Transcription

The Big Data Payoff:Turning Big Data into Business ValueA joint report by Informatica and Capgemini on the keys tooperationalizing Big Data projects

The ultimate success of Big Data projects lies in realizingbusiness value. Achieving that goal is rarely easy, but acomprehensive survey in 2016 of US and European executivesinvolved in Big Data initiatives reveals that many are makingprogress in operationalizing their projects, and a significantnumber of them are generating business value.However, when asked to rate progress in their ability tooperationalize Big Data – another key measurement – theresults are somewhat mixed. Few have achieved all of theirgoals. Just 26% say they’ve met three-quarters of their goals,while the majority, 36%, rate themselves as having achievedhalf or fewer of their goals.This research report details the survey findings and in-depthinterviews with key executives. It reveals the critical differencesbetween companies that have achieved business value fromtheir Big Data initiatives and those that have not.“Like any other technology, Big Data initiatives will fail unlessthere is a clear business strategy,” said a German retailanalytics executive during an in-depth interview conductedfor this report. “Once the business needs were identified, wewere able to develop a solid roadmap. Our approach was asuccess, as we were able to provide a clear business case forthe challenges we needed to address.”Survey of US and European firms underscores theimportance of business leader involvement and datagovernanceBig Data initiatives are launched with the goal of obtainingactionable insights from data that can boost businessperformance. However, while enterprises are makingprogress, much work remains to be done to operationalizethe results of these projects, according to this survey1. Mostof the participants indicate their top priorities to involve thestandardization, automation and governance of data.From a business standpoint, IT projects are generally judgedby strict return on investment criteria; and by that standard,enterprises report great progress. Overall, 27% of thosesurveyed indicate their Big Data projects are already profitable,and 45% indicate they’re at a break-even stage; see Figure 1.Figure 1: How would you describe the profitability ofyour organization’s Big Data initiatives to date?12%14%10%EMEA12%12%13%Put Big Datainitiatives on hold14%11%18%11%10%12%Modify Big Datastrategy to meet changingbusiness needs13%10%16%Accelerate or expandcurrent Big Data initiatives tonew departments or locationsTotalUS3%5%2%The Big Data Payoff: Turning Big Data into Business Value23%16%Continue with current Big Datainitiatives; no expansion plansRadically change Big Datastrategy or start freshEMEA1 This survey was jointly commissioned by Informatica and Capgemini, andcarried out by IDG Research Services. Further information aboutmethodology and scope is provided at the end of this report.2USRemain in the planning/strategy stageIncreasingProgressDo not measure12%9%14%TotalRemain at theproof of concept stageand building business case45%47%44%Breaks evenNot applicable(too early to tell)Figure 2: What are your organization’s plans withrespect to Big Data over the next 12 months?27%24%30%ProfitableLosing moneyAs would be expected with any relatively new digital initiative,most of those surveyed suggest they’re in a state of flux, eithermoving to expand or accelerate their projects, modifying themto meet changing business needs, or simply trying to movebeyond a proof of concept or the planning and strategy stage.Just 16% say they’re moving ahead as intended to continuecurrent projects with no expansion planned, illustrated inFigure 2. Relatively few have retrenched, though 12% have puttheir initiatives on hold and 2% are either radically restructuringthem or starting anew.BeginningStagesExecutive Summary: The Keys toOperationalizing Big Data ProjectsDon’t know11%2%1%3%1%2%0%Base: Total 210; US 100; EMEA 11022%30%35%

