Transcription

Annual Report comps v3.indd, Spread 1 of 4 - Pages (8, 1) 3/17/06 9:56 AMOUR MISSIONAt Atlantic American, our insurance products and services arebacked by a solemn promise. A Promise of4 Financial security and protection for our clients4 Commitment and fairness to our agents4 Respect and opportunity for our employees and4 Increasing value and reward for our shareholdersWe are committed to bringing quality products to market whileproviding the best service at the lowest cost. We will remain flexibleand innovative so we are able to address the changing needs ofour customers.THE STRENGTH OF EXPERIENCEAtlantic American Corporation 4370 Peachtree Rd., NE Atlanta, GA 30319PHONE:(404) 266 5500 FAX:(404) 266 5702 www.atlam.com2 0 0 5A N N UA LR E P O R T

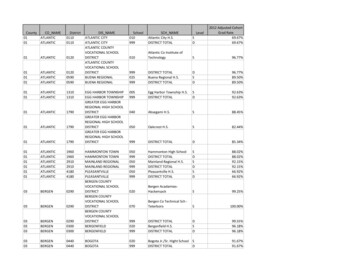

Annual Report comps v3.indd, Spread 2 of 4 - Pages (2, 7) 3/17/06 9:56 AMFinancial HighlightsDirectors & Principal OfficersYEARS ENDED DECEMBER 31,(In thousands, except per share data)1995Insurance premiums 43,3731996 86,0251997 88,6821998 2000Atlantic199991,292 107,594Directors 133,497 AmericanCorporation20012002145,589 154,499Investment income6,56611,15111,25611,49912,724Realized investment gains, net1,7311,5891,0762,9092,831J. Mack Robinson15,55214,31714,011Chairman,1,922 Atlantic American1,708 on H. Howell,124,321Presidentand CEO,152,258163,308170,245Atlantic American CorporationOther incomeTotal revenue51,67099,071101,215106,066Insurance benefits and losses incurred24,68954,28161,01860,84578,162Other 93,04497,363120,399Total benefits and expensesIncome before income taxes and unusual items3,084Income tax provision (benefit)(34)Net income (loss) (6,976) 3,164 8,033 The Honorable Edward E. Elson49,874 Former U.S.52,15958,033Ambassadorto the Kingdom of Denmark8,5583,922 10,910 Unusual items .15 (.54)1Net income (loss) (.39).32 (.23) .09.35 .35.37 .37.46Unusual items1.15 (.54) Tangible book value per common share 2 Common shares outstanding(.39)1.49.33 (.24) 18,679 .46.092.17.35 18,684.353.02.37 18,907.373.37.48 (.73)JohnG. Sample, Jr.12 Senior Vice President.10 and CFO(.63) 19,120.482.14 252,994 271,860 273,131 351,144Total debt 44,921 35,611 28,600 26,000 Total shareholders’ equity before accumulatedother comprehensive income 30,889 41,423 48,685 53,431Total shareholders’ equity after accumulatedother comprehensive income 46,478 59,136 78,183 82,21723 5.7%19.5%16.8%11.6% (.74)MichaelJ. Brasser.12 Vice President,.10Internal Audit(.64) 21,027245,4941 Janie L. RyanCorporate Secretary2.26 21,1572.49 21,2462.79253190,102195,794 21,3746,8445,0173,336 5,017 3,336.25 B. Deuben, .18 RobertJr.AssistantVicePresident,Corporate CommunicationsScott G. ThompsonPresident and CEO.25 .18.10 Robert J. FoskeyAssistant Vice PresidentProperty and Casualty ActuarialServices.26 .18 .10.10Katherine L. SloninaAssistantVice PresidentProperty and Casualty.26.18 Compliance .10Services3.30 21,1993.42 21,213 459,96751,000 46,500 56,238 53,238 51,488 71,112 76,420 78,948 15.1%Unusual items include the cumulative effect of an accounting change in 2002 and net losses from discontinued operations in 1996 and 1995.Excludes goodwill.Operating return on beginning equity is income from operations less realized gains divided by beginning of year total shareholders’ equity before accumulated other comprehensive income.Bankers Fidelity Life Insurance CompanyEugene ChoatePresidentGeorgia Casualty & Surety CompanyHilton H. Howell, Jr.President21,383470,51150,042Association Casualty Insurance CompanyDianne MorrisPresident3.11 Principal Insurance Subsidiariesand OfficersAmerican Southern Insurance CompanyCalvin L. WallChairman443,55244,000Dom H. WyantRetired Partner,Jones DayCasey B. HudsonAssistant Vice Presidentand Controller William H. Whaley, M.D.Georgia Medical & OncologyServices, L.L.C.President and CEO,4,3213,244American SouthernInsuranceCompany(319)(696)(92) 375,777 412,019 421,524ShareholderInformationAnnual MeetingMark C. WestChairman and CEO,Genoa Companies6,5256,844Barbara B. Snyder.12 Vice President,.10Human Resources.10 Operating return on beginning equityHilton H. Howell, Jr. .10Presidentand.10CEO.12Total assets3 James A. LynnVice President, Information Services Net