Transcription

e-conomy SEAUnlocking the 200 billion digital opportunity inSoutheast Asia

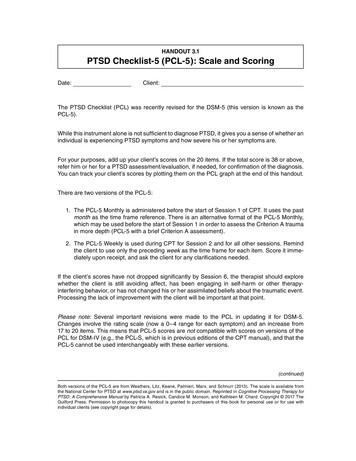

Google & Temasek's joint perspectives were developedusing 4 independent data sourcesDATA SOURCE1234DESCRIPTIONProprietaryGoogle dataQuery and click data to assess demand by country; internetusage data by country; smartphone penetration by countryTemasekresearchVC and startup activity by country (including number ofdeals, exits, size of startups, number of startups by fundingstage, etc.)Expertinterviews59 expert interviews (21 startups, 12 VCs, 23 analysts atleading banks, and 3 industry experts across 6 countries)to validate research findingsSecondarydata sourcesNumerous sources such as Worldbank, UN, EIU,Euromonitor, McKinsey, WEF, and government websiteswere used to calculate economic development indicatorssuch as population trends, GDP growth, etc.1

Research scopeINCLUDED3 major sectors:SectorsGeographies1. First-hand eCommerce (i.e.online spend on electronics,apparel/clothing, householdgoods, food/grocery)2. Travel (online spend onhotels, airlines and ridehailing)3. Media (online spend on adsand gaming)6 major SEA countries includingIndonesia, Singapore, Malaysia,Philippines, Thailand andVietnamEXCLUDEDOnline spending in sectorswhich have not materially beendisrupted by the internet inSEA, such as:1.2.3.4.EducationEntertainment/moviesHealth (insurance, etc.)Financial servicesSecond-hand eCommercepurchasesOther SEA countries such asCambodia, Laos and Myanmar2

Executive summary (1/2)SEA1 is the world’s fastest growing internet region ( 14% 5-year CAGR) with an existing internet userbase of 260m growing to 480m users by 2020 ( 3.8m / month)Consequently, the SEA1 internet economy2 is expected to grow to 200 billion by 2025; driven mostlyby the growth of first-hand eCommerce market (32% CAGR over next 10 years) followed by onlinemedia (18% CAGR), and online travel (15% CAGR)The total first-hand eCommerce market in SEA1 is expected to reach 88 billion by 2025; significantlyoutpacing the growth of offline retail (32% vs. 7% 10-year CAGR) with potential to reach 120 billion3 factors that are unique to SEA1 will drive growth: A burgeoning young population with 70% under the age of 40 Lack of big-box retail (SEA retail stores per capita 1/3rd of US); access particularly difficult in remote islandswhich are abundant in PH and ID Rapidly growing middle-class (forecasted GDP growth of 5.3% over next 10 years)Number of transactions expected to be biggest growth driver (27% 10-year CAGR), as more people gainaccess to the internet and availability of products online increasesAll SEA countries are expected to have an eCommerce market 5bOnline travel (hotels, airlines, and rides) is expected to reach 90 billion by 2025 (15% CAGR); Hotels airlines will compose 85% of total online travel market (15% CAGR) or 77 billion; Low CostCarriers will drive majority of growth due to their prominence in SEA (35% of gross booking vs 13% in rest ofAPAC) and higher online penetration (55% vs 35% for regional carriers)1 includes PH, VN, TH, SG, MY, ID2 includes first-hand eCommerce (apparel, electronics, household goods, food/grocery),travel (hotels, airlines, ride hailing), and online media (ads gaming)SOURCE: Google, Temasek, World Bank, UN3

