Transcription

PROPERTY AND CASUALTY COMPANIES—ASSOCIATION EDITIONCOMBINED ANNUAL STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2004OF THE CONDITION AND AFFAIRS OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.and its affiliated property and casualty insurersNAIC Group Code3548Mail AddressNAIC Combined Company Code385 Washington Street,(Street and Number or P.O. Box)Combined Statement Contact00070St. Paul, MN 55102(City or Town, State and Zip Code)Larry J. Mills651-340-8644(Name)(Area Code) (Telephone Number) (Extension)NAME OF COMPANIES INCLUDED IN THIS STATEMENTName of CompanyUSF&G Specialty Insurance CompanyDiscover Specialty Insurance CompanyUSF&G Insurance Company of MississippiFirst Floridian Auto and Home Insurance CompanyRed Oak Insurance CompanyGeoVera Insurance CompanyAmerican Equity Specialty Insurance CompanyPacific Select Property Insurance CompanyThe Premier Insurance Company of MassachusettsTravelers Casualty and Surety CompanyTravelers Casualty Insurance Company of AmericaThe Automobile Insurance Company of Hartford, CTThe Standard Fire Insurance CompanySt. Paul Protective Insurance CompanyCommercial Guaranty Casualty Insurance CompanyAtlantic Insurance CompanyGulf Insurance CompanySelect Insurance CompanyMendakota Insurance CompanySeaboard Surety CompanyNorthland Insurance CompanyNorthland Casualty CompanySt. Paul Fire and Marine Insurance CompanySt. Paul Guardian Insurance CompanySt. Paul Mercury Insurance CompanyThe Charter Oak Fire Insurance CompanyThe Phoenix Insurance CompanyThe Travelers Indemnity CompanyThe Travelers Indemnity Company of AmericaTravelers Property Casualty Company of AmericaThe Travelers Indemnity Company of ConnecticutFidelity and Guaranty Insurance Underwriters, Inc.United States Fidelity and Guaranty CompanyNorthfield Insurance CompanyThe Travelers Home and Marine Insurance CompanyTravCo Insurance CompanyTravelers Excess and Surplus Lines CompanyFirst Trenton Indemnity CompanySt. Paul Surplus Lines Insurance CompanyTravelers Casualty and Surety Company of AmericaMendota Insurance CompanyFidelity and Guaranty Insurance CompanyTravelers Commercial Insurance CompanyTravelers Personal Security Insurance CompanyTravelers Property Casualty Insurance CompanyTravelers Casualty Company of ConnecticutDiscover Property & Casualty Insurance CompanyCommercial Guaranty Lloyds Insurance CompanyGulf Group LloydsTravelers Personal Insurance CompanyCommercial Guaranty Insurance CompanyTravelers Commercial Casualty CompanySt. Paul Fire and Casualty Insurance CompanyThe Travelers Lloyds Insurance CompanyFarmington Casualty CompanyTravelers Lloyds of Texas Insurance CompanySt. Paul Medical Liability Insurance CompanyAthena Assurance CompanyGulf Underwriters Insurance CompanyNAIC Company tate of DomicileMarylandIllinoisMississippiFloridaNew ndianaTexasConnecticutTexasMinnesotaNew necticutConnecticutNew ticutTexasMinnesotaMinnesotaConnecticut

PROPERTY AND CASUALTY COMPANIES—ASSOCIATION EDITIONCOMBINED ANNUAL STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2004OF THE CONDITION AND AFFAIRS OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.NAME OF COMPANIES INCLUDED IN THIS STATEMENTName of CompanyAmerican Equity Insurance CompanyDiscover Reinsurance CompanyNAIC Company Code4311744440State of DomicileArizonaIndianaNote: This annual statement contains combined data for the property and casualty insurance companies listed above, compiled in accordance with theNAIC instructions for the completion of annual statements.a. Is this an original filing?b. If no,1. State the amendment number2. Date filed3. Number of pages attached

