Transcription

Summary of PPO BenefitsBenefit Period April 1-March 31A PPO, or Preferred Provider Organization, offers two levels of benefits. If you receive services from a provider who is in the PPO network, you’ll receive the highest levelof benefits. If you receive services from a provider who is not in the PPO network, you’ll receive the lower level of benefits. In either case, you coordinate your own care.There is no requirement to select a Primary Care Physician (PCP) to coordinate your care. Below are specific benefit levels.ICUBA Preferred PPO PlanBenefitDeductible Per Benefit Period (PBP)IndividualFamilyCoinsuranceOut-of-Pocket Maximums PBPIn-NetworkOut-of-Network(Coinsurance and Copays displayed as Employee responsibility) 2,500 5,00020% 4,000 10,75040% 4,000 8,000 7,500 15,000(includes deductible, coinsurance, and medical copays)IndividualFamilyLifetime MaximumPhysician Office Visits(Internal Medicine, General Practice, Family Practice,Pediatrician, OB/GYN)No Maximum 15 copay(not subject to deductible)40% after deductibleTotal Care Physician Office Visit(Internist, Family Practice, Pediatrician)Embold Physician Office Visit(Primary Care, Pediatrician, Cardiology, Obstetrics, Jointcare, Spine care, Endocrinology, Gastroenterology,Pulmonology)Teladoc Telemedicine VisitMaternity Office Visit Benefit(initial OB visit only)Specialist Office VisitsIndependent Clinical Labs **(free standing facilities and office visits)Outpatient Facility (Hospital setting)***Preventive Care - Annual Physical andGynecological examChlamydia and STD testsPAP testsProstate cancer screenings (PSA)Mammograms andUltrasounds of the BreastUrinalysisVenipuncture/Conveyance FeeGeneral Health Blood Panel, Glucose Test,Lipid Panel, Cholesterol, and ALT/AST.Adult and Pediatric ImmunizationsRelated Wellness Services (e.g., blood stooltests, colonoscopies, sigmoidoscopies,electrocardiograms, echocardiograms, and bonemineral density tests)0%(not subject to deductible or copayment)0% after 5 copay 15 copay(not subject to deductible) 35 copay(not subject to deductible)0%(not subject to deductible)20% coinsurance0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)0%(not subject to deductible)** Quest Diagnostic Labs is the In-Network Lab for BlueCross BlueShield of Florida.***Outpatient Facility Lab – If you go to your doctor’s office at/in a hospital facility and have lab work done (ex: Moffitt Center)N/AN/A40% after deductible40% after deductible40% after deductibleNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot CoveredNot Covered

