Transcription

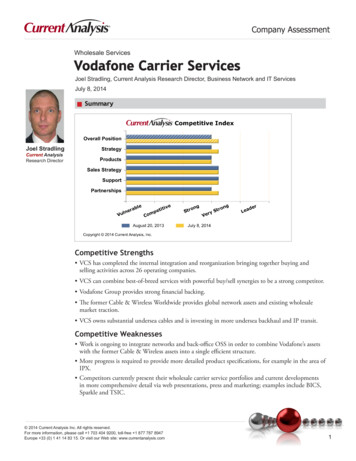

Company AssessmentWholesale ServicesVodafone Carrier ServicesJoel Stradling, Current Analysis Research Director, Business Network and IT ServicesJuly 8, 2014JJSummaryCompetitive IndexOverall PositionJoel StradlingCurrent AnalysisResearch DirectorStrategyProductsSales gust 20, 2013gonStrryVegonStrrdeLeaJuly 8, 2014Copyright 2014 Current Analysis, Inc.Competitive Strengths VCS has completed the internal integration and reorganization bringing together buying andselling activities across 26 operating companies. VCS can combine best-of-breed services with powerful buy/sell synergies to be a strong competitor. Vodafone Group provides strong financial backing. The former Cable & Wireless Worldwide provides global network assets and existing wholesalemarket traction. VCS owns substantial undersea cables and is investing in more undersea backhaul and IP transit.Competitive Weaknesses Work is ongoing to integrate networks and back-office OSS in order to combine Vodafone’s assetswith the former Cable & Wireless assets into a single efficient structure. More progress is required to provide more detailed product specifications, for example in the area ofIPX. Competitors currently present their wholesale carrier service portfolios and current developmentsin more comprehensive detail via web presentations, press and marketing; examples include BICS,Sparkle and TSIC. 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com1

Company AssessmentVodafone Carrier Services(Continued)Strategy: Very StrongVodafone Group Enterprise, the new Vodafone Carrier Services (VCS) division combines the carrier services businesses of Vodafone Group with the global wholesale activities of the former CWW. VCS has completed its integrationprogram placing together buying and selling units across 26 operating companies and the former CWW operations ina single group. This sensible activity results in VCS giving a single face to its customers through global account management and national account management structures. The carrier is now focused on developing three core productareas including voice, network capacity and mobility. Recognizing growth opportunities that derive from grand scaleexisting traffic volumes, including retail traffic from its global base of mobile and fixed customers, VCS is investing inits global voice platform. Leveraging VCS’ scale should deliver cost reductions and revenue growth. When VCS hascompleted its unified global platform, it will be able to control voice quality end-to-end and support of HD voice andVoLTE services, both between Vodafone customers and with interconnected partners.Underpinning its global voice platform, Vodafone is currently deploying IPX connectivity, based on its existing globalMPLS network, which currently covers more than 40 countries and will cover more than 65 by 2015. Their IPXalready supports a rapidly growing 4G roaming footprint and will be the primary interconnection platform for anincreasing range of IP-based services – including voice, roaming, signalling, HD voice and VoLTE. VCS sells its carrier services to other telcos, ISPs, OTT players and communications providers and at the same time delivers efficiencies and cost-savings to Vodafone Group internal customers. Previously, Vodafone operating companies conductede-auction deals for voice trading, but with the formation of VCS as a single interface to Vodafone, the deals are largevolume-based agreements which deliver economies of scale and cost savings when both buying and selling.The company has established business with large Internet players such as Google, Amazon and Skype. In the UK,VCS has a dedicated portfolio for targeting facility-based carriers and partners and its LLU offerings can be providedon flexible terms and the carrier can demonstrate good customer service levels and quality to differentiate fromcompetitors. VCS’ strengths include global network presence in over 150 countries, its IPv6-enabled global networkand presence in over 80 cable systems, including its new investment in the Bay of Bengal Gateway (BBG) as well asthe Europe-Persia Express Gateway (EPEG), Europe India Gateway (EIG) and West Africa Cable System (WACS).Its continuing network investment in India, Africa and Asia-Pacific, as well as its Global Markets Solutions Centre inIndia, make it an attractive partner for carriers in these regions.Solutions/Services/Products: StrongVodafone Carrier Services’ portfolio spans fixed and mobile carrier services backed by global and local/granular reach.The service provider’s portfolio includes international wholesale voice, ITFS, services in mobile and fixed voice,data and messaging connectivity, public and private IP VPN and private carrier MPLS services, access and last-mileservices in countries such as the UK, Germany, India, Turkey and New Zealand, South Africa, the rest of Africa, theNetherlands, Spain, Ghana and Qatar. Current product development initiatives are underway in the areas of IPX,intelligent routing (global IP switching) including consolidating IP traffic onto the single AS 1273 number, and anSMS hub solution. The strategy for voice and IP is first to reduce operational costs and then to begin selling serviceon the lower-cost base platform. VCS offers a Global VoIP Interconnect (GVI) product as part of its wholesale voicerange, appealing to new communication service providers and small ISPs/telcos that wish to start out on a new voicebusiness designed around an IP voice strategy from the outset. VCS also offers ‘managed voice’ outsourcing, whichhas the potential to drive new business and sales and offset falling voice revenue pressure. The company is makinggood progress in adapting such products for global markets through its Global Markets Solutions Centre in India.Wholesale data centre and flexible computing (cloud) solutions are available and the company offers advancedsecurity services such as DDoS blackholing to content providers. VCS carries nearly 60 billion unregulated voiceminutes across its IP and TDM core, with CLI and enterprise QoS for TDM and IP voice calls, with its GlobalVoIP Interconnect gateway bridging between the two technologies. It is working on a TDM-VoIP migration strategy 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com2

