Transcription

Follow us on:@PNBMetLife@pnb metlife@PNBMetLife1@PNB MetLife@PNB MetLifePNB MetLife India Insurance Company Limited, Registered office address: Unit No. 701, 702 & 703, 7th Floor, WestWing, Raheja Towers, 26/27 M G Road, Bangalore - 560001, Karnataka. IRDAI Registration number 117. CIN no.U66010KA2001PLC028883. PNB MetLife Guaranteed Future Plan is an Individual, Non-linked, Non-Participating,Savings, Life insurance plan (UIN: 117N124V03). Please consult your advisor for more details. Please read this Sales brochurecarefully before concluding any sale. Please consult your tax consultant for more details. Goods and Services Tax (GST)shall be levied as per prevailing tax laws which are subject to change from time to time. The marks “PNB” and “MetLife” areregistered trademarks of Punjab National Bank and Metropolitan Life Insurance Company, respectively. PNB MetLife IndiaInsurance Company Limited is a licensed user of these marks. Call us Toll-free at 1-800-425-6969. Phone: 080-66006969,Website: www.pnbmetlife.com, Email: indiaservice@pnbmetlife.co.in or Write to us: 1st Floor, Techniplex-1, TechniplexComplex, off Veer Savarkar Flyover, Goregaon (West), Mumbai - 400062, Maharashtra. Phone: 91-22-41790000,Fax: 91-22-41790203. AD-F/2021-22/590.BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS /FRAUDULENT OFFERS!IRDAI is not involved in activities like selling policies, announcing bonus or investment of premiums.Public receiving such phone calls are requested to lodge a police complaint.KEY FEATURESGuaranteed1Benefits1Flexibility to opt forGuaranteed payout aslumpsum or regular incomeLife cover throughoutpolicy term to protectyour loved onesTax Saving2BenefitTerms and conditions applyTax benefits are as per the Income Tax Act, 1961, & are subject to amendments made thereto from time to time. Please consult your tax consultant formore details. Goods and Services Tax (GST) shall be levied as per prevailing tax laws which are subject to change from time to time.2

PNB METLIFE GUARANTEED FUTURE PLANAn Individual, Non-linked, Non-Participating, Savings, Life insurance planWe all go through various phases of life - from being young and unmarried to married, havingchildren and then the golden years. Throughout life we have various aspirations for ourselvesand for our family members like providing world class education to children, once theygrow-up helping them with starting off in life and in marriage, buying a house, creating aretirement plan for yourself etc.These goals are often accompanied by added responsibilities, unforeseen expenses and thelikelihood of any uncertainty like death, disease or disability. These unforeseen events can befinancially catastrophic for the family. Saving for each of these life goals in a disciplinedmanner throughout ones earning years is the only proven strategy for achieving your financialgoals. Adequate protection for the unforeseen events is essential to ensure these goals are notjeopardised.At PNB MetLife, we are always in the pursuit of offering products & solutions which meetthese specific needs. Life Insurance offers you the dual benefits of allowing you to save andalso safeguard you and your family from some of the unforeseen contingencies.With the same ethos, we present to you the “PNB MetLife Guaranteed Future Plan”, a plan thathelps you systematically save and offers guaranteed returns. It also safeguards you againstcertain unforeseen life events. The plan ensures that you are able to meet your life’s financialgoals with higher degree of certainty. The plan offers you complete control and flexibility tocustomise your savings