Transcription

PEBonds andOther Liabilities

Bonds & Other LiabilitiesBOND OVERVIEWA.For the CPA exam, assume bonds are issued in denominations of 1,000 (faceamount) unless otherwise stated.B.Rate is the interest rate printed on the face of the bond certificate. Also called couponor nominal rate of interest.C.The price of a bond is quoted in the 100’s.D.Carrying value (CV): How the bond is reported on the balance sheet1. 2.–orE.Make the same entry every year using straight-line amortization (both sides)F.The account Bonds Payable always is credited for the face amount of the debt atissueG.Interest payment H.Amortization of a discount alwaysI.When a bond sells at aboth sides.J.xamountcarrying value on both sides; there is effectively more interest for1.Issuer: Effectively more interest2.Investor: Effectively more interestFor the CPA exam, assume that bonds are held-to-maturity investment for theinvestor, unless otherwise stated.1

Bonds & Other LiabilitiesSTRAIGHT–LINE DISCOUNT AMORTIZATIONExample 1: Discount January 1st company issued one bond, 1,000 face value, stated rate 6%Matures in 5 years, interest paid annually on December 31Sold @ 98, effective yield 61/2%Record sale/purchase of bond @ 98 on January 1, Year 1:Issuer: Investor: CV on January 1, Year 1: Same CV for issuer and investorRecord amortization of discount on December 31, Year 1: CV on December 31, Year 1 using shortcut: CV at end of:YearYearYearYear2345 Same CV for issuer and investorRecord bond retirement on December 31, year 5 2

Bonds & Other LiabilitiesEFFECTIVE INTEREST DISCOUNT AMORTIZATIONExample 2: Discount January 1st company issued one bond, 1,000 face value, stated rate 6%Matures in 5 years, interest paid annually on December 31Sold @ 98, effective yield 61/2%Record interest expense/income on December 31, Year 1 (Issuer: (plug)%x ):Investor: (plug) Record interest expense/income on December 31, Year 2 (6.5% x 983.70): (plug) (plug) 3

Bonds & Other LiabilitiesNotes The entries on January 1, Year 1 are identical; all that is affected are the interestcalculations Effective interest method formula: Amortization of a discount alwayscarrying value FASB 115 requires the use of the effective interest method for held-to-maturity investments; held-to-maturity securities must be accounted for at amortized cost Semiannual Adjustments Suppose the coupon rate is 12% and the effective yield is 13%First entry made on June 30, Year 1 (13% 1/2 year 6.5%)Second entry made on December 31, Year 1 (6.5%)Amortization for the year is 3.70 3.94 7.644

Bonds & Other LiabilitiesSTRAIGHT–LINE PREMIUM AMORTIZATIONExample 3: Premium January 1st, company issued one bond, 1,000 face value, stated rate 6%Matures in 5 years, interest paid annually on December 31Sold @ 102, effective yield 51/2%Record sale/purchase of bond @ 102 on January 1, Year 1:Issuer: Investor: CV on January 1, Year 1: – Same CV for issuer and investorRecord amortization of premium on December 31, Year 1:(plug) CV on December 31, Year 1 using shortcut: CV at end of:YearYearYearYear2345 – Same CV for issuer and investorRecord bond retirement on December 31, Year 5: 5

Bonds & Other LiabilitiesNotes When a bond sells at a premium, there is effectively less interest for both sides:Issuer –– effectively less interestInvestor –– effectively less interest Carrying value (CV) of the bond is On the balance sheet of the issuer, the premium is presented with the debt Amortization of premium is the same entry every year using straight-line amortization(both sides) Amortization of a premium alwayscarrying value on both sides6

Bonds & Other LiabilitiesEFFECTIVE INTEREST PREMIUM AMORTIZATIONExample 4 January 1st, company issued one bond, 1,000 face value, stated rate 6%Matures in 5 Years, interest paid annually on December 31Sold @ 102, effective yield 51/2%The entries on January 1, Year 1 are identical; all that is affected are the interest calculations. Effective interest method formula:Record interest expense/income on December 31, Year 1 (Issuer (plug) ):Investor Amortization of a premium alwayscarrying valueRecorded interest expense/income on December 31, Year 2 (5.5% 1,016.10)Interest ExpensePremium (plug)Cash CashInterest IncomeInv. In Bonds Semiannual adjustments: Suppose the coupon rate is 12% and the effective yield is 11% First made on June 30, Year 1 (11% 1/2 5.5%) Second entry made on December 31, Year 1 (5.5%) Amortization for the year is 3.90 4.12 8.027

Bonds & Other LiabilitiesMETHOD SELECTIONA.If a company’s interest expense (issuer) or interest revenue(investor) is a materialitem on the income statement (I/S), the company is required to use themethod of amortization.B.The effective interest method of amortization is theoretically preferred because:1.2.The problem with the straight-line method of amortization is:3.May companies use the straight-line method? YesIndependently answer questions 1 - 3.8No

