Transcription

The best in the land2015 Top Private Banks and WealthManagers survey winners

EDITOR’S NOTE - INTELLIDEXA DETAILED, AUTHORITATIVE ASSESSMENT6.EDITOR’S NOTE - MONEYWEBSURVEY KEEPS THE INDUSTRY’S FINGER ON THE PULSE8.METHODOLOGY 2015CONTENTS4.THE TOP PRIVATE BANKS AND WEALTH MANAGERS AWARDS ARE RESEARCHED AND PREPAREDBY INTELLIDEX9.THE BATTLE FOR THE WEALTH MARKETTOP PRIVATE BANKS AND WEALTH MANAGERS EVOLVE TO MATCH THE CHANGING NEEDS OF THESUPER WEALTHY12.THE ARCHETYPES15.PEOPLE’S CHOICE AWARDSTOP PRIVATE BANKS AND WEALTH MANAGERS BASED ON CLIENT FEEDBACK17.HOW THEY FAREDA DESCRIPTION OF EACH FIRM AND HOW THEY PERFORMED24.A FEW OF THE OTHERSA DESCRIPTION OF SOME NON-PARTICIPANTS

EDITOR’S NOTEA DETAILED,AUTHORITATIVEASSESSMENTThis is the fourth year Intellidex has undertaken its comprehensive researchproject on the private banking and wealth management market in South Africa.It is the first time we have done it with Moneyweb as a media partner, which hasbeen an important enhancement to the project, bringing the results to a muchwider audience than before. My thanks go to the Moneyweb team for comingon board.Wealth management deals with a highly sensitive part of clients’ lives: the assetsthat many rely on to support themselves. The relationships these firms formwith their clients endure across generations, when they are done right. Whennot, they can be a major source of client frustration and lead to long-runningresentment. Getting it right depends on firms being able to harness excellent skillsand capabilities, while bringing sensitivity to often complex client needs.Interrogating this industry has its challenges. The confidential nature of the clientprovider relationship makes it difficult for us to get a complete picture of thequality of it. But we have over the years developed what I believe is an unbeatableapproach to obtaining the best possible insights.My team and I have spent six months researching the industry. This includes acomprehensive survey sent to banks and wealth managers asking them for thefacts of their capabilities, but also posing a series of problematic clients for whomthe firms pose solutions. This reveals both the capacity of firms to deliver servicesand the creative thinking they are able to bring to the table.In reviewing all of the responses I have often been surprised by new solutions firmshave come up with that I hadn’t anticipated. Overall I am constantly impressed bythe depth of intelligent thinking and service capabilities the South African industryis able to offer its clients.More importantly, though, we conduct a large online survey with clients of theindustry. This has been a phenomenal success, with more than 2 400 clientscompleting the extensive survey this year. That so many are willing to share theirfeelings and insights on their relationship shows just how important the relationshipis to them. We are very grateful for their efforts in assisting us to understand howwell the banks and wealth managers do in catering for their clients.Our assessment is fundamentally qualitative, though we draw on a great deal ofdata to guide it. I am confident that the assessment is detailed and authoritative.As always, though, it’s your opinion that matters and I would be very glad to hearit. Please drop me an email on stheobald@intellidex.co.zaStuart Theobald, CFAChairman, Intellidex4

