Transcription

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USAMilitary Software Black-Scholes Pricing Model:Value of Software Option and VolatilityWu Qin, Zhang YadiAbstract—The idea of real option is applied in militarysoftware pricing in this paper. By analysis of Black-Scholespricing model, we figure two crucial variables. One is value ofsoftware option that is regarded as estimated cost in our study.We give the logical analysis based on the option feature ofestimated cost and also the practical test by building up asystem of equations. The other one is the volatility whose valuecan be estimated with the method of Monte Carlo analogy.Finally, the application of this military software pricing modelis demonstrated in a real case.In the theoretical researches on pricing, with the mostapplication value is option pricing model. And the classicalone is Black-Scholes model.C r (T t )(3)Vt X t N ( d1 ) KeN (d 2 )ln( X t / K ) ( r / 2)(T t )2d1 where T td 2 d1 T t(4)(5)CKeywords- military software pricing; Black-Scholes model;price; estimated cost; value of software option; volatility; MonteCarlo analogyI.INTRODUCTIONAs a representative product of the information age,military software has attracted more attention, whether itsdevelopment process or its cost estimation. And among theseaspects of software, the research of cost estimation hasshaped well-developed system. For example, the mostpopular software cost estimation model is COCOMO Ⅱ(Constructive Cost Model Ⅱ ), whose key variable isKSLOC (Thousands of Source Lines of Code). Here are theworkload equations.17PM A ( KSLOC ) EM iE(1)i 15E B 0.01 SFj(2)j 1PM means person-months, EM means effort multiplierand SF means scale effect. There are 17 EM indexes and 5SF indexes. All the cost indexes are divided into 6 grades asfar as their effects to PM are concerned, which are “verylow”, “low”, “nominal”, “high”, “very high”, and “extrahigh”. The numerical value of each effect has been tested byBarry W. Boehm’s work team. The total cost of militarysoftware is the result of multiplication of the workload andunit cost [1].But the estimated cost is not equal to the factual cost ofsoftware, and not regarded as the real price of software. Sowe want to find the hidden relationship between estimatedcost and real price, and apply the relationship to militarysoftware pricing. This is the new approach to militarysoftware pricing.ISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)and Vt means the t -time value of a call option on theunderlying asset with price X t , K means the exercise priceat the mature time T in the future, r means the risk-free rateof return, means volatility of underlying asset and N (.)means the standard Normal distribution function [2].Using the Black-Scholes model in military softwarepricing, we should solve two problems.The first problem is how to redefine the variables of theBlack-Scholes model, and explain the relationship betweenthe variables and price of software reasonably. There aresome successful applications of the real options, and relatedresearches give the detailed analysis about feasibility andlogical relationship. For example, study of enterprises humanresources value measurement proposes the method based onreal options such as Black-Scholes model, and in this study,variable X t expresses discounted present value of expectedcash flow and K expresses related cost [3]. Learning fromthis idea, we will analyze factors related to military softwarepricing and the relationship according to Black-Scholesmodel. In other words, we help the original variables find theexact position in this special situation that is militarysoftware pricing.The second problem is concrete analysis of some specialvariables. During the process of redefinition and solution,there are two kinds of variable. One is that we cannot giveclear definition directly. Firstly, we will assume its definitionand get the result. Secondly, we try to find a solution that canavoid the effect of this factor and can also account the priceof software. Thirdly, by comparison and analysis we provethe accuracy of previous hypothesis. The other kind is whathas no objective value but has clear definition. So we applyanother method to account its value. In this way, we can getthe complete definition of Black-Scholes model for militarysoftware.WCECS 2010

