Transcription

TODD AMEN, PRESIDENT

ATBSshow.comTrusted tax and accounting experts forIndependent contractors.Independent Contractor Benchmarking(ICB)A Fleet’s Guide ToIndependent Contractor SuccessPAYLESS TAXBOOKKEEPINGDONE FOR YOUTAX DEBTRESOLVEDCopyright ATBS

2016 ICB Big Trends Miles reversed their downward trendSpot market rates plummetedReduced Fuel costs helped net incomeBigger truck payments offset with efficienciesOO market is shrinking with slow freightCopyright ATBS

ITS - Broker Load vs Truck ght Imbalance Shifts 42015 2016Source: ITS Trans4cast LetterIndependent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 5Copyright 2014 ATBS, LLC. All Rights Reserved.

ITS - Broker Load vs Truck 2-121-28-1312.1X9.4XSource: ITS Trans4cast LetterIndependent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 6Copyright 2014 ATBS, LLC. All Rights Reserved.

Morgan Stanley – Dry IndexCopyright ATBS

Morgan Stanley – Reefer IndexCopyright ATBS

Morgan Stanley – Flatbed IndexCopyright ATBS

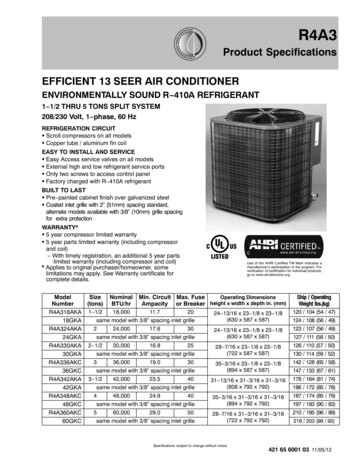

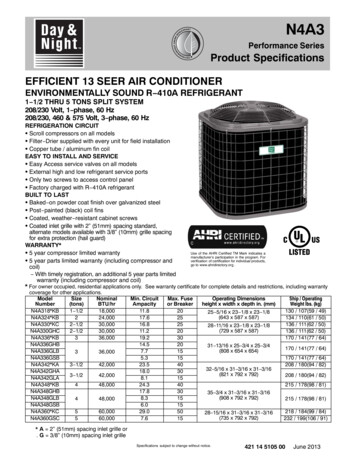

Methodology of Data Sample Size thousands of owner-operators in eachmarket segment Most recent 24 months including an average of each 12month period Specific Fleet Benchmark data is for Fourth Quarter2015 “Scale” remains consistent across each group of charts “Avg All Market Segments” is a weighted average of the“segments”, taking into account the percent of clientsin each market segment Data Tables are available from ATBSCopyright ATBS

ATBSshow.comTrusted tax and accounting experts forIndependent contractors.Operating AnalysisBy Independent Contractor SegmentIndependents, Dry, Reefer, Flatbed,& Average of All SegmentsCopyright ATBS

Miles – Avg All Market SegmentsMiles - Average All ,4008,2008,000JulAugSepOctNovDecJan2015Q2 TTM2015Q2 vs 2016Q2: 2.1% 2,319 to 110,793FebMarAprMayJun12mos2016Q2 TTMIndependentDryReeferFlat 0.8% to 99,940 2.4% to 115,866 4.2% to 126,292 0.3% to 90,426Copyright ATBS

Miles 2003–2017 (Est.)Average All Market Segments-EOBR Efficiency-Low Fuel Costs-HOS Suspension-RecessionMiles: 2003-2017 t HOS Change -Booming Economy-Freight Regionalization2010201120122013201420152016 Est2017 Est12 per. Mov. Avg. (Miles)-Fleet EOBR’s-High Fuel Costs-2nd HOS Changes-Slow Freight-ELD MandateCopyright ATBS

RPM – Avg All Market Segments'15 Nat'l Fuel Price3.903.402.902.401.90'16 Nat'l Fuel PriceRPM - Average All SepOctNovDecJan2015Q2 TTM2015Q2 vs 2016Q2: -9.3% - 0.13 to 1.30FebMar2016Q2 TTMAprMayIndependentDryReeferFlatJun12mos- 0.13 to 1.41- 0.12 to 1.23- 0.14 to 1.18- 0.18 to 1.62Copyright ATBS

Spot market rates vs ATBS ICB fleet rates 1.20 1.00 0.80 0.60BreakevenFleet vsIndependent 0.40 0.20 016

Leased vs Spot Rates – Dry VanDry Van - Spot mkt rates vs Leased rates 2.40 2.20 2.00 1.80 1.60 1.40 1.20 1.002008200920102011Dry - Spot20122013Dry - Leased201420152016

ICB Webinar Poll 4.7.16;Do you plan to increase the ratepaid to your IC's this year?72 % No rate increase12 % 0 to 2%12 % 3% to 5%4 % more than 5%

ICB Webinar Fleet Poll 4.14.15;Do you plan to increase the ratepaid to your IC's this year?53% No rate increase26% 0 to 2%15% 3% to 5%6% more than 5%Independent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 18Copyright 2015 ATBS, LLC. All Rights Reserved.

