Transcription

navigating complexityMarch 2017Car-sharing in ChinaHow to operate a successful business

2 Think:ActCar-sharing in China3THE BIG45%annual growth is expected for the Chinesecar-sharing fleet until 2025.Page 390%of China's car-sharing fleet is operated by local players.Page 620%daily utilization is the breakeven point needed to makea car-sharing business profitable in China.Page 9

Think:Act 3Car-sharing in ChinaChinese car-sharingis blossoming: hugeopportunities areexpected in the next5 years for car-sharingproviders.When CCClub started the first car-sharing business inChina in 2010, it had a small fleet of vehicles to providemobility services for the Alibaba business campus. In2013, the number of shared vehicles nationwidereached 780, with 5 major companies each owningfleets of over 50 cars. Today, it consists of more than26,000 shared vehicles especially in tier 1 and tier 2 cities (e.g. Beijing, Shanghai, Hangzhou, Shenzhen,Changsha, Wuhan etc.), operated by dozens of car-sharing operators (CSOs). Based on our assumptions, theChinese car-sharing market is expected to continue togrow at 45% p.a. in terms of fleet size until 2025. AThis promising outlook is driven predominantly by thefollowing factors:GOVERNMENT POLICY AND REGULATIONSSince 2014, to fight serious air pollution issues and toencourage the development of a sharing economy(called "Internet " in China), the Chinese central gov1 Source: national bureau of statistics of chinaernment and local municipalities have issued multiplepolicies to encourage the growth of car-sharing. Furthermore, plate restrictions in large Chinese cities (e.g.Shanghai, Beijing, Tianjing etc.) have positively impacted the car-sharing market, offering customers alternative mobility solutions to private cars. BINSUFFICIENT PUBLIC TRANSPORTThe development of public transport networks is growing at a slower rate than urbanization in China. For example, from 2004 to 2014, the population of Beijingrose by 1.4% per year while the number of taxis in thecity grew by 0.3% per year on the same period, reaching13,334 000 and 67,500 respectively in 2014 1. The urbanpopulation is therefore being forced to seek alternatives, for example via "Intelligent Mobility" programs.Against this backdrop, car-sharing has its advantagesand is positioned as one of the key alternatives to traditional public transport.

4 Think:ActCar-sharing in ChinaCUSTOMER MOBILITY NEEDSThere continues to be a huge gap between the totalnumber of vehicles ('car parc') and the number of driving license holders in China. Based on Roland Berger'sestimate, in 2020, there will be 355 million licenseholders but only 195 million vehicles. Car-sharingcould be a mobility solution for license holders without a private car.ACAR-SHARING FLEET IN CHINA IS EXPECTED TOGROW BY 45% PER YEAR UNTIL 2025[National fleet size estimate ; '000 vehicles]600 45%SHARING ECONOMY CONCEPTThe concept of a shared economy is growing in China,penetrating various domains such as education, andmedication. Shared mobility, including car-sharing,has become a resounding trend as customers (especially the younger generation) increasingly use this servicerather than own cars. Roland Berger conducted a survey in 2015 of 180 participants which showed 47% ofthe interviewees have heard of car-sharing and 76% areinterested. Another survey by Evcard (one of the leading local car-sharing companies) of its current usersrevealed that more than 57% of members are aged between 25 and 35 years (v.s. 4 to 18% for other ranges)."People between 18-35are the target forcar-sharing, forinstance, young whitecollar workers anduniversity students."CEO of car-sharing providerThe 2015 Chinese car-sharing market represents 16%of the total fleet of car-sharing in the world, while thenumber of members of car-sharing programs in China(approximately 8 million members) represents 14% ofthe global membership population. Only 15% to 30%of these members are active users (varying from operator to operator); Nonetheless, we firmly believe thatthis market still has huge potential and room for newplayers.1002614201520162020e2025eSource: Roland BergerA BATTLE IS CLEARLY LOOMING IN THECHINESE CAR-SHARING MARKET, WITH NOCLEAR WINNER YET.Over the last 5 years, various players with differentbackgrounds have entered the Chinese market assessing operational models and establishing their owncompetitive advantages. International players, mostlyrepresented by OEMs, are increasingly focusing on theestablishment of new ecosystems built around theircore competencies, namely car manufacturing, retailing and professional services. C

