Transcription

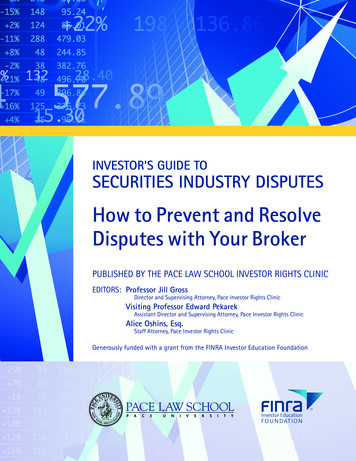

INVESTOR’S GUIDE TOSECURITIES INDUSTRY DISPUTESHow to Prevent and ResolveDisputes with Your BrokerPUBLISHED BY THE PACE LAW SCHOOL INVESTOR RIGHTS CLINICEDITORS: Professor Jill GrossDirector and Supervising Attorney, Pace Investor Rights ClinicVisiting Professor Edward PekarekAssistant Director and Supervising Attorney, Pace Investor Rights ClinicAlice Oshins, Esq.Staff Attorney, Pace Investor Rights ClinicGenerously funded with a grant from the FINRA Investor Education Foundation

This Investor’s Guide has been authored and published byattorneys with the Pace Investor Rights Clinic (PIRC), anon-profit legal services organization affiliated with Pace LawSchool. PIRC offers free legal services to eligible individualinvestors who have disputes with their securities brokers andbrokerage firms. PIRC aims to protect the rights of individualinvestors, particularly investors of modest means whotraditionally have been underrepresented in the legal system.This Guide is made possible by a grant from the FINRA InvestorEducation Foundation. The Foundation supports innovativeresearch and educational projects that give investors tools tobetter understand the markets and the basic principles of savingand investing. For details about grant programs and otherFoundation initiatives, please visit www.finrafoundation.org.Caution: The descriptions of the securities laws and rules,including FINRA rules, contained in this Guide are not intended tobe comprehensive. For completeness and accuracy, please refer tothe text of those laws and rules.This Guide contains legal information, not legal advice. ThisGuide is not intended to provide, nor should it be construed asproviding, legal or investment advice in any particular matter.For legal advice, please consult an attorney licensed in your areaor call your local bar association for a referral to an attorney. Formore information on finding an attorney experienced in securitiesmediation or arbitration, please read the section of this Guide on“How to Find an Attorney.”For investment advice, please consult a licensed and registeredinvestment professional.This Guide is distributed in cooperation with the American BarAssociation Section of Dispute Resolution. 2013 Pace Investor Rights Clinic and FINRA Investor Education Foundation

Table of ContentsINTRODUCTIONPART IPageAvoiding Disputes: Investor Rights and ResponsibilitiesWhat are the top ten best practices for responsible investing? . . . . . . . 1What duties does my broker owe to me as a customer? . . . . . . . . . . . . 6How can I address problems that may arise with my investments?. . . . 8How can I find an attorney to assist me? . . . . . . . . . . . . . . . . . . . . . . . . 9PART IIResolving Disputes: The Arbitration ProcessWhat is arbitration? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11Why arbitration? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12Is there a deadline to file an arbitration?What do you file?What happens after a claim is initiated? . . . . . . . . . . . . . . . . . . . . . . . 14Can I change the Statement of Claim after it has been filed?What are counterclaims, cross claims and third party claims? . . . . . . 15What happens when a respondent does not file an Answer?How are arbitration fees determined?How many arbitrators serve on an arbitration? . . . . . . . . . . . . . . . . . . 16Who is your arbitrator?How are the arbitrators selected? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17What is Simplified Arbitration? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18What are Motions?What is the Initial Prehearing Conference?What is Discovery? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19What are Orders of Production or Appearance from Members? . . . . . 20Where does the hearing take place? . . . . . . . . . . . . . . . . . . . . . . . . . . . 20What happens at the hearing? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21When do the arbitrators decide the case?. . . . . . . . . . . . . . . . . . . . . . . 22What is contained in an arbitration award? . . . . . . . . . . . . . . . . . . . . . 23How do I collect an award or settlement? . . . . . . . . . . . . . . . . . . . . . . 24PART IIIResolving Disputes: The Mediation AlternativeWhat is mediation?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25Why should I agree to use mediation?What is the Small Claims Mediation Pilot Program? . . . . . . . . . . . . . 26Can parties agree to mediate and arbitrate the same dispute? . . . . . . . 26What fees must I pay? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27What takes place during the mediation process? . . . . . . . . . . . . . . . . . 28CONCLUSION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

