Transcription

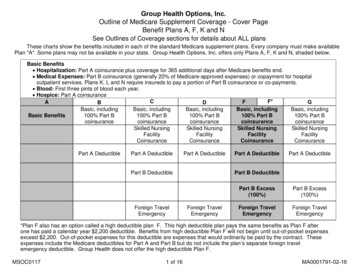

Group Health Options, Inc.Outline of Medicare Supplement Coverage - Cover PageBenefit Plans A, F, K and NSee Outlines of Coverage sections for details about ALL plansThese charts show the benefits included in each of the standard Medicare supplement plans. Every company must make availablePlan "A". Some plans may not be available in your state. Group Health Options, Inc. offers only Plans A, F, K and N, shaded below.Basic Benefits Hospitalization: Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: Part B coinsurance (generally 20% of Medicare-approved expenses) or copayment for hospitaloutpatient services. Plans K, L and N require insureds to pay a portion of Part B coinsurance or co-payments. Blood: First three pints of blood each year. Hospice: Part A coinsuranceCF*FAGBDBasic, includingBasic, includingBasic, includingBasic, includingBasic, includingBasic Benefits100% Part B100% Part B100% Part B100% Part B100% Part uranceSkilled NursingSkilled NursingSkilled NursingSkilled CoinsuranceCoinsuranceCoinsurancePart A DeductiblePart A DeductiblePart A DeductiblePart B DeductibleForeign TravelEmergencyPart A DeductiblePart A DeductiblePart B DeductibleForeign TravelEmergencyPart B Excess(100%)Part B Excess(100%)Foreign TravelEmergencyForeign TravelEmergency*Plan F also has an option called a high deductible plan F. This high deductible plan pays the same benefits as Plan F afterone has paid a calendar year 2,200 deductible. Benefits from high deductible Plan F will not begin until out-of-pocket expensesexceed 2,200. Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the contract. Theseexpenses include the Medicare deductibles for Part A and Part B but do not include the plan’s separate foreign travelemergency deductible. Group Health does not offer the high deductible Plan F.MSOC01171 of 16MA0001791-02-16

Group HealthOutline of Medicare Supplement Coverage - Cover Page 2KLMNHospitalization andpreventive care paidat 100%; other basicbenefits paid at 50%Hospitalization andpreventive care paid at100%; other basicbenefits paid at 75%Basic, including 100%Part B coinsuranceBasic, including 100% PartB coinsurance, except up to 20 copayment for officevisit, and up to 50copayment for ER50% of Skilled NursingFacility Coinsurance75% of Skilled NursingFacility CoinsuranceSkilled Nursing FacilityCoinsuranceSkilled Nursing FacilityCoinsurance50% Part A Deductible75% Part A Deductible50% Part A DeductiblePart A DeductibleForeign TravelEmergencyForeign TravelEmergencyOut-of pocket limit 5,120; paid at 100%after limit is reached.MSOC0117Out-of pocket limit 2,560; paid at 100%after limit is reached.2 of 16

EFFECTIVE 1/1/2017MONTHLY RATES PER PERSON ARE AS FOLLOWS:Group Health PLAN AGroup Health PLAN FGroup Health PLAN KGroup Health PLAN N 135 251 87 141Should the Subscriber elect to make monthly payments in advance of the current monthly rate due date and the revised rate is to becomeeffective at the beginning of a month for which the Subscriber has already paid, the next billing will include a retroactive adjustment for therevised rate.MSOC01173 of 16

