Transcription

2021Snapshot of Race and HomeBuying in AmericaNational Association of REALTORS Research Group

NAR Research StaffLawrence Yun, Ph.D.Chief Economist and Senior Vice PresidentJessica Lautz, Dr. of Real EstateVice President, Demographics and Behavioral InsightsNadia EvangelouSenior Economist and Director of ForecastingBrandi SnowdenDirector, Member and Consumer Survey ResearchMeredith DunnResearch Manager 2021 National Association of REALTORS All Rights Reserved.May not be reprinted in whole or in part without permission of theNational Association of REALTORS .For reprint information, contact data@realtors.org.February 2021CARE: Community Aid and Real Estate2

Table of ContentsCARE: Community Aid and Real EstateHomeownership Trends and Affordability by Race4Methodology: Section One18Home Buyer Demographics from the 2020 Profileof Home Buyers and Sellers19Home Buyers and Fair Housing31Methodology: Section Two and Three353

HomeownershipTrends andAffordability by Race4

IntroductionThe 2020-2021 coronavirus pandemic caused severe economicturmoil last year as households and businesses had to adoptvarious social-distancing measures. Millions of people lost theirjobs due to the shutdown orders while many of them are icans and Hispanic/Latino Americans. Ultimately, theeconomy will improve later this year as the COVID-19 vaccinebecomes available to more Americans and a new stimuluspackage is under negotiations.The booming housing market was a welcome surprise amid thepandemic. In fact, home sales activity rose to its highest in 14years in 2020, contributing significantly to the recovery of theU.S. economy. Excepting the importance of the housing sectoron the economy, research has consistently shown thathomeownership is associated with multiple economic andsocial benefits to individual homeowners. Homeownership hasalways been an important way to build wealth. According to theFederal Reserve, the net worth of a homeowner was 255,000while that of renter’s was 6,300, as of 2019. That being said, thenet worth of a typical homeowner is 40 times the net worth of arenter. In addition to tangible financial benefits, homeownershipbrings substantial social benefits for families, communities, andthe country as a whole.2021 Snapshot of Race and Home Buying in AmericaOwning a home is associated with better educational performancein children, higher participation in civic and volunteering activity,better health care outcomes and lower crime rates in thecommunities.Nevertheless, not all families have the same opportunities forhomeownership, with many facing more constraints in their effortto achieve the American Dream. Indeed, there are sizeabledifferences in the homeownership rate across racial groups, withthe rate of homeownership for minority families lagging behind thenational average. Given that homeownership contributes to wealthaccumulation and that the homeownership rate is lower in minoritygroups, data shows that the net worth for these groups is also lower.At 188,200, the net worth of a typical White family was nearly eighttimes greater than that of a Black family ( 24,100) in 2019.This report examines the homeownership trends among each racialgroup in the last 10 years. Since all real estate is local,homeownership opportunities vary by area. Thus, the report alsoexamines where most of minority homeowners are located andwhich areas are more affordable for these households. Finally, usingthe National Association of REALTORS Profile of Home Buyers andSellers data from 2020, the report looks into the characteristics ofwho purchases homes, why they purchase, what they purchase,and the financial background for buyers based on race.5

Homeownership Trends in the Past DecadeToday, Americans are less likely to own their own homes compared to 10 years earlier. Although thehomeownership rate has continuously risen since 2015, it remains lower than in 2009. Specifically, thehomeownership rate was 64.2% in 2019 compared to 66.0% in 2009.However, more households became homeowners in 2019 from a year earlier. In fact, the homeownership raterose 0.2% in 2019. This translates to nearly 1 million more homeowners across the country.However, the overall homeownership rate does not tell the full story.2021 Snapshot of Race and Home Buying in America6

