Transcription

March 31, 2022

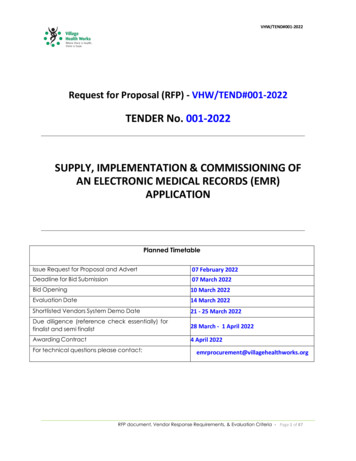

DSP Flexi Cap Fund(erstwhile known as DSP Equity Fund)Flexi Cap Fund - An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocksINCEPTION DATEApril 29, 1997BENCHMARKNifty 500 (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 63.206Direct PlanGrowth: 67.872TOTAL AUM7,661 CrMONTHLY AVERAGE AUM7,332 CrPortfolio Turnover Ratio(Last 12 months):0.273 Year Risk Statistics:Standard Deviation : 22.05%Beta : 0.97R-Squared : 92.36%Sharpe Ratio : 0.56Month End Expense RatioRegular Plan : 1.90%Direct Plan : 0.81%1PortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesBanks ICICI Bank Limited HDFC Bank Limited Axis Bank LimitedSoftware Infosys Limited HCL Technologies LimitedLarsen & Toubro Infotech LimitedMphasiS LimitedTata Consultancy Services LimitedIndustrial ProductsSupreme Industries LimitedPolycab India LimitedKEI Industries LimitedBharat Forge LimitedSchaeffler India LimitedEPL LimitedAIA Engineering LimitedFinance Bajaj Finance LimitedSBI Cards and Payment Services LimitedCan Fin Homes LimitedEquitas Holdings LimitedInsurance Bajaj Finserv LimitedICICI Lombard General Insurance Company LimitedHDFC Life Insurance Company LimitedMax Financial Services LimitedICICI Prudential Life Insurance Company LimitedPharmaceuticalsDr. Reddy's Laboratories LimitedAlkem Laboratories LimitedIPCA Laboratories LimitedDivi's Laboratories LimitedAuto Maruti Suzuki India LimitedTata Motors LimitedCement & Cement Products UltraTech Cement LimitedJK Cement LimitedDalmia Bharat LimitedConsumer Non DurablesEmami LimitedRadico Khaitan LimitedAsian Paints LimitedConsumer DurablesCentury Plyboards (India) LimitedHavells India LimitedDixon Technologies (India) LimitedAmber Enterprises India LimitedAuto AncillariesMinda Industries LimitedMotherson Sumi Systems LimitedBalkrishna Industries LimitedRetailing Avenue Supermarts LimitedChemicalsSolar Industries India LimitedNavin Fluorine International LimitedAtul LimitedGasGujarat Gas LimitedIndraprastha Gas LimitedFerrous MetalsAPL Apollo Tubes LimitedConstructionKNR Constructions LimitedHealthcare ServicesMax Healthcare Institute LimitedPowerKEC International LimitedPesticidesPI Industries LimitedTextiles - SyntheticGanesha Ecosphere LimitedTotalUnlistedSoftwareSIP Technologies & Export Limited**Media & EntertainmentMagnasound (India) Limited**Total% to e of InstrumentMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTAL% to NetAssets3.74%3.74%-2.51%-2.51%100.00%ü Top Ten Holdings*Less than 0.01%** Non Traded / Thinly Traded and illiquid securities in accordance with SEBI RegulationsClassification of % of holdings based on Market Capitalisation: Large-Cap 60.50%, Mid Cap 26.84%, Small-Cap11.43%.Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms offull market capitalization Small Cap: 251st company onwards in terms of full market capitalization

