Transcription

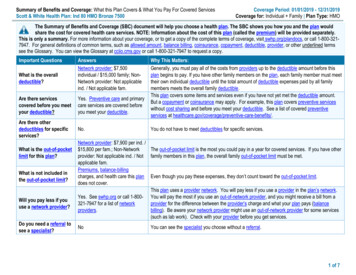

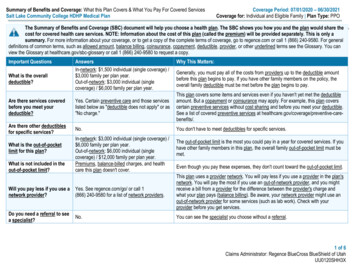

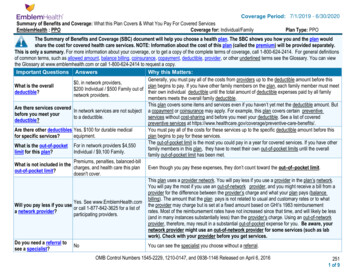

Medicare2021 Summary of BenefitsMolina Medicare Complete CareHMO SNPTexas H7678-001Serving Anderson, Atascosa, Austin, Bandera, Bexar, Cameron, Camp, Chambers, Cherokee, Collin, Comal, Cooke,Dallas, Delta, Duval, El Paso, Fannin, Fort Bend, Franklin, Harris, Hidalgo, Hopkins, Houston, Hudspeth, Jim Hogg,Kendall, Liberty, Marion, Maverick, McMullen, Medina, Montgomery, Morris, Navarro, Panola, Rains, Rockwall, Rusk,San Jacinto, Smith, Starr, Tarrant, Trinity, Upshur, Waller, Webb, Wharton, Willacy, Wilson, Wise, Wood, and ZapataEffective January 1 through December 31, 2021

Introduction to the Summary of BenefitsMolina Medicare Complete CareThank you for considering Molina Healthcare! Everyone deserves quality care. Since 1980, ourmembers have been able to lean on Molina. Because today, as always, we put your needs first.This document does not include every benefit and service that we cover or every limitation orexclusion. To get a complete list of services, please refer to the Evidence of Coverage (EOC).A copy of the Evidence of Coverage is located on our website atwww.MolinaHealthcare.com/Medicare. You may also call Member Services to ask us to mailyou an Evidence of Coverage.To join our plan, you must be entitled to Medicare Part A, be enrolled in Medicare Part B andMedicaid by Texas Health and Human Services Commission (HHSC), and live in our servicearea. Our service area includes the following counties in Texas: Anderson, Atascosa, Austin,Bandera, Bexar, Cameron, Camp, Chambers, Cherokee, Collin, Comal, Cooke, Dallas, Delta,Duval, El Paso, Fannin, Fort Bend, Franklin, Harris, Hidalgo, Hopkins, Houston, Hudspeth, JimHogg, Kendall, Liberty, Marion, Maverick, McMullen, Medina, Montgomery, Morris, Navarro, Panola,Rains, Rockwall, Rusk, San Jacinto, Smith, Starr, Tarrant, Trinity, Upshur, Waller, Webb, Wharton,Willacy, Wilson, Wise, Wood, and initySan lFort BendWhartonWallerAustinWilson apataBanderaBexarMaverickEl PasoSmithWillacyCameronMolinaHealthcare.com 1

Molina has a network of doctors, hospitals, pharmacies, and other providers. Except in emergencysituations, if you use providers that are not in our network, we may not pay for those services.If you want to compare our plan with other Medicare health plans, ask the other plans for theirSummary of Benefits. Or, use the Medicare Plan Finder at medicare.gov.For coverage and costs of Original Medicare, look in your current “Medicare & You” handbook.View it online at medicare.gov or get a copy by calling 1-800-MEDICARE (1-800-633-4227).TTY users should call 1-877-486-2048. If you have any questions, please call our CustomerService team at (866) 440-0012, TTY/TDD 711, 7 days a week, 8 a.m. to 8 p.m.2 MolinaHealthcare.com