Insights & Data the way we see itThe comments of the head of analytics at a large US retailerillustrate how Big Data, for most, represents a goal, rather thanan accomplishment. “We are focused on bringing in moreefficiency to our processes, but are aware that we will face alot of difficulties and may have to increase effort and moneyto achieve it. In order to successfully implement Big Data, wemake sure that we thoughtfully plan out the parameters thatwe need to focus on, so that we do not deviate from our trackof delivering satisfactory products.”Many continue to face barriers and challenges typical ofany major enterprise technology initiative, such as budgetconstraints, data security concerns and integration issues, asis shown in Figure 3.Figure 3: What are your organization’s top challenges with respect to operationalizing Big Data and turning it intoa trusted business asset? (Up to ten challenges selected)TotalUSEMEA44%IT budget constraints39%36%36%Data security concerns35%Integration challenges32%40%30%31%34%Proliferation of data silos28%30%30%30%Corporate culture (e.g., the company is not open to newways of doing business)Poor or insufficient data quality30%23%35%26%27%26%Compliance concerns26%26%26%Concerns regarding user adoption and training needs26%Manual processes/time constraints22%29%24%Unclear organizational roles & responsibilities for data management22%26%22%Managing third-party consultants/outsourced service providers19%27%22%26%No formal data governance guidelines are in place20%22%Business and IT are not aligned on strategyOther42%32%34%Lacking technical expertise (e.g., no Data Scientist on staff)None: not facing any challenges with respect tooperationalizing Big Data50%19%27%3%2%4%1%1%1%Base: Total 210; US 100; EMEA 110Still, more than half of those surveyed indicate that Big Datahas reached a degree of pervasiveness throughout theirorganizations, with more than half engaged on a regular,ongoing basis with either enterprise-wide projects or withsome departments or groups. Another third are engaged inlimited or irregular projects, at either the enterprise level orwith some departments or groups only; see Figure 4.3

Figure 4: How pervasive is Big Data within your organization today?TotalUSEMEAEnterprise-wide projects on a regular, ongoing basis21%26%Regular, ongoing projects in some departments or groups butnot enterprise-wide21%Big Data is only as good as the valueit deliversExecutives from large companies - like those who participatedin the survey - have typically already invested heavily in datamanagement and analytics, but are striving to raise the barfrom traditional reporting capabilities to ultimately transformbusiness decision-making in real time.An analytics executive with an Italian retail enterprise explainsthat his company collects data from physical stores, onlinewebsites, vendors, distributors, and directly from customers.“To this end, you can just imagine the amount of data we are4The Big Data Payoff: Turning Big Data into Business Value32%12%13%11%Limited projects in some departments or groups only (noneelsewhere)No Big Data projects today; still in the planning stage36%24%26%23%Enterprise-wide projects on a limited, irregular basisWorking on proof of concept project to evaluate benefits forbusiness29%6%4%7%3%4%3%dealing with,” he says. “It’s very important that we processthe raw information and use it to our advantage to stay aheadin the market and provide a better service to our customers.[Because of the variety of data], this can’t be achieved withoutBig Data initiatives, as we need to process the information[quickly] and make it available to the decision makers.”“There is no value in data analytics unless you can actuallyderive actionable insights from it,” says the Big Data directorat a European consumer goods company. “So the end resultfor me is not the analytics, rather it’s the insight and action youget from the data you are analyzing.”

Insights & Data the way we see itFigure 5: Which of the following benefits has your organization achieved to date as a result of Big Datainitiatives? (Respondents could select all that applied)TotalUSEMEA37%Improved decision-making36%39%34%35%33%Improved collaboration/information sharingImproved productivity30%31%33%31%30%32%Added reliability and security30%Improved customer satisfaction/retention27%26%Compliance readiness/reduced risk21%25%Increased revenue23%22%Improved employee retention/moraleHave not seen benefitsRegardless of where they are in their Big Data journey orthe degree to which a project has been profitable, nine outof 10 respondents have already seen some benefits, (Figure5). Topping the list is improved decision-making, followedby collaboration and information sharing, then productivity.Improved agility to react quickly to changes in the market andto identify opportunities is another top benefit, followed byadded reliability and security, improved customer satisfactionand/or retention, and reduced costs and operationalefficiencies.“Processing and deriving meaningful information for ourcustomers is the biggest driver for our business,” says anexecutive with a UK telecommunications company. “To best33%30%31%30%Reduced costs and increased operational efficienciesDon’t know35%32%Improved agility to react quickly to changes in the marketand identify %serve them, it’s very important to analyze the data that flowsin or out for each customer and work hard to give them theinformation that would benefit them.”Business sponsorship breeds successThe survey respondents provide compelling evidence thatsupport from top business management is a critical factor inthe success of Big Data initiatives, as in Figure 6. More thanhalf say their CEO or executive management teams, to “someextent,” view these projects as having the potential to drivebusiness benefits such as creating new revenue streams,improving operational efficiency and cutting costs. Onequarter (25%) say they are supported to a “great extent”.5