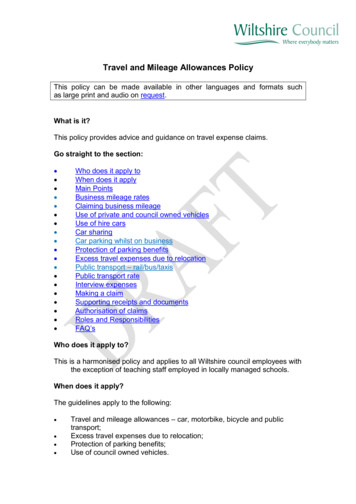

Think:Act 5Car-sharing in ChinaLocal players are divided into three categories: localOEM self-owned, third party backed by OEMs and thirdparty technology companies. Most of them rely on government subsidies and their local networks; they havesigned exclusive partnerships with various stakeholders to gain an initial foothold in the market before establishing a more profitable business model.Following the early years of slower growth, since2013 local players have picked up the pace and expanded the size of their fleets very aggressively, now holdingapproximately 90% of national market share in termsof fleet size, which accounts for about 26,000 vehiclesin China. Microcity only own about 10,000 vehicles, followed by EVCard, I-GO and CCClubs.In this report, we focus on three main car-sharingmodels as practised by three major players in China:Round Trip car-sharing (Car2share), One-Way car-sharing (Evcard) and Free Floating (Car2go). D"We are still lookingfor a suitablebusiness model forthe Chinese market."Manager from a leading internationalOEM which is planning to providecar-sharing services in ChinaBGOVERNMENT POLICY AND REGULATIONSChinese governments are acting in favor of car-sharing developments both at central and local levels.CENTRAL GOVERNMENTLOCAL GOVERNMENTSHENZHENLed by the Shenzhen development research center,the program for the integration and application ofcar-sharing technology was officially launched.20142015CAR-SHARINGIn October 2015, the State Council encouragedautomotive industry players to develop andimplement innovative car-sharing models.QINGDAOLocal government put forward the "Green MobilityPlan", which applies car-sharing to official businesstravel.2016SHARED ECONOMYIn March 2016, led by the National Developmentand Reform Commission, 10 national ministriesand commissions put forward guidelines toencourage an improved credit system and sharedeconomy.SHANGHAISupport for the development of car-sharingnetworks, including offering a certain number ofparking lots for free; target set for at least 4,000cars to be allocated to car-sharing services each year.Source: Desk research; Roland Berger analysisBEIJINGCar-sharing pilot program established in ministries,commissions and related offices, and a plan to add6,000 cars to this service by the end of 2016.

6 Think:ActCar-sharing in ChinaCMAPPING OF CAR-SHARING PROVIDERS AND FLEET SIZE ESTIMATIONMost players in the Chinese market are local – Global players currently have very limited presence. 1,500Car2goGlobalVolkswagenAbout to enterCar2shareBMW 1ORIGIN 1,000 16,000E-sharingLocalVery limitedexperience in theChinese market 8,000E-sharing n ChuxingGofunOEM y3rd-party backed by OEMEv SharingEzzyEvcardUuzucheYi MiaoCCClubI-goYiduUrcar3rd-party technology companiesNATURE OF OPERATORSource: Desk research; Roland Berger analysisDKEY CONCERNS IN THE CHINESECAR-SHARING MARKETConsumers usually use car-sharing as an alternativeto taxis or chauffeurs; the comparatively low taxifares in China mean lower pricing for car-sharing.Consumer malpractice such as incorrect parking andtraffic violations cause increased management issuesand operational costs.THE THREE MAIN CAR-SHARING MODELS ASPRACTISED BY THREE MAJOR PLAYERS INCHINAROUND TRIP (A to A)E.g.: Car2shareONE-WAY (A to B)E.g.: EvcardMost of the current players rely on governmentsubsidies and are still not running profitable andsustainable business models.FREE FLOATING (X to Y) E.g.: Car2go1 Pilot launched in Beijing in 2016

