Transcription

Straight to the pointA primer on registered closed-end funds,specifically interval fundsOctober 19, 2017Cynthia M. KrusPartnerCynthia R. BeyeaPartnerPayam SiadatpourCounsel

Non-traded closed-end funds

Traditional, non-traded closed-end fundsOverview Historically, registered closed-end funds have been listed and traded onstock exchanges The “traditional” non-traded closed-end fund model emerged within thepast decade, following after non-traded REITs and then non-traded BDCs Certain market conditions and the regulatory environment have sparkedan interest in non-traded registered closed-end funds, and specificallyinterval funds because of certain advantages that we will discussEversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds3

Traditional, non-traded closed-end fundsGeneral regulatory framework Non-traded closed-end funds are investment companies registered underthe Investment Company Act (the “1940 Act”) and include several featuresthat are advantageous, including: Securities of closed-end funds are not redeemable and cannot be sold backto the fund upon the shareholder’s request. Public offerings are exempt from state “blue sky” requirements and theshares issued are “covered securities.” A Registration Statement allows for three years and extends for anadditional 180 days by filing a subsequent Registration Statement. (Ofcourse, subsequent registration statements are subject to a SEC andFINRA review/comment process) Semi-annual reports contain less disclosure than are required for operatingcompanies, plus no Form 8-Ks are required.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds4

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) Leverage Limitations - 300% asset coverage ratio requirement. Incentive fees generally permitted only on investment income. Incentive fees on capital gains are permitted to the extent all ofthe fund’s investors are “qualified clients.” Ability to sell shares below NAV: Exception for rights offering. No ability to seek annual blanket approval. Approval required from majority of shareholders.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds5

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) FORM N-PORT – As information is viewed as more “free flowing,”the SEC rescinded semiannual portfolio reporting in favor of a newmonthly portfolio reporting form, requiring information aboutportfolio holdings to be filed 30 days after the end of each month. This information is not made public monthly, but only quarterly,and even then not for 60 days after the quarter’s end. The SEC adopted a tiered compliance dates for Form N-PORT: June 1, 2018, for larger entities (i.e., funds that together with otherinvestment companies in the same “group of related investmentcompanies” have net assets of 1 billion or more as of the end of themost recent fiscal year). June 1, 2019, for smaller entities (i.e., funds that together with otherinvestment companies in the same “group of related investmentcompanies” have net assets of less than 1 billion as of the end of themost recent fiscal year).Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds6

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) FORM N-CEN requires certain registered investment companies toannually report certain census-type information to the SEC in astructured data format within 75 days after the end of the fiscalyear. Form N-CEN will replace Form N-SAR, the current form on whichthe SEC collects census-type information on registeredinvestment companies. The SEC adopted a compliance date of June 1, 2018, to complywith the new Form N-CEN reporting requirements.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds7

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) Rule 38a-1 under the 1940 Act requires all registered closed-endfunds to: adopt and implement policies and procedures designed toprevent violation of the federal securities laws; review these policies and procedures annually for their adequacyand the effectiveness of their implementation; and appoint a chief compliance officer to administer the compliancepolicies and procedures. Registered closed-end funds generally must place and maintaintheir securities and similar investments in the custody of a bank ora broker dealer. Registered closed-end funds generally must provide and maintaina bond issued by a reputable fidelity insurance company to protectthe company against larceny and embezzlement.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds8

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) At least 40% of a registered investment company’s board of directors must be independent, unless using anaffiliated principal underwriter, in which case must have a majority of independent directors In order to rely on certain exemptive rules under the 1940 Act a registered closed-end fund must satisfy therequirements of Rule 0-1(a)(7)(iii)-(vii): Any person who acts as outside legal counsel for the disinterested directors must be independent “legalcounsel” as defined by 1940 Act Rule 0-1(6); The board of directors must evaluate at least once annually the performance of the board of directors andits committees, including the effectiveness of the committee structure and number of companies on whoseboard each director serves; The disinterested directors meet at least once quarterly without the interested directors present (i.e., holdan executive session); and The disinterested directors have been authorized to hire employees, and retain advisers and expertsnecessary to carry out their duties. Exemptive rules under the 1940 Act which may be relevant include the following: Rule 12b-1 relating to asset based distribution fees Rule 15a-4 relating to interim investment advisory contracts for the Company; Rule 17a-7 relating to purchases and sales of securities between Company and certain of its affiliates; Rule 17a-8 relating to mergers with affiliates companies; Rules under Rule 17d-1 relating to joint arrangements and profit-sharing plans between Company and itsprincipal underwriter or affiliates thereof; Rule 17e-1 relating to certain brokerage fees and commissions; Rule 17g-1 relating to the bonding of officers and employees; and Rule 23c-3 relating repurchase offers of securities issued.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds9

