Transcription

Healthcare Sector UpdateMarch 2013Summary –Healthcare ServicesPharmaceutical / Medical Devices / Life Sciencesyy The S&P Healthcare Services Index has yy The current median LTM revenueincreased 16.5% over the last threeand LTM EBITDA multiples for themonths, outperforming the S&P 500.Healthcare Services industry overallare 1.4x and 9.1x, respectively.yy The S&P 500 - Pharmaceuticals,Biotechnology & Life Sciences Indexhas risen 10.6% over the last threemonths, outperforming the S&P 500.yy Over the past three months: Thebest performing sectors wereAcute Care Hospitals (up 29.3%)and Psychiatric Hospitals (up 27.2%). Theworst performing sectors wereSurgicenters/Rehabilitation (down3.8%) and Physician PracticeManagement (up 4.2%).yy The sectors with the highest valuationmultiples include: SpecialtyHCIT (2.5x LTM Revenue,33.1x LTM EBITDA) Provider-BasedHCIT (3.2x LTMRevenue, 14.6x LTM EBITDA)yy Over the past three months: Thebest performing sectors wereLab Instrumentation & Devices (up30.1%) and Infection PreventionDevices (up 16.7%).yy The current median LTM revenueand LTM EBITDA multiples for thePharmaceutical / Medical Device / LifeScience industry overall are 2.4x and10.6x, respectively.yy The sectors with the highest valuationmultiples include: Theworst performing sectors wereNeural Implant Devices (up 3.5%)and Mobility Devices (up 4.5%).Inside02081618M&A Activity Healthcare ServicesPublic Trading Data forHealthcare Services CompaniesM&A Activity - Pharmaceuticalsand Life SciencesPublic Trading Data forPharmaceuticals andLife Sciences Companies Biotechnology(4.2x LTM Revenue,17.5x LTM EBITDA) LifeScience Conglomerates (3.0xLTM Revenue, 13.6x LTM EBITDA)

Source: Global bankruptcy case ranking provided by The Deal Q4 2012 league table. Fairness opinion and M&A rankings calculated by number of deals from Thomson Financial Securities full year 2012 data. Middle-market M&A deals 250 million.

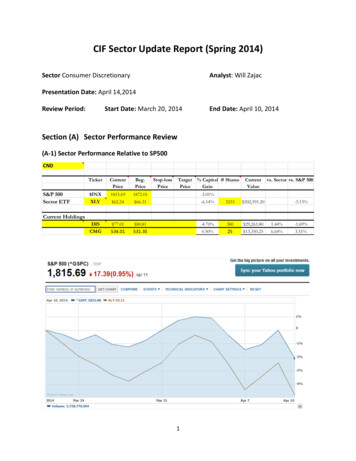

Healthcare Sector UpdateM&A Activity - Healthcare ServicesM&A OverviewThe last twelve months (“LTM”) M&A volume in the Healthcare Services sector has shown ageneral downward trend. The deal volume has declined by 16.7% Y-o-Y to 409 deals. Thedeal volume has declined by 8.0% Y-o-Y to 103 deals for the three months that ended 28thFebruary 2013. The proportion of announced deals made by financial buyers has increasedto 7.3% during the LTM as compared to 5.1% for the same time period last year.M&A Activity by Healthcare Services Industry SectorSpecialty and Home care / Hospice / Long-term Care / Assisted Living have accounted for14% and 12% of activity by number of deals in the last 12 months, respectively, andcollectively they represent the two most active healthcare services sectors.Exhibit 1: Transaction ActivityExhibit 3: M&A Target Spectrum – LTM (01st March 2012- 28th February 2013)Number of Healthcare Services Transactions - LTM(01st Mar. - 28 th Feb.)60049150087.3%14%18%409458Home care/ Hospice/ Long-Term Care/Assisted LivingCare Management / TPA3.2%(16.7%)25400SpecialtyTransactions by Acquirer Type(01st Mar. 2012 - 28 th Feb 2013)Clinical Laboratories1330Surgicenters / Rehabilitation3663001%1%2%200Healthcare Staffing12%Physician Practice Management2%100Diagnostic Imaging3%Emergency Services89.5%02012Strategic acquisition2013Financial acquisitionNot classifiedStrategic acquisitionFinancial acquisition4%Not classified11%Distribution / Supply4%Source: Capital IQPharmacy Management5%4804754736%6%Source: Capital IQ; Note: Other Services include healthcare facilities, diversified healthcareservice centers, asset-related transactions and business consultants.4704606%5%Exhibit 2: Monthly Transaction Volume – Rolling LTMHCITAcute Care HospitalsPsychiatric HospitalsManaged CareOther v-12Dec-12Jan-13Feb-13Source: Capital IQDuff & Phelps 3

