Transcription

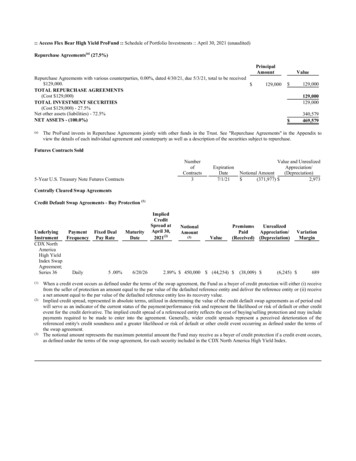

Page 1 of 375:: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Repurchase Agreements(a) (27.5%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received 129,000. TOTAL REPURCHASE AGREEMENTS(Cost 129,000)TOTAL INVESTMENT SECURITIES(Cost 129,000) - 27.5%Net other assets (liabilities) - 72.5%NET ASSETS - (100.0%)(a)Value129,000 129,000129,000129,000340,579469,579 The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.Futures Contracts SoldNumberofContracts35-Year U.S. Treasury Note Futures ContractsExpirationDate7/1/21Value and UnrealizedAppreciation/Notional Amount(Depreciation) (371,977) 2,973Centrally Cleared Swap AgreementsCredit Default Swap Agreements - Buy Protection (1)UnderlyingPaymentInstrumentFrequencyCDX NorthAmericaHigh YieldIndex SwapAgreement;Series 36Daily(1)(2)(3)Fixed DealPay Rate5 .00%MaturityDate6/20/26ImpliedCreditSpread atApril ved)2.89% 450,000 (44,254) UnrealizedAppreciation/(Depreciation)(38,009) VariationMargin(6,245) 689When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receivefrom the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receivea net amount equal to the par value of the defaulted reference entity less its recovery value.Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period endwill serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other creditevent for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may includepayments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of thereferenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms ofthe swap agreement.The notional amount represents the maximum potential amount the Fund may receive as a buyer of credit protection if a credit event occurs,as defined under the terms of the swap agreement, for each security included in the CDX North America High Yield wz5086/tm211666-1 nport.htm6/16/2021

Page 2 of 375:: Access Flex High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)U.S. Treasury Obligation (66.3%)U.S. Treasury Notes, 0.75%, 4/30/26TOTAL U.S. TREASURY OBLIGATION(Cost 11,922,228)Repurchase Agreements(a) (28.1%)Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to bereceived 5,070,000.TOTAL REPURCHASE AGREEMENTS(Cost 5,070,000)TOTAL INVESTMENT SECURITIES(Cost 16,992,229) - 94.4%Net other assets (liabilities) - 5.6%NET ASSETS - (100.0%)(a)PrincipalAmount 12,000,000 0017,013,281 1,016,42618,029,707The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix toview the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.Futures Contracts PurchasedNumberofContracts55-Year U.S. Treasury Note Futures ContractsExpirationDate7/1/21Value and UnrealizedAppreciation/Notional Amount(Depreciation) 619,961 (5,007)Centrally Cleared Swap AgreementsCredit Default Swap Agreements - Sell Protection (1)UnderlyingPaymentInstrumentFrequencyCDX NorthAmericaHigh YieldIndex SwapAgreement;Series 36Daily(1)(2)(3)FixedDealReceiveRate5 .00%MaturityDate6/20/26ImpliedCreditSpread atApril 30,2021(2)NotionalAmount ed) (Depreciation)2.84% 15,170,000 1,491,831 1,289,401 VariationMargin202,430 (23,969)When a credit event occurs as defined under the terms of the swap agreement, the Fund as a seller of credit protection will either (i) pay tothe buyer of protection an amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) paya net amount equal to the par value of the defaulted reference entity less its recovery value.Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period endwill serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other creditevent for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may includepayments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of thereferenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms ofthe swap agreement.The notional amount represents the maximum potential amount the Fund could be required to pay as a seller of credit protection if a creditevent occurs, as defined under the terms of the swap agreement, for each security included in the CDX North America High Yield wz5086/tm211666-1 nport.htm6/16/2021