schedule based on your needs and affordability. You can also choosethe manner in which you receive maturity amounts (i.e. Income, Lump-sum or combinationthereof) and can also customise the timing to best meet your requirements.WITH PNB METLIFE GUARANTEED FUTURE PLANSecure your future with Guaranteed benefitsGet flexibility to receive benefits as Lumpsum or Guaranteed IncomeKEY BENEFITS Pay as you like: Choose from various premium payment options from 5, 7 to 15 yearsor Single pay. Guaranteed Income factor ranging from 103% to 248% of Annualised premium1 Additional benefits to boost your corpus – Booster additions ranging from 41% to 425% of Annualised premium in additionto your regular income payout4 with Income Boosters option. Flexibility to receive your income payout on the date of your choice Protection: Safeguard against uncertainties Get rewarded for higher premium paymentSafeguard your family’s future with life cover for entire policy term* Guaranteed additions will be available with all options, Wealth additions will be available with Lumpsum & Income Lumpsum options only. Boosters will be available with ‘Income Boosters’ Option only and will not be available with other options. Get life cover for the entire policy term. Option to enhance your protection through Accidental Death and Serious Illnessrider coverageTax benefits: You may be eligible to avail tax benefit on premiums paid and benefitsreceived, as per prevailing tax laws1. Guaranteed Income Payout percentage will vary based on Premium payment term, age, policy term and benefit optionchosen. Guaranteed Income is not payable in Option 1.2. Guaranteed Additions (GA) will accrue throughout Premium Payment Term as a percentage of Annualised Premiumand will vary based on Premium payment term, entry age and benefit option chosen.3. Wealth Additions (WA) will be available with ‘Endowment’ & ‘Income Lumpsum’ options. WAs accrue aftercompletion of Premium Payment Term as a percentage of Total Premiums Payable and will vary based on Premiumpayment term and entry age.4. Booster additions will be available with ‘Income Booster Option’ percentage will vary based on Premium paymentterm, age, policy term.5. Policyholder cannot choose the date preceding the due date of the income payout. .Boost your corpus with Guaranteed additions and Wealth additions*Getadditional Boosters – Additional income payouts at fixed intervals withIncome Boosters Option Customization of income payouts to suit your needs – Choose any date tocommence the income pay-out to coincide with any special date likebirthdate or anniversary date.Guaranteed additions2 which accrue with every premium paymentWealth additions3 which accrue after completion of premium payment termHigh Premium Reward for higher premium paymentHOW DOES THE PLAN WORK?Let’s look at a few examples:Illustration 1:Sameer, aged 40 years has a 3-year-old daughter. He wants to invest in a plan whichprovides a guaranteed corpus to secure his daughter’s future. He invests in PNB MetLifeGuaranteed Future Plan and selects: Benefit Payout Option – Option 1- Endowment option Premium payment term of 7 years and Policy term of 15 years Annualised Premium of Rs. 1,00,000 (exclusive of taxes/cesses) and gets BasicSum Assured of Rs.10,00,0000102