SA’sPRIVATE BANKS &WEALTH MANAGERS5

EDITOR’S NOTESURVEY KEEPSTHE INDUSTRY’SFINGER ON THEPULSEMoney is a very emotional topic. People work very hard to earn it, and they expecttheir money to work hard in return. It is of course the responsibility of privatebankers and wealth managers to put this money to work and to create amplifiedfuture wealth, but it is a challenging task.Relationships involving money are by definition emotional, and in many cases longterm, sometimes spanning decades. It is therefore important to regularly gaugethe perceptions in this industry, not only for existing clients to be reassured of thestature of their partners, but also for prospective clients to see which institutionsare leading the pack.Moneyweb is proud to be a partner of Intellidex and to be involved in the latest TopPrivate Bank and Wealth Managers survey.The survey has established itself as the premier private banking and wealthmanagement gauge in the country and provides much more insight than theperformance measurements normally brandished on marketing material.This comprehensive survey acknowledges service excellence and innovation intwo of the most contested market segments in the South African financial servicesindustry. It also produces invaluable insights about client perceptions.It is extremely encouraging that a record number of 2 700 members of theMoneyweb community completed the online survey to rate their respective serviceproviders. It represents a significant sample of affluent clients of virtually all themajor players in the market, and their perceptions will be compulsory reading foreveryone in the industry.This fourth edition of the Top Private Bank and Wealth Managers survey is themost comprehensive yet, and will set a benchmark for existing and prospectiveclients in the industry.Ryk Van NiekerkEditor, Moneyweb6

Make footprints worthleaving behind.YOUR WEALTH. YOUR LEGACY.AT RMB PRIVATE BANK OUR PRIVATE BANKERS UNDERSTANDTHAT YOUR WEALTH CREATION JOURNEY IS A UNIQUE ONE.This is why we pride ourselves on delivering personalised financial solutions forour clients and their families. Starting with an in-depth understanding of yourfinancial needs, we draw on the extensive knowledge, experience and insightwithin RMB Private Bank and the FirstRand Group to optimally aid your wealthcreation. And ultimately your legacy.Visit www.rmbprivatebank.com or call our 24/7 Service Suite on087 575 9411 for more information.RMB Private Bank, a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider. NCA Reg. No. NCRCP20.7

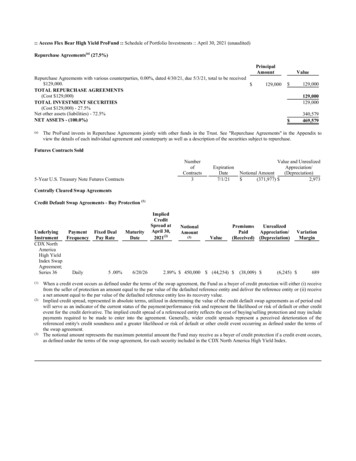

METHODOLOGY 2015The Top Private Banks and Wealth Managers awards are researched and preparedby Intellidex, a specialist financial services research house.This is the fourth year we have undertaken the survey.Our research process has two main elements.The first is a comprehensive questionnaire that thefirms complete. The main part of this are five typicalclient archetypes for which we ask the firms to developa service proposal. The intention is to clarify justwhat areas of the market the firms specialise in andtheir own capabilities. The five are: the passive lumpsum investor, the up-and-coming professional, thesuccessful entrepreneur, the wealthy executive andthe internationally wealthy family. We also interrogatethe decision making processes at the firms and theircosts, as well as obtain details about staffing levels,offices and the size of the businesses. The responsesto that questionnaire formed the core part of thescoring process undertaken by the judges.The second prong is the online client survey fromwhich the People’s Choice award is determined. Thequestions are wide-ranging and designed to assessthe different strengths and weaknesses of the privatebanks and wealth managers. The main areas of focus,though, are on satisfaction levels with products andservices and whether clients believe they are gettingvalue for money for fees charged. We also askquestions relating to why clients used private banksand wealth managers and whether their specific needsare being met. Clients also add comments on aspectsnot covered by our multiple choice format of questions.Here we received some valuable insights and thesewere used to inform the judging process. A record2 700 clients participated in the survey.In terms of the overall judging, we understand thatfirms have different areas of focus. For example fewfirms scored really well across all archetypes. Manyfirms would not be too concerned if they receivedlow scores in areas they do not focus on. Thus, in ourminds, the individual archetype winners are at least asimportant as the overall awards. If a firm is the bestin the industry in its specific area of focus and doesnot pretend to be all things to all people, it deservesrecognition for that area of excellence. However, thenature of such a survey rewards the all-rounder –those firms with comprehensive offerings across allcategories. Those firms do have a better chance ofwinning the overall awards. Most firms, however, couldprovide some services to all the archetypes.We separate wealth managers and private banks inthe awards. Generally, the distinction is whetherthe institution has a banking licence and includestransactional banking products in its range. Wealthmanagers, on the other hand, tend to focus oninvestment management rather than transactional ordebt products.The judging panel consisted of Intellidex chairmanStuart Theobald; financial analyst Orin Tambo andproject editor Colin Anthony.All those who completed the online client questionnairewere entered into a draw to win R10 000 cash.For more information visit www.intellidex.co.za