Think:Act 7Car-sharing in ChinaThe path to achieve aprofitable car-sharingbusiness in China islong and not withoutobstacles.CHALLENGE ONEFULFILL LOCAL GOVERNMENTS'REQUIREMENTSCar-Sharing Operators (CSOs) need to complete severalinitial conditions to launch their car-sharing businessin China: none of these conditions are easily achieved,especially in cities with strict license plate restrictionsand parking lot shortages. In this context, strong relationships with local government are essential to drivethe successful set-up of car-sharing businesses in China. Win-win partnerships should also be developedwith infrastructure partners to rapidly expand networks.Acquire the necessary operating licenses and certificates A rental company operating license authorized bythe Commerce and Industry Bureau is required in allcities A business certificate from the Transportation Bureau is necessary in certain cities, e.g. Beijing andShanghaiObtain sufficient license plates for car-sharing fleets,especially in certain cities with specific car-sharingplates (e.g. Shanghai with "Y" plate), generally limitedby a yearly quota.Construct infrastructure networks Parking lot solutions from government, third partypartnerships etc. Well-equipped charging infrastructure in the case ofNew Energy Vehicles.CHALLENGE TWORESPECT THE ORIGINAL CUSTOMER VALUEPROPOSITIONBy only focusing on initial pre-requisites and local government expectations, operators risk neglecting theoriginal customer value proposition and consequentlycreating inappropriate user scenarios with low utilization rates.A proper selection of car-sharing user scenarios isessential for CSOs to achieve sustainable business development. Ideal car-sharing user scenarios should besituation-specific and ease daily operation, encompassing features such as relatively limited presence ofother alternative mobility services or alternative trafficsolutions (e.g. Didi, etc.).

8 Think:ActCar-sharing in ChinaCHALLENGE THREEMEET HIGH INITIAL INVESTMENT ANDOPERATIONAL COSTSFleet purchase, aftersales maintenance and car recycling are the major costs for a car-sharing operatingmodel. They include high charges such as initial purchase, insurance, etc. Lack of synergies with playersalong the value chain drives the burden of these initialinvestments and operational costs for CSOs, negativelyimpacting cash flow.CHALLENGE FOURMIRROR HIGHLY COMPETITIVE MOBILITYMARKET AND LOW TRIP RATEUnlike in Western countries, the availability of alternative cost efficient mobility solutions in China affectscustomers' price sensitivity regarding car-sharing triprates, which further limits the profitability of thecar-sharing business.CHALLENGE FIVEACCOUNT FOR COSTS OF CONSUMERMALPRACTICEAnother factor driving increased operational costs iscustomer malpractice, such as incorrect parking, damage to cars, key loss, traffic violations, incorrect booking, illegal rental, refused payment, etc. Measures tostrengthen offline teams and technologies must be adopted, resulting again in additional costs: Higher material costs: Loss of keys, fuel cards, vehicle licenses, etc. which insurance cannot cover Higher offline operational costs: Extra cleaning,moving incorrectly parked cars, stolen car trackingand other related costs Higher back-office costs: Dealing with exceptionalcircumstances, e.g. chasing penalties for traffic violations Insurance costs: the average insurance fees per vehicle for a fleet is higher than for an invidually ownedvehicle by 50 to 100% in China, due to the lack ofexperience to feed insurance modellingCHALLENGE SIXINCREASE UTILIZATION RATEBased on Roland Berger's financial modelling, the2 CSO with a fleet of 200 ICE vehicles in one Chinese tier-1 city3 Utilization refers to the percentage of time each car is in use over 24 hourperiodbreakeven point for a CSO2 is around a 20% utilizationrate3, which is largely higher than almost all CSOs atpresent, 12% being the industry average."The business hasn'treached its break-evenpoint and we are stilltrying to achieve quickerpayback in the Chinesemarket."COO from a leading internationalcar-sharing player in ChinaMIRROR HIGHLY COMPETITIVEMOBILITY MARKET AND LOWTRIP RATEChauffeur-based mobility service provider, Yidao,launched a marketing campaign whereby 100 RMBwas rewarded for each 100 RMB a customer recharged in their pre-paid account. This gave it acompetitive edge during the promotion period.100

