Transcription

DentalDental insuranceProduct suite overviewFeatures and benefits.

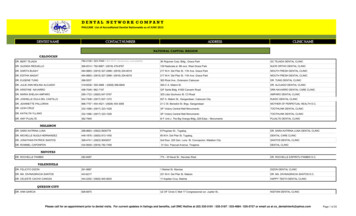

Dental insuranceProduct availability.UnitedHealthcare’s broad product portfolio makes it easy to find a plan that’sright for any group — big or small. Here’s an overview of our product offering.Your UnitedHealthcare representative is always happy to help you find the rightdental plan for your customers. We appreciate your partnership. To compare thefeatures and benefits of each plan, see the chart that Managed Care (Select Plans,DHMO and Direct Compensation)*INOPPO/Open Access and Gateway PPOIndemnityManaged Care Coming Soon*In MD, VA and Washington DC, these plans are only available togroups of 100 or DCTRIDEMDWASHINGTOND.C.

Dental product overview.PPO (Preferred Provider Organization)Product description: Large national network: more than 185,000locations Network discounts: Significant savings —35% on average In- and out-of-network coverage: Standardout-of-network reimbursement optionsinclude maximum allowable charge or70%, 80%, 85%, 90% and 95% of usual andcustomary rate Plan option flexibility increases for groupsof 10 or more Passive and active plan options available inmost states Automated claims processing: No claimspaperwork for in-network services No referrals required Comprehensive and limited benefitplans available, including preventiveand diagnostic and preventive, diagnosticand basic Wellness features included in all plans:Light contrast screening and brush biopsyto detect oral cancer in adults and enhancedprenatal benefit (see details that follow) Optional features: ConsumerMaxMultiplier Rollover Benefit,FlexAppeal Preventive MaxMultiplierand FlexAppeal Enhanced (see detailsthat follow)Cost ranking:leastmostMember flexibility ranking:leastmostIdeal for employers who: Want to offer their employees our mostpopular plan type, featuring network savingsand maximum flexibilityAvailable for: Fully insured groups of two or more Self-funded options available for largegroups only Certain optional features available for groupsof 10 or more only (see details that follow) Available on a voluntary or contributory basis

Gateway PPO (Preferred Provider Organization)Product description: PPO features in a cost-saving design:Cost ranking:leastmost– More than 185,000 locationsMember flexibility ranking:leastmost– Full-mouth and panoramic X-rays shiftfrom Class I to Class IIIdeal for employers who:– Select endodontic/periodontic servicesshift from Class II to Class III Priced 15% below PPO Optional features not available Want to offer comprehensive benefitsand broad access while reducing costsAvailable for: Fully insured groups of two or more Self-funded options available forlarge groups only Available on a voluntary or contributory basisINO (In-network only)Product description: Large national network: more than185,000 locations Network discounts: Significant savings of35% on average for in-network services In-network coverage only Plan option flexibility increases for groupsof 10 or more Automated claims processing:No claims paperwork No referrals required Wellness features included in all plans:Light contrast screening and brush biopsyto detect oral cancer in adults and enhancedprenatal benefit (see details that follow) Optional features: ConsumerMaxMultiplier, FlexAppeal PreventiveMaxMultiplier, and FlexAppeal Enhanced(see details that follow)Cost ranking:leastmostMember flexibility ranking:leastmostIdeal for employers who: Want to offer a cost-saving managed-careplan with broad open-access network andflexible plan designs Available in more than 20 states (see map)Available for: Fully insured groups of two or more Self-funded options available for largegroups only Certain optional features available for groupsof 10 or more only (see details that follow) Available on a voluntary or contributory basis

Managed Care (Dental Health Maintenance Organization and Direct Compensation)Product description: Regional network: Network variesby location Substantial savings: Priced approximately50% less than PPO plan In-network coverage only No claims paperwork Primary care model: Primary care dentistcoordinates all care. Each member chooses aprimary care dentist Referrals may be required for specialty care Simple plan design: Predictable,low‑cost copays. No deductibles; noannual maximumsCost ranking:leastmostMember flexibility ranking:leastmostIdeal for employers who: Are located in select geographic areas wherethe product is available: California, Florida,Mid-Atlantic, Philadelphia, Nevada andNew York Are looking for maximum savings througha more focused network and coordinatedcare practice Are looking for a plan that’s simple formembers to use, with defined copays for allservices. No deductibles. No annual maximumsAvailable for: Fully insured groups of two or more Available on a voluntary or contributory basisIndemnity (No network)Product description: No network restrictions: Choose any dentist Timely reimbursement: Member pays forcare at time of service and submits claimsfor reimbursement Payment based on fee schedule: Providerspaid based on fee schedule of 85% of usualand customary rate; members pay differenceif fee is higher than set amount Included at no additional charge for fullyinsured customers: Adult oral cancerscreening and enhanced prenatal benefit(see details that follow) Optional features: Consumer MaxMultiplier,FlexAppeal Preventive MaxMultiplier,FlexAppeal Enhanced (see details that follow)Cost ranking:leastmostMember flexibility ranking:leastmostIdeal for employers who: Have employees located in areas wherenetwork is not adequate to offer equal benefitsto all employeesAvailable for: Fully insured and self-funded groups oftwo or more Available on a voluntary or contributory basis