THE BATTLE FOR THEWEALTH MARKETTop private banks and wealth managers evolve to match the changing needs ofthe super wealthyBy Colin AnthonyARCHETYPE WINNERSArchetypePassive lump-sum investorUp-and-coming professionalSuccessful entrepreneurWealthy executiveInternationally wealthy familyPrivate BanksWealth ManagersFNB Private Wealth/RMB Private BankSanlam Private WealthStandard Bank: Wealth & InvestmentPSG Wealth and SanlamPrivate WealthNedbank Private WealthCitadel and PSG WealthFNB Private Wealth/RMB Private BankSanlam Private WealthAbsa PB/W&I and Standard Bank: Wealth & InvestmentMaitlandThe firms that perform well in this assessment ofprivate banks and wealth managers are fiercelycompetitive. They’re competing for a slice of a marketworth with more than R800bn in assets.The assets under management of all the firms thatparticipate in the surveys that underpin these awardstotal R801bn while assets under advisement totalR1.5-trillion. This represents the bulk of the market.Specialist financial research house Intellidex conductsthe assessment process over a six-month period,including a detailed study of the firms’ capabilities anda comprehensive client feedback process.RMB Private Bank/FNB Private Wealth is the topranked private bank in this, the fourth assessment ofSA’s private banks and wealth managers. RMB/FNBdeclined to participate in last year’s survey, sayingthey were implementing various changes and werenot ready to be assessed (though we still ranked themwithout their input). Clearly their changes have beenhighly effective and they push last year’s winners –Standard Bank’s wealth grouping (Standard BankWealth & Investment, Standard Private Bank andMelville Douglas) – into second place.Nedbank Private Wealth is third.In the wealth managers’ category (from which entitieswith transactional banking licences are excluded),Sanlam Private Wealth retains its top spot and PSGWealth holds onto second place, with Citadel movingup into third place at the expense of a new-lookStonehage Fleming.Investec entrenches itself as the firm that pleasesits clients the most. Investec Private Bank/Wealth& Investment again wins the Private Banks People’sChoice award – as it has done every year since weinstituted this aspect into the main survey in 2013. ThePeople’s Choice awards are determined by clients whorank their private bank or wealth manager on servicelevels and other issues in an online survey. This year arecord 2 444 clients from across the market completedthe questionnaire.Brantam Financial Services wins the People’s Choiceaward in the wealth managers’ category, having beenranked second-best last year. One of the questionsasked is if clients think their wealth manager couldimprove its offerings to better meet their needs. “No”,responded 88% of Brantam clients.9