Company AssessmentVodafone Carrier Services(Continued)for national markets. VCS offers a specific portfolio for its UK carriers and is working to provide carriers withinnovative solution bundles comprising two or more of the following products: IP VPN, Ethernet WAN options,dedicated Internet access, SIP trunking, wholesale broadband and a managed application/SaaS portfolio, and hostedExchange. IP Centrex and managed fixed/mobile convergence products are in the pipeline.Marketing/Sales Strategy: Very StrongVodafone Carrier Services combines the carrier services businesses of Vodafone’s operating companies and CWWinto a single-entity business. Marketing messages are built upon network capabilities at both the global and granularin-country level, with highlighted benefits of economies of scale. VCS has put in place global account managementand national account management. VCS is building its brand recognition as a wholesale provider around the world,and it has a dedicated, multilingual sales team to spearhead in-region business development. VCS has implementeda global account management approach for its top 50 customers and partners while putting in place dedicated localaccount management teams to serve other customers.Customer Service and Support: Very StrongVCS emphasizes customer service and support. The carrier is focusing on customer experience improvement byintegrating service delivery and assurance across it operating companies and CWW into a consolidated distributedorganization with a common operating model and common processes. Customers within the top 50 are allocateda global service management model, while local service management teams are responsible for other customers.These teams conduct regular service and quality reviews with customers and partners. VCS continues to enhanceits customer portal for wholesale IP VPN, dedicated Internet access, SIP trunking and Ethernet services, increasingthe level of personalization with which wholesale customers can place orders, raise trouble tickets and access billingand performance management data. An online pricing tool supports managed bandwidth, IP VPN, Ethernet andInternet access, with traceability from quote to bill.Partnerships: Very StrongVCS has extensive geographical network coverage and is in a position to deliver network services across Europe,Asia, Africa, the Middle East and Australasia. The company is thus capable of delivering services to customers andpartners such as Orange, BT, Telefonica, Etisalat, AT&T, Verizon, Telecom New Zealand, MTN and Airtel. VCShas a strong partnership strategy through which it extends its network reach for wholesale and enterprise customers.It has eight IP/MPLS NNIs with partner carriers, including China Telecom and China Unicom, which means thatit is one of the few international carriers that can provide extensive MPLS coverage in China, across 200 Chinesecities. Vodafone is also part of a GCC-wide telecoms consortium formed to build a high-bandwidth regionaltransmission cable system for the Middle East region. The system, called the Middle East-Europe Terrestrial System(MEETS), was both conceived and co-promoted by Zain, du, Vodafone and Zajil.Vodafone also partners with BSNL in Asia, OTEGlobe in the Mediterranean basin and North Africa, Telus andSprint in North America, Rogers in Canada, Telefónica in South America, and TDC and Beeline in the Nordics andRussia, respectively. It has an agreement to share an international leased line across the AAG cable between HongKong and PLDT’s cable landing station in Bauang, La Union. 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com3