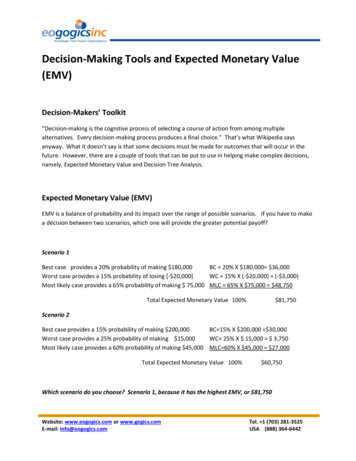

Figure 6: To what extent do you believe your CEO orExecutive team views Big Data initiatives as havingthe potential to drive business benefits (e.g., creatingnew revenue streams, improving operationalefficiency, cutting costs, etc.)?TotalUSEMEA25%19%31%To a great extent51%To some extent60%43%19%17%21%To little extentNot at all3%3%4%Don’t know1%0%2%With the growing emphasis on digital business, somecompanies are anointing the relatively new roles of Chief DataOfficer (14%) and Chief Digital Officer (12%) with strategicresponsibilities for Big Data initiatives. Similarly, with dataincreasingly driving sales and marketing efforts, the ChiefMarketing Officer or top marketing executive often plays aprimary role, although again there is some regional disparity;19% of US enterprises cite the marketing role compared to13% in Europe. When it comes to executing the strategy,there is fragmentation in who’s involved across a diversearray of technology roles, including data specialists (30%), ITmanagement (28%), VPs of data services (22%), and databasearchitects (21%).Placing a premium on data quality,governance and securityMore organizations that considered themselves successfulin their Big Data initiatives still perceive gaps between theimportance of these initiatives and their progress in achievingtheir goals in the areas of quality, governance and security ofdata. The gaps, however, are much narrower than those fromorganizations still focusing on achieving profitability; see Figure 7.Figure 7: Combines 2 questions: How important arethe following priorities as part of your organization’sstrategy to operationalize Big Data? How would yourate your organization’s progress with respect to eachof the following Big Data priorities to date?Base: Total 210; US 100; EMEA 110It’s apparent that without high-level buy-in, Big Data projectsstart from a deep hole. Those with the highest level of buy-infrom the CEO/executive team are more likely to report that BigData initiatives are profitable (49%) vs. those whose executiveteams perceive Big Data as having little potential to achievebenefits (6%).“The most important success factor for any initiativeundertaken within an organization is that the managementteam understands the underlying benefits of a Big Datainitiative,” says the head of analytics with a large UK onlineretailer. “For our own Big Data initiative, we have full buy-infrom the senior management. Starting from the CEO down,we have full agreement on adoption of data analytics as ourcore focus for the next three years.”Overall, the CIO is primarily responsible for formulating BigData strategies at more than half of the enterprises in thesurvey. But there’s a significant geographic disparity, as just39% of the US-based companies cite the CIO’s role as beingresponsible, compared to 64% of Europeans. In the US, 21%cite the CFO as having a primary role compared to just 14% inEuropean enterprises. Twenty percent of respondents indicatethat their COOs have a role, with CTOs trailing somewhat at16% overall.6The Big Data Payoff: Turning Big Data into Business ValueImproving system performance(reliability and speed)Improving data quality and datagovernanceImproving data securityStandardizing and improvingconsistency across the organization(processes, technology, metrics, etc.)Reducing time-intensive datamanagement tasksImproving the level of collaborationbetween lines of business (including IT)Improving technical maturity/technical innovation and relevantanalytics toolsImplementing a strategy tocommunicate the progress andresults of Big Data initiativesEnabling digital transformationDefining and implementingperformanceReshaping the structure of theorganization (people) to have betterbalance of skillsBase: Profitable: 57; Not profitable: 153Importance vs.Progress GapProfitableInitiatives-12 ppImportance vs.Progress GapInitiatives notProfitable-20 pp-13 pp-33 pp0 pp-4 pp-22 pp-29 pp-5 pp-20 pp 1 pp-19 pp 1 pp-23 pp 5 pp-18 pp-2 pp 9 pp-21 pp-22 pp 4 pp-18 pp

