Transcription

This publication isa joint project withDoing business in the UAE

ContentsExecutive summary4DisclaimerForeword6Introduction – Doing business in the UAE8This document is issued by HSBCBank Middle East Limited (the‘Bank‘) in the UAE, which is regulatedby the Jersey Financial ServicesCommission, in partnership withPricewaterhouseCoopers (PwC).This document is not intended as anoffer or solicitation for business toanyone in any jurisdiction. It is notintended for distribution to anyonelocated in or resident in jurisdictionswhich restrict the distribution of thisdocument. It shall not be copied,reproduced, transmitted or furtherdistributed by any recipient.Conducting business in the UAE14Taxation in the UAE18Audit and accountancy22Human Resources and Employment Law24Trade38Banking in the UAE40HSBC in the UAE42Country overview44Contacts46The information contained in thisdocument is of a general nature only.It is not meant to be comprehensiveand does not constitute financial,legal, tax or other professionaladvice. You should not act uponthe information contained in thispublication without obtaining specificprofessional advice. This documentis issued by the Bank together withPricewaterhouseCoopers (‘PwC‘).Whilst every care has been taken inpreparing this document, neither theBank nor PwC makes any guarantee,representation or warranty (expressor implied) as to its accuracy orcompleteness, and under nocircumstances will the Bank or PwCbe liable for any loss caused byreliance on any opinion or statementmade in this document. Except asspecifically indicated, the expressionsof opinion are those of the Bankand/or PwC only and are subject tochange without notice. This documentis not a 'Financial Promotion'.The materials contained in thispublication were assembled inAugust 2012 and were based on thelaw enforceable and informationavailable at that time.

Executive summaryThis document seeks to providea general overview of theUnited Arab Emirates (‘UAE’)for investors (corporates andindividuals) who are looking toestablish business in the UAE.The UAE comprises of aFederation of seven emiratesnamely, Dubai, Abu Dhabi,Sharjah, Fujairah, RasAl-Khaimah, Umm Al-Quwainand Ajman which have theirown rules and regulations.This document covers severalconsiderations that maygenerally apply in all of theseemirates and can be consideredby foreign investors in evaluatingthe prospects of operating andinvesting in the UAE. Theseinclude the economy, regulatoryframework, tax aspects, auditand accountancy, humanresource and employmentissues, trade and banking.When considering doingbusiness in a foreign country,any investor needs to considera range of commercial issuesthat influence the decision ofsetting up in a country. The UAEcould be an attractive hub forinvestors to locate their businessinterests for the following reasons: The UAE has one of the mostliberal trade regimes in the Gulfregion and attracts strong capitalflows from across the region; UAE is focussed on economicdiversification in trade, logistics,banking, tourism, real estateand manufacturing and providesopportunities in variousindustries; UAE has a well-establishedinfrastructure, strong bankingsystem and a stable politicalsystem; Although there are restrictionson company ownership bynon-GCC nationals, the UAEalso provides for a window offree trade zones that can allow100% foreign ownership anda nil taxation regime (subjectto certain limitations);4 UAE provides a tax favourableenvironment for most industries; There are a high number ofexpatriate workers at all levelsof the economy such thatexpatriates accounts for over80% of the work force; There are no exchange controlrestrictions and it is possible tohave unrestricted repatriation ofincome and capital; UAE’s culture is driven by Islamictraditions, however, with over150 nationalities, expatriatesare able to practise their owncultures; and UAE provides a safe and securefamily environment with oneof the lowest crime rates inthe world.This document containsfurther details on key mattersthat investors should considerwhen exploring whether tooperate in the UAE. We hopethat the document provides youwith a useful initial overview ofthe key matters to considerwhen setting up in the UAE.