The homeownership rate for WhiteAmericans has been consistentlynear 70% since 2017. In the sameperiod, the homeownership rate forBlack Americans has been nearly30 percentage points lower thanthose of White Americans – above41% from 2017 on. For HispanicAmericans, the homeownershiprate has held above 47%, and forAsian Americans it has been above59% over the same time period.In the last 10 years, thehomeownership rate rose only forAsians to 60.7% in 2019 from 59.5%in 2009. However, thehomeownership rate for BlackAmericans dropped in 2019compared to 2009, the group mostaffected by declines inhomeownership rates before,during and after the GreatRecession.2021 Snapshot of Race and Home Buying in America7

Homeownership Rate for White Americansby stateDelaware (78%), South Carolina(78%) and Mississippi (78%)were the states with thehighest homeownershiprates for White Americans in2019.In contrast, the District ofColumbia (49%), Hawaii (56%)and California (59%) had thelowest homeownership rates.The homeownership rate forWhite Americans varied from49% to 78% across the country.Among 52 states includingPuerto Rico and the District ofColumbia, 36 states had ahomeownership rate for WhiteAmericans higher than 69.8% –the national rate - in 2019.2021 Snapshot of Race and Home Buying in America8

Homeownership Rate for Black Americansby statePuerto Rico (70%), SouthCarolina (52%) and Maryland(52%) were the states with thehighest homeownershiprates for Black Americans in2019.In contrast, North Dakota (5%),Wyoming (18%) and Montana(20%) had the lowesthomeownership rates.Homeownership rate for BlackAmericans varied from 5% to70% across the country.Among 52 states includingPuerto Rico and the District ofColumbia, 18 states had ahomeownership rate for BlackAmericans higher than 42.0% the national rate - in 2019.2021 Snapshot of Race and Home Buying in America9

Homeownership Rate for Asian Americansby stateMaine (77%), Hawaii (71%) andMaryland (71%) were the stateswith the highest homeownershiprates for Asian Americans in 2019.In contrast, North Dakota (26%),South Dakota (28%) and theDistrict of Columbia (42%) had thelowest homeownership rates.Homeownership rate for AsianAmericans varied from 26% to 77%across the country. Among 52states including Puerto Rico andthe District of Columbia, 22 stateshad a homeownership rate forAsian Americans higher than60.7% - the national rate - in 2019.2021 Snapshot of Race and Home Buying in America10

Homeownership Rate for Hispanic Americansby stateWest Virginia (71%), Puerto Rico(69%) and New Mexico (67%) werethe states with the highesthomeownership rates forHispanic Americans in 2019.In contrast, North Dakota (23%),New York (26%) andMassachusetts (28%) had thelowest homeownership rates.Homeownership rate for HispanicAmericans varied from 23% to 71%across the country. Among 52states including Puerto Rico andthe District of Columbia, 46 stateshad a homeownership rate forHispanic Americans higher than48.1% - the national rate - in 2019.2021 Snapshot of Race and Home Buying in America11

Affordability by RaceDuring the pandemic, demand has far surpassed supplyacross the nation and home prices continue to increase,eroding affordability. Specifically, inventory continues todrop, reaching record lows. In fact, the supply of homeshas been underproduced for the past decade. InDecember, the inventory of existing single-family homesfor sale dropped below two months’ supply, the lowest inthe history of the data, while six months’ supply is neededfor more reasonable affordability and a more balancedmarket.With only a couple of months of available inventory andhomes selling in a median of three weeks, it’s no surprisethat home prices are continuing to rise across the country.In fact, home prices have continuously risen for the lastnine years, since February 2012. The median existing-homeprice rose to nearly 309,800 in December 2020; 13% morethan a year earlier; 40% more than five years earlier.However, affordability conditions vary by area. Fast-risinghome prices seem to be eroding the benefits of thecurrent low rates in some areas, making it more difficult forsome Americans to accomplish their home buying dream.In South Dakota (75%) and Alaska (73%), more than 70% ofBlack Americans can afford to buy a home. In contrast,fewer than 20% of Black Americans can afford to buy ahome in the District of Columbia, Wyoming and Hawaii.Respectively, most Hispanic Americans can afford to buy ahome in Maine (81%), Arkansas (76%) and West Virginia(76%).Read further to see how many households of every raceand ethnicity can afford to buy the typical home in the 50states and the District of Columbia.Nationwide, 43% of Black Americans can afford to buythe typical home compared to 63% of White Americans.Respectively, 71% of Asian Americans and 54% ofHispanic Americans can afford to buy the typical home.2021 Snapshot of Race and Home Buying in America12

