Transcription

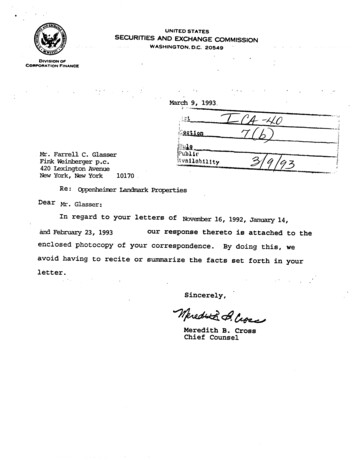

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWASHINGTON. D.C. 20549DIVISION OFCORPRATION FINANCEMach 9, 1993.:i .-. .;::t .,"" 'q,'" --., . ',",-- ri A- - OJ !lU tin,Mr. Farell c. GlasseFin Weinrger p.c.420 lexigton Avenæ, ; ,Ii,., 1 tl.1,4. i ti ! !.New York, New York 10170 .7(bJ./:r!if¡3, ,""Re : Opnhiir Lak PropiesDear Mr. Glasser:In regard to your letters of Noemr 16, 1992, Janua 14,änd Feb 23., 1993our response thereto is attached to theenclosed photocopy of your correspondence. By doing this, weavoid having to recite or sumrize the facts set forth in yourletter.Sincerely, Ø! Meredi th B. CrossChief Counsel. .;.,.1 ¡¡"¡

e Mach 9, 1993PU'RESPONSE OF THE OFFICE OF CHIEF COUNSELDIVISION OF CORPORATION FINANCERe: Oppenheimer Landmrk Properties (the "Partnership")Incoming letters dated November 16, 1992, January 14,and February 23, 1993On the basis of the facts presented, the Division will notrecommend enforcement action if the Liquidating Trust, assuccessor in interest to the Partnership, complies with theireporting obligations of Section 13 (a) of the Securities ExchangeAct of 1934 by filing Form 8-K and 10-K only. In reaching thisconclusion, we note particularly your representation that, inaddi tion to the events set forth in Items 1 through 4 of Form 8 K, the Liquidating Trust will file Form 8-K: (i) at such timeas it shall make any distribution of its assets to itsbeneficiaries; (ii).at such time as -a claim is åsserted by anyperson or entity involving the Liquidating Trust; (iii) at suchtime as a fee to the trustee or a material expense is paid; and(iv) at such time as a material event shall occur which event hasnot previously been disclosed on Form 8-K or 10-K. If theexistence of the Liquidating Trust is extended beyond three yearsfrom the date of its formtion, the Liquidating Trust shallrequest additional no-action assurance from the staff prior toany such extension.The Division of Investment Management has asked us to informyou that on the basis of the fa ts and representations in yourletter of Novemer 16, 1992, it would not recommend enforcementaction to the Commission under Section' 7 (b) of the InvestmentCompany Act of 1940 ("1940 Act") if the Partnership creates theLiquidating Trust for the sole purpose of liquidating thePartnershipi s assets, satisfying the Partnership's liabilities,and distributing the remaining assets without registering theLiquidating Trust under the 1940 Act in reliance on the exceptionfrom registration in Section 7 (b) for "transactions which aremerely incidental to the dissolution of an investmentcompany." 1/ Our position is based, particularly, on thefollowing representations: (1) the Liquidating Trust'sactivities will be limited to satisfying the Partnership'sliabilities or obligations, making liquidating distributions to1/ On Decemer 17, 1992, Farrell C. Glasser, counsel to thePartnership, stated in a telephone conversation with RichardF. Jackson of the Division's Office of Chief Counsel thatthe Liquidating Trust will rely on the exception fromregistration in Section 7 (b) .