Healthcare Sector UpdateNotable Transaction Closings in the Last Three MonthsMcKesson Corporation acquires PSS World MedicalOn October 25th, 2012, McKesson Corporation (NYSE:MCK) announced its strategic acquisition of PSS WorldMedical for 29 per share, implying an equity value of 1,458 million and enterprise value of 1,808 million,including the assumption of 350 million net debt,representing 0.9x Revenue multiple and 10.0x EBITDAmultiple. The transaction closed on February 22nd, 2013.PSS World Medical provides medical products and supplies,diagnostic equipment, healthcare information technology,pharmaceutical products, and professional and consultingservices in the U.S., and operates in two segments, PhysicianBusiness and Extended Care Business.Source: Capital IQ and public dataDuff & Phelps 4

Healthcare Sector UpdateM&A Transaction List - Last Three MonthsDateTarget NameAcquirer NameTarget Subsector02/28/2013Partners for Medical Education, Inc.The WeissComm Group LimitedOther services02/26/2013CareClarity, Inc.Cymetrix CorporationHCIT02/22/2013Freedom Home Healthcare, Inc., Pennsylvania Operations andNursing Services in New JerseyEpic Health Services, Inc.Home care/ Hospice/ Long-term Care/ Assisted Living02/20/2013KRU Medical Ventures, LLC, New Smyrna Beach Artificial KidneyCenterDSI Renal, Inc.Specialty02/19/2013Sci-Cool, Inc.Norman Island Advisors, L.L.C.Other services02/19/2013Evolute Consolidated Holdings, Inc.PipelineRxHCIT02/14/2013MediVista Media, LLC, Everwell Waiting Room Television NetworkDivisionAccentHealth, LLCOther services02/14/2013Internal Medicine Consultants, P.A.IPC The Hospitalist Company, Inc.Physician Practice Management02/12/2013OA Nurse Travel, LLCMedical Solutions L.L.C.Healthcare Staffing02/12/2013Advanced Dental Education InstituteTransitions Group North AmericaOther services02/08/2013ShoreMaster, Inc.High Street CapitalOther services02/07/2013Mayflower Healthcare Textile Services, LLCCompass Group PLCOther services02/06/2013T&K Inspection Inc.Desert Industrial X-Ray LPDiagnostic Imaging02/05/2013Perioperative Nurses Inc.Alliant, Inc.Healthcare Staffing02/05/2013Emergency Physicians, PA and Valley Emergency PhysiciansMedical Group, Inc.Team Health Holdings, Inc.Emergency Services02/02/2013ClinForce, LLC and Akos LimitedICON Public Limited CompanyHealthcare Staffing02/01/2013Willamette Valley Treatment Center IncCRC Health Group, Inc.Surgicenters / Rehabilitation01/31/2013Equinox Healthcare, Inc.AxelaCare Health Solutions, LLC.Specialty01/29/2013Peak Primary Care, PLLCParkway SleepHealth CentersPhysician Practice Management01/28/2013Pediatric Radiology of America Inc.Aris Teleradiology LLCDiagnostic Imaging01/02/2013Mountain States Administrative Services, Inc.HealthSmart Holdings, Inc.Care Management / TPA01/15/2013Genesis Medical Imaging, Inc.BC Technical, Inc.Other services01/15/2013EMT, Inc.First Call Ambulance Service, LLCEmergency Services01/14/2013Grand Villa of Delray East and Grand Villa of Delray WestValStone Partners, LLC; Senior ManagementAdvisors, Inc.Other services12/31/2012Michigan Orthopedic CenterHSA PrimeCare; Boler Properties L.L.C.Specialty01/01/2013Accellent, Inc., Watertown, Connecticut FacilityUtitec Holdings Inc.Other services12/31/2012The Corridor Group, Inc.HealthEdge Investment Partners; HealthEdgeInvestment Fund II, L.P.Other services01/09/2013Anesthesia Revenue Management and Practice SupportResources and ESi Acquisition, Inc.Intermedix CorporationCare Management / TPADuff & Phelps 5