Page 3 of 375Banks UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Common Stocks (73.9%)Bank of America Corp. (Banks)Bank OZK (Banks)BOK Financial Corp. (Banks)Citigroup, Inc. (Banks)Citizens Financial Group, Inc. (Banks)Comerica, Inc. (Banks)Commerce Bancshares, Inc. (Banks)Cullen/Frost Bankers, Inc. (Banks)East West Bancorp, Inc. (Banks)F.N.B. Corp. (Banks)Fifth Third Bancorp (Banks)First Citizens BancShares, Inc. - Class A (Banks)First Financial Bankshares, Inc. (Banks)First Horizon Corp. (Banks)First Republic Bank (Banks)Glacier Bancorp, Inc. (Banks)Home BancShares, Inc. (Banks)Huntington Bancshares, Inc. (Banks)JPMorgan Chase & Co. (Banks)KeyCorp (Banks)M&T Bank Corp. (Banks)New York Community Bancorp, Inc. (Thrifts & Mortgage Finance)People's United Financial, Inc. (Banks)Pinnacle Financial Partners, Inc. (Banks)Popular, Inc. (Banks)Prosperity Bancshares, Inc. (Banks)Regions Financial Corp. (Banks)Signature Bank (Banks)SVB Financial Group* (Banks)Synovus Financial Corp. (Banks)TCF Financial Corp. (Banks)TFS Financial Corp. (Thrifts & Mortgage Finance)The PNC Financial Services Group, Inc. (Banks)Truist Financial Corp. (Banks)U.S. Bancorp (Banks)UMB Financial Corp. (Banks)Umpqua Holdings Corp. (Banks)United Bankshares, Inc. (Banks)Valley National Bancorp (Banks)Webster Financial Corp. (Banks)Wells Fargo & Co. (Banks)Western Alliance Bancorp (Banks)Wintrust Financial Corp. (Banks)Zions Bancorp (Banks)TOTAL COMMON STOCKS(Cost 9584,8722,8508,9641,99691,3582,2851,2563,629 8240,08596,838202,49838,305,635Repurchase Agreements(a)(b) (23.3%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received 12,052,000 TOTAL REPURCHASE AGREEMENTS(Cost 12,052,000)TOTAL INVESTMENT SECURITIES(Cost 38,845,828) - 97.2%Net other assets (liabilities) - 2.8%NET ASSETS - wz5086/tm211666-1 nport.htm12,052,000Value 12,052,00012,052,000 50,357,6351,475,43351,833,0686/16/2021

Page 4 of 375*(a)(b)Non-income producing security.The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to viewthe details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.A portion of these securities were held in a segregated account for the benefit of swap counterparties in the event of default. As of April 30,2021, the aggregate amount held in a segregated account was emp/wz5086/tm211666-1 nport.htm6/16/2021

Page 5 of 375Banks UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Total Return Swap Agreements — LongUnderlying InstrumentDow Jones U.S. Banks IndexDow Jones U.S. Banks Index(1)(2)CounterpartyGoldman Sachs InternationalUBS AGTerminationDate(1)5/24/215/24/21Rate PaidNotionalAmount(Received)(2)0.58% 19,305,0950.43%20,229,639 39,534,734Value andUnrealizedAppreciation/(Depreciation) 471,142415,168 886,310Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of April 30, 2021, on the notional amount of the swap agreement paid to the counterparty orreceived from the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).Banks UltraSector ProFund invested in the following industries as of April 30, 2021:BanksThrifts & Mortgage FinanceOther **Total** Value38,161,880143,75513,527,43351,833,068% ofNet Assets73.6%0.3%26.1%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payablefor capital shares mp/wz5086/tm211666-1 nport.htm6/16/2021