income (loss)(15,816)AtlanticAmericanCorporationOfficers 3,6323,597 (12,215) Basic net income (loss) per common share:Income from operations3,601J. Mack RobinsonChairmanDiluted net income (loss) per common share:Income from operations3,597177,593Scott G. Thompson165,075185,781192,5508,033167,142 Harriett J. Robinson102,343113,077115,676Director,Delta Life Insurance62,73272,704 ,632138(10,094)147,50236010,910204Unusual items1109,109 2005D. Raymond Riddle9001,183and CEO,1,263Retired ChairmanNational Service Industries, Inc.8,5588,7037,611106,896154,7122004Samuel E. 1897,628 Harold K. Fischer4,7564,2533,103Retired President,Association 656Casualty InsuranceCompany1,124(498)7,815Income from operations2003Independent Registered PublicAccounting FirmAtlantic American’s annual meeting of 78,778 65,397 68,600 71,753 74,118shareholders will be held on Tuesday, May 2, Deloitte & Touche LLP2006, at 9:00 a.m. in the Peachtree Insurance Atlanta, Georgia83,240 78,540 86,893 88,960 80,003Center, 437087,526Peachtree Road,N.E., Atlanta,Legal CounselGeorgia. Holders3.3%3.3%of common stock4.1%of10.1%5.2%4.4%Jones Dayrecord at the close of business on March 17,Atlanta, Georgia2006, are entitled to vote at the meeting, andStock Exchange Listingall parties interested in Atlantic American areinvited to attend. A notice of meeting, proxy Symbol: AAMEstatement and proxy were mailed toTraded over-the-counter marketshareholders with this annual report.Quoted on the Nasdaq National MarketSystemTransfer Agent and RegistrarAtlantic American CorporationAttn: Janie L. Ryan, Corporate SecretaryP. O. Box 105480Atlanta, Georgia 30348-5480(800) 441-5001 or (404) 266-5532Additional InformationFor investors and others seeking additionaldata regarding Atlantic American Corporation,please contact Janie L. Ryan, Corporate Secretary,(800) 441-5001 or (404) 266-5532.Please visit our web site at: www.atlam.com

1996Casualty and1997Association19981999ContinuingREVENUE 107,59491,292 43,373 compared86,025 with 57.488,682GeorgiaCasualty, reported combined premiums of 60.2million in 2005Insurancepremiumsmillion in2004. Association Casualty’s premiums declined in 2005compared with6,566to 21.0 million11,15111,256Investmentincome 22.7 million in 2004. Pre-tax operating income however increased from 1.8 million in 2004 to n 2005. Whilethe net7.5% decline in premium levels is notable, the softening market, particularly306 in retaining 201Otherin incomeworkers compensation in Texas, has resulted in significant competitionamong carriersand growingtheir business. In the face of this competition DianneMorris and her99,071team have retained51,670101,215Totalrevenuetheir disciplined underwriting standards rather than price business at a level which does not sustain an24,68954,28161,018Insurance benefits and losses incurredacceptable return to Association Casualty. All of us are aware that had Hurricane Rita entered Galveston23,89736,975 Dianne and32,026OtherexpensesBayand impacted Houston, Association Casualty’s results couldhave been devastated.her teamare thereforecarefully reviewing their property exposuresas appropriate.91,256Georgia Casualty’s48,58693,044Totalbenefitsand expensespremiums grew to 39.3 million in 2005 from 34.7 million in 2004; the pre-tax operating loss3,0847,8158,171Income before income taxes and unusual itemsimproved only slightly from 6.3 million in 2004 to 5.9 million in 2005. Georgia Casualty is the204 seasons. The 138Incometax provision(benefit)Atlantic Americancompanywhich has borne the brunt of the last(34)two years’ hurricanemagnitudeof losses necessitated significant changes and that is whatsenior manage-8,0333,118occurred. From7,611Incomefrom operationsment changes to underwriting changes to expense reductions,no stone was left(4,447)unturned. Other(10,094)Unusual items1underwriting changes have also been made including the substantial reduction in policies with heavy (6,976) 3,164autoNetincomeand(loss)exposuresother lines in which we did not have criticalmass to effectivelyunderwrite. With8,033projections that the 2006 hurricane season will see another serious storm pattern, we have increasedour netcatastropheby in excessDilutedincomereinsurance(loss) perlevelscommonshare:of 70%. Further, in each of the last two years we havehad to pay close to 1.0 million in reinsurance reinstatement premiums. Accordingly, in 2006 we have .15 .32 .35Income from operationspurchased a pre-paid reinstatement at a cost of approximately 0.25 million.