Transcription

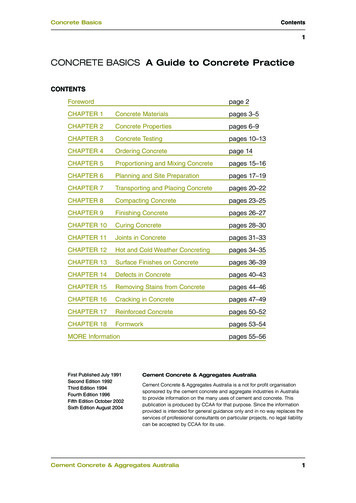

The Macon County& Shopping GuideFNP heads to NYC to fight COVID19 head-on MCPH reports firstdeath from COVID-19April 9, 2020 24 PagesVolume 37Number 46www.themaconcountynews.comFREE INDEPENDENT NEWSPAPERthis is not an unpaid position. Butthe risk and sacrifice are real. Andafter multiple conversations, Mattand I decided that we either believeAubrey Balmer has served as awhat God says, and follow whenFamily Nurse Practitioner at Angelhe leads us, which demands action.Medical Center and Mission HosOr sit on the sidelines and live withpital since graduating with her FNPthe regret of wondering ‘what if.’in 2012. She worked in emergencyIf there is one thing I've learned inmedicine and urgent care for fivemy life, it is that I do not want toyears. Then, for the past three andhave regrets. I know not everyonehalf years, she ran the onsite healthbelieves in God or has the sameclinic for Harrah's Casino offeringfaith that I do. But, I'm so thankfulboth primary care and urgent carethat in this historical moment infor employees. With New Yorkhistory, I will be taking part in it byCity being deemed the epicenterbringing the sacrificial love andfor the COVID19 virus, with a despeace that I built my life upon andperate shortage in qualified profesweaving it in to the lives of peoplesionals, Balmer answered the callwho are scared and suffering.”to spend the next month in the cityBalmer attended Lenoir-Rhyneproviding help wherever it iswhere she obtained her BSN-RN.needed.A year after graduating, she started“If I'm honest, I didn't think Ithe FNP program at WCU.would ever be one to risk going to“One of the best decisions I haveNew York City,” Balmer said ofher decision to go. “I have a 5- Family Nurse Practitioner Audrey Balmer will be ever made was to become a Nurseyear-old son. I want to be with my spending the next month in New York City fighting Practitioner,” she said. “It's allowed me to serve other peoplehusband. It's much more comfort- the COVID-19 pandemic on the front lines.and use my innate aptitude forable being at home with my boysand going for runs every day. But, for two weeks every time medicine in not only a variety of health care settings but alsoI opened my Bible for my quiet time in the morning it wasSee FRONTLINES page 4to Psalm 91. I am going as a government contract employee,Brittney LofthouseContributing WriterHelp is on the way Health care workers learnfor small businesses of further cuts in benefitsBrittney Lofthouse – Contributing WriterNew loans from the federal government are now availableto small businesses following the COVID-19 national emergency declaration.Small businesses across the country headed to their localbanks over the past week in hopes of applying to the SmallBusiness Administration’s emergency funds set up as partof Congress’s 2.2 trillion federal stimulus program. Thefederal relief program has various loans and programs available to business owners — depending on the individualneeds of the business.Like most loans, the SBA loans will vary from one recipient to another. The official title of the SBA loans are Economic Injury Disaster Loans (EIDL).According to the SBA, the administration “offers loanswith long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms areSee SMALL BUSINESSES page 2A Macon County resident diagnosed with COVID-19has died. The person was over the age of 65 and had underlying medical conditions. To protect the families’ privacy, no further information about this patient will bereleased.“Our deepest sympathies are with the family andloved ones at this time. We want to reiterate the importance of citizens staying home and practicing social distancing until further direction from our government andhealth leadership,” stated Carmine Rocco, MaconCounty Interim Health Director. “Our message to thosewho are full-time residents, part-time residents, or visiting Macon County: Stay at home. Stay safe. Practicesocial distancing. Quarantine if you have travelled.Limit your trips outside of your home to necessities.”Macon County Public Health regularly updates itsFacebook page with accurate and current informationregarding COVID-19. The public is encouraged to checkthe Facebook page, www.facebook.com/MaconPublicHealth for up-to-date information.Symptoms for COVID-19 are fever, cough, and otherlower respiratory illness (shortness of breath). If you believe that you may have COVID-19, call the Health Department at (828)349-2517. The call center is openMonday through Friday from 8:00am – 5:00pm, untilfurther notice.Submitted by Kathy McGaha, Public Information Officer67IN THIS ISSUEBrittney Lofthouse – Contributing WriterIn 2019, Macon County EMS transported 28 patients toErlanger Western Carolina Hospital in Cherokee County —with an average of 30 patients transported to the facility annually for the last five years. The majority of Macon Countyresidents transferred to Erlanger’s Cherokee County hospital are Nantahala residents, who are about 20 minutes closerto Erlanger than Angel Medical Center. Nantahala residentsare more frequently transported to Erlanger Hospital inCherokee County than any other hospital in the region.Macon County residents who work at Erlanger WesternCarolina Hospital were dealt another blow Monday viaemail when they learned that specific positions within thehospital system were having their salaries cut by 5 percent.Erlanger Health System announced at the end of Marchthat they had enacted a "temporary expense reduction plan"by furloughing some administrative employees, cuttingSee BENEFITS page 3Page 13Backyard gardening is making a ncountynews@gmail.comPRST STD U.S. POSTAGE PAIDPERMIT 22GOODER PUBLISHING CORP.FRANKLIN, NC 28734-3401