the LiquidatingTrust beneficîaries, '. investingtheLiquidatingTrustl-;--äsSetsH-în sliorl:-ce-rm investments, 2.Tand taking Othersteps ne essary. to conserve and protect the Liquìdating Trust's .assets and provide for thè orderly liquidation of the LiquidatingTrust's assets; (2) the beneficial interests in the LiquidatingTrust will not be transferable except by operation of law or bywill or intestate succession; and (3) the Liquidating Trust willterminate at the .earlier of the distribution of all remainingassets of the Liquidating Trust or three years. from the date offormtion of the Liquidating Trust. á/Because these positions are based on the facts andrepresentations in your letters, any different facts orrepresentations may require a different conclusion. Moreover,this response expresses the Divisions' positions on enforcementaction only, and does not express any legal conclusions on thequestions presented.Sincerely, . Spècial Còunsel .' ,2/ You represent that the Liquidating Trust will invest inshort term certificates of deposit, "short term cashequivalent mutual funds, n or money market accounts. OnDecemer 18, 1992, Mr. Glasser stated in a telephoneconversion with Richard Jackson that the short term cashequivalent mutual funds would be money market funds.á/ You state that the three year period may be extended by upto 1/2 years if the trustee of the Liquidating Trustdetermines that additional time is required for all claimsor liabilities to be settled, but in no event would theLiquidating Trust exist for longer than 4 1/2 years.

FINK WEINBERGER p.c.(FINK WEERGER FRMA, BER, LOWE & FESTEIM, P.e.420 l.GTON AVE NE YORK, NE YORK 10170TEPHONE: (212) 949-8000 FAX: (212) 370-1367WRTE'S DIRECT DIA (212) 916-TE: 697169597t REeEiiF-D- 'l1933 Act/2(1)193 Act/2(3)1934 Ac/12(g)I 'NOV 1 9 1992 IiOrrV' ' ' G t,.;';,L. ',. . -. . CuhPf¡i?J\-:'fCii: .I-'.'- ":"I-' --"--""':'. '- ."';. '. ",,".193 Act/l2(h)193 Ac/13193 Act/14193 Act/15(d)1939 Act/30(a)(l)194.Act/3(a)'.' 1ft'Actf7(a). .194 Actl7(b)November 16, 1992VIA FEDERAL EXPRESSOffice of Chief CounselDivision of Corporation FinanceSecurities and Exchange Commission450 Fifth Street, N.W.Washington, D.C. 20549Off ice of Chief CounselDivision of Investment ManagementSecurities and Exchange Commission450 Fifth Street, N. W.Washington, D.C. 20549Re: Oppenheimer Landmark propertiescommission File No.: 0-7759Gentlemen:On behalf of our client, Oppenheimer Landmark Properties, aNew York limited partnership (the IIPartnership"), we respectfullyrequest that the Division of Corporation .F,inance and Division ofInvestment Management confirm that, on the :basis of the facts setforth below, they will not recommend enforcement action to theSecurities and Exchange Commission (the "Commission") if:(i) beneficial interests (the "Beneficial Interests") in aII ) are granted to theliquidating trust (the IILiquidating TrustManaging General Partner and the Limi ted Partners (hereinaftersometimes referred to as the "Beneficiaries") of the Partnershipwithout registration under the Securities Act of 1933, as amended(the "1933 Act");AN WBERGE p.c.11 MATI AVEWH Pl, NE YOR 10680 ZU SW(914) 682-7700(411) 261 15 55FAX (411) 261 15 IIFAX: (914) 68-8Z1MMEGA 16Ai-l.w56 NOlH BC AR17 El ST811 OlON AVEGRET NE NE YOR 11021AL, NE YORK 12270l, NE JE 07013(516) 482-6511(518) 432-7841FAX (518) 432-4267FAX (21) 614-0FAX (516) 48-618 .(21) 614-833

