Transcription

A BRIEF STUDY ONMARKET SRUCTURE AND DEMAND ANALYSISOF HINDUSTAN UNILEVERPROJECT REPORTSUBMITTED TO:MS. Meghnaa SharmaAccmanInstitute of ManagementGreater noida, knowledge park-3U.PPrepared by:MOHD.ARISHUPMA JOSHIKAPIL1

TABLE OF CONTENTSl.no Content1.Executive summaryPage no.32.Introduction4-53.Objectives and Methodology64.FindingsProduct LineSWOT AnalysisCompetitors AnalysisPerformance AnalysisFuture OpportunitiesFuture Projects of 12

EXECUTIVE SUMMARYHindustan Unilever Limited is the Indian arm of the Anglo-Dutch company –Unilever.Both Unilever and HUL have established themselves well in the Fast Moving ConsumerGoods (FMCG) category. In India, the company offers many households brandslike, Dove,Lifebuoy, Lipton,Lux, Pepsodent, Ponds, Rexona, Sunsilk, Surf, Vaseline etc.Some of its efforts were also rewarded when four of HUL brands found place in the ‘Top10 brands’ list for the year 2008 published in The Economic Times.Unilever was a result of the merger between the Dutch margarine company, MargarineUnie, and the British soap-maker, Lever Brothers, way back in 1930. For 70 years,Unilever was the undisputed market leader but now faces tough competition fromProctor & Gamble and Colgate-Palmolive.HUL is also known for its strong distribution network in India. In order to furtherstrengthen its distribution in the rural areas and to empower the local women, HULlaunched a project Shakti in 2000 in a district in Andhra Pradesh. The idea behind thisproject was to create women entrepreneurs and provide them with micro-credit andtraining in enterprise management, which would enable them to create self-help groupsand become direct-to-home distributors of HUL products. Today Shakti is presentacross 80,000 villages in 15 states and is helping many underprivileged women earntheir livelihood.As thepercapitaincome of India increasing along with the Indian population. So, thefuture for the FMCG Companies is bright. To analysis the past performance & the futuredemand of HUL, FMCG products we have considered following points: We have a listed the different FMCG product lines of HUL.We have donecompetitor’s analysis in which the market share of top FMCG companies areanalayised& the market share of HUL’S different categories product areanalayised with comparison to its competitors.Then we have done SWOT analysis to know the threat & opportunities of HUL inpresent market.Then performance analysis is made by taking 10 year financial data from 19982007. The profit & sales growth is analysed.Then the future opportunities for FMCG products are taken into consideration byanalyzing the increased percapita income & increased disposable income toforecast the future demand of HUL.3

INTRODUCTIONHindustan Unilever Limited (abbreviated to HUL), formerly Hindustan LeverLimited, is INDIAs largest consumer products company and was formed in 1933 asLever Brothers India Limited. It is currently headquartered in Mumbai, India andits 41,000 employees are headed by Harish Manwani, the non-executive chairmanof the board. HUL is the market leader in Indian products such as tea, soaps,detergents, as its products have become daily household name in India. TheAnglo-Dutch company Unilever owns a majority stake in Hindustan UnileverLimited.The company was renamed in late June 2007 as "Hindustan Unilever Limited".Some of its brands include Kwality Wall's ice cream, Lifebuoy, Lux, Breeze, Liril,Rexona, Hamam, Moti soaps, Pureit Water Purifier, Lipton tea, Brooke Bond tea,Bru Coffee, Pepsodent and Close Up toothpaste and brushes, and Surf, Rin andWheel laundry detergents, Kissan squashes and jams, Annapurna salt and atta,Pond's talcs and creams, Vaseline lotions, Fair & Lovely creams, Lakme beautyproducts, Clinic Plus, Clinic All Clear, Sunsilk and Dove shampoos, Vim dish wash,Ala bleach and Domexdisinfectant,Rexona,Modern Bread and Axe deospray.HULhas produced many business leaders for corporate India. It is referred to as a ‘CEOFactory' in the Indian press for the same reasons. It’s leadership building potentialwas recognized when it was ranked 4th in the HewiitGlobal Leadership Survey2007 with only GE, P&G and Nokia ranking ahead of HUL in the ability to produceleaders with such regularityToday, HUL is one of India’s largest exporters of branded Fast MovingConsumer Goods. It has been recognized by the Government of India as a GoldenSuperStarTradingHouse.Over time HUL has developed into a viable & competitive sourcing base forUnilever world wide in Home and Personal Care & Foods & Beverages category ofproducts. HUL is also a global marketing arm for select licensed Unilever brandsand also works on building categories with core country advantage such as4

