Transcription

3rd Quarter FY22 Results9 December 20211

DisclaimerThis document contains certain forward-looking statements with respect to Astro Malaysia Holdings Berhad’s (“Astro”) financial condition,results of operations and business, and management’s strategy, plans and objectives for Astro. These statements include, without limitation,those that express forecasts, expectations and projections such as forecasts, expectations and projections in relation to new products andservices, revenue, profit, cash flow, operational metrics etc.These statements (and all other forward-looking statements contained in this document) are not guarantees of future performance and aresubject to risks, uncertainties and other factors, some of which are beyond Astro’s control, are difficult to predict and could cause actualresults to differ materially from those expressed or implied or forecast in the forward-looking statements. These factors include, but are notlimited to, the fact that Astro operates in a competitive environment that is subject to rapid change, the effects of laws and governmentregulation upon Astro’s activities, its reliance on technology which is subject to risk of failure, change and development, the fact that Astro isreliant on encryption and other technologies to restrict unauthorised access to its services, failure of key suppliers, risks inherent in theimplementation of large-scale capital expenditure projects, and the fact that Astro relies on intellectual property and proprietary rights whichmay not be adequately protected under current laws or which may be subject to unauthorised use.All forward-looking statements in this presentation are based on information known to Astro on the date hereof. Astro undertakes noobligation publicly to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.This presentation has been prepared by Astro. The information in this presentation, including forward-looking statements, has not beenindependently verified. Without limiting any of the foregoing in this disclaimer, no representation or warranty, express or implied, is made asto, and no reliance should be placed on, the fairness, accuracy or completeness of such information. Astro and its subsidiaries, affiliates,representatives and advisers shall have no liability whatsoever (whether in negligence or otherwise) for any loss, damage, costs or expenseshowsoever arising out of or in connection with this presentation.2

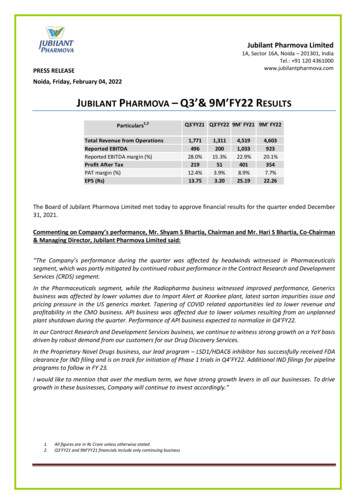

3Q FY22 key performance highlightsCOVID-19updatesQuarter-on-quarter financial highlights2Q FY22 3Q FY22NB:(1)RevenueEBITDARM 1.06bn RM 1.02bnRevenue moderated due to ongoing pandemic and protractedlockdowns which impacted Adex and EnterpriseRM 310mn RM 296mnEBITDA margin of 29%, impacted by sports cost as guidedCommerceNormalised PATAMI (1)RM 105mn RM 94mnPerformance impacted due to lower consumer spendingRM 101mn RM 96mnNormalised PATAMI margin of 9%AdexFCF of RM 207mnRM 99mn RM 94mnAdex moderated 5% QoQ, limited by lockdowns. Recovery seenbeginning October as lockdowns eased195% of PATAMI,1.5 sen interim dividend declaredNormalised PATAMI excludes post-tax impact unrealised forex gain/(loss) 3Q FY22: RM 10mn, 2Q FY21: (RM 14mn) due to mark-to-marketrevaluation of transponder-related lease liabilities3

3Q FY22:Business momentum up towards quarter endContentBusiness highlightsNew launches Launched the new Astro Premiered fresh, edgy Astro Inked deals with TelekomOriginals includingMalaysia to deliver high quality experience and integratedNetflix on the Ultra Box ini-Tanggang and The Hoteldigital experience toNov, more services toMalaysians, laying foundation Most shoots and live showsfollowfor Astro to be an ISPhalted amid imposition of full Broadband customers up 83% Launched simple, new TVlockdown since June,packs bundled with apps inYTD driven by value bundlesresumed only in mid-SepNov2021 Enterprise customers returnedstarting mid-Oct, up 17% QoQ Launched 60 new online Kicked off new season ofas economic activities resumed radio stations on SYOK,Premier Leaguegrowing digital presence inunder MCO Phase 4, boosted Aired Tokyo Olympics sothe audio spaceby interstate traveljump in sports cost seen as NJOI prepaid revenue YTD upguided34% underpinned by HD Packand prepaid offeringsAdexFinancial position Adex improved in October, Free Cash Flow ofsupported by the economic RM545mn YTDreopening and resumption Net Debt/EBITDA ratioof Astro’s signature showsat 1.5x Astro Radio grows listenerbase on FM and digital up Cash and cashequivalent at RM825mn3% to 17.2mn weekly,cementing position as theunrivalled #1 radio andaudio network in Malaysia Flexible adex packages tohelp SMEs andmicrobusinesses4

