Transcription

DISCOVERING THERIGHT PROPERTYCOULD SAVE YOU10-30%!A Guide for Home Buyers

CONTENTsINTRODUCTION2LEARNING OBJECTIVES3MITIGATING PROPERTY RESEARCHTHE RIGHT LOCATIONTHE RIGHT PRICE667CASE STUDYHOME BUYER8CONCLUSION10

INTRODUCTIONMany home buyers harbour fears about making the wrongdecision and wonder how they will know when they have found theright house. Similar to those looking to renovate, knowing whatmakes a good value investment can be difficult to do correctly.To get you on your way to furthering your property journey, youfirst need to understand how to correctly research and shortlistproperties. Doing so can save you 10-30% on your propertypurchase! Knowing what makes a good value purchase, can alsohelp you make wise renovation decisions that potential buyers willappreciate.Purchasing property can mean different things to differentindividuals. Such as, a couple starting out with a young family mayhave a different expectation on generating a return on the fundsoutlaid compared to a person approaching retirement. We helpyou to de-risk with various time-tested strategies as you navigateproperty ownership.Discovering the Right Property Could Save You 10-30%!2

LEARNING OBJECTIVESKnowledge is an integral aspectof property investment. Themore you know and understandabout property and the realestate market, the better ableyou are to make good valueand great future propertypurchasing decisions.We help you to: Understand the risksassociated with the purchasingor renovating of property, Correctly navigate propertyarea and price research, and Make property purchasingand renovating decisions withconfidence.Discovering the Right Property Could Save You 10-30%!3

MITIGATING RISKProperty purchasers or renovators must constantly be scanning theproperty environment for risks and taking measures to eliminate– or at the very least minimise – such risks. In order to mitigaterisk and achieve success, you must first have the ability to identifythe risks associated with your purchase or renovation. There aremany suitable strategies available to you to help to mitigate yourassociated risks, such as:RESEARCHAdequate area and price research (see page 4) is the first and inmany cases the biggest step to mitigate your risk. Research givesyou the tools to understand what the right property is.DIVERSIFICATIONThis strategy involves spreading your capital over the four mainasset classes: cash, property, shares and fixed-interest securities.In addition to choosing different property types, diversificationcan also be achieved by investing in properties across variousgeographical markets.Discovering the Right Property Could Save You 10-30%!4

LIQUIDITYThis refers to the ability to sellan asset, in relation to the timeframe it would take to do so;or in other words, the easein which it can be done. Thelonger it takes to dispose ofan asset, the lower the level ofliquidity. Equally true, the easierit is to dispose of an asset, thehigher the level of liquidity. It isessential that you understandyour level of liquidity, in order tohave buffers in place. Havinga buffer – such as emergencyfunds – can reduce the riskof a forced sale in the event offinancial stress.INSURANCEThere is a range of insurance options available to both propertypurchasers and property renovators, many of which provide auseful strategy in minimising risks. Your decision as to whichinsurance policies to take out and the amount of cover depends onyour unique circumstances and needs. At the very least, we highlyrecommend the building itself and any related contents are insured.\Discovering the Right Property Could Save You 10-30%!PROFESSIONAL ADVICESeeking advice from local industry professionals will ensure youhave the best potential for success on your home purchase orproperty investment. The professionals may include: accountants,conveyancers, solicitors, building and pest inspectors, quantitysurveyors, property managers and qualified investment advisers.Ensure that you conduct the necessary investigation whenselecting each professional, in order to ensure they have thequalifications, accreditations, experience and knowledge to assistyou appropriately.5

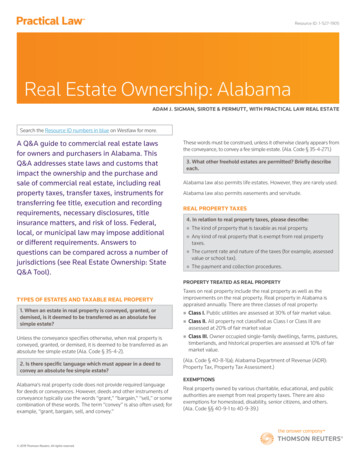

RESEARCHDoing your research will help ensure you are investing in propertywith the most opportunity for success. Not only can it help youto make better decisions that provide better future returns, butit can also help alleviate the stress associated with such a biginvestment.Research is a paramount strategy for minimising risk. It alsoprovides essential information that can assist in minimising thepossibility of buying properties: In low (or no) growth areas;That do not achieve rental growth;With zoning issues;With high vacancy rates; and/orWith poor cash flow.THE RIGHT LOCATIONA good location will have capital growth potential and will provideyou with the best return on your investment. A savvy property buyerwill research the best areas with the most capital growth potential,and then concentrate on finding a property in those areas that fittheir budget. Current Australian property market data that providesfigures on the latest trends is available to you online as well asthrough development professionals and local real estate agencies.Discovering the Right Property Could Save You 10-30%!6