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USAII.III.MODELINGA. Conformation of the military software pricing modelFirstly, we study the option features of military softwarepricing.In this study, our standpoint is the military. It means thisoption pricing method can become one of the objectiveparameters for military software pricing so that the militaryhas the initiative during the negotiations with softwaredevelopment organizations. And there is one important viewthat military software is not regarded as a product no longerbut as a research and development project. It is because ofthe characteristics of military software such as its high-techand high-risk. So the price of military software has largeruncertainty, and the military has the right to postpone thesoftware development in order to solve some uncertainty atthe moment. Or other, the monopoly and expected returnuncertainty determine that the owners or users can wait forthe environment improvement and postpone development[4]. We suppose it as the software option, and apply theoption pricing model to calculate the real price of militarysoftware. Accordingly, it has similar property with the realoptions, and what as description can be regarded as calloption, future cash flow that is price of military software isthe underlying asset, period of development is the maturetime, and actual cost is the exercise price.Secondly, we give the military software pricing modelbased on Black-Scholes model. r V SN ( d1 ) Ce N ( d 2 )(6)ln( S / C ) ( r / 2) 2whered1 (7)(8)d 2 d1 Combined with the actual needs of military softwarepricing, we redefine the variables of this model based ontheir original meanings.V --value of software optionS --price of softwareC -- cost of software developmentr -- risk-free rate of return -- volatility of software price -- period of software developmentN (.) -- the standard Normal distribution functionB. Declaration of variablesAs shown in the key equation (6), there are five factorsthat will influence the calculation result of software pricedirectly. In order to solve the model, we should clear theirvalues above all. Among these variables, cost is actual costthat is accumulated by the process of software development,and in practice it can be provided as initial data. And theperiod is as well. We always take the interest on treasurybills as the risk-free rate in the model. There are twovariables left that we should pay more attention on: softwareoption value and volatility.ISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)ANALYSISA. Analysis of software option valueBy the analysis during conformation of the pricingmodel, we can notice that software option is similar topostponement option which is one kind of real options. Andin research of real options pricing, this option is alwaysregarded as embedded option and the value of which isregarded as embedded value of underlying asset. By thepractical idea, it makes sense that value of software option isembedded value that can be taken as incomplete price, andwe consider the estimated cost of software. Like what isaccounted by COCOMOⅡ, the estimated cost of software isof two characteristics. Firstly, it is based on SDLC (SoftwareDevelopment Life Cycle). This fits the viewpoint in ourstudy that military software is a research and developmentproject. Secondly, estimated cost includes the estimation offund, time, human resource and other related aspects. And itis similar with opportunity cost of software development.This cost provides the reason that the military decide topostpone the software project or not. If the actual cost islarger than the estimated cost at some stage, this project maybe postponed. If the actual cost is lower than the estimatedcost all the stage, this project may be implemented asplanned. In this sense, the estimated cost is similar to the realoptions