ICUBAPreferred PPO PlanIn-NetworkBenefitOut-of-Network(Coinsurance and Copays displayed as Employee responsibility)0%40% after deductibleAllergy Injections(not subject to deductible)Emergency Room ServicesMedically Necessary Emergency Transportation0% after 300 copay (waived if admitted)0% after 250 copayConvenient Care Clinic (Retail)0% after 10 copayUrgent Care CenterHospital ExpensesInpatientOutpatientOutpatient Surgery Office Setting(Physician or Specialist)0% after 30 copayMinute Clinic- CVS/Healthcare Clinic - WalgreensOutpatient FacilityRelated professional servicesNon-Emergent Surgeries with SurgeryPlusPlease call 1-855-200-2119 for this separatebenefitInfertility Services (Counseling and testing todiagnose only)Outpatient Physical TherapyOutpatient Speech Therapy(Restorative services only)Outpatient Occupational TherapySpinal ManipulationDiagnostic Services(X-Ray and other tests)Outpatient Diagnostic Imaging(MRI, MRA, CAT Scan, PET Scan)Durable Medical EquipmentProsthetic AppliancesHearing Care ServicesHearing aid screening/exam20% after deductible20% after deductible20%(not subject to deductible)40% after deductible40% after deductible20% after deductible20% after deductibleDeductible and coinsurance are waived whenutilizing SurgeryPlus services and network40% after deductible40% after deductibleNot Covered20% after deductible40% after deductible 20 copay (not subject to deductible)Limit: 60 visits/ benefit period 20 copay (not subject to deductible)Limit: 60 visits/ benefit period 20 copay (not subject to deductible)Limit: 60 visits/ benefit period 20 copay (not subject to deductible)Limit: 60 visits/ benefit periodInpatient RehabilitationSkilled Nursing RehabilitationHome Health CarePrivate Duty NursingHospice(Inpatient and Outpatient Care)40% after deductible40% after deductible40% after deductible40% after deductible20% after deductible40% after deductibleAllowed Charges up to 500 Copay40% after deductible20% after deductible20% after deductible40% after deductible40% after deductible20% (not subject to deductible)20% after in-network deductibleCombined limit: 1,500/ benefit periodHearing aidTemporomandibular Joint Disorder(Medical necessity required; excludes appliancesand orthodontic treatment)40% after deductible20% after deductible40% after deductible20% after deductibleLimit: 60 days/ benefit period20% after deductibleLimit: 60 days/ benefit period20% after deductible20% after deductible40% after deductible0%(not subject to deductible)40% after deductible40% after deductible40% after deductible40% after deductibleMental Health, Substance Abuse Benefits are provided by Aetna Behavioral Health - Available 24 hours at 877-398-5816Mental Health/Substance AbuseInpatientOutpatient20% after deductible 15 copay (not subject to deductible)40% after deductible40% after deductibleThis is not intended as a contract of benefits. It is designed purely as a reference of the many benefits available under your program. Please see your Plan Document fordetailed information on plan terms and the appeals process. Effective 4/1/2022

ATTENTION ICUBA MEMBERSICUBA April 1, 2022 – March 31, 2023Prescription Medication PlanThe following is a brief overview of your pharmacy benefit‡. To help keep your costslow, ICUBA pays a portion of the cost, and you pay the rest.30-Day SupplyNationwide Pharmacy NetworkYou have access to more than 62,000 chain and independentpharmacies including: Costco, CVS, Publix Super Markets Inc.,Walgreens, Target, The Medicine Shoppe, Walmart, Winn-DixieStores, Inc.90-Day SupplyConvenient Mail Service PharmacyHome Delivery is an easy way to receive up to a 90-day supplyof your maintenance medication delivered by mail to your door.Standard shipping is free. Orders are shipped in confidential,tamper-evident packaging from Home Delivery pharmacies. Calltoll-free at (800) 763-0044.90-Day at Retail ProgramThis program allows you to obtain a 90-day supply of yourmaintenance medication at more than 45,000 participatingcommunity pharmacies.Out-of-Pocket MaximumIn-network Rx copays will be applied toward an individualmaximum out-of-pocket of 2,000 and 4,000 for family. Onceyou reach your out-of-pocket maximum, your prescriptions willbe paid at 100% by the plan and no cost to you ( 0 copay).Diabetic SuppliesThe following prescribed diabetic supplies are covered at 100%, 0 copay: meters, lancets, lancing devices, test strips, controlsolution, insulin needles and syringes.Rx with Over-the-Counter (OTC) alternativesThe Rx with OTC strategy excludes certain prescriptionproducts when therapeutically acceptable over-the-counter(OTC) alternatives are available.Over-The-Counter and Generic Preventive MedicationsWith a prescription from your physician, the following OTC andgeneric preventive medications are covered as part of yourpharmacy benefit with 0 copay: Aspirin for adults, prenatal vitaminsor folic acid for women planning or capable of pregnancy, ironsupplementation, oral fluoride supplementation for children,vaccines, Vitamin D for adults, bowel preparation agents forcolorectal cancer screening, and select statins for prevention ofcardiovascular disease (CVD).Tobacco CessationTobacco cessation medications are covered with 0 copay whenyou participate in coaching or counseling options though local AreaHealth Education Centers, BCBS telephonic coaching or Resourcesfor Living counseling. (See flyer for more information!)Specialty MedicationsCertain medications used for treating complex health conditions(e.g. Hepatitis, HIV/AIDS, Oncology, etc.) must be obtained throughOptum Specialty Pharmacy. Call toll-free at 1-855-427-4682.Optum Rx Web PortalFind answers by visiting the OptumRx Portal through the single signon section at ICUBAbenefits.org with features designed so you canfind your lowest copay, manage your Home Delivery prescriptions,keep track of your health history and more!Health Care AdvisorIf you have a question about your pharmacy benefit, call the HealthCare Advisor team toll-free at (855) 811-2213, 24 hours a day, 7days a week.If you have a question about your pharmacy benefit, and would liketo speak with a Pharmacist at ICUBAcares, call (877) 286-3967.CopaymentsPrescription-Fill Methods*Retail: Up to a30-day supply90-Day at Retail ProgramUp to a 90-day supplyMail: Up to a90-day supplyLow Cost Generics at the Nova Southeast University (NSU) Pharmacy 0 0N/ALow Cost Generics at all other network pharmacies 5 10 10Preventive Generics**** 0 0 0Generics: Tier 1 Medications on the Premium Formulary (PF)** 10 20 20Preferred Brands: Tier 2) Medications on the Premium Formulary 40 80 80Non-Preferred Brands: Tier 3 Medications Premium Formulary 75 150 150Preferred specialty at Optum Specialty Pharmacy 75***N/AN/ANon-preferred specialty at Optum Specialty Pharmacy 75***N/AN/ATier‡Prior authorization may be required to ensure safe and effective use of select prescription drugs. Your physician may be asked to provide additional information to determine medical necessity.*Unless medically necessary, members will be required to pay the difference in cost between a brand and generic drug if the brand is requested when a generic equivalent is available.** The PF is a list of medications preferred by your plan that can help you maximize your pharmacy benefit by minimizing your prescription costs. You can view the PF online by visiting optumrx.com*** Specialty medications are limited to a 30 Day Supply. Copay Assistance Cards are acceptable to preferred specialty products**** Prescribed preventive generic medications to treat one of the conditions designated Essential Health Benefit by the Affordable Care Act (In some cases You may have to meet an additional requirement such as-------age, sex, and diagnosis to qualify for the 0 copay) 2020 Optum, Inc. and its affiliated companies.