Company AssessmentVodafone Carrier ServicesJJ(Continued)PerspectiveCurrent Perspective: PositiveWe are taking a positive stance on VCS’ wholesale activities, because the company has made solid progress integrating its internal organizational structure and is now tightly focused on relevant product areas such as voice, IPX,SMS hubbing and intelligent IP routing. Group synergies are a major strength for the company, with global operations, network assets and skill sets all established, and tremendous buying and selling power to obtain the best dealsand to extend to its partners and customers compelling offerings. VCS has good presence in key markets, includingEurope, the Middle East, Africa, Asia and Australasia. It has a differentiated partnership approach to wholesalecustomers, which focuses on getting to know their businesses and their product and service needs and providingtailored customer sales and service propositions. VCS is also experienced with supporting C7 ISUP v2 and otherprotocols such as calling line identity (CLI), original called number (OCN) and redirected number (RDN) information within its international mobile-to-mobile offering. The company has a solid MPLS offer and has credibleAsian customer references as a result of extensive network investment in the region. VCS has a compelling managedwholesale IP VPN offering and is innovative with product bundling. The operator is accelerating its wholesale datacentre and cloud services strategy, which will help it open up a new revenue stream.VCS faces many challenges from external sources, namely competition and pricing pressure, and internally in termsof integrating back-office systems. Competition is intense from European providers such as Colt, BICS, TSIC andInteroute. Meanwhile, in Asia, VCS faces Tata Communications, PCCW Global and Chinese carriers as well aslongstanding players such as Verizon, AT&T and BT. In the UK, companies with growing network footprints suchas Virgin Media Business and TalkTalk Business are challenging in the areas of basic voice and data services, EFMand superfast broadband, while BT Wholesale is difficult to match for its breadth of ePositivePositivePositivePositivePositiveIP ServicesManaged ServicesMobile Wholesale sitivePositiveVery PositiveVery PositiveVery PositiveVery PositivePositiveStrengths and WeaknessesStrengths VCS has emerged with a new integrated business division and a concrete focus on relevant product areas. Twentysix operating companies give tremendous synergies and a large local access footprint. The integration of the former CWW into VCS creates a single consolidated entity with strong global network assets and a substantial presence in Europe, Africa, the Middle East and Asia-Pacific. VCS is embarking on a new pathwith very solid backing from global and national assets, existing client bases and skilled staff. For example, Asian 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com4

Company AssessmentVodafone Carrier Services(Continued)assets include its backhaul network in Hong Kong, an extensive Indian MSP-based network, investment in EIG andBBG, and NNI agreements with leading Chinese operators. VCS can benefit from an established, fruitful partnership approach and objective of tailoring products and servicesto the specific needs of high-value customers in managed services deals with Tesco and Morrison in the UK. VCS’managed services portfolio, skill sets, track record and Global Markets Solutions Centre put it in a good positionto build a successful and leading-edge managed services business, targeting further domestic as well as internationalcarrier customers. VCS is well positioned to meet growing cable requirements. The operator already has a substantial undersea cablenetwork and is investing in greater capacity, including an innovative in-situ upgrade on the Apollo cable from 2Gbto 10.5Gb, which gives the company a potential future capacity of 24 Tb over this cable alone. The carrier is amongthe world’s top four providers of global connectivity, which it is extending with investment in the WACS, a regionalmarket in which the company is historically strong, and the EIG. VCS’ multi-service platform targeting UK facility-based carriers enables it to offer a single SLA and guaranteedbandwidth regardless of access technology. VCS also has opportunities to capitalize on its presence in emergingmarkets where there are operators looking for all-IP transformation partners.Weaknesses The integration of the former CWW’s international wholesale activities into VCS is complex and it will take timeand attention to integrate networks. Meanwhile, competitors will seek any openings to approach customers withtheir portfolios and messages that the integration may cause confusion and difficulties. VCS faces stiff competition from service providers that have established brands in the carrier-to-carrier segment. VCS has yet to announce a clearly defined product set with backing product specification sheets. The carrier needsto move rapidly to present its range in the main product areas of mobile, data, cloud and carrier outsourcing. Incontrast, BICS has a clear menu of services within its ‘Global Mobile Village’ concept, and several other rivals areahead with strictly defined portfolios. VCS does communicate several services, but there is a lack of laser-focus detailabout each tier at this stage.JJRecommended ActionsRecommended Vendor Actions VCS can bring to the fore in its marketing messages the positive attributes that can be derived from new synergiesof scale and solid financial backing (e.g., Vodafone Group invests around GBP 6 billion each year in the network,and an additional investment of GBP 7 billion is underway through ‘Project Spring’). VCS can develop a broad and threatening service range for mobile providers to challenge BICS’ strong positionin this field. IPX, M2M, security, full outsourcing and international LTE roaming are all hot product areas thatVCS can pursue to bring innovative and differentiated products to market. Leveraging the Vodafone Group mobilesubsidiaries around the world to understand what MNOs really need is an excellent springboard to make a pushinto this segment against existing competitors. VCS should promote its deep access networks in countries such as Germany, Turkey, India, New Zealand andSouth Africa alongside its strong UK footprint and advanced next-generation service portfolio, including Ethernetservices, wholesale broadband and wholesale IP VPN, to ensure that carriers with international enterprise customersto serve understand its attractions as an alternative to BT Wholesale and other incumbents. 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com5

