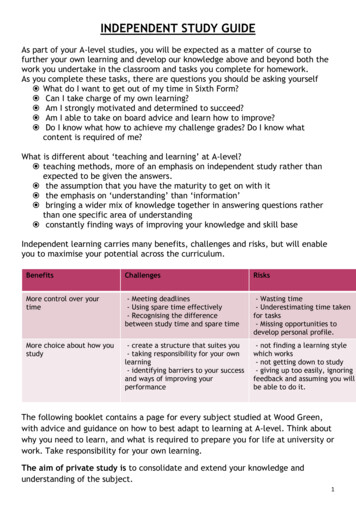

Transcription

INTERNATIONAL ADVANCED LEVELACCOUNTINGSPECIFICATIONPearson Edexcel International Advanced Subsidiary in Accounting (XAC11)Pearson Edexcel International Advanced Level in Accounting (YAC11)First teaching September 2015First examination from June 2016First certification from August 2016 (International Advanced Subsidiary) andAugust 2017 (International Advanced Level)Issue 2

Edexcel, BTEC and LCCI qualificationsEdexcel, BTEC and LCCI qualifications are awarded by Pearson, the UK’s largest awardingbody offering academic and vocational qualifications that are globally recognised andbenchmarked. For further information, please visit our qualification website atqualifications.pearson.com. Alternatively, you can get in touch with us using the details onour contact us page at qualifications.pearson.com/contactusAbout PearsonPearson is the world's leading learning company, with 35,000 employees in more than70 countries working to help people of all ages to make measurable progress in their livesthrough learning. We put the learner at the centre of everything we do, because whereverlearning flourishes, so do people. Find out more about how we can help you and yourlearners at qualifications.pearson.comAcknowledgementsThis specification has been produced by Pearson on the basis of consultation with teachers,examiners, consultants and other interested parties. Pearson would like to thank all thosewho contributed their time and expertise to the specification’s development.References to third party material made in this specification are made in good faith. Pearsondoes not endorse, approve or accept responsibility for the content of materials, which maybe subject to change, or any opinions expressed therein. (Material may include textbooks,journals, magazines and other publications and websites.)All information in this specification is correct at time of going to publication.ISBN 978 1 446 95129 3All the material in this publication is copyright Pearson Education Limited 2018

Summary of Pearson Edexcel International AdvancedSubsidiary/Advanced Level in Accounting SpecificationIssue 2 changesSummary of changes made between previous issue and this currentissuePagenumberThe ‘About this specification’ section has been corrected to show thatassessment opportunities are January, June and October2The ‘Content and assessment overview’ section has been updated to showthe assessment opportunities are January, June and October8, 9Content in Unit 1: 1.3 Financial statements of organisations has beenupdated for 1.3.1, 1.3.7, 1.3.8 and 1.3.9 to say ‘Statements of profit or lossand other comprehensive income ’ rather than ‘Statements ofcomprehensive income ’.13, 14Assessment objective weightings have been amended23Resitting of units section has been updated to reflect the correct rules25Appendix 6: Glossary of International Accounting Standards (IAS)terminology has been updated to use the correct terminology. These changeshave been reflected in the content for Unit 1 and Unit 2.38, 39and 40In Appendix 7: Formulae the first formula has been amended to say ‘1 GrossProfit as a Percentage of revenue (sales margin) (Gross Profit/Revenue) x100’ rather than ‘Gross Profit as a Percentage of revenue (GrossProfit/Revenue) x 100’.41If you need further information on these changes or what they mean, contact us via ourwbsite at: tml.