Think:Act 9Car-sharing in ChinaDespite these challenges,we think a successfulcar-sharing business inChina is attainable.But careful planning isfundamental.Success depends on the ability to seize external opportunities that the current trends offer, but also, andmost importantly, it depends on internal operationalcapabilities.EXTERNAL FACTORSPREPARE A FAVORABLE ENVIRONMENTTwo key factors are identified for setting up a more favorable environment for car-sharing services on boththe Car-Sharing Operator and partner's side.1. Set up a proper partnershipNo firm can successfully operate a car-sharing business singlehandedly and partnerships are needed toacquire operational resources and share risks andcosts. Thus, a pragmatic CSO will initiate negotiationswith potential partners across the entire car-sharingecosystem and try to maximize synergies from thesepartnerships. This will significantly drive demand forthe car-sharing business and reduce operational ex-penses. A fact that needs to be considered is that in adeveloping car-sharing market such as China's, thesepartnerships sometimes lead to exclusive contracts,which means the first mover could gain competitiveadvantages.Partnerships should also be set up to acquire customers. For example, office buildings or corporationscould promote and offer car-sharing services to employees, which in return could be beneficial to theiroverall overhead costs.In our study, we examined various scenarios basedon three areas: 1) customer base, including user preference, population density, etc.; 2) environmental factors, including partnership willingness and possiblegovernment support; 3) potential competition. And asa result we identified four major partner categories inChina, each bringing different resources to thecar-sharing business. We recommend starting with industrial parks/corporate campuses and hotel partners,employing suitable negotiation strategies. E

10 Think:ActCar-sharing in ChinaECAR-SHARING ECOSYSTEMNegotiations for a future partnership should consider theentire car-sharing ecosystem to maximize the possiblesynergies.SuppliersOEMsCar tuning / additionalaccessories, car financing /discounts, etc.Call center, IT, Insurance,Advertisement, Inspector.Algorithm support, back-office support,marketing & promotion, membershipmechanism, subscription validation,violations check Maintenance,used carAftersales servicesolutionsproviders4S stores, IAM, .Local partnersRental company, Realestate, Parking, .CAR-SHARING ationalsupport GovernmentSharing economy,intelligent mobility,green mobility Fuel card,discountprice OfflinemanagementStationsGas station, ChargingstationHot spotsPlatform integrator/competitorsFirms, Hotels, Universities,Airport, Train station, .CAR-SHARING SERVICESCUSTOMERSCATEGORYPARTNERSHIPRESOURCE OFFERINGSCustomerbaseCentral Business DistrictCorporates in CBD with large numbers ofstaff as potential customersProperty management officer in CBD, incharge of parking lots and related servicesIndustrial Park /Corporate CampusCorporates with corporate campuses orwith a strong presence in industrial parksIndustrial park management officer, withinterest in building up 'smart mobility'solutionsHotelsLarge premium hotel groups, with nationalnetwork coverageUniversitiesUniversities with large area coverage andlarge number of students and staffParkinglotsJointmarketing