PREMIUM INFORMATIONWe, Group Health, can only raise your monthly premium if we raise the premium for all contracts like yours in this state.DISCLOSURESUse this outline to compare benefits and premiums among contracts.READ YOUR CONTRACT VERY CAREFULLYThis is only an outline describing your contract's most important features. The contract is your health care coverage contract. Youmust read the contract itself to understand all of the rights and duties of both you and Group Health.RIGHT TO RETURN CONTRACTIf you find that you are not satisfied with your contract, you may return it to Group Health, P.O. Box 34803, Seattle, Washington,98124-1803, Attn: Marketing. If you send the contract back to us within thirty days after you receive it, we will treat the contract as if ithad never been issued and return all of your payments.CONTRACT REPLACEMENTIf you are replacing another health insurance contract, do NOT cancel it until you have actually received your new contract and are sureyou want to keep it.NOTICEThis contract may not fully cover all of your medical costs.Neither Group Health nor its agents are connected with Medicare.This outline of coverage does not give all the details of Medicare coverage. Contact your local Social Security office or consultMedicare and You for more details.COMPLETE ANSWERS ARE VERY IMPORTANTWhen you fill out the application for the new contract, be sure to answer truthfully and completely all questions about your medical andhealth history. Group Health may cancel your contract and refuse to pay any claims if you leave out or falsify important medicalinformation.Review the application carefully before you sign it. Be certain that all information has been properly recorded.MSOC01174 of 16

PLAN A MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out ofthe hospital and have not received skilled care in any other facility for 60 days in a row.SERVICESHOSPITALIZATION*Semiprivate room and board, general nursing andmiscellaneous services and suppliesFirst 60 days61st thru 90th day91st day and after:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:MEDICARE PAYSPLAN PAYSYOU PAYAll but 1,316All but 329 a day 0 329 a day 1,316 (Part A Deductible) 0All but 658 a day 658 a day 0- Additional 365 days 0- Beyond the Additional 365 days 0100% of Medicare EligibleExpenses 0All approved amountsAll but 164.50 a day 0 0 0 0 0Up to 164.50 a dayAll Costs 0100%All but very limitedcoinsurance foroutpatient drugs andinpatient respite care100% 0 0 0 0**All CostsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, includinghaving been in a hospital for at least 3 days andentered a Medicare-approved facility within 30days after leaving the hospitalFirst 20 days21st thru 100th day101st day and afterBLOODFirst 3 pintsAdditional amountsHOSPICE CAREAvailable as long as your doctor certifies you areterminally ill and you elect to receive these servicesMedicareco-payment/coinsurance 0**NOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will paywhatever amount Medicare would have paid for up to an additional 365 days as provided in the contract’s “Core Benefits”. Duringthis time the hospital is prohibited from billing you for the balance based on any difference between its billed charges and theamount. Medicare would have paid.MSOC01175 of 16

PLAN A MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR* Once you have been billed 183 of Medicare-approved amounts for covered services (which are noted with an asterisk), yourPart B Deductible will have been met for the calendar year.SERVICESMEDICARE PAYSMEDICAL EXPENSES - IN OR OUT OF THE HOSPITALAND OUTPATIENT HOSPITAL TREATMENT, such as:physician's services, inpatient and outpatient medical andsurgical services and supplies, physical and speechtherapy, diagnostic tests, durable medical equipmentFirst 183 of Medicare approved amounts*Remainder of Medicare approved amountsPLAN PAYSYOU PAY 0 0 183 (Part B Deductible)Generally 80%Generally 20% 0Part B Excess Charges (Above Medicare approvedamounts)BLOODFirst 3 pintsNext 183 of Medicare approved amounts*Remainder of Medicare approved amounts 0 0All Costs 0 080%All Costs 020% 0 183 (Part B Deductible) 0CLINICAL LABORATORY SERVICES – TESTS FORDIAGNOSTIC SERVICES100% 0 0100% 0 0 080% 020% 183 (Part B Deductible) 0PLAN A PARTS A & BHOME HEALTH CAREMEDICARE APPROVED SERVICES- Medically necessary skilled care services and medicalsupplies- Durable medical equipmentFirst 183 of Medicare approved amounts*Remainder of Medicare approved amountsMSOC01176 of 16