Molina Medicare Complete Care Benefits-At-A-GlanceGet More From Your Medicare PlanIn addition to Medicare Part A & Part B benefits, you will also receive these extra benefits tohelp you stay healthy.Dental coverage 2,000 allowance for comprehensive services every year. 0 copay for routine exams.Hearing exam, fitting hearing aids 0 copay for 1 routine hearing exam every year, and 0 copay for up to 2 hearing aidsevery year.Eye exam & eyewear 0 copay for 1 routine vision exam every year, and a 300 eyewear allowance everyyear.Over-the-Counter benefit 290 allowance every 3 months with carryover.Fitness benefit 0 copay. Members have access to contracted Fitness Facilities and Home Fitness Kits.Transportation services 0 copay for 60 one-way trips every year.Meals 0 copay for a maximum of 56 meals.24-hour Nurse Advice LineCall the line, any time. Our nurses are always ready to answer your health questions.Health Education ResourcesWe offer diabetes counseling, disease management, and case management programs.We can also help you control your weight and quit smoking.MolinaHealthcare.com 3

A dedicated support teamWe’re here to answer your questions, review your benefits and help you get the care youdeserve.4 MolinaHealthcare.com

About MedicareMedicare is health insurance for people who are 65 years old or older, or who are under 65 yearsold with certain disabilities.Original Medicare is a Federal Insurance Program. It pays a fee for your care directly to thedoctors and hospitals you visit. Original Medicare does not cover most preventive care andhas unpredictable out-of-pocket expenses.Medicare Part A (Hospital Insurance) covers inpatient care in hospital, skillednursing facilities, hospice care, and some home health care services.Medicare Part B (Medical Insurance) covers certain doctors’ services, outpatientcare, medical supplies and preventive services.Medicare Part C (Medicare Advantage) is an all-in-one alternative to OriginalMedicare. Medicare Advantage plans include Parts A, B and usually Part D.Some Medicare Advantage plans may have lower out-of-pock costs thanOriginal Medicare and may cover extra benefits that Original Medicare doesn’t– like dental, vision or hearing. Medicare pays a fixed fee to the plan for yourcare, and then the plan directly pays the doctors and hospitals. MedicareAdvantage has predictable out-of-pocket expenses and offers preventive careand care coordination.Medicare Part D (Prescription Drug Coverage)MolinaHealthcare.com 5

Medicaid Dual Eligibility Coverage Categories1 Qualified Medicare Beneficiary (QMB): Medicaid pays your Medicare Part A and Part Bpremiums, deductibles,coinsurance, and copayment amounts only. You receive Medicaidcoverage of Medicare cost-share but are nototherwise eligible for full Medicaid benefits.1 QMB : Medicaid pays your Medicare Part A and Part B premiums, deductibles, coinsurance,and copayment amounts. You receive Medicaid coverage of Medicare cost-share and areeligible for full Medicaid benefits.1 SLMB : Medicaid pays your Medicare Part B premium and provides full Medicaid benefits.As a QMB, QMB , or SLMB beneficiary enrolled in this Plan, your cost-share is 0, except forPart D prescription drug copays.Note – Preventive wellness exams and supplemental benefits have a 0 cost-share. Separatecoinsurances apply for supplemental benefits such as comprehensive dental.6 MolinaHealthcare.com

Eligibility Changes:It is important to read and respond to all mail that comes from Social Security or your stateMedicaid office so you can protect your 0 cost-share status as a QMB, QMB , or SLMB beneficiary.Periodically, as required by CMS, we will check the status of your Medicaid eligibility as well asyour dual eligible category. If you lose Medicaid coverage entirely you will be given a graceperiod so that you can reapply for Medicaid.If you no longer qualify as a QMB, QMB , or SLMB beneficiary you may be involuntarilydisenrolled from the Plan after a grace period. Your state Medicaid agency will send younotification of your loss of Medicaid or change in Medicaid category. We may also contact youto remind you to reapply for Medicaid as a QMB, QMB , or SLMB beneficiary. For this reasonit is important to let us know whenever your mailing address and/or phone number changes.If you are currently entitled to receive full or partial Medicaid benefits please see your Medicaidmember handbook or other state Medicaid documents for full details on your Medicaid benefits,limitations, restrictions, and exclusions. In your state, the Medicaid program can be reachedthrough the office of the Texas Health and Human Services Commission (HHSC).MolinaHealthcare.com 7