(.54)(.23)Unusual items 1Self-Insurance Administrators, our third party workers’ compensation administrators, continues (.39) .09 to meet the .35to Netincome(loss) with a 33.5% increase in pre-tax operatingproducesolid resultsincome. Workinghardhigh level expectations of their clients, Self-Insurance Administrators focuses on outstanding,personalized customer service.Basic net income (loss) per common share:There is no doubt that 2005 was a challenging year. Despite all the difficulties associated with the .15 .33 .35Income from operationsstorms of 2004 and 2005, the insurance companies comprising Atlantic American have never been1(.24) While weUnusualitems in our respective markets, with our agents and(.54)better positionedwith our policyholders.(.39)implemented, .09 decrease our .35the (loss)weather, our new underwriting posture, once fullywillcan’tNetpredictincomepotential for losses from catastrophic storms in 2006. With a little luck the hard work of 2005 shouldpay off with much improved operations in 2006. 1.49 2.17 3.02Tangible book value per common share 2We appreciate your understanding and more importantly your continued support.18,67918,68418,907Common shares outstanding Total assets 245,494 252,994 271,860 273,131Total debt 44,921 35,611 28,600 26,000Operating return on beginning equity3 2002145,589 2003154,499 154,7122004 2005 Earned Premiums2005170,860 0170,245163,3081458,558 8,55801 02 03185,0851,172 10,91004 05 3,632 3,597(498)(319)3,601(15,816) (12,215) 5,0176,844 5,01762.9%Property &Casualty(7,465)(696)6,84437.1%Life & Health(4,290)Life and HealthEarned Premiums(3,175) (3,175)4.4%OtherSupplementalHealth17.6%Lifeamounts in thousands .37 .46 .12 .10 .10 (.73).25 .18 (.21) .46 .12 .10 (.63) .25 .18 (.21).37 .48 .12 .10 .10 .26 .18 (.21)MARKETCAPITALIZATION .37 3.37 19,1203,244 .37(.74).48 .12 .10 (.64) .26 .18 (.21)2.14 2.26 2.49 2.79 3.30 3.42 3.0021,02721,157 351,144 375,777 412,019 421,524 443,552 470,511 460,417 51,000 44,000 50,042 56,238 53,238 plementProperty and CasualtyEarned Premiums7.3 %Other21,38326.3%22.7%Auto LiabilityProperty20.2%5.7% 41,42359,13619.5% 48,68578,18316.8% 0153,43182,21711.6%02 03 71,11257.7346,478 65.76 30,88963.60 34.84Total shareholders’ equity after accumulatedother comprehensive income 133,497200136646.74Total shareholders’ equity before accumulatedother comprehensive income200011,499190,1021995(In thousands,exceptper shareOur regionalpropertyand data)casualty operations, comprisedof78,94815.1%04 05 76,42083,2403.3% 78,77887,5263.3% 65,39778,5404.1% 68,60086,89310.1% 71,75388,9605.2% ionAutoPhysicalDamage5.0%amounts in MILLIONSons in 1996 and 1995.2Excludeseholders’Hilton H. Howell, Jr.President and CEOgoodwill.equity before accumulated other comprehensive income.J. Mack RobinsonChairman of the BoardAtlantic American is an insurance holding company whosesubsidiary companies are involved in well-defined specialty marketsof life, health, property and casualty insurance industries.Visit our web site atwww.atlam.com

3.303.423.002.790405Our balancesheet remainsconservative.Bankers Fidelity, our life and health subsidiary, completed another very successful year. Pre-taxTotalshareholders’equityoperating income was 5.8 million in 2005 compared with 5.4 million for 2004 and premiumsincreased nominally from 65.4 million in 2004 to 65.9 million in 2005. Changes from the federalgovernment in the Medicare program, especially the advent of the new Medicare Part D drug benefit,slowed the sale of our traditional Medicare Supplement products. In response to the changes toMedicare, we teamed with Medco Health Solutions to offer our YOURx PLANTM Prescription Drugcoverage. Additionally, the company has continued to focus on generating new life insurance sales andis developing various approaches to a variety of groups and small businesses. Under the leadershipof Gene Choate, we look forward to another profitable year with a return to more