OVERALL RANKINGS:PRIVATE BANKSOVERALL RANKINGS: WEALTH MANAGERSFNB Private Wealth/RMB Private Bank231Sanlam Private Wealth4,3871Standard Bank: Wealth & Investment222PSG Wealth4,1572Nedbank Private Wealth213Citadel4,1043People’s Choice winner: Investec Private BankPeople’s Choice winner: Brantam Financial ServicesWhat is noticeable is how all the highly ranked firmsare constantly implementing changes to improve theirofferings to a highly demanding wealthy client segment.A change of name and realignment of offerings here,an acquisition bringing in wider services there – standstill and you’re losing in this market.changes within firms, Galileo Capital expanded itsoffshore investment offering to include indexedinvestments combined with direct share portfolios.Executive director Warren Ingram says that aspect ofthe business has grown more than 100% a year overthe past two years. It is now developing representativeoffices in the US and Australia because “the sustaineddrive from our wealthiest clients to move the bulk oftheir investment assets overseas continues. The weakrand has slowed this trend slightly but has certainlynot stopped it.”The changes are mostly triggered by client demand,which is ever-evolving.“Continued volatility in the financial markets both hereand abroad, geopolitical risk and regulatory squeezehave made clients more demanding as they now, morethan ever, require solutions that address their intricateneeds and demands in this ever-growing, complexenvironment,” says Daniel Kriel, CEO of SanlamPrivate Wealth.“If we look at how this demand has effected what wedo on a day-to-day basis, there has been a markedincrease in demand for offshore investments and equity(locally and abroad) mandates. We have also seen ahealthy increase in clients wishing to better structuretheir wealth and estate positions and provide moreefficient solutions for themselves and their families.”Eric Enslin, CEO of FNB Private Wealth, says theincreased regulatory environment and complianceburden have put a lot of pressure on client relationshipsand cost models. “Indications are that these trendsare here to stay.”Other client trends noted by Enslin are reducing debtlevels and increasing cash investments. He has alsoseen an increased appetite for offshore financialservices offerings. Contributing factors to this, hesays, are further relaxation of foreign exchangeallowances and a need for diversification. “There’salso a sense that in the past two years the localstock market performance has reached its peak andthat our markets are expensive relative to offshoreopportunities.” Another factor is the possibility offurther rand weakness driven by SA’s economic outlookand a stronger US performance.As an example of how client demand instigates10FNB Private Wealth recognised the need for a biastowards a client’s balance sheet rather than incomeand therefore changed its entry criteria to be moreof a net asset value play (R15m NAV or more), saysEnslin. Another adaptation is that it now reports on andservices clients under a family construct “because wefocus on the holistic needs of the wider family ratherthan individuals. The family construct and our uniqueclient profitability model allow us to relationship priceour clients across the various banking, lending, adviceand fiduciary product holdings.”Another notable trend is that there is little appetitefor intricate investment products. Ronald King, headof technical support services at PSG Wealth, saysmost assets from high net worth clients go into shareportfolios, “but we have seen a substantial increase inlump-sum investments into our income funds.” PSGthus appointed a new fixed interest team in 2013,expanding its research capabilities.There are plenty more examples of changes andimprovements – of never being satisfied.PSG Wealth has expanded its estate and trustservices department and is strengthening its offshoreplatforms. Now it is consolidating its securities andunit trust platforms into one integrated platform.Sanlam Private Investments was renamed SanlamPrivate Wealth and acquired international businessesto strengthen its trust services, among other areas.Standard renamed its Private Clients to StandardWealth & Investment and added a new unit tocapture clients that don’t quite qualify to be clients