PLAN F MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of thehospital and have not received skilled care in any other facility for 60 days in a row.SERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION*Semiprivate room and board, general nursing andmiscellaneous services and suppliesAll but 1,316 (Part A 1,316 (Part A 0First 60 daysDeductible)Deductible)61st thru 90th dayAll but 329 a day 329 a day 091st day and after:- While using 60 lifetime reserve daysAll but 658 a day 658 a day 0Once lifetime reserve days are used:100% of Medicare 0 0***- Additional 365 daysEligible Expenses- Beyond the Additional 365 days 0 0All CostsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, including havingbeen in a hospital for at least 3 days and entered a Medicareapproved facility within 30 days after leaving the hospitalFirst 20 days21st thru 100th day101st day and afterBLOODFirst 3 pintsAdditional amountsHOSPICE CAREAvailable as long as your doctor certifies you are terminally illand you elect to receive these servicesAll approved amountsAll but 164.50 a day 0 0Up to 164.50 a day 0 0 0All Costs 0100%All but very limitedcoinsurance foroutpatient drugs andinpatient respite care100% 0 0 0Medicare co-payment/coinsurance 0***NOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will paywhatever amount Medicare would have paid for up to an additional 365 days as provided in the contract’s “Core Benefits”. Duringthis time the hospital is prohibited from billing you for the balance based on any difference between its billed charges and theamount Medicare would have paid.MSOC01177 of 16

PLAN F MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR* Once you have been billed 183 of Medicare-Approved amounts for covered services (which are noted with an asterisk), your Part BDeductible will have been met for the calendar year.SERVICESMEDICAL EXPENSES - IN OR OUT OF THE HOSPITAL ANDOUTPATIENT HOSPITAL TREATMENT, such as: physician'sservices, inpatient and outpatient medical and surgical servicesand supplies, physical and speech therapy, diagnostic tests,durable medical equipment,First 183 of Medicare approved amounts*Remainder of Medicare approved AmountsPart B Excess Charges (Above Medicare approved amounts)BLOODFirst 3 pintsNext 183 of Medicare approved amounts*Remainder of Medicare approved amountsCLINICAL LABORATORY SERVICES - TESTS FORDIAGNOSTIC SERVICESMEDICARE PAYSPLAN PAYSYOU PAY 0Generally 80% 0 183 (Part B Deductible)Generally 20%100% 0 0 0 0 080%All Costs 183 (Part B Deductible)20% 0 0 0100% 0 0PLAN F PARTS A & BHOME HEALTH CAREMEDICARE APPROVED SERVICES- Medically necessary skilled care services and medical supplies- Durable medical equipmentFirst 183 of Medicare Approved Amounts*Remainder of Medicare Approved Amounts100% 0 0 080% 183 (Part B Deductible)20% 0 0OTHER BENEFITS - NOT COVERED BY MEDICAREFOREIGN TRAVEL - NOT COVERED BY MEDICAREMedically necessary emergency care services beginning duringthe first 60 days of each trip outside the USAFirst 250 each calendar yearRemainder of ChargesMSOC0117 0 0 080% to a lifetimemaximum benefit of 50,0008 of 16 25020% andamounts overthe 50,000lifetimemaximum

PLAN K* You will pay half the cost-sharing of some covered services until you reach the annual out-of-pocket limit each calendar year. Theamounts that count toward your annual limit are noted with diamonds ( ) in the chart below. Once you reach the annual limit, the planpays 100% of your Medicare co-payment and coinsurance for the rest of the calendar year. However, this limit does NOT includecharges from your provider that exceed Medicare-approved amounts (these are called “Excess Charges”) and you will beresponsible for paying this difference in the amount charged by your provider and the amount paid by Medicare for the itemor service.PLAN K MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD**A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of thehospital and have not received skilled care in any other facility for 60 days in a row.SERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION**Semiprivate room and board, general nursing andmiscellaneous services and suppliesFirst 60 days61st thru 90th day91st day and after:- While using 60 lifetime reserve daysOnce lifetime reserve days are used:- Additional 365 days- Beyond the Additional 365 daysSKILLED NURSING FACILITY CARE**You must meet Medicare's requirements, including havingbeen in a hospital for at least 3 days and entered a Medicareapproved facility within 30 days after leaving the hospitalFirst 20 daysAll but 1,316 (Part ADeductible)All but 329 a day 658 (50% of PartA Deductible) 329 a day 658 (50% of PartA deductible) 0All but 658 a day 658 a day100% of MedicareEligible Expenses 0 0 0Up to 82.25 aday (50% of PartA coinsurance) All Costs50% 0 0 0101st day and afterBLOODFirst 3 pintsAdditional amounts 0 0Up to 82.25 a day(50% of Part Acoinsurance) 0 0100%50% 0MSOC01179 of 1621st thru 100th dayAll approved amountsAll but 164.50 a day 0***All Costs