DSP Top 100 Equity FundLarge Cap Fund- An open ended equity scheme predominantly investing in large cap stocksPortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesBanks ICICI Bank Limited HDFC Bank Limited Axis Bank LimitedKotak Mahindra Bank LimitedSoftware Infosys Limited HCL Technologies Limited Tech Mahindra LimitedCement & Cement Products UltraTech Cement LimitedACC LimitedInsurance SBI Life Insurance Company LimitedICICI Lombard General Insurance Company LimitedAuto Eicher Motors LimitedHero MotoCorp LimitedMahindra & Mahindra LimitedFinance SBI Cards and Payment Services LimitedCholamandalam Investment and Finance Company LimitedManappuram Finance LimitedConsumer Non DurablesITC LimitedGodrej Consumer Products LimitedKansai Nerolac Paints LimitedEmami LimitedPharmaceuticalsCipla LimitedIPCA Laboratories LimitedAlkem Laboratories LimitedIndustrial Capital GoodsSiemens LimitedGasGujarat Gas LimitedIndraprastha Gas LimitedTransportationContainer Corporation of India LimitedFertilisersCoromandel International LimitedPowerPower Grid Corporation of India LimitedChemicalsLinde India LimitedFerrous MetalsRatnamani Metals & Tubes LimitedLeisure ServicesJubilant Foodworks LimitedConsumer DurablesWhirlpool of India LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTALINCEPTION DATE% to Net 80%0.18%0.18%98.44%ü Top Ten HoldingsClassification of % of holdings based on Market Capitalisation: Large-Cap 81.88%, Mid Cap 15.16%, Small Cap1.40%.Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms offull market capitalization Small Cap: 251st company onwards in terms of full market capitalizationMar 10, 2003BENCHMARKS&P BSE 100 (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 279.320Direct PlanGrowth: 297.148TOTAL AUM2,652 CrMONTHLY AVERAGE AUM2,566 CrPortfolio Turnover Ratio(Last 12 months):0.523 Year Risk Statistics:Standard Deviation : 22.94%Beta : 1.03R-Squared : 93.85%Sharpe Ratio : 0.29Month End Expense RatioRegular Plan : 2.23%Direct Plan : 1.35%1.97%1.97%-0.41%-0.41%100.00%2

DSP Equity Opportunities FundLarge & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocksINCEPTION DATEMay 16, 2000BENCHMARKNifty Large Midcap 250 (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 341.543Direct PlanGrowth: 369.329TOTAL AUM6,514 CrMONTHLY AVERAGE AUM6,337 CrPortfolio Turnover Ratio(Last 12 months):0.503 Year Risk Statistics:Standard Deviation : 22.75%Beta : 0.97R-Squared : 95.88%Sharpe Ratio : 0.50Month End Expense RatioRegular Plan : 1.90%Direct Plan : 0.98%3PortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesBanks ICICI Bank Limited Axis Bank Limited HDFC Bank Limited State Bank of IndiaThe Federal Bank LimitedBank of BarodaSoftware Infosys Limited HCL Technologies LimitedCoforge LimitedPharmaceuticalsDr. Reddy's Laboratories LimitedAlkem Laboratories LimitedSun Pharmaceutical Industries LimitedLupin LimitedIPCA Laboratories LimitedFinanceSBI Cards and Payment Services LimitedLIC Housing Finance LimitedManappuram Finance LimitedEquitas Holdings LimitedCholamandalam Investment and Finance Company LimitedConsumer Non DurablesEmami LimitedKansai Nerolac Paints LimitedGodrej Consumer Products LimitedHatsun Agro Product LimitedIndustrial ProductsSupreme Industries LimitedBharat Forge LimitedKEI Industries LimitedPolycab India LimitedCement & Cement Products ACC LimitedDalmia Bharat LimitedUltraTech Cement LimitedInsurance SBI Life Insurance Company LimitedMax Financial Services LimitedAutoMahindra & Mahindra LimitedHero MotoCorp LimitedMaruti Suzuki India LimitedConstructionThe Phoenix Mills LimitedKNR Constructions LimitedAhluwalia Contracts (India) LimitedPower NTPC LimitedCESC LimitedConsumer DurablesCrompton Greaves Consumer Electricals LimitedWhirlpool of India LimitedGasGujarat State Petronet LimitedIndraprastha Gas LimitedTelecom - Services Bharti Airtel LimitedBharti Airtel Limited - Partly Paid SharesCity Online Services Ltd**Ferrous MetalsJindal Steel & Power LimitedAPL Apollo Tubes LimitedTransportationContainer Corporation of India LimitedChemicalsAtul LimitedTata Chemicals LimitedFertilisersCoromandel International LimitedPetroleum ProductsBharat Petroleum Corporation LimitedAuto AncillariesMinda Industries LimitedAerospace & DefenseBharat Electronics LimitedNon - Ferrous MetalsHindalco Industries LimitedLeisure ServicesJubilant Foodworks LimitedRetailingCartrade Tech LimitedFinancial Technology (Fintech)PB Fintech LimitedTotal% to %0.70%0.70%0.35%0.35%0.33%0.33%98.66%Name of InstrumentMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentCash MarginNet Receivables/PayablesTotalGRAND TOTAL% to NetAssets0.85%0.85%0.46%0.03%0.49%100.00%ü Top Ten Holdings* Less than 0.01%Classification of % of holdings based on Market Capitalisation: Large-Cap 54.68%, Mid Cap 36.20%, Small-Cap7.78%.Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms offull market capitalization Small Cap: 251st company onwards in terms of full market capitalization