Bonds & Other Liabilities1. On May 1, 2002, Bolt Corp. issued 11% bonds in the face amount of 1,000,000that mature on May 1, 2012 The bonds were issued to yield 10%, resulting in bondpremium of 62,000. Bolt uses the effective interest method of amortizing bondpremium. Interest is payable semiannually on November 1 and May 1. In its October 31,2002 balance sheet, what amount should Bolt report as unamortized bond premium?a. 62,000b. 60,100c. 58,900d. 58,590(3271)2. Webb Co. has outstanding a 7%, 10-year 100,000 face-value bond. The bond wasoriginally sold to yield 6% annual interest. Webb uses the effective interest rate methodto amortize bond premium. On June 30, 2002, the carrying amount of the outstandingbond was 105,000. What amount of unamortized premium on bond should Webb reportin its June 30, 2003 balance sheet?a. 1,050b. 3,950c. 4,300d. 4,500(4405)3. On January 2, 2004, West Co. issued 9% bonds in the amount of 500,000, whichmature on January 2, 2014. The bonds were issued for 469,500 to yield 10%. Interest ispayable annually on December 31. West uses the interest method of amortizing bonddiscount. In its June 30, 2004 balance sheet, what amount should West report as bondspayable?a. 469,500b. 470,475c. 471,025d. 500,000(5288)Candidate work area9

Bonds & Other LiabilitiesA.Question 1 NotesRecord sale of bonds on May 1, 2002:Dr: Cr: Cr: Face amount of the debt: Coupon rate:%Carrying value of bond:Effective yield:% CV on May 1, 2002: face plus unamortized premiumRecord semi-annual interest expense on October 31, 2002(% x 1/2 % x 1,062,000):Dr: Dr: Cr: Calculation of interest payable:% Balance in unamortized premium on October 31, 2002:May 1, 2002 balanceLess: 6 months amortizationOctober 31, 2002 balanceB. 62,000(1,900) 60,100Question 2 NotesFace amount of the debt: Coupon rate:%Carrying value of bond:Effective yield:% Webb Co. uses the method to amortize bondInterest expense Effective yield % CV 10

Bonds & Other LiabilitiesRecord annual interest payment on June 30, 2003:Dr: Dr: Cr: % Calculation of check amount: Balance in unamortized premium on June 30, 2003:June 30, 2002 balanceLess: 12 months amortizationJune 30, 2003 balanceC. 5,000(700) 4,300Question 3 NotesFace amount of the debt: Coupon rate:Carrying value of bond: Effective yield:%%West Co. uses the method to amortize bond discountBonds payable is reported in the B/S at face –– unamortizedEven though interest is payable annually, on June 30 we makeRecord semiannual accrual of interest expense on June 30, 2004 (5% 469,500):Dr: Cr: Cr: Calculation of interest payable:% Amortization of a discount alwaysCVCV of bonds payable on June 30, 2004:CV on January 2, 2004Add: 6 months amortizationCV on June 30, 2004 469,500975 470,47511

Bonds & Other LiabilitiesBOND MARKET PRICEA.How is the market price of a bond determined?1.Use present value (PV) of 1 (table) for:2.Use present value (PV) of annuity (table) for:Answer question 4 with Bob.4. On January 1, 2000, Dean Company issued ten-year bonds with a face value of 1,000,000 and a stated interest rate of 8% per year payable semiannually on July 1 andJanuary 1. The bonds were sold to yield 10%. Present value factors are as follows:Present value of 1 for 10 periods at 10%Present value of 1 for 20 periods at 5%Present value of an annuity of 1 for 10 periods at 10%Present value of an annuity of 1 for 20 periods at 5%0.3860.3776.14512.462The total issue price of the bonds is:a.b.c.d. 875,480 877,600 980,000 1,000,000B.Question 4 NotesInterest is paid periods of% eachCalculate issue (discount) price of the bonds:Principal ( Interest ( ))Issue (discount) price of the bonds 377,000498,480 875,480Independently answer questions 5 - 8.1220 semiannual interest checks

Bonds & Other Liabilities5.The following information pertains to Camp Corp.'s issuance of bonds on July 1, 2001.Face amountTermStated interest rateInterest payment datesYield 800,00010 years6%Annually on July 19%Present value of 1 for 10 periodsFuture value of 1 for 10 periodsPresent value of ordinary annuity of 1 for10 periodsAt 6%0.5581.791At 9%0.4222.3677.3606.418The market price of each bond is:a. 1,000b. 864c. 807d. 7006. The market price of a bond issued at a premium is equal to the present value of itsprincipal amounta.Only, at the stated interest rate.b.And the present value of all future interest payments, at the stated interest rate.c.Only, at the market (effective) interest rate.d.And the present value of all future interest payments, at the market (effective) interestrate.(6489)7.a.b.c.d.8.a.b.c.d.How would the amortization of a discount on bonds payable affect each of the following?CarryingAmount of BondsIncreaseIncreaseDecreaseDecreaseNet IncomeDecreaseIncreaseDecreaseIncrease(1890)How would the amortization of a premium on bonds payable affect each of the following?CarryingAmount of BondIncreaseIncreaseDecreaseDecreaseNet IncomeDecreaseIncreaseDecreaseIncrease13(9020)