Page 6 of 375Basic Materials UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Common Stocks (72.9%)Air Products & Chemicals, Inc. (Chemicals)Albemarle Corp. (Chemicals)Alcoa Corp.* (Metals & Mining)Ashland Global Holdings, Inc. (Chemicals)Axalta Coating Systems, Ltd.* (Chemicals)Celanese Corp. (Chemicals)CF Industries Holdings, Inc. (Chemicals)Commercial Metals Co. (Metals & Mining)Corteva, Inc. (Chemicals)Dow, Inc. (Chemicals)DuPont de Nemours, Inc. (Chemicals)Eastman Chemical Co. (Chemicals)Ecolab, Inc. (Chemicals)Element Solutions, Inc. (Chemicals)FMC Corp. (Chemicals)Freeport-McMoRan, Inc. (Metals & Mining)Huntsman Corp. (Chemicals)Ingevity Corp.* (Chemicals)International Flavors & Fragrances, Inc. (Chemicals)Linde PLC (Chemicals)LyondellBasell Industries N.V. - Class A (Chemicals)NewMarket Corp. (Chemicals)Newmont Corp. (Metals & Mining)Nucor Corp. (Metals & Mining)PPG Industries, Inc. (Chemicals)Reliance Steel & Aluminum Co. (Metals & Mining)Royal Gold, Inc. (Metals & Mining)RPM International, Inc. (Chemicals)Steel Dynamics, Inc. (Metals & Mining)The Chemours Co. (Chemicals)The Mosaic Co. (Chemicals)The Scotts Miracle-Gro Co. - Class A (Chemicals)Valvoline, Inc. (Chemicals)W.R. Grace & Co. (Chemicals)Westlake Chemical Corp. (Chemicals)TOTAL COMMON STOCKS(Cost 792,2064,6135462,425835463 epurchase Agreements(a)(b) (26.8%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received 4,057,000 TOTAL REPURCHASE AGREEMENTS(Cost 4,057,000)TOTAL INVESTMENT SECURITIES(Cost 12,256,102) - 99.7%Net other assets (liabilities) - 0.3%NET ASSETS - 100.0%*(a)(b)4,057,000Value 4,057,0004,057,000 15,071,64242,06015,113,702Non-income producing security.The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to viewthe details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.A portion of these securities were held in a segregated account for the benefit of swap counterparties in the event of default. As of April 30,2021, the aggregate amount held in a segregated account was emp/wz5086/tm211666-1 nport.htm6/16/2021

Page 7 of 375Basic Materials UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Total Return Swap Agreements — LongUnderlying InstrumentCounterpartyDow Jones U.S. Basic Materials Index Goldman Sachs InternationalDow Jones U.S. Basic Materials Index UBS AG(1)(2)TerminationDate(1)5/24/215/24/21Rate PaidNotionalAmount(Received)(2)0.58% 6,567,6390.43%5,162,703 11,730,342Value andUnrealizedAppreciation/(Depreciation) (13,645)(8,644) (22,289)Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of April 30, 2021, on the notional amount of the swap agreement paid to the counterparty or receivedfrom the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).Basic Materials UltraSector ProFund invested in the following industries as of April 30, 2021:ChemicalsMetals & MiningOther **Total** Value8,762,9102,251,7324,099,06015,113,702% ofNet Assets58.0%14.9%27.1%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payable forcapital shares mp/wz5086/tm211666-1 nport.htm6/16/2021

