Transcription

Report No. DODIG-2013-083May 15, 2013Efforts to Minimize Improper Payments for theShipment of Household Goods Were GenerallyEffective But Needed Improvement

Additional CopiesTo obtain additional copies of this report, visit the Department of Defense InspectorGeneral Web site at http://www.dodig.mil/pubs/index.cfm, or contact the SecondaryReports Distribution Unit at auditnet@dodig.mil.Suggestions for AuditsTo suggest or request audits, contact the Office of the Deputy Inspector General forAuditing at auditnet@dodig.mil, or by mail:Department of Defense Office of Inspector GeneralOffice of the Deputy Inspector General for AuditingATTN: Audit Suggestions/13F25-044800 Mark Center DriveAlexandria, VA 22350-1500Acronyms and TTACTSPU.S.C.USTRANSCOMHundredweightDefense Finance and Accounting ServiceDefense Personal Property SystemFuel SurchargeGeneral Services AdministrationHousehold GoodsImproper Payments Elimination and Recovery ActNational Traffic ServicePersonal Property Shipping OfficeSurface Deployment and Distribution CommandStorage In TransitTransportation Account CodeTransportation Service ProviderUnited States CodeUnited States Transportation Command

INSPECTOR GENERALDEPARTMENT OF DEFENSE4800 MARK CENTER DRIVEALEXANDRIA, VIRGINIA 22350-1500May 15, 2013MEMORANDUM FOR COMMANDER, SURFACE DEPLOYMENT AND DISTRIBUTIONCOMMANDDIRECTOR, DEFENSE FINANCE AND ACCOUNTING SERVICESUBJECT: Efforts To Minimize Improper Payments for the Shipment of Household GoodsWere Generally Effective But Needed Improvement (Report No. DODIG-2013-083)We are providing this report for your information and use. The Surface Deployment andDistribution Command was taking steps to minimize overpayments on the shipment ofhousehold goods, but improvements were needed. The Defense Finance and Accounting Servicealso needed to improve reporting procedures on overpayments. We considered managementcomments on a draft of this report when preparing the final report.Management comments conformed to the requirements of DoD Directive 7650.3 ; therefore, wedo not require additional comments. We deleted draft report Recommendation B.l.a. from thereport .We appreciate the courtesies extended to the staff. Please direct questions to me at(703) 601-5945.dz T LLorinT. Venable , CPAActing Assistant Inspector GeneralDoD Payments and Accounting Operations

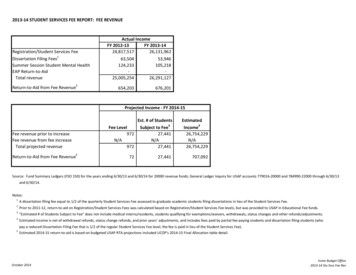

Report No. DODIG-2013-083 (Project No. D2012-D000DC-0098.000)May 15, 2013Results in Brief: Efforts To MinimizeImproper Payments for the Shipment ofHousehold Goods Were GenerallyEffective But Needed Improvementrelated to shipments of household goods duringFY 2012. DFAS accounting techniciansmanually corrected the errors at a cost of about 2.6 million to the Military Departments andDefense Agencies. The accounting errorsoccurred primarily because DoD shipmentcounselors entered invalid accounting data intothe Defense Personal Property System.What We DidWe determined whether the Department’sefforts to minimize, identify, report, and recoverimproper payments on the shipment ofhousehold goods were sufficient, effective, andin compliance with applicable laws andregulations.If the Department made needed improvementsto prevent accounting errors within the first yearof the 6-year Future Years Defense Program, 13 million of costs can be saved over theremaining 5 years.What We FoundU.S. Transportation Command officials weretaking action to minimize the number ofoverpayments made on the shipment ofhousehold goods by implementing the DefensePersonal Property System. However, for theperiod July 2010 through March 2012, GeneralServices Administration (GSA) post-paymentaudits identified 15,081 automated invoices and1,313 paper invoices with potentialoverpayments that DoD had not detected. TheSurface Deployment and Distribution Command(SDDC) and the Defense Finance andAccounting Service (DFAS) did not obtaininformation from GSA that could assist inidentifying and preventing the improperpayments. SDDC did not make system changerequests to detect payment errors such as statuteof limitations violations, duplicate payments,and inaccurate shipping weights. DFAS did notreport the overpayments as required byimproper payment guidance.What We RecommendWe recommended the Commander, SDDC, useGSA data to improve compliance andimplement automated controls over the input ofHousehold Goods information. We alsorecommended the Director, DFAS, reportimproper payment information in accordancewith guidance.Management Comments andOur ResponseThe Deputy Commander, U.S. TransportationCommand, agreed with six recommendationsand disagreed with three. The Director, DFASIndianapolis agreed with threerecommendations. As a result of the commentsfrom U.S. Transportation Command, we deletedone draft recommendation. All other commentsfrom the Deputy Commander, U.S.Transportation Command and the Director,DFAS Indianapolis were responsive.As a result, DoD lost use of 4.6 million ofoverpayments, and DFAS underreported thenumber of improper payments.DFAS identified that 142,636 of 229,411processed line items contained accounting errorsi