brandedbasmatirice.HUL Exports offers high level of service with flexibility and responsivenessthorough out the supply chain. It has a dedicated organization structure tosupport this endeavor and this has helped in growth of these businesses inparticular. Intrinsic cost competitiveness in the end to end Supply chain withappropriate technology and competitive capital investment operations whiledelivering best in class quality enables HUL to position itself as a key sourcing hubfor Unilever and also become a preferred partner for Global customers incategories we operate.HUL’s key focus in the exports business is on two broad categories. It is a sourcingbase for Unilever brands in Home & Personal Care (HPC) and Food and Beverages(F&B) for supplies to other Unilever companies. It also focuses on becoming apreferred supplier to both non-Unilever and Unilever clients in three categories inwhich India, as a country, has competitive advantage – Branded Rice, MarineProducts and Castor and its Derivatives. HUL enjoys international recognitionwithin Unilever and outside for its quality, reliability and speed of customerservice.HUL's Exports geography comprises, at present, countries in Europe, Asia, MiddleEast, Africa, Australia, and North America etc. HUL’s products touches two out of three Indian everyday Reach 80% Households Direct Coverage of 1mln outlets 2000 Suppliers and Associates 71 Manufacturing locations 15000 Employees 1100 managers Shelf availability 84% outlets in India5

OBJECTIVES AND METHODOLOGYOBJECTIVEPrimary objectiveTo find the past sale growth and demand analysisSecondary ObjectiveMarket structure analysisSWOT analysisCompetitor analysisPerformance evaluationMethodologyIn this project we have followed descriptive method of study.Research instrumentHere project analysis is made by collecting secondary data from differentwebsites, journals, etc. Secondary data’s are pre published and research data’s collected fromdifferent websites, journals, newspapers, company research papers. These documents and data’s are very useful for the theoretical, conceptualand organizational background analysis. Detailed analysis of data’s is made by plotting different graphs and tableswhich can be easily understandable. Then by observing these graphs we have made our conclusions andrecommendations.6

PRODUCT LINEA) HOME AND PERSONAL CARE:1) Personal washLuxLifebuoyLirilHamamBreezeDovePearsRexona2) Laundry3) Skin CareSurf ExcelRinWheelFair and lovelyPond’sAviance4) Hair care5) Oral careSunsilk naturalsClinicPepsodentClose up6) Deodorants7)Colour CosmeticsAxeRexonaLakme8)Ayurvedic Personal and health care:AyushB) FOODS1) TeaBrooke BondLipton2) CoffeeBrooke Bond Bru3) Foods4) Ice creamKissanKwality wallsKnorAnnapurnaC) WATER PURIFIERPureit7

SWOT ANALYSISSTRENGTH Variety of products Distribution Network Brand image Quality Management Innovation and R&D strengthTHREATS From High Class Competitor Proctor & Gamble Pantene Dabur Babool Dabourlal Dent Manjan Reckitt Benckiser Dettol Palmolive Colgate, NirmaOPPORTUNITIES Huge Market Increasing per capital income Increasing consumption pattern Potential for making more impact of brand image.8

Coming in technology e.g. in water purifiersWEAKNESS Not able to compete with local competitor in the rural market Not focus on upper class population Pricing policy is not goodCOMPETITORS ANALYSISAccording to the market survey done by BUSINESS TODAY the top 10 companiesof FMCG sector are given below.1.2.3.4.5.6.7.8.9.10.Hindustan Unilever Ltd.ITC (Indian Tobacco Company)Nestlé IndiaGCMMF (AMUL)Dabur IndiaAsian Paints (India)Cadbury IndiaBritannia IndustriesProcter & Gamble Hygiene and Health CareMarico Industries9

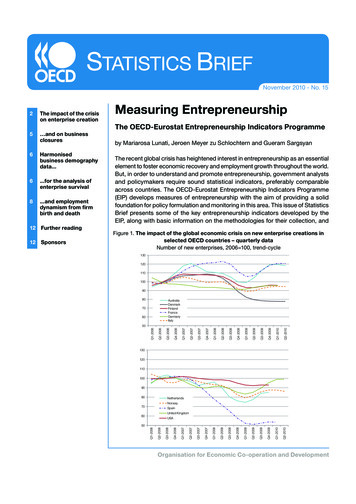

THE COMPARATIVE DATA OF % MARKET SHARE OF HUL AND ITS COMPETITORINQUARTER ENDED JUN’08807060504030HUL(MARKET SHARE %)2010COMPETITOR (MARKET SHARE%)0(Above graph showing %age Market share of HUL and its competitor in differentcategories of FMCG products)As mentioned in the above graph, HUL is enjoying the leader position in themarket and is having highest market shares which are followed by the marketchallengers like Dabur India Ltd, Nestle India Ltd, and ITC LTD, ETC .In differentcategories of FMCG products likeshampoo, skincare , deo, jams, coffee, etc10