Page 8 of 375Bear ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Repurchase Agreements(a)(b) (102.9%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received 11,620,000 TOTAL REPURCHASE AGREEMENTS(Cost 11,620,000)TOTAL INVESTMENT SECURITIES(Cost 11,620,000) - 102.9%Net other assets (liabilities) - (2.9)%NET ASSETS - 100.0%(a)(b)11,620,000Value 11,620,00011,620,000 11,620,000(323,010)11,296,990The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to viewthe details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.A portion of these securities were held in a segregated account for the benefit of swap counterparties in the event of default. As of April 30,2021, the aggregate amount held in a segregated account was 1,410,000.Futures Contracts SoldNumberofContracts8E-Mini S&P 500 Futures ContractsExpirationDate6/21/21Value andUnrealizedAppreciation/Notional Amount (Depreciation) (1,669,760) (124,355)Total Return Swap Agreements — ShortUnderlying InstrumentS&P 500S&P 500(1)(2)CounterpartyGoldman Sachs InternationalUBS AGTerminationDate(1)5/27/215/27/21Value andUnrealizedRate ived)(2)(0.43)% (6,572,805) 11,130(0.23)%(3,223,682)3,759 (9,796,487) 14,889Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of April 30, 2021, on the notional amount of the swap agreement paid to the counterparty or receivedfrom the counterparty, excluding any commissions. This amount is included as part of the unrealized he/AppData/Local/Temp/wz5086/tm211666-1 nport.htm6/16/2021

Page 9 of 375Biotechnology UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Common Stocks (79.7%)10X Genomics, Inc.* - Class A (Life Sciences Tools & Services)AbbVie, Inc. (Biotechnology)ACADIA Pharmaceuticals, Inc.* (Biotechnology)Acceleron Pharma, Inc.* (Biotechnology)Agilent Technologies, Inc. (Life Sciences Tools & Services)Agios Pharmaceuticals, Inc.* (Biotechnology)Alexion Pharmaceuticals, Inc.* (Biotechnology)Alkermes PLC* (Biotechnology)Allogene Therapeutics, Inc.* (Biotechnology)Alnylam Pharmaceuticals, Inc.* (Biotechnology)Amgen, Inc. (Biotechnology)Avantor, Inc.* (Life Sciences Tools & Services)Berkeley Lights, Inc.* (Life Sciences Tools & Services)Biogen, Inc.* (Biotechnology)BioMarin Pharmaceutical, Inc.* (Biotechnology)Bio-Techne Corp. (Life Sciences Tools & Services)Bluebird Bio, Inc.* (Biotechnology)Blueprint Medicines Corp.* (Biotechnology)Charles River Laboratories International, Inc.* (Life Sciences Tools & Services)Emergent BioSolutions, Inc.* (Biotechnology)Exact Sciences Corp.* (Biotechnology)Exelixis, Inc.* (Biotechnology)FibroGen, Inc.* (Biotechnology)Gilead Sciences, Inc. (Biotechnology)Horizon Therapeutics PLC* (Pharmaceuticals)Illumina, Inc.* (Life Sciences Tools & Services)Incyte Corp.* (Biotechnology)Ionis Pharmaceuticals, Inc.* (Biotechnology)IQVIA Holdings, Inc.* (Life Sciences Tools & Services)Mettler-Toledo International, Inc.* (Life Sciences Tools & Services)Moderna, Inc.* (Biotechnology)Nektar Therapeutics* (Pharmaceuticals)Neurocrine Biosciences, Inc.* (Biotechnology)Novavax, Inc.* (Biotechnology)PPD, Inc.* (Life Sciences Tools & Services)PRA Health Sciences, Inc.* (Life Sciences Tools & Services)Regeneron Pharmaceuticals, Inc.* (Biotechnology)Repligen Corp.* (Biotechnology)Sarepta Therapeutics, Inc.* (Biotechnology)Seagen, Inc.* (Biotechnology)Syneos Health, Inc.* (Life Sciences Tools & Services)Ultragenyx Pharmaceutical, Inc.* (Biotechnology)United Therapeutics Corp.* (Biotechnology)Vertex Pharmaceuticals, Inc.* (Biotechnology)Vir Biotechnology, Inc.* (Biotechnology)TOTAL COMMON STOCKS(Cost 4,69427,3936,870 6,1235,977,152327,974123,238,470Repurchase Agreements(a)(b) (25.9%)PrincipalAmountRepurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received 40,077,000 TOTAL REPURCHASE AGREEMENTS(Cost 40,077,000)TOTAL INVESTMENT SECURITIES(Cost 86,336,770) - 105.6%Net other assets (liabilities) - (5.6)%NET ASSETS - wz5086/tm211666-1 nport.htm40,077,000Value 40,077,00040,077,000163,315,470(8,602,858) 154,712,6126/16/2021

