Transcription

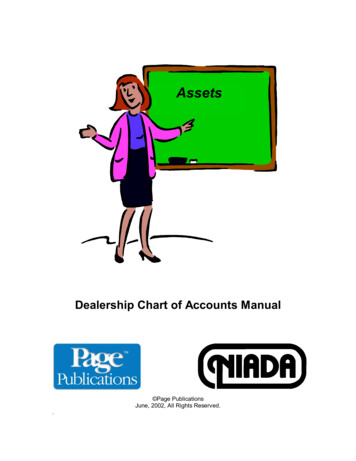

AssetsDealership Chart of Accounts Manual Page PublicationsJune, 2002, All Rights Reserved.

Asset Accounts.This chapter should provide the NIADA dealer, office manager, internal auditor and outsideaccountant with an overview for Asset account numbers and descriptions.ASSET ACCOUNTSAccount No.Page No.CASH AND 6601670Petty Cash FundCash in BankCash in Bank - PayrollContracts in TransitCash InvestmentsUndeposited Cash ClearingCash Sales ClearingRECEIVABLESRetail VehiclesWholesale & Dealer Transfer VehiclesLease & Rental AccountsFinance & Insurance Receivables - CurrentCustomer NotesService, Parts & Body AccountsService Contract ClaimsAllowance for Doubtful AccountsTrade Receivables - AffiliatesOther ReceivablesINVENTORIESDemonstratorsOther AutomotiveUsed CarsUsed TrucksRemarketed VehiclesParts & AccessoriesFuel, Oil & GreasePaint & Body Shop MaterialsSublet RepairsWork in Process - LaborOther InventoryAllowance - Parts Inventory AdjustmentLIFO Reserve - Used VehiclesLIFO Reserve - Parts & AccessoriesPREPAID EXPENSESPrepaid ExpensesPrepaid TaxesPrepaid RentPrepaid InsurancePrepaid OtherOther Current 728293031323334353637

ASSET ACCOUNTS - CONTINUEDAccount 930194019501960197019801990Page No.LEASE & RENTAL VEHICLESLease VehiclesLease Vehicles - Accumulated DepreciationRental VehiclesRental Vehicles - Accumulated DepreciationDriver Training VehiclesDriver Training Vehicles - Accumulated DepreciationFIXED ASSETSLand & ImprovementsLand & Improvements - Accumulated DepreciationBuilding & ImprovementsBuilding & Improvements - Accumulated Depreciation.Machinery & Shop EquipmentMachinery & Shop Equipment - Accumulated DepreciationParts & Accessories EquipmentParts & Accessories Equipment - Accumulated DepreciationFurniture, Fixtures & SignsFurniture, Fixtures & Signs - Accumulated DepreciationCompany VehiclesCompany Vehicles - Accumulated DepreciationLeaseholds & ImprovementsLeaseholds & Improvements - Accumulated DepreciationOther Fixed AssetsOTHER ASSETSLife Insurance - Cash ValueNotes & Accounts Receivable - Officers & OwnersInvestments in Affiliated CompaniesAdvances - Affiliated PartiesAdvances - Other PartiesNotes & Accounts Receivable - OtherFinance Receivables - DeferredOther Investments & Miscellaneous AssetsDeposits on ContractsOther 606162636465666768

CONTINUE TO THE NEXT PAGE.