Healthcare Sector UpdateM&A Transaction List - Last Three MonthsDateTarget NameAcquirer NameTarget Subsector12/31/2012Guardian Healthcare Group and St. Vincent Anesthesia Medicaland Golden State Anesthesia ConsultantsEmCare Holdings, Inc.; Evolution Health, LLCSpecialty01/08/2013National Pain Institute LLCProspira PainCare Holdings, LLCSpecialty01/08/2013San Francisco Physicians Internationale Medical Group, Inc.Team Health Holdings, Inc.Emergency Services01/08/2013Dermatology Associates of TylerHarbert Mezzanine Partners; Eagle Private Capital;Candescent Partners, LLCSpecialty01/07/2013Fresenius Medical Care AG & Co. KGAA, Dialysis Centers inPortugal and PolandDaVita HealthCare Partners Inc.Specialty01/07/2013Pacific Interpreters, Inc.LL Services, Inc.Other services01/07/2013Northern Valley Anesthesiology PATeam Health Holdings, Inc.Specialty01/07/2013Presscott Associates, Ltd.ParenteBeard LLCCare Management / TPA01/06/2013Vesper Hospice and Emblem HospiceCornerstone Healthcare, Inc.Home care/ Hospice/ Long-term Care/ Assisted Living01/07/2013Puget Sound Home Health, LLCThe Ensign Group, Inc.Home care/ Hospice/ Long-term Care/ Assisted Living01/07/2013Corporate Family Network Inc.E4 Health, Inc.Other services01/07/2013Bockian & Cowan, D.D.S., P.A.Northwestern Management Services LLCOther services01/07/2013Grace Hospice LLC (nka:Halcyon Hospice)Halcyon Home Health, LLCHome care/ Hospice/ Long-term Care/ Assisted Living01/01/2013Orthopaedic Associates of Saratoga, LLP (nka:OrthoNY, LLP)Northeast Orthopaedics, LLPSpecialty01/04/2013Seacoast Eye Associates Inc.Koch Eye Associates, Inc.Specialty01/03/2013Four Separate Physician PracticesBaptist Medical Group, LLCPhysician Practice Management01/03/2013OncoMDx, Inc.Core Diagnostics Private LimitedClinical Laboratories01/02/2013UMass Memorial Medical Center, Inc., Anatomic PathologyOutreach Laboratory BusinessQuest Diagnostics Inc.Clinical Laboratories01/02/2013Access Family Services, Inc.South Bay Mental Health Center, Inc.Psychiatric Hospitals01/02/2013Morehead Associates, Inc.Press Ganey Associates, Inc.Care Management / TPA01/02/2013Prime Care Urgent Care and Prime Care ImagingSt. Peter's Health Care ServicesAcute Care Hospitals01/02/2013Rocky Mountain Medical Service, PCSt. James Healthcare Inc.Other services01/02/2013Town Total Nutrition, Inc.BelHealth Investment Partners, LLCPharmacy Management01/02/2013Anesthesiologists Associated, P.C.American Anesthesiology, Inc.Specialty12/28/2012Pediatric Surgical Associates Inc.Pediatrix Medical Group, Inc. (Florida)Specialty01/01/2013Extrakare, LLCAdvanced Home Care, Inc.Distribution / Supply12/31/2012Lenox Hill Radiology & Medical Imaging Associates P.C.RadNet, Inc.Diagnostic Imaging12/31/2012Sports Asylum, Inc.SearchCore, Inc.HCIT12/31/2012OralDNA Labs, Inc.Access Genetics, LLCDiagnostic Imaging12/31/2012Correctional Healthcare Companies, Inc.GTCR, LLC; GTCR Fund X, L.P.Other services12/31/2012Remuda Ranch CompanyThe Meadows of Wickenburg, Inc.Specialty12/31/2012Atlantic Dermatology Associates, P.A.Dermatology Clinics of Southwest Virginias, PLLCSpecialtyDuff & Phelps 6