ContentsAbout this specification2Why choose Edexcel qualifications?4Why choose Pearson Edexcel International AdvancedSubsidiary/Advanced Level qualifications in Accounting?5Supporting you in planning and implementing these qualifications6Qualification at a glance7Accounting content10Unit 1: The Accounting System and Costing11Unit 2: Corporate and Management Accounting16Assessment information22Administration and general information25Entries and resitting of units25Access arrangements, reasonable adjustments, specialconsideration and malpractice25Awarding and reporting27Student recruitment and progression28Appendices29Appendix 1: Codes30Appendix 2: Pearson World Class Qualification design principles31Appendix 3: Transferable skills33Appendix 4: Level 3 Extended Project qualification35Appendix 5: Glossary37Appendix 6: Glossary of International Accounting Standards (IAS)terminology38Appendix 7: Formulae41Appendix 8: Command words used in examinations43Appendix 9: Use of calculators44

About this specificationThe Pearson Edexcel International Advanced Subsidiary in Accounting and the PearsonEdexcel International Advanced Level in Accounting are part of a suite of InternationalAdvanced Level qualifications offered by Pearson.These qualifications are not accredited or regulated by any UK regulatory body.Key featuresThis specification includes the following key features.StructureThe Pearson Edexcel International Advanced Level in Accounting is a modular qualification.However, the Pearson Edexcel International Advanced Subsidiary in Accounting is not amodular qualification. The Advanced Subsidiary can be claimed on completion of theInternational Advanced Subsidiary (IAS) unit. The International Advanced Level can beclaimed on completion of both units (IAS and IA2 units).ContentThe content is engaging and relevant to international customers using InternationalAccounting Standard (IAS) terminology and requiring presentation in International Standardformat.Assessment100% external assessment, with January, June and October assessment opportunities.ApproachThis qualification has been designed using Pearson’s Efficacy Framework, developed in linewith world-class principles.Students who successfully complete these qualifications will have a good knowledge andunderstanding of the principles, concepts and techniques of accounting. These qualificationsprovide a secure foundation for further study. They also provide a worthwhile course forstudents who will end their study at the International Advanced Subsidiary or InternationalAdvanced Level stage.Specification updatesThis specification is Issue 2 and is valid for first teaching from September 2015. If there areany significant changes to the specification, we will inform centres in writing. Changes willalso be posted on our website.For more information please visit qualifications.pearson.com2Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Using this specificationThis specification gives teachers guidance and encourages effective delivery of thesequalifications. The following information will help you get the most out of the contentand guidance.Compulsory content: as a minimum, all the bulleted content must be taught.Teachers should deliver the qualification using a good range of examples to support theassessment of the unit content.Students need to demonstrate knowledge of technical language where required.Depth and breadth of content: teachers should use the full range of content and all theassessment objectives given in the assessment information section.Qualification aims and objectivesThe aims and objectives of these qualifications are to enable students to develop: an understanding of the importance of effective accounting information systems and anawareness of their limitations through a critical consideration of current financial issuesand modern business practices an understanding of the purposes, principles, concepts and techniques of accounting transferable skills of numeracy, communication, ICT, application, presentation,interpretation, analysis and evaluation in an accounting context an appreciation of the effects of economic, legal, ethical, social, environmental andtechnological influences on accounting decisions methodical and critical thought which would serve as an end in itself, as well as a basisfor further study of accounting and other subjects.Qualification abbreviations used in this specificationThe following abbreviations appear in this specification:International Advanced Subsidiary – IASInternational A2 – IA2 (the additional content required for an IAL)International Advanced Level – IAL.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 20183