You need to consider what is located nearby: good schools, publictransport links, shopping centres, amenities and access to theCBD. All of these will majorly impact the potential of an area andthe properties within it. So too will this impact your renovationdecisions, as what you put into your property will dependdramatically on what potential buyers are seeking in that area.THE RIGHT PRICEArea research gives you the tools to understand what the right priceis for a property so that you don’t overspend. By researching saleprices of comparable properties in the area, you can determinethe accurate range to spend on your potential property purchase.Spending too much on a property is going to severely affect yourreturn on investment when you sell.If the area you are researching looks like a great location to investin, but its success has affected property pricing to a point thatit is no longer within your budget, you should consider a suburbadjacent that is better suited or look into a different area altogether.Overspending can seriously harm your chances of success shouldyou have to sell prematurely due to bad cash flow. This is equallytrue of renovating, if you overspend on your renovations or investtoo much in the wrong aspects of your home, when it comes time tosell you can seriously harm your chances of a successful return oninvestment.Discovering the Right Property Could Save You 10-30%!7

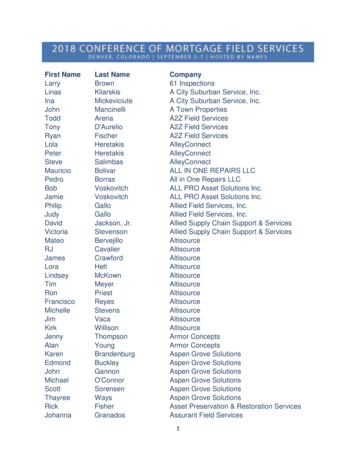

CASE STUDYSARAH’S STORYSarah is a part-time officeworker looking to upgrade herhome. She has been waitingfor the right property. She hasput off seeing how much shecan borrow on a new mortgageas she was nervous about thedifficulty of the process due toher part-time career status. Sheis stressed about making sucha big purchase and worriedthat she might make the wrongdecision. This has led to Sarahwaiting over a year to purchaseher new home.CASH FLOWSarah has saved 80k for adeposit. This means that minusexpenses and assuming a 20%deposit, she has the potentialto conservatively purchase ahome valued at approximately 375,000 for her and her kids.This leaves little room forrenovations, so Sarah needsa home requiring very littleupgrades upon purchase.PREFERABLE LOCATIONSarah’s ideal home is locatedwithin easy distance to thelocal school and communitybuildings as well as parks andplaygrounds. Her family liveswithin her preferred suburb,and ideally, she would like topurchase a home near them. Tofit her and her children, she willneed a three-bedroom home.Discovering the Right Property Could Save You 10-30%!8

RESEARCH & RISKSUpon researching her preferredsuburb, Sarah has discoveredthe homes in that area werepriced too high for her currentbudget. She considered waitingfurther and saving more, butafter speaking with both heraccountant and a mortgagebroker, she discovered thatalthough she has saved enoughfor a deposit on a home valuedat 380k, her repaymentcapability is suitable more to ahome valued at 350k.Sarah received advice from atrusted local real estate agentthat suggested she seek out asurrounding suburb, just outsideof her preferred location thatwas better suited to her budget.Upon researching the areafurther, Sarah discovered manywell-suited homes for her andher children within her budget.She also learned that the benefitof purchasing a lower valuehome than she had originallyplanned, meant she had someremaining cash flow for smallupgrades to the new home.PURCHASINGSarah purchased a threebedroom, one-bathroom homevia auction for 345,000. Shefeels very proud of her purchase,as the auction was a distressedsale due to separation. As it wasin the suggested surroundingarea, she is located only a20-minute drive from her family.The property required a fewsmall upgrades, which she wasable to complete with the cashshe saved.Discovering the Right Property Could Save You 10-30%!By seeking professionaladvice and doing her ownresearch, Sarah managedto save 10% of her initialsavings!OUTCOMESarah initially planned to spendall of her 80,000 savingspurchasing a home. She actuallyspent 69,000 on her deposit, 3,000 on expenses such as asolicitor and building and pest, 4,000 on small upgrades tothe home and managed to save 4,000 which she has placedinto an emergency fund for anyunexpected expenses.Sarah has a home with enoughbedrooms for all of her children,she lives a short 10-minutedrive from the local school, sheis surrounded by local shops,parks and community areasand lives only a quick 20-minutedrive from her family in theneighbouring suburb.9

SO WHAT DO I DO NEXT?This guide has provided information on how to mitigate risk andvarious strategies that can help make your next home purchaseor renovation a success. Some you may never consider or use,but having an awareness and depth of knowledge will enableyou to choose a strategy appropriate for you and take the stepstowards new home ownership or renovations. This information isdesigned to help you recognise and shortlist the right property orrenovation for you, in order to save you money.We wish you the best of luck and if you have any questionsmake sure you jump into our Facebook Group, where we havea community of like-minded people in the same boat. It’s asupportive group to help buyers get through the maze of all thehoops they need to jump through and find the right home.You can join hereAll the best,James and the mrkts.com.au team

Discovering the Right Property Could Save You 10-30%! 3 Knowledge is an integral aspect of property investment. The more you know and understand about property and the real estate market, the better able you are to make good value and great future property purchasing decisions. We help you