Company AssessmentVodafone Carrier Services(Continued) Vodafone is in an ideal position to offer smaller MNOs fully managed consulting and mobile voice and backhaul.Vodafone Partner Markets has a very strong level of experience here, and the provider can develop compelling suitesfor smaller MNOs that operate in niche and emerging markets where Vodafone is not present.Recommended Competitor Actions Competitors should emphasise that VCS will continue to be spending time and attention on integrating disparatesystems, and in the meantime, buying a number of products from the company might not give the most convenientuser experience – for example, no single online portal across multiple product sets. Colt and Interoute can highlight their more extensive European networks, their strong Ethernet and softswitchVoIP services and their strategies for wholesale data centre/cloud services to customers looking for partners witha pan-European reach. Ethernet, in all its guises, and cloud services are growing in interest among corporate datausers, and Colt and Interoute are in a good position to fulfil the need at either the retail or wholesale level. Level 3 should point out that it is a match for VCS’ wholesale activities in the UK and international markets; plus,it has a strengthened overseas and US footprint via Level 3. With an extensive UK network and US, Latin Americanand Asian reach; a strong VoIP offering; advanced managed services; and content delivery strategies, Level 3 is astrong competitor for VCS. Tata Communications and other Asia-Pacific players can promote their network footprint in Asia-Pacific as well astheir increasing breadth of capabilities, particularly in the voice, Ethernet managed services and content delivery segments. Tata and BT have strengthened their economies of scale in the wholesale voice market through their recentpartnership agreement. TSIC can point to far greater IP network assets and traffic volumes compared with CWW and note that the TSICrollout of 100 Gbps services in the US and available in parts of Europe provides differentiation. BT Wholesale should promote its IP exchange capabilities, which provide customers (and especially mobile operators) with a convincing TDM-to-IP migration strategy, and its Wholesale Broadband Connect services and strategyas an alternative to the more limited, though uncontended, speeds available from VCS. BT Wholesale can presentits strong abilities and operations resources to deliver managed and outsourced services.Recommended End-User/Customer Actions Global and regional carriers looking for a partner with a strong national and regional presence in Europe, theMiddle East, Africa, Asia, New Zealand and Australia can evaluate VCS’ footprint and expansion in key marketssuch as South Africa, India, Hong Kong and Singapore, where it is investing in its own next-generation facilities,and its partnerships in China, Oman, Vietnam and the Philippines, as well as with Telekom Malaysia. Tier 2/3 Asian operators seeking to differentiate themselves in their domestic markets should talk to VCS about itsability to provide them with an international network footprint as well as a strong portfolio of managed services thatcan be tailored for their local needs. Carriers considering IP transformation should investigate VCS’ capabilities in this area, since it has won a majorNGN build and operate contract for National Grid and gained its own transformation experience on which todraw. UK facility-based carriers looking to broaden the portfolio of services they can offer to their enterprise customersshould evaluate other operators and seek reassurance from VCS that wholesale will remain an area of focus. 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com6