IntroductionThe Pace Investor Rights Clinic produced this Guideto Securities Industry Disputes for the individualinvestor who hopes to prevent or may already have adispute with his or her securities broker. Our goal isfor investors to learn more about their legal rights andbest practices for responsible investing, before adispute arises, and to gain an understanding of theiroptions in case a dispute does arise. We hope thatinformed investors will be better able to preventdisputes with their broker as well as identify andresolve legitimate grievances.The first section of this Guide covers investors’ rightsand responsibilities, tips on how to researchbrokerage firms and brokers, and brokers’ duties totheir customers. The second section takes youthrough the arbitration process, including whenarbitration is appropriate, procedural requirements,fees, and what to expect at the hearing. The third andfinal section focuses on mediation, an increasinglypopular alternative to arbitration.This Guide can also assist individual investorsrepresenting themselves (“pro se” investors) byproviding a foundation in the basic rules andprocedures in arbitration and mediation.Note: A resource available to both attorneys andparties to arbitration is the staff of the FinancialIndustry Regulatory Authority (FINRA). Formerlyknown as NASD, FINRA is the largest nongovernmental regulator for all securities firms doingbusiness in the United States. FINRA also operates thelargest securities dispute resolution forum in the worldand offers arbitration and mediation facilities in 71locations around the United States and abroad.FINRA staff attorneys are neutral. They cannot offerlegal advice or opinions as to the probability ofsuccess or failure of a particular claim or defense.However, they can provide information about theprocedural requirements under FINRA’s arbitrationand mediation codes of procedure.To find a FINRA arbitration or mediation facility nearyou, please ndex.htm.

PART IAvoiding Disputes: Investor Rights and ResponsibilitiesWhat are the top ten best practices forresponsible investing?Responsible investing may help to protect you from unexpected lossesand avoid disputes with your broker. This section lists and details thetop ten “best practices” you can follow to avoid disputes.1Understand that all investments involve risk.When you invest, you take certain risks. Some of these risks include:With many types of securities, such as stocks, bonds, and mutualfunds, one of the risks you face is market risk, or a risk that theinvestment principal will decline in value if the price falls and you sellfor less than what you paid.Market riskYou could also be taking liquidity risk, or a risk that the investmentmight not be easily sold or converted to cash when you need that cash.Liquidity riskEven with bank savings products that preserve your principal, such ascertificates of deposit (CDs), you face inflation risk, which meansinvestments may not earn enough over time to keep pace with theincreasing cost of living.Inflation riskIf you want to reap the financial rewards of investing successfully, youhave to be willing to take some risk. In general, remember that everyinvestment carries some degree of risk—and the greater the potential forhigh returns or earnings on an investment, the greater the risks as well.1