ICUBA Preferred PPO PlanAetna Behavioral Health and Substance AbuseAetna Open Choice PPO NetworkPlan Year April 1, 2022 through March 31, 2023Employee Assistance Program (EAP), Mental Health, Substance Abuse Benefits and Applied Behavioral Analysis (ABA)Provided by Aetna Behavioral Health - Available 24/7 - 877-398-5816Deductibles and Out of Pocket Maximum Amounts are COMBINED with BCBS MedicalEmployee Assistance Program (EAP) *Up to 6 short-term professional counseling sessions perepisode per year. Talk with a licensed clinician regardingstress, relationship issues, grief, etc.Inpatient*Mental Health Hospital Admission*Substance Abuse Hospital Admission*Residential*Residential Services focus on evaluating and stabilizing thepatient. They help the patient learn effective ways to copewith the symptoms and impact of the patient’s illness.In NetworkOut of Network 0No coverage20% after deductible20% after deductible20% after deductible40% after deductible40% after deductible40% after deductible20% after deductible40% after deductible20% after deductible40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 15 copayment (not subject to deductible)40% after deductible 0No coverageInpatient Detoxification*Inpatient detoxification provides 24 hour treatment in aresidential or hospital setting for patients who are abusingalcohol or other physically addictive drugs. Patients typicallystay in detoxification only as long as their withdrawalsymptoms require 24 hour medical and nursing services.OutpatientProfessional Counseling SessionsTalk with a licensed clinician regarding anxiety, attentiondeficit hyperactivity disorder (ADHD), depression, mooddisorders, oppositional defiance disorder (ODD),schizophrenia, trauma, etc.Psychiatric Medication EvaluationApplied Behavioral Analysis Therapy*Behavioral health services related to Autism SpectrumDisorder (ASD) diagnosisPartial Hospitalization (PHP)*These programs are longer and more intensive than an IOP,usually 4-6 hours per day, 5-7 days per week. Servicesinclude physician and nursing services, as well as group,individual, family or multi-family group psychotherapy,psycho-educational services, and other services. Theseprograms are often used in lieu of an inpatient stay, or as atransition from an inpatient stay.Outpatient DetoxificationMonitor withdrawal from alcohol or another substance ofabuse and may administer medications that assist withdetoxification and recovery from addiction.Intensive Outpatient Sessions (IOP)These planned and structured programs are usually 2-3hours/day (or evening), and 3-7 days per week. They mayinclude group, individual, family or multi-family grouppsychotherapy, psycho-educational services, and otherservices.AbleToMeet with a therapist and coach via web-basedvideoconferencing, or over the telephone for a 8 weekprogram for select conditions including breast andprostate cancer recovery, heart problems, diabetes,depression, digestive health, pain management,respiratory problems, substance abuse, anxiety, postpartumdepression, caregiver status (child, elder,Autism, etc.), grief/loss, and military transition.*Services require prior-authorizationProprietary