2021 Snapshot of Race and Home Buying in America13

Financing the Home Purchase for Black Home BuyersData shows that African-American/Black andHispanic/Latino home buyers and would-be homebuyers face extra challenges in getting a mortgage.According to NAR’s Profile of Home Buyers andSellers, 10% of Black home buyers and 6% of Hispanichome buyers were denied mortgages, comparedwith about 4% of White and Asian applicants.While the main reason the mortgage lender rejectedtheir application is their debt-to-income ratio, Blackand Hispanic/Latino home buyers reported that theywere denied for having a lower credit score.However, according to ACS PUMS data, Black homebuyers are more likely to finance their homepurchase. Nationwide, 76% of White home buyersfinanced their home purchase in 2019 compared to81% of Black home buyers. In the meantime, Blackhome buyers earn less than White home buyers. Infact, the median income for Black home buyers wasnearly 70,000 compared to 90,000 for White homebuyers in 2019.2021 Snapshot of Race and Home Buying in AmericaAt the local level, in the following nine states, all Blackhome buyers were able to finance their homepurchase in 2019: Delaware, Hawaii, Iowa, Montana,New Hampshire, Utah, Vermont, West Virginia andWyoming.However, the share of Black home buyers whofinanced their home purchase was lower than 60% inthe following states: New Mexico (0%), Maine (29%),Oklahoma (53%), Connecticut (56%) and Michigan(60%). This also means that more than 40% of Blackhome buyers paid all cash for their home purchase inthese areas. Based on the data, all Black home buyerspaid all cash for their home purchase in New Mexico.While the data doesn’t provide any information aboutthe reason that they didn’t get a home loan, the smallvalue of their purchased homes may be one of thereasons. In fact, the median home value of the homespurchased by Black Americans was 35,000 in 2019.14

2021 Snapshot of Race and Home Buying in America15

Distribution of Home Sales by RaceAccording to ACS data, nationwide, 81% of the homesales in 2019 were purchased by Whites compared to7% for Black home buyers. Respectively, the share ofhome sales for Asian Americans was 6% and 11% forHispanic Americans.The next chart shows you how many of the homesthat were sold in 2019 were bought by race.Maryland (23%), the District of Columbia (23%) andDelaware had the highest share of homes thatwere purchased by Black home buyers across thecountry.2021 Snapshot of Race and Home Buying in America16

2021 Snapshot of Race and Home Buying in America17

Methodology: Section OneUsing the ACS Public Microdata Sample (PUMS) data, NAR was able to computehomeownership rates and affordability by race at the state level. The AmericanCommunity Survey releases the Public Use Microdata Sample (PUMS) files every year,which include population and housing unit records with individual response information.Regarding affordability, qualifying income for a 30-year fixed rate mortgage wascomputed assuming 10% down payment. Monthly principal and interest was limited to25% of income. After defining the qualifying income for each state, NAR calculated thepercent of households for each race/ethnicity that have an income higher than thequalifying income for that specific area.2021 Snapshot of Race and Home Buying in America18

