Transcription

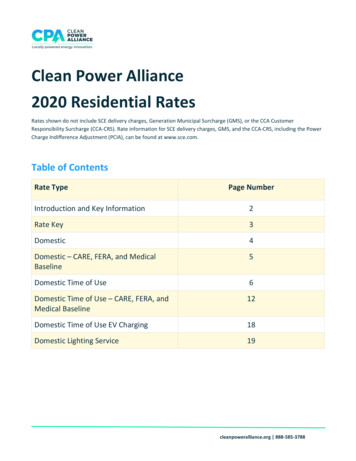

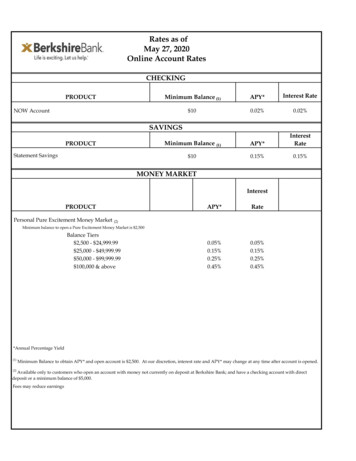

Rates as ofMay 27, 2020Online Account RatesCHECKINGPRODUCTMinimum Balance (1)APY*Interest Rate 100.02%0.02%Minimum Balance (1)APY*InterestRate 100.15%0.15%NOW AccountSAVINGSPRODUCTStatement SavingsMONEY .05%0.15%0.25%0.45%Personal Pure Excitement Money Market (2)Minimum balance to open a Pure Excitement Money Market is 2,500Balance Tiers 2,500 - 24,999.99 25,000 - 49,999.99 50,000 - 99,999.99 100,000 & above*Annual Percentage Yield(1)Minimum Balance to obtain APY* and open account is 2,500. At our discretion, interest rate and APY* may change at any time after account is opened.(2)Available only to customers who open an account with money not currently on deposit at Berkshire Bank; and have a checking account with directdeposit or a minimum balance of 5,000.Fees may reduce earnings

TRUTH-IN-SAVINGSDISCLOSURECHECKING ACCOUNTSFREE CHECKINGMinimum balance to open the account – You must deposit 10.00 to open this account.Minimum balance to avoid imposition of fees – No maintenance service charge fees will be charged on thisaccount regardless of the balance maintained.GPS CHECKINGMinimum balance to open the account – You must deposit 10.00 to open this account.Minimum balance to avoid imposition of fees – No maintenance service charge fees will be charged on thisaccount regardless of the balance maintained.Miscellaneous Information – If the requirements of the account are met, you will not incur any foreign ATMInquiry or Withdrawal fees and any ATM surcharges that were charged will be credited. To qualify for No ATM feesand surcharge credits, each qualification period (monthly statement cycle) you must:1. Use your Berkshire Bank debit card for a minimum of 15 purchases. Qualifying transactions are measured foritems posted to your account for the monthly period beginning the first business day of the statement cyclethrough the last business day of the statement cycle; and2. Utilize eStatements.If you qualify, we will credit all non-Berkshire Bank ATM surcharges at the end of your monthly statement cycle.Your surcharge (non-Berkshire Bank ATM fee) credits may be reportable to the IRS on Form 1099-MISC. If you donot qualify, you will NOT receive a credit of these surcharge fees and you will be charged for any foreign ATM Inquiryor foreign ATM Withdrawal transactions you have during your monthly statement cycle.NOW CHECKINGRate information – Your interest rate and annual percentage yield may change.Frequency of rate changes – We may change the interest rate on your account at any time.Determination of rate – At our discretion, we may change the interest rate on your account.Compounding and crediting frequency – Interest will be compounded every month. Interest will be credited toyour account every month.Minimum balance to open the account – You must deposit 10.00 to open this account.Minimum balance to avoid imposition of fees – A maintenance service charge of 7.00 will be imposed everystatement cycle if the balance in the account falls below 750.00 any day of the monthly statement cycle.Minimum balance to obtain the annual percentage yield disclosed – You must maintain a minimum balance of 10.00 in the account each day to obtain the disclosed annual percentage yield.Daily balance computation method – We use the daily balance method to calculate the interest on youraccount. This method applies a daily periodic rate to the principal in the account each day.Accrual of interest on non-cash deposits – Interest begins to accrue on the business day you deposit non-cashitems (for example, checks).September 2019berkshirebank.comLife is exciting. Let us help. Banking products are provided by Berkshire Bank: Member FDIC