Why choose Edexcel qualifications?Pearson – the world’s largest education companyEdexcel academic qualifications are from Pearson, the UK’s largest awarding organisation.With over 3.4 million students studying our academic and vocational qualificationsworldwide, we offer internationally recognised qualifications to schools, colleges andemployers globally.Pearson is recognised as the world’s largest education company, allowing us to driveinnovation and provide comprehensive support for Edexcel students to acquire theknowledge and skills they need for progression in study, work and life.A heritage you can trustThe background to Pearson becoming the UK’s largest awarding organisation began in 1836,when a royal charter gave the University of London its first powers to conduct exams andconfer degrees on its students. With over 150 years of international education experience,Edexcel qualifications have a firm academic foundation, built on the traditions and rigourassociated with Britain’s educational system.To find out more about our Edexcel heritage please visit our ut-pearson/our-historyResults you can trustPearson’s leading online marking technology has been shown to produce exceptionallyreliable results, demonstrating that at every stage, Edexcel qualifications maintain thehighest standards.Developed to Pearson’s world-class qualifications standardsPearson’s world-class standards mean that all Edexcel qualifications are developed to berigorous, demanding, inclusive and empowering. We work collaboratively with a panel ofeducational thought-leaders and assessment experts to ensure that Edexcel qualificationsare globally relevant, represent world-class best practice and maintain a consistentstandard.For more information on the world-class qualification process and principles please go toAppendix 2: Pearson World Class Qualification design principles or visit our 4Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Why choose Pearson Edexcel InternationalAdvanced Subsidiary/Advanced Level qualificationsin Accounting?We have listened to feedback from all parts of the international school subject community,including a large number of teachers. We have made changes that will engage internationallearners and give them skills that will support their progression to further study ofAccounting and to a wide range of other subjects.Key qualification featuresStructure – two units comprising one IAS unit and one IA2 unit.Content: Updated, engaging and relevant to international students using InternationalAccounting Standard (IAS) terminology and requiring presentation in International Standardformat.Approach – These qualifications were designed using Pearson’s Efficacy Framework. Theywere developed in line with World-Class Design principles giving students who successfullycomplete the qualifications the opportunity to acquire a good knowledge and understandingof the principles, concepts and techniques of accounting. These qualifications provide asecure foundation for further study. They also provide a worthwhile course for students whowill end their study at the International Advanced Subsidiary or International AdvancedLevel stage.Assessment: 100% external assessment with examinations available in January, June andOctober series.Clear and straightforward question papers – our question papers are clear andaccessible for students of all ability ranges. Our mark schemes are straightforward so thatthe assessment requirements are clear.Consistent and updated command word taxonomy – we have updated the commandwords used in the assessment and applied a consistent mark tariff.Broad and deep development of learners’ skills – we designed the InternationalAdvanced Level qualifications to extend learners’ knowledge by broadening and deepeningskills, for example learners will have an opportunity to develop:Decision-making – students must have been able to carry out problem solving, analysis andinterpretationEthics – the whole of Accounting involves presenting a true and fair representation ofinformationInter-personal skills – required to obtain data, work within a team, discuss outcomes andmake recommendations.Progression – International Advanced Level qualifications enable successful progression toundergraduate studies, further education and work.Increased level of support – Getting Started Guide with scheme of work, exemplaranswers with commentaries Student Book and training. Additional planned resources includeonline digital resources.Our Accounting sits within our wider subject offer for Business, Economics and Commerce.More information is available on our website (qualifications.pearson.com) on theEdexcel International Advanced Level pages.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 20185

Supporting you in planning and implementingthese qualificationsPlanning Our Getting Started Guide gives you an overview of the Pearson Edexcel InternationalAdvanced Subsidiary/Advanced Level in Accounting qualifications to help you understandthe changes to content and assessment, and what these changes mean for you and yourstudents. This guide incorporates the scheme of work.Teaching and learningOur skills maps will highlight opportunities to develop: Decision-making processes making use of problem solving, analysis and interpretationskills Ethics as the whole of Accounting involves presenting a true and fair representation ofavailable information Inter-personal skills which are required to obtain data, work within a team, discussoutcomes and make recommendations Free teaching and learning materials including marked exemplar scripts with examinercommentaries to give indications of standards required to achieve marks across levels.Preparing for examsWe also provide a range of resources to help you prepare your students for theassessments, including: examiner reports following each examination series example marked scripts with examiner commentaries.ResultsPlusResultsPlus provides the most detailed analysis available of your students’ examinationperformance. It can help you identify the topics and skills where further learning wouldbenefit your students.Training eventsIn addition to online training, we host a series of training events each year for teachers todeepen their understanding of our qualifications.Get help and supportOur subject advisor service will ensure that you receive help and guidance from us. Clickhere to sign up to receive qualification updates and product and service news.6Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Qualification at a glanceQualification overviewPearson Edexcel International Advanced Subsidiary in AccountingThis qualification consists of one externally-examined unit.The International Advanced Subsidiary is the first half of the International Advanced Levelqualification and consists of one IAS unit, Unit 1. This qualification may be awarded as adiscrete qualification or may contribute 50 per cent towards the International AdvancedLevel qualification.Pearson Edexcel International Advanced Level in AccountingThis qualification consists of two externally-examined units.The International Advanced Level consists of the one IAS unit (Unit 1) plus one IA2 unit(Unit 2). Students wishing to take the International Advanced Level must, therefore,complete all two units.Course of studyThe structure of these qualifications allows teachers to construct a course of study that canbe taught and assessed as either: a linear course assessed in its entirety at the end for the Pearson Edexcel InternationalAdvanced Subsidiary or Advanced Level in Accounting; or distinct modules of teaching and learning with related units of assessment taken atappropriate stages during the course for the Pearson Edexcel International AdvancedLevel in Accounting.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 20187