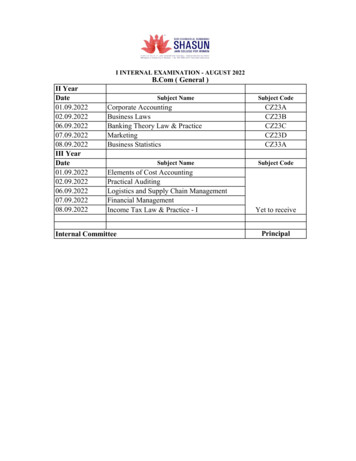

DSP India T.I.G.E.R. Fund(The Infrastructure Growth and Economic Reforms Fund)An open ended equity scheme following economic reforms and/or Infrastructure development themePortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesIndustrial Products Rhi Magnesita India Limited KEI Industries LimitedGrindwell Norton LimitedPolycab India LimitedSupreme Industries LimitedKirloskar Pneumatic Co.LtdBharat Forge LimitedCarborundum Universal LimitedEsab India LimitedFinolex Cables LimitedCement & Cement Products UltraTech Cement Limited ACC LimitedJK Lakshmi Cement LimitedPrism Johnson LimitedPower Power Grid Corporation of India Limited NTPC LimitedKalpataru Power Transmission LimitedCESC LimitedConstructionG R Infraprojects LimitedKNR Constructions LimitedPNC Infratech LimitedAhluwalia Contracts (India) LimitedConstruction Project Larsen & Toubro LimitedTechno Electric & Engineering Company LimitedH.G. Infra Engineering LimitedIndustrial Capital Goods Siemens LimitedABB India LimitedVoltamp Transformers LimitedHoneywell Automation India LimitedConsumer DurablesEureka Forbes LimitedCentury Plyboards (India) LimitedCrompton Greaves Consumer Electricals LimitedWhirlpool of India LimitedPetroleum Products Reliance Industries LimitedAerospace & DefenseBharat Dynamics LimitedBharat Electronics LimitedHindustan Aeronautics LimitedFerrous MetalsJindal Steel & Power LimitedAPL Apollo Tubes LimitedRatnamani Metals & Tubes LimitedTransportationContainer Corporation of India LimitedAdani Ports and Special Economic Zone LimitedGasGAIL (India) LimitedGujarat State Petronet LimitedIndraprastha Gas LimitedChemicalsAtul LimitedSolar Industries India LimitedTelecom - Services Bharti Airtel LimitedBharti Airtel Limited - Partly Paid SharesInsuranceSBI Life Insurance Company LimitedAutoAshok Leyland LimitedFertilisersChambal Fertilizers & Chemicals LimitedPesticidesDhanuka Agritech LimitedPublic UtilitiesVA Tech Wabag LimitedFinancial Technology (Fintech)PB Fintech LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTALINCEPTION DATE% to NetAssetsJune 11, 2004BENCHMARKS&P BSE 100 %1.36%1.36%1.03%1.03%0.60%0.60%96.93%NAV AS ONMARCH 31, 2022Regular PlanGrowth: 142.761Direct PlanGrowth: 150.570TOTAL AUM1,474 CrMONTHLY AVERAGE AUM1,410 CrPortfolio Turnover Ratio(Last 12 months):0.413 Year Risk Statistics:Standard Deviation : 26.31%Beta : 1.12R-Squared : 83.37%Sharpe Ratio : 0.45Month End Expense RatioRegular Plan : 2.29%Direct Plan : 1.52%3.21%3.21%-0.14%-0.14%100.00%ü Top Ten Holdings4