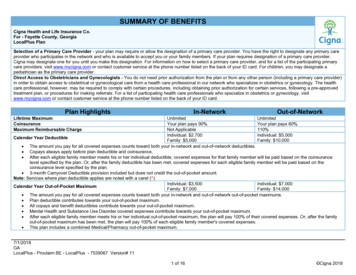

Summary of Premiums & BenefitsMolina Medicare Complete CareMonthly Premium 0 per monthDeductibleThis plan does not have a deductible.MaximumOut-of-PocketResponsibility 7,550 annually for services you receive from in-network providers.(does not include prescription drugs)8 MolinaHealthcare.com

Questions? Call our team of Medicare Trusted Advisors at (866) 403-8293, TTY: 711.Molina Medicare Complete CareInpatient HospitalYou pay 0 for days 1 - 90 of an inpatient hospital stay.Our plan also covers 60 "lifetime reserve days." These are "extra" daysthat we cover. If your hospital stay is longer than 90 days, you can usethese extra days. But once you have used up these extra 60 days, yourinpatient hospital coverage will be limited to 90 days.Prior authorization may be required.Outpatient Hospital 0 copayPrior authorization may be required.AmbulatorySurgical Center 0 copayDoctor VisitsPrimary Care 0 copayPrior authorization may be required.Specialists 0 copayPreventive Care 0 copayAny additional preventive services approved by Medicare during thecontract year will be covered.MolinaHealthcare.com 9

Summary of Premiums & Benefits (Continued)Molina Medicare Complete CareEmergency Care 0 copayUrgently NeededServices 0 copayDiagnosticServices/Labs/ImagingDiagnostic tests and procedures 0 copayPrior authorization may be required.Lab services 0 copayPrior authorization may be required.Diagnostic radiology services (such as MRI, CT scan) 0 copayPrior authorization may be required.Outpatient X-rays 0 copayTherapeutic radiology 0 copayPrior authorization may be required.10 MolinaHealthcare.com

Questions? Call our team of Medicare Trusted Advisors at (866) 403-8293, TTY: 711.Molina Medicare Complete CareHearing ServicesMedicare-covered diagnostic hearing and balance exam 0 copayRoutine hearing exam 0 copay, 1 every yearFitting for hearing aid/evaluation 0 copay, 1 every yearHearing aids 0 copayOur plan pays for up to 2 pre-selected hearing aids provided by aplan-approved provider every year, both ears combined.Prior authorization may be required.MolinaHealthcare.com 11

Summary of Premiums & Benefits (Continued)Molina Medicare Complete CareDental ServicesMedicare-covered dental services 0 copayPreventive Dental 0 office visit copayNo maximum allowance per year for the following preventive careservices:1 Oral exams1 Prophylaxis (cleaning)1 Fluoride treatment1 Dental x-raysComprehensive Dental 0 office visit copayAll comprehensive dental services listed below are covered up to theannual plan maximum benefit coverage amount of 2,000:1 Extractions1 Endodontics1 Restorative services1 Intraoral and extraoral incision and drainage1 Dentures and denture adjustments1 Non-Routine services such as scaling, full mouth debridement,periodontal maintenance, and palliative emergency treatment1 Other services such as deep sedation with oral surgery, andintravenous with oral surgeryPrior authorization may be required.12 MolinaHealthcare.com

