Transcription

ANDREW MOORE / FLICKRDIGITAL FINANCE COUNTRY REPORTJORDANDISCLAIMER: The USAID local enterprise support (LENS) project is funded by the United States Agency for International Development(USAID) and implemented by FHI 360. This report is made possible by the generous support of the American people through the UnitedStates Agency for International Development (USAID). The contents are the responsibility of MEDA and do not necessarily reflect theviews of USAID or the United States.

ACKNOWLEGDEMENTSUSAID Jordan Local Enterprise Support Project (LENS) would like to acknowledge the strongsupport of all key informants Interviewees Annex 2.This report was drafted by Peter Nzebileand Davy Denadi. Further, reviews from Chris Statham and Caroline Averch (USAID LENS) andImad Aloyoun (Dinarak) were invaluable. This document has been produced with the financialassistance of USAID LENS. The views expressed herein can in no way be taken to reflect theofficial opinion of USAID.1 DIGITAL FINANCE COUNTRY REPORT- JORDAN

TABLE OF CONTENTSTABLE OF CONTENTS . 1TABLE OF TABLES . 3TABLE OF FIGURES . 3LIST OF ABBREVIATIONS AND ACRONYMS . 3GLOSSARY . 6EXECUTIVE SUMMARY . UCTION . 8DFS STAKEHOLDERS . 8POLICY AND REGULATION . 9INFRASTRUCTURE . 10CUSTOMER AND MARKET POTENTIAL . 11PAYMENT SERVICE PROVIDERS AND VOLUME DRIVERS . 12AGENT NETWORK . 13DFS ECOSYSTEM SUMMARY . 14KEY FINDINGS . 14IDENTIFIED OPPORTUNITIES AND CHALLENGES FOR DFS GROWTH . 152.COUNTRY OVERVIEW . 163.DEMAND FOR FINANCIAL SERVICES . 184.REGULATIONS . 20DIGITAL FINANCE SERVICES OVERVIEW. 20MOBILE FINANCIAL SERVICE MODELS . 21AGENT NETWORK . 22KYC/AML . 23CONSUMER PROTECTION. 23OTHER ISSUES . 23OTHER INITIATIVES . 244.1.4.2.4.3.4.4.4.5.4.6.4.7.FINANCIAL SECTOR . 5.12.5.13.5.14.1 OVERVIEW . 25FINANCIAL INCLUSION . 25BANKS . 26MICROFINANCE . 27OTHER FINANCIAL SERVICE INSTITUTIONS . 29INSURANCE COMPANIES. 29PAYMENT SYSTEM . 30EFAWATEERCOM . 30SUPPORTING PAYMENT INFRASTRUCTURE . 31GOVERNMENT’S IT AND COMMUNICATION STRATEGY . 32JORDAN CREDIT BUREAU (CRIF) . 32GIZ DIGI#ANCES PROJECT. 32CONSUMER FINANCIAL EDUCATION AND PROTECTION. 32WOMEN AND FINANCIAL SERVICES . 33DIGITAL FINANCE COUNTRY REPORT- JORDAN