PROVIDED TO YOU AS A MEMBER OF ANICUBA MEDICAL PLANSurgeryPlus is a comprehensive benefit at NO ADDITIONAL COST thatprovides access to a premier network of high-performing surgeons fornon-emergent/planned surgical procedures.SurgeryPlus has identified the nation’shighest quality surgeons for the best possiblecare in an elite network, setting them apart fromother under-performing surgeons.The Same DedicatedCare AdvocateManages the EntirePathway of Care For YouSurgeo nSelectio nRecommends at Least Three Best FittingSurgeons for Your Individualized NeedsSchedulingBooks Appointments, Transfers MedicalRecords & Manages LogisticsYou Can Save MoneySurgeryPlus will waive your deductible and coinsurance, eliminating allout-of-pocket costs, including consultation, your surgical procedure andpost-procedure appointments for up to 90 days.You Do Not Need to Enroll in SurgeryPlusIf you are covered under ICUBA’s medical plan, you have beenautomatically enrolled in this extra benefit at no additional cost. If youare planning a procedure, call SurgeryPlus as you could savethousands of dollars.To learn more aboutSurgeryPlus, contac t855.200.2119AdvocacyListens & AnticipatesAll Your NeedsFollow-upEnsures YourComplete SatisfactionEmployer Direct Healthcare 2100 Ross Avenue, Suite 550, Dallas, TX 75201 Phone: 855.200.2119 Fax: 855.764.0264