Questions? Call our team of Medicare Trusted Advisors at (866) 403-8293, TTY: 711.Molina Medicare Complete CareVision ServicesMedicare-covered1 Vision exam to diagnose/treat diseases of the eye (including yearlyglaucoma screening): 0 copay1 Eyeglasses or contact lenses after cataract surgery: 0 copaySupplemental routine eye exam 0 copay, 1 every yearSupplemental eyewear 0 copay, our plan pays up to 300 every year for eyewear.1 Contact lenses1 Eyeglasses (frames and lenses)1 Eyeglass frames1 Eyeglass lenses1 UpgradesMental HealthServicesInpatient visitYou pay 0 for days 1 - 90 of an inpatient hospital stay.There is a 190 day lifetime limit for inpatient psychiatric hospital care.The inpatient hospital care limit does not apply to inpatient mentalservices provided in a general hospital.Our plan also covers 60 "lifetime reserve days." These are "extra" daysthat we cover. If your hospital stay is longer than 90 days, you can usethese extra days. But once you have used up these extra 60 days, yourinpatient hospital coverage will be limited to 90 days.Prior authorization may be required.Outpatient individual/group therapy visit 0 copaySkilled NursingFacilityYou pay 0 for days 1-100 of a skilled nursing facility stay.No prior hospitalization is required.Prior authorization may be required.MolinaHealthcare.com 13

Summary of Premiums & Benefits (Continued)Molina Medicare Complete CarePhysical TherapyPhysical therapy and speech therapy 0 copayPrior authorization may be required.Cardiac and pulmonary rehabilitation 0 copayPrior authorization may be required.Occupational therapy services 0 copayPrior authorization may be required.Ambulance 0 copayPrior authorization required for non-emergent ambulance only.Transportation 0 copay60 one-way trips every year to and from plan-approved locations.Prior authorization may be required.Medicare Part B DrugsChemotherapy/Radiation Drugs 0 copayPrior authorization may be required.Other Part B Drugs 0 copayPrior authorization may be required.14 MolinaHealthcare.com

Summary of Drug CoverageDepending on your income and institutional status, you pay the following:Standard Retail PharmacyMail Order PharmacyTier 1: PreferredGenericOne-, two-, orthree-month supply 0 copay 0 copayTier 2: GenericOne-, two-, orthree-month supplyFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor all other drugs, either:For all other drugs, either: 0 copay; or 4.00 copay; or 9.20 0 copay; or 4.00 copay; or 9.20copaycopayTier 3: PreferredBrandOne-, two-, orthree-month supplyFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor all other drugs, either:For all other drugs, either: 0 copay; or 4.00 copay; or 9.20 0 copay; or 4.00 copay; or 9.20copaycopayTier 4: Non-PreferredDrugOne-, two-, orthree-month supplyFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor all other drugs, either:For all other drugs, either: 0 copay; or 4.00 copay; or 9.20 0 copay; or 4.00 copay; or 9.20copaycopayTier 5: Specialty TierOne-month supply(Specialty drugs arelimited to aone-month supply.)For generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor generic drugs (including branddrugs treated as generic), either: 0 copay; or 1.30 copay; or 3.70copayFor all other drugs, either:For all other drugs, either: 0 copay; or 4.00 copay; or 9.20 0 copay; or 4.00 copay; or 9.20copaycopayMolinaHealthcare.com 15

Summary of Drug Coverage (Continued)Coverage StagesStage 1:Initial CoverageIf you receive "Extra Help" to pay your prescription drugs, the deductiblestage does not apply to you.After you pay your applicable deductible, you begin this stage whenyou fill your first prescription of the year.During this stage, the plan pays its share of the cost of your drugs andyou pay your share of the cost.If you reside in a long-term care facility, you pay the same as at a retailpharmacy. You may get drugs from an out-of-network pharmacy at thesame cost as an in-network pharmacy.You stay in this stage until your year-to-date “total drug costs” (yourpayments plus any Part D plan payments) total 4,130.Stage 2:Gap CoverageYou pay a 0 copay for drugs in tier 1. For other generic drugs, you payno more than 25% of the cost. For brand name drugs, you pay 25% ofthe price (plus a portion of the dispensing fee). You stay in this stageuntil your year-to-date “out-of-pocket costs” (your payments) reacha total of 6,550. This amount and rules for counting costs toward thisamount have been set by Medicare.Stage 3:CatastrophicCoverageAfter your yearly out-of-pocket drug costs (including drugs purchasedthrough your retail pharmacy and through mail order) reach 6,550 theplan will pay most of the costs of your drugs.16 MolinaHealthcare.com