appreciablegrowth in 2006.American Southern and American Safety, our specialty property and casualty insurancecompanies, produced another exceptional year. Pre-tax operating income for 2005 was 8.5 million,a 14.7% increase, over the 7.4 million in 2004. Premium growth was a moderate 7.0% increasingfrom 48.1 million in 2004 to 51.4 million in 2005. Under the leadership of Calvin Wall and ScottThompson, American Southern has most recently been successful in building a quality block of suretybusiness. Earned surety premiums in 2003 and 2004 were 0.4 million and 4.0 million, respectively;whereas in 2005 such premiums totaled 8.3 million. The company’s unique underwriting approachcoupled with experienced and motivated agents has combined to create a quality operation of whichwe are extremely proud.80,453On a consolidated basis, for the year ended December 31, 2005, premium revenue increased 3.9%from 170.9 million in 2004 to 177.6 million in 2005. Approximately half of that growth originatedfrom American Southern, while the other half was in the regional property casualty operations, consistingof Association Casualty and Georgia Casualty. Due to the automobile industry impairment chargementioned above, total revenues declined 2.6% from 190.1 million in 2004 to 185.1 million in 2005.Specifically, realized investment losses in 2005 were 10.5 million compared to realized investment gainsof 2.2 million in 2004. Operating income, defined as pre-tax income excluding realized investmentgains and losses, increased 41.0% from 2.1 million in 2004 to 3.0 million in 2005 even though for2005 we posted a net loss of 3.2 million, or 0.21 per share compared to net income of 5.0 million,or 0.18 per share in 2004.0388,960The hurricanes and investment impairment charge obscured the outstanding results of our remaininginsurance operations. Of particular note was American Southern’s record operating profits in 2005and a significant increase in operating profits over preceding years by Association Casualty, whichwas only minimally impacted by Hurricane Rita. Bankers Fidelity also turned in another extremelysuccessful year.0286,893The write down of the value of our holdings in General Motors, General Motors Acceptance Corporationand Ford Motor Credit was not only significant but disappointing. We believe that ultimately someportion of these holdings, particularly those of General Motors Acceptance Corporation, will reboundin value.0178,540It is times suchas these thatthe value ofthe insuranceyou buy andthe carrier youchoose becomesso apparent.During 2005, we engaged consultants to assist us in preparation for our SarbanesOxley Section 404 compliance. That effort is now close to completion. To date,the costs of our consultants alone have exceeded 1.0 million and have requiredsubstantial amounts of time from our management team and from our Board ofDirectors. Additionally, our annual audit costs have been rising dramatically.Although we appreciate our brief association with Deloitte & Touche, uponevaluation and after much discussion, we concluded that a change in auditors was necessary. TheAudit Committee of the Board of Directors has approved the change and effective the first of April2006 our new auditors will be BDO Seidman.Taxablebook valueper share2.49After “weathering” four devastating hurricanes in Florida in 2004, we started the year optimisticthat 2005 had to be better in terms of catastrophes. We were wrong. Once again, MotherNature wreaked havoc with the U.S. Gulf Coast and with our financial results. Despitebeginning a significant re-underwriting of our commercial property book at the beginning of theyear, the unprecedented onset of the 2005 season in June, and especially Hurricanes Dennis, Rita andWilma, resulted in fairly significant losses; but they were nothing compared to Hurricane Katrina,which became the single costliest catastrophe in Atlantic American’s history. That being said, ourlosses paled next to those of our customers, many of whom lost their homes, their businesses, and inmany cases their friends and family members. Our thoughts and prayers go out to all those whohave lost so much to these devastating storms. It is times such as these that the