Gross Revenue –Average All Market SegmentsRevenue - Average All 11,50011,00010,500JulAugSepOctNovDecJan2015Q2 TTM2015Q2 vs 2016Q2: -7.4% - 11,387 to 143,537FebMarAprMayJun12mos2016Q2 TTMIndependentDryReeferFlat-7.5% to 140,687-7.0% to 142,704-6.6% to 149,420-9.5% to 146,433Copyright ATBS

Fuel CPM – Avg All Market Segments'15 Nat'l Fuel Price3.903.402.902.401.90'16 Nat'l Fuel PriceFuel - Average All lAugSepOctNovDec2015Q2 TTMJanFebMar2016Q2 TTM2015Q2 vs 2016Q2: -30.5% down 0.16 to 0.36AprMayIndependentDryReeferFlatJun12mos-29.0% to 0.37-30.7% to 0.34-29.1% to 0.36-34.4% to 0.39Copyright ATBS

Revenue CPM vs. Fuel CPM –Average All Market SegmentsRev/mi vs. Fuel/mi - Average All 300.401.250.351.200.30JulAugSepOct'15ttm Revenue2015 vs 2016 Revenue CPM:2015 vs 2016 Fuel CPM:NovDecJan'16ttm RevenueFebMar'15ttm FuelAprMayJun12mos'16ttm Fuel-9.3% down 0.13 to 1.30 Decrease of 11,387-30.5% down 0.16 to 0.36 Decrease of 16,072Copyright ATBS

uck Payment 2003–2016Average All Market Segments2,500Truck Payment: ruck Payment20082009Linear (Truck Payment)2010201120122013201420152016Copyright ATBS

ovJanMarMayJulSepNovJanMarMayMaintenance 2003–2016Average All Market Segments1,100Maintenance: 009Linear 0142014201520152016Maintenance CPM: 2003-2016Linear (Maintenance/mi)2016Copyright ATBS

Estimated Avg MPG – 2016 TTMMiles / (Fuel / DOE avg per gallon)MPG (estimated)miles / (fuel / DOE avg per .45Avg All6.64TTM-2015TTM-2016Copyright ATBS

ATBSshow.comTrusted tax and accounting experts forIndependent contractors.Net IncomeDollars vs Cents Per Mile (CPM)Copyright ATBS

Net Income – Avg All Market SegmentsNet Income - Average All 80.464,5000.440.424,0000.40JulAugSepOct'15ttm NovDec'16ttm JanFeb'15ttm cpm2015Q2 vs 2016Q2: 1.7% up 1,007 to 60,700MarAprMayJun12mos'16ttm cpmIndependentDryReeferFlat- 2,372 to 61,182 2,990 to 60,964 1,544 to 54,018- 1,395 to 67,477Copyright ATBS

JulSepNovJanMarMayJulSepNovNet Income 2003–2015Average All Market Segments6,000Net Income: 020062007Net Income20072008Net Income Per Mile20082009Linear (Net 42015Net Income Per Mile: 2003-20150.500.40Linear (Net Income Per Mile)2015Copyright ATBS

Net Income6-Month Periods2014Q3 & Q42015Q1 & Q22015Q3 & Q42016Q1 & Q2Average All 29,681 30,012 31,155 29,545Independent 31,463 32,091 31,284 29,898Dry Van 28,693 29,281 31,276 29,688Refrigerated 26,550 25,924 26,858 27,160Flatbed 34,604 34,268 36,196 31,281Copyright ATBS

Net Income6-Month Periods 37,000 36,000 35,000 34,000 33,000 32,000 31,000 30,000 29,000 28,000 27,000 26,000 25,0002014 Q3 & Q42015 Q1 & Q2Average AllIndependent2015 Q3 & Q4Dry VanRefrigerated2016 Q1 & Q2FlatbedCopyright ATBS

Net Income 2003–2016295Average All Market SegmentsWork13,00027512,000279,000 IC’sMiles: 2003-2016139,00011,00010,000118,0009,000255Est 250,000 00.50215238,000 IC’s20102011201220132014Linear (Miles)2016109,500 61,000Net Income Per Mile: 2003-2016Pay2015 52,000224,000 IC’s0.40195175 47,800 .302003200420052006200720082009Net Income Per 16Linear (Net Income Per Mile)2008200920102011Copyright2012 ATBS

ICB Webinar Fleet Poll 4.7.16;Do you plan to add to your IC fleetthis year?12 % No additions23 % 0 to 5%35 % 5% to 10%15 % 10% to 20%15 % more than 20%Independent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 31Copyright 2014 ATBS, LLC. All Rights Reserved.

ICB Webinar Fleet Poll 4.14.15Do you plan to add to your IC fleetthis year?2% No additions13% 0 to 5%32% 5% to 10%30% 10% to 20%21% more than 20%Independent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 32Copyright 2014 ATBS, LLC. All Rights Reserved.

ICB Webinar Fleet Poll 4.7.16;Have you already implementedELDs or EOBRs in your fleet?100 % Yes0 % NoIndependent Contractor Benchmarking (ICB)Fourth Quarter - 2014Slide 33Copyright 2014 ATBS, LLC. All Rights Reserved.

Elog Survey-IC’sDo you think the 2017 Electronic Logging Regulation will.38.2%53.2%8.6%Make it more difficult for you todeliver freight on timeMake it easier for you to deliverfreight on timeHave no impact on your ability todeliver freight on time34Copyright ATBS

Driver Survey – Driver TurnoverDo you feel that shippers view you, the trucker, as an important part oftheir business model?33.5%YesNo66.5%35Copyright ATBS

2016 to 2017 - ICB Predictions IC miles will remain higher thru 2016, thenstart to go down with ELDs in mid 2017 Net Income will be flat to down with a slowfreight market – fuel dependent Fragmented Capacity will begin to consolidateunder ELD mandate By 2017 Net Rates will increase 10% Copyright ATBS

TODD AMEN, PRESIDENT888-640-4829www.atbsshow.com

Leased vs Spot Rates –Dry Van 1.00 1.20 1.40 1.60 1.80 2.00 2.20 2.40 2008 2009 2010 2011 2012 2013 2014 2015 2016