that decide whether to proceed with real investment.In this way, the variable V in the pricing model (6) canbe supposed as estimated cost of software. And it establishesin theory on the basis of the previous analysis. But we needmake it clear in practical term especially in demonstration.The idea is that we build up a system of equations tocalculate the result when value of variable V is regarded asunknown, and this is one result. We can also get anotherresult after substituting the estimated cost, which isaccounted already, in the pricing model. By comparing thetwo results, we can prove the accuracy of the hypothesisabove.Because the method is based on option pricing model, weconsider another kind of option pricing model that isbinomial tree. The military software pricing model based onbinomial tree has been proposed in Wu Qin’s research [1],and we only quote the result as equation (9).MV5 p1 p2 p3 p4 p5q4 (1 rt5 )p4 (1 rt1 )(1 rt 2 )(1 rt3 )(1 rt 4 )(1 rt5 )p5( c1 c2 c3 c4 ) q2 (1 rt3 )(1 rt 4 )(1 rt5 )p2p3 p4 p5MV0 q3 (1 rt 4 )(1 rt5 )p3(c1 c2 ) p4 p5q5p5(c1 c2 c3 c4 c5 )(c1 c2 c3 )q1 (1 rt 2 )(1 rt3 )(1 rt 4 )(1 rt5 )p1p2 p3 p4 p5c1(9)And MV5 means price of software, MV0 means value ofsoftware option, r means risk-free rate. Of stage i( i 1, 2, , 5 ), time is ti , cost is ci , success probability orfailure probability is pi or qi ( pi qi 1 ). And in (9), onlyWCECS 2010

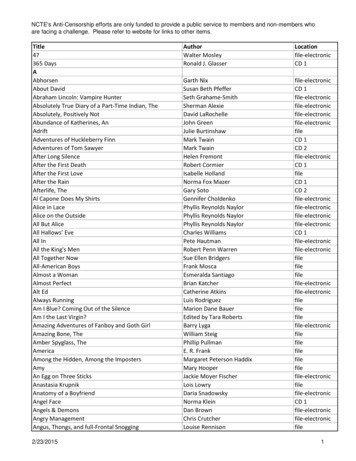

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USAtwo variables MV5 and MV0 are unknown. For consistency,we can get another form of (9).S mV n(1 rt1 )(1 rt 2 )(1 rt3 )(1 rt 4 )(1 rt5 )m p1 p2 p3 p4 p5n q5p5 (c1 c2 c3 c4 c5 ) q3 (1 rt 4 )(1 rt5 )p3p4 p5(c1 c2 ) q4 (1 rt5 )p4(c1 c2 c3 ) p5p2 p3 p4 p5(11)( c1 c2 c3 c4 )q2 (1 rt3 )(1 rt 4 )(1 rt5 )p2q1 (1 rt 2 )(1 rt3 )(1 rt 4 )(1 rt5 )p1(10)p 3 p 4 p5c1(12)By equation (6), (7), (8), (10), (11), (12), we can get asystem of equations of two unknowns (13). r V SN ( d1 ) Ce N ( d 2 ) S mV n ln( S / C ) ( r 2 /2) d1 d 2 d1 (1 rt1 )(1 rt2 )(1 rt3 )(1 rt4 )(1 rt5 ) m p1 p2 p3 p4 p5 qq (1 rt5 ) n 5 ( c1 c2 c3 c4 c5 ) 4( c1 c2 c3 c4 )p4 p5 p5 q3 (1 rt4 )(1 rt5 ) ( c1 c2 c3 ) q2 (1 rt3 )(1 rt4 )(1 rt5 ) p3p3 p4 p5p4 p5p2 q(1rt)(1rt)(1rt)(1rt) 2345 ( c c ) 1c1 1 2 p1p2 p3 p4 p5 pi qi 1(i 1,2, ,5)(13)To solve this system of equations, we get a simultaneousequation (14) by the two key equations (6) and (10).Sn r SN ( d1 ) Ce N ( d 2 ) (14)mmAnd we use the method of approximation in Excel tableto calculate the price of military software S1 .On the other hand, we account the estimated cost V byCOCOMOⅡ and substitute it in (6). So we can calculateanother result S 2 . If S 2 is approximately equal to S1 , wecan get the conclusion that it is reasonable for the value ofsoftware option to be assumed as the estimated cost innumerical method.B. Analysis of VolatilityIt is very difficult to get objective value of the volatilityin Black-Scholes model.ISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)The volatility of underlying asset plays a pivotal role inthe Black-Scholes model. In the option theory, the volatilityrises, the potential of project appreciation increases and thepotential of project depreciation decreases. So the accuracyof volatility directly influences whether the value of optioncan truly reflect the potential value of project, and serves fordecision. However, the real option has the characteristic ofnon-transaction, and there is no transaction history forunderlying asset. So it is very difficult to accurately estimatethe volatility and there is a big subjective influence in thecurrent method.In order to calculate the volatility accurately, we applythe analogue principle of Monte Carlo to forecast the futurecash flow of software project, and solve the probabilitydistribution function of project NPV (Net Present Value). Inthis way we can derive the volatility [5].1) Feasibility of application:Monte Carlo simulation method supposes that price ofinvestment portfolio changes to a random process, and canbe emulated by computer. So the price may produce severalpaths, and we