Scenario I: If Sameer survives till Maturity, he will receive a lumpsum of Rs. 13,04,240 atmaturity when his daughter turns 18 years of age.Amount (Rs.)Guaranteed Income Guaranteed Addition accrual @116.75% of Annualised Premium Annualised Premium2,16,750 216.75% of Annualised premium every year throughoutPPT (A)Amount (Rs.)Guaranteed additions (GA) @10% - accrue every yearthroughout PPT10,000High premium reward – added to the GAs12,00022,000 x 7 1,54,000High Premium Reward (B) applicable on GA(12% of Annualised Premium)12,000Accrued Guaranteed additions (a)Accrued Wealth additions (b)56,280 x 8 4,50,240Guaranteed Income Payout (A B)2,28,750Total premiums payable (c )7,00,000Total Income Pay-out throughout Income Pay-outPeriod34,31,25013,04,240LIFE COVER THROUGHOUT THE POLICY TERMGuaranteed additions ofRs. 22,000 accure every yearPremium payment ofRs. 1 lakh for 7 yearsYear 0LIFE COVER THROUGHOUT THE POLICY TERMGuaranteedMaturity BenefitRs. 13,04,240Wealth additions ofRs. 56,280 accure every year6Guaranteed income payout ofRs. 2,28,750 p.a. till end of Policy TermReturn of AnnualizedPremium of Rs 1,00,000.Premium of Rs. 1 lakh p.a.for 15 yearsGuaranteed additionsof Rs. 1,28,750 p.a.15Scenario II: In case of unfortunate demise of Sameer in the 10th policy year, his nomineereceives a lump sum benefit of Rs.11,00,000 and the policy terminates.Where Sum Assured at death is as mentioned under ‘Death Benefit’ section in thisdocument.Illustration 2:Sachin, aged 40 years wants to plan his retirement and invest in a plan that provides hima guaranteed income payouts during his golden years. He invests in PNB MetLifeGuaranteed Future Plan and selects: Benefit Payout option – Option 2 - ‘Income Option’ Premium payment term of 15 years, Deferment period of 0 years and Policy term of30 years Annualised Premium of Rs. 1,00,000 (exclusive of taxes/cesses) and gets Basic SumAssured of Rs.10,00,000Scenario I: He starts receiving Guaranteed Income payout of Rs. 2,28,750 from end of16th policy year till end of the policy term.He can choose to start receiving Guaranteed Income payout at any selected date duringthe income payout year till the due date of next income payout provided it is succeedingthe due date of income payout.03Guaranteed additionsaccrual ofRs. 1,28,750 every yearYear 0Age 40145416563070Scenario II: In case of unfortunate demise of Sachin in the 25th policy year, his nomineereceives a lump sum benefit of Rs. 15,75,000 and the policy terminates.Where Sum Assured at death is as mentioned under ‘Death Benefit’ section in this document.Illustration 3:Aryan, aged 35 years is married to Neha and has a son Vihaan who is 2-year-old. Aryanwants to save for his son’s education and wants a plan which provides guaranteed regularincome payouts to meet Vihaan’s tuition fees and considerable lumpsum for Vihaan’shigher education.He can choose to start receiving Guaranteed Income payout on any date to coincide withthe date on which Vihaan’s tuition fees is due provided it is succeeding the due date ofincome payout.He invests in PNB MetLife Guaranteed Future Plan and selects: Benefit Payout option – option 3 - ‘Income Lumpsum’ Premium payment term of 10 years, Deferment period of 1 year and Policy term of21 years Annualised Premium of Rs. 1,00,000 (exclusive of taxes/cesses) and gets Basic SumAssured of Rs. 10,00,00004

Scenario I: He will start receiving Guaranteed income payout of Rs. 1,55,000 from theend of 12th year which he uses to pay his son’s tuition fees and receives a lumpsum ofRs. 4,33,000 at maturity which he can use towards his child’s higher education.He can choose to start receiving a Guaranteed Income payout at any selected date duringthe income payout year till the due date of next income payout.Amount (Rs.)Guaranteed addition @ 43% of Annualised premiumaccrued every year throughout PPT (A)43,000Return of Annualised Premium (B)1,00,000High Premium Reward @ 12% of Annualised Premiumapplicable on GA ( c)12,000Guaranteed Income Payout (A B