MOBILE SECTOR. 336.OVERVIEW . 33OPPORTUNITIES FOR THE MOBILE INDUSTRY IN JORDAN . 34CHALLENGES . 344-G PENETRATION. 34SOCIAL MEDIA . 35MOBILE FINANCIAL SERVICES: . 356.1.6.2.6.3.6.4.6.5.6.6.MOBILE FINANCIAL SERVICE PROVIDERS . IEW . 35PAYMENT SERVICES PROVIDERS. 36ZAIN CASH . 37AL-HULOOL . 38DINARAK . 39AYA PAY . 39MEPS . 39BANKS . 40MICROFINANCE INSTITUTIONS . 40SUMMARY . 42DONOR ACTIVITIES . 428.GIZ . 42MERCY CORPS . 43USAID LENS . 43THE BILL AND MELINDA GATES FOUNDATION . 448.1.8.2.8.3.8.4.OPPORTUNITIES AND CHALLENGES FOR DFS. 459.OPPORTUNITIES . 45CHALLENGES . 469.1.9.2.INVESTMENT OPPORTUNITIES IN JORDAN . 4710.10.1.10.2.THE NEED FOR AN AGENT NETWORK MANAGEMENT MODEL THAT CAN ENHANCE OPERATIONS . 47THE NEED FOR FLEXIBLE CORE BANKING SYSTEMS THAT OFFERS BOTH SECURITY,FLEXIBILITY AND FACILITATES FULL INTEROPERABILITY BETWEEN THE CONNECTEDDIGITAL FINANCIAL SERVICE PROVIDER . 4710.3.10.4.RECOMMENDED ACTIONS TO DEVELOP THE MARKET. 4811.11.1.11.2.GOVERNMENT AND CBJ (POLICY & REGULATIONS) . 48THE PRIVATE SECTOR . 49ANNEXES . 5112.12.1.ANNEX 1: LIST OF INTERVIEWS . 51ANNEX 2: BIBLIOGRAPHY . 5213.1PRODUCT DEVELOPMENT . 47THE NEED FOR DIGITAL FINANCE EDUCATION- . 48 DIGITAL FINANCE COUNTRY REPORT- JORDAN

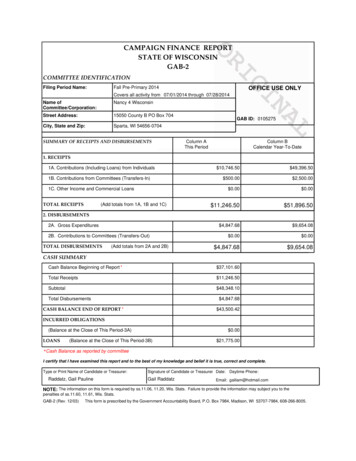

TABLE OF TABLESTable 1: Transactions volumes . 13Table 2: Key Country Statistics. 17Table 3: Banking Sector Financial Indicators (2015-2017). 27Table 5: Financial service provider. 28Table 6: GSM penetration . 33Table 8: PSPs market-share in terms of subs and agents . 37Table 9: DFS activities within the MFI sector . 41Table 8: e-wallet transaction limits . 46TABLE OF FIGURESFigure 1: The state of Digital Finance in Jordan. 8Figure 2: Jordan’s Payment settlement system . 10Figure 3: Framework for Financial Inclusion in Jordan. 11Figure 4: Country Map . 16Figure 5: Channels used by MSME (Source: LENS MSME market assessment) . 18Figure 6: DFS Council Session (source CBJ) . 24Figure 7: eFAWTEERcom monthly transaction . 31Figure 8: Jordan PSP ecosystem players . 38Figure 9: WIT loan disbursement and repayment model. 433 DIGITAL FINANCE COUNTRY REPORT- JORDAN

LIST OF ABBREVIATIONS AND ACRONYMSACCAgricultural Credit CorporationAMLAnti-Money LaunderingAPIApplication Programme InterfacesATMAutomated Teller MachineBMGFBill and Melinda Gates FoundationCBJCentral Bank of JordanCBOCommunity Based OrganizationCBSCore Banking SoftwareCBTCash Based TransferCGAPConsultative Group to Assist the PoorDEFDevelopment and Employment FundEFTElectronic Funds TransferEMPSEmerging Markets PaymentsEUEuropean UnionFSPFinancial Service ProviderG2PGovernment to PersonGDPGross Domestic ProductIWSInternet World StatisticsJo-PACCJordan Payments and Clearing CompanyJPCJordan Post CompanyKYCKnow-Your-CustomerMCFMilitary Credit FundMerchantA business that accepts digital forms of paymentsMEPSMiddle East Payment ServicesMfWMicrofund for WomenDIGITAL FINANCE COUNTRY REPORT - JORDAN 4

