Transcription

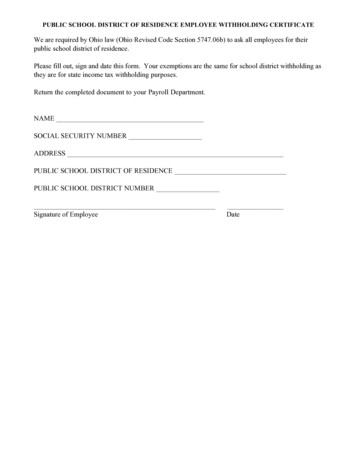

PUBLIC SCHOOL DISTRICT OF RESIDENCE EMPLOYEE WITHHOLDING CERTIFICATEWe are required by Ohio law (Ohio Revised Code Section 5747.06b) to ask all employees for theirpublic school district of residence.Please fill out, sign and date this form. Your exemptions are the same for school district withholding asthey are for state income tax withholding purposes.Return the completed document to your Payroll Department.NAMESOCIAL SECURITY NUMBERADDRESSPUBLIC SCHOOL DISTRICT OF RESIDENCEPUBLIC SCHOOL DISTRICT NUMBERSignature of EmployeeDate

IT 4Rev. 5/07Notice to Employee1. For state purposes, an individual may claim only natural dependency exemptions. This includes the taxpayer, spouseand each dependent. Dependents are the same as definedin the Internal Revenue Code and as claimed in the taxpayer’sfederal income tax return for the taxable year for which thetaxpayer would have been permitted to claim had the taxpayer filed such a return.2. You may file a new certificate at any time if the number of yourexemptions increases.You must file a new certificate within 10 days if the number ofexemptions previously claimed by you decreases because:(a) Your spouse for whom you have been claiming exemption is divorced or legally separated, or claims her (or his)own exemption on a separate certificate.(b) The support of a dependent for whom you claimed exemption is taken over by someone else.(c) You find that a dependent for whom you claimed exemption must be dropped for federal purposes.The death of a spouse or a dependent does not affect yourwithholding until the next year but requires the filing of a newcertificate. If possible, file a new certificate by Dec. 1st of theyear in which the death occurs.For further information, consult the Ohio Department of Taxation, Personal and School District Income Tax Division, oryour employer.3. If you expect to owe more Ohio income tax than will bewithheld, you may claim a smaller number of exemptions;or under an agreement with your employer, you may havean additional amount withheld each pay period.4. A married couple with both spouses working and filing ajoint return will, in many cases, be required to file an individual estimated income tax form IT 1040ES even thoughOhio income tax is being withheld from their wages. Thisresult may occur because the tax on their combined income will be greater than the sum of the taxes withheldfrom the husband’s wages and the wife’s wages. Thisrequirement to file an individual estimated income tax formIT 1040ES may also apply to an individual who has twojobs, both of which are subject to withholding. In lieu offiling the individual estimated income tax form IT 1040ES,the individual may provide for additional withholding withhis employer by using line 5. please detach herehioDepartment ofTaxationPrint full nameIT 4Rev. 5/07Employee’s Withholding Exemption CertificateSocial Security numberHome address and ZIP codePublic school district of residence(See The Finder at tax.ohio.gov.)School district no.1. Personal exemption for yourself, enter “1” if claimed .2. If married, personal exemption for your spouse if not separately claimed (enter “1” if claimed) .3. Exemptions for dependents .4. Add the exemptions that you have claimed above and enter total .5. Additional withholding per pay period under agreement with employer . Under the penalties of perjury, I certify that the number of exemptions claimed on this certificate does not exceed the number to which I am entitled.SignatureDate