Executive summary (2/2) Online rides (e.g., Uber, Grab) should reach 13 billion (18% CAGR); Number of riders biggest driver ofgrowth; 30-day active riders expected to reach 29m (vs 7.3m in 2015)Online media (ads gaming) will contribute 20 billion by 2025 ( 10% of total GMV) but will be highlyprofitable sectorsMaking SEA a 200 billion internet economy2 will require 40-50 billion of additional investments overthe next 10 years (assumes VC investment as a percentage of GDP reaches similar levels to India andSEA 1 GDP grows at 5.3% CAGR )Additionally, 5 other challenges must be addressed through public and private-sector initiativesincluding:1.Talent / engineering: Lack of senior developer and CXO-level talent causing startups to rely on expat talentfrom China and US; new tech-focused educational programs will need to be instated to create future pipeline2.Payment mechanisms: Still no scalable e-payment alternative resulting in increase of ‘Cash on Delivery’transactions, which, in turn increases risk and cost for merchants3.Internet infrastructure: Low internet speeds and penetration rate due to regulatory and geographicalconstraints (e.g., Philippines has 2nd slowest internet in Asia due to duopoly structure); innovative PPPinitiatives (e.g., Project Loon) required to make high-speed internet a commodity in SEA4.Logistics infrastructure: Government investment and focus will be required to improve road and rail networkswhich are critical to ensure a fast and efficient delivery system5.Lack of consumer trust: Consumers wary of making transactions online due to various security issues suchas fraud (e.g., orders from Indonesia are 12x as likely to be fraudulent as global average);1 includes PH, VN, TH, SG, MY, ID2 includes first-hand eCommerce (apparel, electronics, household goods, food/grocery),travel (hotels, airlines, ride hailing), and online media (ads gaming)SOURCE: Google, Temasek, World Bank, UN4

AgendaOverview of SEA Internet economyThe SEA internet opportunitySEA VC and startup landscapeChallenges to overcome5

SEA’s internet economy is ready to take off, with 124kusers coming online every day for the next 5 years260M3.8M700MUsers alreadyonline; 4th largestinternet marketin the worldUsers comingonline everymonth; fastestgrowing internetmarket in theworldMobileconnections;130% ofpopulationSOURCE: World Bank, Google6

SEA to be the fastest growing internet market in theworld ( 480m users by 2020); Indonesia fastest growingnation in the world1414Growth in internet users(CAGR%, 2015-20)4ASEANIndiaChina11USEUIndonesia is the fastestgrowing internet marketin the worldInternet users by country1 (# m, 2015-2020)8259Thailand38Vietnam44 9% CAGR(2015-20)Singapore 13% CAGR(2015-20)593655Philippines 3% CAGR(2015-20) 11% CAGR(2015-20)215Indonesia 19% CAGR(2015-20)22921 Assumes internet penetration will reach 92% in SG, 85% in VN, TH, PH, and MY, and 78% in ID28Malaysia 5% CAGR(2015-20)SOURCE: World Bank, Google7

AgendaOverview of SEA Internet economyThe SEA internet opportunitySEA VC and startup landscapeChallenges to overcome8

The internet economy in SEA is expected to reach 200 billion by 2025 (6.5x increase over 10 years)eCommerce and Travel to make up 90% of total online retail spend in 2025Market size by segment ( , billion)10-year CAGR (%)6.5x19720321Online media (ads gaming)ChinaTravel (hotels andflights, ride hailing)eCommerce(apparel, electronics,household goods,food / grocery)901815312248832620152025SOURCE: World Bank, Temasek, Phocuswright, Canalys, Government websites, Team analysis9

1The eCommerce market is split into two key segments,each with a different operating and monetization modeleCommerceFirst-hand goodsResearch focusSecond-hand goodsModelDescription Sale of ‘new goods’ (contributing toGDP) either through a market place,online store or social media Re-sale of ‘used goods’ through amarket place or social media (couldbe an exchange / barter)MonetizationStrategy Margin-based (Online retailer receivesa % of sales revenue) Transaction fee-based (Online retailerreceives a fee for enabling transaction) Margin-based (Marketplace providerreceives a % of sales revenue) Classifieds-based (Marketplaceprovider monetizes traffic with ads)2015 market size 5.5 billion Several billion1Companies /channels1 exact market size unknown due to infancy of market and unavailability of concrete dataSOURCE: Expert Interviews10