Home BuyerDemographicsfrom the 2020 Profileof Home Buyersand Sellers19

Home Buyer Demographics by Race/EthnicityUsing data from the 2020 Profile of Home Buyers and Sellers reportwe can look into the characteristics of recent home buyers, theirreasons for purchasing, the steps they took in the home buyingprocess, and the ways buyers financed their home purchase basedon race.Among all home buyers, White/Caucasian home buyers made upthe largest share at 82% after April 2020, followed by Hispanic/Latino(9%), Asian/Pacific Islander (8%) and Black/African-American homebuyers (5%), and Other at 2%.Among Asian/Pacific Islander home buyers, we see the largest shareof married couples at 70%. Single female home buyers were mostcommon among Black/African-American home buyers (31%). Fiftytwo percent of Asian/Pacific Islanders, and 50% of Hispanic/Latinoswere first-time home buyers. While the plurality of all buyers hadtwo-income households, the highest share of Black/AfricanAmerican households had one-income households.Twenty-three percent of Asian/Pacific Islanders, and 18% ofHispanic/Latinos purchased multi-generational homes. Amongthose groups, they primarily purchased a multi-generational hometo spend more time with aging parents, health/caretaking of agingparents/relatives, wanting a larger home that multiple incomescould afford together, and cost savings. The share of multigenerational buyers was only 15% among Black/African-Americanbuyers and 10% among White/Caucasian buyers.Family can help buyers in enter the buying market. Fifteen percent2021 Snapshot of Race and Home Buying in Americaof Asian/Pacific Islanders, and 9% of Black/African-American,Hispanic/Latino, White/Caucasian buyers used a gift fromrelative or friend towards their downpayment for their home.Another way to help family is living at home before buying.Seventeen percent of Hispanic/Latino home buyers, 16% ofAsian/Pacific Islander home buyers, and 15% of Black/AfricanAmerican buyers lived with parents, relatives, or friends prior topurchasing their home compared to only 10% ofWhite/Caucasian buyers.Black/African-American home buyers reported the highestshare of student loan debt at 43%, with a median amount of 40,000. Asian/Pacific Islander home buyers reported the largestmedian student loan debt amount at 42,600, with 16% sayingthey had student loan debt. Black/African-American andAsian/Pacific Islander buyers had the highest share of buyerswith at least some college education.Ten percent of Black/African-American home buyers, and 6% ofboth Hispanic/Latino and Asian/Pacific Islander buyers have hada mortgage application denied, compared with just 4% ofWhite/Caucasian buyers. While the main reason dWhite/Caucasian buyers for being rejected by a mortgagelender was their debt to income ratio, the main reason forHispanic/Latino buyers was due to low credit score.20

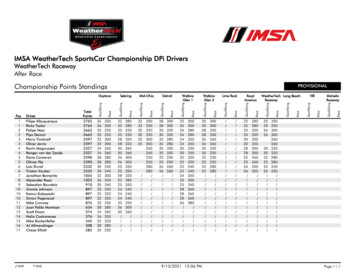

Race/Ethnicity of Home BuyersPurchased July 2019-March 2020 Purchased April 2020-July cific Islander48Black/African-American55Other32Note: Respondents were permitted to select as many races and ethnicities as they felt applicable.The percentage distribution may therefore sum to more than 100 percent.Source: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America21

Household Composition by Race/EthnicityRacial and Ethnic le female31101617Single male1081010Unmarried couple710119Other2242Married coupleSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America22

Buyer Demographics by Race/EthnicityRacial and Ethnic at buyers52485072Median age48394049 84,200 112,500 88,300 time buyersMedian household incomeIncome earners in householdThree or moreSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America23

Home Characteristics Purchased by Race/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific 74767986Detached single-family76%82%79%82%Townhouse/row 02,0501,8401,900 237,700 391,700 268,000 270,000Purchased new homePurchased previously ownedhomeMedian square feet of homepurchasedMedian home priceSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America24

Purchased Through Real Estate Agent/Broker, and Reasons For Purchase byRace/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific 41%39%39%25%Desire for larger home107710Job-related relocation or moveChange in family situation (e.g.marriage, birth of child, divorce,etc.)Desire to be closer tofamily/friends/relatives5756657835410Desire for a home in a better area4556Desire to be closer tojob/school/transit2943Purchased through a real estateagent or brokerPrimary reason for purchasing ahomeDesire to own home of ownSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America25

Purchased Multi-Generational Home by Race/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific 15None of the Reasons for purchaseChildren/relatives over18 moving back into thehouseWanted a larger homethat multiple incomescould afford togetherHealth/caretakingof aging parents/relativesTo spend more timewith aging parentsCost savingsChildren/relatives over18 never left homeSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America26