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.ASSETS1. Bonds (Schedule D)2. Stocks (Schedule D):2.1 Preferred stocks2.2 Common stocks3. Mortgage loans on real estate (Schedule B):3.1 First liens3.2 Other than first liens4. Real estate (Schedule A):4.1 Properties occupied by the company (less encumbrances)4.2 Properties held for the production of income(less encumbrances)4.3 Properties held for sale (less encumbrances)5. Cash ( , Schedule E, Part 1), cash equivalents( , Schedule E, Part 2) and short-terminvestments ( , Schedule DA)6. Contract loans, (including premium notes)7. Other invested assets (Schedule BA)8. Receivable for securities9. Aggregate write-ins for invested assets10. Subtotals, cash and invested assets (Lines 1 to 9)11. Investment income due and accrued12. Premiums and considerations:12.1 Uncollected premiums and agents’ balances in the course ofcollection12.2 Deferred premiums, agents’ balances and installments booked butdeferred and not yet due (including earnedbut unbilled premium)12.3 Accrued retrospective premium13. Reinsurance:13.1 Amounts recoverable from reinsurers13.2 Funds held by or deposited with reinsured companies13.3 Other amounts receivable under reinsurance contracts14. Amounts receivable relating to uninsured plans15.1 Current federal and foreign income tax recoverable and interest thereon15.2 Net deferred tax asset16. Guaranty funds receivable or on deposit17. Electronic data processing equipment and software18. Furniture and equipment, including health care delivery assets( )19. Net adjustment in assets and liabilities due to foreign exchange rates20. Receivables from parent, subsidiaries and affiliates21. Health care ( ) and other amounts receivable22. Other assets nonadmitted23. Aggregate write-ins for other than invested assets24. Total assets excluding Separate Accounts, Segregated Accounts andProtected Cell Accounts (Lines 10 to 23)25. From Separate Accounts, Segregated Accounts and ProtectedCell Accounts26. Total (Lines 24 and 25)DETAILS OF WRITE-INS0998. Summary of remaining write-ins for Line 9 from overflow page0999. Totals (Lines 0901 thru 0903 plus 0998)(Line 9 above)2398. Summary of remaining write-ins for Line 23 from overflow page2399. Totals (Lines 2301 thru 2303 plus 2398)(Line 23 above)21Current Year23Prior Year4AssetsNonadmitted AssetsNet Admitted Assets(Cols. 1 - 2)Net AdmittedAssets

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.LIABILITIES, SURPLUS AND OTHER FUNDS1Current Year1. Losses (Part 2A, Line 34, Column 8)2. Reinsurance payable on paid loss and loss adjustment expenses (Schedule F, Part 1, Column 6)3. Loss adjustment expenses (Part 2A, Line 34, Column 9)4. Commissions payable, contingent commissions and other similar charges5. Other expenses (excluding taxes, licenses and fees)6. Taxes, licenses and fees (excluding federal and foreign income taxes)7.1Current federal and foreign income taxes (including on realized capital gains (losses))7.2 Net deferred tax liability8. Borrowed money and interest thereon 9. Unearned premiums (Part 1A, Line 37, Column 5)(after deducting unearned premiums for ceded reinsurance of reserves of )and including warranty10. Advance premiums11. Dividends declared and unpaid:11.1 Stockholders11.2 Policyholders12. Ceded reinsurance premiums payable (net of ceding commissions)13. Funds held by company under reinsurance treaties (Schedule F, Part 3, Column 19)14. Amounts withheld or retained by company for account of others15. Remittances and items not allocated16. Provision for reinsurance (Schedule F, Part 7)17. Net adjustments in assets and liabilities due to foreign exchange rates18. Drafts outstanding19. Payable to parent, subsidiaries and affiliates20. Payable for securities21. Liability for amounts held under uninsured accident and health plans22. Capital Notes and interest thereon 23. Aggregate write-ins for liabilities24. Total liabilities excluding protected cell liabilities (Lines 1 through 23)25. Protected cell liabilities26. Total liabilities (Lines 24 and 25)27. Aggregate write-ins for special surplus funds28. Common capital stock29. Preferred capital stock30. Aggregate write-ins for other than special surplus funds31. Surplus notes32. Gross paid in and contributed surplus33. Unassigned funds (surplus)34. Less treasury stock, at cost:34.1shares common (value included in Line 28 )34.2shares preferred (value included in Line 29 )35. Surplus as regards policyholders (Lines 27 to 33, less 34) (Page 4, Line 38)36. TOTALS (Page 2, Line 26, Col. 3)DETAILS OF WRITE-INS2398. Summary of remaining write-ins for Line 23 from overflow page2399. Totals (Lines 2301 thru 2303 plus 2398) (Line 23 above)2798. Summary of remaining write-ins for Line 27 from overflow page2799. Totals (Lines 2701 thru 2703 plus 2798) (Line 27 above)3098. Summary of remaining write-ins for Line 30 from overflow page3099. Totals (Lines 3001 thru 3003 plus 3098) (Line 30 above)32Prior Year