DSP Mid Cap FundMid Cap Fund- An open ended equity scheme predominantly investing in mid cap stocksINCEPTION DATENov 14, 2006PortfolioName of InstrumentBENCHMARKNifty Midcap 150 (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 86.201Direct PlanGrowth: 92.875TOTAL AUM13,715 CrMONTHLY AVERAGE AUM13,333 CrPortfolio Turnover Ratio(Last 12 months):0.313 Year Risk Statistics:Standard Deviation : 21.23%Beta : 0.80R-Squared : 93.83%Sharpe Ratio : 0.58Month End Expense RatioRegular Plan : 1.79%Direct Plan : 0.80%5 EQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesConsumer DurablesBata India LimitedSheela Foam LimitedCrompton Greaves Consumer Electricals LimitedVoltas LimitedKajaria Ceramics LimitedDixon Technologies (India) LimitedWhirlpool of India LimitedIndustrial ProductsSupreme Industries LimitedBharat Forge LimitedPolycab India LimitedAIA Engineering LimitedFinolex Cables LimitedTimken India LimitedChemicalsAtul LimitedTata Chemicals LimitedSRF LimitedLinde India LimitedPharmaceuticalsIPCA Laboratories LimitedAlkem Laboratories LimitedAlembic Pharmaceuticals LimitedBanksICICI Bank LimitedThe Federal Bank LimitedCity Union Bank LimitedFinanceCholamandalam Investment and Finance Company LimitedManappuram Finance LimitedAptus Value Housing Finance India LimitedConsumer Non DurablesEmami LimitedHatsun Agro Product LimitedKansai Nerolac Paints LimitedFertilisersCoromandel International LimitedChambal Fertilizers & Chemicals LimitedSoftwareCyient LimitedZensar Technologies LimitedeClerx Services LimitedCoforge LimitedInsuranceSBI Life Insurance Company LimitedMax Financial Services LimitedCement & Cement ProductsThe Ramco Cements LimitedJK Cement LimitedAuto AncillariesBalkrishna Industries LimitedTube Investments of India LimitedMinda Industries LimitedSuprajit Engineering LimitedGasGujarat Gas LimitedGujarat State Petronet LimitedTransportationContainer Corporation of India LimitedConstructionThe Phoenix Mills LimitedLeisure ServicesJubilant Foodworks LimitedAutoEicher Motors LimitedPesticidesDhanuka Agritech LimitedConstruction ProjectTechno Electric & Engineering Company LimitedIndustrial Capital GoodsThermax LimitedFerrous MetalsRatnamani Metals & Tubes LimitedTextiles - CottonVardhman Textiles Limited% to Net 80%0.80%0.71%0.71%0.62%0.62%0.61%0.61%Name of InstrumentRetailingJust Dial LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTAL% to Net %ü Top Ten HoldingsNotes: 1. Classification of % of holdings based on Market Capitalisation: Large-Cap 9.35%, Mid-Cap 65.45%,Small-Cap 22.46%.Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms offull market capitalization Small Cap: 251st company onwards in terms of full market capitalizationDSP Mid Cap Fund erstwhile known as DSP Small & Mid Cap Fund