C)1,55,000Accrued Wealth additions @ 4.33% of Total premiumspayable paid at Maturity4,33,000Benefit Payout option – Option 4 - Income Boosters Premium payment term of 10 years, Deferment period of 0 year and Policy term of 20 years Annualised Premium of Rs. 1,00,000 (exclusive of taxes/cesses) and gets Basic SumAssured of Rs.10,00,000Scenario I: He starts receiving a guaranteed income of Rs. 1,48,000 from end of 11thpolicy year till end of the policy term. He can choose to start receiving a GuaranteedIncome payout on any date to coincide with his anniversary or birthday, provided it issucceeding the due date of income payout.Amount (Rs.)19,83,000and Maturity Guaranteed addition @ 36% of Annualised premiumaccrued every year throughout PPT (A)36,000High Premium Reward (12% of Annualised Premium) (B)12,000Return of Annualised Premium (C)1,00,000Guaranteed Income (A B C)1,48,000Booster additions of 100.97% of Annualised premiumpaid at the end of 14th, 17th, & 20th policy year alongwith Guaranteed Income PayoutBooster 1: 1,00,970Booster 2: 1,00,970Booster 3: 1,00,97017,82,910LIFE COVER THROUGHOUT THE POLICY TERMWealth additions accrual ofRs. 43,300 every yearGuaranteed additionsaccrual ofRs. 55,000 every yearAccruedWealthAdditionsGuaranteed income payout ofRs. 4,33,000LIFE COVER THROUGHOUT THE POLICY TERMBooster additions: Rs. 1,00,970Rs. 1,55,000 p.a. for 10 yearsPremium of Rs. 1 lakh p.a.for 10 yearsGuaranteed Additionsof Rs. 55,000Guaranteed additionsaccrual ofRs. 48,000 every yearReturn of AnnualisedPremium of Rs. 1,00,000Year 0591221Guaranteed income payout ofRs. 1,48,000 p.a. for 10 yearsPremium of Rs. 1 lakh p.a.for 10 yearsGuaranteed Additionsof Rs. 48,000Scenario II: In case of unfortunate demise of Aryan in the 15th policy year, hisnomineereceives a lump sum benefit of Rs. 12,58,200 and the policy terminates.Where Sum Assured at death is as mentioned under ‘Death Benefit’ section in thisdocument.Illustration 4:Ayush, aged 30 years wants to invest in a savings plan that provides him a secondary incometo cater to his rising needs and also ensures his lifestyle needs are met by providing periodiclumpsum. He invests in PNB MetLife Guaranteed Future Plan and selects:05Return of AnnualisedPremium of Rs. 1,00,000Year 05911141720Scenario II: In case of Ayush’s unfortunate demise in the 15th policy year, his nomineereceives a lump sum benefit of Rs. 11,50,000 and the policy terminates.Where Sum Assured at death is as defined in ‘Death Benefit’ section in this document.06

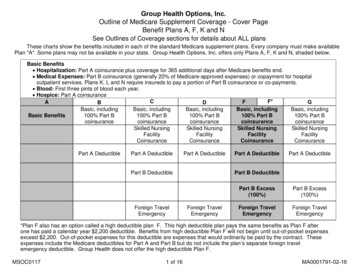

PLAN AT A GLANCEBenefit payoutoptionsThis is a guaranteed savings plan wherein at inception of the policy, the policyholder canchoose to receive benefits in any one following form:Option 1: Endowment Option – Total Premium payable along with accrued GuaranteedAdditions and accrued Wealth additions is paid as a lumpsum at the end of the policy term.Option 2: Income Option – Guaranteed Income payouts are paid during the IncomePayout Period.Option 3: Income Lumpsum Option – Guaranteed Income payouts are paid during theIncome Payout Period and accrued Wealth additions are paid as lumpsum at the end ofpolicy term.Option 4: Income Boosters – Guaranteed Income payouts are paid at regular intervalsduring the Income Payout Period. Additional payouts termed as ‘Booster Additions’ will bepaid at specified intervals along with the Guaranteed Income Payouts.The above benefits will be payable provided the policy in-force and all due instalmentpremiums have been paid.Minimum ageat entry (Years)6You can choose to defer survival benefit payout by choosing any one Deferment Period (incomplete