can structure the remuneration distribution toestimate its value-at-risk. The most common model to selectthe stochastic process of price is Geometric BrownianMotion which is the theoretical basis of real options [4].2) Steps of simulationa) Determine the factors of cash flow and itsprobability distribution.b) Random sampling according to the probabilitydistribution, and forecast the cash flow of each year.c) Calculate a number of NPV according to thesimulative cash flow.d) Calculate the average net present value NPV andthe standard deviation S .e) Calculate the all-stage volatility *S NPVf) Calculate the annual volatility / n *And the simulation can be realized by Matlabprogramming. The program code is provided indemonstration.IV.DEMONSTRATIONA. IntroductionThis is a real military software project. In this case, theparty undertaking research and development projects is amilitary software constitution of Hang Zhou, and theunderlying asset is a kind of military software [1]. There arefive stages during the development period: requirements,WCECS 2010

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USAdesign, coding, test and maintenance. And the initial data isshown in Table1.The calculation process has been shown in Table 2.TABLE II.TABLE I.Stage( ,554.0 1, 2, , 5 0002,200,0001,000,0001,000,000(year)ci(RMB)From a military software constitution of Hang Zhou.We want to provide the information that is the softwareprice accounted by Black-Scholes pricing model for themilitary at date of delivery. In this situation, the time is dateof delivery, that is, the development project has already beenimplemented as planned and what we need to calculate is thefinial price of software.B. Values of variablesHere, the risk-free risk is 5%.Firstly, we account the estimated cost. It is the estimationof all the development stages and it can be accounted byCOCOMOⅡ that is not listed in this paper and we only givethe calculation result V 7, 230, 554.0 .Secondly, we calculate the volatility by Monte Carloanalogy.The computational formula of NPV isnCALCULATIONINITIAL DATA tNPV ( MVt ct )(1 r ) t 0So the factors are MV and c whose distribution aresupposed as normal distribution. By the method of MonteCarlo analogy, we give the Matlab program to calculate thevolatility which has been shown in Figure1.The calculation results have been shown in Figure2.And the estimated results are 0.2839 when times ofsimulation are 100, 0.2761 when times are 1000, 0.2732 when times are 4000, 0.2720 when timesare 10000. According to these figures, we can find that withthe increasing times of simulation, the expectations level off.In this case we take 0.272 as the value of volatility .C. CalculationWe build up the military software pricing model based onBlack-Scholes. V SN ( d1 ) Ce r N ( d 2 ) 2ln( S / C ) ( r / 2) d1 d 2 d1 ISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)According to it, we obtain the price of military softwareis 44,548,874.6RMB. In order to test the rationality of theprevious hypothesis, we quote the result in Research ofMilitary Software Pricing Based on Binomial tree Method.The calculation results are that m is 6.9526 and n is5752231.37 [1]. By equation (14), we also obtain anotherresult that the price is 44,559,706.6. Comparing it with theprevious result that the price is 44,548,874.6, we can findthat there is a little difference and get a conclusion that it isreasonable for the value of software option to be supposed asestimated cost.V.CONCLUSIONSWe propose a new method for military software pricingbased on Black-Scholes model and find the solution to theabove two problems.A. The value of software option in Black-Scholes pricingmodel can be regarded as estimated cost, and it providesa path from cost of software to price of software.We have designed the option model for military softwarepricing and found the new way to calculate the price basedon the known cost. In the above analysis, the estimated costis 7,230,554RMB accounted by COCOMOⅡ, and the finialprice accounted by Black-Scholes pricing model is44,548,874.6RMB. There is a big difference and it isinaccurate to regard estimated cost as price of militarysoftware in the current pricing methods. And it willunderestimate the value of software. We apply the realoption and the classical option model to calculate theobjective price for software, and in other view, we find themathematical relationship between cost and price shown asBlack-Scholes equation.WCECS 2010