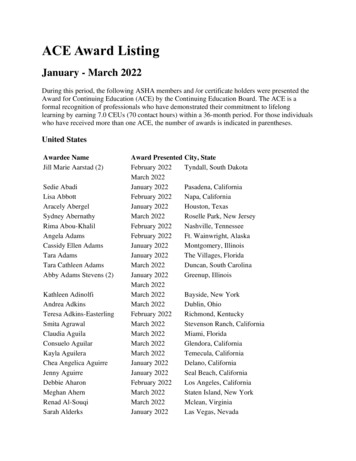

DSP Tax Saver FundAn open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefitPortfolioName of Instrument EQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesBanksICICI Bank LimitedHDFC Bank LimitedAxis Bank LimitedState Bank of IndiaSoftwareInfosys LimitedHCL Technologies LimitedMphasiS LimitedPharmaceuticalsSun Pharmaceutical Industries LimitedDr. Reddy's Laboratories LimitedLupin LimitedIPCA Laboratories LimitedAlembic Pharmaceuticals LimitedJB Chemicals & Pharmaceuticals LimitedFinanceSBI Cards and Payment Services LimitedLIC Housing Finance LimitedManappuram Finance LimitedEquitas Holdings LimitedCholamandalam Investment and Finance Company LimitedConsumer DurablesCrompton Greaves Consumer Electricals LimitedCentury Plyboards (India) LimitedSheela Foam LimitedWhirlpool of India LimitedIndustrial ProductsKEI Industries LimitedBharat Forge LimitedSupreme Industries LimitedFinolex Cables LimitedCement & Cement ProductsACC LimitedUltraTech Cement LimitedInsuranceSBI Life Insurance Company LimitedMax Financial Services LimitedAutoMahindra & Mahindra LimitedHero MotoCorp LimitedMaruti Suzuki India LimitedChemicalsGHCL LimitedAtul LimitedGasGAIL (India) LimitedGujarat State Petronet LimitedTelecom - ServicesBharti Airtel LimitedBharti Airtel Limited - Partly Paid SharesConsumer Non DurablesEmami LimitedMarico LimitedGodrej Consumer Products LimitedConstructionKNR Constructions LimitedAhluwalia Contracts (India) LimitedG R Infraprojects LimitedPowerNTPC LimitedFertilisersCoromandel International LimitedChambal Fertilizers & Chemicals LimitedFerrous MetalsJindal Steel & Power LimitedTransportationContainer Corporation of India LimitedOilOil & Natural Gas Corporation LimitedPetroleum ProductsBharat Petroleum Corporation LimitedAerospace & DefenseBharat Electronics LimitedLeisure ServicesJubilant Foodworks LimitedINCEPTION DATEJan 18, 2007% to Net 32%1.32%1.23%1.23%1.12%1.12%0.97%0.97%Name of InstrumentTextiles - CottonVardhman Textiles LimitedFinancial Technology (Fintech)PB Fintech LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTALü Top Ten Holdings% to Net .40%100.00%BENCHMARKNifty 500 (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 80.068Direct PlanGrowth: 86.225TOTAL AUM9,872 CrMONTHLY AVERAGE AUM9,463 CrPortfolio Turnover Ratio(Last 12 months):0.543 Year Risk Statistics:Standard Deviation : 22.06%Beta : 0.99R-Squared : 96.66%Sharpe Ratio : 0.65Month End Expense RatioRegular Plan : 1.92%Direct Plan : 0.80%6