Traditional, non-traded closed-end fundsGeneral regulatory framework (cont.) Closed-end funds can elect to be treated and to qualify eachyear for taxation as a Regulated Investment Company (“RIC”)under Subchapter M of the of the Internal Revenue Code of1986, as amended (the “Code”). In order for a closed-end fund to qualify as a RIC, it must meetcertain source-of-income, asset diversification and annualdistribution requirements. RICs are not be subject to federal income tax to the extentthey distribute investment company taxable income and netcapital gains. The Code imposes a 4% nondeductible excise tax on RICs tothe extent they do not meet certain distribution requirementsby the end of each calendar year.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds10

Traditional, non-traded closed-end fundsShareholder liquidity May institute share repurchase program and periodically offer torepurchase shares from stockholders via tender offers subject toRule 13e-4 of the 1934 Act. Amount and frequency of repurchase offers are at the solediscretion of the Fund’s Board of Directors (e.g., repurchaseamounts can be limited to amount of cash retained from dividendreinvestment program). The Fund’s Board of Directors has the sole power to amend orsuspend the share repurchase program.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds11

Traditional, non-traded closed-end fundsUnderwriting compensation limits Registered closed-end funds are subject to substantive FINRAreview. Certain information, including offering documents, must besubmitted to FINRA. Must receive FINRA “no objection” letter before commencing sales,which can take anywhere from 3 to 6 months. Subject to FINRA Rule 5110, which limits underwritingcompensation under a “fair and reasonable” standard.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds12

Traditional, non-traded closed-end fundsUnderwriting compensation limits (cont.) Underwriting compensation for non-traded closed-end fundsusually consists of: a sales load deducted from offering proceeds, generally ataround 4.5%, plus fees paid to underwriters, underwriter expenses covered by fund advisers, and total underwriting compensation in an amount generally up to8% of offering proceeds. There is no explicit cap on total underwriting compensation underthe “fair and reasonable” standard, as each offering is evaluatedon its merits, risks, etc., and relative to other similar offerings.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds13

Interval funds

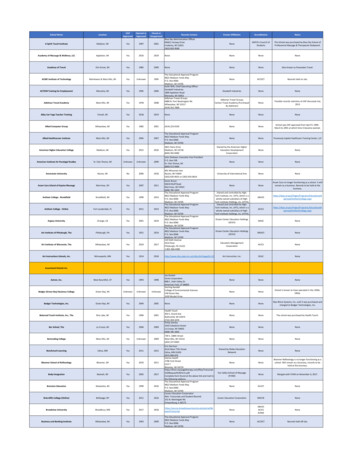

Interval fundsMarket overview As of June 30, 2017, there were approximately 56 active intervalfunds that have collectively raised approximately 3.9 billion. Interval funds can have a wide range of investment strategies,including listed, non-listed, public and private investments. Investment strategies include real estate focused funds,commercial real estate loans, small-and-middle market loans,institutional funds, and private funds. Interval fund capital raising broken down by investment focus asof June 30, 2017 is as follows: Insurance/Reinsurance Focused: 1.54 billionReal Estate Focused: 1.5 billionDebt/Fixed-Income: 914.1 millionDerivatives/Hedge Funds/Exotics: 188.0 millionEquities: 129.2 millionHybrid (Equities & Debt): 21.3 millionEversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds15

Interval fundsGeneral regulatory framework Interval Funds are closed-end investment companies registeredunder the 1940 Act, and are generally similar to Traditional, NonTraded Closed-End Funds. Leverage Limitations - 300% asset coverage ratio requirement. Incentive fees are generally permitted only on investment income. Incentive fees on capital gains are permitted to the extent all ofthe fund’s investors are “qualified clients.” Ability to sell shares below NAV: Exception for rights offering. No ability to seek annual blanket approval. Approval required from majority of shareholders.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds16

Interval fundsGeneral regulatory framework (cont.) Public offerings are exempt from state “blue sky” as “coveredsecurities.” Registration statements extend indefinitely, and there is an SECprocess for automatic effectiveness of subsequent registrationstatements and post-effective amendments. Interval Funds are not subject to substantive FINRA review.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds17

Interval fundsGeneral regulatory framework (cont.)Determination of NAV Interval funds are required to determine NAV weekly. If engaging in a continuous daily offering, an interval fund mustdetermine NAV on a daily basis. All sales are made at a price equal to the Fund’s NAV per share.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds18

Interval fundsGeneral regulatory framework (cont.) Semi-annual reports contain less disclosure than are required foroperating companies, plus no Forms 8-K are required. The new forms noted earlier also apply to interval funds: FORM N-PORT FORM N-CEN The SEC adopted the same tiered compliance dates for theseforms.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds19

Interval fundsGeneral regulatory framework (cont.) Interval funds can elect to be treated and to qualify each yearfor taxation as a Regulated Investment Company (“RIC”) underSubchapter M of the of the Internal Revenue Code of 1986, asamended (the “Code”). In order for an interval fund to qualify as a RIC, it must meetcertain source-of-income, asset diversification and annualdistribution requirements. RICs are not be subject to federal income tax to the extentthey distribute investment company taxable income and netcapital gains. The Code imposes a 4% nondeductible excise tax on RICs tothe extent they do not meet certain distribution requirementsby the end of each calendar year.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds20