Healthcare Sector UpdateM&A Transaction List - Last Three MonthsDateTarget NameAcquirer NameTarget Subsector12/31/2012SeraCare Life Sciences, Inc., Biorepository, Biobanking andLaboratory Services BusinessPrecision Health Holdings, Inc.Clinical Laboratories12/30/2012Florida Heart Group, PAFlorida Hospital Medical Group, Inc.Specialty12/28/2012Michiana Cancer Center, LLC, Michiana Hematology OncologyMedical Office BuildingAmerican Realty Capital Healthcare Trust, Inc.Specialty12/28/20124M Emergency ManagementIsland Medical Management HoldingsEmergency Services12/27/2012Guardian Medical Logistics LLCBeavEx IncorporatedOther services12/23/2012Karmanos HospiceResidential Home Health, LLCHome care/ Hospice/ Long-term Care/ Assisted Living12/21/2012South Oakland Anesthesia Associates, PCAmerican Anesthesiology, Inc.Specialty12/21/2012PathCentral Inc., Diagnostic Laboratory BusinessAscend Clinical, LLCClinical Laboratories12/20/2012Sundance Helicopters, Inc.Air Methods Corp.Emergency Services12/20/2012PhysIOM Group, LLCProNerve, LLCHCIT12/20/2012AmeriCare Health Services, Inc.Epic Health Services, Inc.Healthcare Staffing12/20/2012Midwest Acute Care Consultants, P.C.IPC The Hospitalist Company, Inc.Physician Practice Management12/20/2012InQuiry Research, LLC, Clinical Services and BusinessDevelopment ComponentsDZS Software Solutions, Inc.Other services12/19/2012Merrimack Health Group, Inc., Three Building Portfolio of SeniorCare Facilities in MassachusettsGriffin-American Healthcare REIT II, Inc.Home care/ Hospice/ Long-term Care/ Assisted Living12/19/2012Santé Pediatric ServicesEpic Health Services, Inc.Surgicenters / Rehabilitation12/19/2012Alliance of Home Care Physicians LLCIPC The Hospitalist Company, Inc.Physician Practice Management12/17/2012Homecare Advantage, Inc.Kindred Healthcare Inc.Home care/ Hospice/ Long-term Care/ Assisted Living12/17/2012Creative Health Concepts Inc.WeiserMazars LLP, Investment ArmHome care/ Hospice/ Long-term Care/ Assisted Living12/17/2012Greater Houston Anesthesiology, P.A.U.S. Anesthesia Partners, Inc.Specialty12/17/2012Eye Health Vision Centers, LLCPlexus Capital; Koch Eye Associates, Inc.Specialty12/15/2012Mobile Emergency Group, P.C.Team Health Holdings, Inc.Emergency Services12/14/2012Memphis Primary Care Associates, PLLCBaptist Medical Group, LLCPhysician Practice Management12/14/2012Northeast Anesthesiology, Inc. and Anesthesiology Solution, LLCNorth American Partners in Anesthesia, L.L.P.Specialty12/13/2012Amerita, Inc.PharMerica CorporationSpecialty12/12/2012Raj K. Bansal, M.D., P.C.MEDNAX, Inc.Specialty12/11/2012Weedmaps, LLCRJM BVHCIT12/11/2012Scisive Consulting, LPBionest PartnersOther services12/10/2012Home Healthcare Connection, Inc.Encompass Home Health, Inc.Home care/ Hospice/ Long-term Care/ Assisted Living12/07/2012Liberty Medical Supply, Inc.-Distribution / Supply12/06/2012GEO Care, Inc.-Psychiatric Hospitals12/06/2012Heartland Phone Friends, LLCSenior Service Concierge, LLCHome care/ Hospice/ Long-term Care/ Assisted Living12/06/2012NKY Med, LLCPinnacle Treatment Centers, Inc.Surgicenters / RehabilitationDuff & Phelps 7