SAVINGS ACCOUNTSSTATEMENT SAVINGSRate information – Your interest rate and annual percentage yield may change.Frequency of rate changes – We may change the interest rate on your account at any time.Determination of rate – At our discretion, we may change the interest rate on your account.Compounding and crediting frequency – Interest will be compounded every month. Interest will be credited toyour account every month.Minimum balance to open the account – You must deposit 10.00 to open this account.Minimum balance to avoid imposition of fees – A maintenance service charge of 5.00 will be imposed everymonth if the balance in the account falls below 250.00 any day of the monthly calendar period.Minimum balance to obtain the annual percentage yield disclosed – You must maintain a minimum balance of 10.00 in the account each day to obtain the disclosed annual percentage yield.Daily balance computation method – We use the daily balance method to calculate the interest on youraccount. This method applies a daily periodic rate to the principal in the account each day.Accrual of interest on non-cash deposits – Interest begins to accrue on the business day you deposit non-cashitems (for example, checks).Transaction limitations – Transfers from a statement savings account to another account or to thirdparties by preauthorized, automatic, online banking, telephone transfer, check, draft, or similarorder to third parties are limited to six per monthly statement period. An excess transaction fee may be chargedfor each transaction in excess of the transaction limitations. See separate Common Features FeeSchedule. If you exceed the limitations three times in a rolling twelve month period, we will contact you andconvert your account to a Free Checking account without transaction limitations, and your account will no longerearn interest.These are the accounts you have opened or inquired about. Further details about these accounts are inside thisbrochure. For rate information please see the rate sheet insert that is with this disclosure or your periodicstatement.Life is exciting. Let us help. Banking products are provided by Berkshire Bank: Member FDIC

Truth-In-Savings DisclosurePure Excitement Money MarketOnline Account Creation (OAC) RegionRates current as of March 18, 2020Rate Information - The interest rate and annual percentage yield for your account depend upon the applicablerate tier. The interest rate and annual percentage yield for these tiers may change.Frequency of rate changes – We may change the interest rate on your account at any time.Determination of rate – At our discretion, we may change the interest rate on your account.Compounding and Crediting Frequency - Interest will be compounded and credited to your account every month.Minimum Balance to open the account - You must open this Pure Excitement Money Market with 2,500.00that is not already on deposit in other accounts with us.Minimum Balance to Obtain the Annual Percentage Yield Disclosed - You must maintain a minimum balanceof 2,500.00 in the account each day to obtain the disclosed annual percentage yield.Minimum Balance to Avoid Imposition of Fees – No maintenance service charge fees will be charged onthis account regardless of the balance maintained.Balance Cap Requirement – The maximum balance cap for the Pure Excitement Money Market accountis 1,000,000.00.Daily Balance Computation Method - We use the daily balance method to calculate the interest on youraccount. This method applies a daily periodic rate to the principal in the account each day.Accrual of Interest on Non-Cash Deposits - Interest begins to accrue no later than the business day wereceive credit for the deposit of non-cash items (for example, checks).Transaction Limits – Transfers from a money market account to another account or to third parties bypreauthorized, automatic, online banking, telephone transfer, check, draft, debit card, or similar order to thirdparties are limited to six per monthly statement period. An excess transaction fee may be charged for eachtransaction in excess of the transaction limitations. See separate Common Features Fee Schedule. If you exceedthe limitations three times in a rolling twelve month period, we will contact you and convert your account to a NOWChecking account without transaction limitations. You may receive a lower interest rate and you will have a monthlymaintenance service charge.Miscellaneous Information – Limit one account per person. You must maintain a Berkshire Bank personalchecking account with a minimum daily balance of 5,000; or have at least one monthly direct deposit into thechecking account and be the primary OWNER of the qualifying checking account.If these requirements are not maintained, account will be changed to the regular money market tiered account.The new rate will be effective the date of disqualification.Life is exciting. Let us help. Banking products are provided by Berkshire Bank: Member FDICPage 1 of 2

If the balance of the Pure Excitement Money Market account exceeds the 1,000,000.00 cap, the accountwill earn the regular money market account rate for the applicable rate tier. The new rate will be effective thedate of disqualification.Rate information:Tier 1 – if your daily balance is more than 0.01 but less than or equal to 2,499.99 the interest rate paid onthe entire balance in your account will be 0.00% with an annual percentage yield of 0.00%.Tier 2 – if your daily balance is equal to or more than 2,500.00 but less than or equal to 24,999.99 theinterest rate paid on the entire balance in your account will be 0.05% with an annual percentage yield of0.05%.Tier 3 – if your daily balance is equal to or more than 25,000.00 but less than or equal to 49,999.99 theinterest rate paid on the entire balance in your account will be 0.15% with an annual percentage yield of0.15%.Tier 4 – if your daily balance is equal to or more than 50,000.00 but less than or equal to 99,999.99 theinterest rate paid on the entire balance in your account will be 0.25% with an annual percentage yield of0.25%.Tier 5 – if your daily balance is 100,000.00 or more, the interest rate paid on the entire balance in youraccount will be 0.45% with an annual percentage yield of 0.45%.Life is exciting. Let us help. Banking products are provided by Berkshire Bank: Member FDICwww.berkshirebank.comPage 2 of 21.800.773.5601