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USAB. After volatility is estimated by Monte Carlo analogy,the new method for military software pricing has beenperfected based on Black-Scholes model. And it providesa new field of application for real option.In original Black-Scholes model, the volatility remainsinvariant. But in real options, volatility will make greatinfluence in result and it always changes in specificproblems. By analysis we make it feasible to use MonteCarlo method. And we give the Matlab program. In addition,there is a extended application for volatility estimation andapplication of Monte Carlo analogy. During the simulation,we predict the future cash flow of software project whichwill also provide another according for decision-making innext researches.clear;N 12;R 10000;REFERENCES[1][2][3][4][5]Wu Qin, Wei Ruxiang, “Research of Military Software Pricing Basedon Binomial Tree Method,” IEEE in press.Zhang Jing, “Dynamic Methods for Multivariate Option Pricing,”2008 Doctor Thesis.Liu Dawei, “Study of Enterprises Human Resources ValueMeasurement in New Economy,” CI: F240, u.d.c: 331.021.822.Hu Mingkun, “Evaluation on the Patent Economic Value on the Baseof Real Option Theory & Research on the Fluctuation Rate,” 2007Master Thesis.Ma Zhiwei, Liu Yingzong, “Study on Estimation of Whole StageVolatility in Real Options,” CI: F830.59, pp.1006-7205(2007)020028-03.% the length of time in each calculation(unit:3 months)% times of repeated simulationMVdata [15338958, 28643312, 34403718, 38684162, 44527832];cdata [500000, 800000, 2200000, 1000000, 1000000];meanMV mean(MVdata);meanc mean(cdata);r 0.0125;t 0:N;meantNPV (meanMV - meanc) * sum((1 r). (-t));vartNPV 0.272 * sqrt(N/4) * meantNPV;varMVc vartNPV*sum((1 r). (2*t))/170;varMV varMVc/2;varc varMVc/2;MV random('norm', meanMV, sqrt(varMV), R, N 1);%figure; plot(reshapt(MV,N*R,1)); xlabel('times of simulation'); ylabel('value ofMV');c random('norm', meanc, sqrt(varc), R, N 1);%figure; plot(reshapt(c,N*R,1)); xlabel('times of simulation'); ylabel('value ofc');NPV zeros(1,R);for i 1:RNPV(i) sum((MV(i,:)-c(i,:)).*((1 r). (-t)));endmeanNPV mean(NPV);varNPV mean((NPV-meanNPV). 2);varNPV/meanNPV/sqrt(N/4)figure; plot(NPV); xlabel('times of simulation'); ylabel('value of NPV');title(sprintf('mean value of NPV: %d, variance: %d', meanNPV, varNPV));Figure 1. Matlab programISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)WCECS 2010

Proceedings of the World Congress on Engineering and Computer Science 2010 Vol IWCECS 2010, October 20-22, 2010, San Francisco, USA3.77158x 10 mean value of NPV: 3.771095e 008, variance: 2.063588e 0083.77163.77153.77143.77143.77133.7713value of NPVvalue of .77083.77083.77073.77068x 10 mean value of NPV: 3.771114e 008, variance: 1.803616e 0083.77070102030405060times of simulation7080903.77061000100200300(a)for 100 times3.7716400500600times of simulation7008009001000(b)for 1000 times8x 10 mean value of NPV: 3.771113e 008, variance: 1.768671e 0083.77188x 10 mean value of NPV: 3.771110e 008, variance: 1.793390e 0083.77153.77163.77143.77143.7712value of NPVvalue of .77063.77073.770605001000150020002500times of simulation3000350040003.770401000(a)for 4000 times200030004000 5000 6000times of simulation700080009000 10000(b)for 10000 timesFigure 2. Distribution of NPV valueISBN: 978-988-17012-0-6ISSN: 2078-0958 (Print); ISSN: 2078-0966 (Online)WCECS 2010

Value of Software Option and Volatility Wu Qin, Zhang Yadi Abstract—The idea of real option is applied in military software pricing in this paper. By analysis of Black-Scholes . consider another kind of option pricing model that is binomial tree. The military software pricing model based on binomial tree has been proposed in Wu Qin's .