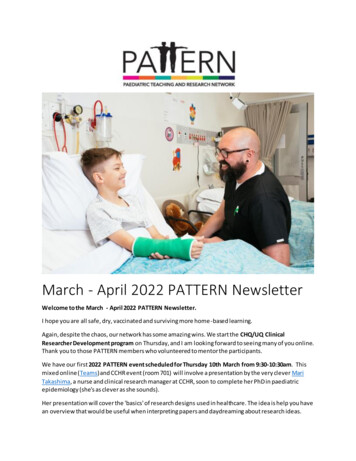

DSP Healthcare FundAn open ended equity scheme investing in healthcare and pharmaceutical sectorINCEPTION DATENov 30, 2018BENCHMARKS&P BSE HEALTHCARE (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 21.875Direct PlanGrowth: 23.092TOTAL AUM1,291 CrMONTHLY AVERAGE AUM1,265 CrPortfolio Turnover Ratio(Last 12 months):0.203 Year Risk Statistics:Standard Deviation : 17.78%Beta : 0.74R-Squared : 86.87%Sharpe Ratio : 1.35PortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesPharmaceuticals Sun Pharmaceutical Industries Limited Cipla Limited IPCA Laboratories Limited Dr. Reddy's Laboratories Limited Lupin Limited Procter & Gamble Health Limited Alkem Laboratories LimitedIndoco Remedies LimitedAlembic Pharmaceuticals LimitedAarti Drugs LimitedUnichem Laboratories LimitedHealthcare Services Max Healthcare Institute Limited Apollo Hospitals Enterprise Limited Vijaya Diagnostic Centre LimitedSyngene International LimitedNarayana Hrudayalaya Ltd.Kovai Medical Center & Hospital LimitedInsuranceICICI Lombard General Insurance Company LimitedRetailingMedplus Health Services LimitedTotalForeign Securities and/or overseas ETF(s)Listed / awaiting listing on the stock exchangesHealthcare ServicesIntuitive Surgical IncGlobus Medical IncAbiomed IncPharmaceuticalsAbbott LaboratoriesIllumina IncTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalOTHERSOverseas Mutual FundGlobal X Funds - Global X Genomics & Biotechnology ETFTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTALü Top Ten Holdings7% to Net AssetsMonth End Expense RatioPlan -0.35%100.00%TERSchemeUnderlying Funds* TotalDirect0.82%0.01%0.83%Regular2.16%0.01%2.17%* Weighted average TER of the underlying funds. Kindly refer Foreign Securities and/or overseas ETF(s) section of the scheme portfolio for more details.The investors are bearing the recurring expenses of the Fund, in addition to the expenses of the underlying Fund.

DSP Quant FundAn Open ended equity Scheme investing based on a quant model themePortfolioName of Instrument EQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesSoftwareInfosys LimitedTech Mahindra LimitedTata Consultancy Services LimitedHCL Technologies LimitedLarsen & Toubro Infotech LimitedWipro LimitedMphasiS LimitedL&T Technology Services LimitedOracle Financial Services Software LimitedConsumer Non DurablesAsian Paints LimitedMarico LimitedITC LimitedDabur India LimitedNestle India LimitedColgate Palmolive (India) LimitedHindustan Unilever LimitedBritannia Industries LimitedInsuranceBajaj Finserv LimitedICICI Lombard General Insurance Company LimitedHDFC Life Insurance Company LimitedICICI Prudential Life Insurance Company LimitedFinanceBajaj Finance LimitedHousing Development Finance Corporation LimitedCement & Cement ProductsUltraTech Cement LimitedAmbuja Cements LimitedACC LimitedShree Cement LimitedBanksICICI Bank LimitedHDFC Bank LimitedPharmaceuticalsCipla LimitedIPCA Laboratories LimitedAlkem Laboratories LimitedDr. Reddy's Laboratories LimitedAbbott India LimitedPfizer LimitedConsumer Durables Titan Company LimitedRelaxo Footwears LimitedIndustrial ProductsAstral LimitedCummins India LimitedAutoBajaj Auto LimitedHero MotoCorp LimitedConstruction ProjectLarsen & Toubro LimitedChemicalsPidilite Industries LimitedTextile ProductsPage Industries LimitedCapital MarketsHDFC Asset Management Company LimitedHealthcare ServicesDr. Lal Path Labs Ltd.FertilisersCoromandel International LimitedPowerTorrent Power LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalINCEPTION DATEJun 10, 2019% to Net .04%0.91%0.91%0.84%0.84%0.81%0.81%99.62%Name of InstrumentCash & Cash EquivalentCash MarginNet Receivables/PayablesTotalGRAND TOTALü Top Ten Holdings% to Net Assets0.04%-0.10%-0.06%100.00%Subject to SEBI (MF) Regulations and the applicable guidelines issued by SEBI, Scheme has entered into securitieslending in accordance with the framework specified in this regard.BENCHMARKS&P BSE 200 TRINAV AS ONMARCH 31, 2022Regular PlanGrowth: 16.152Direct PlanGrowth: 16.496TOTAL AUM1,336 CrMONTHLY AVERAGE AUM1,290 CrPortfolio Turnover Ratio:(Last 12 Months):0.51Month End Expense RatioRegular Plan : 1.28%Direct Plan : 0.56%0.44%0.44%8

