Transcription

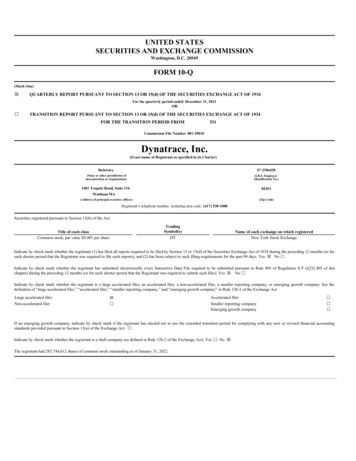

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWashington, D.C. 20549FORM 10-Q(Mark One) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934For the quarterly period ended December 31, 2021OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934FOR THE TRANSITION PERIOD FROMTOCommission File Number 001-39010Dynatrace, Inc.(Exact name of Registrant as specified in its Charter)Delaware47-2386428(State or other jurisdiction ofincorporation or organization)(I.R.S. EmployerIdentification No.)1601 Trapelo Road, Suite 11602451Waltham MA(Address of principal executive offices)(Zip Code)Registrant’s telephone number, including area code: (617) 530-1000Securities registered pursuant to Section 12(b) of the Act:TradingSymbol(s)DTTitle of each classCommon stock, par value 0.001 per shareName of each exchange on which registeredNew York Stock ExchangeIndicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or forsuch shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of thischapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See thedefinition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.Large accelerated filerNon-accelerated filer Accelerated filerSmaller reporting companyEmerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accountingstandards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No The registrant had 285,744,612 shares of common stock outstanding as of January 31, 2022.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTSThis Quarterly Report on Form 10-Q (“Quarterly Report”) contains forward-looking statements within the meaning of the federal securities laws, which statements involvesubstantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. All statements of historical factincluded in this Quarterly Report regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives ofmanagement are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “may,” “should,” “expects,”“plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words orother similar terms or expressions that concern our expectations, strategy, plans or intentions. When considering forward-looking statements, you should keep in mind the riskfactors and other cautionary statements described under the heading “Risk Factors” included elsewhere in this Quarterly Report and in our Annual Report on Form 10-K for theyear ended March 31, 2021 (“Annual Report”). These forward-looking statements are based on management’s current beliefs, based on currently available information, as to theoutcome and timing of future events. Forward-looking statements contained in this Quarterly Report include, but are not limited to, statements about: our future financial performance, including our expectations regarding our revenue, annual recurring revenue, gross profit or gross margin, operating expenses, ability togenerate cash flow, revenue mix and ability to maintain future profitability; our expectations regarding the potential impact of the novel coronavirus (“COVID-19”), pandemic on our business, operations, and the markets in which we and ourpartners and customers operate; anticipated trends and growth rates in our business and in the markets in which we operate; our ability to maintain and expand our customer base and our partner network; our ability to sell our applications and expand internationally; our ability to anticipate market needs and successfully develop new and enhanced solutions to meet those needs; our ability to hire and retain necessary qualified employees to grow our business and expand our operations; the evolution of technology affecting our applications, platform and markets; our ability to adequately protect our intellectual property; and our ability to service our debt obligations.We caution you that the foregoing list may not contain all of the forward-looking statements made in this Quarterly Report.You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Reportprimarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations andprospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “RiskFactors” in the Annual Report and as filed with the SEC and “Risk Factors” in Part II, Item 1A in this Quarterly Report and elsewhere in this Quarterly Report. Moreover, weoperate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks anduncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report. We cannot assure you that the results, events and circumstancesreflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forwardlooking statements.

PART I - FINANCIAL INFORMATIONItem 1.Condensed Consolidated Financial Statements (Unaudited)Condensed Consolidated Balance Sheets as of December 31, 2021 and March 31, 20212Condensed Consolidated Statements of Operations for the Three and Nine Months Ended December 31, 2021 and 20203Condensed Consolidated Statements of Comprehensive Income for the Three and Nine Months Ended December 31, 2021 and 20204Condensed Consolidated Statements of Shareholders’ Equity for the Three and Nine Months Ended December 31, 2021 and 20205Condensed Consolidated Statements of Cash Flows for the Nine Months Ended December 31, 2021 and 20207Notes to Condensed Consolidated Financial Statements8Item 2.Management's Discussion and Analysis of Financial Condition and Results of Operations15Item 3.Quantitative and Qualitative Disclosures About Market Risk30Item 4.Controls and Procedures30PART II - OTHER INFORMATIONItem 1.Legal Proceedings31Item 1A.Risk Factors31Item 2.Unregistered Sales of Equity Securities and Use of Proceeds59Item 3.Default Upon Senior Securities59Item 4.Mine Safety Disclosures59Item 5.Other Information59Item 6.Exhibits60Signatures611