Company AssessmentVodafone Carrier ServicesJJ(Continued)Fast FactsCompany DescriptionCompany NameVodafone Carrier ServicesCompany TypeGlobal network operatorHeadquartersVodafone Group: LondonPublic/PrivatePublic; LSE: VOD. NASDAQ: VODRevenueVodafone Group: GBP 43.6 billion (year ending 31st March 2014)Primary MarketsEurope, Africa, the Middle East, the US and Asia-PacificEmployeesVodafone Group 91,000 employees. Over 300 people are dedicated to VCS.Target CustomersCommunications service providers, Internet companies, OTT players, mobile network operators, carriers (Tier1s seeking route diversity, Tier 2/3 carriers looking for international networking partner) via the wholesale divisionKey CustomersWholesale customers include BT, Amazon, Artel, AT&T, Bharti, BSNL, Completel, Deutsche Telekom,Etisalat, Google, Hellas Online, KPN/iBasis, MTN, Orange Business Services, Rostelecom, Seacom, Skype,SoftBank, Sri Lankan Telecom, Tata Communications, Telefonica, Telekom Malaysia, Verizon, Virgin MediaSales StructureVCS operates a global account management structure for its top 50 customers with dedicated local accountmanagement teams serving the remaining 1,000 named communication service providers. Customer service and support is structured in a similar way.Service LinesCarrier voice/VoIP, voice transit, IP transit, IPX, bandwidth, Ethernet, IP VPN with five classes of service,MPLS, WLR, indirect access, directory inquiry services, local access, hosting, managed applications. VCS offers four wholesale voice offerings: GVI, mobile to mobile, TDM switched interconnect and route access.Network DescriptionGeographic NetworkCoverage1 million km global network (including submarine and terrestrial), 562 PoPs across 76 countries.Fixed/Wireline NetworkIP/MPLS multi-service platform (MSP) network based on Alcatel-Lucent 7750 Service Router and 5620Service Aware Manager products. Plans to move to a multi-vendor environment.Mobile/Wireless NetworkWireless footprint that includes more than 80 countries (including its own equity interests in more than30 operating companies, affiliates, and joint ventures, as well as more than 50 partner networks)Expansion or UpgradePlansMajor plans include integrating networks in Africa, Europe and India together with the expansion of thenetwork in India and participation in the EIG upgrade.Network Operation Center(NOC)Europe (the UK, Germany, Portugal) and India (Bangalore, Pune, Chennai)Data Centers14 data centres in the UK and Ireland as well as South Africa and expansion into Germany; plus accessto 100 data centres globallySupport CentersIndia (Pune & Bangalore), 24x7 multi-lingual support centre for global carrier customers; Hong Kong, a24x7 multi-language (North Asian languages) centre for Asian customers. Global service delivery teamsin India (Bangalore) and the UK manage the backend processes and handle all customer requests centrally.Investor in 80 cables globally, including Apollo, EPEG, Europe India Gateway, APCN2, West AfricaCable System and BBG (Bay of Bengal Gateway). 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com7

Company AssessmentVodafone Carrier Services(Continued)Select Customer WinsDateCustomerCommentaryJune 2013Numeric FuturesA focus on inbound voice traffic both nationally and internationallyJuly 2013DigicelBilateral contract for international termination of traffic in 39 countriesJuly 2013TelusAgreement for bilateral international voice traffic, terminating traffic between NorthAmerica and the UKMay 2014SFR FranceExpansion of existing partnership, which includes IPX Interconnect agreementJune 2014Telenor Global ServicesIPX Interconnect agreementKey Partnerships and AlliancesPartnerDescriptionEPEG ConsortiumVodafone is an investor in the EPEG Consortium, which is the first terrestrial high-capacity cable betweenEurope and the Middle East that avoids the Suez Canal and Egypt. The 150 million project was completed in December 2012.BBG ConsortiumVodafone is a member of the BBG Consortium. The submarine cable system, spanning 8,000 km, willprovide a low-cost, low-latency route for communications traffic between Southeast Asia, India and theMiddle East.MPLS NNI partnershipsThese include China Telecom and China Unicom for MPLS coverage across 200 Chinese cities;Telefonica; Vimpelcom in Russia; Batelco and Tawasul in the Middle East; SoftBank in Japan; andTelekom Malaysia.MEETS consortiumMiddle East-Europe Terrestrial System – subsea capacity and capacity via a power cable. 2014 Current Analysis Inc. All rights reserved.For more information, please call 1 703 404 9200, toll-free 1 877 787 8947Europe 33 (0) 1 41 14 83 15. Or visit our Web site: www.currentanalysis.com8

dedicated Internet access, SIP trunking, wholesale broadband and a managed application/SaaS portfolio, and hosted Exchange. IP Centrex and managed fixed/mobile convergence products are in the pipeline. Marketing/Sales Strategy: Very Strong Vodafone Carrier Services combines the carrier services businesses of Vodafone's operating companies and CWW