Content and assessment overviewIASUnit 1: The Accounting System and CostingExternally assessedWritten examination: 3 hoursAvailability: January, June and October*Unit code:WAC11/01100% ofthe totalIAS50% ofthe totalIALFirst assessment: June 2016200 marksContent overviewStudents will be assessed on their knowledge, understanding and skills of accountingsystems and costing.This unit is divided into six topics:1. Principles of accounting and double entry bookkeeping2. Control procedures3. Financial statements of organisations4. Introduction to costing5. Analysis of accounting statements6. Social and ethical accounting.Assessment overviewThe paper is split into two sections. Students must complete: Section A – Two compulsory 55-mark, multi-part questions based on given data. Section B – Three optional 30-mark, multi-part questions from a choice of four. There will be a resource booklet that accompanies the examination paper.8Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

IA2Unit 2: Corporate and Management AccountingExternally assessedWritten examination: 3 hoursAvailability: January, June and October*Unit code:WAC12/01100% ofthe totalIA250% ofthe totalIALFirst assessment: June 2017200 marksContent overviewStudents will be assessed on their knowledge and understanding of and skills in corporateand management accounting.This unit is divided into nine topics:1. Limited companies2. Investment ratios3. Statement of cash flows4. Budgeting5. Standard costing6. Project appraisal7. Break-even analysis8. Marginal costing and absorption costing9. Information and communication technology (ICT) in accounting.Assessment overviewThe paper is split into two sections. Students must complete: Section A – Two compulsory 55-mark, multi-part questions based on given data. Section B – Three optional 30-mark, multi-part questions from a choice of four. There will be a resource booklet that accompanies the examination paper.*See Appendix 1: Codes for a description of this code and all other codes relevant tothese qualifications.CalculatorsCalculators may be used in the examinations. Please see Appendix 9: Use of calculators.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 20189

Accounting content10Unit 1: The Accounting System and Costing11Unit 2: Corporate and Management Accounting16Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Unit 1: The Accounting System and CostingIAS compulsory unitExternally assessedUnit descriptionStudents will be assessed on their knowledge and understandingof, and skills in, accounting systems and costing.This unit is divided into six topics:1. Principles of accounting and double entry bookkeeping2. Control procedures3. Financial statements of organisations4. Introduction to costing5. Analysis of accounting statements6. Social and ethical accounting.Assessment information First assessment: June 2016. The assessment is 3 hours. The assessment is out of 200 marks. The paper is split into two sections. Students must complete:o Section A – Two compulsory 55-mark, multi-part questionsbased on given data.o Section B – Three optional 30-mark, multi-part questionsfrom a choice of four. There will be a resource booklet that accompanies theexamination paper. Calculators may be used in the examination. Please seeAppendix 9: Use of calculators.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 201811