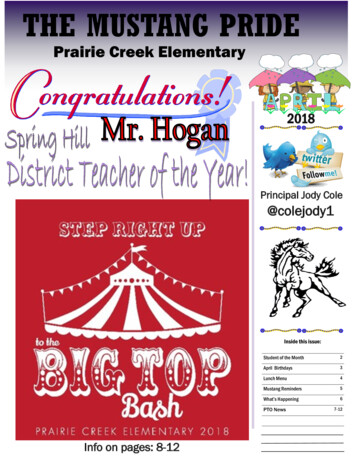

SMALL BUSINESSES2VOLUME 37THE MACON COUNTY NEWS & SHOPPING GUIDEdetermined on a case-by-case basis, basedupon each borrower’s ability to repay.”Macon County Economic DevelopmentDirector Tommy Jenkins has been providingregular updates and information for localbusinesses via email during this time.“At this point, the EDC is working withvarious strategic partners to provide localbusinesses with the information they need toaccess available resources, as well as assessing the needs of the business community,” said Jenkins.According to releases from Jenkins, smallbusinesses with 500 or fewer employees including nonprofits, veterans organizations,tribal concerns, self-employed individuals,sole proprietorships, and independent contractors - are eligible. Businesses with morethan 500 employees are eligible in certain industries.Interest rates for SBA economic injuryloans depend on the classification of the applying organization. For nonprofit organizations, including nonprofit aging servicesproviders, the interest rate is generally 2.75percent.Per SBA, “The law limits economic injurydisaster loans to 2,000,000 The actualamount of each loan is limited to the economic injury determined by SBA, less business interruption insurance and otherrecoveries up to the administrative lendinglimit. SBA also considers potential contributions that are available from the businessand/or its owners or affiliates. If a businessis a major source of employment, SBA hasthe authority to waive the 2,000,000 statutory limit.”Starting April 3, 2020, small businessesand sole proprietorships were able to applyand starting April 10, 2020, independentcontractors and self-employed individualscan apply. Jenkins noted that businessesContinued from page 1should apply as quickly as possible becausethere is a funding cap.The application process comes with confusion from many local branches. In theory,experts claim businesses could applythrough any existing SBA 7(a) lender orthrough any federally insured depository institution, federally insured credit union, andFarm Credit System institution that is participating. However, some banks, such asBank of America have said that they willonly loan to businesses with existing accounts.Inquiries to Entegra Bank, which recentlymerged with First Citizens, regarding theirprocess yielded no answers. Entegra Banksaid while they are still operating under theEntegra Bank name, questions needed to besent to First Citizens Bank. Questions tolocal branches were redirected to the headquarters in Raleigh, who then directed questions to the North Carolina BankersAssociation.Jenkins said for those who may not wantto take out a loan, staying connected withtheir customers is more important than ever.“Stay connected with your customer baseby email and social media,” said Jenkins.“Promote online sales, gift card purchasesfor future use. If a restaurant, continue tooffer take-out and delivery services. Encourage customers to ‘buy local.’ Work withresources such as SCC’s Small BusinessCenter for new ideas and strategies. Now isa good time to think ‘outside the box’ whenit comes to your business’s future.”In addition to operational loans under theeconomic injury disaster loan program, theSmall Business Administration has the ability to make “loan advances” of up to 10,000 to companies hurt by the coronavirus. The 10,000 will be issued withinthree days, and in some cases won’t have toNUMBER 46be paid back at all.The process starts with an application onSBA.gov for an Economic Injury DisasterLoan (EIDL). Applying for emergency fundswill entitle business owners to the 10,000cash advance — if you get approved for theEIDL, the 10,000 is taken from the totalloan amount, if you do not get the loan, businesses may be able to keep the 10,000.Another program available under the loanTHURSDAY, APRIL 9, 2020said the state continues to streamline the unemployment process for the state.“We went from having one of the lowestunemployment rates in our state’s history, tohaving 220,000 people file for unemployment in the last two weeks and it has overwhelmed the system,” said Corbin. “Thestate hired 50 new workers just to get theprocess moving so I am confident we willsee better results this week.”United Community Bank at 257 East Main Street is among those banks in Franklin that can helpwith the Paycheck Protection Program.Photo by Vickie Carpenterfor small businesses is the Paycheck Protection Program. The Paycheck Protection Program also has a grant component — whichallows the loan to be forgivable if used according to the established guidelines.“If you use that over the next two monthsto pay for certain expenses, like payroll, rent,certain debt service and things like that, upto 100 percent of the loan can be forgiven,”Said North Carolina Representative KevinCorbin.The Paycheck Protection loan is designedto help businesses and nonprofits keep or rehire their workers. Corbin says the forgiveness could be reduced if an employer laysoff workers.Corbin was appointed to the North Carolina COVID19 Task Force — which iscomprised of Republicans and Democrats.Corbin said the group holds frequent virtualmeetings, which are open to the public andcan be accessed through the General Assembly’s website. In addition to ironing outthe details of the federal CARES Act, CorbinCorbin said as a member of the task force,he has been working on education concernssurrounding COVID19 which includesemergency funding to be used at the discretion of school districts for needs relating tothe pandemic. Corbin said those funds willhave little restriction and can be used for amultitude of reasons, depending on theunique needs of each district.Local businesses needing more information about the SBA Loans, go towww.sba.gov; or locally, contact the MaconCounty EDC at 828.369.2306 or edc@maconnc.org.; Southwestern Community College’s Small Business Center; or the SmallBusiness and Technology DevelopmentCenter at Western Carolina University forguidance and information on SBA and otheravailable programs. Businesses can alsocontact their local lender or accountant.“It’s going to be a challenging time forMacon County,” said Jenkins. “That’s whyit’s important for businesses to take advantage of all available resources.”