FINK WEINBERGER p.c.November 16, 1992Page 2(ii) the Liquidating Trust does not register the BeneficialInterests under the Securities Exchange Act of 1934, as amended(the "1934 Act"); . .(iii) the Liquidating Trust does not qualify an indenturerelating to the Beneficial Interests in the Liquidating Trust underthe Trust Indenture Act of '1939, as amended (the " 19 3 9 Act"); and. . ". . '.:." . . . .0. . . . e.".' : (í v) the,. 'Liqtd.dàt.ing Trust doeÈ; i: t );egiåtér uIid,er thè .Investment Company Act of 1940, as 'amended (the "1940 Act").I. BACKGROUND/The Partnership was formed on February 29, 1972 in order toacquire ownership of certain real property. During 1972, thePartnership registered under the 1933 Act 2,200 limited partnershipinterests (the "Units") which were offered and sold to the public.The units are presently registered under section 12 (g) of the 1934Act. The Units have never been traded publicly and transfers canonly be made with the consent of the Managing General Partner (the"Managing General Partner"). There is currently no market in theunits.In July, 1982, the Managing General Partner adopted a policyof liquidating the assets of the Partnership by disposing of theexisting real estate portfolio and distributing the net proceeds tothe partners. Dur ing 1992, the Partnership sold the last of thereal properties owned by it and subsequently made distributions toits partners with the result that the Partnership's sole assets nowconsist of cash and receivables.The Managing General Partner has determined that in accordancewi th the intent of section 26 of the Limited Partnership Agreementof the Partnership, dated February 29, 1972, as amended (the"Partnership Agreement"), a Liquidating Tr st should be funded withapproximately 450,000 in cash and/or recelvables as a reserve topay liabilities and/or obligations of the Partnership, whethercontingent or absolute. Information regarding the creation andoperation of the Liquidating Trust will be set forth in a letter tothe Limited Partners of the Partnership.On the date the remaining assets of the Partnership aretransferred to the Liquidating Trust, the Partnership's transferrecords wiii be closed. Simultaneously the Beneficiaries inexchange for their interests in the Partnership will be given aninterest in the Liquidating Trust in accordance with section 26 (d)of the Partnership Agreement on. the basis of their respectiveownership interest in the Partnership. On that date, thePartnership will file a certificate of cancellation, dissolving the

FINK WEINBERGER p.c.November 16, 1992Page 3Partnership. Upon completion of the foregoing steps thePartnership will no longer have any Limited Partners nor assets andwill file a Form 15 with the Commission to terminate theregistration of the Units under Section 12 (g) of the 1934 Act andcease filing periodic reports with respect thereto.The Liquidating Trust Agreement would contain cnstomary terms: . . . . . . o. . . . : . . . .ançi ':conçlit:ign;;': and woul.d h ly'e. the. ,follow.ing .,charaÐteristi,c .:. .'(i) The Managing 'General Partner and each LimitedPartner would become a beneficiary of the Liquidating Trust to theextent of their respective pro-rata interest in the Partnership.(ii) The trustee of the Liquidating Trust ("Trustee")would be the Managing General Partner of the Partnership.(iii) The Liquidating Trust's activities would consistof: (a) satisfying any liabilities or obligations of thePartnership which are not paid or otherwise discharged; (b) makingliquidating distributions to the Beneficiaries; (c) investing itsassets in short term certificates of deposit, short term cashequi valent mutual funds and/ or money market accounts; and (d)taking such other action as is necessary to conserve and protectthe assets of the Liquidating Trust and provide for the orderlyliquidation of the assets transferred to the Liquidating Trust.(iv) Beneficial Interests would not be transferableexcept by will, intestate succession, or operation of law and nocertificates representing such Beneficial Interests will be issued.(v) The Trustee would issue annual reports to theBeneficiaries showing the assets and liabilities of the LiquidatingTrust at the end of each calendar year and the receipts anddisbursements of the Trustees for the period. The annual reportwould also describe changes to the assets a( the Liquidating Trustduring the period and actions taken by the Trustee during theperiod. Such reports would be audited by the Liquidating Trust'soutside certified public accountants. The Trustee may also issueinterim reports to the Beneficiaries. These interim reports wouldbe issued whenever, in the opinion of the Trustee, a significantevent relating to the assets of the Liquidating Trust has occurred.(vi) The Liquidating Trust would terminate at theearlier of the distribution of all of the remaining assets, if any,to the Beneficiaries or 3 years from the date of formation of theLiquidating Trust, provided, however, that the Trust may beextended for an additional term of up to 1 1/2 years if in theopinion of the Trustee additional time is required for all claims. . .e.