Unit content1.1 Principles of accounting and double entry bookkeepingWhat students need to learnRole and purpose ofaccounting1.1.1The role of accounting as a need to record, analyse andcommunicate accounting information to users.1.1.2The purpose of accounting information as an aid to themanagement of a business.1.1.3Transaction recording in books of account.1.1.4Transaction recording in books of prime entry.1.1.5End of period transfers and adjustments.1.1.6Ledger accounts to create and maintain allowance forirrecoverable debts, including calculation from a scheduleof trade receivables.1.1.7The use of information and communication technology(ICT) in recording transactions and preparingreconciliations (control accounts, trial balance) andfinancial statements. Note: candidates will not beexamined on the use of specific applications or softwarepackages.1.1.8The concepts of going concern, prudence, accruals andconsistency.1.1.9The concepts and conventions of historic cost, materiality,money measurement, realisation and business entity.1.1.10The use of International Accounting Standards (IAS).Capital expenditureand revenueexpenditure1.1.11Capital expenditure and revenue expenditure.1.1.12The correct accounting treatment of capital expenditureand revenue expenditure with reference to relevantaccounting concepts.Non-current assetdepreciation1.1.13The causes of depreciation of non-current assets.1.1.14The reasons for charging depreciation on non-currentassets.1.1.15The depreciation of non-current assets using reducingbalance, straight line and revaluation methods.1.1.16Ledger accounts for non-current assets and provisions ofdepreciation.1.1.17The effect on profit of different methods of depreciation.1.1.18The effect on profit of a change in the method ofdepreciation.1.1.19Disposal and disposal accounts for non-current assets.1.1.20Schedule of non-current assets.Double entry systemAccounting conceptsand conventions12Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

1.2 Control proceduresWhat students need to learnTrial balanceControl accountsCorrection of errors1.2.1The trial balance.1.2.2The limitations of a trial balance.1.2.3Control accounts as an independent check on receivableand payable ledgers.1.2.4Control accounts for trade receivable and trade payableledgers.1.2.5The errors that do and do not affect the balancing of thetrial balance.1.2.6Journal entries to correct errors.1.2.7The suspense account.1.2.8Statements of revised profit.1.2.9Correction of errors in control accounts.1.3 Financial statements of organisationsWhat students need to learnFinancial statementsof sole traders1.3.1Statements of profit or loss (and other comprehensiveincome) showing the gross profit and profit for the year.1.3.2Statements of financial position.1.3.3Prepaid or accrued income or expenditure.1.3.4The nature and use of provisions.1.3.5Provisions for depreciation.1.3.6Irrecoverable debts and allowances for nts of profit or loss (and other comprehensiveincome) in columnar format to show departmentalprofits/losses.Incomplete records1.3.8Statements of profit or loss (and other comprehensiveincome) and statements of financial position fromincomplete records and information.Year-endadjustmentsPearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 201813