PART I. FINANCIAL INFORMATIONITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTSDYNATRACE, INC.CONDENSED CONSOLIDATED BALANCE SHEETS(In thousands, except share data)December 31, 2021(unaudited)March 31, 2021AssetsCurrent assets: Cash and cash equivalentsAccounts receivable, netDeferred commissions, currentPrepaid expenses and other current assets408,723264,29357,97881,326Total assetsLiabilities and shareholders' equityCurrent liabilities:Accounts payableAccrued expenses, currentDeferred revenue, currentOperating lease liabilities, 9,933 2,397,761 2,256,218 22,256116,154563,04511,700 653,328(513,799)(26,211)Total current liabilitiesDeferred revenue, non-currentAccrued expenses, non-currentOperating lease liabilities, non-currentDeferred tax liabilitiesLong-term debtTotal liabilitiesCommitments and contingencies (Note 8)Shareholders' equity:Common shares, 0.001 par value, 600,000,000 shares authorized, 285,701,744 and 283,130,238 shares issued andoutstanding at December 31, 2021 and March 31, 2021, respectivelyAdditional paid-in capitalAccumulated deficitAccumulated other comprehensive lossTotal shareholders' equity1,276,015 Total liabilities and shareholders' equity2,397,761The accompanying notes are an integral part of these condensed consolidated financial statements.2324,962242,07948,98664,255812,320Total current assetsProperty and equipment, netOperating lease right-of-use assets, netGoodwillOther intangible assets, netDeferred tax assets, netDeferred commissions, non-currentOther assets 1,113,601 2,256,218

DYNATRACE, INC.CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS(Unaudited – In thousands, except per share data)Three Months Ended iceTotal revenueCost of revenue:Cost of subscriptionCost of serviceAmortization of acquired technologyTotal cost of revenueGross profit 170,30825712,346182,911 ,48792,373414,632 57)17,408(2,821)14,587 623,178(4,762)18,416 ,345)54,375(2,853)51,522 74462,618(13,858)48,760 0.050.050.070.060.180.18284,722291,845 281,010286,427The accompanying notes are an integral part of these condensed consolidated financial 444,460196,306Operating expenses:Research and developmentSales and marketingGeneral and administrativeAmortization of other intangiblesRestructuring and otherTotal operating expensesIncome from operationsInterest expense, netOther (expense) income, netIncome before income taxesIncome tax expenseNet incomeNet income per share:BasicDilutedWeighted average shares outstanding:BasicDiluted226,290214,474240,766Nine Months Ended December 31,20212020283,773290,895 0.170.17280,057285,884

DYNATRACE, INC.CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME(Unaudited - In thousands)Three Months Ended December 31,Nine Months Ended December 31,2021202020212020 14,587 18,416 51,522 48,760Net incomeOther comprehensive income (loss)Foreign currency translation adjustmentTotal other comprehensive income (loss)Comprehensive income 69269215,279 (4,786)(4,786)13,630 The accompanying notes are an integral part of these condensed consolidated financial statements.41,4281,42852,950 (9,920)(9,920)38,840

DYNATRACE, INC.CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY(Unaudited - In thousands)Three Months Ended December 31, 2021Common SharesBalance, September 30, 2021Foreign currency translationRestricted stock units vestedIssuance of common stock related toemployee stock purchase planExercise of stock optionsShare-based compensationEquity repurchasesNet incomeBalance, December 31, 2021Shares285,025Amount 285252—1682571—285,702 AdditionalPaid-In Capital hareholders'DeficitLossEquity (476,864) (25,475) 1,221,002692692—7,3205,31127,123(21)286 1,762,789 14,587(462,277) (24,783) 7,3215,31127,123(21)14,5871,276,015Three Months Ended December 31, 2020Common SharesBalance, September 30, 2020Foreign currency translationRestricted stock units vestedRestricted stock awards forfeitedIssuance of common stock related to theemployee stock purchase planExercise of stock optionsShare-based compensationEquity repurchasesNet incomeBalance, December 31, 2020Shares282,024Amount 281229(7)——172125——282,543 AdditionalPaid-In Capital hareholders’DeficitLossEquity (559,169) (23,239) 81 1,632,446 18,416(540,753) The accompanying notes are an integral part of these condensed consolidated financial statements.5(28,025) 5,6032,02015,588(11)18,4161,063,949