years) at inception of the policy. Deferment period starts at end of the PremiumPayment Term. Options available are as mentioned below:Defermentperiodoptions(Years)For Limited Pay: PPT 5 years: 0, 1 or 2 (option to choose the Deferment period) PPT 5 years: 2 (Deferment period is fixed) For Single pay: 5 (Deferment period is fixed)*You can choose to receive the survival benefits on any one date, succeeding the due dateof first income payout, to coincide with any special date like birthdate or anniversary date.This option needs to be selected at policy inception and cannot be changed during thepolicy tenure.Income Payoutperiod (Years)Income pay-outfactorsPremium PayingTerm (PPT)(Years)Income Payout Period is the period equal to the Premium Payment Term (PPT) which shallcommence after the end of PPT and the Deferment Period (if applicable) chosen by thepolicyholder.Yearly /Half-yearly/ MonthlyFor monthly income payout is chosen, a factor of 0.95/12 will be applied to annual incomeFor half-yearly income payout is chosen, a factor of 0.97/2 will be applied to annual 9For Options 2, 3 & 4:Policy term(Years)PPTSP 5*PT15,20& 301214,18,16, 1715 &19 && 18162010111213141520, 22,24, 26, 28, 30,21 & 23 & 25 & 27 & 29 & 31 &222426283032*Not available under Option 4: Income Booster SP will not be available for Option 1, 3 &POS channelMaximum Policy Term allowed for policies sold through POS channel is 20 years07Minimum Entry Age126 years last birthday144 years last birthday153 years last birthday162 years last birthday171 year last birthday18 and above0 (30 days)Maximumage6 at entry(Years)60 yearsFor policies purchased through POS channel, the maximum age at entry will be 55 yearsas per prevailing POS guidelines, as amended from time to timeMaximumage6 at Maturity(Years)Single pay: 80Limited pay: 75 YearsFor policies purchased through POS channel, the maximum age at maturity for Limitedpay will be 65 years; as per prevailing POS guidelines, as amended from time to time.MinimumAnnualisedPremium (Rs.)Single Pay: Rs. 2,00,000Limited Pay (Other than POSP): Rs. 24,000Limited Pay (Sourced through POSP): Rs. 12,000MaximumAnnualisedPremium (Rs.)1,00,00,00,000 subject to maximum Basic Sum Assured limit as per Board ApprovedUnderwriting Policy.Minimum BasicSum AssuredFor Limited pay: 10 x Annualised premiumFor Single pay: 1.25 x Annualised premiumMaximum BasicSum AssuredAs per Board approved underwriting policyFor policies purchased through POS channel, the maximum Sum Assured will beRs. 10 lakh as per prevailing POS guidelines, as amended from time to timeRider optionsPNB MetLife Accidental Death Benefit Rider Plus,PNB MetLife Serious Illness RiderRiders will not be available for policies purchased through POS channel.PremiumPayment modesSingle/Yearly / Half Yearly / MonthlySingle pay option will not be available with Option 1 and Option 3.Following PT and PPT combinations are available:For Option 1: Endowment Option:PPTPolicy Term (Years)All reference to age are as on age last birthday. For policies issued to minor lives the risk cover starts immediately atinception. Also, in case the life assured is a minor, the policy will vest with the life assured when the life assured attains anage of 18 years.608