Report No. DODIG-2013-083 (Project No. D2012-D000DC-0098.000)May 15, 2013Recommendations TableManagementRecommendationsRequiring CommentSurface Deployment andDistribution CommandDefense Finance andAccounting ServiceiiNo AdditionalComments RequiredA.1.a, A.1.b, A.1.c, B.1.a, B.1.b,B.1.c, B.1.d, B.1.eA.2.a, A.2.b, B.2

Table of ContentsIntroductionObjectivesBackgroundReview of Internal ControlsFinding A. Additional Steps Needed To Identify, Report, and PreventOverpayments to ShippersDefense Personal Property System Minimizes ErrorsAudits Disclosed OverpaymentsObtaining Information From General Service Administration andInitiating System Change Requests To Prevent OverpaymentsStatute of Limitations ViolationsUsing Overpayment Information To Monitor Prepayment Audits ofPaper InvoicesImproved Coordination Needed To Collect the Information onOverpayments for Agency Financial ReportingBenefits of Reducing Future OverpaymentsRecommendations, Management Comments, and Our Response1112334569111212Finding B. Shipping Offices Data Processing Errors in Submitting PaymentInformation Increased Accounting Costs14Data Input GuidanceData Entry Errors Increased Processing CostsShipment Counselors Used Invalid Data to Override ControlsControls To Prevent Overrides Were InadequateReduced Accounting CostsRecommendations, Management Comments, and Our Response141516181919AppendixesA. Scope and MethodologyUse of Computer-Processed DataUse of Technical AssistancePrior CoverageB. Overpayments Reviewed2223232324Management CommentsUnited States Transportation CommandDFAS Indianapolis3235

IntroductionObjectivesThe audit objective was to determine whether the Department’s efforts to minimize, identify,report, and recover improper payments on the shipment of household goods were sufficient,effective, and in compliance with applicable laws and regulations. See Appendix A for the scopeand methodology and prior coverage related to the objective.BackgroundDoD processed 1,336,911 invoices and paid 3.5 billion from July 2010 to March 2012 to shiphousehold goods for DoD military and civilian employees who relocated to and from DoDinstallations worldwide. DoD used US Bank’s third party payment system (called Syncada) tomake the payments to Transportation Service Providers (TSPs).United States Transportation Command (USTRANSCOM) and Surface Deployment andDistribution Command (SDDC) managers used the Defense Personal Property System (DPS) tomanage the shipment of Household Goods (HHG). The shipments were processed by112 Personal Property Shipping Offices (PPSOs) worldwide. USTRANSCOM was in theprocess of consolidating the operations from 151 PPSOs to 17.Invoices, such as those from European locations, could not yet be processed electronically. Forexample, in the first half of FY 2012, TSPs submitted 14,588 paper invoices, and the DefenseFinance and Accounting Service (DFAS) made 24.6 million in related payments. However, byJuly 2017, DPS is scheduled to replace paper invoices and the methods for approving paperinvoices.The Transportation Act of 1940, as amended, title 31, United States Code, section 3726(31 U.S.C. § 3726 [2011]), authorizes the General Services Administration (GSA) to performpost-payment audits of all paid transportation billings for DoD. As required by the law, theoverpayments GSA recovers are transferred to miscellaneous receipts of the Treasury. DFASused a private contractor to perform prepayment audits of shipments to assist it in validatingcharges on paper invoices.During FY 2012, nearly 97 percent of the HHG contractor invoices were electronically processedthrough DPS and its predecessor (Transportation Operational Personal Property StandardSystem).The DPS Functional Review Board initiates, approves, and prioritizes system change requests.Board members include representatives from the Services, USTRANSCOM, and SDDC.Improper PaymentsOn July 22, 2010, the President signed Public Law 111-204, “Improper Payments Eliminationand Recovery Act of 2010” (IPERA), which amended the “Improper Payments Information Actof 2002.” According to IPERA, “improper payment” means any payment that should not have1