DYNATRACE, INC.CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY(Unaudited - In thousands)Nine Months Ended December 31, siveShareholders'Paid-In CapitalDeficitLossEquity 1,653,328 (513,799) (26,211) 1,113,6011,4281,428(1)——Common SharesBalance, March 31, 2021Foreign currency translationRestricted stock units vestedRestricted stock awards forfeitedIssuance of common stock related toemployee stock purchase planExercise of stock optionsShare-based compensationEquity repurchasesNet incomeBalance, December 31, 2021Shares283,130 Amount2831,049(19)1—3721,17011285,702 13,91323,65071,950(51)286 1,762,789 51,522(462,277) (24,783) 13,91423,65171,950(51)51,5221,276,015Nine Months Ended December 31, 2020Common SharesBalance, March 31, 2020Foreign currency translationRestricted stock units vestedRestricted stock awards forfeitedIssuance of common stock related toemployee stock purchase planExercise of stock optionsShare-based compensationEquity repurchasesCumulative effects adjustment for ASU2016-02 adoptionNet incomeBalance, December 31, 2020Shares280,853Amount 2811,035(103)——331427——282,543 AdditionalPaid-In Capital hareholders’DeficitLossEquity (589,819) (18,105) 965,704(9,920)(9,920)——9,1956,84943,091(36)281 1,632,4469,1956,84943,091(36) 30648,760(540,753) The accompanying notes are an integral part of these condensed consolidated financial statements.6(28,025) 30648,7601,063,949

DYNATRACE, INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS(Unaudited – In thousands)Nine Months Ended December 31,20212020Cash flows from operating activities:Net incomeAdjustments to reconcile net income to cash provided by operations:DepreciationAmortizationShare-based compensationDeferred income taxesOtherNet change in operating assets and liabilities:Accounts receivableDeferred commissionsPrepaid expenses and other assetsAccounts payable and accrued expensesOperating leases, netDeferred revenueNet cash provided by operating activities 51,522 ash flows from investing activities:Purchase of property and equipmentCapitalized software additionsAcquisition of businesses, net of cash acquiredNet cash used in investing ��(9,116)Cash flows from financing activities:Repayment of term loansProceeds from employee stock purchase planProceeds from exercise of stock optionsEquity repurchasesNet cash used in financing 9,1956,849(36)(43,992)Effect of exchange rates on cash and cash equivalents(1,400)4,878Net increase in cash and cash equivalents83,76186,335Cash and cash equivalents, beginning of periodCash and cash equivalents, end of period 324,962408,723 213,170299,505Supplemental cash flow data:Cash paid for interestCash paid for (received from) tax, net 6,54912,902 9,914(14,472)The accompanying notes are an integral part of these condensed consolidated financial statements.7

DYNATRACE, INC.NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS(Unaudited)1.Description of the BusinessBusinessDynatrace, Inc. (“Dynatrace”, or the “Company”) offers an observability platform, purpose-built for modern multicloud environments. The Company designed its all-in-oneDynatrace Software Intelligence Platform to address the growing complexity faced by technology and digital business teams as these enterprises further embrace the cloud toeffect their digital transformation. The Company’s platform does so by utilizing artificial intelligence at its core and continuous automation to deliver precise answers about theperformance and security of applications, the underlying infrastructure, and the experience of its customers’ users that enables organizations to innovate faster, operate moreefficiently, and improve user experiences for consistently better business outcomes.Fiscal yearThe Company’s fiscal year ends on March 31. References to fiscal 2022, for example, refer to the fiscal year ended March 31, 2022.2.Significant Accounting PoliciesBasis of presentation and consolidationThe condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S.GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. All intercompany balances andtransactions have been eliminated in the accompanying condensed consolidated financial statements.Unaudited interim consolidated financial informationThe accompanying interim condensed consolidated balance sheet as of December 31, 2021 and the interim condensed consolidated statements of operations, statements ofcomprehensive income, and statements of shareholders’ equity for the three and nine months ended December 31, 2021 and 2020, statements of cash flows for the nine monthsended December 31, 2021 and 2020, and the related disclosures, are unaudited. In management’s opinion, the unaudited interim condensed consolidated financial statementshave been prepared on the same basis as the audited consolidated financial statements and includes all normal and recurring adjustments necessary for the fair presentation ofthe Company’s financial position as of December 31, 2021, its results of operations for the three and nine months ended December 31, 2021 and 2020, and its cash flows for thenine months ended December 31, 2021 and 2020 in accordance with U.S. GAAP. The results for the three and nine months ended December 31, 2021 are not necessarilyindicative of the results to be expected for the full fiscal year or any other interim period.These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes in the Company’sAnnual Report on Form 10-K for the fiscal year ended March 31, 2021 (“Annual Report”).Use of estimatesThe preparation of unaudited condensed consolidated financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affectthe reported amounts of assets, liabilities, the disclosure of contingent assets and liabilities as of the date of the unaudited condensed consolidated financial statements, and thereported amounts of revenue and expenses during the reporting period. Management periodically evaluates such estimates and assumptions for continued reasonableness. Inparticular, the Company makes estimates with respect to the stand-alone selling price for each distinct performance obligation in customer contracts with multiple performanceobligations, the uncollectible accounts receivable, the fair value of tangible and intangible assets acquired, valuation of long-lived assets, the period of benefit for deferredcommissions and material rights, share-based compensation expense, income taxes, and the determination of the incremental borrowing rate used for operating lease liabilities,among other things. Appropriate adjustments, if any, to the estimates used are made prospectively based upon such periodic evaluation. Actual results could differ from thoseestimates.Significant accounting policiesThe Company’s significant accounting policies are discussed in Note 2, “Significant Accounting Policies” in the Company’s Annual Report. There have been no changes to theCompany’s significant accounting policies described in the Company’s Annual Report that have had a material impact on its condensed consolidated financial statements andrelated notes.8

