Transcription

Trust Accounts,Representative Payeeand DeceasedAccounts

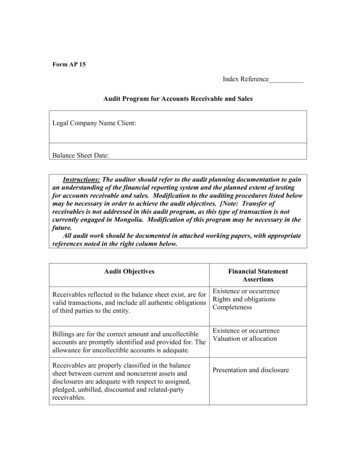

Account Ownership Ownership means the possession of legal title or a beneficialinterest in an asset, such as a savings account. Three elements of ownership need to be considered whenselecting the proper account ownership: Who owns the money? Who will be able to conduct transactions and other activity on theaccount? What will happen to the money when the account owner dies?

Topics Trust Representative Payee Deceased

Trust Accounts

Trust TermsWhat is a Trust?A formal agreement or fiduciary relationshipwhere a person (settlor) entrusts ownershiprights of one or more assets to someone. Thatindividual (trustee) administers and managesthe assets on behalf of another (beneficiary).

Trust TermsSettlor/Grantor:The settlor/grantor is the person who creates andowns the trust. They identify who is in each role,what they can do and which assets are within thetrust. This person does not always have access tothe trust. The only way they can access this trust isby being named the trustee.

Trust TermsTrustee:The trustee may be an individual or legal entity towhich the settlor transfers legal title/ownership to thetrust. The trustee managers the assets (funds) withinthe trust for the benefit of the beneficiaries. It iscommon that the settlor names themselves as thetrustee to retain access to the funds. There can bemultiple trustees. Privileges vary from trust to trustand are stated within the document. Distributes thefunds according to the instructions in the trust whenthe settlor passes away.

Trust TermsSuccessor Trustee:The successor trustee is the person who is named bythe settlor/grantor to take over the role of trusteewhen a current trustee resigns, dies or becomeincapacitated. When this happens, the successortrustee becomes the trustee. Typically there is morethan one successor trustee named either to becomea co-trustee or as the second successor trustee.

Trust TermsBeneficiary:The beneficiary is the person who is entitled to thebenefit of the trust arrangement. The beneficiary isnormally a person; however, could be a company,organization or charity.

Trust Accounts

Common Types of TrustsRevocableIrrevocable Can be changed, revokedor terminated by thesettlor/grantor at any time. Becomes irrevocable uponthe death of thesettlor/grantor. The settlor/grantor is not toretain any right to amend,revoke, or alter the trust inany way. The settlor/grantor cannotretain any right to controlthe ownership or enjoymentof the property placed inthe trust or the incomegenerated by the property.

Trust AccountsBest Practices Know who has rights to the funds on depositChecks made payable to the name of a TrustLending under a Trust AccountA way to avoid probate when assets are transferred after thedeath of the individual who set up the trust. A trust is a type of legal entity that is separate from your ownpersonal estate. This legal entity has certain rights andadvantages for those engaging in estate planning.

Certificate of TrustWhat is a Certificate of Trust?A Certificate of Trust provides your banking institution,brokerage firm, transfer agent or other third party withnecessary information regarding the trust to facilitatethis transfer. This document confirms the trustee’sauthority to act on behalf of the trust.

Certificate of Trust

Certificate of TrustSec. 7913 (1) Instead of furnishing a copy of the trust document, the trusteemay provide a certificate of trust containing all of the following information: Name and date of Trust and any amendments Name and address of current acting trustee Powers of the trustee relating to the purposes for which the certificate isbeing offered Revocability or irrevocability of the trust and the identity of any personholding a power to revoke the trust Authority of co-trustee to sign or otherwise authenticate and whether all orless than all are required in order to exercise powers of the trustee

Certificate of TrustA certificate of trust may be signed or authenticated bythe settlor, any trustee, or an attorney for the settlor ortrustee. Best practice for a certificate of trust is to haveit in the form of an affidavit.A certificate of trust should state the trust has notbeen revoked, modified, or amended in any mannerthat would cause the representations contained in thecertificate of trust to be incorrect.

Certificate of TrustWhy would I only take a Certificate of Trust andnot the entire Trust Agreement?When a Financial Institution takes the entire Trust Agreement,the Financial Institution could become liable for all instructionswithin it. Should the Trustee do something against the will ofthe Trust, the Financial Institution runs the risk of beingaccountable for those actions. When only a Certificate of Trustis received and used to open an account, the liability remainson the Trustee for following all instructions within the document.

Representative Payee

Representative PayeeRepresentative Payee:A representative payee is a person or an organizationappointed by the Social Security Administration (SSA)to receive the Social Security and/or SSI benefits foranyone who can’t manage or direct the managementof his or her benefits/money.

BeneficiaryBeneficiary:A beneficiary is a person who receives SocialSecurity and/or Supplemental Security Income (SSI)payments. Social Security and SSI are two differentprograms and both are administered by SSA.