ForewordHSBC has a proud traditionof long-term investment andcommitment to the countriesin which it conducts business.This tradition has allowedHSBC to build deep and trustedrelationships with individuals,companies, governmentdepartments and rulingfamilies. It has also helpedHSBC understand how ourbusiness principles can bestbe complemented by givingback in appropriate ways tothe communities in whichwe operate.For 64 years HSBC hassupported local UAEbusinesses, and foreigninvestors coming to the countryto establish new ventures.Their combined success haspropelled the UAE to newheights, establishing it as thecentre for trade and financein the region. In recent years,HSBC has witnessed stronggrowth in demand from UAEbusinesses for assistanceand support as they expandoverseas. In parallel, majormultinational companies havemade the strategic choiceto relocate businesses andregional Head Office functionsto the country, a true testamentto the quality and confidencein the future of their investment6decisions. Today, as ever,HSBC stands ready to supportthe country’s next phaseof economic growth anddevelopment.However, we believe thatbusiness and society areinterdependent, and that strongeconomic growth requires aneducated society and skilledworkforce living in a healthyand sustainable environment.This belief has driven us ata fundamental level to supportnot only financial but also socialdevelopment. The volunteerwork that our staff carryout to support their localcommunities has become asmuch a part of our businessprinciples as financial strengthand acumen. Focused oneducational and environmentalprogrammes, HSBC and itsstaff work hand-in-hand withUAE and global institutionsin creating awareness andunderstanding througheducation and experience.HSBC’s commitment to socialresponsibility will continue togrow over the long term, withtime and funding provided tovolunteers to engage in andsupport this tradition of givingback to the community.Abdulfattah SharafChief Executive Officer UAEHSBC Bank Middle East Limited

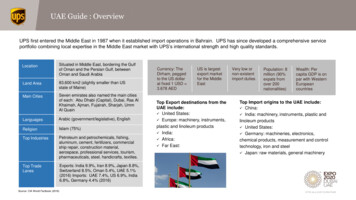

IntroductionDoing business in the UAEEconomic environmentThe United Arab Emirates(‘the UAE/country’) is in theMiddle East, bordering the Gulfof Oman and the Arabian Gulf,between Oman and SaudiArabia. The UAE has an openeconomy with a high per capitaincome and a sizeable annualtrade surplus. With Abu Dhabiand Dubai as its dual financialcentres, the UAE has longcommanded economicsuperiority in the GCC.Successful efforts at economicdiversification in trade, logistics,banking, tourism, real estate andmanufacturing have reduced theportion of GDP based on oil andgas output to 25%. Since thediscovery of oil in the UAE morethan 31 years ago, the UAE hasundergone a profoundtransformation from animpoverished region of smalldesert principalities to a modernstate with a high standard ofliving. The government hasincreased spending on jobcreation and infrastructureexpansion and is opening uputilities to greater private sectorinvolvement.8The country‘s Free TradeZones – offering 100% foreignownership and zero taxes –are helping to attract foreigninvestors. The global financialcrisis, tight international credit,and deflated asset pricesconstricted the economy in2009 and 2010. UAE authoritieshave tried to blunt the crisis byincreasing spending and boostingliquidity in the banking sector.The crisis hit Dubai hardest,as it was heavily exposed todepressed real estate prices.made on debt restructuringin the Emirate's troubledgovernment related entities.In February 2009, Dubailaunched a US 20bn bondprogramme to meet its debtobligations. The Central Bankof the UAE and Abu Dhabibased banks bought thelargest proportion of thesebonds. In December 2009,Dubai received an additionalUS 10bn loan from the emirateof Abu Dhabi. Dependence onoil and on a large expatriateworkforce are significantlong-term challenges.StrengthsThe UAE has one of the mostliberal trade regimes in the Gulfand attracts strong capital flowsfrom across the region.Currently, the UAE economy isrecovering from the previousheadwinds, driven by a pick-upin trade, tourism and publicspending, and supported byhigher oil prices. Real GDPrecorded a sound 3.3%growth in 2011, with nominaloutput regaining its pre-crisislevel of US 360 billion. TheUAE have benefited fromincreased investments lookingfor diversification within theregion, along with the spillover effects of higher oil pricesbenefiting the economy as ahydrocarbon exporter on thebackground of abundant oiland gas reserves, the seventhlargest in the world. The ArabSpring and the European debtcrisis have indeed divertedtourists, businesses andfinancial capital into Dubai.A significant headway has beenSWOT AnalysisIn common with most Gulfstates, there are a high numberof expatriate workers at alllevels of the economy.The UAE is progressivelydiversifying its economy,minimising vulnerabilityto oil price movements.The UAE is very wellconnected to the rest ofthe world, mainly due toEthihad, the UAE's nationalcarrier and Emirates, Dubai'sairline, rapidly expandingtheir fleet networks.WeaknessThe UAE’s currency is peggedto the dollar, giving it minimalcontrol over monetary policyand reducing its ability to tackleinflationary pressure. Thecountry’s location in a volatileregion means that its riskprofile is, to some extent,affected by events elsewhere.US concerns about regionalmilitant groups and regionalpolitical instability could affectinvestor perceptions.OpportunitiesOil prices are expected to stayhigh (by historical standards)over the near future.Economic diversification intogas, tourism, financial servicesand high-tech industries offerssome protection against volatileoil prices.Despite the impact ofthe 2009 downturn, thetourism and financialservices sectors still havegood medium-term growthprospects, driven by domesticand foreign investment.The prevailing unrest in theMiddle East Region and NorthAfrica which erupted in thebeginning of 2011 seems tohave worked to the UAE's, andparticularly Dubai's advantage,with businesses, financialinstitutions and people relocatingto the UAE. Capital inflows andtourism also seem to haveincreased as a consequence ofthe regional unrest.UAE‘s real estate sector hasbenefited from the extensionof visas by the UAE federalgovernment in June 2011 fromsix months to three years, areduction in mortgage ratesas banks remain more liquidand increasing oil prices.