Recently adopted accounting pronouncementsIn December 2019, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2019-12, Income Taxes (Topic 740): Simplifying theAccounting for Income Taxes, which removes certain exceptions for investments, intraperiod allocations and interim calculations, and adds guidance to reduce complexity inaccounting for income taxes. ASU 2019-12 is effective for annual periods, and interim periods within those years, beginning after December 15, 2020. The Company adoptedthe new standard on a prospective basis as of April 1, 2021. The adoption did not have a material impact on the condensed consolidated financial statements.Recently issued accounting pronouncementsIn October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers,which requires contract assets and contract liabilities acquired in a business combination to be recognized in accordance with Accounting Standards Codification (“ASC”) 606,Revenue from Contracts with Customers, as if the acquirer had originated the contracts. ASU 2021-08 is effective for annual periods beginning after December 15, 2022, andinterim periods within those years, with early adoption permitted. The Company plans to early adopt this standard in the fourth quarter of fiscal 2022 and does not expect thestandard to have a material effect on its condensed consolidated financial statements.3.Revenue RecognitionDisaggregation of revenueThe following table is a summary of the Company’s total revenues by geographic region (in thousands, except percentages):North AmericaEurope, Middle East and AfricaAsia PacificLatin America Total revenue Three Months Ended December 31,20212020Amount%Amount133,70455 % 100,91871,10230 %55,94524,92710 %20,64311,0335%5,405240,766 182,911%55 % 31 %11 %3% Nine Months Ended December 31,20212020Amount%Amount370,36855 % 281,806207,49331 %154,86871,00210 %56,85427,9974%13,477676,860 507,005%56 %30 %11 %3%For the three and nine months ended December 31, 2021 and 2020, the United States was the only country that represented more than 10% of the Company’s revenues in anyperiod, constituting 124.3 million and 52% and 94.2 million and 51% of total revenue during the three months ended December 31, 2021 and 2020, respectively, and 343.9million and 51% and 263.3 million and 52% of total revenue for the nine months ended December 31, 2021 and 2020, respectively.Deferred revenueRevenues recognized during the three months ended December 31, 2021 and 2020, which was included in the deferred revenue balances at the beginning of each respectiveperiod, was 110.6 million and 87.1 million, respectively. Revenues recognized during the nine months ended December 31, 2021 and 2020 which was included in thedeferred revenue balances at the beginning of each respective period, was 447.2 million and 339.5 million, respectively.Remaining performance obligationsAs of December 31, 2021, the aggregate amount of the transaction price allocated to remaining performance obligations was 1,402.0 million, which consists of both billedconsideration in the amount of 594.0 million and unbilled consideration in the amount of 808.0 million that the Company expects to recognize as subscription and servicerevenue. The Company expects to recognize 57% of this amount as revenue over the next twelve months and the remainder thereafter.9