FINK WEINBERGER p.c.November 16, 1992Page 4and/or liabilities to be settled. In no event would the Trustextend eyond 4 1/2 years.II. ISSUES. . . . e" . . .A. Benef;icial Interests in the Liquidating Trust may bedistributed without registration under the 193 Act and need not be, . :' :'" ',' ' i:eg.lstetec:.- ua er, the. '.i:93 ' .A t .:.;. ,:1 :' ,'. . '., . "., ,.' . :.':.":::.,'The registration' requirements of the 1933 Act are notapplicable because (i) the Beneficial Interests in the LiquidatingTrust are nontransferable and are therefore not a security withinthe definition of Section 2 (1) of the 1933 Act; and (ii) even ifthe Beneficial Interests in the Liquidating Trust are deemedsecurities, the distribution of the Beneficial Interests does notconstitute a sale within the definition of Section 2 (3) of the 1933Act, due to the fact that no new consideration is given for theBeneficial Interests and no new investment decision is required tobe made by the recipients of the Beneficial Interests, since theBeneficial Interests in the Liquidating Trust represent assetsalready owned by those holders. Although the Division ofCorporation Finance has not established a policy expressly adoptingeither of the above theories it has consistently stated that itwould not recommend enforcement action with respect to adistribution of similar beneficial interests, if such distributionwas not registered under the 1933 Act or the 1934 Act. See, Grubb& Ellis Realty Income Trust (available May 26, 1992); GraphicScanning Corporation (available August 2l, 1991); Lockwood BancGroup. Inc. (available December 19, 1990); JMB Realty Trust(available November 19, 1990) ; Enerqy Assets InternationalCor oration (available June 18, 1990); Federated Natural ResourcesCorp. (available July 13, 1989); Newhall Investment Properties(available September 21, 1988); ASI Communications. Inc. (availableMarch 12, 1987); Timber Realization CompanY (available June 15,1987); Invest-Tex. Inc. (available January 12, 1987) and DamsonOil Corp. (available April 26, 1985).with respect to registration under the 1934 Act, for thereasons stated above, the Liquidating Trust would not be the issuerof "equity securities" within the meaning of Section 12 (g) of the1934 Act. In addition, there is no need for the Beneficiaries toreceive the extensive disclosure mandated by the 1934 Act because(i) the Beneficial Interests will not be transferable, except underthe limited circumstances described above and (ii) its sole assetswill consist of cash and receivables and there will be no ongoingbusiness activities. Section 12 (h) of the 1934 Act allows theCommission to exempt an issuer from sections 12 (g), 13, 14 or 15 (d)of the 1934 Act if due to tne "numer of public investors", the"amount of trading interest in the securities," or "the nature or. e. .'