been made or that was made in an incorrect amount (including overpayments andunderpayments) under statutory, contractual, administrative, or other legally applicablerequirements. An improper payment includes duplicates and payments to an ineligible recipient,payments for an ineligible good or service, and payments for a good or service not received.Reportable improper payments include overpayments, underpayments, and recovered funds.Statute of LimitationTitle 31, U.S.C. section 3726, “Payment for Transportation,” requires each agency that receives abill from a carrier for transporting property to verify its correctness using a prepayment audit inaccordance with section 3726 and GSA regulations. Furthermore, a claim received under section3726 will be allowed only if the claim is received not later than 3 years after the later of thefollowing: accrual of the claim, payment for the transportation, refund for an overpayment, ordeduction from an amount subsequently due.Review of Internal ControlsDoD Instruction 5010.10, “Managers’ Internal Control Program (MICP) Procedures,” July 29,2010, requires DoD organizations to implement a comprehensive system of internal controls thatprovides reasonable assurance that programs are operating as intended and to evaluate theeffectiveness of the controls. We identified internal control weaknesses concerning theminimization, identification, reporting, and recovery of improper HHG payments. Wedetermined that SDDC and DFAS needed to improve controls over the processing of HHGpayments. Specifically, SDDC officials did not implement sufficient and effective controls toensure compliance with payment procedures, and PPSO shipment counselors frequently inputinvalid accounting data into DPS. This occurred because SDDC and DFAS did not obtaininformation from GSA that could assist in identifying and preventing the improper payments. Inaddition, SDDC did not make system change requests to detect payment errors such as statute oflimitations violations, duplicate payments, and inaccurate shipping weights, and DFAS did notreport the overpayments as required by improper payment guidance. We will provide a copy ofthe report to the senior official responsible for internal controls at SDDC and DFAS.2

Finding A. Additional Steps Needed To Identify,Report, and Prevent Overpayments to ShippersDuring the audit, USTRANSCOM officials were taking action to minimize the number ofoverpayments made on the shipment of household goods by implementing the Defense PersonalProperty System, which standardizes processes for approving invoices. However, for the periodJuly 2010 through March 2012, GSA post-payment audits identified 15,081 automated invoicesand 1,313 paper invoices with potential overpayments that DoD had not detected. A review of anon-statistical sample of 60 of the largest overpayments GSA recovered showed that theseproblems occurred for the following reasons: SDDC personal property division staff did not obtain information on electronic invoiceoverpayments from GSA and did not initiate systems change requests and automatedchecks to assist PPSOs in identifying errors such as statute of limitations violations,duplicate payments, and inaccurate shipping weights; DFAS transportation payment office personnel did not effectively use GSA’s informationon paper invoice overpayments to monitor the contractor performing pre-payment auditsof paper invoices; and DFAS Transportation Payment Office did not coordinate with GSA officials to collect theinformation on the overpayments for reporting the improper payments in the AgencyFinancial Report.As a result, DoD lost the use of 4.6 million of funds that GSA identified as overpayments,recovered, and transferred to miscellaneous receipts of the Treasury. Additionally, DFASunderstated the number of improper payments and recoveries in DoD financial statement reports.Defense Personal Property System Minimizes ErrorsDuring the audit, the USTRANSCOM Joint Program Management Office for HHG Systems wasin the process of implementing DPS to provide an integrated, Web-based informationmanagement system. Implementation of DPS began in January 2009, and all household goodsshipments are scheduled to be managed in DPS by FY 2017.DPS employs a costingThe transportation process within DPS consists of sixengine to minimizefunctional areas: counseling, shipment management, qualityovercharges.assurance, claims, customer satisfaction survey, andinvoicing. PPSO staff, Service members, and transportation service providers gain access toDPS on its host Web site www.move.mil. DPS employs a costing engine to minimizeovercharges and interfaces with Syncada to control the processing and approval of invoicessubmitted by the TSPs. TSPs are required to annually file their rates in DPS, which uses a ratereasonableness methodology to evaluate the rates and assign a unique rating score for each TSP.TSPs are assigned a ranking that PPSOs use to distribute shipment awards.3