Social Security Benefits based on earningsFinanced by employer and wage contributionsNo income limitNo resource limitMust have enough work creditsMedicareBenefit Types: Retirement (age 62 & older) Survivor Disability (includes blindness)

Social Security Continued Provides benefits to eligible family membersBenefit amount based on average lifetime earningsOther income does NOT generally affect benefitsWhere you live or who lives with you does NOT affectbenefits

SSI Benefits based on needFinanced by General RevenuesLimited incomeLimited resourcesNo work credits are requiredMedicaidBenefit Types: Aged (age 65 & older) Disability (any age, includes children) Blindness (any age, includes children)

SSI Continued No family benefits Benefit amount based on Federal and State laws Other income MAY affect benefits – report anyincome you receive Where you live and who lives with you MAYaffect benefits – report all changes

Representative PayeeWhat is the Representative Payee’s main duty? Act on behalf of the beneficiary Responsible for everything related to benefits that acapable beneficiary would do for themselves SSA encourages them to go beyond just managingfinances – be actively involved in the beneficiary’s life

Representative PayeeRequired duties: Determine beneficiary’s needs and use thepayments to meet those needs Save any money left in an interest bearing accountor savings bonds for the beneficiary’s future needsafter meeting the current needs are met Report any changes or events which could affectthe beneficiary’s eligibility for benefits or paymentamount Keep records of all payments received and howthey are spent and/or saved

Representative PayeeRequired duties: Provide benefit information to social service agencies ormedical facilities that serve the beneficiary Help the beneficiary get medical treatment whennecessary Notify SSA of any changes in your (the payee’s)circumstances that would affect your performance orcontinuing as payee Complete written reports accounting for the use of funds Return any payments to which the beneficiary is notentitled to SSA

Bank AccountWhat Type of Bank Account? Set up so fees are minimized Enables clear records – checking account Account title must show beneficiary’s ownership of the funds and showrepresentative payee as the financial agent Neither representative payee or another 3rd party can have any ownershipof the account Beneficiary must never have direct access to the account Must be titled so that it is clear that the money in the account belongs tothe beneficiary“(Beneficiary’s name) by (Rep Payee Name), representative payee”“(Rep Payee Name), representative payee for (beneficiary’s name)”

Representative PayeeIf the beneficiary dies: Any saved benefits belong to the estate Must be given to the legal representative of the estate, or thesavings must be handled according to state law Social Security benefits - No check is payable for the monthof death, even if he/she dies on the last day of the month Social Security benefits - Any check must be returned that isreceived for the month the beneficiary dies SSI – is payable the month of death SSI – any checks received after the month of death must bereturned

Representative Payee Power of Attorney, being an authorized representative orhaving a joint bank account with the beneficiary is not thesame thing as being a “payee”. These arrangements do not give legal authority to negotiateand manage a beneficiary’s Social Security and/or SSIpayments. In order to be a representative payee, a person ororganization must apply for and be appointed by SSA.

Deceased

DeceasedGeneral Accounts Need proof of death Joint Accounts with Survivorship Joint member can keep account if they qualify for membership Beneficiaries Named on account No Joint Member or Beneficiaries named Probate paperwork with named executor of the estate Will presented for account disbursement Checks made payable to the deceased Proper endorsement Checks payable to an Estate

Deceased Trust AccountsRevocable Trust becomes an Irrevocable Trust upon Deathof grantorSuccessor Trustee now becomes Trustee, if no other currenttrusteeChange in Beneficiaries – Person(s) named in trustdocuments to inherit assets become the new beneficiariesAssets pass to the Beneficiaries similar to the way if theywere being distributed with a WillAssets placed in generally do not have to go through ProbateThe Trust would be closed out or dissolved

DeceasedRepresentative Payee Contact the Social Security Administration Determine if any funds on deposit need returned Saved funds become an asset of the Estate

Power of Attorney

Power of Attorney (POA)What is a Power of Attorney?A power of attorney is a legal document giving oneperson (called an “agent” or “attorney-in-fact” thepower to act for another (the principal). The agent canhave broad legal authority or limited authority to makelegal decisions about the principal’s property andfinance.

Power of Attorney (POA)General Power of Attorney Gives broad powers Powers include handling financialtransactions Used in the event someone is ill ordisabled Effective tool when the principal can’t bepresent to sign necessary legaldocuments for financial transactions

Power of Attorney (POA) If you accept POAs, it is critical that you read theentire document to determine what powers theagent has Know if the POA is in effect May have a starting and expiration date May be considered “springing” POA Ceases immediately upon death of the Principal person who granted the powers

Power of Attorney (POA) POA and Trust POA document must reference the Trust Trust Agreement/Document must reference thePOA If you question the Power of Attorneydocument, seek legal advice

Power of Attorney (POA)

Power of Attorney (POA)Certification and Acceptanceof AuthorityThis document attests to the best ofthe agent’s knowledge it is still ineffect and they are still the Attorneyin-Fact

DeAnne M. RamosPlanning and Innovation p.com

Enables clear records –checking account Account title must show beneficiary’s ownership of the funds and show representative payee as the financial agent Neither representative payee or another 3rd party can have any ownership of the account Beneficiary must