Additional features and options. Dual offerings are available to groups with at least 10 or more enrolled members Plan differential should have at least 20% variance Plans must differ significantly in benefit richness Each plan should target a minimum participation level of 20% ormore subscribersOrthodontia Plans with orthodontia coverage require 10 or more employees with aminimum of eight enrolled membersPPO, Indemnity and INO plans automatically include thesewellness features: Oral cancer benefit: Provides routine screenings for adults. Special lightenables dentists to detect lesions that could indicate oral cancer. Benefit plansincludes brush biopsy, if needed Prenatal dental care program: Additional preventive and periodontal servicesare provided to women during their entire pregnancy and for the first threemonths following deliveryPPO, Indemnity and INO plans may be enhanced with the followingoptional features at an additional charge: Consumer MaxMultiplier Rollover Benefit: Members who have at leastone dental visit during a plan year and do not exceed a set threshold arerewarded with dollars that roll over to the next plan year. These dollarsare to be used for future dental expenses. PPO plan members who receiveall of their care from network providers will receive an additional award.Awards are carried over to the next plan year and never expire. Should claimsexceed the benefit‑year maximum, Consumer MaxMultiplier rollover fundsare automatically applied to the charge. Required participation for theConsumer MaxMultiplier Rollover Benefit is two or more members whenthere are waiting periods and endodontics; periodontics and oral surgery areClass III (Major). These stipulations are not required for groups with 10 ormore members

Dental FlexAppeal Preventive MaxMultiplier: This feature is designed to promoteoral health. With this benefit, preventive and diagnostic services are notapplied to the deductible or annual maximum. The result is that restorativeservices are covered, while ensuring that the annual preventive care benefitswill always be available. Required participation for FlexAppeal is 10 ormore members FlexAppeal Enhanced: This benefit provides coverage for white fillings onback teeth, dental implants and expanded coverage for adults that includes anycombination of four preventive visits and periodontal maintenance treatmentsduring a 12-month period. Required participation for FlexAppealEnhanced is 10 or more membersAvailable plan options subject to state regulation.

Get a quote today.Contact your UnitedHealthcarerepresentative for more information.UnitedHealthcare Dental coverage underwritten by UnitedHealthcare Insurance Company, located in Hartford, Connecticut, or its affiliates.Administrative services provided by Dental Benefit Providers, Inc., Dental Benefit Administrative Services (CA only), United HealthCare Services,Inc. or their affiliates. Plans sold in Texas use policy form number DPOLO6. TX and associated COC form number DCO.CER.06. Benefits for theUnitedHealthcare Dental DHMO plans are provided by or through the following UnitedHealth Group companies: Dental Benefit Providers, Inc., itssubsidiaries or affiliates, including Nevada Pacific Dental, National Pacific Dental, Inc. and Dental Benefit Providers of Illinois, Inc. The New York SelectManaged Care Plan is underwritten by UnitedHealthcare Insurance Company of New York located in Islandia, New York. Administrative services providedby Dental Benefit Providers, Inc. The Select DHMO plan is underwritten by Dominion Dental Services, Inc. Dominion is licensed as a Limited Health CareServices HMO in Virginia, Pennsylvania and a Dental Plan Organization in Maryland and Delaware.UnitedHealthcare Insurance Company; National Pacific Dental in TX; Nevada Pacific Dental in NV, Dental Benefit Providers of Illinois in IL, IN (MD & FL);Dental Benefit Providers of California, Inc. in CA; UnitedHealthcare Insurance Company of New York; DHMO – Dominion Dental Services, Inc.100-1092712/12 2012 United HealthCare Services, Inc.

UnitedHealthcare Dental DHMO plans are provided by or through the following UnitedHealth Group companies: Dental Benefit Providers, Inc., its subsidiaries or affiliates, including Nevada Pacific Dental, National Pacific Dental, Inc. and Dental