Transcription

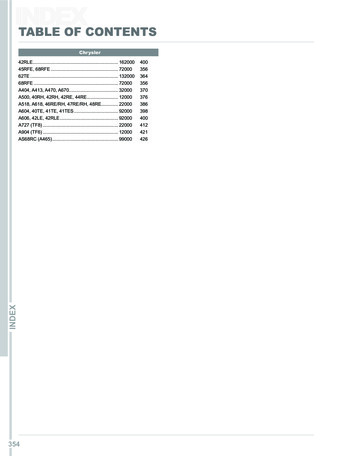

CATERPILLAR FINANCIAL SERVICES CORPORATIONTABLE OF CONTENTS AND FIGURES LISTP: Organizational Profile. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Figure P-1Figure P-2Figure P-3Figure P-4Figure P-5Figure P-6Figure P-71: Leadership. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6Figure 1-1Figure 1-2Figure 1-3Figure 1-4Figure 1-5Figure 1-6Figure 1-7Figure 1-82: Strategic Planning3: Customer and Market Focus4: Measurement, Analysis, and Knowledge ManagementMeasurement ArchitectureSources & Uses of Comparative DataInformation SystemsKnowledge Management Approaches. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Figure 5-1Figure 5-2Figure 5-3Figure 5-4Figure 5-56: Process ManagementCustomer Listening ApproachesCustomer Contact MechanismsCustomer Survey Approaches. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24Figure 4-1Figure 4-2Figure 4-3Figure 4-45: Human Resource FocusStrategic Planning ProcessStrategies and Action PlansPerformance Projections. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19Figure 3-1Figure 3-2Figure 3-330Compensation SystemsPerformance and DevelopmentProcess/Career ManagementTraining and Delivery MethodsHealth & Safety ErgonomicsEmployee Benefits and Services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36Figure 6-1Figure 6-2Figure 6-37: Business ResultsLeadership DirectionCommunication ProcessesCommunications PurposesOrganizational Performance Review ProcessesReview Findings and Action PlansLegal Regulatory Practices & MeasuresEthics SystemCommunity Involvement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14Figure 2-1Figure 2-2Figure 2-3Glossary1Divisions and DepartmentsProducts and ServicesCustomer RelationshipsBusiness Excellence ModelEmployee DemographicsSuppliers6 SigmaProcess StructureValue Creation ProcessSupport Processes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