ThreatsHeavy subsidies on utilitiesand agriculture, as well as anoutdated tax system, havecontributed to persistentfiscal deficits in the past,although rising oil revenueshave addressed theproblem in recent years.The existence of free tradezones with 100% ownership,zero taxes, excellentinfrastructure, a relatively stableoutlook on country risks, andvery a convenient geographicallocation almost midway betweeneast and west are attractiveaspects for foreign investments.Several high-profile constructionprojects have been delayed andthe property market crash couldthreaten future development.Some 80% of Fortune 500companies (including all ofthe top 10) have establisheda presence in UAE accordingto The Economist, and theUAE’s 25 plus free zonesare now host to numerousmultinational and regionalcompanies – including over6,400 companies from over120 different countries locatedin Dubai’s Jebel Ali Free Zone.For the first time in its history,the credit rating of the UnitedStates of America wasdowngraded from AAA to AAplus by S & P which has had asignificant negative impact onthe USA's stock market andcurrency. Despite this, the UAEis committed to maintaining itspeg with the US Dollar and,therefore, the prices of non-USDollar imports are expected towitness volatility in line with themovements in the US Dollarexchange rate.Why it is a good placeto do businessThe UAE is the 30th largesteconomy in the world1 and No.2in the Middle East and NorthAfrica. The UAE ranks 33rd outof 183 countries for the overall‘Ease of Doing Business’2benchmarked as of June 2011.Some of the challengesto invest in the UAE includethe need for a local sponsorowning 51% of the business(if not in a free zone); abilityto enforce contracts; morelimited creditors’ rights andoptions (bankruptcy lawsnot keeping pace with theeconomy development);and some inherent risksto the region becauseof geopolitical concerns.Languages spoken includeArabic (official), Persian,English, Hindi and Urdu. Thelabour workforce is 4.1 millionand expatriates account forabout 85% of the workforcewith over 150 nationalitiesworking and living harmoniouslyin a safe, almost entirelycrime-free environment.(FDI) sources from outside theregion. On the positive side,the absence of income taxcompensates for the restrictiveinvestment environment.The UAE attracts a highlyskilled workforce, whichis absorbed by the growingnumber of internationalcompanies, professionalservice firms and financialinstitutions. Expatriatesenjoy tax-free salaries,schools accredited tointernational standards,a high standard of healthcare and excellent recreationalfacilities – including a numberof championship golf courses.The UAE’s substantialhydrocarbons resourcerevenues means governmenthas no pressing need to raiseincome via direct taxes.Incentives for foreign investorsThe UAE’s investment climateis becoming more clementfor foreign direct investors:the federal government, led byAbu Dhabi, has made significantheadway in the past five yearsin increasing the role of theprivate sector. Yet the overalllegal framework continuesto favour local over foreigninvestors – a fact that partlyreflects the historically benignmacro environment in light ofthe country’s substantial oilrevenue windfall. This hasendowed local and regional Gulfinvestors with substantial liquidity,disincentivising the search fornew foreign direct investmentThere are also several benefitsto corporates and their employeesin relation to taxation. Refer toTaxation section.Barriers, risks or downsidesfor foreign investorsUnfortunately, just as everycountry has some incorporationdisadvantages, so does UAE.However, these disadvantagesare far outweighed by theadvantages of settingup business in the UAE. The UAE is not an Englishcommon law jurisdiction; A foreigner wishing to conductbusiness outside a free zonemust have a local partner owningat least 51% of the business; and The existence and interaction offederal laws, individual emiratelaws and free zone laws can bequite complex and confusing.Key markets and tradeThe major trading partners ofthe UAE include the EuropeanUnion (with 27 memberstates), India, Japan, China,South Korea, United States ofAmerica, Thailand, Singaporeand Oman.Export commodities includecrude oil (45%), natural gas,re-exports, fish and dates toJapan (17.1%), India (13.6%),South Korea (6.1%), andThailand (5.1%). Importcommodities includemachinery and transportequipment, chemicals andfood from India (17.5%),China (14%), United Statesof America (7.7%), Germany(5.6%) and Japan (4.8%)1.Intellectual property rightsThe UAE is a regional leaderin the protection of intellectualproperty rights, with improvingenforcement of copyright,trademark and patent laws.Anecdotal evidence suggeststhat the federal governmentis enforcing these laws, whichwere passed in 2002. The rateof software piracy in the UAEis regarded as one of thelowest in the Middle East.However, enforcement ofanti-piracy measures canvary between emirates,2000-2011 CIA World Factbook.www.doingbusiness.org,a co-publication of the World Bank andthe International Finance Corporation.1210