Insights & Data the way we see itThat said, most respondents report a significant distanceto travel before fully operationalizing their Big Data efforts.Improving data quality and data governance is rated by77% of respondents as the top-ranked priority for achievingoperationalization, followed closely by improving data security(74%), and standardizing and improving consistency acrossthe organization (69%).“If businesses want to be sure to capture critical opportunitiesand leverage data to support operations, strategy, andcustomer experience, they need to govern data as theydo other enterprise assets,” says the head of analytics at aLondon-based, multinational consumer goods company. Dataintegration, data quality, master data management, metadatamanagement, data masking, data security, and data archiving- all play a role in good governance.Organizations that have already achieved profitability aremore likely to have made progress in these areas as well. Forexample, 75% of profitable enterprises suggest they’ve madeexcellent or very good progress in improving data quality anddata governance, compared to 50% overall. Similarly, 75% ofthe profitable companies rate their organizations as excellentor very good in the area of standardizing and improvingconsistency in processes, technology, metrics, and so on,compared to 47% across the entire survey base.A clear way forward to substantive business valueBig Data holds the key to unlocking the insights-drivenenterprise. But moving from a proof of concept tooperationally embedded initiatives that deliver real businessvalue requires an unwavering commitment to governing,integrating, relating, mastering and securing the data indata lakes.The survey findings and in-depth interviews underscore bestpractices of those that excel in their efforts to leverage BigData initiatives: Define digital business objectives and design astrategy roadmap that harnesses new data assets toachieve these objectives. “As a successful data scienceteam, we have adopted a two-year plan, and we are alreadyworking on the solutions to mitigate the issues that we feelcan occur in the future,” says the analytics chief at oneUK company. Appreciate and understand how value is derivedfrom data. A focus on business value needs to beembedded throughout the enterprise as the route to betterinformed decisions, starting with top-level sponsorship. “Itis crucial to have good leadership that not only foreseesthe potential problems we might come across, but alsocreates a congenial environment for Big Data researchand innovation,” says the head of Big Data at a Germantelecommunications company. Blend the existing data landscape, seamlessly andstepwise, with parts of emerging Big Data platformsproviding built-in integration services. “The true valuein incorporating a Big Data initiative comes from integratingand, in some cases, aggregating with more conventionalsources of data,” says an information and analyticsexecutive with an Italian utility company. “This often involvesaccounting for issues related to data governance, masterdata management, metadata management, traceability,etc., that frequently require more than simply dumping datainto a single repository - which could lead to a proverbialdata swamp.” Create powerful, active data governance. Makesure it does justice to a company culture that is graduallybecoming more agile, yet pays special attention to thefoundations of data security, privacy and quality. Work towards a dynamic, data-driven culture. Asabove, make sure that executives, department stakeholdersand data management teams are involved at the earlieststages in developing, using and improving Big Datasolutions. “If it comes from an IT committee, financecommittee or analytics committee only, then it won’tsucceed,” says the head of Big Data at a German consumergoods company. Ultimately, establish a robust platform that deliversinsights ‘on demand’ to business users who feel thatthey can rapidly access what they need, when theyneed it. “There is a big load on the legacy systems, andthey are dealing with large volumes of data, making theprocess quite slow,” observes the director of IT operationsat a US utility company. “We have heavily invested in gettingthe required infrastructure to support this process. One ofthe things that we have undertaken is to utilize automationto our advantage. We have made the process of datapreparation automated to a large extent.”Forging a path to success and profitabilityWhile still at a relatively early stage of adoption, theimplementation of Big Data initiatives is beginning to pay offfor early adopters. Organizations that profit from Big Dataare significantly more likely to be agile and insights-driven.They modify their Big Data strategy quickly to meet changingbusiness needs, as they build on early successes and evolveinto insights-driven organizations.Business engagement, data governance and standards which are often some of the most difficult issues to manageas new technology paradigms take shape - appear to bekey differentiators in success and profitability. For mostenterprises, existing data governance will be a challenge insupporting emerging Big Data use cases. But operationalizingand ensuring compliance with data governance policies andstandards can bridge yesterday’s enterprise to the unique,emerging requirements of the insights-driven enterprise oftomorrow.The survey results and best practices of those trendsetterswho have achieved early results can help shorten the path toreal business value in any Big Data initiative.7