3Q FY22 key performance highlightsYear-on-year financial highlights3Q FY21 3Q FY22NB:(1)RevenueEBITDARM 1.11bn RM 1.02bnRevenue impacted by ongoing pandemic and protracted lockdownswhich impacted Adex and EnterpriseRM 402mn RM 296mnEBITDA margin of 29%, impacted by sports cost as guidedCommerceNormalised PATAMI (1)RM 111mn RM 94mnPerformance impacted due to lower consumer spendingRM 152mn RM 96mnNormalised PATAMI margin of 9%AdexFCF of RM 207mnRM 127mn RM 94mnAdex down 26% YoY, limited by MCO 3.0. Recovery seen beginningOctober as lockdowns eased195% of PATAMI,1.5 sen interim dividend declaredNormalised PATAMI excludes post-tax impact unrealised forex gain/(loss) 3Q FY22: RM 10mn, 3Q FY21: RM 13mn due to mark-to-marketrevaluation of transponder-related lease liabilities5

FY22 year to date overviewYTD FY21Total TV households in Malaysia (’000) (1)TV household penetration (2)TV customer base (’000)Pay TV ARPU (RM)Astro TV viewership share (3)Radio listeners weekly (FM and digital) (mn) (4)Digital MUV (mn) (5)Connected STBs (’000) (6)7,65074%5,69197.673%16.713.41,012YTD FY21Revenue (RM mn)YTD FY227,77772%5,63397.473%17.214.71,082YTD FY22Change2%(2 144(3%)Commerce (RM mn)351314(10%)Adex (RM (3 p.p.)(9%)(49%)(10%)EBITDA (RM mn)EBITDA marginNormalised PATAMI (RM mn) (7)FCF (RM mn)EPS (RM sen)NB(1)(7)(8)TV household data sourced from the Department of StatisticsMalaysia and Media Partners AsiaHousehold penetration comprises residential Pay-TV customersand NJOI customersViewership share is based on DTAM deployed by Kantar MediaDTAMWeekly audience measurement is based on GfK for FM andRadioActive for digitalDigital monthly unique visitors (“MUV”) to Astro’s digitalbrands, averaged over the last 12 months as sourced fromcomScoreConnected set-top boxes (STBs) are internet-ready withrecording functionality and have access to Astro’s On Demandlibrary of contentNormalised PATAMI excludes post-tax impact of unrealisedforex gain/(loss) YTD FY22: (RM 10mn), YTD FY21: (RM 8mn)due to mark-to-market revaluation of transponder-relatedlease liabilitiesNumbers may not add up due to rounding differences6

On Demand and Astro GO key in engaging customersTV Viewership Share (1)Avg. Daily Viewers (mn)Avg. Time Spent/Day (hrs)9%7%27%12.4TV73%7.4TV 11.6YTD FY21Total Connected STBs (2)(3)(’000)3:283:096.7YTD FY22On Demand Shows Streamed (mn)2:13YTD FY21YTD FY2228%189%1,082556711YTD FY21YTD FY22387134On Demand 2:08Avg. Weekly Viewing (mins)7%1,0124%10%NB:(1) Target Audience: KantarMedia, Dynamic TVAudience Measurement(DTAM). All Astro Pay-TVviewers YTD(2) Cumulative since inception(3) Connected set-top boxes(STBs) are internet-readywith recording functionalityand have access to Astro’sOn Demand library ofcontent(4) Pay-TV customers who havelinked their account to AstroGO for seamless viewing(5) Source: App Annie as of 31October at device levelYTD FY21YTD FY22Linked Customers (4) (’000)YTD FY21YTD FY22Monthly Active Users (5) (’000)Avg. Weekly Viewing viceYTD FY21YTD FY22YTD FY21YTD FY22YTD FY21YTD FY227