of their wealth divisions, in so doing attempting tooffer a cradle-to-grave private banking and wealthmanagement proposition. Stonehage is merging withUK-based Fleming Family & Partners and has moved itsmarket focus exclusively to the top end, ultra-wealthysegment. Absa’s restructuring has probably beenamong the most intense as it aligns its offerings withthat of its parent, Barclays. But it has also noticed thatfor clients, “service quality and value for money arebecoming more important than the performance of theorganisation” and it is strengthening accordingly. AndNedbank Private Wealth South Africa has absorbedits international specialist team and aligned the twobusinesses in terms of client engagement processes,products, services and fees.For the wealthy, all of this means that they receivebest-practice service and products and, coupled with astrong-running JSE over the past few years, have beengetting excellent returns as well. FNB’s Enslin pointsout that the wealth market segment growth has beenoutperforming other client sub-segments.Ryan Tholet, head of Investec Private Bank, sums upwhy the personal touch is so important in the wealthmarket: “In essence, an exceptional client experienceevokes a positive emotional response. By taking thetime and effort to deliver and exceptional experience,we win our clients’ hearts and loyalty.”Client Survey SnapshotClient Survey SnapshotSanlam’s Kriel reports that 2014 continued to delivergood returns off the back of the strong market returnsand investor confidence in 2013. “This resulted inanother successful year for both our clients andour business.”The good times in terms of portfolio performances,however, might not last much longer. PSG’s Kingexpects 2015 to be a difficult one for the market.“Growth in South Africa will be subdued givenincreased taxes and concerns about Eskom and otherinfrastructure providers,” he says. “We believe thatcompanies who will shine this year are those whofocus on their personal relationships with their highnet worth clients.”Client Survey SnapshotThe importance of personal relationships and buildingtrust is emphasised by just about every private bankand wealth manager. Those factors are at the core ofeach firm’s strategy and wealth managers particularlystand or fall by it. It is impossible for us to measurehow successful each firm is in that endeavour, but thePeople’s Choice survey reflects which firms are bestat it.Brantam’s success in that survey was based on it.The firm was founded 27 years ago and MD DerekSumption says the clients who started with it are allretired and Brantam is now advising their offspring,who are mostly in the accumulation phase. The firmdoes no marketing – clients refer family and friends.And Investec Private Bank’s ability to form trustingrelationships is summed up in this verbatim commentfrom a client, submitted in the People’s Choice survey:“Caters for my every need, gives me the opportunity tosave and invest on the JSE. Exceptional client servicesprovided by my private bank.”11

THE ARCHETYPESEach client has different needs and private banks andwealth managers tend to specialise in certain niches.While the overall awards favour institutions thatcater to a broad range of client types, that doesn’tnecessarily mean they are the best for your particularniche. The rankings here reflect the best institutionsfor particular client types. These archetypes, drawnup following consultation with industry players, bestcover the typical spread of needs.Each private bank and wealth manager was askedhow they would cater for the needs of each of thesetypical clients. Our panel of judges then assessedthose responses, together with client feedback fromthe client survey, to give scores to each institution.The top three for each client type are listed here.PASSIVE LUMP-SUM INVESTORRankFNB Private Wealth/RMB Private Bank4,501Nedbank Private Wealth4,172Standard Bank: Wealth & Investment4,153Score/5RankSanlam Private Wealth4,421Brantam Financial Services4,172Galileo Capital4,083Wealth ManagersNelly recently retired from the bank she had worked atfor 30 years, having turned 65. Throughout her careershe contributed to the employer’s defined contributionpension fund which is now worth R5m. She alsomaintained a retirement annuity fund which has a pretax value of R2m. She has no other investments.Nelly got divorced five years earlier and used thedivorce settlement as part-payment on a retirementhome in which she already lives, and the balanceof her mortgage is R1.5m. Her two children arefinancially independent. She would like to pay the12She would like a lump-sum payment but is not sureif she can afford to take one out, given that sheestimates that her income requirements would beabout R20,000 a month (net) and that she still feels fitand healthy. Throughout her life she played tennis andran regularly, though now her exercise is confined tobrisk walks in the evenings.She requires a plan to structure her investments tosupport her for the remainder of her life.UP-AND-COMING PROFESSIONALPrivate BanksScore/5Private Banksmortgage balance now as well as settle her otherdebts of R350,000 (balance of car loan plus a revolvingcredit loan).Score/5RankStandard Bank: Wealth & Investment4,421FNB Private Wealth/RMB Private Bank4,332Nedbank Private Wealth4,303Wealth ManagersScore/5RankCitadel/ PSG Wealth4,331Sanlam Private Wealth4,183Tina is in her 30s and is an established actuary at aprominent asset consultant. She has enjoyed frequentpromotions in her relatively short career. She hassome assets but is still mostly in the accumulationphase. She owns a holiday home on the coast that sherents out, valued at R1.2m which is fully paid off. Sheand her husband have a primary residence valued atR2.0m, which has R1.5m outstanding on the mortgageheld in an access bond. They are married in communityof property and are planning to have children soon.Some of their friends have told them they have starteda family trust and Tina would like to know if she andher husband should open one now in relation to theirfuture children’s financial security.