Summary of Other BenefitsMolina Medicare Complete CareAcupunctureMedicare-covered Acupuncture 0 copayMedicare-covered acupuncture visits are for chronic lower back pain.Up to 12 visits in 90 days are covered under Medicare. An additionaleight sessions will be covered for those patients demonstrating animprovement. No more than 20 acupuncture treatments may beadministered annually.Additional 0 copayTelehealth ServicesChiropractic CareMedicare-Covered Chiropractic Services 0 copayManipulation of the spine to correct a subluxation (when one or moreof the bones of your spine move out of position).Dialysis 0 copayFitness Benefit 0 copaySilver&Fit offers Members access to contracted fitness facilities andHome Fitness Kits for Members who prefer to exercise at home or whiletraveling.Foot Care(Podiatry)Medicare-Covered Foot Exam and Treatment 0 copayFoot exams and treatment if you have diabetes-related nerve damageand/or meet certain conditions.Routine Foot Care 0 copayUp to 12 of routine foot care every year.MolinaHealthcare.com 17

Summary of Other Benefits (Continued)Molina Medicare Complete CareHealth Education 0 copayPrograms to help you learn to manage your health conditions, includinghealth education, learning materials, health advice, and care tips.Home Health Care 0 copayPrior authorization may be required.Meals Benefit 0 copayStandard meal cycle is a 2-week menu with a total of 28 meals deliveredto the Member, based on Member need. Additional 28 meals withapproval.Prior authorization may be required.Medical Equipment Durable Medical Equipment (such as wheelchairs, oxygen)and Supplies 0 copayPrior authorization may be required.Prosthetics/Medical Supplies 0 copayPrior authorization may be required.Diabetic Supplies and Services 0 copayPrior authorization not required for preferred manufacturer.24-Hour NurseAdvice Line 0 copayAvailable 24 hours a day, 7 days a week.Nutritional/Dietary 0 copayBenefit12 individual or group sessions every year; individual telephonic nutritioncounseling upon request.18 MolinaHealthcare.com

Questions? Call our team of Medicare Trusted Advisors at (866) 403-8293, TTY: 711.Molina Medicare Complete CareOpioid TreatmentProgram Services 0 copayOutpatient BloodServices 0 copay3-pint deductible waivedOutpatientSubstance AbuseGroup Therapy Visit 0 copayPrior authorization may be required.Individual Therapy Visit 0 copayOver-the-CounterItems 0 copay 290 allowance every 3 months, expires at the end of the calendar year.Personal Emergency 0 copayResponse SystemWhen authorized, we will provide an in-home device to notify thePlus (PERSPlus)appropriate personnel in the event of an emergency (e.g., a fall).Prior authorization may be required.WorldwideEmergency andUrgent Care 0 copayYou are covered for worldwide emergency and urgent care services upto 10,000.MolinaHealthcare.com 19

Summary of Medicaid-Covered BenefitsWhat Medicaid CoversThe chart below shows what services are covered by Medicare and Medicaid. You will see theword “Covered” under the Medicaid column if Medicaid also covers a service that is coveredunder the Molina Medicare Complete Care Plan. The chart applies only if you are entitled tobenefits under your state’s Medicaid program.BenefitMolina MedicareComplete CareTexas MedicaidGeneral 0 monthly plan premium.Medicaid assistance withpremium payments andcost-share may vary basedon your level of Medicaideligibility.IMPORTANT INFORMATIONPremium and Other ImportantInformationIf you get Extra Help fromMedicare, your monthly planpremium will be lower or youmay pay nothing.In-Network 0 annual deductible. 7,550 out-of-pocket limit forMedicare-covered services.However, in this plan you willhave no cost-sharingresponsibility forMedicare-covered services,based on your level ofMedicaid eligibility.Doctor and Hospital Choice(For more information, seeEmergency Care and UrgentlyNeeded Care.)In-NetworkYou must go to networkdoctors, specialists, andhospitals.Members should followMedicare guidelines related tohospital and docto

San Jacinto, Smith, Starr, Tarrant, Trinity, Upshur, Waller, Webb, Wharton, Willacy, Wilson, Wise, Wood, and Zapata . Effective January 1 through December 31, 2021 . Medicare . Introduction to the Summary of Benefits . Molina Medicare Complete Care . Original Medicare is a Federal Insurance