Bonds & Other LiabilitiesA.Question 5 Notesperiods @%Calculate issue (discount) price of each 1,000 bond:Principal ( Interest ( ))Issue (discount) price of the bondsB. 422385 807Question 7 NotesWhich side are we on? Issuer, investor, or no way to tell?Why?Amortization of a discount alwaysthe CV of a bondWhen a bond sells at a discount, there is effectively for the issuer for the investorAnswer: Issuer sideInvestor sideWhich side are we on: issuer, investor, or no way to tell?Amortization of a premium alwaysthe CV of a bondWhen a bond sells at a premium, there is effectively for the issuer for the investorAnswer: Issuer sideInvestor side14

Bonds & Other LiabilitiesMID-PERIOD ISSUESA.Bonds Issued Between Interest Dates: Assume the seller will charge the purchaserup to the date of sale.Example 5September 1, A Company issues 10,000 of 6% bonds that pay interest semi-annually onJune 30 and December 31.Purchasers are charged accrued interest for and August.IssuerInvestorIndependently answer questions 9 - 10.15

Bonds & Other Liabilities9. On July 1, 2006, Howe Corp. issued 300 of its 10%, 1,000 bonds at 99 plus accruedinterest. The bonds are dated April 1, 2006, and mature on April 1, 2016. Interest is payablesemiannually on April 1 and October 1. What amount did Howe receive from thebond issuance?a. 304,500b. 300,000c. 297,000d. 289,50010. On March 1, 2000, Cain Corp. issued at 103 plus accrued interest, two hundred of its 9%, 1,000 bonds. The bonds are dated January 1, 2000 and mature on January 1, 2010. Interest ispayable semiannually on January 1 and July 1. Cain paid bond issue costs of 10,000. Cain shouldrealize net cash receipts from the bond issuance ofa. 216,000b. 209,000c. 206,000d. 199,000D.Question 9 NotesHowe sold in bonds x % Investors are charged accrued interest for months of:Coupon Rate x Face Amount AnnualInterest% x QuarterlyInterestx /12 Calculation of proceeds from bond issuance:Principal sold @ 99Accrued interest receivedTotal proceeds from issuance 297,0007,500 304,500Record sale of bonds @ 99 between interest dates:Dr: Dr: Cr: Cr: 3,000 discount 300,000 bonds (face value) x 1% discount rate16

Bonds & Other LiabilitiesE.Question 10 NotesCain sold in bonds x % Investors are charged accrued interest for the months of:Coupon Rate x Face Amount Annual Interest x Time Two Months Interest% x x/12 Calculation of proceeds from bond issuance:Principal sold @ 103 206,000Accrued interest received3,000Total proceeds from issuance 209,000Record sale of bonds @ 103 between interest dates:Dr: Cr: Cr: Cr: On exam, it is safe to assume that bond issuance costs are paid in cash, up front:Dr: Cr: Net cash proceeds at issuance: Examples of bond issue costs:The account, bond issue costs, is shown in other assets on the B/S; the costs areandto expense over the life of the bondsAnswer question 11.17

Bonds & Other LiabilitiesEARLY DEBT RETIREMENT11. On January 1, 1997, Fox Corp. issued 1,000 of its 10%, 1,000 bonds for 1,040,000.These bonds were to mature on January 1, 2007 but were callable at 101 any time afterDecember 31, 2000. Interest was payable semiannually on July 1 and January 1. On July 1,2002, Fox called all of the bonds and retired them. Bond premium was amortized on astraight-line basis. Before income taxes, Fox's gain or loss in 2002 on this earlyextinguishment of debt wasa. 30,000 gainb. 12,000 gainc. 10,000 lossd. 8,000 gain(9022)A.Question 11 NotesRecord gain or loss from early retirement of bonds on July 1, 2002:Dr: Dr: Cr: Cr: Cash paid out:%x Calculation of unamortized premium:Premium at issuance of bonds 40,000Less: straight-line-amortizationyears x 22,000Unamortized premium on July 1, 2002 18,000B.When you retire debt from your B/S, you must also retire anyrelated to that debtC.Rarely an extraordinary itemIndepe

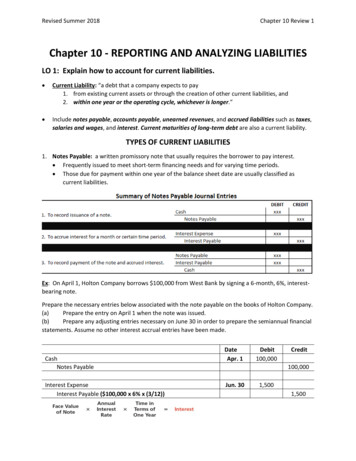

Carrying value (CV): How the bond is reported on the balance sheet 1. or 2. – Make the same entry every year using straight-line amortization (both sides) The account Bonds Payable always is credited for the face amount of the debt at issue Interest payment x amount Amortization of a discount always carrying value on both sides When a bond sells at a ; there is effectively more interest .