with Dubai seen as the bestperformer. More could bedone in other emirates, whilethe UAE still remains a majorcentre for the transhipmentof counterfeit goods.Local customs andbusiness etiquetteUAE’s culture is rooted inIslamic traditions. Courtesyand hospitality are amongstthe most highly prized ofvirtues, and this is reflected inthe warmth and friendliness ofthe local people. UAE societyis marked by a high degree oftolerance for different lifestyles.It is a liberal society by anymeasure and is rated as amongthe safest in the world.Foreigners are free to practicetheir own religion, and thedress code is liberal. Women,whether married or single,do not face any form ofdiscrimination and may drive,work, and move aroundunescorted. In spite of itsrapid economic developmentin recent years, UAE remainsclosely linked to its heritage.The customary greeting is‘As-salam alaikum,’ (peace beupon you) to which the replyis ‘Waalaikum as-salam,’(and upon you be peace).When entering a meeting,general introductions will beginwith a handshake. You shouldgreet each of your Emiraticounterparts individually. Inline with Muslim customs,avoid shaking hands with awoman unless they extendtheir hand first. Business cardsare common but not essentialto Emirati business culture. Ifyou do intend to use businesscards whilst in the UAE, ensurethat the information is printedin both English and Arabic.People in the UAE prefer to dobusiness in person. Relationshipsand mutual trust are paramountfor any successful businessinteraction and can only bedeveloped through face-to-facemeetings. It is important tospend time with Emirati businesscounterparts and ensure futuremeetings take place to continuecultivating the relationship.It is also important to haveconnections with people inthe UAE who can facilitateintroductions before attemptingto do business in the country.Emiratis prefer to do businesswith those they know, soappropriate introductions areimportant in order to establish asuccessful business relationship.

Conducting business in the UAEForms of businessForeign investors can carryout any activities in the UAEonly after being registeredand licensed by the relevantauthorities in the UAE.In general, a foreign investorcan establish a suitablebusiness presence in eitherthe UAE mainland (alsocommonly known as ‘onshore’)or a business presence‘offshore’. An ‘offshore’business presence typicallyrefers to a registration in oneof the UAE free trade zones.This type of registration ofbusiness inside the free tradezone is not to be confusedwith the regulatory systemfor offshore companies (alsoreferred to as ‘InternationalBusiness Companies’) whichexist in certain freezones.In terms of the legal forms,UAE Company Law providesthe regulations governing theoperations of foreign business.The Federal Law provides forseven categories of businessorganisation: limited liabilitycompany, branches, partnership,joint venture company, publicshareholding company, privateshareholding company andshare partnership company.14However, owing to certainrestrictions, the choicescommonly adopted by foreigncompanies are generally limitedto a limited liability company(‘LLC’) or a branch. The otheroptions e.g. partnerships andjoint venture etc. are usuallynot favoured by foreign investors.A representative office is broadlysimilar to a branch, except in thata representative office is onlypermitted to promote its parentcompany’s activities and is notpermitted to undertake anyincome earning activities.As per the UAE CommercialCompanies Law, the foreignownership of a LLC maynot exceed 49%, with thebalance of 51% to be heldby a UAE national.Investors also have a choiceto set up operations in oneof the free trade zones in theUAE. A free trade zone is ageographical area within theUAE that has been establishedby the UAE government togenerally encourage directforeign investment into theUAE and, as such, there aregenerally no foreign ownershiprestrictions, unlike ‘onshore’entities. That is, foreign investorscan set up 100% fully-ownedentities in the free trade zones.The principle drawback of afree trade zone is that strictly,entities registered in the freetrade zone are not permitted toconduct commercial activitiesin the UAE, outside of the freetrade zone.The UAE CommercialCompanies Law is currentlybeing re-drafted, and the newlaw is expected to allow 100%foreign ownership (subjectto approval from the relevantauthorities) for specificindustries set up onshore.However, there are no furtherdetails at this time as to howthis new law will apply.A branch is an extension ofthe foreign parent company. Assuch, it is wholly-owned by itsparent company and there is norequirement for UAE nationalsto take an ‘equity’ interest inthe business of the branch.Free trade zonesCurrently, there are over 30established free trade zones inthe UAE, of which the majorityare in the Emirate of Dubai.The free trade zones alsoprovide a choice of establishingeither a company or a branch.