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.UNDERWRITING AND INVESTMENT EXHIBIT STATEMENT OF INCOME1Current YearUNDERWRITING INCOME1. Premiums earned (Part 1, Line 34, Column 4)DEDUCTIONS2.3.4.5.6.Losses incurred (Part 2, Line 34, Column 7)Loss expenses incurred (Part 3, Line 25, Column 1)Other underwriting expenses incurred (Part 3, Line 25, Column 2)Aggregate write-ins for underwriting deductionsTotal underwriting deductions (Lines 2 through 5)7. Net income of protected cells8. Net underwriting gain or (loss) (Line 1 minus Line 6 plus Line 7)INVESTMENT INCOME9. Net investment income earned (Exhibit of Net Investment Income, Line 17)10. Net realized capital gains (losses) (Exhibit of Capital Gains (Losses))11. Net investment gain or (loss) (Lines 9 10)OTHER INCOME12. Net gain or (loss) from agents'or premium balances charged off (amount recovered charged off )13. Finance and service charges not included in premiums14. Aggregate write-ins for miscellaneous income15.Total other income (Lines 12 through 14)16.17.18.19.20.Net income before dividends to policyholders and before federal and foreign income taxes (Lines 8 11 15)Dividends to policyholdersNet income, after dividends to policyholders but before federal and foreign income taxes (Line 16 minus Line 17)Federal and foreign income taxes incurredNet income (Line 18 minus Line 19) (to Line 22)CAPITAL AND SURPLUS ACCOUNT21. Surplus as regards policyholders, December 31 prior year (Page 4, Line 38, Column 2)GAINS AND (LOSSES) IN SURPLUS22.23.24.25.26.27.28.29.30.31.32.Net income (from Line 20)Change in net unrealized capital gains or (losses)Change in net unrealized foreign exchange capital gain (loss)Change in net deferred income taxChange in nonadmitted assets (Exhibit of Nonadmitted Assets, Line 26, Col. 3)Change in provision for reinsurance (Page 3, Line 16, Column 2 minus Column 1)Change in surplus notesSurplus (contributed to) withdrawn from protected cellsCumulative effect of changes in accounting principlesCapital changes:31.1. Paid in31.2. Transferred from surplus (Stock Dividend)31.3. Transferred to surplusSurplus adjustments:32.1. Paid in32.2. Transferred to capital (Stock Dividend)32.3. Transferred from capitalNet remittances from or (to) Home OfficeDividends to stockholdersChange in treasury stock (Page 3, Lines 34.1 and 34.2, Column 2 minus Column 1)Aggregate write-ins for gains and losses in surplus33.34.35.36.37. Change in surplus as regards policyholders for the year (Lines 22 through 36)38. Surplus as regards policyholders, December 31 current year (Line 21 plus Line 37) (Page 3, Line 35)DETAILS OF WRITE-INS0598. Summary of remaining write-ins for Line 5 from overflow page0599. Totals (Lines 0501 thru 0503 plus 0598) (Line 5 above)1498. Summary of remaining write-ins for Line 14 from overflow page1499. Totals (Lines 1401 thru 1403 plus 1498) (Line 14 above)3698. Summary of remaining write-ins for Line 36 from overflow page3699. Totals (Lines 3601 thru 3603 plus 3698) (Line 36 above)4amount2Prior Year