NCBA offers paycheck protection program updateTHuRSDAy, APRIL 9, 2020VOLUME 37NUMBER 46Since the launch of the Small Business AdministrationPaycheck Protection Program on Friday, April 3, North Carolina bankers worked through the weekend and around theclock processing Paycheck Protection Program (PPP) loansfor small businesses in their communities. Nationwide, as ofTuesday afternoon, 3,299 banks and other SBA-approvedlenders had processed 265,000 applications totaling 71 billion.“Bankers are working as fast as humanly possible to meetthe overwhelming demand for Paycheck Protection Programloans,” said North Carolina Banker’s Association (NCBA)president and CEO Peter Gwaltney. “North Carolina bankshave committed significant resources to originate these loansfor small businesses in the communities that they serve. Ourmember banks are proud to play a role in the administrationof this important economic relief program.”Small businesses should visit www.sba.gov to learn moreabout the Paycheck Protection Program and gather the required information before applying for a PPP loan with theirprimary bank. Not every North Carolina financial institutionis a fit to participate in the program. If your bank is not aparticipant in the Paycheck Protection Program, small businesses should inquire with other lenders.BENEFITSContinued from page 1by furloughing some administrative employees, cutting leadership pay, reducing overtime, suspending vacation accruals, suspending job recruitment for administrative positionsand suspending retirement contributions by the company. Inthe email, employees were notified that paid time off orPTO, which is accrued based on time worked, is being suspended beginning with the current pay period. PTO balanceswill remain intact and accessible to employees, but any PTOthat would be accrued as a result of additional hours workedduring the pandemic, will not be generated. Erlanger willalso no longer contribute to employee retirement plans during the indefinite suspension.In addition to the changes for employees, the email statedthat Erlanger President and CEO Dr. Will Jackson will takea 15 percent pay reduction (his base salary is 625,000), withother executives losing 10 percent of their pay and remaining Erlanger leaders losing 5 percent.In a follow up email sent Monday, Jackson stated that Erlanger Medical Group physicians and advanced practiceproviders will be taking a 5 percent reduction in base pay.Advanced Practice providers include outpatient doctors,nurse practitioners, and physicians assistants.Hospital systems across the country are struggling duringthe COVID19 crisis. The CEO HCA Healthcare, which operates Angel Medical Center, the Highlands-Cashiers Hospital and all of Mission Health Systems announced last weekthat he will donate the next two months of salary to a fundto help system workers struggling with reduced hours duringthe COVID-19 pandemic.The senior leadership team of the system also will take a30 percent cut in pay for the duration of the pandemic, CEOSam Hazen announced in a letter to employees last week.HCA Healthcare, which has 184 hospitals, has had to reduce hours for employees.“Many of our outpatient facilities, clinics and departmentshave closed,” Hazen wrote.Any employee that can’t be redeployed can be eligible fora pandemic pay program that continues paying 70 percentof their base salary for up to seven weeks.“This is not a furlough,” Hazen said. “Instead, it is a paycontinuation program to assist colleagues until we better understand the long-term implications of this pandemic on theThe 349 billion appropriated by Congress for the program is expected to run out. Senate Majority Leader MitchMcConnell announced on Tuesday, April 7, that he is working with Senate Minority Leader Chuck Schumer on additional funding for the Paycheck Protection Program,possibly as early as Thursday. According to Senate SmallBusiness Committee Chairman Marco Rubio, an additional 200- 250 billion in funding is needed.North Carolina banks have already implemented