Think:Act 11Car-sharing in China2. Benefit from local government subsidiesContinuous government support for car-sharing easesthe overall setup and operation of car-sharing businesses, e.g. financial incentives for vehicle purchaseand parking lot resources.In a large number of cities, local governments haveinitiated car-sharing or shared mobility programswhich offer relevant incentives and resources. For instance, the Beijing local government plans to replaceofficial government sector vehicles with several pilotprograms. Leading CSOs have also received subsidiesfrom local governments for vehicle purchases, especially for EV models.INTERNAL CAPABILITIESOPTIMIZE BUSINESS FOR CHINESECAR-SHARING OPERATIONS1. Map a clear vision of target customersand bespoke product offeringsCSOs should first gain a clear vision of target customergroups, and then develop bespoke product offerings toattract potential customer groups.For leading CSOs in China, younger generationsare the clear target customers. According to public surveys, younger generations are more interested incar-sharing services due to their awareness of the concept of sharing and of the limited nature of private vehicle ownership. They also have more frequent mobility needs, e.g. for social events, weekend outings or fordaily journeys within the city.These targets use online platforms, which createlower costs for operators. They are also highly reactiveto other marketing strategies such as: Free trials to increase product awareness Discounts or coupons to address budget concerns ofthe younger generation Free social event tickets provided to attract targetcustomers2. Be innovative and think beyond carsIn order to set up user scenarios, CSOs must also generate innovative ideas to promote car-sharing, such asconsidering car-sharing as a complete customer journey rather than a simple mobility solution. The journey could include other ways customers use cars –shopping, hotels, tourism and sight-seeing etc. Forexample, Feezu established in Hainan an integratedcar-sharing network covering the main mobility scenarios, connecting hotels, shopping centers and tourist attractions. Such integrated services not only improve the user experience, but also bring added valueto all stakeholders with additional customers for shopping centers, tourist attractions, etc, and more choiceand special prices for tourists. F3. Define an appropriate pricing strategy adaptedto the Chinese marketFor Chinese customers, car-sharing should be pricedmore cheaply than chauffeur-based mobility servicesor taxis because the cars are self-driven. Furthermore,taxi fares in China are relatively low, which makes pricing highly competitive for CSOs.In the case of ICE vehicles, car-sharing pricing consists of two factors –time-dependent pricing and distance-dependent pricing. Based on our analysis, CSOs'pricing strategy is intrinsically linked to target customers and user scenarios.In Beijing, for example, a CSO named "EZZY" mainly provides premium car-sharing services (BMW i3) toyoung female white collar workers. As this target customer group is not overly price sensitive, EZZY chargesa relatively higher membership fee with more exclusiveand higher quality services.For user scenarios, we conducted a comparativeanalysis on practical user scenario cases in Shanghai.In the A-A station based operating model, stops arehighly likely during a trip, resulting in a lower time-dependent price to avoid customers overpaying for idletime. As the case shows, even with a 20 minute stop,A-A operators, such as car2share and Togo, still have acomparative advantage over free-floating X-X playersuch as Car2go in China. G4. Improve operational performanceKey operational questions to ask before starting up: How to set a deposit or membership fee to balancerisk control and user experience? Should platforms offer advanced booking options aswell as special packages? If so, how? Should platforms encourage users to fill or rechargethe cars themselves? If so, how? How to deal with user traffic violations and relatedmaintenance so as not to affect utilization rates?

12 Think:ActCar-sharing in ChinaFTOURISM MODEL IN HAINANTaking advantage of Hainan's tourism market, Feezu setup an integrated car sharing network covering the mainmobility scenariosHotels bring revenues to theCSO with car rental incomeCustomersAttractionsoffer discountfor Feezu'susersHotels are chosen as customerentry, which functions ascustomer filteringCustomers directly pay thecar-sharing service inconvenient ways at hotelcheck outAppointedtouristattractionPayment flowCar-sharingserviceproviderHotelShopping centersbring revenues tothe CSO Customer flowSource: Desk research; Roland Berger analysisGIMPACT OF USER SCENARIOS ON PRICING SCHEMECSOs' pricing strategy is intrinsically linked to target customers and user scenariosPRICING SCHEMEOverall drivingspeed equivalent to13 km/hAverage speed:20 km/hDistance:6.6 kmSource: Desk research; Roland Berger analysisDistance:6.6 kmInterval stop for20 mnBy min [RMB]By km [RMB]Car2Share0.331.2ToGo0.281.880.591.19A-AX-Y Car2go

Think:Act 13Car-sharing in ChinaOperational performance is key in such a competitivemarket: any slight improvement will accelerate the rateat which positive profitability can be achieved. Therefore, a successful CSO needs to identify operationalissue areas and examine all possible solutions. By evaluating all these possibilities against criteria such asuser experience, cost control and risk control, the bestsolutions can be chosen and implemented.5. Invest in strong digitalization capabilitiesDigitalization capabilities are essential for making theinteraction between cars, customers, providers and offline teams faster, stronger and smarter. Digitalizationcapabilities include a solid IT system that can collectthird-party data through car users' phones, On BoardDiagnostic Systems and other systems, then analyze itand support the application of this to real case scenarios. Roland Berger has categorized the four main usesof car-sharing data which can improve operational efficiency. Valuable data collected from On Board Diagnostic (OBD) systems and other information systems,when properly leveraged, can help improve operationsby: H Triggering offline maintenance actions and partiallyreplacing manual checks Supporting back-office status checking at car returnand billing Setting up a membership rating system Providing evidence in case of traffic violations or accidentsHENHANCE DIGITALIZATION CAPABILITIESUsing smart digitization capabilities, car-sharing operational efficiency can be greatly improvedCOLLECT VALUABLE DATAIMPROVE OPERATIONS BY LEVERAGING DATAMaintenanceOBDCar locationDriving behaviorDriving timeDriving mileageDriving speedBraking behaviorCar conditionFuel amountBattery voltageFault information (code)On/Off statusDoor statusCharging statusEXTERNALKey statusViolation information / historyUser informationReturn /PaymentMembershipevaluationDutyjudgment