c.70% of customers’ time spent on vernacular, up 7 p.p.73% AstroTV Viewership(1)share27% FTA69% Vernacular (up 7p.p. YoY)31% Others(3)152(2)channels130HD o-brandedchannels1Ultra HD channel 65,000 OD shows 4K Ultra HD VOD2 Astro GO access1.2mn64k41k729k788k397k556k33k40k18free channelsTV viewershipOn Demand streams on STB1.0mnNB(1)(2)(3)307k192k763k191k68kTarget Audience: Kantar Media, Dynamic TV Audience Measurement (DTAM). All Astro Pay-TV viewersNumber of channels as of 31 October 2021Others include Sports, English and International content237k567k490kStreams on Astro GO 60prepaid channels& packs8

Revenue and ARPU resilient amid protracted lockdowns(RM mn)Total 6886686986983785683480Subscriptions/(1)Others (-3%)ARPU (-0.2%)604030202001Q FY21(2)(3)Adex ( 2%)50400NB(1)GoShop (-10%)9070800600100YTD growth(2)2Q FY213Q FY214Q FY211Q FY222Q FY223Q FY22Disclosed as Subscription revenue and Other revenue in our financial statements, includes revenue streams such as TV subscription, licensing income,programme sales, NJOI revenue and theatrical revenueYTD refers to 9 months ended 31 OctoberNumbers may not add up due to rounding differences9

Adex: impacted by lockdowns, recovery seen in Oct 21Advertising revenue(1)(RM mn)TVRadioDigitalYTD GrowthTotalTotal Malaysiagross ADEXgrowth (2)(5) 2%1271290833498084613013421091039 10%9911302430(4%)OVERALL ADEX11%DIGITAL14%RADIO0.2%75605954 4%TV26%Digital MUV (mn)3%2%13.414.7YTD FY21YTD FY22YTD FY21YTF FY22Share of radexRadio listeners weekly(FM and digital) (mn)(3)79%76%16.717.2YTD FY21YTD FY22YTD FY21YTD FY22Share of TV adex69489410Share of digital adexTV viewership share(4)77%39%35%73%73%YTD FY21YTD FY22YTD FY21YTD FY221Q FY21 2Q FY21 3QFY21 4QFY21 1Q FY22 2Q FY22 3Q FY22NB(1)(2)(3)(4)(5)Advertising income is net of commissions and discountsMalaysia gross adex figures (covering TV, print, radio, cinema, in store media, outdoor and digital) are based on Nielsen gross adex and IPG’s estimatesShare of radex is based on Astro and IPG’s estimates (with Nielsen gross adex as base). Weekly audience measurement is based on GfK for FM and RadioActive for digitalShare of TV adex is based on Astro and IPG’s estimates (with Nielsen gross adex as base). Viewership share is based on DTAM deployed by KantarNumbers may not add up due to rounding differences10

Focused on operational efficiencies(RM mn)Total costEBITDA margin2,00031%34%36%33%Higher sports costas guided in2QFY22 & 3QFY2250%withairing ofEURO and Tokyo40%Olympics35%29%29%30%20%Content cost/TV revenue1,50034%30%32%32%30%39%36%10%0%Other 53-10%-20%500554-30%Content costs3092802993022743563191Q FY212Q FY213Q FY214Q FY211Q FY222Q FY223Q FY22-NB(1)(2)(3)-40%-50%Content costs are disclosed as part of cost of sales in our financial statementsOther expenses include marketing and distribution costs, administrative expenses, STB installation and smartcard costs, depreciation andamortisation, as well as maintenance costsNumbers may not add up due to rounding differences11

Disciplined capex spendCash capexas % ofrevenue(RM mn)2%4%Set-top box (STB) capexas % ofrevenue2%14180YTD FY21NB(1)(RM mn)4%12173YTD FY22YTD FY21YTD FY22Key capex investments in FY22 include: Technology infrastructure across OTT & digital, TV and VOD Customer experience Product and service upgrading STBs/ODUs are owned by Astro, and are capitalisedCash capex set to accelerate for the remainder of FY22 as guidedas investments are made in support of ongoing Technologyrefresh As at end of Q3FY22, vendor financing stood at RM337mn, ofwhich RM144mn is current and RM194mn is non-currentNumbers may not add up due to rounding differences STBs/ODUs are conservatively amortised over 3 years; note thatactual useful life is typically greater than 5 years Discretionary 36-month bullet payment vendor financing isavailable for Astro for STB/ODU purchases12