Healthcare Sector UpdateM&A Transaction List - Last Three MonthsDateTarget NameAcquirer NameTarget Subsector12/05/2012Faith Prosthetic-Orthotic Services Inc. and Scope Orthotics &Prosthetics Inc.Hanger, Inc.Specialty12/04/2012Mission Road Pharmacy Inc.Salveo Specialty Pharmacy, Inc.Specialty12/04/2012Martin, Fletcher, & Associates, LPParallon Business Solutions, LLCHealthcare Staffing12/04/2012Europa Apotheek Venlo B.V.-Pharmacy Management12/03/2012Solamor Hospice, Inc.National Hospice Holdings, LLCHome care/ Hospice/ Long-term Care/ Assisted Living12/03/2012DeKalb Anesthesia Associates, P.A.American Anesthesiology, Inc.Specialty12/03/2012Abacus International LimitedDecision Resources GroupCare Management / TPA12/03/2012Tulips Dialysis Centre Sdn BhdDaVita HealthCare Partners Inc.Specialty12/03/2012Sensia Healthcare Inc.U.S. Healthworks, Inc.Specialty12/03/2012Metropolitan ENT Associates Inc.University of Pittsburgh Medical CenterAcute Care Hospitals12/01/2012StarPlus EMSAcadian Ambulance Service, Inc.Emergency ServicesDuff & Phelps 8

Healthcare Sector UpdateNo. ofCo’sAg. EqtyMkt.Value3 mo12 moEBITDALTM2013EPEGRatio2013EAcute Care Hospitals9 36,40629.3%42.7%1.08x7.1x14.0x13.0x1.1xAssisted Living86,43820.7%Care Management / 19x9.4x22.8x21.6x1.3xClinical Contract Research Orgs6Diagnostic 813.2%(3.8%)1.41x4.9x20.8x6.2xDialysis Distribution / gency KET SECTORHCIT - Provider BasedMedian % ChangeLTM MultiplesRevEarnings RatioMedian % Change — 3 monthsAcute Care HospitalsPsychiatric HospitalsHealthcare StaffingAssisted LivingCare Management / TPAHCIT - SpecialtyContract Research OrgsEmergency ServicesDistribution / SupplyManaged Care - GovernmentDiagnostic ImagingSpecialty Managed CareHome Care / T - ealthcare P 500 IndexOther ServicesLong Term CareHome Care / Hospice62,85811.8%21.5%0.56x6.3x13.7x13.1x1.0xLong Term Care42,0077.6%12.2%0.64x7.2x15.7x14.6x0.9xManaged Care - Managed Care - Government36,24314.1%(3.4%)0.20x11.7x13.3xOther Services410,2747.6%12.8%1.39x21.7x34.7xPharmacy HCIT - Provider BasedDialysis ServicesPharmacy ManagementManaged Care - Commercial1.7xClinical Laboratories13.6x0.9xPhysician Practice Mgmt28.3xSurgicenters / RehabilitationPhysician Practice ic 0%)Specialty Managed Care23,87812.9%(11.2%)0.40x5.9x8.6x8.5x1.0xSource: Capital IQSurgicenters / RehabilitationTotal / Median ( .1x13.1%17.8%1.35x9.1x20.3x15.3x1.2xSource: Capital IQNo. ofCo’sAg. EqtyMkt.Value% TotalNo. ofCo’s% Ag.Eqty Mkt.Value3 moYTD12 mo36 mo 5 billion21 345,47417.8%75.9%9.7%29.3%17.7%7.9% 1 billion - 5 billion3989,15333.1%19.6%20.3%45.8%30.6%16.5% 250 million - 1 7.6%0.3%10.7%18.9%0.6%5.9%CAPITALIZATION PROFILE 100 million - 250 million 100 millionTotal / Median ( MM)Stock Performance1568712.7%0.2%0.3%18.0%6.0%(8.5%)118 455,316100.0%100.0%13.1%29.3%17.8%7.9%Source: Capital IQMARKET INDICESValue at3/5/13% Change3 moYTD12 mo36 mo 14,253.89.0%8.8%11.7%34.9%S&P 500 Index1,539.88.9%8.0%14.6%35.2%NASDAQ Composite 9.2%Dow Jones Industrial AverageRussell 2000 IndexAMEX Sector Index - Health Care87.57.7%7.1%0.6%0.5%S&P Healthcare Facilities (Sub Ind) Index244.630.1%21.6%41.5%34.3%S&P Healthcare Providers & Services (Industry) Index354.117.7%14.1%29.6%47.3%S&P Managed Healthcare (Sub Ind) Index198.810.3%10.8%3.7%64.8%S&P Healthcare Services328.716.5%13.2%39.3%48.8%(5%)05%INTEREST RATES10%15%20%25%30%35%Value at 3/5/131 mo ago3 mo ago12 mo agoLIBOR - USD - 5 Month0.39%0.41%0.45%0.66%U.S. Treasury - 2 year0.25%0.27%0.25%0.30%U.S. Treasury - 5 years0.78%0.88%0.61%0.88%U.S. Treasury - 10 years1.90%2.01%1.59%2.01%U.S. Treasury - 30 years3.11%3.22%2.78%2.78%U.S. Prime Rate3.25%3.25%3.25%3.25%Source: Capital IQPerformance of Market Indices for Latest 36 109/6/10Dow Jones Industrial Average12/6/103/7/11S&P 500 Index6/6/119/5/1112/5/11NASDAQ Composite Index3/5/126/4/12Russell 2000 Index9/3/1212/3/123/4/13S&P Healthcare ServicesSource: Capital IQSource: Capital IQDuff & Phelps 9