Form W-4 (2019)Future developments. For the latestinformation about any future developmentsrelated to Form W-4, such as legislationenacted after it was published, go towww.irs.gov/FormW4.Purpose. Complete Form W-4 so that youremployer can withhold the correct federalincome tax from your pay. Considercompleting a new Form W-4 each year andwhen your personal or financial situationchanges.Exemption from withholding. You mayclaim exemption from withholding for 2019if both of the following apply. For 2018 you had a right to a refund of allfederal income tax withheld because youhad no tax liability, and For 2019 you expect a refund of allfederal income tax withheld because youexpect to have no tax liability.If you’re exempt, complete only lines 1, 2,3, 4, and 7 and sign the form to validate it.Your exemption for 2019 expires February17, 2020. See Pub. 505, Tax Withholdingand Estimated Tax, to learn more aboutwhether you qualify for exemption fromwithholding.General InstructionsIf you aren’t exempt, follow the rest ofthese instructions to determine the numberof withholding allowances you should claimfor withholding for 2019 and any additionalamount of tax to have withheld. For regularwages, withholding must be based onallowances you claimed and may not be aflat amount or percentage of wages.You can also use the calculator atwww.irs.gov/W4App to determine yourtax withholding more accurately. Considerusing this calculator if you have a morecomplicated tax situation, such as if youhave a working spouse, more than one job,or a large amount of nonwage income notsubject to withholding outside of your job.After your Form W-4 takes effect, you canalso use this calculator to see how theamount of tax you’re having withheldcompares to your projected total tax for2019. If you use the calculator, you don’tneed to complete any of the worksheets forForm W-4.Note that if you have too much taxwithheld, you will receive a refund when youfile your tax return. If you have too little taxwithheld, you will owe tax when you file yourtax return, and you might owe a penalty.Filers with multiple jobs or workingspouses. If you have more than one job ata time, or if you’re married filing jointly andyour spouse is also working, read all of theinstructions including the instructions forthe Two-Earners/Multiple Jobs Worksheetbefore beginning.Nonwage income. If you have a largeamount of nonwage income not subject towithholding, such as interest or dividends,consider making estimated tax paymentsusing Form 1040-ES, Estimated Tax forIndividuals. Otherwise, you might oweadditional tax. Or, you can use theDeductions, Adjustments, and AdditionalIncome Worksheet on page 3 or thecalculator at www.irs.gov/W4App to makesure you have enough tax withheld fromyour paycheck. If you have pension orannuity income, see Pub. 505 or use thecalculator at www.irs.gov/W4App to findout if you should adjust your withholdingon Form W-4 or W-4P.Nonresident alien. If you’re a nonresidentalien, see Notice 1392, Supplemental FormW-4 Instructions for Nonresident Aliens,before completing this form.Specific InstructionsPersonal Allowances WorksheetComplete this worksheet on page 3 first todetermine the number of withholdingallowances to claim.Line C. Head of household please note:Generally, you may claim head of householdfiling status on your tax return only if you’reunmarried and pay more than 50% of thecosts of keeping up a home for yourself anda qualifying individual. See Pub. 501 formore information about filing status.Line E. Child tax credit. When you file yourtax return, you may be eligible to claim achild tax credit for each of your eligiblechildren. To qualify, the child must be underage 17 as of December 31, must be yourdependent who lives with you for more thanhalf the year, and must have a valid socialsecurity number. To learn more about thiscredit, see Pub. 972, Child Tax Credit. Toreduce the tax withheld from your pay bytaking this credit into account, follow theinstructions on line E of the worksheet. Onthe worksheet you will be asked about yourtotal income. For this purpose, total incomeincludes all of your wages and otherincome, including income earned by aspouse if you are filing a joint return.Line F. Credit for other dependents.When you file your tax return, you may beeligible to claim a credit for otherdependents for whom a child tax creditcan’t be claimed, such as a qualifying childwho doesn’t meet the age or socialsecurity number requirement for the childtax credit, or a qualifying relative. To learnmore about this credit, see Pub. 972. Toreduce the tax withheld from your pay bytaking this credit into account, follow theinstructions on line F of the worksheet. Onthe worksheet, you will be asked aboutyour total income. For this purpose, totalSeparate here and give Form W-4 to your employer. Keep the worksheet(s) for your records.FormW-4Department of the TreasuryInternal Revenue Service1Employee’s Withholding Allowance CertificateOMB No. 1545-0074Whether you’re entitled to claim a certain number of allowances or exemption from withholding issubject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.aYour first name and middle initialLast nameHome address (number and street or rural route)20192 Your social security number3SingleMarriedMarried, but withhold at higher Single rate.Note: If married filing separately, check “Married, but withhold at higher Single rate.”City or town, state, and ZIP code4 If your last name differs from that shown on your social security card,check here. You must call 800-772-1213 for a replacement card.567aTotal number of allowances you’re claiming (from the applicable worksheet on the following pages) . . . .5Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . .6 I claim exemption from withholding for 2019, and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . a 7Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.Employee’s signature(This form is not valid unless you sign it.) a8 Employer’s name and address (Employer: Complete boxes 8 and 10 if sending to IRS and completeboxes 8, 9, and 10 if sending to State Directory of New Hires.)For Privacy Act and Paperwork Reduction Act Notice, see page 4.Date a9 First date ofemploymentCat. No. 10220Q10 Employer identificationnumber (EIN)Form W-4 (2019)