loan payment deferrals, loan modifications, fee waivers, and manyother measures to help their customers through these difficult times. Banks are tailoring their financial assistance foreach customer based on their own unique situation. With theenactment of the CARES Act, Congress gave banks additional tools to utilize in the effort to aid small businesses inurgent need of assistance because of the pandemic, including the Paycheck Protection Program.North Carolina banks entered this pandemic from a position of strength, thanks to record capital and liquidity levels, as well as prudent planning and risk mitigation. We lookforward to helping small businesses across North Carolinaget back to work.Submitted by the North Carolina Bank Associationorganization.”Hospitals have lost valuable funds due to the fact that elective procedures have been discontinued which generates alarge portion of their revenues. Elective procedures havebeen discontinued for two main reasons, one to keep stafffree in the event of a surge of COVID19 patients and also tosave personal protective equipment (PPE) that are in shortsupply and high demand.Hazen added that the patient volume declines are likelytemporary and that “we hope we can return to taking care ofmore patients sometime in May, which should lead to scheduling work for you.”The HCA Healthcare Hope Fund helps with financialneeds and also has counseling services. The HCA HealthcareHope Fund is a public 501(c)3 charity that's employee-runand employee-supported "to help HCA Healthcare employees and their immediate families who are affected by financial hardship."The Board of Directors decided to waive "their cash compensation for the remainder of the year allowing the company to make an additional contribution to the HCA HopeFund."THE MACON COuNTy NEWS & SHOPPING GuIDEOPEN – Daily Delivery ServiceWill leave flowers at door w/ no contactFlorist / Farmer ofSpecialty Cut Flowers11485 Georgia Road, Otto, NC 1 mi. North of the State Line8 2 8 . 5 2 4 . 2 8 2 9 t h e f l o w e r c o m p an y n c . c o m828-524-7773highlandernc.comFranklin, NC - Five Day 8o/37o 53o/31o 65o/39o 65o/48o 69o/45oUSED BOOK STOREWe are open!With God’s blessing and your support,we will continue to serve our communityfor as long as possible. Stay safe out there!1781 Georgia Rd., Franklin, NC (828) 369-9059Open: Tues– Fri 10–5; Sat 10–2; Closed Sun & MonYES, WE ARE OPEN!Town council will nextmeet Monday, April 13Notice is hereby given that the Town Council meetings scheduled for April 6 and April 14, have been cancelled. The meetings will be combined and rescheduledas a Special Called Meeting to discuss regular businessand to include a budget work session for April 13, at 5:30p.m. at the Town Hall board room located at 95 EastMain Street, Franklin.Onsite access to the meeting will not be permitted tothe public, but there will be a link to the live stream ofthe meeting found on the front page ofwww.franklinnc.com.Anyone wishing to make a public comment shall havean opportunity to submit questions or comments viaemail to contactus@franklinnc.com that will be readduring the meeting. Comments and/or questions mayalso be mailed to P.O. Box 1479, Franklin, NC 28744.The deadline for these will be Monday April 13, at 12p.m. We are limiting the amount of people inside the store Curbside Service Available Call ahead to place order & we will bringit to your car Customers can download ACE App to your phone Garden Center Open – Seeds for your Garden,Flowers and all your other Garden needs75 W. Palmer Street Franklin, NC(828) 524-05023

FRONTLINES4VOLUME 37THE MACON COUNTY NEWS & SHOPPING GUIDEContinued from page 1multiple places around the world. My husband and I hope toconsider ourselves mission minded; we value using our gifts,talents and resources to serve others

Apr 09, 2020 · Entegra Bank said while they are still operating under the Entegra Bank name, questions needed to be sent to First Citizens Bank. Questions to local branches were redirected to the head-quarters in Raleigh, who then direc