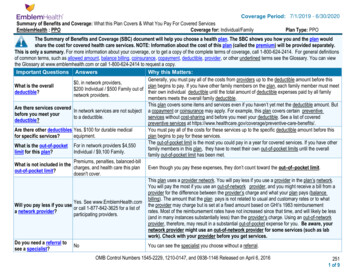

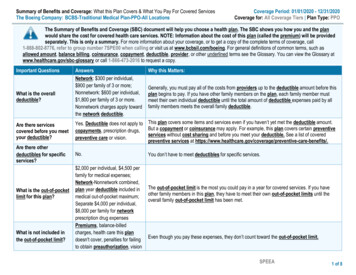

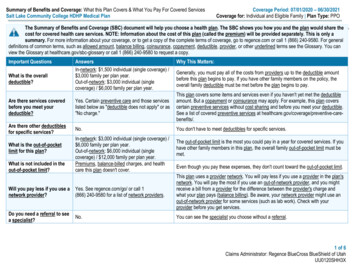

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCoverage Period: 04/01/2022 – 03/31/2023The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the costfor covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit http://icubabenefits.org or by calling 1-866377-5102. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlinedterms see the Glossary. You can view the Glossary at https://www.healthcare.gov/sbc-glossary or www.cciio.cms.gov or call 1-855-258-9029 to request a copy.Important QuestionsAnswersWhy This Matters:What is the overalldeductible? 2,500 in-network per person; 5,000family/ 4,000 out-of-network per person; 10,750family.You must pay all of the costs from providers up to the deductible amount before this planbegins to pay. If you have other family members on the plan, each family member must meettheir own individual deductible until the total amount of deductible expenses paid by all familymembers meets the overall family deductible. The deductible starts over each April 1st. Seethe chart starting on page 2 for how much you pay for covered services after you meet thedeductible.Are there servicescovered before you meetyour deductible?Yes. Deductible doesn’t apply to in-network:preventive care, Teladoc, office visits, prescriptiondrugs, outpatient facility labs, or advancedimaging. Doesn’t apply to in- or out-of-network:emergency room, urgent care, convenient care, oremergency transportation.This plan covers some items and services even if you haven’t yet met the deductible amount.But a copayment or coinsurance may apply. For example, this plan covers certain preventiveservices without cost-sharing and before you meet your deductible. See a list of coveredpreventive services at e-benefits/.Are there otherdeductibles for specificservices?No.You do not have to meet deductibles for specific services, but see the chart starting on page 2for other costs for services this plan covers.What is the out-of-pocketlimit for this plan? 4,000 in-network per person; 8,000 family/ 7,500 out-of-network per person/ 15,000 family.There is a separate out-of-pocket limit forprescription drugs (see page 3).The out-of-pocket limit is the most you could pay in a year for covered services. If you haveother family members in this plan, they have to meet their own out-of-pocket limits until theoverall family out-of-pocket limit has been met.What is not included inthe out-of-pocket limit?Premiums, balance-billing charges, and healthcare this plan doesn’t cover.Even though you pay these expenses, they don’t count toward the out–of–pocket limit.Will you pay less if youuse a network provider?Yes. See http://myhealthtoolkitfl.com, contactEssential Advocate at 1-888-521-2583 or callBCBS customer service at 1-855-258-9029 for alist of network providers.This plan uses a provider network. You will pay less if you use a provider in the plan’snetwork. You will pay the most if you use an out-of-network provider, and you might receive abill from a provider for the difference between the provider’s charge and what your plan pays(balance billing). Be aware, your network provider might use an out-of-network provider forsome services (such as lab work). Check with your provider before you get services. See thechart starting on page 2 for how this plan pays different kinds of providers.Do you need a referral tosee a specialist?No.You can see the specialist you choose without permission from this plan.Questions: Call 1-866-377-5102 or visit us at http://icubabenefits.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at https://healthcare.gov/SBC-Glossary or call 1-855-258-9029 to request a copy.OMB Control Numbers 1545-0047/Exp Date: 12/31/19, 12100147/Exp Date: 5/31/22, and 0938-1146/Exp Date: 10/31/221 of 8

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCoverage Period: 04/01/2022 – 03/31/2023All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You May NeedPrimary care visit to treat aninjury or illnessBlue Distinction Total Care(Family Practice, InternalMedicine, Pediatrics)Embold HealthIf you visit a healthcare provider’s officeor clinic(No Deductible)If you have a testWhat You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)Deductible 40% 15 Copayment//VisitCoinsurance 0 Copayment/VisitNot Applicable 0 Copayment/VisitNot CoveredDeductible 40%CoinsuranceLimitations, Exceptions, &Other ImportantInformationAdditional cost shares mayapply for physicianadministered drugs.Embold Health (PrimaryCare, Pediatrician,Cardiology, Obstetrics, Jointcare, Spine Care,Endocrinology,Gastroenterology, andPulmonology). Visits AreAlways Free.Specialist visit 35 Copayment/VisitConvenient Care Clinic 10 Copayment/Visit 10 Copayment/VisitPhysical/Occupational/SpeechTherapy and ChiropractorVisits 20 Copayment/VisitDeductible 40%CoinsurancePreventive care/screening/immunizationNo ChargeNot CoveredDiagnostic test (blood work) 0 for Quest Diagnostic Laboratories;20% Coinsurance for clinical outpatientfacility labsDeductible 40%CoinsuranceMust be medicallynecessary.X-RayDeductible 20% CoinsuranceDeductible 40%CoinsuranceNoneQuestions: Call 1-866-377-5102 or visit us at http://icubabenefits.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at https://healthcare.gov/SBC-Glossary or call 1-855-258-9029 to request a copy.Therapy and Chiropracticvisits are limited to 60 eachper Plan Year.You may have to pay forservices that aren’tpreventive. Ask yourprovider if the services youneed are preventive. Thencheck what your plan willpay for.2 of 8