ASSET ACCOUNT1000CASH AND CONTRACTSPETTY CASH FUNDACCOUNT DESCRIPTIONThis cash account is used to record dealership cash on hand in a small permanent imprest fundto be used for minor expenditures and for change.TYPICAL TRANSACTIONSAccount NameAccount #Debit10001010X8200821083301010XXXCreditExample 1. Check issued to establish or increase pettycash fund. Entry posted in cash disbursements journal.Petty CashCash in Bank – GeneralXExample 2. Check issued to reimburse petty cash fund forstamps, miscellaneous shop supplies, and small freightcharges. Entry posted in cash disbursements journal.Office SuppliesTools & SuppliesFreight – PartsCash In Bank – GeneralXACCOUNT COMMENTSEach petty cash payment should be supported with a petty cash voucher written in ink, signed bythe recipient and signed off on by a manager. Suppliers’ invoices should be attached to the pettycash voucher and stamped paid or otherwise canceled to prevent duplicate payment. The sum ofall petty cash vouchers on hand and the cash on hand should always equal to the recordedbalance in the account. The petty cash fund should be reimbursed periodically and at the end ofthe month by issuing a check to the person in charge of the fund. A petty cash summary listingthe paid vouchers should be prepared to support the reimbursement. All vouchers and invoicesshould be cancelled to prevent possible future misuse. Payroll or payroll advances should not begiven out of petty cash.NIADA Dealership Chart of Accounts Manual1[June, 2002]

ASSET ACCOUNT1010CASH AND CONTRACTSCASH IN BANKACCOUNT DESCRIPTIONThis cash account is used to record cash on deposit with the bank in the dealership’s regularchecking account. Transactions include cash receipts, disbursements and fees deducted fromthe bank account.TYPICAL TRANSACTIONSAccount NameAccount #DebitExample 1. Payment of finance contract amount by outsidefinancial institution. Posted in cash receipts journal.Cash in Bank – GeneralContracts in Transit10101020XExample 2. Customer payment on service accountsreceivable balance. Posted in cash receipts journal.Cash in Bank – GeneralAccounts Receivable – Parts and Service10101150XExample 3. Deposit of cash at end of day from cashclearing account. Posted in cash receipts journal.Cash in Bank – GeneralUndeposited Cash Clearing10101040XExample 4. Miscellaneous bank charges on month-endstatement. Posted in general journal.Miscellaneous ExpenseCash in Bank - General84101010XCreditXXXXACCOUNT COMMENTSAll cash received should be deposited into this account on a daily basis. It is recommended thatall checks require two authorized signatures. All copies of a voided check should be retainedtogether and the signature area should be removed. Bank reconciliation should be preparedimmediately upon receipt. If possible a different person should reconcile this account two orthree times a year.NIADA Dealership Chart of Accounts Manual2[June, 2002]

ASSET ACCOUNT1015CASH AND CONTRACTSCASH IN BANK – PAYROLLACCOUNT DESCRIPTIONThis cash account is used to record cash on deposit with the bank in the dealership’s payrollchecking account maintained on an imprest basis.TYPICAL TRANSACTIONSAccount NameAccount #Debit10151010X10151010XCreditExample 1. Establish minimum balance in payrollaccount.Cash in Bank – PayrollCash in Bank – GeneralXExample 2. Transfer general funds to payroll account tocover total net amount due for payroll period.Cash in Bank – PayrollCash in Bank – GeneralXACCOUNT COMMENTSUse of a payroll bank account simplifies the bank reconciliation procedure by separating payrollchecks from the regular checking account and allows more than one employee to reconcile theregular checking account. A deposit equal to the amount of the payroll should be made into theaccount. This can be done as each payroll is done or a transfer at the beginning of each monthto cover the monthly payroll. Bank reconciliation should be prepared immediately upon receiptof the bank statement.NIADA Dealership Chart of Accounts Manual3[June, 2002]

ASSET ACCOUNT1020CASH AND CONTRACTSFINANCE CONTRACTS IN TRANSITACCOUNT DESCRIPTIONThis short-term (1-5 days) receivable account is considered as a near-cash account and is usedto record money due from banks and other financial companies on financed vehicle salecontracts.TYPICAL TRANSACTIONSAccount NameAccount #Debit10203500X10401020XCreditExample 1. Vehicle sales contract money due from bank isset up as part of vehicle sale entry. Posted in vehicle salesjournal.Finance Contracts in TransitUsed Car Retail SalesXExample 2. Vehicle sales contract check received frombank or other financial institution. Posted in cash receiptsjournal.Undeposited Cash ClearingContracts in TransitXACCOUNT COMMENTSDetailed records should be kept to support this account. At month end, a detail (i.e. schedule) ofthis account should be prepared showing the finance source, customer name, contract date, datecontract submitted to bank, and the amount outstanding. For control purposes and cash flowpurposes, this schedule should be reviewed on a daily basis to insure that money due is receivedfrom the finance source promptly.NIADA Dealership Chart of Accounts Manual4[June, 2002]