Sources of Downpayment by Race/EthnicityRacial and Ethnic 2137155105Gift from relative or friend91599Loan from relative or friend2522Sale of stocks or bonds41456SavingsProceeds from sale of primaryresidence401k/pension fund including aloanSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America27

Prior Living Arrangement by Race/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific Owned previous home31343454Lived withparents/relatives/friends, paid rent989568852111Previous living arrangementRented an apartment or houseLived withparents/relatives/friends, did notpay rentRented the home ultimatelypurchasedSource: 2020 Profile of Home Buyers and Sellers2021 Snapshot of Race and Home Buying in America28

Education Level of Household Head and Student Debt by Race/EthnicityRacial and Ethnic nderHispanic/LatinoWhite/CaucasianLess than high school*1%3%1%High School diploma1672018Associates degree1661613Bachelor's degree263228315167303322247205743%16%24%21% 40,000 42,600 20,000 30,000Some graduate workMaster's degree/MBA/lawdegreeDoctoral degreeHave student loan debtMedian student loan debtamount* Less than 1 percent2021 Snapshot of Race and Home Buying in AmericaSource: 2020 Profile of Home Buyers and Sellers29

Buyer Mortgage Application Had Been Rejected From Mortgage Lenderby Race/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific 159%18%31%32%4893522Income was unable to be verified591416Not enough money in reserves59610Insufficient downpayment3936Too soon after refinancing anotherproperty***2Don't know51468Other18502629Have had application deniedMedian number of timesapplication was deniedReason for being rejected bymortgage lenderDebt to income ratioLow credit score* Less than 1 percent2021 Snapshot of Race and Home Buying in AmericaSource: 2020 Profile of Home Buyers and Sellers30

Home Buyers andFair Housing31

Home Buyers and Fair HousingIn addition to being asked about their recent home buyingexperience, recent home buyers were also asked if they hadexperienced or witnessed discrimination during their realestate transaction. When asked about their neighborhood andif the majority of residents are the same race as them, 64% ofAsian/Pacific Islander, 63% of Black/African-American, and 55%of Hispanic/Latino home buyers said that the majority of theirneighborhood is not the same race as them. This is comparedto only 14% of White/Caucasian home buyers saying that themajority of their neighborhood is not the same race as them.Seventy-one percent of White/Caucasian home buyers saidthat the majority of the neighborhood was the same race asthem. In comparison, 26% of Hispanic/Latino, 24% ofBlack/African-American, and 23% of Asian/Pacific Islanderhome buyers said that the majority of their neighborhood wasthe same race as them.When recent home buyers were asked whether theyexperienced discrimination in a real estate transaction, 7% ofBlack/African-American, 5% of Asian/Pacific Islander, and 1% ofHispanic/Latino home buyers experienced discrimination basedon race. Three percent of Black/African-American, and 2% ofAsian/Pacific Islander home buyers experienced discriminationbased on color. Forty-five percent of Black/African-American,35% of Asian/Pacific Islander, 32% of Hispanic/Latino, and 26%of White/Caucasian home buyers did not experiencediscrimination in their real estate transaction, but believe that itexists. Nine percent of Black/African-American, and 1% ofWhite/Caucasian home buyers reported the discriminationagainst them to a government agency.Looking at ways recent home buyers witnessed or experienceddiscrimination in a real estate transaction, the most commondiscrimination was steering towards or away from specificneighborhoods with 34% of both Hispanic/Latino andWhite/Caucasian home buyers experienced this. Black/AfricanAmerican and Asian/Pacific Islander home buyers were morelikely to report witnessing or experiencing discrimination withmore strict requirements for themselves, the type of loanproduct offered, and purchase offers being denied for possiblydiscriminatory reasons.2021 Snapshot of Race and Home Buying in America32