For Single PayBENEFITS IN DETAILSGuaranteed Addition as a percentage of Single PremiumSURVIVAL BENEFITOn survival of the Life Assured until the end of the Premium Payment Term, provided thatthe Policy is in In-force Status and all due Installment Premiums have been received in fullby Us, the following benefit will be payable on eachOption 1- Endowment Option – No survival benefit will be payable under this option.Option 2: Income Option – If this option is chosen, the Guaranteed Income Payouts willbe payable at policy anniversaries during the Income Payout period after completion ofthe premium payment term and deferment period, if chosen. If Single pay is chosen, theGuaranteed Income Payouts will be equal to the Guaranteed Addition specified in thetable below.The Guaranteed Income payout will be equal to the sum of Annualised Premium paid andGuaranteed Additions accrued. Guaranteed Additions will start accruing at beginning ofevery year during the Premium Payment Term.Guaranteed Additions will be expressed as a percentage of Annualised Premium asspecified below and may vary depending on the premium payment term, entry age andpolicy term.For Limited Pay:Guaranteed Addition as percentage of Annualised PremiumPPT/Age(years)5Deferment Period 00-35-Deferment Period 136404145465051 &above0-35-----Deferment Period 236404145465051 &above----0-3536404145465051 &above28.72% 26.67% 23.56% 17.38% 10.16%733.33% 30.24% 26.13% 19.96%12.77% 45.24% 42.14% 36.98% 28.74% 22.55% 54.13% 51.03% 45.86% 36.54% 30.33%840.08% 35.95% 31.83% 24.61%16.36% 53.10% 49.99% 43.78% 34.47% 27.22%951.82% 48.76% 45.70% 38.54% 33.44% 61.45% 58.38% 54.28% 47.11%1063.71% 61.68% 58.63% 52.54% 47.47% 75.13% 73.10% 68.05% 60.13% 55.92% 85.59% 82.54% 77.30% 68.30% 63.10%1176.15% 73.37% 68.66% 60.72% 56.30% 85.77% 82.67% 77.53% 68.52% 63.52% 95.95% 92.71% 86.89% 77.46% 71.34%1285.94% 82.90% 77.86% 69.79% 63.73% 95.18% 92.15% 86.09% 78.01%1363.11% 58.95% 53.75% 42.32% 35.05%40.97% 72.15% 69.07% 63.94% 55.72% 49.56%Deferment Period 5Term/Age(years)0-3536-4041-4546-5051 7%12.53%12.35%12.09%309.68%9.57%9.42%9.18%NAOption 3: Income Lumpsum:If this option is chosen, the Guaranteed Income Payouts will be payable at policyanniversaries during the Income Payout period after completion of the premium paymentterm and deferment period, if chosen.The Guaranteed Income payout will be equal to the sum of Annualised Premium paid andGuaranteed Additions accrued. Guaranteed Additions will start accruing at beginning ofevery year during the Premium Payment Term.Guaranteed Additions will be expressed as a percentage of Annualised Premium as specifiedbelow and will and may vary depending on the premium payment term and policy term.Guaranteed Addition as percentage of Annualised PremiumPPT (years)Deferment Period 0Deferment Period 1Deferment Period 0%50%71.95% 106.46% 103.43% 96.35% 87.26% 79.17%1255%55%55%96.19% 93.16% 87.10% 78.01%71.95% 107.48% 104.44% 97.37% 87.26% 80.19% 119.78% 115.73% 107.65% 96.52% 88.43%1360%60%60%14108.48% 104.44% 97.37% 87.26%80.19% 120.80% 115.73% 107.65% 96.52% 88.43% 134.14% 128.07% 118.95% 106.81% 96.68%1465%65%65%15121.81% 116.75% 109.67% 97.53% 89.44% 135.15% 129.08% 120.98% 107.82% 98.71% 148.51% 141.43% 133.32% 118.13% 108.00%1575%75%75%0910

Option 4 - Income Boosters:If this option is chosen, the Guaranteed Income Payouts will be payable at policyanniversaries during the Income Payout period after completion of the premium paymentterm and deferment period, if chosen. Additional payouts called Booster Additions will bepaid along with the Guaranteed Income Payouts paid at specified policy anniversariesduring the Income Payout period.The Guaranteed Income payout will be equal to the sum of Annualised Premium paid andGuaranteed Additions accrued. Guaranteed Additions will start accruing at beginning ofevery year during the Premium Payment Term.Guaranteed Additions will be expressed as a percentage of Annualised Premium asspecified below and will and may vary depending on the premium payment term.Guaranteed