PART I2Avoiding Disputes: Investor Rights and ResponsibilitiesResearch the broker and the brokerage firmbefore opening an account.Doing some research about brokers and brokeragefirms before you hand them any money can help youavoid problems later. If you are looking for a brokerto work with, try to meet with several of them faceto-face to compare them before making anydecisions. Learn about which products and serviceshe or she offers and how they would meet yourneeds. Be wary of anyone who promotes a one-sizefits-all approach to investing or who touts only oneparticular product.VERIFY any professional designation(s) orcredential(s) by contacting the issuing organizationand determining whether the broker is currentlyauthorized to use the designation and whether he orshe has been disciplined. For more information, seeFINRA’s “Understanding Professional Designations,”at www.finra.org/designations.VERIFY that the broker is also licensed by your state’sOnce you are considering a broker or brokerage firm,there are a few more steps you should take beforehanding anyone your money:insurance commissioner, if he or she sells anyinsurance products. In order to sell variable annuitiesor variable life insurance policies, your broker must beproperly licensed with both FINRA and your state’sinsurance commission. Look up the contactinformation of your state’s insurance commissionerthrough the National Association of InsuranceCommissioners at www.naic.org.registered and licensed with FINRA and your state’ssecurities regulator. Ask about the broker’s workexperience, disciplinary history (including any pastcustomer complaints), and financial health (includingany outstanding arbitration awards or court judgments).Ask about the firm’s customer complaint record.Securities Investor Protection Corporation (SIPC).While SIPC does not insure against losses fromdeclines in the market value of your securities, SIPCdoes provide limited customer protection by replacingcertain customer assets if a firm becomes insolvent orbankrupt. See www.sipc.org for more information.ASK whether the broker and firm are properlyVERIFY the broker’s and firm’s registration, licensing,and other background information by using FINRABrokerCheck (www.finra.org/BrokerCheck), FINRA’sDisciplinary Actions Online Database tions/FDAS/),and by calling your state’s securities regulator. Formore information on FINRA BrokerCheck, see theSidebar on page 6. For the contact information of yourstate’s securities regulator, please call the NorthAmerican Securities Administrators Association at(202) 737-0900 or visit www.nasaa.org.2VERIFY that your brokerage firm is a member of theRemember, up-front researchabout brokers and brokeragefirms you are consideringcan help you avoid problems later.

Avoiding Disputes: Investor Rights and Responsibilities3Formulate investment goals andcommunicate them clearly to your broker.Most people invest to achieve specific financial goals.For example, many people want to own their ownhome, send their children or grandchildren to college,and retire comfortably. Some investors may have othergoals, such as accumulating enough money to start abusiness or to leave a job to pursue other interests.Make sure to have a clear sense of your investmentgoals and when you want them to happen.Communicate this clearly to your broker beforemaking any investment decision. Your broker shouldask you for this information in order to make suitableinvestment recommendations for you and shouldrecord this information in what is called a “customerprofile” or “account record.” You should ask for acopy of this document, and make sure it accuratelyreflects your investment objectives and risk tolerance.Also update your broker whenever your financialcircumstances or goals change.4Learn about account features.Often investors do not know about or misunderstandthe features of their brokerage account until it’s toolate. Here are some key account features of which youshould be aware:Pre-dispute arbitration clause — Virtually everybrokerage customer account agreement contains a predispute arbitration clause, which requires that youarbitrate all claims concerning your account in asecurities arbitration forum, such as FINRA DisputeResolution. By signing the account agreement, yougive up the right to sue your broker and brokerage firmin a court of law. See Part II of this Guide for moreinformation on arbitration.Authority to make decisions — Make sure youknow and understand exactly who has authority tomake decisions in your account. Typically, you’llPART Iindicate this choice in your account opening form.Having a “non-discretionary” account means that youmake investing decisions. Before you consideropening a discretionary account, be sure to considercarefully whether such an arrangement is right for you.Having a “discretionary account” means your brokercan make investment decisions for your accountwithout consulting you in advance about the price,type, amount, or timing of each trade, as long as tradesare consistent with your stated investment objectives.Ability to borrow — You should also know whetheryou have a cash account or a margin loan account(customarily known as a “margin account”). A marginaccount allows you to borrow funds from your brokerto buy securities. In a cash account, you must pay foryour securities in full when you buy them. Typically,you’ll choose whether you want a margin loan accountor cash account in your account opening form. In somecases, however, you may be given a margin account bydefault, unless you specify otherwise. Make sure youread the account opening documents about marginaccounts carefully. If you have any questions, ask yourbroker.Beware: Borrowing money from your brokeragefirm to buy securities can expose you tosignificant risks. For more information, visitwww.finra.org/investor/margin, and read FINRA’sInvestor Alert, “Investing With Borrowed Funds: NoMargin for Error,” at www.finra.org/alerts/margin.5Learn about fees you may be charged forinvestment services and products.Investing with a brokerage firm costs money. To avoidsurprises later, it is very important that you understandup front what services your broker provides and howmuch those services cost. Always ask about all the feesrelated to your account, such as account opening, closing,transfer, and maintenance fees, as well as any othercosts. Always ask about how your broker is compensatedand how that varies depending on the different3