COMMON FEATURES CONSUMER FEE SCHEDULEEffective November 1, 2019AccountEarly Account Closure (Checking, Savings or MoneyMarket account within 90 days of opening)IRA Transfer (Includes Account Closure) 25.00 50.00 5.00Lost PassbookExcess Transaction (Reg. D Violation Money Market &Savings) 15.00/TransactionTelephone Account Transfers via Branch orCall CenterTelephone Account Transfers via TelephoneBanking (VRU) 5.00Charged when your Statement is Returnedundeliverable) 10.00Signature Guarantee – Medallion Stamp Fee 10.00CustomerNot AvailableNon-CustomerPercent of Amount PurchasedPixcard Fee - Create Custom Debit CardFirst PixcardReplacement Pixcard 10.00 50.00No Fee 2.50No Fee 2.501.1% 9.95 9.95Bank Fees 25.00*Check Collection 10.00*Foreign Currency Collection/Purchase 4.50Gift CardsReturn Check Chargeback Fee 7.50Massachusetts 10.00New York, Rhode IslandConnecticut, New Jersey, Pennsylvania 15.00 0.00Vermont 3.50/MonthStatement w/ Images (Mailed) 35.00Stop Payment FeeChecksCounter Checks (4 checks per Page)Money OrdersCustomerNon-CustomerTreasurer’s (Cashier’s) CheckCustomerNon-CustomerMember FDICOnline BankingInternet BankingeStatementExternal Transfers (Incoming)External Transfers (Outgoing)Online Bill Pay 5.00 2.00No FeeNo FeeNo Fee 3.00No FeeNo FeeAdministrative 50.00Abandoned Property Fee (Per Account) 25.00/HourAccount Reconciliation ( 25.00 Minimum) 15.00Certificate of Protest- NY OnlyLevy Processing Fee 125.00Federal 125.00StateNotary FeeNo FeeCustomerNo FeeNon-CustomerReturned Statement (Deposit Account, One-Time FeeATM and Debit CardATM/Debit Replacement CardATM/Debit RUSH Replacement CardATM Withdrawal FeesATMs at Berkshire BankDirect S/C-Fee (ATMs at Other Banks)ATM Inquiry FeesATMs at Berkshire BankDirect S/C-Fee (ATMs at Other Banks)Int’l Trans Fee (Currency Conversion)Check CashingCheck Cashing Card (for Non-customers)Check Cashing Card Replacement 4.00 5.00 10.00Overdraft ProtectionOverdraft Protection/Transfer from Another Deposit 10.00/TransferAccount Transfer ChargeOverdraftFees Created by Check, In-person Withdrawal, Deposit Return Item(DRI) or Other Electronic Means.Overdraft/ UAF Overdraft Fee (Items paid for overdraft,uncollected/unavailable funds) 37.00/ItemNSF Return Item Fee 37.00/Item(Items returned for insufficient funds)No more than five (5) Overdraft, UAF Overdraft and NSF Return ItemFees, totaling 185.00, will be charged on any one business day.Debit transactions of 4.49 or less will not be assessed an OverdraftFee if the available balance is negative. 35.00Continuous OD (Overdraft) FeeThe Continuous OD fee is applied to your account if the accountremains overdrawn for five consecutive business days, and each fifthbusiness day thereafter, up to a maximum of five (5) charges (totaling 175.00), until you bring your account to a positive balance. OtherBank fees (including but not limited to Overdraft, UAF Overdraft, andNSF Return Item fees) can result in a negative balance, which can leadto the assessment of a Continuous OD (Overdraft) Fee.Please refer to the Courtesy Pay Disclosure for more information aboutBerkshire Bank’s overdraft practices and fees.ResearchChargeback NoticeResearch Time ( 25.00 Minimum)StatementStatement with Check ImagesTax FormSafe Deposit (contents not insured under FDIC)Annual RentKey ReplacementLate Payment FeeBox Drilling (Lost Keys/Non-Payment)Wire TransfersPersonal IncomingCustomerNon-CustomerPersonal OutgoingDomesticForeignNon-Customer 5.00/Notice 25.00/Hour 5.00/Stmt 7.00/Stmt 5.00/FormVaries by size 60.00/Key 5.00 200.00 15.00Not Available 30.00 50.00Not AvailableSome fees may be reduced or eliminated for customers (in MA only)18 years of age or younger or 65 years of age or older. 10.00Not Availablewww.berkshirebank.com*Plus correspondent bank charges1.800.773.5601

preauthorized, automatic, online banking, telephone transfer, check, draft, debit card, or similar order to third parties are limited to six per monthly statement period. An excess transaction fee may be charged for each transaction in excess of the transaction limitations.