Transcription

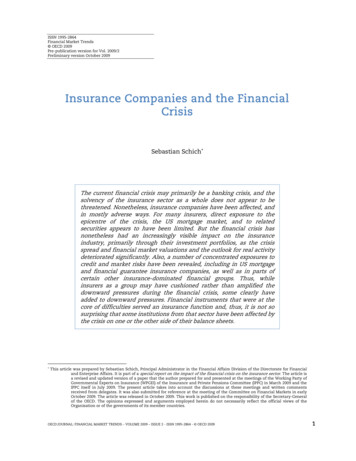

ISSN 1995-2864Financial Market Trends OECD 2009Pre-publication version for Vol. 2009/2Preliminary version October 20090BInsurance Companies and the FinancialCrisisSebastian Schich The current financial crisis may primarily be a banking crisis, and thesolvency of the insurance sector as a whole does not appear to bethreatened. Nonetheless, insurance companies have been affected, andin mostly adverse ways. For many insurers, direct exposure to theepicentre of the crisis, the US mortgage market, and to relatedsecurities appears to have been limited. But the financial crisis hasnonetheless had an increasingly visible impact on the insuranceindustry, primarily through their investment portfolios, as the crisisspread and financial market valuations and the outlook for real activitydeteriorated significantly. Also, a number of concentrated exposures tocredit and market risks have been revealed, including in US mortgageand financial guarantee insurance companies, as well as in parts ofcertain other insurance-dominated financial groups. Thus, whileinsurers as a group may have cushioned rather than amplified thedownward pressures during the financial crisis, some clearly haveadded to downward pressures. Financial instruments that were at thecore of difficulties served an insurance function and, thus, it is not sosurprising that some institutions from that sector have been affected bythe crisis on one or the other side of their balance sheets. This article was prepared by Sebastian Schich, Principal Administrator in the Financial Affairs Division of the Directorate for Financialand Enterprise Affairs. It is part of a special report on the impact of the financial crisis on the insurance sector. The article isa revised and updated version of a paper that the author prepared for and presented at the meetings of the Working Party ofGovernmental Experts on Insurance (WPGEI) of the Insurance and Private Pensions Committee (IPPC) in March 2009 and theIPPC itself in July 2009. The present article takes into account the discussions at these meetings and written commentsreceived from delegates. It was also submitted for reference at the meeting of the Committee on Financial Markets in earlyOctober 2009. The article was released in October 2009. This work is published on the responsibility of the Secretary-Generalof the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of theOrganisation or of the governments of its member countries.OECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 20091