Processing of Electronic InvoicesIn October 2003, GSA approved the use of electronic billing systems for HHG payments. InFebruary 2004, DFAS reviewed the electronic billing system and concluded that the processoffered reasonable assurance that payments would be correct and free from fraud and error. Anoverview of the process follows.Upon delivery of HHG to a service member’s residence, the TSP submits an invoice viaSyncada. Syncada assigns a unique identifier and transmits the information to DPS for approvalby the responsible PPSO. Once all services on the invoice are reviewed and subsequentlyapproved or denied, DPS costs the shipment. Syncada uses a matching model to compare theTSP’s data to DPS. If the data is within established tolerances, Syncada automatically approvespayment to the TSP. However, when a transaction does not meet the established tolerances,Syncada flags the invoices, and the PPSO must manually approve the payment. The PPSOreviews the invoice in DPS and approves, disputes, or denies each line item. The DPS systemrequires invoices to be approved before payment. However, additional improvements can bemade to the system to prevent duplicate payments, statute of limitation violations, and weighterrors.At the end of the monthly billing cycle, Syncada generates a summary invoice that is availableonline for review by an account certifying officer. The certifying officer reviews the individualtransactions on the summary invoice and confirms accounting information and cost accuracy.Once certified, an invoice cannot be changed. Syncada is required to maintain an audit trail ofall changes to shipment information in accordance with the Chief Financial Officer’s Act of 1990and the Federal Financial Management Improvement Act of 1996.Audits Disclosed OverpaymentsAs required by 31 U.S.C. § 3726, the Department relied on GSA to perform post-payment auditsof DoD HHG shipments. Table 1 shows the results of GSA post-payment audits of DoD HHGshipments for the period July 2010 through March 2012. GSA issued about 12.7 million inovercharge notices to TSPs and recovered about 4.3 million.Table 1. GSA Overcharge Notices from Electronic InvoicesJuly 2010 – March t Recovered15,0817,852 12,695,915 6,333,1687,229 4,262,874 2,099,8734

The 4.3 million recovered by GSA is not a significant amount compared to the total value ofHHG payments processed through Syncada.1 However, there is still room for improvement.Specifically, SDDC and DFAS needed to establish a process to obtain improper paymentinformation from GSA.Obtaining Information From General Services Administrationand Initiating System Change Requests ToPrevent OverpaymentsGSA audits identified areas in which SDDC could have stopped overpayments before they weremade had SDDC coordinated with GSA to analyze the information and made systems changes toautomatically detect overpayments. Of the 7,229 settled invoices with recoveries that GSAaudits identified, we reviewed the 50 largestThe SDDC personal propertyoverpayments processed electronically throughdivision should obtain this type ofSyncada. See Appendix B for details of theinformation from GSA quarterly.50 overpayments. The data showed that PPSOpersonnel did not comply with control procedures and made errors during the approval ofinvoices that caused overpayments to be made to TSPs. Table 2 shows the 10 types of errors thatoccurred in the 50 items sampled. Statute of limitation violations, duplicate payments, andweight inaccuracies were the most frequent errors.Table 2. Invoice Errors on Syncada OverpaymentsJuly 2010 Through March 2012Type of ErrorNumberOvercharge AmountAmount Recovered*Statute of LimitationDuplicate Payment1514 254,976159,146 256,904159,424Weight InaccuraciesStorageTerminationsMileage ErrorsBunker Surcharge ErrorCrating OverchargeFuel Surcharge ErrorLinehaul Charge 18,62916,93816,345 6,537 712,423* Includes InterestThe SDDC personal property division should obtain this type of information from GSA quarterlyand use it to identify areas that need improvement. SDDC officials can improve the system and1According to the IPERA, overpayments become significant when totaling 1.5 percent of the program outlays. Forthe HHG program, 1.5 percent of 3.5 billion in payments would total about 52 million.5

the existing processes to prevent duplicate payments and reduce other overpayments bycoordinating with GSA to understand the causes of overpayments discovered during postpayment audits and making changes based on the results.Statute of Limitations ViolationsThe most frequent cause of overpayments in the sample of 50 GSA identified overpayments wasthat PPSO personnel did not comply with Statute of Limitation control procedures. As shown inTable 2, 15 of the 50 Syncada overpayments, valuedDPS should automatically flag statuteat 254,976, were made after the expiration of theof limitation violations for review by3-year statute of limitations prescribed byPPSO approving officials.31 U.S.C. 3726.Table 3 shows that 15 invoice dates exceeded the 3-year statute of limitations. Personnel at theNavy’s Puget Sound shipping office processed 13 of the 15 overpayments, and personnel at FortLewis and Fort Belvoir processed the other 2.Table 3. Violations of the 3-Year Statute of ngOfficePuget SoundDeliveryDateApril 7, 2007InvoiceDateMay 5,2010ElapsedMonths37Puget SoundJune 19, 2006July 7, 201049ZX145704 44,50926,551ZX14495723,381Puget SoundMay 19, 2006Mar 12, 201046ZX40773719,668Puget SoundJune 2

May 15, 2013 · SDDC personal property division staff did not obtain information on electronic invoice overpayments from GSA and did not initiate systems change requests and automated checks to assist PPSOs in identifying errors such as statute of limitations violati