15 key systemic changes are expected to occur, leadingto the exponential growth of eCommerceThriving youngpopulation70% of SEA's population is under the age of 40 (vs. 57% in China)Increase ininternet speedand penetrationInternet speeds in SEA are expected to reach global average (23.3mbps) with more than 80% of population having access (vs. 46% today)GDP GrowthSEA as a region has a nominal GDP of 2.5 trillion USD (larger thanIndia) growing at 5.3% over the next 10 yearsMore conducivepaymentecosystemPayment ecosystem is expected to accelerate with increased access tofinancial system, going from 0.7 acct/capita to 1 acct/capit1Lack of storeaccess# of organized retail store available per capita is significantly less thandeveloped markets, (1/3rd of US)1 China and US in 2015 had 3.7 and 4.3 financial accounts per capita respectively. OECD average is 1.2SOURCE: World Bank, Google, Ookla (speedtest.net)11

1SEA eCommerce expected to 16x by 2025, reaching 88billion ( 32% CAGR), with the potential to exceed2015 Calculation methodologyTotal eCommerce1 spend in SEA2 ( , billion) Determined 2015 retail market size andeCommerce penetration rate throughproprietary Google / Temasek data secondary research (e.g., Euromonitor)16x Forecasted 2025 retail market size(assumed retail growth equals GDP growth3,except in VN, ID, and PH where risingmiddle-class will drive consumption growth)88 Identified benchmark country for each SEAcountry by comparing 9 indicators includinginternet penetration, logistics performance,population under 40 Forecasted 2025 eCommerce penetrationrate for each SEA country using eCommercepenetration growth curve of benchmarkcountry (e.g., 2015-20 eCommercepenetration rate for VN is expected to grow atsame rate as India’s grew from 2009-14) Calculated 2025 eCommerce market size as2025 retail market x eCommerce penetration Validated model through 59 expert interviewsTotal retail market 1.4 trillionTotal retail market .7 trillion5.5eComm % oftotal retail10-year CAGR(%)1 includes groceries, apparel/clothing, electronics, household goods, and food / grocery2 defined as PH, TH, VN, ID, MY, and SG3 based on constant GDP (2005 USD)201520250.86.432SOURCE: Singstat.gov; Malaysia government, Vietnam government,McKinsey, Temasek, Google12

127% CAGR in # of online transactions will be driven bygrowth in internet penetration, consumer sentiment andproduct availability10-yearCAGR (%)Variable247Onlinebuyers1849Growth driver Internetpenetration growthSEA eCommerce market size( , billion) Consumersentiment/security#, million 32%Annualpurchasesper buyer1486#26Averagebasketsize27% CAGR intotal # of onlinetransactions184 20151 based on constant GDP (2005 USD)2025 Increase in rangeof availableproducts (e.g.,online groceries) GDP/capitagrowth1885.520152025 Increase in rangeof availableproductsSOURCE: eMarketer, Google13

1By 2025, all SEA countries will have an eCommercemarket 5 billion; Indonesia expected to reach 46 billion20152025eComm market( , billion)eComm as% of retailTOTAL5.51.7IDVN0.4PHTHMYSG0.50.91.01.0eComm market( , billion)0.887.80.646.00.60.50.81.12.1eComm as% of retail7.59.711.18.25.410-yearCAGR (%)6.4328394.7334.7345.5295.4246.718 Indonesia is expected tocomprise 52% ofeCommerce in SEA by 2025(vs 31% in 2015), driven bylarge middle-classpopulation, increasedaccess to internet, andgrowth of tier2/3 cities,where access to organizedretail is limited Vietnam, Philippines,Thailand and Malaysia willall be sizeable markets,ranging between 8-11billion SG eCommerce will be 5billion, larger than the 2015casino industry ( 4 billion)SOURCE: Temasek, McKinsey, Government websites, Google14