Setting up a businessLimited Liability Company (LLC)A LLC can be formed bya minimum of two and amaximum of fifty personsand the minimum capitalrequirements vary from Emirateto Emirate (e.g. Dubai is AED300,000, whereas Abu Dhabirequires AED150,000). Theforeign minority shareholderis, however, able to exercisecontrol of a LLC through powersvested to the foreign partner inthe Memorandum and Articlesof Association. It is also possibleto attribute profit entitlementsin favour of the foreignpartner in a ratio other thanthe respective shareholdingswould otherwise suggest.It takes approximately eightto twelve weeks to incorporatea LLC, since there area number of steps, andsupporting legaliseddocumentation, to completein the incorporation process.Branch16A branch has no separate legalpersonality and is an extensionof the foreign parent company.According to Law number 13 of2011 free zone companies areallowed to set up branches inthe wider Emirate, provided theyobtain the proper licence fromthe Department of EconomicDevelopment and the approval ofthe Ministry of Economy. Branchregistrations may not be availableto all businesses (in broad termsthey are permitted for serviceproviders and contractors) andthe trade licence limits theactivities of branches to specifiedpermitted activities only.A branch is wholly-owned byits parent company and thereis no requirement for UAEnationals to take an ‘equity’interest in the business ofthe branch.A UAE national service agent,sometimes referred to as a‘sponsor’ must, however, beappointed to represent thebranch in all administrativedealings with Governmentdepartments (such asimmigration formalities). Theremuneration of the sponsoris normally agreed on anannual fixed fee basis, andis a matter of commercialagreement and can varydepending on the prominenceof the sponsor and the precisecontribution he makes to thebusiness of the branch.It takes a similar amount of timeto set up a representative officeas it takes to set up a branch.Free trade zonesThe free trade zones aregoverned by their own regulatoryauthorities and have their ownrules and regulations and areseen to adopt an industry focus.This means that the free tradezones are typically tailored tospecific industries and onlylicence specific types of activities.A representative office is broadlysimilar to a branch except,as mentioned above, it isnot permitted to undertakeany income earning activities.The regulations for establishingand operating a business inthe zones are less rigorous andtime consuming than thoseapplying to entities locatedin the ‘onshore’ UAE. Theregistration requirements aremore or less similar across thefree trade zones and involvea two-staged process. Thefirst stage is to obtain an initialapproval from the free trade zoneauthority and the next stageis to apply for a trade licenceand registration. As mentionedabove, the free trade zones alsoprovide a choice of establishingeither a company or a branch.The capital requirements (onlyfor companies, not branches),licence categories and fees varyamong different free trade zonesaccording to their rules, industryprioritisation as well as the typeof entity that is established.A representative office however,is also required to recruit theservices of a UAE nationalservices agent or sponsor.It normally takes up to four to sixweeks to complete a registration,though this may vary for eachfree trade zone.It takes approximately eightto twelve weeks to establisha branch.Representative officeInternationalBusiness CompaniesBusinesses not intending todo any business in the UAE,whether in a free trade zoneor onshore, can be set up underthe offshore regulatory system.Typically, such businesses actas holding companies forsubsidiaries outside the UAE.Under the offshore regulationsof certain free trade zones, thesecompanies act as a vehicle toown freehold property onshore.Annual filingsUnder the UAE CommercialCompanies Law, most companiesor branches are required tohave their accounts auditedlocally, and these accountswill then need to be filed withthe appropriate Emirate levelauthorities on an annual basisas part of the licence renewalfiling process. There is also anannual licence renewal fees tobe paid which is based on thetype of licence, entity and itsactivities. Similar requirement isfor the free trade zone entities,although the requirementsand fees vary and need to beconsidered based on the legalentity set up and its location.Foreign ExchangerequirementsThere are currently no foreignexchange control restrictions inthe UAE that may impact therepatriation of profits or capital.