Common traits of profitable Big Data companiesCritical ingredients for achieving business valuefrom Big DataThis study reveals some clear distinctions between thoseorganizations that have already achieved profitability fromtheir investments and those that haven’t. It should come asno surprise that Big Data is more pervasive in organizationsthat have realized value from their early initiatives.Don’t let limitations hamper progressJust under one-half of organizations (49%) in the midstof ongoing, enterprise-wide Big Data projects are in theprofitable category, compared to 18% that are not. Forthose running such projects on an ongoing basis at thedepartmental level or with particular groups, 25% haveachieved profitability. Most notably, no companies achievedprofitability while running limited projects in some groups ordepartments.Those with profitable initiatives report that Big Data is 72%operationalized across their enterprise, compared to 49%that have yet to achieve profitability. The more advancedorganizations are significantly more likely to emphasizecollaboration, accelerated digital transformation, andimproved employee retention as Big Data objectives.Leverage legacy process and skillsMany organizations leverage and integrate legacy businessintelligence (BI) and data management processes andexpertise when launching enterprise-wide Big Dataprojects, to a great extent (11%) or to some extent(55%). Among those with profitable projects, the figuresare substantially higher, with 91% able to leverage BIcompetencies, either to a great extent (28%) or to someextent (63%).“We are on the right track as far as integration of existingIT legacy data with large-scale Big Data,” says the CTO ofa large, US-based technology company. “We strongly feelthat the legacy data is as important as the new Big Data.We have placed a lot of attention in this area.”Only 4% of respondents are currently using Hadoop, theopen-source distributed computing environment thatsupports the low-cost storage and processing of Big Data.However, an additional 57% are in some stage of evaluatingits use. “We don’t have the necessary infrastructure forHadoop, but we are working on it,” says the director of ITgovernance for a French company. “We are really keen touse Hadoop for efficient functioning and governance.”Get management involved earlyTop IT and data management executives are more likelyto be spearheading Big Data strategy at organizationsthat have realized a profit from these initiatives, with COOs8The Big Data Payoff: Turning Big Data into Business Valueand CMOs also more engaged in the more successfulenterprises. There’s a strong correlation between COOstaking the lead on Big Data strategy and profitability; 33%in the profitable category are COO-led, compared to 14%unprofitable. This is the biggest differentiation among themore than 20 positions examined.There’s a size differentialLarge-sized companies are more likely to have profitableBig Data initiatives, although those that are unprofitable areskewed heavily to those with fewer than 2,500 workers.However, smaller companies should note that respondentswhose organizations have profited from Big Data aresignificantly more likely to place emphasis on collaboration,accelerated digital transformation, and improved employeeretention as Big Data objectives.Mind the gapsIn operationalizing Big Data, progressive organizations haveclosed many of the gaps between the importance of ratingtheir priorities and the progress being achieved. Those thatare not profitable are struggling to close large gaps. Forexample, companies that have achieved profitability withtheir projects have erased the difference between priorityand progress in the area of security, while unprofitableprojects have a looming 22% gap. Companies that haverealized a profit, however, see data security as increasinglychallenging, probably because they now feel they havemore to lose from a security breach.There appears to be a correlation between skills gapissues and the struggle to achieve profitability. Those withprofitable projects say their in-house resources in sevenkey functions related to executing strategy do have theappropriate skills. They range from 74% to 88% as beingextremely or very capable, compared to 42% to 51%among those with unprofitable projects.Foster change through demonstrating valueCompanies with the expertise and assertiveness toundertake more ambitious, enterprise-wide Big Dataprojects are seemingly able to make faster progress towardachieving value. It is incumbent on organizations strivingfor more tangible progress to be able to demonstrateto the business how leveraging data enables people,process, organization, and technology improvementsfor greater business value. Only in this way can theypersuade executive leaders to make ongoing investmentsin data governance, Big Data, and the data managementtechnologies that enable it.

