Transcription

18/F, Cosco Tower, 183 Queen's Road Central, Hong KongIssued by Bank Consortium Trust Company LimitedPB-ISE-03/2020MPF SCHEME BROCHUREFORBCT (MPF) INDUSTRYCHOICESponsor: BCT Financial LimitedTrustee: Bank Consortium Trust Company LimitedVersion Date: 23 March 2020Enquiry Contact: Member Hotline 2298 9333Employer Hotline 2298 9388Website: www.bcthk.com

Important:If you are in doubt about the meaning or effect of the contents of this Brochure, you should seekindependent professional advice.The BCT (MPF) Industry Choice (“Plan”) is an industry scheme constituted by a trust deed dated 12 April2000, as amended and supplemented (“Trust Deed”), and is governed by the laws of the Hong KongSpecial Administrative Region (“Hong Kong”).The Plan is designed with the object of providing retirement benefits to the workforce in the catering andconstruction industries in Hong Kong. All employers, employees and self-employed persons who areengaged in either of the two industries are eligible to join the Plan. In addition, any person (whether or notsuch person is engaged in the catering and construction industries in Hong Kong) may join the Plan (i) asa personal account member by transferring his accrued benefits to the Plan or (ii) as a TVC member, inaccordance with the rules of the Trust Deed and the Regulation (as defined in section 1.1 headed “AboutBCT (MPF) Industry Choice”).Although the Plan has been registered with the Mandatory Provident Fund Schemes Authority (the“Authority”) and authorised by the Securities and Futures Commission (the “SFC”), such registration andauthorisation does not constitute official recommendation of the Plan by the Authority or the SFC. SFCauthorisation is not a recommendation or endorsement of the Plan nor does it guarantee the commercialmerits of the Plan or its performance. It does not mean the Plan is suitable for all participants of the Plannor is it an endorsement of its suitability for any particular participant of the Plan.BCT (MPF) INDUSTRY CHOICEImportant: Fees and charges of an MPF Conservative Fund can be deducted from either (i) the assets of thefund or (ii) members’ account by way of unit deduction. The BCT (Industry) MPF ConservativeFund uses method (i) and, therefore, unit prices / NAV / fund performance quoted haveincorporated the impact of fees and charges. You should consider your own risk tolerance level and financial circumstances before makingany investment choices or investing according to the Default Investment Strategy. When, in yourselection of funds or the Default Investment Strategy, you are in doubt as to whether a certainfund or the Default Investment Strategy is suitable for you (including whether it is consistent withyour investment objective), you should seek financial and / or professional advice and choose theinvestment choice(s) most suitable for you taking into account your circumstances. In the event that you do not make any investment choices, please be reminded that yourcontributions made and / or accrued benefits transferred into the Plan will be invested inaccordance with the Default Investment Strategy, which may not necessarily be suitable for you.Please refer to section 3.3 headed “Default Investment Strategy” for further information.For further enquiries, please call our Employer Hotline at 2298 9388 or Member Hotline at 2298 9333 orwrite to us by facsimile at 2992 0809.BCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE

TABLE OF CONTENTS Page NumberINTRODUCTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11.1ABOUT BCT (MPF) INDUSTRY CHOICE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11.2SCHEME STRUCTURE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .22.DIRECTORY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .33.FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIES . . . . . . . . . . . . . . . . . . . . . . . .43.1FUND OPTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43.2INVESTMENT OBJECTIVES AND POLICIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .53.3DEFAULT FUND AND DEFAULT INVESTMENT STRATEGY . . . . . . . . . . . . . . . . . . . . . . .173.4INVESTMENT AND BORROWING RESTRICTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24RISKS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .264.1GENERAL INVESTMENT RISKS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .264.2RISK CLASS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .29FEES AND CHARGES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .305.1FEE TABLE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .305.2SIGNPOSTING OF ON-GOING COST ILLUSTRATIONS AND THE ILLUSTRATIVEEXAMPLE FOR THE MPF CONSERVATIVE FUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .39ADMINISTRATIVE PROCEDURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .406.1CONTRIBUTIONS AND WITHDRAWAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .406.2CHANGES, REBALANCING AND SWITCHING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .52OTHER INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .547.1INVESTMENT MANAGEMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .547.2MANDATORY PROVIDENT FUND SCHEME ORDINANCE . . . . . . . . . . . . . . . . . . . . . . . .557.3VALUATION AND PRICING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .567.4GENERAL INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .58GLOSSARY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .631.4.5.6.7.8.BCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE

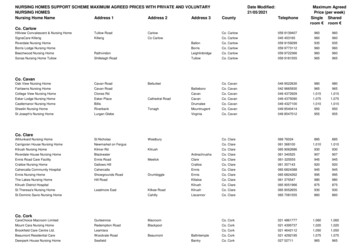

1.INTRODUCTION1.1 ABOUT BCT (MPF) INDUSTRY CHOICEThe Plan offers the Default Investment Strategy and twelve constituent funds. Each constituent fundhas been approved* by the Authority and will only be offered to the members of the Plan. Subject tothe investment restrictions in section 3.4, the funds in each constituent fund will be invested in eitherpermissible investments or pooled investment funds as defined, respectively, under Part II and Part IV ofSchedule 1 of the Mandatory Provident Fund Schemes (General) Regulation as amended from time to time(the “Regulation”). Subject to the approval of the Authority and the SFC, additional constituent funds canbe established at any time by the Trustee.The Plan is a defined contribution provident fund scheme which is made available to all eligible persons,including employees and self-employed persons in the catering and construction industries. In view ofthe nature and mobility of the workforce in the two industries, the Plan has been designed to cater forthe special needs of various types of employees participating in the Plan. Under the Plan, employeesare classified as either “casual employees” or “regular employees”. Employees who are employed by aparticipating employer on a day-to-day basis or for a fixed period of less than 60 days may join the Planas “casual employees” while all other employees who are employed for a period of 60 days or more mayjoin the Plan as “regular employees”. All members of the Plan are bound by the rules of the Trust Deed.In this Brochure, “employee member” refers to “casual employee member” or “regular employee member”.All mandatory contributions (see section 6.1.2) will be fully vested from the dates on which suchcontributions are made. The participating employers and Plan members may elect to make additionalcontributions on a voluntary basis. Such voluntary contributions will be vested in the members inaccordance with the rules specified in their respective participating plans.The twelve constituent funds in the Plan are defined and categorized in the following table:Date ofEstablishmentConstituent FundsEquity Funds(1)BCT (Industry) Hong Kong Equity Fund (the “Hong Kong Equity Fund”)1 October 2002(2)BCT (Industry) Asian Equity Fund (the “Asian Equity Fund”)1 May 2004(3)BCT (Industry) Global Equity Fund (the “Global Equity Fund”)1 October 2002Mixed Asset Funds(4)BCT (Industry) E70 Mixed Asset Fund (the “E70 Mixed Asset Fund”)12 April 2000(5)BCT (Industry) E50 Mixed Asset Fund (the “E50 Mixed Asset Fund”)12 April 2000(6)BCT (Industry) E30 Mixed Asset Fund (the “E30 Mixed Asset Fund”)12 April 2000(7)BCT (Industry) Flexi Mixed Asset Fund (the “Flexi Mixed Asset Fund”)1 April 2005(8)BCT (Industry) Core Accumulation Fund (the “Core Accumulation Fund”)1 April 2017(9)BCT (Industry) Age 65 Plus Fund (the “Age 65 Plus Fund”)1 April 2017*Such approval by the Authority does not imply official recommendation of the constituent funds bythe Authority.BCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE1

Bond / Money Market Funds(10) BCT (Industry) RMB Bond Fund (the “RMB” Bond Fund”)4 March 2013(11) BCT (Industry) Global Bond Fund (the “Global Bond Fund”)1 October 2002(12) BCT (Industry) MPF Conservative Fund (the “MPF Conservative Fund”)12 April 2000The constituent funds in the Plan and the Default Investment Strategy are subject to risks inherent inall investments. Please refer to the risk factors in section 4 and section 3.3.4 (relating to the DefaultInvestment Strategy) for more details.1.2SCHEME STRUCTUREA chart of the Plan and its Constituent Funds is set out below:Diagram – BCT (MPF) Industry Choice – Structure of the Constituent FundsBCT (MPF) Industry ChoiceInvestmentManagersInvesco Hong Kong tFranklin TempletonInvestors Manage- ManageInvestment ong)Kong)Limited ry)(Industry)(Industry) (Industry) (Industry) (Industry) (Industry)Con(Industry)(Industry)(Industry) (Industry) (Industry)MPFCoreE70E50E30FlexiHongstituentRMBAge d irectmentInvestFundments– RMBBondFund* 2InvescoInvescoInvescoPooled InvescoPooledPooledInvest- PooledInvestInvestmentInvestmentmentFund –mentFund –Fund –CoreFund –GlobalGlobalAccum- Age 65StableBalancedulation Plus FundGrowthFundFundFundFeeder fundInternal portfolio fundBCT (MPF) INDUSTRY CHOICE MPF SCHEME mple- TempleInvestSchroderChoicementton MPF ton MPFmentMPFFlexiFund –GlobalGlobalFund –AsianBalanced tyFundFund