Neighborhood Residents and Discrimination in Transactions by Race/EthnicityRacial and Ethnic DistributionBlack/AfricanAmericanAsian/Pacific Islander Hispanic/LatinoWhite/CaucasianThe majority of residents in yourneighborhood are the same race as youYes, majority are same race24%23%26%71%No, majority are not same race63645514Don’t know1213191441%27%19%16%34251214Ways you witnessed or experienceddiscrimination in a real estate transactionMore strict requirements for myselfType of loan product offeredPurchase offer denied for possiblydiscriminatory reasonsSteering towards or away from specificneighborhoodsRefusal of home owner or agent to showproperty to particular classes3120*1130283434111699Other31393936* Less than 1 percent2021 Snapshot of Race and Home Buying in AmericaSource: 2020 Profile of Home Buyers and Sellers33

Discrimination in Home Search and Reporting Discrimination by Race/EthnicityRacial and Ethnic DistributionExperienced discrimination in a realestate transaction against any of thefollowingRaceColorReligionSexDisabilityFamilial status (including marriage orparental status)National OriginSexual orientationNot sureNo, but I believe it existsNoReported the discrimination to agovernment agencyYes, reportedNo, did not report* Less than 1 percent2021 Snapshot of Race and Home Buying in AmericaBlack/AfricanAmericanAsian/Pacific 0*1001%99Source: 2020 Profile of Home Buyers and Sellers34

Methodology: Section Two and ThreeIn July 2020, NAR mailed out a 131-question survey using a random sample weighted to be representative of sales ona geographic basis to 132,550 recent home buyers. The recent home buyers had to have purchased a primaryresidence home between July of 2019 and June of 2020. A total 8,212 responses were received from primary residencebuyers. After accounting for undeliverable questionnaires, the survey had an adjusted response rate of 6.2 percent.Respondents had the option to fill out the survey via hard copy or online. The online survey was available in Englishand Spanish.Consumer names and addresses were obtained from Experian, a firm that maintains an extensive database of recenthome buyers derived from county records. Information about sellers comes from those buyers who also sold a home.All information in this Profile is characteristic of the 12-month period ending June 2020, with the exception of incomedata, which are reported for 2019. In some sections comparisons are also given for results obtained in previoussurveys. Not all results are directly comparable due to changes in questionnaire design and sample size. Some resultsare presented for the four U.S. Census regions: Northeast, Midwest, South, and West. The median is the primarystatistical measure used throughout this report. Due to rounding and omissions for space, percentage distributionsmay not add to 100 percent.Data gathered in the report is based on primary residence home buyers. From the Realtors Confidence Index, 85percent of home buyers were primary residence buyers in 2019, which accounts for 5,270,000 homes sold in 2019(accounting for new and existing homes). Using that calculation, the sample at the 95 percent confidence level has aconfidence interval of plus-or-minus 1.08%.2021 Snapshot of Race and Home Buying in America35

The National Association of REALTORS is America’s largest trade association, representing more than 1.4 million members, including NAR’s institutes, societies and councils,involved in all aspects of the real estate industry. NAR membership includes brokers, salespeople, property managers, appraisers, counselors and others engaged in bothresidential and commercial real estate.The term REALTOR is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS andsubscribes to its strict Code of Ethics.Working for America’s property owners, the National Association provides a facility for professional development, research and exchange of information among its members andto the public and government for the purpose of preserving the free enterprise system and the right to own real property.NATIONAL ASSOCIATION OF REALTORS RESEARCH GROUPThe Mission of the NATIONAL ASSOCIATION OF REALTORS Research Group is toproduce timely, data-driven market analysis and authoritative business intelligence to servemembers, and inform consumers, policymakers and the media in a professional and accessiblemanner.To find out about other products from NAR’s Research Group, visitnar.realtor/research-and-statisticsNATIONAL ASSOCIATION OF REALTORS Research Group500 New Jersey Avenue, NWWashington, DC 20001202-383-1000data@realtors.org2021 Snapshot of Race and Home Buying in America36

Feb 19, 2021