DSP VALUE FUNDAn open ended equity scheme following a value investment strategyINCEPTION DATEDec 10, 2020BENCHMARKNifty 500 TRINAV AS ONMARCH 31, 2022Regular PlanGrowth: 13.100Direct PlanGrowth: 13.231TOTAL AUM598 CrMONTHLY AVERAGE AUM579 CrPortfolio Turnover Ratio:(Last 12 Months):1.129PortfolioName of InstrumentEQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesSoftware Tech Mahindra Limited Infosys Limited HCL Technologies LimitedWipro LimitedMphasiS LimitedOracle Financial Services Software LimitedCyient LimitedeClerx Services LimitedPharmaceuticals Cipla LimitedDr. Reddy's Laboratories LimitedIPCA Laboratories LimitedAlkem Laboratories LimitedAarti Drugs LimitedConsumer Non Durables ITC LimitedRadico Khaitan LimitedBalrampur Chini Mills LimitedDCM Shriram LimitedCCL Products (India) LimitedCement & Cement ProductsUltraTech Cement LimitedAmbuja Cements LimitedDalmia Bharat LimitedAerospace & DefenseBharat Electronics LimitedHindustan Aeronautics LimitedIndustrial ProductsKEI Industries LimitedPolycab India LimitedEPL LimitedFinolex Industries LimitedNilkamal LimitedConstruction ProjectLarsen & Toubro LimitedMinerals/MiningCoal India LimitedAutoBajaj Auto LimitedHero MotoCorp LimitedChemicalsAtul LimitedSudarshan Chemical Industries LimitedFertilisersCoromandel International LimitedTextile ProductsK.P.R. Mill LimitedConstructionKNR Constructions LimitedPNC Infratech LimitedPowerCESC LimitedTransportationThe Great Eastern Shipping Company LimitedGasGujarat State Petronet LimitedTextiles - CottonVardhman Textiles LimitedTotalForeign Securities and/or overseas ETF(s)Listed / awaiting listing on the stock exchangesFinance Berkshire Hathaway Inc - Class BTotalArbitrageIndex OptionsTotalArbitrage (Cash Long)Stock FuturesTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalOTHERSOverseas Mutual Fund Veritas Asset Management LLP Harding Loevner Global Equity Fund (Class A USD Shares) Heptagon Capital LLP Lindsell Train Global Equity Fund (Class C USD Shares)Total% to 97%0.97%20.28%5.88%5.38%4.77%4.24%20.27%% to NetAssetsName of InstrumentCash & Cash EquivalentCash MarginNet Receivables/PayablesTotalGRAND TOTAL2.75%-0.16%2.59%100.00%ü Top Ten HoldingsMonth End Expense RatioPlan NameTERSchemeUnderlying Funds* TotalDirect0.74%0.19%0.93%Regular1.48%0.19%1.67%* Weighted average TER of the underlying funds. Kindly refer Foreign Securities and/or overseas ETF(s) section of the scheme portfolio for more details.The investors are bearing the recurring expenses of the Fund, in addition to the expenses of the underlying Fund.