Page 2Form W-4 (2019)income includes all of your wages andother income, including income earned bya spouse if you are filing a joint return.Line G. Other credits. You may be able toreduce the tax withheld from yourpaycheck if you expect to claim other taxcredits, such as tax credits for education(see Pub. 970). If you do so, your paycheckwill be larger, but the amount of any refundthat you receive when you file your taxreturn will be smaller. Follow theinstructions for Worksheet 1-6 in Pub. 505if you want to reduce your withholding totake these credits into account. Enter “-0-”on lines E and F if you use Worksheet 1-6.Deductions, Adjustments, andAdditional Income WorksheetComplete this worksheet to determine ifyou’re able to reduce the tax withheld fromyour paycheck to account for your itemizeddeductions and other adjustments toincome, such as IRA contributions. If youdo so, your refund at the end of the yearwill be smaller, but your paycheck will belarger. You’re not required to complete thisworksheet or reduce your withholding ifyou don’t wish to do so.You can also use this worksheet to figureout how much to increase the tax withheldfrom your paycheck if you have a largeamount of nonwage income not subject towithholding, such as interest or dividends.Another option is to take these items intoaccount and make your withholding moreaccurate by using the calculator atwww.irs.gov/W4App. If you use thecalculator, you don’t need to complete anyof the worksheets for Form W-4.Two-Earners/Multiple JobsWorksheetComplete this worksheet if you have morethan one job at a time or are married filingjointly and have a working spouse. If youdon’t complete this worksheet, you mighthave too little tax withheld. If so, you willowe tax when you file your tax return andmight be subject to a penalty.Figure the total number of allowancesyou’re entitled to claim and any additionalamount of tax to withhold on all jobs usingworksheets from only one Form W-4. Claimall allowances on the W-4 that you or yourspouse file for the highest paying job inyour family and claim zero allowances onForms W-4 filed for all other jobs. Forexample, if you earn 60,000 per year andyour spouse earns 20,000, you shouldcomplete the worksheets to determinewhat to enter on lines 5 and 6 of your FormW-4, and your spouse should enter zero(“-0-”) on lines 5 and 6 of his or her FormW-4. See Pub. 505 for details.Another option is to use the calculator atwww.irs.gov/W4App to make yourwithholding more accurate.Tip: If you have a working spouse and yourincomes are similar, you can check the“Married, but withhold at higher Singlerate” box instead of using this worksheet. Ifyou choose this option, then each spouseshould fill out the Personal AllowancesWorksheet and check the “Married, butwithhold at higher Single rate” box on FormW-4, but only one spouse should claim anyallowances for credits or fill out theDeductions, Adjustments, and AdditionalIncome Worksheet.Instructions for EmployerEmployees, do not complete box 8, 9, or10. Your employer will complete theseboxes if necessary.New hire reporting. Employers arerequired by law to report new employees toa designated State Directory of New Hires.Employers may use Form W-4, box

PUBLIC SCHOOL DISTRICT OF RESIDENCE _ PUBLIC SCHOOL DISTRICT NUMBER _ _ _ Signature of Employee Date. IT 4 Rev. 5/07 Employee’s Withholding Exemption Certificate Print full name Social Security number Home address and ZIP code Public school district of residence School district no. (See The Finder at tax.ohio.gov.) 1. Personal exemption for yourself, enter “1” if