Page 10 of 375*(a)(b)Non-income producing security.The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to viewthe details of each individual agreement and counterparty as well as a description of the securities subject to repurchase.A portion of these securities were held in a segregated account for the benefit of swap counterparties in the event of default. As of April 30,2021, the aggregate amount held in a segregated account was Temp/wz5086/tm211666-1 nport.htm6/16/2021

Page 11 of 375Biotechnology UltraSector ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Total Return Swap Agreements — LongUnderlying InstrumentDow Jones U.S. Biotechnology IndexDow Jones U.S. Biotechnology Index(1)(2)CounterpartyGoldman SachsInternationalUBS AGTerminationDate(1)5/24/215/24/21Rate Paid(Received)(2)NotionalAmountValue andUnrealizedAppreciation/(Depreciation)0.58% 59,467,629 (814,872)0.58% 49,353,648(782,883) 108,821,277 (1,597,755)Agreements may be terminated at will by either party without penalty. Payment is due at termination/maturity.Reflects the floating financing rate, as of April 30, 2021, on the notional amount of the swap agreement paid to the counterparty or receivedfrom the counterparty, excluding any commissions. This amount is included as part of the unrealized appreciation/(depreciation).Biotechnology UltraSector ProFund invested in the following industries as of April 30, 2021:BiotechnologyLife Sciences Tools & ServicesPharmaceuticalsOther **Total**Value 89,132,68227,507,6916,598,09731,474,142 154,712,612% ofNet Assets57.6%17.8%4.3%20.3%100.0%Includes any non-equity securities and net other assets (liabilities), which includes any receivable for capital shares issued and payablefor capital shares mp/wz5086/tm211666-1 nport.htm6/16/2021

Page 12 of 375Bull ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Common Stocks (82.5%)Shares3M Co. (Industrial Conglomerates)A.O. Smith Corp. (Building Products)Abbott Laboratories (Health Care Equipment & Supplies)AbbVie, Inc. (Biotechnology)ABIOMED, Inc.* (Health Care Equipment & Supplies)Accenture PLC - Class A (IT Services)Activision Blizzard, Inc. (Entertainment)Adobe, Inc.* (Software)Advance Auto Parts, Inc. (Specialty Retail)Advanced Micro Devices, Inc.* (Semiconductors & Semiconductor Equipment)Aflac, Inc. (Insurance)Agilent Technologies, Inc. (Life Sciences Tools & Services)Air Products & Chemicals, Inc. (Chemicals)Akamai Technologies, Inc.* (IT Services)Alaska Air Group, Inc.* (Airlines)Albemarle Corp. (Chemicals)Alexandria Real Estate Equities, Inc. (Equity Real Estate Investment Trusts)Alexion Pharmaceuticals, Inc.* (Biotechnology)Align Technology, Inc.* (Health Care Equipment & Supplies)Allegion PLC (Building Products)Alliant Energy Corp. (Electric Utilities)Alphabet, Inc.* - Class A (Interactive Media & Services)Alphabet, Inc.* - Class C (Interactive Media & Services)Altria Group, Inc. (Tobacco)Amazon.com, Inc.* (Internet & Direct Marketing Retail)Amcor PLC (Containers & Packaging)Ameren Corp. (Multi-Utilities)American Airlines Group, Inc.* (Airlines)American Electric Power Co., Inc. (Electric Utilities)American Express Co. (Consumer Finance)American International Group, Inc. (Insurance)American Tower Corp. (Equity Real Estate Investment Trusts)American Water Works Co., Inc. (Water Utilities)Ameriprise Financial, Inc. (Capital Markets)AmerisourceBergen Corp. (Health Care Providers & Services)AMETEK, Inc. (Electrical Equipment)Amgen, Inc. (Biotechnology)Amphenol Corp. - Class A (Electronic Equipment, Instruments & Components)Analog Devices, Inc. (Semiconductors & Semiconductor Equipment)ANSYS, Inc.* (Software)Anthem, Inc. (Health Care Providers & Services)Aon PLC (Insurance)APA Corp. (Oil, Gas & Consumable Fuels)Apple, Inc. (Technology Hardware, Storage & Peripherals)Applied Materials, Inc. (Semiconductors & Semiconductor Equipment)Aptiv PLC* (Auto Components)Archer-Daniels-Midland Co. (Food Products)Arista Networks, Inc.* (Communications Equipment)Arthur J. Gallagher & Co. (Insurance)Assurant, Inc. (Insurance)AT&T, Inc. (Diversified Telecommunication Services)Atmos Energy Corp. (Gas Utilities)Autodesk, Inc.* (Software)Automatic Data Processing, Inc. (IT Services)AutoZone, Inc.* (Specialty Retail)AvalonBay Communities, Inc. (Equity Real Estate Investment Trusts)Avery Dennison Corp. (Containers & Packaging)Baker Hughes Co. - Class A (Energy Equipment & mp/wz5086/tm211666-1 0,7471,20635573473254769,37716828956229184109960 42,45935,32823,34519,2776/16/2021