Strong cash generation capabilitiesFree cash flow(RM mn)as % of PATAMI290%82163%Drop mainly due toworking capital changesand payments tosuppliers( 250 )( 271 )1,2461,328( 341 )1,0781,157886545Cash fromWorkingoperating capital changesactivitiesbefore workingcapital changesCash fromoperatingactivitiesCash used in Free cash flow (2)investing(1)Cash fromWorkingoperating capital changesactivitiesbefore workingcapital changesYTD FY21Cash fromoperatingactivities(2)Cash used in Free cash flowinvesting (1)YTD FY22 enabling significant flexibility on capital management and dividend policyNB(1)(2)(3)Excludes investments, disposals and maturities of unit trust and money market fundsExcludes repayments of vendor financing and payments of finance leases, which are categorised as cash from financing for consistency withBursa disclosureNumbers may not add up due to rounding differences13

Quarterly dividend announcement Leveraging on invested capital, AMH continues to be highly cash generative The Board of Directors of AMH has declared a quarterly dividend of 1.5 sen per share for 3Q FY22 Quarterly dividend entitlement and payment dates are 24 December 2021 and 7 January 2022 respectively14

Malaysia’s #1 Entertainment DestinationAggregated:Standalone: Malaysia’s leadingcontent creator &aggregator Produced andcommissioned over 9khours of local contentin FY21 Rich On Demand libraryof over 65,000 titles Largest aggregator of Largest Pay-TV operatorthe best global andin SEAlocal streaming Serving 5.7mnservices, for eventualhouseholdsintegration onto STBs 72% household Privileged rates forpenetrationstreaming services for 7.5k enterprise customersAstro customers 35% TV adex share Launched sooka, our 1.1mn connected STBsown standalonestreaming servicecatering to millennials 14.7mn digital MUV SYOK app aggregateslive radio, podcast,across over 25 digitalvideos with 60 newbrandsonline radio stations Gempak is the #1 #1 radio brand inMalaysian digitalevery languageentertainment brandEnglish, Malay, AWANI is the MostChinese, Tamilfollowed news brand 17.2mn radio listenerson social mediaweekly (FM and 2% digital adex sharedigital) 76% radex share 24/7 multilanguageshopping experience Five 24/7 dedicatedchannels in Malayand Mandarin Multiplatform: TV,web and mobile 3.1mn registeredcustomers15

FY22 Strategic de customers the best viewing experience at homeIncrease content choice and ease path to purchaseGrow broadband bundle take-upOTT aggregation on app and onto our Ultra and Ulti boxesProduce more premium Astro OriginalsStreamingRadioDigital brandsCommerceLaunch our own standalone, snacking, streaming product for millennialsReinvent radio for the digital futureServe growing appetite for vernacular digital contentDrive home shopping businessAdexEnterpriseRefresh adex proposition with better targeting capabilitiesSupport businesses, adding value through our content solutions16