ASSET ACCOUNT1030CASH AND CONTRACTSCASH INVESTMENTSACCOUNT DESCRIPTIONThis cash account is used to record deposits and withdrawals in investment accounts or moneymarket accounts maintained in the dealership’s name.TYPICAL TRANSACTIONSAccount NameAccount #Debit10301010X10309050X10101030XCreditExample 1. Deposit of cash to investment account. Postedin cash disbursements journal.Cash InvestmentsCash in Bank - GeneralXExample 2. Recording of interest earned on account.Posted in general journal.Cash InvestmentsInterest IncomeXExample 3. Withdrawal of funds from investment accountand deposited into the dealership general bank account.Cash in Bank - GeneralCash InvestmentsXACCOUNT COMMENTSFor good cash management, cash that will not be needed for short periods of time can be kept ina daily-interest bearing account or immediately accessible mutual fund. This is an excellentsource of short-term interest income. Investment statements should be reconciled whenreceived, and the interest credited to the appropriate account.NIADA Dealership Chart of Accounts Manual5[June, 2002]

ASSET ACCOUNT1040CASH AND CONTRACTSUNDEPOSITED CASH CLEARINGACCOUNT DESCRIPTIONThis is a clearing account for all cash received in the ordinary course of business and not yetdeposted in the bank. It is generally considered the office cash clearing account with all incomingmonies posted to this account with an offsetting bank deposit entry at the end of the day. All cashreceived should be deposited each banking day, intact as received. No money should be paidout of the Undeposited Cash Clearing account.TYPICAL TRANSACTIONSAccount NameAccount #Debit10401100X10401050X10101040XCreditExample 1. Down payment received on car sale. Posted incash receipts journal.Undeposited Cash ClearingAccounts Receivable – VehicleXExample 2. Service cash turned in by service cashier tooffice cashier. Posted in cash receipts journal.Undeposited Cash ClearingCash Sales ClearingXExample 3. End of day deposit is recorded and posted incash receipts journal.Cash in Bank - GeneralUndeposited Cash ClearingXACCOUNT COMMENTSAs a daily cash clearing account, this account should maintain a zero balance. The posting ofcash receipts and the bank deposit on a daily basis should assure this If a balance does exist thefollowing day, all account transactions for the previous day should be reviewed and the reasonfor the balance found. If required, an adjustment should be made that day to correct anyproblems found.NIADA Dealership Chart of Accounts Manual6[June, 2002]

ASSET ACCOUNT1050CASH AND CONTRACTSCASH SALES CLEARINGACCOUNT DESCRIPTIONThis is a second cash clearing account used to track money from the sale of parts and the repairof vehicles. It is considered a parts and service cash clearing account used if the dealership hasa second cashier. It is considered an optional clearing account for those dealerships with onlyone cashier.TYPICAL TRANSACTIONSAccount NameAccount #Debit10505310X10505000X10401050XCreditExample 1. Parts sold over the counter to retail customerfor cash. Posted in parts sales journal.Cash Sales ClearingParts Sales – CounterXExample 2. Service RO labor sales to retail customer forcash. Posted in service sales journal.Cash Sales ClearingCustomer Labor Sales - MechanicalXExample 3. End of day total service and parts cash isturned into the office by the service cashier in exchange fora cash receipt from the office cashier. Posted in cashreceipt journal.Undeposited Cash ClearingCash Sales ClearingXACCOUNT COMMENTSTickets from parts, service and body shop will be posted to this account as a debit when thesales are posted. The total of daily funds received by the service cashier will be posted to thisaccount as a single net credit. This end-of-day batched total entry should zero out the account.Since this account is considered a daily clearing account, it should have a zero balance at theend of any day’s postings. The posting of tickets and the receipt board on a daily basis shouldassure this. If a balance does exist at the end of day, all entries to the account should bereviewed for the day and the reason for the balance determined. If there is an error, the errorshould be found and adjustments made immediately.NIADA Dealership Chart of Accounts Manual7[June, 2002]