Page 13 of 375Ball Corp. (Containers & Packaging)Bank of America Corp. (Banks)Baxter International, Inc. (Health Care Equipment & Supplies)Becton, Dickinson & Co. (Health Care Equipment & Supplies)Berkshire Hathaway, Inc.* - Class B (Diversified Financial Services)Best Buy Co., Inc. (Specialty Retail)Biogen, Inc.* (Biotechnology)Bio-Rad Laboratories, Inc.* - Class A (Life Sciences Tools & Services)BlackRock, Inc. - Class A (Capital Markets)Booking Holdings, Inc.* (Internet & Direct Marketing Retail)BorgWarner, Inc. (Auto Components)Boston Properties, Inc. (Equity Real Estate Investment Trusts)Boston Scientific Corp.* (Health Care Equipment & Supplies)Bristol-Myers Squibb Co. (Pharmaceuticals)Broadcom, Inc. (Semiconductors & Semiconductor Equipment)Broadridge Financial Solutions, Inc. (IT Services)Brown-Forman Corp. - Class B (Beverages)C.H. Robinson Worldwide, Inc. (Air Freight & Logistics)Cabot Oil & Gas Corp. (Oil, Gas & Consumable Fuels)Cadence Design Systems, Inc.* (Software)Caesars Entertainment, Inc.* (Hotels, Restaurants & Leisure)Campbell Soup Co. (Food mp/wz5086/tm211666-1 48,22826,71012,7496/16/2021