YTD FY22 Brief12Content Slides #27 to #29 Astro First home cinema revenue jumped 7% YTDNo.1 destination during Raya, EURO and OlympicsCelebrating Merdeka and Astro25 with special offeringsPremiered new Astro originals including The Hotel and i-TanggangAdding more new content- local and international- for customersPay-TV Slide #19 to #21 Launched the new Astro experience and made available Netflix onthe Ultra Box, more services to follow Launched new TV packs for greater value and convenience Introduced Plug & Play Ultra and Ulti Box Introduced 4K HDR and Dolby Atmos viewing experience Introduced continuous viewing on Ultra Box3NJOI Slide #26 578Prepaid revenue increased by 34% YTDOver 60 prepaid a-la-carte channels and packs for purchaseIntroduced NJOI HD Pack offering 12 HD channelsLaunched My NJOI app and 2021 Sports Pass for EURO and OlympicsAdex Slides #30 Launched addressable advertising on Astro GO and On Demandacross Ultra and Ulti boxesStreaming services Slides #24 to #25 Launched sooka, our own standalone streaming service Added Netflix, Disney Hotstar and TVB Anywhere to our streaming family,more to come Launched Interactive mode on Astro GO for an immersive sporting experienceRadio Slide #31 Launched 60 new online radio stations on SYOKNo.1 radio brand across all major languages in Malaysia17.2mn weekly listeners across FM and digital, up 3%Reinventing radio - including podcasts and customised audiocontent delivered through digitalDigital brands Slide #32 Monthly MUVs of 14.7mn across all digital brands AWANI is No.1 news brand on social media Gempak, Xuan, Ulagam are Malaysia’s Top digital brandsBroadband Slide # 22 to #23 Inked deals with Telekom Malaysia Berhad (TM) to collaborate indelivering high quality digital experience to all Malaysians, layingfoundation for Astro to be an ISP Broadband customers increased by 83% YoY Greater bundled value with new TV packs Speeds of up to 1Gbps, with greater value and convenience469Commerce Slide #33 Customer grew 16% YoY, performance impacted due to lower consumer spending Expanded product offering to meet rising demand for health and wellness duringthe pandemic Special festive shows to engage customers and drive sales momentum10 Enterprise Slide #34 Enterprise customers returned as economy reopened, customers up 17% QoQ Flexible content solutions for businesses Special adex packages for SME and microbusinesses17

Serving all Malaysians via 3 distinct servicesFor those who wantthe best entertainmentFor those who preferprepaid contentFor pure streamersand cord-neversPay-TVFreemium TVFreemium StreamingTV Packs bundled with:with: The best global and localstreaming services Broadband 18 free TV channels HD option at RM15 for 30 days Many prepaid content packs tochoose fromwith: Free content tier Premium live sports and Astro’swinning local content from RM15.90per month, renewable monthly18

Pay-TV: Welcoming Netflix onto our connected boxesEnjoy more content, greater savings &convenience with Astro and Netflix bundle19

Pay-TV: The new Astro experiencePlug & Play Ultra and Ulti Box variantsConnect and stream Astro via home broadband withouta satellite dish at homeContinuous Viewing on Ultra BoxContinue to watch shows without interruption duringheavy rainfallCloud RecordingRecord all the programmes you want at the sametimeDiscover VODStream over 65,000 of videos anytime, anywhere500,000Play From StartMissed the beginning? Just restart whenever you wantInstalls to dateNew Home ScreenExplore all programmes based on your subscriptionSearchFind what you are looking for faster and easierUlti BoxHDUltra Box4K UHD20

Pay-TV: 7 new Astro packs launched, bundled with appsPrimarySportsMoviesEntertainmentEntertainment 90 channels1 app100 channels1 app100 channels3 apps105 channels2 apps110 channelsUp to3 appsPremium (1,2,3)From105 channelsUp to5 appsPlatinum145 channelsUp to5 124.99/monthRM194.99/monthSwitch to fast fibre and enjoy greater bundle value withNB(1)(2)(3)TVB Anywhere app is only applicable for Chinese Favourites selectionPrices are based on 24 months contract period. Separate pricing applicable for 0,12 months contractsPrices are subject to 6% Service Taxpriced from RM80 for 30mbps & RM90 for 100mbps21

Broadband: Bundling drives customer growth, up 83% YTDNow with WiFi 6 RouterSpeeds of up to 1GbpsIn partnership with22

Broadband: Laying the foundation to be an ISP Inked deals with Telekom MalaysiaBerhad (TM) to collaborate in deliveringhigh quality digital experience to allMalaysians in September 2021 Strategic partnership enable Astro togain access to TM's full suite ofinfrastructureandconnectivitysolutions that comprises wholesaleservices inclusive of high-speedbroadband, bandwidth, backhaul andInternet access Lays the foundation for Astro to be aninternet service provider (ISP), toprovide Malaysians with the bestentertainmentexperienceandbroadband23

Streaming: Malaysia’s #1 Aggregator of Streaming ServicesComing soonComing soonComing soonComing soon& more24

Streaming: sooka, our standalone service for millennialsserving the young10,300 2.1mn273mnHours of contentand growingMinutes watchedto dateUsersto dateCatch live sporting events & premium local content Freemium streaming servicetargeted at Malaysian millennials,launched in June 2021 Featuring premium live sports, thebest local entertainment and sookaexclusives Stream for free with ads or sign upfor ad-free VIP plans from RM15.90per month, renewable monthly25