In some category these market challengers are giving high level competition indifferent product lines such as ketchup and toothpaste (As shown in the graphbelow).6047.95040303024.527.620100TOOTH PASTEKETCHUPHUL(Market share%)COMPETITOR(Market share%)(Above graph showing the two category of products in which HUL percentagemarket share is less than its competitor in Quarter ended JUN’08)So we can see that in overall FMCG business HUL is distantly ahead of rest of thecompanies as far as market share of different products are concerned.11

MARKET SHARE OF FMCG COMPANIES IN 9%In the above pie chart we see the position of various FMCG companies doingbusiness in India. We can see that HUL is enjoying the position of market leaderand is followed by ITC as close second in the market share of FMCG products.12

PERFORMANCE ANALYSISHindustan Unilever Ltd is one of the leading FMCG company in India which havingthe following past financial records we have taken for the analysis as follows:Table showing past 10 years financial dataSales growth of last 10 years1500000140000013000001200000sales(Rs. Lakhs)110000010000009000001998 1999 2000 2001 2002 2003 2004 2005 2006 200713

PROFIT OF LAST 10 Lakhs)8000060000400002000001998 1999 2000 2001 2002 2003 2004 2005 2006 2007DATA ANALYSIS:We have the sales and profit figures of HUL from the year 1998 to 2007 in the10year past data from Yr1998-2007, after plotting two graph one of sales & otherof profit as shown in here we can see that both profit and sales of the companyrose from the year 1998 till 2001, but in the year 2002 we see that the sales fellbut there was actually rise in the profit of the company . In the year 2004 we seethat there was a steep fall in the profit of the company and from the year 2005onwards there was a slow but steady rise in the profit of the company, but a rapidrise in the sales of the company in the given years.Reason for the steep fall in the profit of the company in the year 2004:The FMCG market in Urban India was attaining the saturation level and socompanies had to expand its market in rural India. This resulted in thedownfall in the profit of HUL. There was very aggressive advertisingcampaign by ITC in that year to set itself in the market this affected HULwho was enjoying the position of market leader and resulted in the fall inthe profit of the company.14

In the following graph we can see thepercentage growth in FMCG sales of HULfrom March quarter ’07 to March quarter ’08.FMCG Sales volume growth in last 5 quarterin 07-08252015FMCG Sales volume growth inlast 5 quarter in 07-081050MQ'07JQ'07SQ'07DQ'07MQ'08(Graph showing the FMCG trend through last quarters)FUTURE OPPORTUNITIESIndia is a fast developing country with a huge population whose per capita incomeis growing rapidly and there is huge opportunity for FMCG companies.The opportunities are as follows:Increasing per capita income is driving FMCG growth in IndiaIndia’s consuming class is growing rapidlyChanging consumption pattern: Per capita income of Indian customer isincreasing and FMCG products are relatively elastic in nature hence theexpected sale should increase.15

By the following three graphs(data collected from a research made by govt. ofINDIA) we can expect increase future demand of FMCG products, the graphsshowing the increasing percapita income, percapita disposable income andpopulation of India respectively are as follows:Percapita income(Rs)12001000800600Percapita 008(Above graph showing percapita income of INDIANS through out Yr2000-2008)As shown in the above graph the percapita income of an INDIAN increasedthroughout years, and if this trend will continue in future the people can purchasemore FMCG products.16

02200320062007Percapita disposible income(Above graphs showing increased percapita disposable income from Yr20022007)% Of past population riseand future expetation4541.5403535302523.525203027.5% Of pastpopulation riseand futureexpetation2017 ve graph shows the past population and expected future population rise,data are collected from the research made by govt. of INDIA)Here by the abovegraphs we can see that there is huge scope for FMCG products and since HUL isthe market leader in India hence it can gain the most out of it.17

CATEGORY WISE SALE GROWTH OF FMCG SECTOR OF HUL IN INDIA:2520CATEGORY%AGESoaps & Detergents19.3Personal Products22.4Ice Cream15.7Processed 13.713.61050% GROWTH OF DIFFERENT FMCG PRODUCTS OF HUL(Above graph shows the data of MAR’08 Quarter %growth of different products ofHUL)18

FUTURE PROJECTS OF HUL:As competition is increasing d

Unilever was a result of the merger between the Dutch margarine company, Margarine Unie, and the British soap-maker, Lever Brothers, way back in 1930. For 70 years, Unilever was the undisputed market leader but now faces tough competition from Proctor & Gamble and Colgate-Palmolive. HUL is also known for its strong distribution network in India. In order to further strengthen its distribution .