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.CASH 9.Cash from OperationsPremiums collected net of reinsuranceNet investment incomeMiscellaneous incomeTotal (Lines 1 to 3)Benefits and loss related paymentsNet transfers to Separate, Segregated Accounts and Protected Cell AccountsCommissions, expenses paid and aggregate write-ins for deductionsDividends paid to policyholdersFederal and foreign income taxes paid (recovered) net of tax on capital gains (losses)Total (Lines 5 through 9)Net cash from operations (Line 4 minus Line 10)Cash from InvestmentsProceeds from investments sold, matured or repaid:12.1 Bonds12.2 Stocks12.3 Mortgage loans12.4 Real estate12.5 Other invested assets12.6 Net gains or (losses) on cash, cash equivalents and short-term investments12.7 Miscellaneous proceeds12.8 Total investment proceeds (Lines 12.1 to 12.7)Cost of investments acquired (long-term only):13.1 Bonds13.2 Stocks13.3 Mortgage loans13.4 Real estate13.5 Other invested assets13.6 Miscellaneous applications13.7 Total investments acquired (Lines 13.1 to 13.6)Net increase (or decrease) in policy loans and premium notesNet cash from investments (Line 12.8 minus Line 13.7 and Line 14)Cash from Financing and Miscellaneous SourcesCash provided (applied):16.1 Surplus notes, capital notes16.2 Capital and paid in surplus, less treasury stock16.3 Borrowed funds16.4 Net deposits on deposit-type contracts and other insurance liabilities16.5 Dividends to stockholders16.6 Other cash provided (applied)Net cash from financing and miscellaneous sources (Line 16.1 to Line 16.4 minus Line 16.5 plus Line 16.6)RECONCILIATION OF CASH AND SHORT-TERM INVESTMENTSNet change in cash and short-term investments (Line 11 plus Line 15 plus Line 17)Cash and short-term investments:19.1 Beginning of year19.2 End of period (Line 18 plus Line 19.1)Note:Supplemental disclosures of cash flow information for non-cash transactions:!"20.0001.% !! & !20.0002. # % !!"20.0003. # 51Current YearTo Date2Prior Year EndedDecember 31

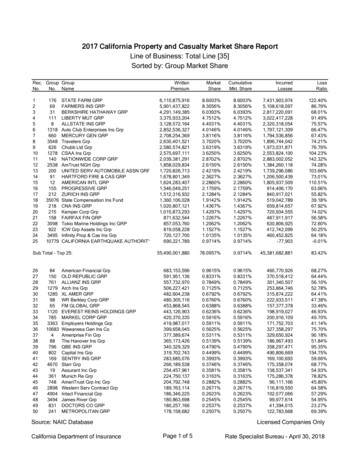

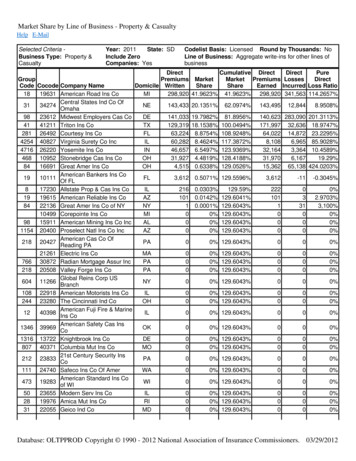

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.UNDERWRITING AND INVESTMENT EXHIBITPART 1 - PREMIUMS EARNED1Lines of Business1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical malpractice - occurrence11.2Medical malpractice - claims-made12.Earthquake13.Group accident and health14.Credit accident and health (group and individual)15.Other accident and health16.Net PremiumsWritten perColumn 6, Part 1BWorkers'compensation17.1Other liability - occurrence17.2Other liability - claims-made18.1Products liability - occurrence18.2Products liability - claims-made19.1,19.2 Private passenger auto liability19.3,19.4 Commercial auto liability21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and machinery28.Credit29.International30.Reinsurance - Nonproportional Assumed Property31.Reinsurance - Nonproportional Assumed Liability32.Reinsurance - Nonproportional Assumed Financial Lines33.Aggregate write-ins for other lines of business34.TOTALSDETAILS OF WRITE-INS3398.Summary of remaining write-ins for Line 33 from overflow page3399.Totals (Lines 3301 thru 3303 plus 3398) (Line 33 above)623Unearned Premiums Unearned PremiumsDec. 31 Prior Year Dec. 31 Currentper Col. 3, Last Year’sYear - per Col. 5Part 1Part 1A4Premiums EarnedDuring Year(Cols. 1 2 - 3)

