Transcription

Appel 03.qxd2/22/0510:26 AMPage 433Moving Averages and Ratesof Change: Tracking Trendand MomentumIn the last chapter, you learned a method of constructing and maintaining movingaverages. The method described there applies to the construction of what is called asimple moving average, a moving average that gives equal weight to all the datapoints included in that average. Other forms of moving averages assign greaterweight to more recent data points so that the average is more influenced by recentdata. This chapter provides additional information regarding the construction andapplication of moving averages.The Purpose of Moving AveragesMoving averages are used to smooth out the “noise” of shorter-term price fluctuations so as to more readily be able to identify and define significant underlyingtrends.For example, Chart 3.1 shows the Nasdaq 100 Index along with three simple moving averages, a ten-day moving average that reflects short-term trends in the market,a 50-day (if plotted weekly, a 10-week) moving average that reflects intermediatemarket trends, and a 200-day (or 40-week) average that reflects major trends in thestock market. (Moving averages can employ monthly entries for very major termtrends or, conversely, can be plotted even at one-minute intervals for very shortterm, intra-day, day-trading purposes.)

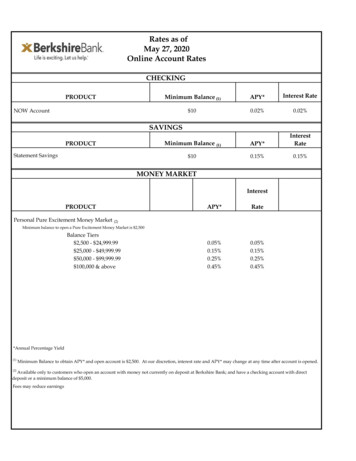

Appel 03.qxd442/22/0510:26 AMPage 44Technical Analysis160016001550155010-Day Moving Average15001500145014001350Nasdaq 100 Index145014002003 - 501050200-Day Moving Average1000100095095050-Day Moving Average9002003 FebruaryAprilMayJuneJulyAugust September900November2004 FebruaryAprilMayJuneJulyAugustChart 3.1 The Nasdaq 100 Index with Moving Averages Reflecting Its Long-, Intermediate-,and Short-Term TrendsChart 3.1 shows the Nasdaq 100 Index with three moving averages, reflecting different timeframes. The 200-day moving average reflects a longer-term trend in the stock market—in thiscase, clearly up. The 50-day or approximately 10-week moving average reflects intermediateterm trends in the stock market during this period, also clearly up. The ten-day moving average reflects short-term trends in the stock market that, on this chart, show a bullish bias intheir patterns but are not consistently rising.Chart 3.1 starts as the 2000–2002 bear market was moving toward completion, reaching its bear market lows and completing its transition into the emerging bull marketthat developed during 2003. The ten-day moving average was penetrated by dailyprice movement in mid-March that year, turning sharply upward. You can see howturns in the ten-day average took place, reflecting changing trends in daily pricemovement.Let’s review this ten-day moving average more carefully. The slopes of movingaverage thrusts indicate the underlying strength of market trends. Examine theupturn in the ten-day moving average that took place in mid-February 2003 andcontinued into March. The slope and length of this upturn were moderate, as wasthe subsequent downturn into mid-March.Now look at the upturn in the ten-day moving average that took place starting inmid-March: This had very different characteristics. The slope of the March advancewas much more vertical, indicating greater initial momentum, a sign of increasingmarket strength. The length of the initial upthrust lengthened, another positive indication. The subsequent retracement into April took place at a lesser slope. Theadvancing leg had more vitality than the declining leg, which was of lesser duration.