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCommonMedical EventServices You May NeedImaging (CT/PET scans, MRIs)Preferred Generic drugsIf you need drugs totreat your illness orconditionMore information aboutprescription drugcoverage is available atwww.optumrx.comNon-Preferred Generic drugsPreferred brand drugs(No Deductible)Out of pocket limit is 2,000 in-network forindividual, 4,000family. No limit for outof-network.Non-Preferred brand drugsPreferred Specialty drugsNon-Preferred Specialty drugsCoverage Period: 04/01/2022 – 03/31/2023What You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)Deductible 40% 500 Copay (or actual cost if less) forCoinsurance family physician,family physician, IndependentIndependent DiagnosticDiagnostic Testing Center andTesting Center and OutpatientOutpatient Hospital facilityHospital facility 0 Copay/Prescription (retail 30 and90-day at NSU pharmacy, NCPDP#40% Coinsurance (after1082041)payment in full and filing 5 Copay/Prescription (retail 30-day)paper claim for 10 Copay/Prescription (retail 90-day)reimbursement) 10 Copay/Prescription (mail order)40% Coinsurance (after 10 Copay/Prescription (retail 30-day)payment in full and filing 20 Copay/Prescription (retail 90-day)paper claim for 20 Copay/Prescription (mail order)reimbursement)40% Coinsurance (after 40 Copay/Prescription (retail 30-day)payment in full and filing 80 Copay/Prescription (retail 90-day)paper claim for 80 Copay/Prescription (mail order)reimbursement)40% Coinsurance (after 75 Copay/Prescription (retail 30-day)payment in full and filing 150 Copay/Prescription (retail 90-day)paper claim for 150 Copay/Prescription (mail order)reimbursement)40% Coinsurance (after 75 Copay/Prescription (preferredpayment in full and filingspecialty medication copay cardspaper claim foraccepted)reimbursement) 75 Copay/PrescriptionQuestions: Call 1-866-377-5102 or visit us at http://icubabenefits.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at https://healthcare.gov/SBC-Glossary or call 1-855-258-9029 to request a copy.40% Coinsurance (afterpayment in full and filingpaper claim forreimbursement)Limitations, Exceptions, &Other ImportantInformationPrior Authorization required.Retail 30: 30 day supply;Retail 90: 84-91 day supply;Mail Order: 84–91 daysupplySpecialty Drugs: Certainmedications used fortreating complex healthconditions must be obtainedthrough the specialtypharmacy program.Manufacturer coupons maynot be applied to copay fornon-preferred specialtydrugs.Prescribed preventivegeneric medications to treatone of the conditionsdesignated Essential HealthBenefit by the AffordableCare Act, such ashyperlipidemia, have a 0copay. Certain additionalrequirements such as age,sex, and diagnosis may alsoneed to be met.3 of 8