Addition as a percentageof Annualised PremiumGuaranteed Addition as apercentage of Single premiumPPT (years)Applicable for all Ages& all deferment (years)1520307.5%7.5%7.0%*Term 30 is not available for Age 51 & aboveBOOSTER ADDITIONS AS A PERCENTAGE OF ANNUALISED PREMIUMPPT/Age T/Age (yrs)Deferment Period 046-5051 &above0-3536-4041-45-135.79%122.23%106.58% 77.35% 46.03%16-185.66%167.95%145.02% 104.36% 65.78%1318-189.18%174.78%157.30% 123.36% Booster3rdBoosterDeferment Period 10-3536-4041-4546-5051 &above75.16%71215-165.86%152.31%132.51% 101.24%81317-225.84%210.16%181.94% 137.99% 102.41%91419-229.77% 217.48%197.00% 161.14%131.41%10151821139.26% 132.34%117.23%87.48%72.18%11162023172.12%139.27% 103.53%84.24%159.38%12172125209.73% 194.55%13182227256.79% 240.59% 209.20% 158.57%170.26% 130.78% 102.45%125.15%14192429315.43%291.11%251.58% 190.77% 152.25%15202631354.43% 325.01%283.42% 207.35% 160.67%Deferment Period 5Booster Additions: Booster Addition is a percentage of Annualised premium as specifiedbelow and will vary depending on the entry age and premium payment term.Year of Booster Payout(End of Year)Year of Booster Payout(End of Year)Year of Booster Payout(End of Year)PPT/1stAge (yrs) Booster713Deferment Period 22ndBooster3rdBooster16-205.75% 195.30%168.10% 130.44% 104.27%0-3536-4041-4546-5051 &above81418-264.25%251.73%220.44% 171.39% 135.90%91520-278.56% 268.30%242.64% 202.60% %198.50%175.71% 138.30% 113.52%116.85%98.64%12182226258.01% 242.82%213.44% 168.88% 135.45%13192328313.29% 294.03%258.57% 199.80% 164.33%14202530380.21% 350.79%307.19% 238.22% 189.52%15212732425.48% 391.97%346.30% 261.02% 209.25%Boosters as a percentage of Single PremiumYear of Booster Payout(End of Year)Term/1stAge (yrs) Booster2ndBooster3rdBoosterDeferment Period 50-3536-4041-4546-5051 73%25.27%23.05%NA11151922133.29%121.28%104.53% 71.58%55.40%2012162024164.43%150.40%129.16% 93.77% 69.48%3013172126204.41%190.25%162.94% 117.39% 88.05%14182328254.81% 234.55%199.10% 144.41% 109.97%15192530287.55% 261.20%224.71% 155.77% 114.20%Term 30 is not available for Age 51 & above12

Income Payout Period:MATURITY BENEFITIncome Payout Period is the period over which the Guaranteed Income installments arepaid. Income Payout Period is equal to the Premium Payment Term (PPT) which willcommence after the end of PPT and the Deferment Period (if applicable) chosen by thepolicyholder. During Income Payout Period ,the Wealth Additions (if applicable) shallaccrue at the beginning of each year and survival benefits shall be paid in arrears.Option 1 – Endowment od5Policy termIncome Payout period (Income starts from156th206th256thOn survival of the Life Assured till the Maturity Date, provided that the Policy is in In-forceStatus, the Guaranteed Maturity Benefit which is equal to sum of Total Premiums Payable,accrued Guaranteed Additions and accrued Wealth Additions will be payable at maturity.Guaranteed Additions will start accruing from the beginning of the 1st policy year till theend of Premium Payment Term. Guaranteed additions will be calculated as a percentageof the Annualised premium and vary by Premium Payment Term (PPT) and Policy Term(PT) as detailed below.PT(years)Guaranteed Additions as percentageof Annualised 8th14