Page 14 of 375Bull ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited)Common Stocks, continuedSharesCapital One Financial Corp. (Consumer Finance)Cardinal Health, Inc. (Health Care Providers & Services)CarMax, Inc.* (Specialty Retail)Carnival Corp.* - Class A (Hotels, Restaurants & Leisure)Carrier Global Corp. (Building Products)Catalent, Inc.* (Pharmaceuticals)Caterpillar, Inc. (Machinery)Cboe Global Markets, Inc. (Capital Markets)CBRE Group, Inc.* - Class A (Real Estate Management & Development)CDW Corp. (Electronic Equipment, Instruments & Components)Celanese Corp. (Chemicals)Centene Corp.* (Health Care Providers & Services)CenterPoint Energy, Inc. (Multi-Utilities)Cerner Corp. (Health Care Technology)CF Industries Holdings, Inc. (Chemicals)Charter Communications, Inc.* - Class A (Media)Chevron Corp. (Oil, Gas & Consumable Fuels)Chipotle Mexican Grill, Inc.* (Hotels, Restaurants & Leisure)Chubb, Ltd. (Insurance)Church & Dwight Co., Inc. (Household Products)Cigna Corp. (Health Care Providers & Services)Cincinnati Financial Corp. (Insurance)Cintas Corp. (Commercial Services & Supplies)Cisco Systems, Inc. (Communications Equipment)Citigroup, Inc. (Banks)Citizens Financial Group, Inc. (Banks)Citrix Systems, Inc. (Software)CME Group, Inc. (Capital Markets)CMS Energy Corp. (Multi-Utilities)Cognizant Technology Solutions Corp. - Class A (IT Services)Colgate-Palmolive Co. (Household Products)Comcast Corp. - Class A (Media)Comerica, Inc. (Banks)Conagra Brands, Inc. (Food Products)ConocoPhillips (Oil, Gas & Consumable Fuels)Consolidated Edison, Inc. (Multi-Utilities)Constellation Brands, Inc. - Class A (Beverages)Copart, Inc.* (Commercial Services & Supplies)Corning, Inc. (Electronic Equipment, Instruments & Components)Corteva, Inc. (Chemicals)Costco Wholesale Corp. (Food & Staples Retailing)Crown Castle International Corp. (Equity Real Estate Investment Trusts)CSX Corp. (Road & Rail)Cummins, Inc. (Machinery)CVS Health Corp. (Health Care Providers & Services)D.R. Horton, Inc. (Household Durables)Danaher Corp. (Health Care Equipment & Supplies)Darden Restaurants, Inc. (Hotels, Restaurants & Leisure)DaVita, Inc.* (Health Care Providers & Services)Deere & Co. (Machinery)Delta Air Lines, Inc.* (Airlines)DENTSPLY SIRONA, Inc. (Health Care Equipment & Supplies)Devon Energy Corp. (Oil, Gas & Consumable Fuels)DexCom, Inc.* (Health Care Equipment & Supplies)Diamondback Energy, Inc. (Oil, Gas & Consumable Fuels)Digital Realty Trust, Inc. (Equity Real Estate Investment Trusts)Discover Financial Services (Consumer Finance)Discovery, Inc.* (Media)Discovery, Inc.* - Class C (Media)DISH Network Corp.* - Class A (Media)Dollar General Corp. (Multiline /wz5086/tm211666-1 215382325323 7,09545,9428,09712,34214,55769,3646/16/2021

Page 15 of 375Dollar Tree, Inc.* (Multiline Retail)Dominion Energy, Inc. (Multi-Utilities)Domino's Pizza, Inc. (Hotels, Restaurants & Leisure)Dover Corp. (Machinery)Dow, Inc. (Chemicals)DTE Energy Co. (Multi-Utilities)Duke Energy Corp. (Electric Utilities)Duke Realty Corp. (Equity Real Estate Investment Trusts)DuPont de Nemours, Inc. (Chemicals)DXC Technology Co.* (IT Services)Eastman Chemical Co. (Chemicals)Eaton Corp. PLC (Electrical Equipment)eBay, Inc. (Internet & Direct Marketing Retail)Ecolab, Inc. (Chemicals)Edison International (Electric Utilities)Edwards Lifes

Pinnacle Financial Partners, Inc. (Banks) 1,679 147,148 . Banks) 1,191 681,050 Synovus Financial Corp. (Banks) 3,285 153,935 TCF Financial Corp. (Banks) 3,371 153,448 TFS Financial Corp. (Thrifts & Mortgage Finance) 1,057 20,675 The PNC Financial Services Group, Inc. (Banks) 9,370 1,751,722 . (liabilities), which includes any receivable for .