value of the insuranceyou buy and the carrier you choose becomes so apparent. We believe that the value of our policies andthe quality of our service is now readily apparent to all of our customers and agents, especially those inMississippi. As a group of regional carriers, we pride ourselves on being close to our policyholders andagents, allowing us to respond more quickly than the sometimes lumbering giants of our industry—andrespond quickly we did. Following Hurricane Katrina, we were the first company with “boots on theground” in Mississippi and quickly began getting our policyholders and agents back on their feet andback in business. As soon as danger had passed, we set up a temporary claims office in the WTOK TVbuilding in Meridian, Mississippi. We would like to thank Tim Walker, the General Manager ofWTOK, a Gray Television station, for opening his facility to us as it was critical in getting our claimsadjusting process up and running so quickly. This rapid response—long before there was electricity,gasoline, and telephone or cell service—is clearly valued by our policyholders, but it has also proved itsworth to us as we were able to establish legitimate reserves based on actual physical inspections, notestimates or inaccurate industry models. Consequently, over 90% of our claims from Hurricane Katrinahave been settled. The remainder should close as soon as rebuilding is complete. Fortunately, we hadpurchased significant reinsurance protection which was critical in helping Atlantic American’s insurancecompanies honor their promises to their policyholders and protect our balance sheet at the same time.Our balance sheet remains conservative. As of December 31, 2005, cash and investments aggregatedapproximately 318.7 million and comprised approximately 69% of our total assets which is consistentwith our totals at December 31, 2004. At December 31, 2005, approximately 85% of our investmentsare in fixed maturity and/or short term investments and the bond portfolio includes 90% investmentgrade securities, primarily U.S. Treasury and agency securities. Receivables totaled 95.0 million atDecember 31, 2005 or 20.6% of total assets as compared to 110.0 million at December 31, 2004 or23.4% of total assets. Increased emphasis on collecting balances due from reinsurers, agents andcustomers has resulted in the reduction. While our debt obligations reflect a decline in balances outstanding at December 31, 2005 in comparison with year end 2004, we borrowed an additional 3.0million on February 28, 2006. The purpose of the borrowings was to contribute additional capital toour regional property and casualty operations. Furthermore, subsequent to December 31, 2005, wealso executed a “no cost collar” to limit the impact of rising interest rates on our variable rate debt.The collar effectively fixes the LIBOR component of the interest rate on approximately 35% of theCompany’s debt for a seven year period with LIBOR at a rate of not less than 4.77%, but not greaterthan 5.85%. This agreement should provide some protection against increasing debt costs in theevent that interest rates continue to rise, but likewise, could prove costly if rates drop precipitously.Barring something truly significant such as another terrorist attack comparable to September 11th, webelieve the former to be more likely than the later.87,526To Our Atlantic American Shareholders:0102030405amounts in thousands

3.303.423.002.790405Our balancesheet remainsconservative.Bankers Fidelity, our life and health subsidiary, completed another very successful year. Pre-taxTotalshareholders’equityoperating income was 5.8 million in 2005 compared with 5.4 million for 2004 and premiumsincreased nominally from 65.4 million in 2004 to 65.9 million in 2005. Changes from the federalgovernment in the Medicare program, especially the advent of the new Medicare Part D drug benefit,slowed the sale of our traditional Medicare Supplement products. In response to the changes toMedicare, we teamed with Medco Health Solutions to offer our YOURx PLANTM Prescription Drugcoverage. Additionally, the company has continued to focus on generating new life insurance sales andis developing various approaches to a