PartnershipClubs and tements of profit or loss (and other comprehensiveincome) and appropriation accounts.1.3.10Partners’ current accounts and capital accounts on a fixedor floating basis.1.3.11Use of the Partnership Agreement in appropriation ofprofit/loss.1.3.12Provisions of Section 24 of the Partnership Act 1890 inrelation to partners’ salaries, division of profit or loss,interest on loans, capital and drawings.1.3.13Introduction (or retirement) of a partner, including theintroduction of assets and treatment of goodwill.1.3.14Receipts and payments accounts.1.3.15Trading accounts of different activities.1.3.16Subscription accounts.1.3.17Long-term/ life membership.1.3.18Losses of inventory or cash.1.3.19Income and expenditure accounts and statements offinancial position.1.3.20Manufacturing accounts with subheadings for prime cost,factory overhead, work in progress and production cost.1.3.21Allocation and apportionment of costs between productsand functions.1.3.22Unrealised profit resulting from goods manufactured.1.4 Introduction to costingWhat students need to learnValuation ofinventoryLabour costs141.4.1Characteristics of Last In First Out (LIFO), First In FirstOut (FIFO) and Net Realisable Value (NRV) as methods ofinventory valuation.1.4.2Inventory valuations using FIFO and LIFO on a perpetualand periodic basis.1.4.3The effect of different methods of inventory valuation onprofit and the statements of financial position inventoryvalue.1.4.4Labour productivity.1.4.5Methods of remuneration, day work, piecework, individualand group bonus schemes.1.4.6Employer cost and employee earnings under differentremuneration methods.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Overhead costsJob costing1.4.7The characteristics of overhead expenses, fixed, semifixed, semi-variable and variable.1.4.8Allocation, apportionment and absorption of overheads.1.4.9Apportionment and continuous allotment of servicedepartments.1.4.10Machine hour and labour hour rates per hour.1.4.11Over absorption and under absorption of overheads.1.4.12Characteristics of job costing.1.4.13Job costing of batch production and customer orders.1.5 Analysis of accounting statementsWhat students need to learnRatios1.5.1Ratios: gross profit as a percentage of revenue percentage mark-up profit for the year as a percentage of revenue return on capital employed (percentage) non-current assets to revenue inventory turnover current ratio liquid (acid test) ratio trade payables payment period trade receivables collection period.1.5.2The profitability, liquidity and use of asset ratios inappraising sole traders and partnership financialstatements.1.5.3Use of ratios to make future financial projections.1.6 Social and ethical accountingWhat students need to learnSocial accountingEthics1.6.1The implications of accounting decisions in the socialcontext of the local community, environment, workforce,health and safety, and use of natural resources.1.6.2Significance of non-financial factors.1.6.3Effect of accounting decisions on different stakeholders.1.6.4Ethics in accounting analysis and decision making.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 201815

Unit 2: Corporate and Management AccountingIA2 compulsory unitExternally assessedUnit descriptionStudents will be assessed on their knowledge and understandingof and skills in accounting systems and costing.The unit is divided into nine topics:1. Limited companies2. Investment ratios3. Statement of cash flows4. Budgeting5. Standard costing6. Project appraisal7. Break-even analysis8. Marginal costing and absorption costing9. Information and communication technology (ICT) inaccounting.Assessment information First assessment: June 2017. The assessment is 3 hours. The assessment is out of 200 marks. The paper is split into two sections. Students must complete:o Section A – Two compulsory 55-mark, multi-part questionsbased on given data.o Section B – Three optional 30-mark, multi-part questionsfrom a choice of four. There will be a resource booklet that accompanies theexamination paper. Calculators may be used in the examination. Please seeAppendix 9: Use of calculators.16Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting– Specification – Issue 2 – September 2018 Pearson Education Limited 2018

Unit content2.1 Limited companiesWhat students need to learnFinancial statementsCapital structure2.1.1Financial statements in accordance with InternationalAccounting Standards (IAS) 1: statement of comprehensive income statement of changes in equity statement of financial position.2.1.2The role of the auditor and content and importance of theAuditors’ Report and the Directors’ Report, including therole of the auditor in corporate governance.2.1.3The importance of disclosing continuing and discontinuedactivities and the significance of exceptional items.2.1.4Capital reserves and revenue reserves.2.1.5How the following reserves are created and utilised: retained earnings general foreign exchange share premium revaluation capital redemption.2.1.6Authorised, issued and called-up share capital.2.1.7Rights issues and bonus issues.2.1.8Ledger accounts and journal entries to record the issue ofnew shares, bonus issues and rights issues.Note: Candidates will not be examined on the forfeiture ofshares.2.1.9The features of shares and debentures.2.1.10Capital gearing and its implications.2.1.11The creation and features of provisions.Pearson Edexcel International Advanced Subsidiary/Advanced Level in Accounting –Specification – Issue 2 – September 2018 Pearson Education Limited 201817

Merger or purchaseof limited companies2.1.122.1.13Journal entries and ledger accounts for the pu

answers with commentaries Student Book and training. Additional planned resources include online digital resources. Our Accounting sits within our wider subject offer for Business, Economics and Commerce. More information is available on our website (qualifications.pearson.com) on the Edexcel International Advanced Level pages.