Insights & Data the way we see itRegional distinctions on Big Data progressDifferences between the US and Europeanapproach to Big Data initiativesWhile Big Data projects in the US are increasinglyspearheaded by business leaders as opposed to IT, a greaterpercentage of European projects (30% compared to 24% ofUS) have already proven profitable. This may indicate that USfirms have taken a more aggressive ‘fail fast’ approach, whileEuropean companies have been more conservative.Some of the key regional differences include: Of those with regular, ongoing Big Data projects, moreEuropean companies (36%) have focused on enterprisewide impacts compared to US companies (21%).Conversely, more US companies (32% compared to 21%)have focused on some departments or groups. More European Big Data projects (30%) are profitable thanthose in the US (24%), but slightly more European initiatives(14%) are losing money than those in the US (9%). Improved decision-making is the number one expectedoutcome of Big Data initiatives in European enterprises,while improved collaboration and added reliability andsecurity are top of mind for US respondents. IT budget restraints are viewed as the top challenge by 50%of US survey respondents, while data security concerns topthe list for Europeans (42%).Sector distinctions on Big Data progressDifferences by industry sectorThere are many similarities in Big Data implementations acrossindustry sectors, but there are also some notable distinctions.LeadershipAcross all industry sectors, the CIO is most often responsiblefor Big Data strategy. From there, it varies with differentexecutives playing more prominent roles in different segments. Retail: The CFO followed by the CEOCommunications: The CTO and Chief Data OfficerUtilities/Energy/Chemicals: The COOConsumer and Packaged Goods: The VP of Data ServicesOperationalization progressWhen it comes to progress in operationalizing Big Data, thereare only slight differences across industry sectors, suggestingthere is a widespread recognition of the value of Big Data, seeFigure 8 below.55%Consumer andPackaged unicationsFigure 8: Differences between industry sectors in operationalizing Big Data.9

Top challenges:Although all the sectors cite budget as a top challenge, each sector has its own burden to bear.RetailCommunicationsIT budget constraintsIT budget constraints43%50%Integration challenges35%Data security concernsLack of tech expertise35%Integration challenges39%35%Data silos39%Corporate culture45%Utilities/Energy/ChemicalsConsumer and Packaged GoodsData security concernsIT budget constraints44%Data silos44%IT budget constraints40%Poor data quality40%61%Data security concernsIntegration challenges50%44%Top benefits achieved:For benefits, the focus across the board is on business value. Though again, industry sectors have their own nuances.RetailCommunicationsIncreased revenueImproved productivityImproved decision-making35%Improved agility to reactquickly to changes inthe market and calsConsumer and Packaged GoodsImproved decision-makingImproved collaborationImproved agility36%32%Improved decision-makingImproved collaboration32%Compliance readiness32%Improved customersatisfaction/retention56%50%44%Running or piloting Hadoop:Interestingly, industry sectors place varying levels of importance on Hadoop as a tool for Big Data success.8%10Retail16%CommunicationsThe Big Data Payoff: Turning Big Data into Business ValueUtilities/Energy/Chemicals8%Consumer and17% Packaged Goods

Insights & Data the way we see itFind out moreAbout the SurveyIDG Research Services surveyed 210executives - half from the US andhalf from the UK, Germany, France,Italy and the Netherlands - to assessthe business value and benefits thatenterprises are seeking and realizingfrom Big Data. Commissioned byCapgemini and Informatica, the surveysought insight into the top challengesthese executives faced and the bestpractices for operationalizing theirinitiatives to realize that value. Datawas gathered via an online survey.In addition, 20 in-depth qualitativeinterviews were also carried out.Contact us today to learn more about how Informatica andCapgemini Big Data and Data Management solutions can helpyour enterprise generate true business value from your BigData initiatives.Axel ToonenInformaticaGlobal Alliance Directoraxel@informatica.comSri KanthadaiCapgemini Insights & DataGlobal Head of Data ManagementSrikant.kanthadai@capgemini.comSteve JonesCapgemini Insights & DataGlobal Head of Big DataSteve.g.jones@capgemini.comAll survey participants were withcompanies with greater than 1,000employees, with an average employeebase of 23,000. The industrysectors covered in the researchspanned consumer goods, retail,communications, including media andinformation services, as well as utilities,energy and chemicals. IT management- from CIO to director level - madeup 85% of the survey base, with datamanagement positions representingthe remaining 15%.11

About InformaticaInformatica is 100 percent focused on data because the world runs on data. Organizations need businesssolutions around data for the cloud, big data, real-time and streaming. Informatica is the world’s No. 1 provider ofdata management solutions, in the cloud, on-premise or in a hybrid environment. More than 7,000 organizationsaround

their Big Data initiatives and those that have not. Executive Summary: The Keys to Operationalizing Big Data Projects Survey of US and European firms underscores the importance of business leader involvement and data governance Big Data initiatives are launched with the goal of obtaining actionable insights from data that can boost business