Interval fundsShareholder liquidity Like all closed-end funds, the securities issued by Interval Fundsare not redeemable by shareholders. The securities cannot be sold back to the Interval Fund upon theshareholder’s demand. Interval Funds typically do not trade on a securities exchange orother secondary market. Interval Funds are required to adopt a “fundamental policy” torepurchase their shares: at a price equal to NAV, from shareholders at periodic, pre-determined intervals.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds21

Interval fundsShareholder liquidity (cont.) Rule 23c-3 requires Interval Funds to establish a periodic, predetermined interval in offering to repurchase shares every 3, 6, or12 months (i.e., quarterly, semi-annually or annually). Rule 23c-3 also requires each such repurchase offer to be for anamount that is equal to between 5% and 25% of outstandingshares. Repurchase offers are made pursuant to a notice filing on FormN-23c-3 under the 1940 Act. Significantly less burdensome than filing tender offer materialsunder Rule 13e-4 of the 1934 Act.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds22

Interval fundsShareholder liquidity (cont.) This fundamental policy can be changed only by the vote ofa majority of the Interval Fund’s shareholders. There are certain limited circumstances where the Board ofDirectors, by a vote of the majority of the independentdirectors, can suspend or postpone a repurchase offer. Under Rule 23c-3, additional liquidity may be providedoutside of the fundamental policy only once every twoyears.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds23

Interval fundsShareholder liquidity (cont.) Liquidity Considerations: Required to maintain “liquid assets,” equal to 100% of the repurchase offering amount, from the date of the notification of the repurchase offer, through the repurchase pricing date. The actual repurchase must be within 7 days of this date. Liquid assets refer to assets that: “can be sold or disposed of in the ordinary course ofbusiness,” and “at approximately the price at which the company has valuedthe investment.”Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds24

Interval fundsShareholder liquidity (cont.) Liquidity Considerations: Interval Funds can invest in illiquid assets: real estate, equity investments in private companies, and directly originated loans, as long as the portfolio manager maintains a sufficient level ofliquidity.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds25

Interval fundsShareholder liquidity – a new approach Combining 1940 Act and 1934 Act Repurchase Offers. “Fundamental policy” to conduct one or two repurchaseoffers annually under Rule 23c-3 of the 1940 Act,supplemented with discretionary repurchase offers underthe 1934 Act. Creates a more flexible Interval Fund. Greater ability to effectuate investment strategy. Maintains all the regulatory benefits of being an IntervalFund.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds26

Interval fundsUnderwriting compensation limits Interval Funds are not subject to substantive FINRA review. Interval Funds are subject to FINRA’s “Sales Charge Rule” for mutualfunds. FINRA has issued guidance that specifically exempts Interval Fundsfrom FINRA Rule 5110. An offering subject to FINRA review cannot proceed until theunderwriting terms have been approved by FINRA. Interval Fund offerings do not require a FINRA filing or FINRAdetermination. The fact that Internal Funds are not subject to the CorporateFinancing Rule results in considerable cost and time savings.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds27

Interval fundsUnderwriting compensation limits (cont.) Fee structures for Interval Funds range from the high end of 8.5%of the offering price to the low end of 6.25% of total gross sales. Interval Funds may charge investors a front-end sales chargeand/or a continuing asset-based fee that generally takes the formof a “distribution fee” and/or a “service fee.” Distribution Fee: A “distribution fee” is an asset-based sales charge thatcompensates broker-dealers for effecting sales for the fund, and Any distribution-related asset-based sales charge may notexceed 0.75% of the average annual net assets of the fund. Service Fee: A “service fee” is a payment for personal services and/or themaintenance of shareholder accounts, and May not exceed 25 basis points of the average annual NAV of theshares.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds28

Interval fundsOffering process Interval Funds typically offer their shares for sale to the public ona continuous basis at a price based on the NAV of their shares. Once the SEC review and comment process has been completed and theregistration statement has been declared effective by the SEC Staff, theInterval Fund may commence sales of its shares. Interval Funds are permitted to update their registrationstatements by filing post-effective amendments that, in certaincircumstances, become automatically (60 days after filing) orimmediately effective. These automatically effective amendments are not available to othernon-traded vehicles, including other registered closed-end funds, BDCsand REITs, affording significant benefits to Interval Funds with respect tocomplying with the updating requirements and providing more certainty.Eversheds Sutherland October 19 2017 A primer on registered closed-end funds, specifically interval funds29

Interval fundsOffering related matters Easier and More Efficient Distribution Methods. Stemming from the view that Interval Funds are similar to openend funds, the manner in which Interval Funds are distributed isconsiderably more efficient than the manner in which moretraditional non-traded closed-end funds are typically sold. Interval Funds can be sold through an electronic platform, referredto as “point and click,” without the use of a written subscriptionagreement. Many large brokerage firms have demonstrated a greaterwillingness to place Interval Funds on their selling platforms ascompared to other non-traded closed-end funds, largely becauseof the predictable liquidity that In

Oct 19, 2017 · a bond issued by a reputable fidelity insurance company to protect the company against larceny and embezzlement. A primer on registered closed-end funds, . Subject to FINRA Rule 5110, which limits underwri