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.UNDERWRITING AND INVESTMENT EXHIBITPART 1A - RECAPITULATION OF ALL PREMIUMS(a) Gross premiums (less reinsurance) and unearned premiums on all unexpired risks and reserve forreturn premiums under rate credit or retrospective rating plans based upon experience.1234Amount UnearnedAmount UnearnedReserve for Rate(Running One Year or (Running More ThanCredits andLess from Date ofOne Year from DateEarnedRetrospectivePolicy)of Policy)butAdjustments BasedLine of Business(b)(b)Unbilled Premiumon Experience1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical malpractice - occurrence11.2Medical malpractice - claims-made12.Earthquake13.Group accident and health14.Credit accident and health (group and individual)15.Other accident and health16.Workers'compensation17.1Other liability - occurrence17.2Other liability - claims-made18.1Products liability - occurrence18.2Products liability - claims-made19.1,19.2 Private passenger auto liability19.3,19.4 Commercial auto liability21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and machinery28.Credit29.International30.Reinsurance - Nonproportional Assumed Property31.Reinsurance - Nonproportional Assumed Liability32.Reinsurance - Nonproportional Assumed FinancialLines33.Aggregate write-ins for other lines of business34.TOTALS35.Accrued retrospective premiums based on experience36.Earned but unbilled premiums37.Balance (Sum of Line 34 through 36)DETAILS OF WRITE-INS3398.Summary of remaining write-ins for Line 33 fromoverflow page3399.Totals (Lines 3301 thru 3303 plus 3398) (Line 33above)(a) By gross premiums is meant the aggregate of all the premiums written in the policies or renewals in force.Are they so returned in this statement?(b) State here basis of computation used in each case ." ! ! %7&'5Total ReserveforUnearned PremiumsCols. 1 2 3 4

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.UNDERWRITING AND INVESTMENT EXHIBITPART 1B - PREMIUMS WRITTENGross Premiums (Less Return Premiums), Including Policy and Membership Fees Written and Renewed During YearReinsurance AssumedReinsurance Ceded1Direct2345BusinessFromFromToToLine of ffiliates1.Fire2.Allied lines3.Farmowners multiple peril4.Homeowners multiple peril5.Commercial multiple peril6.Mortgage guaranty8.Ocean marine9.Inland marine10.Financial guaranty11.1Medical malpractice occurrence11.2Medical malpractice claims-made12.Earthquake13.Group accident and health14.Credit accident and health(group and individual)15.Other accident and health16.Workers'compensation17.1Other liability - occurrence17.2Other liability - claims-made18.1Products liability occurrence18.2Products liability claims-made19.1,19.2 Private passenger autoliability19.3,19.4 Commercial auto liability21.Auto physical damage22.Aircraft (all perils)23.Fidelity24.Surety26.Burglary and theft27.Boiler and machinery28.Credit29.International30.Reinsurance Nonproportional AssumedPropertyXXX31.Reinsurance Nonproportional AssumedLiabilityXXX32.Reinsurance Nonproportional AssumedFinancial LinesXXX33.34.Aggregate write-ins for otherlines of businessTOTALSDETAILS OF WRITE-INS3398.Summary of remaining writeins for Line 33 fromoverflow page3399.Totals (Lines 3301 thru 3303plus 3398) (Line 33above)(a) Does the company’s direct premiums written include premiums recorded on an installment basis?If yes: 1. The amount of such installment premiums 2. Amount at which such installment premiums would have been reported had they been reported on an annualized basis 86Net PremiumsWritten Cols.1 2 3-4-5

COMBINED STATEMENT FOR THE YEAR 2004 OF THETHE ST. PAUL TRAVELERS COMPANIES, INC.UNDERWRITING AND INVESTMENT EXHIBITPART 2 - LOSSES PAID AND INCURRED19Line of Business1.Fire2.Allied lines3.Farmowners multiple peril4.

GeoVera Insurance Company 10799 Maryland American Equity Specialty Insurance Company 10819 California Pacific Select Property Insurance Company 10887 California . Travelers Lloyds of Texas Insurance Company 41564 Texas St. Paul Medical Lia