variety of groups and small businesses. Under the leadershipof Gene Choate, we look forward to another profitable year with a return to more appreciablegrowth in 2006.American Southern and American Safety, our specialty property and casualty insurancecompanies, produced another exceptional year. Pre-tax operating income for 2005 was 8.5 million,a 14.7% increase, over the 7.4 million in 2004. Premium growth was a moderate 7.0% increasingfrom 48.1 million in 2004 to 51.4 million in 2005. Under the leadership of Calvin Wall and ScottThompson, American Southern has most recently been successful in building a quality block of suretybusiness. Earned surety premiums in 2003 and 2004 were 0.4 million and 4.0 million, respectively;whereas in 2005 such premiums totaled 8.3 million. The company’s unique underwriting approachcoupled with experienced and motivated agents has combined to create a quality operation of whichwe are extremely proud.80,453On a consolidated basis, for the year ended December 31, 2005, premium revenue increased 3.9%from 170.9 million in 2004 to 177.6 million in 2005. Approximately half of that growth originatedfrom American Southern, while the other half was in the regional property casualty operations, consistingof Association Casualty and Georgia Casualty. Due to the automobile industry impairment chargementioned above, total revenues declined 2.6% from 190.1 million in 2004 to 185.1 million in 2005.Specifically, realized investment losses in 2005 were 10.5 million compared to realized investment gainsof 2.2 million in 2004. Operating income, defined as pre-tax income excluding realized investmentgains and losses, increased 41.0% from 2.1 million in 2004 to 3.0 million in 2005 even though for2005 we posted a net loss of 3.2 million, or 0.21 per share compared to net income of 5.0 million,or 0.18 per share in 2004.0388,960The hurricanes and investment impairment charge obscured the outstanding results of our remaininginsurance operations. Of particular note was American Southern’s record operating profits in 2005and a significant increase in operating profits over preceding years by Association Casualty, whichwas only minimally impacted by Hurricane Rita. Bankers Fidelity also turned in another extremelysuccessful year.0286,893The write down of the value of our holdings in General Motors, General Motors Acceptance Corporationand Ford Motor Credit was not only significant but disappointing. We believe that ultimately someportion of these holdings, particularly those of General Motors Acceptance Corporation, will reboundin value.0178,540It is times suchas these thatthe value ofthe insuranceyou buy andthe carrier youchoose becomesso apparent.During 2005, we engaged consultants to assist us in preparation for our SarbanesOxley Section 404 compliance. That effort is now close to completion. To date,the costs of our consultants alone have exceeded 1.0 million and have requiredsubstantial amounts of time from our management team and from our Board ofDirectors. Additionally, our annual audit costs have been rising dramatically.Although we appreciate our brief association with Deloitte & Touche, uponevaluation and after much discussion, we concluded that a change in auditors was necessary. TheAudit Committee of the Board of Directors has approved the change and effective the first of April2006 our new auditors will be BDO Seidman.Taxablebook valueper share2.49After “weathering” four devastating hurricanes in Florida in 2004, we started the year optimisticthat 2005 had to be better in terms of catastrophes. We were wrong. Once again, MotherNature wreaked havoc with the U.S. Gulf Coast and with our financial results. Despitebeginning a significant re-underwriting of our commercial property book at the beginning of theyear, the unprecedented onset of the 2005 season in June, and especially Hurricanes Dennis, Rita andWilma, resulted in fairly significant losses; but they were nothing compared to Hurricane Katrina,which became the single costliest catastrophe in Atlantic American’s history. That being said, ourlosses paled next to those of our customers, many of whom lost their homes, their businesses, and inmany cases their friends and family