P.1 ORGANIZATIONAL DESCRIPTIONa: Organizational EnvironmentP.1a1 Caterpillar Financial Services Corporation U.S. (CFSC) is thefinancial services business unit within Caterpillar Inc., the leading manufacturer of construction and mining equipment, gas and diesel engines,and industrial turbines. CFSC was initially incorporated in 1981 to financeforklift trucks. This vision expanded in 1985 to include financing forCaterpillar’s primary product lines. The company relocated from Peoria,IL to Nashville, TN in 1991.With total net finance receivables exceeding 14 billion, CFSC is thesecond largest captive-equipment lender following IBM Credit. CFSC hasgrown exponentially over the past decade by meeting the needs ofCaterpillar Users, Dealers, and Caterpillar Business Units (CatBUs).CFSC maintains a supplier-customer relationship with the other 26CatBUs who produce and market Cat products. CFSC complies withCaterpillar corporate policies and standards, but maintains separate Legal,Treasury, Accounting/Tax, Planning, Marketing, Information Technology,and Human Resources functions. CFSC issues commercial paper andmedium-term notes, and reports to the Securities and ExchangeCommission independently of Caterpillar.As illustrated in the Organization Chart, this Application describesCFSC operations based in the U.S. and serving U.S. Users and Dealers.These include four major Divisions which offer a wide range of financingalternatives for the complete line of Cat equipment and engines, includingSolar turbines, products equipped with Cat components, and new and usedrelated products sold through independent Caterpillar dealers. Figures P-1and P-2 describe CFSC and the products and services offered.CFSC serves three primary customer groups: the CatBUs, Dealers, andUsers of Cat equipment and engines. Figure P-3 illustrates how CFSC andCatBUs work together to serve Dealers who serve the User. Finance andlease contracts are long-term legal agreements between CFSC and theUser. Therefore CFSC maintains direct contact with users for many yearsafter the initial sale. Field-based Territory Managers (TMs) work withUsers and Dealers to promote CFSC products, while most processing iscentralized in Nashville.P.1a2 CFSC is on a never-ending journey to a clear destination: to achieveBusiness Excellence in all that we do. Business Excellence is CFSC’soverall business model (Figure P-4). It was developed by a crossfunctional team in 1996 and revised in 2001 to meet changing organizational and market needs.FIGURE P-2 CFSC Products serve a complete range of financing needsFinance TypeInstallment Sales Contracts 20% Finance Leases (non-tax)16%Tax Leases20% Dealer Loans8%Wholesale Financing17% Govt. Lease-Purchase Contracts 1%Business Excellence is more than just a slogan—it aligns all strategies,reviews, and daily decisions. In Business Excellence, CFSC has clearlydefined what we will be (Vision), what we will do (Mission), what webelieve (Shared Values), what we must achieve (Critical Success Factors,Strategy), and how we improve (6 Sigma). Business Excellence definesCFSC’s culture, in which empowered and motivated employees focus onimproving processes to serve internal and external customers.This integrated model incorporates the needs of CFSC’s key stakeholders: customers (Users, Dealers, and CatBUs), employees, our shareholder(Caterpillar), and the community. CFSC has determined the expectationsfor each of these groups. To Customers (Users, Dealers, and CatBUs), we must be anindustry leader in providing innovative financing alternatives. To our employees, we must provide strategic direction andpromote our Shared Values by making them a part of our daily lives. To our shareholders, we must add value to Caterpillar by offeringinnovative financing alternatives and by providing a reliable return. To our community, we must care for others in our workplace andour world.Shared Values define what we believe. In 1995, senior leaders commissioned an assessment, not to change the company culture, but to preservethe “magic” that sparked CFSC’s early success as it continued to grow.Focus groups were held where employees described what made CFSCsuccessful. Their thoughts and sentiments were distilled into a statement ofShared Values and documented in a hardbound book and video thatCFSC’s President personally gave to every employee. Today, newemployees receive the book and a replica of the Business ExcellenceFIGURE P-3 CFSC works with CatBUs and Dealers to meet User needs.CaterpillarBusiness UnitsFIGURE P-1: CFSC’s Divisions and Departments are diverse in size and scope.Managed # CustomersUnitAssets (# Contracts) ment financing and leasing for CAT users and Dealers in the U.S. All operations except salesare centralized in the Nashville Customer Business Center (CBC). Average transaction 125,000,with cycle time 1day.MarineDivision35Construction loans and financing of marine vessels powered by CAT engines. 750,000- 60 milliontransactions, typically conducted through shipyards and brokers. Cycle time 2- 12 months.14New Division established in 2002 financing non-marine power systems. Transactionsaverage 25,000 with cycle time, 3 days.GlobalDivision34Highly selective financing for Users and Dealers in higher risk and developing countries.Average transaction 100,000, cycle times average 1-2 months.SupportDepts.392Legal, Accounting, Human Resources, Information Technology, Treasury, Risk Management& Marketing, Remarketing, Business Excellence (Strategic Planning, 6 Sigma)PowerDivisionProprietary DataCaterpillar Financial Services I 1