,.FINK WEINBERGER p.c,November 16, 1992Page 5extent of the acti vi ties of the issuer," such action would not be"inconsistent wi th the public interest or the protection ofinvestors. " The Division of Corporation Finance has taken a no-action position on the issue of 1934 Act registration ofliquidating entities, and has also taken a no-action position withrespect to 1934 Act reporting requirements, where, as in this case,the holders of interests in the liquidating entity receive annual:., . i,naricià,i, tatemeRt'S, 'and other :relev:a1't: informâti n. : .see.;" Grubb ,& .;: . " .":"Ellis'Realtv Income Trtis-t('''s1lp.r'a,; "GÒlPhiö 'Scanninq CorDora.t"îol\;' :'supra; Lockwood Banc GrouD, Inc., supra; JM Realtv Trust, supra;Enerqy Assets International CorDoration, supra; Federated NaturalResources CorD., supra; Newhall Investment ProDerties, supra; ASIcommunications, Inc., supra; Timber Realization ComDany, supra;Invest-Tex. Inc., supra; and Damson oil CorD., supra. .In contrast to the reporting issuers described in the Grubb &Ellis Realty Income Trust, JMB Realty Corp. and Timber RealizationCompany no-action letters where the liquidating trusts continued toown operating businesses on an ongoing basis and therefore thestaff required certain reports to be filed with the Commission, theLiquidating Trust will have no ongoing business activities apartfrom the responsibility of the Trustee to pay the debts andobligations of the Partnership. Therefore, we believe the filing ofreports with the Commission is not warranted. This position wasaccepted by the staff in the Graphic Scanninq Corporation no actionletter. However, as discussed above, the Liquidating Trust willprovide the Beneficiaries annually with the audited financialstatements.B. The Liquidating Trust need not qualify an indenturerelating to the interests in the Liquidating Trust under the 1939Act.We believe that the Liquidating Trust should not be requiredto qualify an indenture relating to the Beneficial Interests underthe 1939 Act because (i) for the reasons discussed above, theBeneficial Interests in the Liquidating Trust are not securitiesand, therefore, the 1939 Act is not applicable or (ii) even if theBeneficial Interests are deemed securities, they would fall withinthe exemption provided by Section 304 (a) (l) of the 1939 Act whichstates that the provisions of the 1939 Act do not apply to "anysecurity other than (A) a note, bond, debenture, or evidence ofindebtedness, whether or not secured, or (B) a certificate ofinterest or participation in any such note, bond, debenture, orevidence of indebtedness." The Benef icial Interests in theLiquidating Trust represent only a right to receive a portion ofthe assets held by the Liquidating Trust, and do not constitute anote, bond, debenture, or evidence of indebtedness as such termsare generally defined.

.FINK WEINBERGER p.c.November 16, 1992Page 6The Division of Corporation Finance has repeatedly stated itwould not recommend enforcement action if a liquidating trust doesnot qualify an indenture under the 1939 Act. See, Grubb & EllisRealty Income Trust, supra; Graphic Scanninq Corporation, supra;Lockwood Banc Group. Inc., supra; JMB Realty Trust, supra; EnerqyAssets International Cor oration, supra; Federated NaturalResources Corp., supra; Newhall Investment Properties, supra; ASI, Communications. Inc., .supra; Timber 'Realization. Company, supra;Invest-Tex. Inc., supra; and Damson oil Corp., supra.Act.C. The Liquidating Trust need not register under thp 1940The Liquidating Trust should not be required to register underthe 1940 Act. Since the sole purpose of the Liquidating Trust willbe to liquidate the trust assets, satisfy its liabilities anddistribute its remaining assets, followed by its immediatetermination, it should be exempt from the registration requirementsof the 1940 Act insofar as it is not pursuant to Section 3 (a) ofthe 1940 Act "engaged primarily . . . in the business of investing,reinvesting, holding or trading in securities" nor "engaged in thebusiness of . . . owning, holding, or trading in securities . . ." Even if the Liquidating Trust is held to be an investmentcompany for the purposes of Section 3 (a) of the 1940 Act, Sections7 (a) and (b) of the 1940 Act, which prohibit an investment companyfrom transacting business in ìnterstate commerce or offering to thepublic securities, unless the investment company is registeredunder the 1940 Act, are specifically not applicable to transactionsof an investment company which are merely incidental to itsdissolution. See, Grubb & Ellis Realty Income Trust, supra;Graphic Scanning Corporation, supra; Lockwood Banc Group. Inc.,supra; JMB Realty Trust, supra; Enerqy Assets InternationalCorporation, supra; Federated Natural Resources Corp., supra;Newhall Investment Properties, supra; ASI Communications. Inc.,supra; Timber Realization Company, supra; Invest-Tex. Inc., supra;and Damson oil Corp., supra.III. CONCLUSIONWe respectfully request that the staff of the Division ofCorporation Finance and the Division of Investment Managementconfirm to us that they will not recommend the Commission to takeaction against the Partnership or the Trustee if they form theLiquidating Trust and otherwise act as herein described. If forany reason you do not concur in any of the views expressed above,we respectfully request the opportunity to discuss the matter withyou before you issue any written response.