INSURANCE COMPANIES AND THE FINANCIAL CRISISEXECUTIVE SUMMARYFor many insurers, the direct exposure to the epicentre of the crisis, the US mortgage market, and torelated securities appears to have been limited. But the financial crisis has nonetheless had an increasinglyvisible impact on the insurance industry, primarily through their investment portfolios, as the crisis spreadand financial market valuations and the outlook for real activity deteriorated significantly. The financialcrisis may primarily be a banking crisis, and as insurance industry representatives have regularlyemphasised, the solvency of the insurance sector as a whole does not appear to be threatened. Nonetheless,companies from that sector have been affected, and in mostly adverse ways. A number of concentratedexposures to credit and market risks have been revealed, including in US mortgage and financial guaranteeinsurance companies, as well as in certain other insurance-dominated financial groups. Beyond theseimmediate issues related to the financial health of insurance sectors and companies, the crisis has clearlydemonstrated that protection against systemic risks should also include monitoring and mitigating risks inthe insurance sectors and companies.Even so, the evidence available so far suggests that the role of the insurance function in this financialcrisis has had a stabilising rather than a destabilising influence on the system as a whole (notwithstandingthat it may be too early to write a proper post mortem). Insurance companies are large investors and they(especially life insurers) typically have longer-term investment horizons than several other financialinstitutions such as banks. They thus have the capacity to hold a relatively large part of their investments tomaturity, which helps the system withstand short-term shocks. In contrast, some other types of marketparticipants have had to sell into falling markets as a result of leverage, liquidity, regulatory and otherconsiderations.That said, the picture is not as rosy if one zooms from the aggregate picture into specific segments ofthe insurance sector. In the case of a number of insurance companies, especially those involved in activitiestraditionally associated with investment banks, valuation and rating pressures have been very significant.These pressures, in turn, have had repercussions that have tended to amplify downward pressures infinancial markets during the crisis. Perhaps the most egregious example is afforded by the financialguarantee insurance sector, where subsequent downgrading of the various entities operating in this sectorled to waves of downward pressures on market valuations of the securities “wrapped” by these entities andpresent in the portfolios of many other financial institutions.Such activities had also contributed to the build-up of imbalances before the crisis. Financialguarantors elevated the credit ratings of complex structured financial instruments, making these productsattractive to more conservative investors (including some other insurance companies). Also, theparticipation of insurance companies as counterparties to investment and commercial banks in creditdefault swap transactions enabled the latter to hedge their credit risks, thus permitting them to continue toexpand their securitisation activities, including in the form of collateralised debt obligations involving subprime mortgage-related debt.What is often less noted is the fact that the financial instruments used in the massive credit risktransfer prior to the financial crisis have had at their core, in many cases, insurance-like innovativefinancial instruments, that is credit default swaps. Granted, insurers themselves may not have been frequentcounterparties to these transactions, as the capacity of these companies to engage in such transactions is2OECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 2009

INSURANCE COMPANIES AND THE FINANCIAL CRISISseverely restricted by regulation. But the crisis has shown nonetheless that, despite such constraints, sometypes of insurance companies actually accumulated significant exposure to credit default derivatives on oneor the other side of their balance sheets.In part, the various caveats attached to the overall positive role that the insurance function may haveplayed in this crisis are related to the expansion into investment-bank-like activities of financial companiesthat conduct insurance business. In the past, different types of financial activities have often beencombined under one company’s roof and such combinations have often been defended on the grounds ofthe scope economies associated with the more diversified revenue stream of the group as a whole. But theweight of the empirical evidence suggests that, in crisis situations, asset returns turn out to be more closelycorrelated than during normal times and more so than has been expected and built into risk managementmodels. As a consequence, the adequacy of the buffer for the group as a whole, e.g. in terms of capitalcushion, tends to disappoint as well.Moreover, such structures can become very complex. An example is American International Group(AIG), which was viewed by some observers as the world’s largest insurance company.1 It was actuallyquite a complex large financial group, consisting of a global financial service holding company with about70 US based insurance companies and another more than 170 other financial service companies. Given thecompany’s role in a wide range of financial markets, the volume of business written and in particular thecomplexity of interconnections created (especially through credit default swaps and securities lending),AIG appears to have become an important counterparty to systemically important banks, thus making thecompany itself systemically important. The opacity of its structure appears to have hindered the ability ofsupervisors and stakeholders to properly understand the risks facing the group. The example of AIG hasadded to the accumulating empirical evidence that specific incentive problems could arise in complexfinancial groups when different parts of the group pursuing different activities (and generating differentrisk profiles) either use the same capital base or when some parts of the groups either explicitly orimplicitly benefit from capital raised via less risky members of the group.DOECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 20093