members. Our thoughts and prayers go out to all those whohave lost so much to these devastating storms. It is times such as these that the value of the insuranceyou buy and the carrier you choose becomes so apparent. We believe that the value of our policies andthe quality of our service is now readily apparent to all of our customers and agents, especially those inMississippi. As a group of regional carriers, we pride ourselves on being close to our policyholders andagents, allowing us to respond more quickly than the sometimes lumbering giants of our industry—andrespond quickly we did. Following Hurricane Katrina, we were the first company with “boots on theground” in Mississippi and quickly began getting our policyholders and agents back on their feet andback in business. As soon as danger had passed, we set up a temporary claims office in the WTOK TVbuilding in Meridian, Mississippi. We would like to thank Tim Walker, the General Manager ofWTOK, a Gray Television station, for opening his facility to us as it was critical in getting our claimsadjusting process up and running so quickly. This rapid response—long before there was electricity,gasoline, and telephone or cell service—is clearly valued by our policyholders, but it has also proved itsworth to us as we were able to establish legitimate reserves based on actual physical inspections, notestimates or inaccurate industry models. Consequently, over 90% of our claims from Hurricane Katrinahave been settled. The remainder should close as soon as rebuilding is complete. Fortunately, we hadpurchased significant reinsurance protection which was critical in helping Atlantic American’s insurancecompanies honor their promises to their policyholders and protect our balance sheet at the same time.Our balance sheet remains conservative. As of December 31, 2005, cash and investments aggregatedapproximately 318.7 million and comprised approximately 69% of our total assets which is consistentwith our totals at December 31, 2004. At December 31, 2005, approximately 85% of our investmentsare in fixed maturity and/or short term investments and the bond portfolio includes 90% investmentgrade securities, primarily U.S. Treasury and agency securities. Receivables totaled 95.0 million atDecember 31, 2005 or 20.6% of total assets as compared to 110.0 million at December 31, 2004 or23.4% of total assets. Increased emphasis on collecting balances due from reinsurers, agents andcustomers has resulted in the reduction. While our debt obligations reflect a decline in balances outstanding at December 31, 2005 in comparison with year end 2004, we borrowed an additional 3.0million on February 28, 2006. The purpose of the borrowings was to contribute additional capital toour regional property and casualty operations. Furthermore, subsequent to December 31, 2005, wealso executed a “no cost collar” to limit the impact of rising interest rates on our variable rate debt.The collar effectively fixes the LIBOR component of the interest rate on approximately 35% of theCompany’s debt for a seven year period with LIBOR at a rate of not less than 4.77%, but not greaterthan 5.85%. This agreement should provide some protection against increasing debt costs in theevent that interest rates continue to rise, but likewise, could prove costly if rates drop precipitously.Barring something truly significant such as another terrorist attack comparable to September 11th, webelieve the former to be more likely than the later.87,526To Our Atlantic American Shareholders:0102030405amounts in thousands

1996Casualty and1997Association19981999ContinuingREVENUE 107,59491,292 43,373 compared86,025 with 57.488,682GeorgiaCasualty, reported combined premiums of 60.2million in 2005Insurancepremiumsmillion in2004. Association Casualty’s premiums declined in 2005compared with6,566to 21.0 million11,15111,2

autO phySiCal Damage 11.2% liability 22.7% prOperty 17.6% life 78% meDiCare Supplement 37.1% life & health 62.9% prOperty & CaSualty 4.4% Atlantic American is an insurance holding company whose subsidiary companies are involved in well-defined specialty markets of life, health, property and casualty insurance industries. Visit our web site at