Wealth additions will start accruing at beginning of every year after completion of PPTtill the end of Policy Term. Wealth additions will be calculated as a percentage of theTotal Premium Payable and vary by Premium Payment Term (PPT) and Policy Term (PT)as detailed below.Wealth Addition as a percentage of Total Premiums PayablePPT/Age(years) 5--46-50Deferment Period 151 &above--51 &above76.12% 5.59% 4.75%3.26%1.99%85.56% 4.93% 4.08%2.60%1.22%4.67% 4.36% 3.84%2.80%2.07%Wealth Additions as percentage of Total premium payable-Deferment Period 00-3536404145---46-50Deferment Period 251 &above0-35414546-5051 &above--5.47% 4.63% 3.47%1.69%4.84%3.67%9.07% 8.55% 7.59% 6.10%4.73%6.91% 6.38% 5.53%4.15%2.77%8.39%7.75% 6.79% 5.30%3.92%6.07% 5.66% 5.14%3.99%3.16%7.59%7.27% 6.65% 5.39%4.56%7.59% 7.07% %8.04%7.52%6.48%4.91%102.86% 2.66% 2.15%1.22%0.60%4.33% 4.13% 3.48%2.45%1.83%5.70% 5.39% 4.73% 3.48%2.74%113.31% 3.10% 2.56%1.62%0.95%4.50% 4.20% 3.71%2.57%1.78%5.78%2.82%5.47% 4.84% %7.58%6.04%123.74% 3.44% 2.92%1.91%1.30%5.07% 4.77% 4.05%2.94%2.22%6.42%6.10% 5.40% 3.97%3.15%4.37% 4.05% 3.44%2.32%1.61%5.70% 5.40% 4.68%3.35%2.54%7.15%6.73% 6.02% 8%10.48%9.73%9.02%7.20%145.09% 4.78% 4.07%2.85%2.02%6.53% 6.13% 5.41%3.88%3.07%7.98%7.57% 6.65% 5.02%4.00%122010.87%10.37%9.67%8.86%7.09%155.42% 5.02% 4.30%2.87%2.05%6.87% 6.46% 5.64%4.00%3.08%8.41%7.91% 6.98% 7%8.34%153014.04%13.42%12.42%11.30%8.76%No maturity benefit is payable under Option 2 and Option 4.For policy with non-annual premium frequency, Guaranteed Additions and BoosterAdditions shall accrue proportionally by applying factor as per below:Where, Total Premiums Payable shall be the total Premiums payable during the PPTexcluding any extra premium, frequency loadings on premium, if any, the premiums paidtowards the Riders, if any, and applicable tax and cess.Option 3 – Income Lumpsum Option:On survival of the Life Assured till the Maturity Date, provided that the Policy is inIn-force Status, Guaranteed Maturity Benefit which is equal to the Accrued WealthAdditions will be payable.Wealth additions will accrue during the Income Payout period at beginning of eachpolicy year and will be calculated as a percentage of the Total premiums payable andvary by Premium Payment Term (PPT) and Policy Term (PT) as detailed below.ModeFactor on Guaranteed Additions and Booster Additionsexpressed as a percentage of Annualised PremiumHalf-YearlyMonthly1/21/12DEATH BENEFITIn the event of the unfortunate death of the Life Assured during the policy term providedthat the policy is still In-force status on the date of death, the nominee shall receive DeathBenefit and the Policy shall terminate.The Death Benefit payable on death shall be higher of Sum Assured on Death:Sum Assured on Death shall be defined as higher of: Basic sum assured (BSA), which is the absolute amount assured to be paid on death. Annualised Premium or Single premium multiplied by the Death Benefit Multiple 105% of total premiums paid up to the date of deathThe Death benefit payable shall not be less than following based on plan option chosen: 15Option 1: Endowment – Total Premiums Paid plus accrued Guaranteed Additionsand accrued Wealth Additions (if any) till the date of death.16

Option 2: Income – Total Premiums Paid plus accrued Guaranteed Additions lessGuaranteed Income Payouts made during the Income Payout Period (if any) till dateof death. Option 3: Income Lumpsum – Total Premiums Paid plus accrued GuaranteedAdditions and accrued Wealth Additions (if any) less Guaranteed Income Payoutsmade during the Income Payout Period (if any) till date of death.Option 4: Income Boosters – Total Premiums Paid plus accrued GuaranteedAdditions and accrued Booster Additions less Guaranteed Income Payouts madeduring the Income Payout Perio

Savings, Life insurance plan (UIN: 117N124V03). Please consult your advisor for more details. Please read this Sales brochure carefully before concluding any sale. Please consult your tax consultant for more details. Goods and Services Tax (GST) shall be levied as per prevailin