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCommonMedical EventIf you have outpatientsurgery (Must meetDeductible)If you need immediatemedical attention (NoDeductible)If you have a hospitalstay (Must meetDeductible)If you need mentalhealth, behavioralhealth, or substanceabuse servicesInpatient: (Must MeetDeductible)Outpatient: (NoDeductible)Services You May NeedCoverage Period: 04/01/2022 – 03/31/2023What You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)Limitations, Exceptions, &Other ImportantInformationFacility fee (e.g., ambulatorysurgery center)Deductible 20% Coinsurance forOutpatient Hospital FacilityPhysician/surgeon feesDeductible 20% CoinsuranceEmergency room careEmergency medicaltransportationUrgent careTeladoc Telemedicine 300 CopaymentDeductible 40%Coinsurance for OutpatientHospital FacilityDeductible 40%Coinsurance 300 Copayment 250 Copayment 250 CopaymentNone 30 Copayment/Visit 5 Copayment/Visit 30 Copayment/VisitNot CoveredNoneNonePrior Authorization required.Inpatient RehabilitationServices are limited to 60days per benefit period.Facility fee (e.g., hospital room) Deductible 20% CoinsurancePhysician/surgeon feesDeductible 20% CoinsuranceOutpatient services 15 Copayment/VisitInpatient servicesDeductible 20% CoinsuranceDeductible 40%CoinsuranceDeductible 40%CoinsuranceDeductible 40%CoinsuranceDeductible 40%CoinsuranceNoneNoneWaived if AdmittedNoneNonePrior Authorization required.Limited to 60 days per PlanYearFor more informationon Behavioral HealthQuestions: Call 1-866-377-5102 or visit us at http://icubabenefits.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at https://healthcare.gov/SBC-Glossary or call 1-855-258-9029 to request a copy.4 of 8

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCommonMedical Eventand Substance Abusecall: 1-877-398-5816If you are pregnantServices You May NeedPrenatal and postnatal care(In-network: FullChildbirth/delivery and alldeductible notfacility servicesrequired until delivery)If you need helprecovering or haveother special healthneedsIf your child needsdental or eye careCoverage Period: 04/01/2022 – 03/31/2023What You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most) 15 Copayment (Initial Visit Only)Deductible 40%CoinsuranceDeductible 20% CoinsuranceDeductible 40%CoinsuranceHome health careDeductible 20% CoinsuranceRehabilitation services 20 Copayment/Visit for SpecialistOffice, Outpatient Rehabilitation Facilityand Outpatient Hospital FacilityHabilitation servicesNot Covered, except for AutismBenefitsSkilled nursing careDeductible 20% CoinsuranceDurable medical equipmentDeductible 20% CoinsuranceHospice servicesNo ChargeChildren’s eye examChildren’s glassesChildren’s dental check-upCovered under Vision PlanCovered under Vision PlanCovered under Dental PlanQuestions: Call 1-866-377-5102 or visit us at http://icubabenefits.org.If you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at https://healthcare.gov/SBC-Glossary or call 1-855-258-9029 to request a copy.Deductible 40%CoinsuranceDeductible 40%Coinsurance for SpecialistOffice, OutpatientRehabilitation Facility andOutpatient Hospital FacilityNot Covered, except forAutism BenefitsDeductible 40%CoinsuranceDeductible 40%CoinsuranceDeductible 40%CoinsuranceSee Vision PlanSee Vision PlanSee Dental PlanLimitations, Exceptions, &Other ImportantInformationNonePrior Authorization requiredUp to 60 combined visits perbenefit period. Includesphysical therapy, speechtherapy, and occupationaltherapy.Prior Authorization requiredUp to 60 visits per benefitperiodPrior Authorization requiredNoneSee Vision PlanSee Vision PlanSee Dental Plan5 of 8

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered ServicesICUBA: Preferred PPO PlanCoverage Period: 04/01/2022 – 03/31/2023Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Acupuncture Cosmetic surgery Dental care Long-Term Care Routine Eye Care Routine Foot Care unless for treatment of Weight loss programsdiabetes Infertility treatmentsOther Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Chiropractic Care Hearing Aids Diagnosis of Infertility Coverage provided outside the United States. Non-emergency care when traveling outside the Bariatric Surgery with prior authorizationSee www.bluecardworldwide.comUnited StatesYour Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. For more information on your rights tocontinue coverage, contact the plan at 1-855-258-9029. You may also contact your state insurance department, the U.S. Department of Labor, Employee BenefitsSecurity Ad

Aetna Behavioral Health and Substance Abuse . Aetna Open Choice PPO Network. Plan Year April 1, 2022 through March 31, 2023 . Proprietary . E. mployee Assistance Program (EAP), Mental Health, Substance Abuse Benefits and Applied Behavioral Analysis (ABA) P. rovided by. Aetna Behavioral