Tina has directed her free cash flow into a stockbrokeraccount that now has NAV of R1m. She is quiteconservative and prefers buying blue chip stocksand ETFs. She doesn’t have the time to researchinvestments, so prefers to have ideas suggested toher by her stockbroker.place to facilitate growth. The facility could possiblybe secured by the company’s factory building, which isvalued at R20m and is unencumbered. This company,established in 1998, is held in an offshore truststructure in the Isle of Man but due to recent publicityhe is worried about its tax compliance.Her basic salary has just been increased by 30% toR1.5m a year and she will be entitled to performancerelated bonuses that will be between R600,000 andR1m in the current year. She owns an SUV worthR450,000 with an outstanding loan of R300,000. Tinaand her husband have not done any estate planningEver the entrepreneur, Robert hasn’t done anyin-depth needs analysis on what risk cover he needsversus what he currently has. He is the sole source ofincome in the family, which includes his wife and threedaughters, aged 10, eight and four.SUCCESSFUL ENTREPRENEURRobert has properties including houses in CampsBay and on the Vaal River, and owns three vehicles.While he has the transactional basics of a bankingrelationship covered, his priority is his businesses andhis development objectives.Score/5RankNedbank Private Wealth4,501FNB Private Wealth/RMB Private Bank4,402Private BanksStandard Bank: Wealth & Investment4,353Private BanksScore/5RankCitadel/ PSG Wealth4,331Sanlam Private Wealth4,183Wealth ManagersRobert runs a portfolio of businesses including a coaltransport company, a property development companyand 60% of a mining supplies company that nowexports to five countries. He has been successful –the companies are all profitable. Last year he bankeddividends of R8m and has a net asset value of R40m.His property development company has been quietlately, but with demand starting to improve, he wouldlike to borrow money to develop high-end executivesuites on an unencumbered property he owns inClifton, Cape Town.The coal transport company has been growing nicelyand has got to the stage where Robert needs tointroduce a BEE partner to help the business grow.He is concerned about complying with Eskom’s newprocurement rules. Last year the business earned aprofit before tax of R7m.The mining supplies company is requiring ever moreworking capital as it begins to enter export markets.Robert would like to put a trade finance facility inWEALTHY EXECUTIVEScore/5RankFNB Private Wealth/RMB Private Bank4,421Investec4,402Standard Bank: Wealth & Investment4,353Score/5RankSanlam Private Wealth4,601Citadel4,502Maitland4,323Private BanksJulius has climbed the corporate ladder and at age 51is now an executive director of a JSE-listed hospitalgroup. His own investment company, with an NAVnorth of R130m, is one of the largest partners of theBEE consortium that owns 26% of the company, so themajority of his wealth is exposed to the share price ofthe hospital group. Julius is nervous about what effectcompetition authority investigations into the healthmarket and the prospect of a national health insurancescheme will have on the value of the hospital groupand is eager to protect his investment vehicle fromany downside risk.Julius has also taken an interest in alternativeinvestments involving private equity and hedge funds.13