INSURANCE COMPANIES AND THE FINANCIAL CRISISINSURANCE COMPANIES AND THE FINANCIAL CRISIS2BI4BIntroductionThe purpose of the present paper is to discuss vulnerabilities inselected segments of the insurance sector as well as to identify specificissues related to the role of the insurance sector in the current financialcrisis. The paper is part of a special report on the financial crisis andprivate pensions and insurance policies to be included as part of the“OECD Strategic Response to the Crisis” and it provides a frameworkfor the analysis in that report.DAt the outset, it should be noted that while financial guaranteeinsurance companies in the United States and the company AIG haveattracted considerable attention in the press and are described insomewhat more detail in this paper, problems have not been limited toUS-based entities. Other notable examples include insurance companiesin Europe.The financial crisis may be a banking crisis, as insurance industryrepresentatives have regularly emphasised, and the solvency of theinsurance sector as a whole does not appear to be threatened.Nonetheless, insurance companies have also been affected, and inmostly adverse ways. The exposure of most insurance companies to thesignificant deterioration in global financial markets has been primarilythrough their investment portfolios. This is not surprising as the assetsare largely held in bonds and stocks, which simultaneously experiencedepisodes of significant valuation pressures during this crisis.Further to these widespread (although mostly limited) pressures onasset portfolios of many life and non-life insurance companies, a numberof concentrated exposures to credit and market risks have been revealed,however, including in mortgage and financial guarantee insurancecompanies, as well as in at least one insurance-dominated financialgroup and one large reinsurance company that took on significantamounts of credit risk.The remainder of this note first discusses selected aspects of onetype of financial instrument at the core of the risk transfers prior to thecrisis (i.e. a credit default swap) in section II, and developments inselected insurance sectors in section III, before drawing somepreliminary lessons regarding the role of insurance sectors in the currentfinancial crisis (section IV). Section V concludes.4OECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 2009

INSURANCE COMPANIES AND THE FINANCIAL CRISISII5BAn insurance-like product at the core of the risk transfers preceding the crisisDifferent views exist regardingthe role of the insurancesectorDifferent views exist regarding the role of the insurance sector inthe context of this crisis, reflecting among other things differences in theinterpretation given to some financial contracts that were at the heart ofthe recent financial crisis. One view, which is shared among at leastseveral insurance industry representatives, is illustrated by the followingstatement:There are no indications whatsoever that insurers havecontributed to the systemic issues that many banks are facingtoday. Insurers have not originated and repackaged subprimemortgages. They did not act as major investors in mortgagebased financial instruments. To the contrary, the insuranceindustry displayed resilience in the face of adverse marketconditions and was in a position to absorb market volatility asan institutional investor with a long-term perspective. In thissense, the insurance sector acted as a stabilising factor at a timeof considerable stress in the global financial system.2DPerhaps at the other end of the spectrum of views is that expressedby the Chief Executive of the US-based insurance company Allstate, asquoted with the following argumentation:It was, after all, an insurance product that contributed tothe risk that almost brought down the global economy. It shouldbe no surprise that a big insurer like AIG would be a majorissuer of credit default swap. What is surprising is the claim thatinsurance did not contribute to the recent market failures, andtherefore insurers don’t need to consider how to prevent themfrom happening again. 3DBanks’ business models havechanged fundamentally,increasingly shifting towardsthe originate-to-distributemodeDWhile the discussion about the causal factors for the crisis isongoing, there is broad agreement that a number of different factors havebeen at play, not just a single one. Having said that, most commentatorsagree that the fundamental change in the bank business model thatoccurred during the last decade or two is one of the significant causalfactors: banks, rather than holding loans until maturity on their ownbalance sheets, instead focused on originating and distributing risks suchas credit risks. Such a change in business model was accompanied by thespreading of innovative financial instruments.There has been a long-standing debate on the advantages anddisadvantages of this new business model. It certainly permitted a widerspread of risk, away from bank balance sheets and towards portfolios ofother entities, perhaps better able, but more likely just more willing, tobear the additional risk. In any case, with hindsight it is clear that toomuch additional risk has been created in that process, with indebtednessrising significantly in many sectors of the economy, including inparticular in household sectors to levels that proved to be unsustainable.OECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 20095