4.Goodwill and Other Intangible Assets, NetChanges in the carrying amount of goodwill on a consolidated basis for the nine months ended December 31, 2021 consists of the following (in thousands):Balance, beginning of periodGoodwill from acquisitions (1)Foreign currency impactBalance, end of period December 31, 20211,271,19510,3741951,281,764(1) Theinitial allocation of the purchase price from acquisitions was based on preliminary valuations and assumptions and is subject to change. The Company expects to finalize the allocation of the purchaseprices within the measurement period.Other intangible assets, net excluding goodwill consists of the following (in thousands):WeightedAverageUseful Life(in months)107120120Capitalized softwareCustomer relationshipsTrademarks and tradenamesTotal intangible assetsLess: accumulated amortizationTotal other intangible assets, net December 31, 2021192,536 351,55555,003599,094(481,186)117,908 March 31, rtization of other intangible assets totaled 11.6 million and 13.0 million for the three months ended December 31, 2021 and 2020, respectively, and 34.7 million and 39.0 million for the nine months ended December 31, 2021 and 2020, respectively.5.Income TaxesThe Company computes its interim provision for income taxes by applying the estimated annual effective tax rate to income from operations and adjusts the provision fordiscrete tax items occurring in the period. The Company’s effective tax rate for the three months ended December 31, 2021 was 16% compared to 21% for the three monthsended December 31, 2020. The Company’s effective tax rate for the nine months ended December 31, 2021 was 5% compared to 22% for the nine months ended December 31,2020. The decrease in the effective tax rate for both the three months ended December 31, 2021 and 2020 and nine months ended December 31, 2021 and 2020 is primarily dueto additional share-based compensation tax windfall benefits and a 2.1 million one-time benefit related to anticipated tax refunds resulting from a favorable Polish research anddevelopment ruling received by the Company in August 2021.Based on the Company’s review of both positive and negative evidence regarding the realizability of deferred tax assets at December 31, 2021, a valuation allowance continuesto be recorded against certain deferred tax assets based upon the conclusion that it was more likely than not that these assets would not be realized. The valuation allowance atDecember 31, 2021 relates primarily to accrued interest, capitalized development costs, and foreign tax credits. Given the Company’s current earnings and anticipated futureearnings, it is reasonably possible that within the next twelve months sufficient positive evidence may become available to allow the Company to conclude that a significantportion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition of certain deferred tax assets. However, theexact timing and amount of the valuation allowance release are subject to change based on the Company’s growth and profitability.10

6.Long-term DebtLong-term debt consists of the following (in thousands, except percentages):First Lien Term LoanRevolving credit facilityTotal principalUnamortized discount and debt issuance costsTotal debtLess: Current portion of long-term debt Long-term debtDecember 31, 2021AmountEffective Rate311,1252.4 %—311,125(7,710)303,415—303,415 March 31, 2021AmountEffective Rate401,1252.4 %—401,125(9,212)391,913—391,913First lien credit facilitiesThe Company’s First Lien Credit Agreement, as amended, provides for a term loan facility, or the First Lien Term Loan, in an aggregate principal amount of 950.0 million anda senior secured revolving credit facility, or the Revolving Facility, in an aggregate amount of 60.0 million. The Revolving Facility includes a 25.0 million letter of creditsub-facility. The First Lien Term Loan and Revolving Facility mature on August 23, 2025 and August 23, 2023, respectively. There were 15.7 million and 15.6 million lettersof credit issued as of December 31, 2021 and March 31, 2021, respectively. The Company had 44.3 million and 44.4 million of availability under the Revolving Facility asof December 31, 2021 and March 31, 2021, respectively.Borrowings under the First Lien Term Loan and the Revolving Facility currently bear interest, at the Company’s election, at either (i) the Alternative Base Rate, as defined perthe credit agreement, plus 1.25% per annum, or (ii) LIBOR plus 2.25% per annum. The Company has satisfied all required principal payments under the First Lien Term Loanand the remainder is due at maturity. Interest payments are due quarterly, or more frequently, based on the terms of the credit agreement.The Company incurs fees with respect to the Revolving Facility, including (i) a commitment fee of 0.25% per annum of unused commitments under the Revolving Facility,(ii) facility fees equal to the applicable margin in effect for Eurodollar Rate Loans, as defined per the credit agreement, times the average daily stated amount of letters of credit,(iii) a fronting fee equal to either (a) 0.125% per annum on the stated amount of each letter of credit or (b) such other rate per annum as agreed to by the parties subject to theletters of credit, and (iv) customary administrative fees.All of the indebtedness under the First Lien Credit Agreement is and will be guaranteed by the Company’s existing and future material domestic subsidiaries and is and will besecured by substantially all of the assets of the Company and such guarantors. The First Lien Credit Agreement contains customary negative covenants. At December 31, 2021,the Company was in compliance with all applicable covenants.7.LeasesThe Company leases office space under non-cancelable operating leases which expire at v

Dynatrace, Inc. (Exact name of Registrant as specified in its Charter) Delaware 47-2386428 (State or other jurisdiction of incorporation or organization) (I .RSEmployer Identification No.) 1601 Trapelo Road, Suite 116 02451 WalthamMA (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (617 .