. (-II ,.FINK WEINBERGER p.c.November 16, 1992Page 7It is presently intended that the Partnership be dissolved onor before December 31, 1992 so that it will not have to incur thecost of preparing tax returns for the Partnership for 1993.Therefore, it is respectfully requested that we receiveconfirmation of our request by December 15, 1992.If you have any questions or require any further informationregarding this request, please call the undersigned at (212) 916 9784 or Elaine Moshe at (212) 916-9738. Pursuant to Release No.6269 under the 1933 Act, seven additional copies of this letter areenclosed.Very truly yours,FINK WEINBERGER p. c.By:/5/Farrell c. Glasser

.;. .,FINK WEINBERGER p.C.(FINK, WEBERGER, FRDMA, BERM, LOWE & FEST, P,q420 LEGTON AVE. NE YORK NE YORK 10170lEHONE: (212) 949.8000 FAX: (212) 370-1367o-nú) C"- TE: 6971695 '-9,C;, "\rn ".-n,.9.0 otAWRTE'S DIRECT DIA (212) 916. 9784ú'õ a-. -; "' rr gJanuary 14, 1993 .-?; "".\ ;: ("-VIA FEDERA EXPRESS MAIL STOP 3-13Securities and Exchange CommissionDivision of Corporation Finance450 Fifth street, N.W.Washington, D.C. 20549Attention: Meredith CrossChief CounselRe: Oppenheimer Landmrk properties (the "partnership")No Action Letter Reqúestfiled Novemer 17, 1992File No. 0-7759Dear Ms. Cross:This letter is being submitted to your office in responseto certain questions you have raised with Elaine Moshe of this Firmconcerning the referenced no action request (the "No-ActionRequest"). The def ined terms used herein have the same meanings asthose used in the No-Action Request.The No-Action Request describes a plan by which therewould be established a liquidating trust to be known as OppenheimerLandmark Properties Liquidating Tru.st (the "Liquidating Trust")which is intended to be the recipient of the remaining assets ofthe Partnership consisting of cash and recei vables. TheTrust would have no on-going business activities; itssole purpose would be to provide for the orderly liquidation of theremaining assets of the Partnership by paying liabilities and/orLiquidatingobligations of the Partnership and making distributions of theremaining assets to the Beneficiaries. In that regard, it is thepresent intention of the Trustee to make annual distributions tothe Beneficiaries. The Trustee believes that the first annualdistribution will be approximately 150,000.Fl WEER p.c.,11 MATI AVEWHITE PUJNS, NE YORK 106(914) 682-7700FAlt (914) 682-858Aamq-l.80 ZUCH, SWI56 NOR1l BOAR.17 EL sn811 aJON AVEGRET NECK NE YORK 11021Al, NE YORK 1227aJON, NE JE 07013('tll) 261 15 55(516) 482-6511('18) 432.781(201) 614-833FAX. (411) 261 15 11FAX. (516) 482-6318FAX: ('18) 't32-'t267FAX. (201) 61't-0ZlMMGAS 16

.I., rFINK WEINBERGER p:c,Securities and Exchange Commission14 ,1993JanuaryPage TwoAs part of the relief sought in the No Action Request itwas requested that the Liquidating Trust not be subject to thereporting requirements of the Securities Exchange Act of 1934.However, in view of the staff i s comments, the Trustee would agreeto file reports on Form 8-K and 10-K but requests for the reasonsdescribed below, that it not be required to file reports on Form10-Q.The Liquidating Trust will have no on-going businessactivities, its sole activities being to (i) receive interestincome resulting from the investment of the Liquidating Trust'sassets in short term certificates of deposit, short term cashequivalent mutual funds and/or money market accounts; and (ii) payany liabilities and/or obligations of the Partnership and theadministrati ve expenses of the Liquidating Trust. Because of thelimited activities in which the Liquidating Trust will engage andbecause it will be required to file reports on Form 8-X and 10-K wedo not believe a requirement to file reports on Form 10-Q wouldprovide any additional meaningful disclosure regarding thefinancial condition of the Liquidating Trust. Further, we believethat the cost of preparing such reports would be an unnecessaryexpendi ture .We hope this responds to your questions and requestconfirmation of our request at your earliest convenience.Very truly yours,FINK WEINBE GER p. c.By:FCG/rjcc: Richard Jackson, Esq,Off ice of Chief CounselDivision of Investment Management. xLFarrell C. Glasser