FIGURE P-4 Business ExcellenceFIGURE P-5 Employee DemographicsVisionMissionCritical Success FactorsStrategy6 SigmaShared ValuesVisionWe will be a significant reason customers select Caterpillar worldwide.We will leverage our intellectual capital to deliver customer-drivensolutions and enhance shareholder value.We will grow on our strong foundation as a caring and learningorganization.MissionHelping Caterpillar and our customers succeed through financialservice excellenceCritical Success Factors Customer Satisfaction Growth Reliable Returns Employee Satisfaction Leadership World-class Core ProcessesShared ValuesWe are people of integrity who respect and care for others in ourworkplace and our world.We are driven by the freedom and responsibility toexceed expectations of those we work with and serve.pyramid with the Shared Values statement engraved in the base.CFSC defines six Critical Success Factors (CSFs) essential to accomplishing our Mission. They provide alignment and structure throughoutBusiness Excellence. Customer Satisfaction – We must delight our customers byunderstanding and exceeding their expectations. Employee Satisfaction – We must develop a more diverse, globalenvironment that encourages personal growth, rewardsachievement, and values each individual. Growth – We must invest our resources to increase averagemanaged assets. Leadership – We must demonstrate individual leadership inachieving our goals and living our Shared Values. Reliable Returns–We must consistently meet or exceed ourfinancial performance plans. World Class Core Processes–We must utilize 6 Sigma to establishCFSC as a world–class provider of financial solutions and toachieve operating efficiencies.Leaders, managers, and employees develop key business strategies andannual plans linked to these CSFs. The Performance and DevelopmentProcess (PDP) links every employee’s individual action plan to CFSC’sGenderMale: 50%Female: 50%PayrollNon-Exempt: 17% Exempt: 83%EducationPost Secondary Degree: 74%Graduate Degree: 15%annual plan for each CSF. The CFSC measurement architecture(Figure 4-1) continuously monitors performance in key areas.P.1a3 Figure P-5 describes CFSC’s 734 employees. They are highly educated with 74% holding post-secondary degrees and 15% holdingadvanced degrees. A diverse workforce is consistent with Shared Values.The employee base mirrors the Nashville community. As an internationalorganization, CFSC diversity considerations include full appreciation ofvaried cultures. Job diversity and career opportunities are evident withemployees in a wide range of disciplines including legal, financial,marketing, technology, and human resources, in addition to our lendingoperations. Contract employees are used on a limited basis, primarily intechnical disciplines such as Information Technology and Accounting,according to skills and availability.CFSC operates in a professional service industry, non-union officeenvironment. The CFSC compensation structure includes incentivecompensation for every employee and a benefits package described byMoney magazine as one of the Top 20 in the U.S. There are no specialsafety requirements for employees in our industry above OSHA standards,primarily those for ergonomics and building safety.Employee needs are systematically evaluated and job satisfaction ismeasured twice a year. Results, analyzed by employee demographic andprocesses, exceed national benchmarks in many areas.P1a4 Technology and Equipment: CFSC handles over 100,000 contractsmonthly. Users and Dealers demand accurate, timely, complete, andresponsive service. This requires substantial investment in leading-edgeinformation- management systems and hardware.Figure 4-3 describes the systems and applications that support CFSCemployees, Users, and Dealers. Every employee has a networked desktopor laptop PC. Our systems support over one million e-mails per week andover 225,000 phone calls per month. Most systems are available to off-siteemployees via dial-up or secure intranet portals.CFSC utilizes two primary loan and lease processing systems.FinancExpress is CFSC’s proprietary e-commerce solution and is used totransact most equipment financing. It gives Users, Dealers, and CFSCemployees varied access to the same information. Users and Dealers mayinitiate their own quotes, credit application, and documents 24/7.AccountExpress provides Users and Dealers the ability to access and maintain their account records online. A highly customized installation of thecommercially available InfoLease system provides a robust legacy systemthat is integrated with FinancExpress and supports CFSC’s back office functions. It is the primary system for the Marine, Global, and Power Divisions.FinancExpress provides automated approvals on loans with specifiedlimits. While automated credit scoring is common in lower-dollarconsumer lending, CFSC was among the first to deploy this technology forcommercial finance. Other specialized applications have been designed orpurchased for individual job requirements.CFSC has an extensive presence on the Internet and a sophisticatedtelephone system to help maintain customer relationships.CustomerExpress, CFSCs customer relationship management software(coming on line in 2003) provides employees and Dealers one convenientCaterpillar Financial Services I 2

portal to the full array of customer information. The CFSC intranet andpublic folders provide employees with wide access to company knowledgeand information. Comprehensive processes and metrics maintain andimprove these systems for maximum uptime.Facilities: In 2000, CFSC opened the 11-story Caterpillar FinancialCenter in Nashville. This state-of-the-art facility provides a comfortable,productive work environment and includes amenities such as an on-sitefitness facility, auditorium, cafe

11.10.2017 · P.1 ORGANIZATIONAL DESCRIPTION a: Organizational Environment P.1a1 Caterpillar Financial Services Corporation U.S. (CFSC) is the financial services business unit within Caterpillar Inc., the leading manu-facturer of construction and mining equipment, gas and diesel engines, and industrial turbines. CFSC was initially incorporated in 1981 to finance