DSP Small Cap FundSmall Cap Fund- An open ended equity scheme predominantly investing in small cap stocksPortfolioName of Instrument EQUITY & EQUITY RELATEDListed / awaiting listing on the stock exchangesConsumer DurablesSheela Foam LimitedGreenlam Industries LimitedCera Sanitaryware LimitedButterfly Gandhimathi Appliances LimitedLa Opala RG LimitedKajaria Ceramics LimitedTTK Prestige LimitedThangamayil Jewellery LimitedAmber Enterprises India LimitedSafari Industries (India) LimitedIndustrial ProductsNilkamal LimitedMold-Tek Packaging LimitedFinolex Industries LimitedSwaraj Engines LimitedFinolex Cables LimitedRhi Magnesita India LimitedGraphite India LimitedMold-Tek Packaging Limited - WarrantTCPL Packaging LimitedAuto AncillariesSuprajit Engineering LimitedTube Investments of India LimitedSubros LimitedLumax Auto Technologies LimitedSandhar Technologies LimitedFerrous MetalsRatnamani Metals & Tubes LimitedAPL Apollo Tubes LimitedKalyani Steels LimitedWelspun Corp LimitedChemicalsAtul LimitedGHCL LimitedConsumer Non DurablesTriveni Engineering & Industries LimitedVST Industries LimitedLT Foods LimitedDwarikesh Sugar Industries LimitedDodla Dairy LimitedTextile ProductsK.P.R. Mill LimitedSiyaram Silk Mills LimitedHimatsingka Seide LimitedS. P. Apparels LimitedWelspun India LimitedSoftwareeClerx Services LimitedCyient LimitedZensar Technologies LimitedPharmaceuticalsIPCA Laboratories LimitedAmrutanjan Health Care LimitedAarti Drugs LimitedRetailingShoppers Stop LimitedV-Mart Retail LimitedVedant Fashions LimitedJust Dial LimitedFertilisersChambal Fertilizers & Chemicals LimitedPesticidesSharda Cropchem LimitedDhanuka Agritech LimitedFinanceManappuram Finance LimitedEquitas Holdings LimitedAnand Rathi Wealth LimitedRepco Home Finance LimitedMuthoot Capital Services LimitedEntertainmentINOX Leisure LimitedBanksDCB Bank LimitedEquitas Small Finance Bank LimitedINCEPTION DATEJun 14, 2007% to Net 8%0.31%0.30%1.88%1.88%1.60%1.09%0.51%Name of InstrumentHealthcare ServicesNarayana Hrudayalaya Ltd.Cement & Cement ProductsPrism Johnson LimitedTextiles - CottonVardhman Textiles LimitedConstructionKNR Constructions LimitedLeisure ServicesWestlife Development LtdConstruction ProjectTechno Electric & Engineering Company LimitedIndustrial Capital GoodsVoltamp Transformers LimitedTotalMONEY MARKET INSTRUMENTSTREPS / Reverse Repo Investments / Corporate Debt RepoTotalCash & Cash EquivalentNet Receivables/PayablesTotalGRAND TOTAL% to Net %1.01%0.97%0.97%0.91%0.91%95.99%BENCHMARKS&P BSE 250 Small Cap (TRI)NAV AS ONMARCH 31, 2022Regular PlanGrowth: 110.061Direct PlanGrowth: 117.443TOTAL AUM8,625 CrMONTHLY AVERAGE AUM4.30%4.30%-0.29%-0.29%100.00%ü Top Ten HoldingsClassification of % of holdings based on Market Capitalisation: Mid Cap 13.09%, Small-Cap 82.17%.Large Cap: 1st -100th company in terms of full market capitalization Mid Cap: 101st -250th company in terms offull market capitalization Small

ICICI Lombard General Insurance Company Limited 1.27% HDFC Life Insurance Company Limited 1.14% . Century Plyboards (India) Limited 1.93% Havells India Limited 1.14% Dixon Technologies (India) Limited 0.83% . (TRI) TOTAL AUM 2,652 Cr MONTHLY AVERAGE AUM 2,566 Cr Month End Expense Ratio