HOSPICE CAREAvailable as long as your doctor certifies you are terminally illand you elect to receive these servicesAll but very limitedcoinsurance foroutpatient drugs andinpatient respite care50% Medicare copayment/coinsurance50% of Medicare copayment/coinsurance ***NOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will paywhatever amount Medicare would have paid for up to an additional 365 days as provided in the contract’s “Core Benefits”. Duringthis time the hospital is prohibited from billing you for the balance based on any difference between its billed charges and the amountMedicare would have paid.MSOC011710 of 16

PLAN K MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR**** Once you have been billed 183 of Medicare-Approved amounts for covered services (which are noted with an asterisk),your Part B Deductible will have been met for the calendar year.SERVICESMEDICAL EXPENSES - IN OR OUT OF THE HOSPITAL ANDOUTPATIENT HOSPITAL TREATMENT, such as: physician'sservices, inpatient and outpatient medical and surgical servicesand supplies, physical and speech therapy, diagnostic tests,durable medical equipment,First 183 of Medicare approved amounts****MEDICARE PAYSPLAN PAYSYOU PAY 183 (Part BDeductible)**** All costs aboveMedicare approvedamountsGenerally 10% All costs (and theydo not counttoward annual outof-pocket limit of 4,960)* 0 0Generally 80% ormore of Medicareapproved amountsGenerally 80%Remainder ofMedicare approvedamountsGenerally 10%Part B Excess Charges (Above Medicare approved amounts) 0 0BLOODFirst 3 pints 050%Next 183 of Medicare approved amounts**** 0 0Remainder of Medicare approved amountsCLINICAL LABORATORY SERVICES - TESTS FORDIAGNOSTIC SERVICESGenerally 80%Generally 10%50% 183 (Part BDeductible)**** Generally 10% 100% 0 0Preventive Benefits for Medicare covered servicesRemainder of Medicare approved Amounts*This plan limits your annual out-of-pocket payments for Medicare-approved amounts to 4,960 per year. However, this limit doesNOT include charges from your provider that exceed Medicare-approved amounts (these are called “Excess charges”) andyou will be responsible for paying this difference in the amount charged by your provider and the amount paid by Medicarefor the item or service.MSOC011711 of 16

PLAN K PARTS A & BHOME HEALTH CAREMEDICARE APPROVED SERVICES- Medically necessary skilled care services and medical supplies- Durable medical equipment100% 0First 183 of Medicare Approved Amounts***** 0 0Remainder of Medicare Approved Amounts80%10% 0 183 (Part BDeductible) 10% ***** Medicare benefits are subject to change. Please consult the latest Guide to Health Insurance for People with Medicare.MSOC011712 of 16