Appel 03.qxd2/22/0510:26 AMPage 45Moving Averages and Rates of Change: Tracking Trend and MomentumLet’s consider now the moving average pulses that developed in mid-April, lateMay, and early July. The April to late May advancing pulse was relatively long in itsconsistent advance, which developed at a strongly rising angle. The May to Junepulse was shorter (signifying lessening upside momentum or strength). The June toJuly pulse showed further reductions in its length and steepness of thrust, reflectingstill diminishing upside momentum.As a rule, a series of diminishing upside pulses during a market advance suggeststhat a market correction lies ahead. A series of increasing upside pulses suggests thatfurther advances are likely.You might want to review the series of pulses between August and November forfurther examples of these concepts. You might also want to notice the series of higher highs and higher lows in the ten-day moving average, clearly signifying anuptrend in motion.The Intermediate-Term Moving AverageThe ten-day moving average during the period in Chart 3.1 was clearly tracing outpatterns that, between March and October, signified a strong market climate.However, market indications produced by moving average patterns became somewhat more ambiguous as October moved into early December. Upside pulses weakened, and a more neutral pattern developed.Although short-term patterns were becoming more neutral, intermediate trendsremained strongly uptrended, as you can see from the 50-day moving average,which based during March and April, turned upward thereafter, and rose steadilythrough the end of the year.When intermediate trends are strong, the strategy of choice is usually to buy whenprices fall to or below the shorter-term moving averages. Such patterns frequentlyprovide fine entry points within favorable, strongly rising stock market cycles. Therules are reversed during more bearish periods. When intermediate-term markettrends are clearly in decline, selling opportunities frequently develop when dailystock prices or market indices approach or penetrate shorter-term moving averagesfrom below.The Long-Term 200-Day Moving AverageThe 200-day moving average reflects longer-term market trends. As you can see, itnaturally responds more slowly than the 50-day moving average to changes in thedirection of market movements. The 200-day average turned upward in April 2003and continued upward throughout the year, with the slope of its advance accelerating and reflecting ongoing market strength. Again, accelerating slopes suggest extensions of trends in motion. Decelerating trends imply that current trends might beapproaching reversal. The 200-day moving average did lose momentum early in2004, reflecting the weakening stock market that year.Be sure to check the lengths of pulses and the slope of moving averages that youare tracking. The longer the pulse is, the more vertical the slope is and the greater theodds there are of a continuation in trend. As pulses and slopes moderate, the oddsof an imminent market reversal increase.45

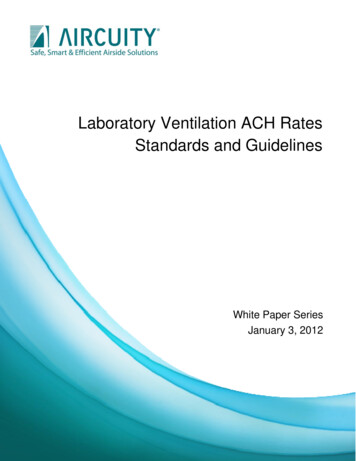

Appel 03.qxd462/22/0510:26 AMPage 46Technical AnalysisUsing Weekly-Based Longer-Term Moving Averages750030-Week Moving 0005000B45004500New York Stock Exchange IndexWeekly40004000350035003000B BuyS SellMoving AverageLends Support25003000(Not All Signals Chart 3.2 The New York Stock Exchange Index Weekly Chart, 30-Week Moving AverageThis chart shows the New York Stock Exchange Index of 1995–1997, along with its 30-weekmoving average. The symbols B and S indicate periods during which upside penetrations ofthe 30-week moving average proved significant, and periods during which downside penetrations proved significant. These marked penetrations were followed by above-averageadvances and declines respectively.Chart 3.2, the New York Stock Exchange Index, is based on weekly price closings andemploys a weekly-based 30-week moving average, calculated at the ends of weeksbased upon weekly closing price levels. This was a strongly trended period for thestock market, marked by upward action during the late 1990s into 2000, sharplydowntrended action thereafter until late 2002, and then a renewal of sharp advancesduring 2003. To the extent that longer-term trends were more pronounced than usualduring this period, the significance of whether prices stood above or below the 30week moving average was probably greater than normal.Do you remember the rule regarding diminishing market pulses? You might want toreview the long-term buying pulses, reflected by the moving average on the chart. Thelongest and strongest rising pulse took place between 1996 and mid-1998. This was followed by a sharp decline and then by a second significant upswing between mid-1998and mid-1999, the pulse of which was not as strong as the 1996–1998 advance.The final upside pulse between late 1999 and early 2000 took place at a more moderate slope than both of the previous two pulses, confirming a weakening of upsidemomentum in the New York Stock Exchange Index. Price levels and the moving