Besides the investment holding company he uses forthe BEE structure, Julius has kept all other investmentsin his name. He would like to know what legal vehicleshe should use to invest in alternative asset classes, aswell as what options he would have to invest in hedgefund and private equity funds offshore.He earns R6m annually in salary and dividends, and closeto a quarter of this is surplus to his living requirementsand is accumulating in his cheque account.INTERNATIONALLY WEALTHY FAMILYScore/5RankAbsa Private Bank and Absa Wealth& Investment Management4,331Standard Bank: Wealth & Investment4,331FNB Private Wealth/RMB Private lam Private Wealth4,253Private BanksWealth ManagersZainab is the second generation of a family that evenby world standards is extremely wealthy. Now 55 yearsold and following the death of his father, Zainab hasassumed the mantle of family patriarch.His father established numerous trusts and companiesin various offshore jurisdictions to house the assetsthat now hold the family fortune. He suspects theseare unnecessarily complicated and wants to knowwhether it would be more efficient – from a taxationand cost point of view – to consolidate these into oneor a handful of structures.His accountant tells him that the total asset value hasgrown to R3.2bn, but more than half of this is accountedfor by the family’s 51% interest in an international hotelgroup. Apart from these investments, the family ownsproperties in six countries and has a 50% interest in a2007 Lear jet.Besides business, Zainab has keen interests in art andphilanthropy. The current structures were set up byhis father’s personal accountant and they have not14been reviewed for more than a decade. He requiressophisticated tax and estate planning across multiplejurisdictions. His two daughters have no interest insucceeding him in the family business, so he needsto think carefully about succession planning, andwhether the family should even continue to own thehotel business when he retires or dies.

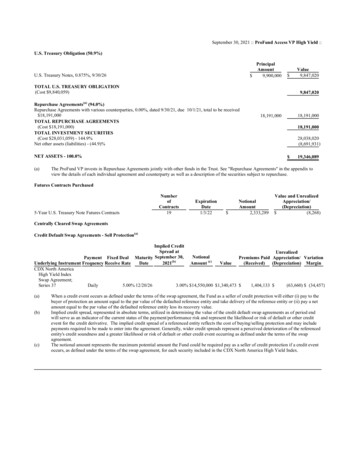

PEOPLE’S CHOICEAWARDSTop private banks and wealth managers based on client feedbackTOP PRIVATE BANKSRankOverallOverall satisfaction level(out of 5)Likelihood of referral(out of 5)Weighted score(out of 5)1Investec Private Bank4,314,364,332Nedbank Private Wealth4,144,154,143RMB Private Bank3,974,244,10Overall satisfaction level(out of 5)Likelihood of referral(out of 5)Weighted score(out of 5)TOP WEALTH MANAGERSRankOverall1Brantam Financial Services4,704,864,782Galileo Capital4,654,764,713PSG Konsult4,514,604,56PEOPLE’S CHOICEThe People’s Choice awards are based on nothingbut feedback from clients. As a result they area very important part of Top Private Banks andWealth Managers Awards and the outcome is strongendorsement of the winners.The opinions of clients in any market segment are animportant factor in assessing a company’s servicesand products. In the case of our survey, these opinionsalso serve as one of the checks to the informationprovided by the firms nagers all about their service providers in an onlinequestionnaire conducted earlier this year. More than2 700 respondents started the survey while 2 444completed it.These awards are based purely on that feedback. Twosets of responses went into these rankings with equalweight given to each: clients’ overall satisfaction levelsand their willingness to recommend their serviceprovider to friends and family. For this industry,client referrals are critical. In fact, quite a few wealthmanagers do very little marketing and rely only onword of mouth.15

But some clients are happier than others. In theprivate banks category, Investec Private Bank wins forthe third time in the three years we’ve conducted thisaward – an achievement that matches the group’s “outof the ordinary” claim.The core questions in the survey related to clientperceptions of the standards of service, the rangeof products to suit their specific needs and othersatisfaction ratings. We also invited them to commenton aspects outside the range of questions and answers,and the responses informed the final judging process.Investec received high rankings across all the serviceand satisfaction levels but what is parti

the top private banks and wealth managers awards are researched and prepared by intellidex 9. the battle for the wealth market top private banks and wealth managers evolve to match the changing needs of the super wealthy 12. the archetypes 15. people's choice awards top private banks and wealth managers based on client feedback 17. how they fared