j ;r.FINK WEINBERGER p.c.(FIK, WENBERGER, FRMA, BER, LOWE & FESTElM, P.C)420 LEGTON AVE NE YORK NE YORK 101701EHONE: (212) 949-800 FAX: (212) 370-1367WRTER'S DIRECT DIA (212) 916,TE: 69716959784oFebruary 23, 1993V'0 -. 'P\. (" :; OO?3l- :: -r l"VIA FEDERA EXPRESS MAIL STOP 3-3'" Pi¡; õ:: :l Securities and Exchange CommissionDivision of Corporation FinanceChief Counsel's Office450 Fifth Street, N.W.Washington, D.C. 20549 ("o:. 0I-.- 7C -- pP. . c. g% ¡Attn: Anne M. Krauskopf, ExaminerRe: Oppenheimer Landmark properties (the"partnership") No-Action LetterRequest filed Novemer 17, 1992 asSupplemented by Letter dated January14, 1993File No. 0-7759Dear Ms. Krauskopf:This letter is in response to our telephone conversationof January 2l, 1992 in which you asked for certain clarificationconcerning the referenced no-action request (the "No-ActionRequest"). The def ined terms used herein have the same meanings asthose used in the No-Action Request.Pursuant to our discussions with the staff we herebywithdraw our request for a no action position with regard to theregistration requirements of the Securities Act of 1933, as amended(the "1933 Act") as they relate to the issuance of BeneficialInterests in the Liquidating Trust to the Managing General Partnerand the Limited Partners. We hereby modify our request for a noaction position with regard to the registration requirements of theSecurities Exchange Act of 1934, as amended (the "1934 Act"). Inthat regard, the Liquidating Trust as successor in interest to thePartnership requests relief from the requirement that it filereports with the Commission on Form 10-Q.fI WEERGE p.c.11 MATI AVEWH PI NE YORK 106(91") 682-7700FAX (9l-) 68"*58Aamc-lZlGA 1656 NO iiARGRT NE NE YOR 11021("11) 261 15 55FAX ("11) 261 15 11(516) -t-6511(518) "32-7&l(21) 61-l33FAX (516) -l:z318FAX: (518) .32.267FAX (21) 61.-480 ll 5W17. El STAL, NE YOR 1227811 CJ AVECU NE JE 0713

'.r. "FINK WEINBERGER p.c,and Exchange CommissionFebruary 23, 1993Page TwoSecuritiesFor the reasons discussed in our letter to you datedJanuary 14, 1993, we believe that compliance with the Form 10-Qreporting requirement will be an unnecessary expense for theLiquidating Trust. The Liquidating Trust will agree to file withthe Commission reports on Forms 8-K and 10-K. In that regard, inaddition to the events set forth in items 1 through 4 of Form 8-K,the Liquidating Trust will agree to file such reports: (i) at suchtime as it shall make any distribution of its assets to theBeneficiaries; (ii) at such time as a claim is asserted by anyperson or entity involving the Liquidating Trust; (iii) at suchtime as a fee to the Trustee or a material expense is paid; and(iv) at such time as a material event shall occur which event hasnot previously been disclosed on Forms 8-K or 10-K.If you have any questions or comments on the foregoing orrequire any additional information, please feel free to call theundersigned at the above number.1 Y YO#", tfF rrell C. GlasserMember of the FirmFCGlrjcc: Richard Jackson, Esq,Off ice of Chief CounselDi vision of Investment ManagementSecurities and Exchange Commission450 Fifth Street, N.W.Washington, D.C. 20549

equivalent mutual funds would be money market funds. á/ You state that the three year period may be extended by up. to 1/2 years if the trustee of the Liquidating Trust . Oppenheimer Landmark Properties, a New York limited partnership (the IIPartnership"), we respectfully