ASSET ACCOUNT1100RECEIVABLESRETAIL VEHICLESACCOUNT DESCRIPTIONThis receivable account is used to record customer accounts resulting from the sales of cars andtrucks. This account is used to post vehicle cash down amounts and cash settlement amounts.Depending on dealer preference, this account may be used to record both short-term and longterm vehicle receivables (i.e. Buy Here – Pay Here Accounts).TYPICAL TRANSACTIONSAccount NameAccount #Debit11003500X10401100XCreditExample 1. Retail customer purchases vehicle for cash.Cash settlement amount is debited to this account invehicle sales journal.Accounts Receivable - VehicleUsed Car Retail SaleXExample 2. Cash received from customer on vehiclepurchase is recorded by issuing cash receipt. Receipt isposted in cash receipts journal.Undeposited Cash ClearingAccounts Receivable - VehiclesXACCOUNT COMMENTSThis account should be scheduled with customer transactions shown on a customer by customerbasis. The schedule should be summarized with balance aging for both individual customers, aswell as aging totals. All receivables over 30 days old should be followed up for payment. Whilethis account may be used for both long-term and short-term receivables, a separate account maybe preferred for long-term Buy Here – Pay Here receivables. To reduce losses on receivables,the authority to extend credit should be strictly limited. Collection of receivables should be majorpriority of dealership management.NIADA Dealership Chart of Accounts Manual8[June, 2002]

ASSET ACCOUNT1110RECEIVABLESWHOLESALE & DEALER TRANSFER VEHICLESACCOUNT DESCRIPTIONThis receivable account is used to record short-term receivables due from the sale of vehicles toother dealers on a wholesale (i.e. for resale) basis.TYPICAL TRANSACTIONSAccount NameAccount #Debit11103520X10401110XCreditExample 1. Dealership sells over-aged vehicle to anotherdealer for cash. Payment to be made within 5 days of sale.Sale is posted in vehicle sales journal.Wholesale & Dealer Trade VehiclesUsed Car Wholesale SalesXExample 2. Purchasing dealer delivers check in paymentfor wholesale vehicle sale to selling dealership. Payment isposted in cash receipts journal.Undeposited Cash ClearingWholesale & Dealer Trade VehiclesXACCOUNT COMMENTSThe term dealer transfers may be more applicable to new franchise dealers selling new unitsfrom one franchise owner to another, but is also applicable to mutli-corporation used dealerstransferring inventory between different corporately owned sales lots. The term wholesale sale isused here as a sale from one dealer to another, either through direct purchase or through anauction. A schedule with aged balances should be maintained for this account with promptfollow-up on over-due balances.NIADA Dealership Chart of Accounts Manual9[June, 2002]

ASSET ACCOUNT1120RECEIVABLESLEASE & RENTAL ACCOUNTSACCOUNT DESCRIPTIONThis receivable account is used to track balances of leased and rental vehicle customers.TYPICAL TRANSACTIONSAccount NameAccount #Debit11203500X10401120X11209100XCreditExample 1. Retail customer leases a vehicle for 24 monthsfor an agreed upon monthly fee. Assume dealership is theleasing agent and owner of the vehicle.Lease & Rental AccountsLease, Rental & Other Vehicle-Related IncomeXExample 2. Customer makes monthly payment on lease.Undeposited Cash ClearingLease & Rental AccountsXExample 3. Customer rents car for seven days, withpayment due at the end of week. Assume rental agreementis posted when customer picks up rental vehicle tomaintain accurate vehicle inventory records.Lease & Rental AccountsLease, Rental & Other Vehicle-Related IncomeXACCOUNT COMMENTSDepending on the dealer’s preference and applicable laws, the balance in this account may ormay not include the following items: Principal amount due on lease.Rental taxes due.Insurance premiums due.This account should be scheduled, with individual customer balances recording monthlytransactions and balance forward amounts due.NIADA Dealership Chart of Accounts Manual10[June, 2002]