2SEA online travel market expected to 4x by 2025,reaching 90 billion ( 15% CAGR)SEA1 Online travel market size ( , billion)10-year CAGR (%) Number of riders biggest driver of growth;30-day active riders expected to reach 29m(vs 7.3m in 2.52015Description1836.41940.11220251 defined as PH, TH, VN, ID, MY, and SG2 only includes passenger revenue and is attributed to the market where the company is based (i.e.,100% of SIA revenue attributed to Singapore)3 Includes consumer spend on taxis, buses and rail. Excludes air travel Average fare per ride to decrease slightlydue to increased competition as well asgrowth of PH, TH, VN, ID, and MY markets,where average ride per fare is 1/3rd of SG Smaller GMV than airlines but higher profitpool (15 20% of gross booking value vs1 5% for airlines) Largest segment within travel ( 45% of totalGMV) Growth will be driven by high demand forLow Cost Carriers (35% of gross booking inSEA vs 13% in rest of APAC), which havemuch higher online penetration (55% vs 35%for regional carriers)SOURCE: Phocuswright, airline websites, Google, Canalys,Euromonitor15

2AOnline hotels and airlines expected to 5x by 2025,reaching 76 billion (15% CAGR) and making up 85%of the total travel market20152025Online hotels airlinesmarket ( , ine as %of totalOnline hotels airlinesmarket ( , ine as %of total10-yearCAGR (%)5615551737153415691869116910 Hotels airlines to reach 77 billion market by 2025,bigger than gross bookingsize of the largest marketplayers in 2015: (Expedia,Inc. 60 billion; Priceline 55 billion, globally) Indonesia is expected to bethe largest market,comprising 32% of onlinetravel in SEA by 2025 (vs26% in 2015) Thailand positioned to bethe second largest market inSEA due to booming tourismindustry (Bangkok is 2ndmost visited city in theworld1) VN, SG and MY will also besizeable ( 8-10 billion)SOURCE: Phocuswright, airline websites, Mastercard Global Destinations Index, Google16

2BOnline rides expected to 5x by 2025, reaching 13billion and making up 15% of the total travel market2015202530-dayactive riders(#, million)Online rides market( , ne rides market( , ayactive riders(#, million)10-yearCAGR (%)28.71815.4222.6203.8231.573.6241.814 28.7 million active riderseach month (4x over 2015) All SEA markets to exceed 1 billion by 2025; Indonesiaexpected to become largestmarket due to populationsize, growing at 22% CAGR Thailand and Philippines tobecome 2 billion market,growing at 20% and 23%respectively, over the next10 years Singapore will continue tohave highest fare per trip( 3x of SEA average)SOURCE: Google, Canalys, World Bank, Euromonitor17

3Online media is expected to increase by 5x, reaching 20 billion by 2025 ( 18% CAGR)SEA1 Online media market size ( , billion)10-yearCAGR (%)Growth driven by 2 major factors:5x19.617Growth driven by mobile gaming2 which willcompose 75% of market by 2025 (vs 53% in2025); 2 key drivers:3.7Online ads2.1AGaming1.620151. Steady increase in internet usage within SEAleading to increase in total time spent onlineby SEA consumers2. Greater alignment between media spend bychannel and time spent by consumer perchannel9.9BDescription9.620251 defined as PH, TH, VN, ID, MY, and SG2 includes smartphone, tablet, and handheld games ( 1%)201. 3.6x growth in revenue per gamer ( 21 in2025 vs 6 in 2015)2. Growth in number of mobile gamers drivenby:a. growth in smartphone users (280mnew users expected in next 10 years)b. high % of smartphone users that aregamers (72% in SEA vs 58% in US)SOURCE: Google18

3A3.6x increase in revenue per mobile gamer will drivegrowth of mobile segment from 53% to 75% of total GMVRevenue per mobile gamer is expected to 3.6xbetween 2015 and 2025 resulting in 24% CAGR (vs 12% CAGR for non-mobilegaming revenue)Mobile revenue per gamer ( )SEA1 Online gaming revenueby segment (% of total)10-yearCAGR 3 main drivers in growth of RPU:1. Greater engagement due to improvement in qualityof mobile games2. Growth in GDP / capita; all SEA countries exceptVN will break the 3k barrier3. Prominence and growth of messenger platforms inSEA, which have a 2-3x higher LTV than regulargamers1 defined as PH, TH, VN, ID, MY, and SG2 includes smartphone, tablet, and handheld games3 Includes TV/console games, casual web games, PC/MMO gamesNon- 3mobileSome growthdriven by growthin number ofmobile gamers( 10% CAGR)47%25%2015122025SOURCE: Newzoo, Google19