PART IAvoiding Disputes: Investor Rights and Responsibilitiesinvestment products you buy. This may influence yourbroker’s investment recommendations to you.In addition, make sure you ask about and understand allthe fees and expenses you’ll have to pay with regard toeach investment. These can include commissions, as wellas a variety of sales charges or “loads,” transfer fees,surrender charges (penalties for converting an investmentto cash before a permitted time), “markups” and annualmanagement fees. If you do not fully understand them,maybe the investment is not right for you.6Understand your investments, and avoid anyyou do not understand.When choosing an investment, make certain youunderstand what you are buying. This can help youform realistic expectations, avoid disputes with yourbroker, and make better buy, sell, or hold decisions.Investing in a financial product you do not fullyunderstand that promises high returns could exposeyou to risks for which you are not prepared.It is your right to ask your broker questions until youfully understand an investment. At a minimum, youshould know: How the investment works. How and when the investment value grows or shrinks. How and when you would earn money on theinvestment (for example, does the investment payinterest or dividends?). How much and what kinds of risk you would be taking. How and why the investment is right for you.47Read carefully all documents relating toyour account and investments.When you open a new brokerage account, you willcomplete and sign a number of forms andagreements. Among the many papers you will beasked to sign is an account agreement, a legallybinding contract that governs the terms of yourrelationship with your brokerage firm. Make sure tokeep all these forms and agreements in a safe place.As you make trades and invest in your account, youshould receive a trade confirmation for each trade,which should include details about each transaction.You should also receive regular account statementswhich summarize your holdings and your investmentactivity on a monthly or quarterly basis. Promptlyreview your trade confirmations and accountstatements. This better enables you to monitor youraccount for any unauthorized activity, and make moreinformed investment decisions.For certain investments such as mutual funds andvariable annuities, you should receive documentsdescribing the investment, called prospectuses, ator shortly after the time of purchase. If you don’treceive these documents, request copies from yourbroker. These documents can be lengthy andcomplex, but try to read and understand them. Askquestions if you do not understand anything inthese documents.

Avoiding Disputes: Investor Rights and Responsibilities8Keep documents and note conversationswith your broker.You may need the following documents in the future toreport or pursue a problem, look up information for taxpurposes, or for other reasons: Account opening agreement, including pre-disputearbitration clause. Customer profile and/or account record. Any document that gives your broker discretionaryauthority over your account. Account statements. Trade confirmations. Notes of discussions with your broker. Correspondence with your broker. Prospectuses or other offering circulars forinvestments.9Report any problems with your account inwriting immediately.If you notice an error in any documents you receivefrom your broker, such as a trade confirmation thatdoes not accurately reflect your investment decision,or if you have questions about your account, write toyour broker or branch manager immediately. Thismay help you minimize financial losses and preserveyour legal rights. Also seek independent legal advice.10PART ITop Ten Investor’s Best Practices1. Understand that all investmentsinvolve risk.2. Research the broker and thebrokerage firmyou select one.3. Formulate investment goals andcommunicate them clearly toyour broker.4. Learn about your account’s features.5. Learn about the fees you may be chargedfor investment services and products.6. Understand your investments,and avoid any you do not understand.7. Read all documents related to youraccount and investments.8. Keep documents and noteconversations with your broker.9. Report problems with your accountimmediately and in writing.10. Ask questions about your money.Ask questions.Asking questions is one of the best ways toinvest wisely and avoid disputes between you and yourbroker. You are taking risk if you assume your brokerwill tell you everything you need to know. Rememberthat you are the customer and are entitled to have allyour questions answered—after all, it is your moneyat stake.5

PART IAvoiding Disputes: Investor Rights and ResponsibilitiesFINRA BrokerCheckFINRA’s BrokerCheck is a free tool to help investorsresearch the professional backgrounds of current andformer FINRA-registered brokerage firms and brokers, aswell as investment adviser firms and representatives.The information about brokers and brokerage firms isderived from the Central Registration Depository (CRD ),the securities industry online registration and licensingdatabas

brokerage customer account agreement contains a pre-dispute arbitration clause, which requires that you arbitrate all claims concerning your account in a securities arbitration forum, such as FINRA Dispute Resolution. By signing the account agreement, you give up the right to sue your