NJOI: Prepaid revenue up 34% YTD, driven by new HD packs18 free TV channels26 free radio channelsNJOI HD for only RM15 for 30 days*Terms and conditions applySENANGNYA NAK NJOI HIBURAN TERHANGAT26

Content: Astro First revenue up 7% YTD#1 Local Movie Franchise in Malaysia 2021RM 5.1mnRM 2.7mnRM 1.7mnRM 1.3mnrevenue to daterevenue to daterevenue to dateand countingrevenue to dateand countingA film that centersaround the driftmotor sports2nd film produced undergrant collaboration withFINAS for Astro First27

Content: No.1 Sporting destinationCatch all 380 matchesLive exclusively on Astro28

Content: Bringing the best local originals to our audiences29

Addressable Advertising: Revolutionising TV AdvertisingFirst in Southeast AsiaComing soon on linear TV Launched addressable advertising in December 2021 forVideo On Demand on Astro GO, Ultra and Ulti boxes. Plans underway to roll out the service on linear TV acrossall Astro home by in FY23 Leveraging data and technology, Addressable advertisingoffers advertisers greater digital-style targeting andaccountability capabilities30

Radio: 60 new online radio stations on the new SYOK!761kPodcast listensmonthlyNB(1)(2)27% YoYWeekly audience measurement is based on GfK for FM and RadioActive for digitalTotal listens averaged over 3 months (Aug – Oct 2021) based on Whooshkaa Analytics17.2mnRadio listeners weeklyon FM and digital76%Radex share31

Digital brands: Serving 14.7mn monthly visitors No.1digital entertainmentbrandNo.1Chinese digitalentertainment ian digitalbrandMalaysia’s most popularaudio multilingualentertainment app to meet growing demand for vernacular digital contentNB(1)Digital monthly unique visitors (“MUV”) to Astro’s digital brands, average over9months (Feb – Oct 2021) based on Google Analytics32

Commerce: Customers up 16% amid lower spendingStay Home, Stay SafeAvailable across all platforms:No.1 Home Shopping brand in Malaysia Five 24/7 dedicated Go Shopchannels in Malay andMandarin Hourly slots across Astrochannels in multiple languagesand dialects Harness social media to reachyounger customers Brand trust, quality products andvalue bundles continue to attractcustomersRegistered Customers (1)(mn)3.1Cumulative as of 31 JanuaryData presented for financial period ended 31 October3513142.7YTD FY21NB(1)(2)Revenue (2)(RM mn)YTD FY22YTD FY21YTD FY2233

Enterprise: Serving 7.5k customers, up 17% QoQFlexi Packs designed to givecommercial businesses acompetitive edge with awide choice of contentHospitality Packs providesentertainment solution designedfor hospitality-focused businesseswith greater content flexibility andchoicesAstro SINI keeps your customersentertained with Astro content ontheir personal devices at yourbusiness outlet without using mobiledata or internet bandwidth34

Key Social impact in FY22Education for all Reach over 5mn students annually through 3 Astro Tutor TV channels on Astro and NJOI, providing fresh educationalcontent, such as Pelan A SPM. RM120mn invested in learning content over the last decade including RM7mn in FY21 Launched new learning series, SPM Pro , featuring a virtual teacher who helps students to revise core subjects Collaborated with Universiti Malaya, Unimas and Universiti Malaysia Sabah on #BetterTogether University Challengeto support projects by tertiary students towards realising sustainable communities Contributed laptops for students at SK Magandai and SK Malinsau in Sabah; and SK Sungai Paku in Sarawak to makeonline education content accessibleVoice for good Aired over 9,500 hours of PSAs across TV, radio and digital as an agent for positivity to amplify community messagesHelping communities and businesses Astro First partners local film producers to premiere first run films directly to homes Collaborate with FINAS on TV/OTT Programme Fund to aid local film companies in production, distribution & marketingof local films Supports the needy through #KAMICARE community programmes, blood donation and COVID-19 vaccination drives Astro Radio supports microbusinesses by offering radio and social media advertising slots through #KAMICAREMBIZinitiatives Go Shop spearheaded Kita Sayang Malaysia campaign during Merdeka Day period to promote local brands, enterprisesand entrepreneurs; and partner them to aid families in needCaring for the Environment Partnered ERTH (E-Waste Recycling Through Heroes) to launch an e-waste recycling campaign, where e-waste collectionsare channeled towards providing students in the B40 community with laptops to facilitate online learning35