3BThe online ads market is expected to increase by 5x,reaching 10 billion by 2025 (17% CAGR)20152025Online ad market( , billion)Digital as %of total 62.3220.3PHOnline ad market( , billion)Highpenetrationdriven byexportbusinessfrom pureplayers31171.61.51.00.9Digital as %of total AdEx110-yearCAGR (%)3917402640194017363040440141 includes ad spends via agency and direct spend with platform providers; based on billing country All SEA markets 1B by2025, with Indonesia andThailand 50% of totalmarket due to largepopulation size and mediaconsumption behavior (e.g.,Thailand has highestYouTube watch time in theworld) Digital penetration to reach 39% of total ad spend (vs16% in 2015) as mediaspend by channel alignsmore closely with consumertime spent by channelSOURCE: Google Internal20

AgendaOverview of SEA Internet economyThe SEA internet opportunitySEA VC and startup landscapeChallenges to overcome21

Capturing the 200 billion SEA internet opportunity willrequire 40-50 billion of investment over next 10 yearsVC investment as a percent of GDP1 (%, 2014)0.305.7x Investments levels in SEA arelagging India and China; althoughSEA had a larger GDP1 than India in2014 ( 2.4 trillion vs 2.1 trillion), itreceived less than a fifth of thefunding3.4x0.25 SEA’s funding profile must catch upto that of India’s by 2025 in order forthe online economy to reach 200billion0.150.06USIndiaChinaEurope0.04SEA This implies an investment of 40-50 billion over next 10 years,assuming SEA GDP1 growth of 5.3%and a straight line CAGR growth ofVC investment as a % of GDP1 from0.04% to 0.25% from 2014 to 2025A total of 40-50bn of investments must be injected over next 10 years tomake SEA a 200 billion internet economy in 20251 based on nominal GDP (2014)SOURCE: E&Y, Temasek, World Bank, Google22

Overview of SEA Startup and VC landscape1VC landscapeoverview 1.1 billion invested in SEA in 2015; with 355 total deals 88% of deal value in SG and ID representing 227 deals ( 64%of total) eCommerce and logistics contribute 61.4% of totalinvestments from 2010 to 2015 65% of investments going to just 5 startups in 20151(GrabTaxi, PropertyGuru, Trikomsel, Qoo10, and iCarsClub)2Startuplandscapeoverview 7k startups in SEA with 80% in ID, SG, and VN Lifestyle and eCommerce sectors with most startups ( 18.8%of total) 4 unicorns ( 1billion valuation) all of which are in SG(Garena, GrabTaxi, Lazada, and Razer) 7% ( 450) of startups have raised funding post seed2 orhave been acquired1 Does not include 249m investment (2014) and 1b investment (2016) in Lazada2 Excludes startups with undisclosed funding informationSOURCE: TechinAsia, Merger Market, Factiva, Team Estimates23

1Deal flow growing but activity is concentrated to SG and IDwith majority of funding going to few prominent startupsDEAL FLOW ( , million; 2015)1,061DEALS BY COUNTRY (#; 2015)Agg value( , million)1,147SG800131ID9650MY1131852011 2012 2013 2014 2015 Deal flow in SEA lags that ofIndia, US, and China, despiteseeing 127% CAGR from 2010 to2015 5 startups making up 65% oftotal investments; includingGrabTaxi and PropertyGuruFUNDING BY SECTOR (%; 2010-2015)820188492828VN2635TH2426PHeCommerce SG most active country w/ 37%of deal quantity and 72% of dealvalue SG activity driven by Grabtaxiand PropertyGuru ( 350m and 130m investment rnet1%8%25%Logistics eCommerce and Logisticverticals contribute 61.4% oftotal investments from 2010 to2015 because of largeinvestments into Grab andLazadaSOURCE: TechinAsia, Merger Market, Factiva, team estimates24

2SEA startups are currently concentrated in SG, ID, andVN; focus mostly on eCommerceSTARTUPS BY COUNTRY (#)ID2,033SG1,850VNMY1,541STARTUPS BY STAGES (#)

The eCommerce market is split into two key segments, each with a different operating and monetization model 1 exact market size unknown due to infancy of market and unavailability of concrete data eCommerce First-hand goods Second-hand goods Model Description Mo