PLAN N MEDICARE (PART A) - HOSPITAL SERVICES - PER BENEFIT PERIOD* A benefit period begins on the first day you receive service as an inpatient in a hospital and ends after you have been out of thehospital and have not received skilled care in any other facility for 60 days in a row.SERVICESMEDICARE PAYSPLAN PAYSYOU PAYHOSPITALIZATION*Semiprivate room and board, general nursing andmiscellaneous services and suppliesAll but 1,316 (Part A 1,316 (Part A 0First 60 daysDeductible)Deductible)61st thru 90th dayAll but 329 a day 329 a day 091st day and after:- While using 60 lifetime reserve daysAll but 658 a day 658 a day 0Once lifetime reserve days are used:100% of Medicare 0 0**- Additional 365 daysEligible Expenses- Beyond the Additional 365 days 0 0All CostsSKILLED NURSING FACILITY CARE*You must meet Medicare's requirements, including havingbeen in a hospital for at least 3 days and entered a Medicareapproved facility within 30 days after leaving the hospitalFirst 20 days21st thru 100th day101st day and afterBLOODFirst 3 pintsAdditional amountsHOSPICE CAREAvailable as long as your doctor certifies you are terminally illand you elect to receive these servicesAll approved amountsAll but 164.50 a day 0 0Up to 164.50 a day 0 0 0All Costs 0100%All but very limitedcoinsurance foroutpatient drugs andinpatient respite care100% 0 0 0Medicare co-payment/coinsurance 0** NOTICE: When your Medicare Part A hospital benefits are exhausted, the insurer stands in the place of Medicare and will paywhatever amount Medicare would have paid for up to an additional 365 days as provided in the contract’s “Core Benefits”.During this time the hospital is prohibited from billing you for the balance based on any difference between its billed charges andthe amount Medicare would have paid.MSOC011713 of 16

PLAN N MEDICARE (PART B) - MEDICAL SERVICES - PER CALENDAR YEAR* Once you have been billed 183 of Medicare-Approved amounts for covered services (which are noted with an asterisk), your Part BDeductible will have been met for the calendar year.SERVICESMEDICAL EXPENSES - IN OR OUT OF THE HOSPITAL ANDOUTPATIENT HOSPITAL TREATMENT, such as: physician'sservices, inpatient and outpatient medical and surgical servicesand supplies, physical and speech therapy, diagnostic tests,durable medical equipment,First 183 of Medicare approved amounts*MEDICARE PAYS 0PLAN PAYS 0YOU PAY 183 (Part BDeductible)Part B Excess Charges (Above Medicare approved amounts)BLOODFirst 3 pints 0Balance, other than 20 per office visit and 50 per emergencyroom visit. The copayment of 50 iswaived if the insuredis admitted to anyhospital and theemergency visit iscovered as aMedicare Part Aexpense. 0 0All CostsNext 183 of Medicare approved amounts* 0 0Remainder of Medicare approved amountsCLINICAL LABORATORY SERVICES - TESTS FORDIAGNOSTIC SERVICES80%20% 0 183 (Part BDeductible) 0100% 0 0Remainder of Medicare approved AmountsMSOC0117Generally 80%14 of 16 20 per office visit and 50 per emergencyroom visit. The copayment of 50 iswaived if the insuredis admitted to anyhospital and theemergency visit iscovered as aMedicare Part Aexpense.All costs

PLAN N PARTS A & BHOME HEALTH CAREMEDICARE APPROVED SERVICES- Medically necessary skilled care services and medicalsupplies- Durable medical equipment100% 0First 183 of Medicare Approved Amounts* 0 0Remainder of Medicare Approved Amounts80%20% 0 183 (Part BDeductible) 0OTHER BENEFITS - NOT COVERED BY MEDICAREFOREIGN TRAVEL - NOT COVERED BY MEDICAREMedically necessary emergency care services beginning duringthe first 60 days of each trip outside the USAFirst 250 each calendar yearRemainder of ChargesMSOC0117 0 015 of 16 080% to a lifetimemaximum benefit of 50,000 25020% and amountsover the 50,000lifetime maximum

Mailing AddressGroup Health Options, Inc.Medicare Suppl

Benefit Plans A, F, K and N . See Outlines of Coverage sections for details about ALL plans . These charts show the benefits included in each of the standard Medicare supplement plans. Every company must make available Plan "A". Some plans may not be available in your state. Group Health Opt