14 Think:ActCar-sharing in ChinaWhether it be for anOEM or for a third partyoperator, car-sharingwill be an interestingrevenue or profit pool inthe near future.Compared to mature markets, car-sharing is a relativelynew business model in China and is still in its earlystages. Nevertheless, as seen with the new car salesmarket 20 to 30 years ago, the car-sharing market has apromising future in China, in particular as a result ofthe significant customer potential, the rapid increase infleet size and the increasingly intense competition created by players with varying backgrounds.Due to the nature of the business model and severalissues specific to China, few car-sharing operators arecurrently succeeding from a financial perspective,which is mainly explained by the large cost base andlower than expected revenues.However we have faith in the potential of the Chinese car-sharing market, and we believe that playerscould reach profitability if they are able to optimize thepromising levers available. With a clear vision of targetcustomers and innovative user scenarios, improved andoptimized operational capabilities, and strong partner-ships across the value chain, they could profit from thefuture potential of this market.Furthermore, China is home to a particularly favorable external environment, with customers fully awareand welcoming car-sharing, strong support from thegovernment both financial and through the development of programs to promote car-sharing ("IntelligentMobility"), and the entry of multiple third parties onthe market.The automotive industry is changing from a purelymanufacturing industry to a more customer-orientedservice industry, with China being no exception. Thefirst-movers in the Chinese car-sharing market willdoubtless capture the greatest market share, as seen 30 years ago when VW knocked at the door and entered the Chinese automotive market.

Think:Act 15Car-sharing in ChinaABOUT USRoland Berger, founded in 1967, is the only leading global consultancy ofGerman heritage and European origin. With 2,400 employees working from34 countries, we have successful operations in all major international markets.Our 50 offices are located in the key global business hubs. The consultancyis an independent partnership owned exclusively by 220 Partners.Navigating ComplexityFor the past 50 years, Roland Berger has helped its clients manage change.Looking at the coming 50 years, we are committed to supporting our clientsconquer the next frontier. To us, this means facilitating navigating thecomplexities that define our times by providing clients with the responsivestrategies essential to success that lasts.FURTHER READINGLINKS & LIKESORDER AND DOWNLOADwww.rolandberger.comSTAY TUNEDwww.twitter.com/RolandBergerLIKE AND ON OF THE CARINDUSTRYWho will capture most ofthe future profit pools?In this issue of Automotive Insights, ourexclusive publication targeting issues atthe heart of the industry, we investigatethe topics that automotive players needto understand to succeed in this newworld. The goal is to give stakeholdersthe advanced knowledge of likelychanges in the automotive ecosystemthey needed to make empoweredchoices in their strategic investments.SERVING THE LAST MILEThe van-Reincarnation of an urbanwarrior?How can vehicle manufacturers leavetheir mark on the urban deliverybusiness? Modern commercial vehiclesare supposed to be quiet andemission-free, reliable, flexible, fast andwith low maintenance costs: in anutshell, genuine all-rounders. Thelatest issue of THINK ACT AutomotiveInsights "SERVING THE LAST MILE",leads with a new vision of the van of thefuture.

EditorROLAND BERGER GMBHSederanger 180538 MunichGermany 49 89 9230-0WE WELCOME YOUR QUESTIONS, COMMENTSAND SUGGESTIONSRON ZHENGPrincipal 86 21 52986677 - 163ron.zheng@rolandberger.comThis publication has been prepared for general guidance only. The reader should not act according to anyinformation provided in this publication without receiving specific professional advice. Roland Berger GmbHshall not be liable for any damages resulting from any use of the information contained in the publication. 2017 ROLAND BERGER GMBH. ALL RIGHTS RESERVED.TA 17 013SHENGYUN LUSenior consultant 86 13 524799684shengyun.lu@rolandberger.com

ly the younger generation) increasingly use this service rather than own cars. Roland Berger conducted a sur-vey in 2015 of 180 participants which showed 47% of the interviewees have heard of car-sharing and 76% are interested. Another survey by Evcard (one of the lead-ing local car-sharing companies) of its current users