ages 25-44(126 and 130), those who attended collegefor less than 1-3 years, and the Midwesternregion (above 100) are most likely to be DIYcustomers. Households with an income 60,000- 99,999 are most likely to be DIYcustomers. Consequently, households withincomes above 250,000 are most likely tobe DIFM customers.36Target Market3 years held 30% of the sample to have remodeled in the past 12 months and heldAccording to the interpretation of the Sim-31% in planning to remodel in the future.mon’s Market Research Bureau, The HomePeople with and income of 150,000-Depot should focus on white females, ages 249,000 had the highest percentage for35-54, with an income above 60, 000 fromplanning to re

The Home Depot. The Industry Overview also illustrates how The Home Depot compares to its competitors. Key points in the Indus-try Overview are the history of the industry, industry size, advertising expenditures, growth Industry Overview are The Home Depot's primary and secondary competitors, social and cultural trends, the effect of the