Healthcare Sector Update( in millions, except per share amounts)Company NameTickerPrice3/5/13% Change3 mo52-Week12 moHighLowMarketCapEnt Val(TEV)LTMRevEPSEBITDA2012LTM MultiplesEarnings Ratio2013ERevEBITDALTM2013EPEGRatio2013EAcute Care HospitalsChindex International Inc.CHDX 11.146.9%22.1% 11.40 8.22 183 179 140.9 15.1NMNM1.27x11.8xNMNMNMCommunity Health Systems, 01,844.92.963.721.04x7.4x14.2x11.3x0.92xHCA Holdings, .06,492.03.493.221.40x7.1x10.6x11.5x1.04xHealth Management oint Hospitals 537.03.142.981.12x7.0x14.2x14.9x1.73xSunLink Health Systems M0.12x1.6x9.8xNMNMTenet Healthcare 1,200.01.702.811.01x7.6x23.7x14.3x1.11xUniversal Health Services ,286.24.534.481.40x7.6x12.9x13.0x1.22xVanguard Health Systems 30.54x6.4x13.8x18.0x1.34x1.08x7.1x14.0x13.0x1.11x ssisted LivingAdCare Health Systems Inc.ADK 4.605.5%7.8% 5.50 3.00 67 235 212.4 18.3Assisted Living Concepts 410.231.96x8.4xNMNMNMBrookdale Senior Living 74.8(0.54)(0.02)2.52x16.4xNMNMNMCapital Senior Living 300.403.18x20.0xNMNMNMEmeritus 252.3(1.73)(1.18)3.83x21.1xNMNMNMFive Star Quality Care 80.320.28x7.6x23.5x20.6x2.06xSkilled Healthcare Group, 70.690.77x6.8x10.3x8.5x0.78xStellar Resources .4x1.42x 23.5225.2%(5.4%) 0x22.8x21.6xNMMedian( 0.06)Care Management / TPAAlere Inc.ALRCorVel CorporationCRVLCrawford & CompanyCRD.B8.1430.0%ExamWorks Group, Inc.EXAM15.2519.6%Healthways Inc.HWAY12.83Hooper Holmes Inc.HH0.45MAXIMUS, Inc.MMS74.44Median 26.50 17.13 1,910 5,289 2,818.8 32x163.2( 1.23)2.13NM2.30NM3.32Source: Capital IQ as of March 5, 2013; For definitions, see page 15Duff & Phelps 10