Taxation in the UAECorporation income tax(or equivalent)Currently, the UAE federationdoes not impose a federalcorporate income tax in theEmirates. However, most of theEmirates constituting the UAEfederation introduced income taxdecrees in the late 1960’s andtaxation is therefore determinedon an Emirate by Emirate basis.Tax residence under the taxdecrees of the various Emiratesis based upon the Frenchconcept of territoriality.Basically, the Frenchterritoriality concept taxesprofits based on territorialnexus, rather than taxing profitsearned outside the country.Under the Emirate based taxdecrees, corporate incometaxes may be imposed on allcompanies (including branchesand permanent establishments)at rates of up to 55%. However,in practice the corporate incometax is currently imposed onlyon oil and gas companies andbranches of foreign banks havingoperations in the Emirate.In addition, some of the Emirateshave introduced their ownspecific banking tax decreeswhich impose tax on branches offoreign banks at the rates of 20%.18Entities established in a freetrade zone in the UAE aretreated differently than a normal‘onshore’ UAE entity. Aspreviously noted, free tradezones have their own rules andregulations and typically, froma tax perspective, they generallyoffer guaranteed tax holidays tobusinesses (and their employees)set up in the free trade zone fora period between 15 to 50 years(which are mostly renewable).On the basis of the above,most of the entities registeredin the UAE are currently notrequired to file corporate taxreturns in the UAE, regardlessof where its UAE businessis registered.and the remaining 12.5%is payable by the employer.The rates can differ indifferent Emirates.The withholding obligationis on the employer. Thereare no social securitypayments for expatriates.For completeness, expatriatesemployed by a UAE employerare entitled under the UAELabour Law to a gratuitypayment (or an ‘end of service’benefit). End of servicebenefits are not applicableto UAE national employees.On the basis of the above,individuals in the UAE arecurrently not required to filepersonal tax returns in the UAE.Personal income taxThere are currently no Federal orEmirate level personal incometaxes imposed on individualsworking in the UAE.There is a social securityregime in the UAE whichapplies to employees whoare GCC nationals. Generally,for UAE nationals the socialsecurity payment is at a rateof 17.5% of the employee’sgross remuneration as statedin an employee’s employmentcontract and applies regardlessof the free zone tax holidays.5% is payable by the employeeSales tax/VATThere is currently no VAT in theUAE. However, the UAE (alongwith the other member countriesof the Gulf Cooperation Council)has committed, in principle, tointroduce a VAT system and UAEhas made significant progresstowards its introduction, whichis expected in the near future.At this point in time there isno confirmation on its ratesor how this will effect businessoperations in the UAE (onshoreor free trade zones).

Other taxesWithholding taxHotel taxThere are currently nowithholding tax regulationsin the UAE that would applyto payments such as royalties,interest or dividends etc. madefrom the UAE entities to anotherperson (resident or nonresident). That is, paymentsof any kind made by a UAEcompany should not suffer anywithholding taxes in the UAE.Most emirates imposea 5-10% hotel tax on thevalue of hotel servicesand entertainment.Municipal taxMunicipal property taxes arelevied in the various emiratesin various forms, but generallyas a percentage of the annualrental value. In some cases,separate fees are payableby both tenants and propertyowners. (For example, in Dubaithey are currently levied at 5%of the annual rental value fortenants or for property ownersat 5% of the specified rentalindex).These levies are administereddifferently by each emirate.These levies may also becollected at the same timeas (or as part of) licence fees,or the renewal of licences,or by another method.(For example, in Dubaithe payments have recentlystarted to be collected via theDubai Electricity and WaterAuthority’s billing system).Transfer pricing and thincapitalisationThere is currently no transferpricing regime in the UAE.There are currently also no thincapitalisation (or debt-equityratio) requirements in the UAE.

Audit andaccountancyJoint stock and limited liabilitycompanies must appoint oneor more auditors. All legallyincorporated companies haveto file their audited financialstatements with the Ministryof Economy or relevantauthority in order to renewtheir trade licences. Thereare no exceptions availableor restrictions on appointmentof auditors, although

and reducing its ability to tackle inflationary pressure. The country’s location in a volatile region means that its risk profile is, to some extent, affected by events elsewhere. US concerns about regional militant groups and regional political instability could affect investor perceptions. Introduction