2.DIRECTORYTrustee, Administrator and CustodianBANK CONSORTIUM TRUST COMPANY LIMITED18/F, Cosco Tower183 Queen’s Road CentralHong KongSponsorBCT FINANCIAL LIMITED18/F, Cosco Tower183 Queen’s Road CentralHong KongInvestment Managers(1) INVESCO HONG KONG LIMITED (“Invesco”)41/F, Champion Tower3 Garden Road, CentralHong Kong(2) FRANKLIN TEMPLETON INVESTMENTS (ASIA) LIMITED (“Templeton”)17th Floor, Chater House8 Connaught Road CentralHong Kong(3) FIL INVESTMENT MANAGEMENT (HONG KONG) LIMITED (“Fidelity”)Level 21, Two Pacific Place88 Queensway, AdmiraltyHong Kong(4) SCHRODER INVESTMENT MANAGEMENT (HONG KONG) LIMITED (“Schroders”)Suite 3301, Level 33Two Pacific Place88 Queensway, AdmiraltyHong Kong(5) ALLIANZ GLOBAL INVESTORS ASIA PACIFIC LIMITED (“AllianzGI AP”)27th Floor, ICBC Tower3 Garden Road, CentralHong KongLegal AdvisersDEACONS5th Floor, Alexandra House18 Chater RoadCentralHong KongAuditorsPRICEWATERHOUSECOOPERS22nd Floor, Prince’s Building1 Des Voeux Road CentralCentral, Hong KongBCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE3

3.3.1FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIESFUND OPTIONSNo.Name ofConstituentFundInvestmentManagerFund StructureFund Descriptor Investment Focus1.BCT (Industry)Hong KongEquity FundFidelityInvesting in asingle APIFEquity Fund– Hong KongNormally 95% in equitiesand 5% in cash or cashequivalent2.BCT (Industry)Asian EquityFundSchrodersInvesting in asingle APIFEquity Fund– Asia ex-Japan60% to 100% in equity and0 to 40% in cash or cashequivalent3.BCT (Industry)Global EquityFundTempletonInvesting in asingle APIFEquity Fund –GlobalNormally invest 0 to 100% inequity securities4.BCT (Industry)InvescoE70 Mixed AssetFundInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 70%Normally 70% in equitiesand 30% in fixed incomesecurities5.BCT (Industry)InvescoE50 Mixed AssetFundInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 50%Normally 50% in equitiesand 50% in fixed incomesecurities6.BCT (Industry)InvescoE30 Mixed AssetFundInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 30%Normally 30% in equitiesand 70% in fixed incomesecurities7.BCT (Industry)Flexi MixedAsset FundAllianzGI APInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 50%Under normal circumstances,it is expected that 0 to 25%will be invested in equitiesand 75% to 100% in fixedinterest securities and cash.In strong equity markets, 0to 50% will be invested inequities and 50% to 100%in fixed interest securitiesand cash; while in weakerequity market conditions, upto 100% will be invested infixed-interest securities8.BCT (Industry)CoreAccumulationFundInvescoInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 65%Around 60% in higher riskassets (such as globalequities) and around 40%in lower risk assets (suchas global bonds, cash andmoney market instruments.)9.BCT (Industry)Age 65 PlusFundInvescoInvesting in asingle APIFMixed AssetFund – Global– Maximumequities 25%Around 20% in higher riskassets (such as globalequities) and around 80%in lower risk assets (suchas global bonds, cash andmoney market instruments.)10.BCT (Industry)RMB Bond FundInvescoInvesting in asingle APIFBond Fund –China70% to 100% in debtinstruments and 0 to 30%in cash and money marketinstruments11.BCT (Industry)Global BondFundTempletonInvesting in asingle APIFBond Fund –GlobalNormally invest 0 to 100% infixed income securities andcash4BCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE

No.Name ofConstituentFundInvestmentManagerFund StructureFund Descriptor Investment Focus12.BCT ntMoney MarketFund – HongKong3.2100% in Hong Kong dollardenominated bank depositsand short-term debtsecuritiesINVESTMENT OBJECTIVES AND POLICIESTwelve constituent funds, each with a different investment policy, have been established under the Plan.Each Plan member may invest his or her contributions in one or more of these constituent funds and / or inthe Default Investment Strategy. Please refer to section 6.1.5 entitled “Investment Mandate” and section6.2.1 entitled “Change of Investment Instructions” for further details.EQUITY FUNDS3.2.1 Hong Kong Equity FundStatement of investment policy(a)Objective and policyThe objective of the Hong Kong Equity Fund is to provide members with long term capitalappreciation by investing solely in “Fidelity Global Investment Fund – Hong Kong EquityFund” which is an APIF and in turn invests in equity market of Hong Kong, namely equities ofcompanies listed in Hong Kong (including Greater China companies that are listed in HongKong) or companies which have a business connection with Hong Kong (including companieswhich are listed outside Hong Kong). Companies which have a business connection withHong Kong include but are not limited to companies that are domiciled or incorporated inHong Kong.It is expected that the Hong Kong Equity Fund will achieve long term return which follows themajor stock market indices of Hong Kong. (Note: short term performance of the Hong KongEquity Fund may be higher or lower than the long term expected return.)(b)Balance of investmentsThe underlying APIF will normally invest 95% of its net assets in equities and 5% in cash,although actual portfolios may vary as market, political, structural, economic and otherconditions change. The underlying APIF will also have the flexibility to invest in bonds in alimited manner.The underlying APIF will maintain an effective currency exposure to Hong Kong dollars of notless than 30%.The investment policy of the underlying APIF is such that up to 10% of its net asset value maybe invested in shares listed on a stock exchange that is not an approved stock exchange asdefined in the Regulation.(c)Security lending and repurchase agreementsThe fund will not engage in any securities lending or repurchase agreements. The underlyingAPIF may engage in securities lending and repurchase transactions.(d)Futures and optionsThe fund will not enter into financial futures contracts and financial option contracts. Theunderlying APIF may enter into financial futures contracts and financial option contracts forhedging purposes only.(e)RisksThe performance of the fund is subject to a number of risks, including the following: generalinvestment risk, currency risk, risk of changes in laws, regulations, policies and practices,emerging markets risk, equity market risks, risks of China A shares market and Stock Connect,and RMB currency risk. As the underlying APIF will be mainly invested in the stock marketof Hong Kong, the inherent risk and return of the underlying APIF will be associated with theHong Kong stock market.Please refer to section 4 entitled “Risks” for a detailed description of the risks listed above.BCT (MPF) INDUSTRY CHOICE MPF SCHEME BROCHURE5

3.2.2 Asian Equity FundStatement of investment policy(a)Objective and policyThe objective of the Asian Equity Fund is to provide members with long term capital growth byinvesting solely in the Schroder MPF Asian Fund which is an APIF and in turn invests primarilyin securities of companies in Asian equity markets (excluding Japan).It is expected that the Asian Equity Fund will achieve a long-term capital growth whichmodestly exceeds Hong Kong price inflation (as measured by the Consumer Price Index TypeA).(b)Balance of investmentsThe underlying APIF will seek to achieve its objective through investing its non-cash assetsprimarily in Asian (ex-Japan) equities in a range of 60 – 100%. The underlying APIF mayinvest up to 10% of its net asset value in shares listed on a stock exchange that is not anapproved stock exchange as defined in the Regulation, including without limitation shares ofcompanies listed on the stock exchange(s) of the People’s Republic of China (the “PRC”) viathe Stock Connect. The underlying APIF holds a minimum of 30% of its assets in Hong Kongdollars investments. As the underlying APIF will be mainly invested in the stock markets inAsia, the inherent risk and return of the Asian Equity Fund will be associated with the Asianstock markets.(c)Security lending and repurchase agreementsThe fund will not engage in any securities lending or repurchase agreements. The underlyingAPIF will not engage in any securities lending, and may engage in repurchase agreements.(d)Futures and optionsThe fund will not enter into financial futures contracts and financial option contracts. Theunderlying APIF may enter into financial futures contracts and financial option contracts forhedging purposes only.(e)RisksThe performance of the fund is subject to a number of risks, including the following: generalinvestment risk, currency risk, risk of changes in la

Issued by Bank Consortium Trust Company Limited MPF SCHEME BROCHURE FOR BCT (MPF) INDUSTRY CHOICE Sponsor: BCT Financial Limited Trustee: Bank Consortium Trust Company Limited Version Date: 23 March 2020 Enquiry Contact: Member Hotline 22