Healthcare Sector Update( in millions, except per share amounts)Company NameTickerPrice3/5/13% Change3 mo52-WeekLowMarketCapEnt Val(TEV)12 moHigh 32.86 18.29 780 778EBITDA20122013ERevEBITDALTM2013EPEGRatio2013E 673.0 95.6 1.56 1.851.16x8.1x18.0x15.2x0.88xLTMRevEPSLTM MultiplesEarnings RatioClinical LaboratoriesBio-Reference Laboratories Inc.BRLI 28.143.0%22.1%CML Healthcare Inc.TSX:CLCLaboratory Corp. of 7x8.1x15.1x12.6x1.12xPsychemedics x10.9x21.1xNMNMQuest Diagnostics .61,605.23.924.411.63x7.5x14.4x12.8x1.21xSonic Healthcare .1x15.6x12.8x1.12x 0.431.14x8.4xNM20.7xNMMedian4.9%4.1%NMContract Research OrgsAlbany Molecular Research Inc.AMRI 8.8970.0%223.3% 8.99 2.25 275 260 226.7 31.1BioClinica, 501.33x10.2x31.5x14.5xNMCharles River LaboratoriesInternational, 6.92.102.862.25x9.9x19.7x14.4x1.59xCovance 03.21.683.041.63x11.7x40.2x22.2x1.72xICON Public Limited 5.0116.60.921.531.57x15.0x34.8x20.9x1.09xPAREXEL 2%Median( 0.12)Diagnostic ImagingAlliance Healthcare Services, Inc.AIQ 7.02American Shared HospitalServicesAMS1.97(28.2%)RadNet, Inc.RDNT2.78Median 7.43 6.62 72 673 478.1 sis ServicesDaVita HealthCare Partners Inc.DVAFresenius Medical Care AG &Co. KGAADB:FME 123.3567.98Median 123.96 77.81 13,013 21,791 8,186.3 1,741.2 5.47 .38x11.5x20.2x16.9x1.62xSource: Capital IQ as of March 5, 2013; For definitions, see page 15Duff & Phelps 11

Healthcare Sector Update( in millions, except per share amounts)Company NameTickerPrice3/5/13% Change3 mo52-Week12 moHighLowMarketCapEnt 13ELTMRevEPSLTM MultiplesEarnings RatioDistribution / SupplyAceto Corp.ACET 10.659.1%28.0% 10.81 7.90 291 312 458.1 35.3 0.68 0.880.68x8.9x15.7x12.1x0.67xAmerisourceBergen rdinal Health, 3.02,290.03.293.600.16x7.2x14.1x12.8x1.21xHenry Schein, 759.54.324.870.98x11.5x20.8x18.4x1.55xMcKesson xOwens & Minor 7.41.721.900.23x8.4x18.0x16.3x1.72xPatterson Companies, 3x8.9x17.0x15.1x1.24x .52x2.01x8.2x20.3x20.6x1.31xMedianEmergency ServicesAir Methods Corp.AIRM 48.5631.3%61.1%InfuSystem Holdings, Inc.INFU1.603.2%(20.8%)17.3%20.1%Median 48.91 26.97 1,880 2,524 850.8 253.62.511.38356056.69.3 2.39(0.06)HCIT - Provider BasedAccretive Health, Inc.AH 9.40(20.9%)(58.9%) 25.28 7.75 914 718 973.6 28.7 0.25 0.470.74x25.0x55.4x20.1x0.77xThe Advisory Board 665.80.611.254.08x26.8x86.9x42.4x2.12xAllscripts Healthcare Solutions, , .10.501.227.94x65.6xNM80.1x2.93xCerner puter Programs & Systems .712.893.07x12.7x19.4x18.2x1.37xGreenway Medical s, 4.9(0.12)1.283.17x10.4xNM15.0x1.18xMerge Healthcare 8.931.1(0.31)0.161.80x14.4xNM15.4x1.07xNational Research 72.374.62x14.6x26.3x24.1x2.01xQuality Systems 6x33.6x20.1x1.40xMedianSource: Capital IQ as of March 5, 2013; For definitions, see page 15Duff & Phelps 12