5MFIMicrofinance InstitutionMFSMobile Financial ServicesNFISNational Financial Inclusion StrategyNGONon-Governmental OrganisationOTCOver –the-counterP2GPerson to GovernmentP2PPerson-to-Person (transfer)PoSPoint of SalePSPPayment Service ProviderRTGSReal Time Gross SettlementUNHCRUnited Nations Human Rights Commission for RefugeesUSAIDU.S. Agency for International DevelopmentWFPWorld Food ProgramWITWater Innovations Technology DIGITAL FINANCE COUNTRY REPORT- JORDAN

GLOSSARY 11TERMINOLOGYDEFINITIONAgent (third party)Any third party acting on behalf of a bank, a financial institution or a non-bankinstitution (including an E-Money issuer or other payment service providers) todeal directly with customers, under contractual agreement. Third party outletscould include: exchange houses, grocery stores, post offices and fuel stations.Agent (own/Sub agent)Employee of the PSP. Someone who work under the PSP main account.Agent OutletA physical location that perform enrolment as well as cash-in and cash-outtransactions for customers on behalf of one or more providers.Agent BankingAn owner of an outlet who conducts banking transactions on behalf of a bank.Biometric IdentificationSystemA system that facilitates the identification of a person through biometricverification or by evaluating one or more distinguishing biological traits, such asfingerprints, hand geometry, earlobe geometry, retina and iris patterns and voicewaves.CommissionAn incentive payment made, typically to an agent or other intermediary who actson behalf of a DFS provider. A commission provides an incentive for agent.Digital Finance ServicesBroad range of financial services accessed and delivered through digital channels,including payments, credit, savings, remittances and insurance. The digital financialservices (DFS) definition includes, but is not limited to, mobile financial services(MFS).Digital PaymentA broad term including any payment which is executed electronically. Includespayments which are initiated by mobile phone or computer. Card payments insome circumstances are considered to be digital payments.Digital Payment PlatformA term used to describe the software or service used by a provider, a scheme, ora switch to manage end user accounts and to send and receive paymenttransactions.e-Know Your CustomerA process by which identification is established electronically.e-MoneyA record of funds or value available to a consumer stored on a payment devicesuch as chip, prepaid cards, mobile phones, or on computer systems as a nontraditional account with a banking or non-banking entity.Financial LiteracyConsumers and businesses having essential financial skills, such as preparing afamily budget or an understanding of concepts such as the time value of money,effective interest rates, the use of a DFS product or service, or the ability to applyfor such a service.FintechA term that refers to the companies providing software, services, and products fordigital financial services: often used in reference to newer technologies.InteroperabilityInteroperability allows two or more proprietary platforms or even differentproducts to interact seamlessly resulting in the ability to exchange paymentstransactions between and among providers.ITU-T Focus Group Digital Financial Services: DFS GlossaryDIGITAL FINANCE COUNTRY REPORT - JORDAN 6

7TERMINOLOGYDEFINITIONKnow Your Customer-LiteBasic identification that enable the on-boarding people who do not meet up withstandard KYC requirements.m-CommerceRefers to buying or selling in a remote fashion: by phone or tablet (m-Commerce) orby computer (e-Commerce).Mobile Financial ServicesThe use of mobile phones to deliver financial services, including payments, credit,savings, remittances and insurance.Mobile MoneyMoney that is transferred electronically using mobile networks and SIM-enableddevices, primarily mobile phones.Mobile BankingPerform actions on a traditional bank account with a mobile phone. These actionsinvolve obtaining account information, and transacting on accounts.Mobile Network OperatorsCompanies with government-issued license to p

A company that provides services enabling funds to be deposited and withdrawn from an account; payment transactions involving transfers of funds; the issuance and/or acquisition of payment instruments such as checks, E-Money, credit cards and debit cards; and remittances and other services