INSURANCE COMPANIES AND THE FINANCIAL CRISISThe capacity of banks tochange their business modelsdepended on the availability ofcredit risk transferinstruments and on investorswilling to add them to theirportfoliosWhat is sometimes overlooked in this context is that the capacity ofbanks to change their business models as described depended on theavailability of credit risk transfer instruments and on investors willing toadd them to their portfolios. Some insurance companies, as largeinvestors in international financial markets, have added credit risk totheir portfolios, like many other investors, while other insurancecompanies have provided enhancements that made these instrumentsmore attractive for many investors.Indeed, the massive transfer ofcredit risk has at the corerelied on an insurance-likefinancial instrumentAnother aspect that is often overlooked is that the massive transferof credit risk involving entities from various financial sectors has at thecore relied on an insurance-like financial instrument: credit defaultswaps. A credit default swap (CDS) is a contract under which theprotection seller agrees to make a payment to the protection buyer in theevent that the referenced entity, typically a company issuing a bond,experiences one of several so-called “credit events”, which arebankruptcy, reorganisation, or default. The protection seller receives afee in exchange for this promise. Originally, CDS were used in thecontext of bond issues, essentially transferring part or all of the risk ofthe owner of the bond to the seller of credit protection. Literally, theprotection buyer “swaps” the risk of default with the protection sellerand, in the event of any number of the various credit events actuallyoccurring, the owner of the bond suffers the associated loss on thatposition, while the swap contract provides full or partial recovery of thatloss.Some transactions involvingCDS are similar to standardinsurance contracts This type of transaction may be referred to as a covered creditdefault swap, to the extent that the buyer of credit protection through aCDS also owns a bond issued by the reference entity. It helps the ownerof the bond to manage the risk associated with the bond investment. It issimilar in this respect to a standard insurance contract. although others aredifferentBut CDS transactions are not necessarily linked to specific bondpositions on the part of the protection buyer. Actually, CDS can be soldor bought between counterparties independently from any specific bondor other asset positions on the part of either of the parties involved, andindeed, this aspect explains a large part of the rapid growth of the CDSmarket since its inception.In this context, the New York State Insurance Department, in May2008, began using the term “naked CDS” to describe swaps in which theprotection buyer does not own the particular reference obligation. Themotivation behind the use of the term “naked” as opposed to “covered”appears to have been an attempt to distinguish contracts depending onthe motivation for writing them, that is in terms of the mix of eitherinsurance versus speculation motives.4 Clearly, in practice, distilling themotivations of partners to financial transactions is notoriously difficult.On 22 September 2008, the New York State Insurance Departmentannounced that it planned to begin in 2009 regulating (covered) creditdefault swaps as a type of insurance contract. 5 In the meantime, the issueof regulation of CDS more generally has been intensively discussed inDD6DOECD JOURNAL: FINANCIAL MARKET TRENDS – VOLUME 2009 – ISSUE 2 - ISSN 1995-2864 - OECD 2009

INSURANCE COMPANIES AND THE FINANCIAL CRISISvarious international forums and the proposals currently underdiscussion include establishing an exchange, a central counterparty and aclearing house for CDS.On a conceptual level, aninsurance function has beeninvolved in the risk transferprior to the crisis Whatever the specific outcome of these discussions, the main pointthat is relevant for the issue under consideration in the present paper isthat CDS, at least some types of CDS, are similar to insurance contracts.Thus, it would seem that, the insurance function has been involved inthe run-up to and evolution of the financial crisis, at least on aconceptual level. but institutionalinvolvement is another issueBut these considerations regarding the insurance function broadlydefined may or may not have implications for the role of insurance in aninstitutional sense, that is, for the question of the role of insurancecompanies per se in the current crisis. Actually, in practice, the capacityof insurers to engage in derivatives activities differs from onejurisdiction to another. For example, in some European countries,insurers are limited by existing regulation in their capacity to sell but notnecessarily buy credit protection through credit default swaps.III6BDevelopments in selected insurance sectorsOverview of selected vulnerabilities on asset and liabilities sides9BInsurance and reinsurancecompanies are major investorsin capital marketsThe conceptual considerations developed in the previous sectionnotwithstanding, exposure of most insurance companies to the financialcrisis has been primarily through their investment portfolios. Insuranceand reinsurance companies are major inve

An example is American International Group (AIG), which was viewed by some observers as the world’s largest insurance company.1 D It was actually quite a complex large financial group, consisting of a global financial service holding company with about 70 US based insurance companies and