Appendix36

PAT reconciliation(RM mn)YTD FY21YTD 141)491438Tax expense(115)(103)Tax rate AMargin %(1)Depreciation and amortisationEBITMargin %Finance incomeFinance costPBTMargin %Normalised PATAMI (2)Margin %NB(1)(2)(3)Depreciation and amortisation excludes theamortisation of film library and programme rightswhich is expensed as part of content costs (cost ofsales)Normalised PATAMI excludes post-tax impact ofunrealised forex gain/(loss) YTD FY22: (RM 10mn),YTD FY21: (RM 8mn) due to mark-to-marketrevaluation of transponder-related lease liabilitiesNumbers may not add up due to roundingdifferences37

Balance sheet overview(RM mn)FY213Q FY22Non-current assets4,044Property, plant and equipment and right–ofuse assetsOther non-current assets(RM mn)FY213Q FY223,946Non-current liabilities2,9962,7371,7251,556Other financial liabilities2091942,3192,3902,6912,4539690Current 85,7855,303BorrowingsOther non-current liabilitiesCurrent assetsReceivables and contract assetsCash and bank balances(1)Other current assets1,7411,357583496Payables, contract & other financial liabilities1,107825Borrowings5136Other current liabilitiesShareholders’ equity5,7855,303Net debt / LTM EBITDA: 1.5x (FY21: 1.3x)NB(1)(2)Includes investment in unit trustsNumbers may not add up due to rounding differences38

Debt profile Total borrowings:RM 2,795mn* 971RM term loan 6151,2093Q FY22SyntheticForeignCurrency Loan(SFCL) Lease Liabilities(primarily satellitetransponders)*Includes accrued interest of RM8.8mn As of 31 October 2021, total outstanding principal stood at RM965mn.RM380mn is a term loan facility with a 5-year tenor fully drawn down on 23 August 2018, at a fixed rateof 5.18% p.a. with quarterly interest payment. Repayment will be in 2 tranches i.e. RM50mn on 23February 2023 and RM330mn on 23 August 2023.RM300mn is a term loan with a 5-year tenor drawn down in 2 tranches of RM50mn on 28 March 2019and RM250mn on 28 June 2019. Floating rate facility (based on cost of funds) of 3.37% p.a. as of 31October 2021, with quarterly interest payment. Repayment will be in 5 equal semi-annual installments,commencing 36 months from the first drawdown i.e. 28 March 2022.RM285mn is from a RM300mn term loan facility with a 6-year tenor fully drawn down on 2 September2020. This has an amortized semi-annual repayment schedule with final maturity date on 2 September2026 (Average life: 4.45 years), at a floating rate (based on cost of funds) of 3.24% p.a. as of 31 October2021, with quarterly interest payment. The third principal repayment of RM7.5mn will be paid on 2March 2022.The USD150mn SFCL facility of 4 years 11 months tenor amounted to RM612.7mn upon conversion atthe agreed exchange rate of USD/RM4.0850.Drawn in 2 tranches of RM306.4mn each on 29 December 2017 and 28 February 2018 respectively, at afixed rate of 4.80% p.a. with quarterly interest payment.Bullet repayment on 29 November 2022.Lease liabilities related to lease of Ku-band transponders on MEASAT-3, MEASAT-3A and MEASAT-3B.Payment arrangement for the remaining contractual years for M3 and M3A have been redenominatedinto Ringgit at USD/RM3.0445 w.e.f. 21 May 2013. The unhedged portion of the lease liabilities relatedto M3B is USD141.9mn.Effective interest rate: 6.2%, 4.6%, 12.5% and 5.6% p.a. for M3, M3-T11, M3A and M3B respectively,average life: 15 years.39

Thank you40

This document contains certain forward-looking statements with respect to Astro Malaysia Holdings erhad's ("Astro")financial condition, results of operations and business, and management'sstrategy, plans and objectives for Astro. . Normalised PATAMI excludes post-tax impact unrealised forex gain/(loss) 3Q FY22: RM 10mn, 2Q FY21: (RM .