Healthcare Sector Update( in millions, except per share amounts)Company NameTickerPrice3/5/13% Change3 mo12 mo52-WeekMarketCapEnt Val(TEV)LTMHighLowRev 9.97 7.44 529 413 7x1.21xNMNMNMLTM MultiplesEarnings RatioLTM20122013ERevEBITDA 10.9( 0.19) 0.372.54x37.9x0.9(0.49)0.40x51.0xHCIT - SpecialtyAccelrys Inc.ACCL 9.507.6%23.5%CardioNet, Inc.BEAT2.4812.2%(20.5%)3.24Epocrates, 190.221.94xNMNM52.8x3.11xHealthstream .280.324.34x22.4x73.5x62.4x3.07xHMS Holdings 4.30.570.975.99x18.4x53.2x31.3x1.33xMedidata Solutions, 5.80.711.145.86x35.7x75.8x47.2x2.42xOmnicell 471.021.76x14.0x39.5x18.1x1.11xStreamline Health Solutions, .94x31.2x31.2x25.7x1.19xWebMD Health 53.2x31.3x1.33xMedianNMHealthcare StaffingAMN Healthcare Services Inc.AHS 14.5428.2%182.9% 14.65 4.85 666 819 954.0 67.5Cross Country Healthcare, Inc.IPC The Hospitalist .3IPCM43.7514.8%25.5%48.4233.10732736523.5On Assignment Inc.ASGN23.5320.2%68.7%25.1013.131,2361,662Team Health Holdings, 7%25.3%100.0%Median 0.35 .0x21.6x1.23xHome Care / HospiceAddus HomeCare CorporationADUS 8.48Almost Family Inc.AFAM20.80(0.3%)Amedisys Inc.AMED11.5911.5%Chemed Corp.CHE77.69Gentiva Health Services Inc.GTIV11.32LHC Group, Inc.LHCG21.36Median 10.00 3.57 92 0%16.3%22.4215.6937611.8%21.5% 277.8 12.9 0.59 .56x6.3x13.7x13.1x1.05xSource: Capital IQ as of March 5, 2013; For definitions, see page 15Duff & Phelps 13

Healthcare Sector Update( in millions, except per share amounts)% Change52-WeekAdvocat Inc.AVCA 5.44Kindred Healthcare Inc.KND10.95National Healthcare Corp.NHC48.79The Ensign Group, Inc.ENSG32.267.6%12.2% 47.859.9%2.3% 51.14 34.58 15,695 19,644 36,595.9 3,522.2 4.813 moEnt Val(TEV)EPSTickerCompany NameMarketCapLTMPrice3/5/1312 moHighLowRev7.9%(10.2%) 7.54 4.01 32 62 ITDALTM MultiplesEarnings RatioPEGRatio2013E20122013ERevEBITDALTM2013E 8.6( 0.38) x 5.530.54x5.6x9.9x8.6x0.82xLong Term CareMedianManaged Care - CommercialAetna Inc.AETCigna .03,224.05.616.320.66x6.0x10.6x9.4x0.88xCoventry Health Care 27.73.523.340.45x6.8x13.0x13.7x1.30xHealth Net, 194.70.302.070.20x23.3xNM12.4x1.45xHumana th Group IncorporatedUNH53.50(0.6%)(2.8%)60.7550

Public Trading Data for Healthcare Services Companies 16 M&A Activity - Pharmaceuticals and Life Sciences 18 Public Trading Data for Pharmaceuticals and Life Sciences Companies. Source: Global bankruptcy case ranking provided by The Deal Q4 2012 league table. Fairness opinion and M&A rankings calculated by number of deals from Thomson Financial .