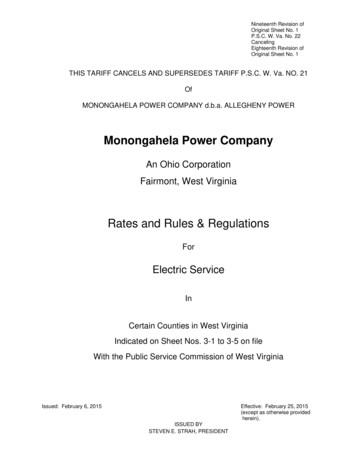

Appel 03.qxd2/22/0510:26 AMPage 47Moving Averages and Rates of Change: Tracking Trend and Momentumaverage flattened quickly, a harbinger of the weakness to come. These are the samepatterns that are present in Chart 3.1, the daily price action of the Nasdaq 100 Index.In both periods, the series of pulses involved were completed in three waves. Thisthree-wave pattern, which occurs frequently, appears to be associated with TheElliott Wave Theory, an approach to studying wave movements and their predictivesignificance that has a wide following among stock market technicians. We willreturn to the significance of pulse waves when we examine moving average tradingchannels, which I consider to be a very powerful market timing tool.Moving Averages and Very Long-Term Moving AveragesMoving averages, as we have seen, may be applied to shorter-term, intermediateterm, and very long-term price movements. You may also apply them, if you are avery active trader, to intra-day market data for day trading purposes. Such data maybe plotted on hourly, 30-minute, 15-minute, and even 5-minute bases, but at this timewe are considering longer term applications.Chart 3.3 is a monthly chart of the Standard & Poor’s 500 Index, posted with a 30month moving average. You should note two items. First, consider the significanceof the moving average in providing areas of support for the stock market. Duringpositive market periods, price declines frequently come to an end in the area of keyintermediate- and major-term moving averages. Second, note that the acceleratingrise in the moving average creates a rising parabolic curve. Such formations usuallyoccur only during very speculative periods (for example, consider the price of goldin 1980) and are generally followed by long-lasting and serious market declines. Asyou can see, the highs of 2000 had still not been surpassed by early 2004. The peakin gold prices that developed during 1980 has to date remained unchallenged fornearly a quarter of a century.165016001550STANDARD & POOR’S 500 INDEXMonthly1500145014001350130012501985 - 050045040035030-Month Moving Average300250200150100501985 19861987 19881989 199019911992 19931994 19951996 19971998 19992000 200120022003 2004200Chart 3.3 The Standard & Poor’s 500 Index, 1986–2003 30-Month Moving Average47

Appel 03.qxd482/22/0510:26 AMPage 48Technical AnalysisAs illustrated in Chart 3.3, the stock market advanced in an accelerating, parabolic advancebetween 1986–2000, with the 30-month moving average line providing support throughoutthe rise. Market tops generally end in gradual decelerations, but sometimes advances aremarked by parabolic acceleration, such advances often ending with a spikelike peak.Parabolic patterns of this nature usually take place during highly speculative periods, whichare great fun for as long as they last, although they usually do end badly.Moving Averages: Myths and MisconceptionsIt is frequently said that the stock market is in a bullish position because prices lieabove their 30-week moving averages or that it is bearish because prices lie belowtheir 30-week moving averages. Sometimes 10-week or 20-week moving averagesare referenced instead. There are some elements of truth to these generalizations, butstrategies of buying and selling stocks based on crossings of moving averages tendto add only moderately, if at all, to buy-and-hold performance.For example, consider two possible strategies. The first strategy involves buyingthe Dow Industrials when its daily close exceeds its 200-day moving average, andselling at the close of days when its close declines to below the 200-day moving average. The second strategy employs the same rules but is applied to crossings of the100-day moving average.Trading the Dow Industrials on Moving Average Crossings (January 5, 1970–January 13, 2004)200–Day MovingAverage ModelTotal round-trip trades120100-Day MovingAverage Model195Profitable trades26 (21.7%)44 (22.6%)Unprofitable trades94 (78.3%)151 (77.4%)Average gain, winning trades14.1%18.7%Average loss, losing trades–1.2%–1.1%Percentage of time invested68.6%65.5%Rate of gain per annum while invested9.6%9.1%Gain per annum, including cash periods6.6%6.0%Open drawdown44.2%48.1%Buy and hold: Gain per annum 7.8%; open drawdown –45.1%* Gain per annum includes neither money market interest income while in cash, which hasaveraged approximately 2% per year, nor dividend payments. If these were included, gainsper annum for the trading and buy-and-hold strategies would have been essentially equal.As you can see, there has been very little benefit or disadvantage to trading the DowIndustrial Average based on penetrations of either the 100-day or the 200-day moving averages. The Dow has not been a particularly volatile or trendy market index.The Nasdaq Composite Index, more volatile and trendy, has generally proven in the

Appel 03.qxd2/22/0510:26 AMPage 49Moving Averages and Rates of Change: Tracking Trend and Momentumpast to be somewhat more compatible with this form of timing model, although lessso in recent years because this market sector has lost a good deal of its autocorrelation, the tendency of rising market days to be followed by rising market days,

Price levels and the moving Appel_03.qxd 2/22/05 10:26 AM Page 46. Moving Averages and Rates of Change: Tracking Trend and Momentum 47 average flattened quickly, a harbinger of the weakness to come. These are the same patterns that are present in Chart 3.1, the daily price action of the Nasdaq 100 Index. In both periods, the series of pulses involved were completed in three waves. This three .