ASSET ACCOUNT1130RECEIVABLESFINANCE & INSURANCE RECEIVABLES – CURRENTACCOUNT DESCRIPTIONThis receivable account is used to record short-term finance receivables currently due andpayable to the dealership. These monies (referred to as F&I income) are typically earned ascommissions on insurance policies sold to customers on behalf of outside insurance (ex.warranty) companies. Alternatively, F&I income is paid in the form of fees from financialinstitutions to the dealership for directing and assisting customers in arranging financing with thefinancial institution.TYPICAL TRANSACTIONSAccount NameAccount #Debit11303720X11303700X10401130XCreditExample 1. Dealership earns commission on sale ofextended warranty policy to vehicle purchase customer.Warranty contract premium payable and commission dueare posted in vehicle sales journal as part of vehicle sale.Finance & Insurance Receivables - CurrentInsurance Income - UsedXExample 2. Dealership earns referral fee for assistingcustomer in arranging financing with financial institution.F&I receivable posted in vehicle sales journal as part ofsale.Finance & Insurance Receivable – CurrentUsed Vehicle Finance IncomeXExample 3. Dealership receives referral fee check fromfinancial institution for finance sale earlier in month. Entryfor check is posted in cash receipts journal.Undeposited Cash ClearingFinance & Insurance Receivables - CurrentXACCOUNT COMMENTSFinance income should be calculated and recorded on each contract as the vehicle sale isrecorded, since fees and commissions vary by financial institution and insurance company. Asdesired, separate F&I receivable sub-accounts may be used for each finance source orinsurance company. Examples might be example 1131 – Finance Source A, 1132- FinanceSource B, 1133 – Insurance Company A, etc.Each account should be scheduled on a deal-by-deal basis with control numbers for eachreceivable earned by the dealership. These records (schedules) should be reconciled tostatements received from finance sources and insurance companies on a monthly basis.NIADA Dealership Chart of Accounts Manual11[June, 2002]

ASSET ACCOUNT1140RECEIVABLESCUSTOMER NOTESACCOUNT DESCRIPTIONThis receivable account may be used for miscellaneous short term notes, such as a promissorynotes extended by the dealership to one of its customers. Depending on dealer preference, itmay also be used for formal long term notes or finance contracts, such as Buy Here – Pay Herecontracts.TYPICAL TRANSACTIONSAccount NameAccount tExample 1. Dealership agrees to internally financesettlement amount on vehicle sale for customer.Settlement (assume principal only) amount is posted aspart of vehicle sale in vehicle sale journal.Customer NotesUsed Car Retail SalesXExample 2. Customer makes payment to dealership asagreed to in finance agreement. Payment is posted in cashreceipts journal.Undeposited Cash ClearingCustomer NotesUsed Vehicle Finance Income (interest)XXExample 3. Customer makes payment to dealership asagreed to in finance agreement. Note amount is carried ondealership books as principal and calculated interest total.Undeposited Cash ClearingCustomer NoteUnearned InterestUsed Vehicle Finance Income (Interest)XXXACCOUNT COMMENTSDepending on the dealership’s preference and/or software, customer notes may be carried inaccounting records as either (a) note principal amounts only or as (b) note principal andcalculated interest totals. When notes are carried on a principal and interest basis, a separatepayable account for unearned interest is also required to be maintained. As interest is earnedover time, each customer payment entry will recognize current interest earned and reduce thebalance of unearned interest.NIADA Dealership Chart

This end-of-day batched total entry should zero out the account. Since this account is considered a daily clearing account, it should have a zero balance at the end of any day’s postings. The posting of tickets and the receipt board on a daily basis should assure this. If a balance does exist at the